Global Cardiotoxicity Treatment Market

Market Size in USD Million

CAGR :

%

USD

592.05 Million

USD

1,021.26 Million

2024

2032

USD

592.05 Million

USD

1,021.26 Million

2024

2032

| 2025 –2032 | |

| USD 592.05 Million | |

| USD 1,021.26 Million | |

|

|

|

|

Cardiotoxicity Treatment Market Size

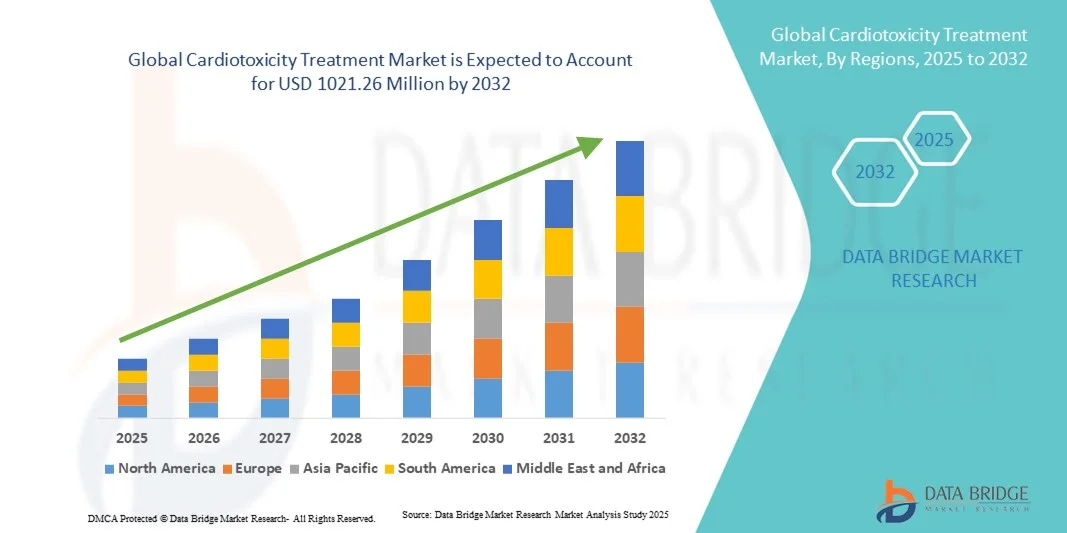

- The global cardiotoxicity treatment market size was valued at USD 592.05 Million in 2024 and is expected to reach USD 1021.26 Million by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular complications associated with cancer therapies, chemotherapy, and other cardiotoxic drugs, leading to higher demand for early diagnosis, monitoring, and effective treatment interventions

- Furthermore, rising awareness among healthcare professionals and patients, advancements in cardioprotective drugs, and the development of targeted therapeutic and monitoring solutions are accelerating the uptake of cardiotoxicity treatment solutions, thereby significantly boosting the industry’s growth

Cardiotoxicity Treatment Market Analysis

- The Cardiotoxicity Treatment market is witnessing significant growth, driven by the increasing incidence of cardiovascular complications resulting from cancer therapies, chemotherapy, and other cardiotoxic medications, as well as rising demand for early detection and effective treatment interventions

- The escalating demand for cardiotoxicity treatment is primarily fueled by advancements in cardioprotective drugs, growing awareness among healthcare professionals and patients, and the expansion of specialized cardiology and oncology care facilities

- North America dominated the cardiotoxicity treatment market with the largest revenue share of 41.5% in 2024, supported by advanced healthcare infrastructure, higher adoption of diagnostic and therapeutic solutions, and the presence of leading pharmaceutical and medical device companies. The U.S. is the primary contributor to regional growth due to strong clinical adoption and research initiatives

- Asia-Pacific is expected to be the fastest-growing region in the cardiotoxicity treatment market during the forecast period, with a projected CAGR driven by improving healthcare access, increasing awareness of therapy-induced cardiac risks, and rising investments in oncology and cardiology facilities in countries such as China, India, and Australia

- The Medication segment dominated with a revenue share of 52.3% in 2024, due to the extensive use of cardioprotective drugs such as beta-blockers, ACE inhibitors, and dexrazoxane. Hospitals and specialty clinics implement guideline-based therapy

Report Scope and Cardiotoxicity Treatment Market Segmentation

|

Attributes |

Cardiotoxicity Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cardiotoxicity Treatment Market Trends

Rising Adoption of Targeted Cardioprotective Therapies in Cancer Patients

- A significant and accelerating trend in the global cardiotoxicity treatment market is the increasing adoption of targeted cardioprotective therapies for patients undergoing cancer treatment. These therapies are designed to mitigate heart damage caused by chemotherapeutic agents, improving patient outcomes and long-term cardiovascular health

- For instance, the use of dexrazoxane alongside anthracycline-based chemotherapy is gaining traction, particularly in high-risk patient populations, as it has been shown to reduce cardiotoxic effects without compromising anti-cancer efficacy. Similarly, ongoing clinical trials are evaluating novel agents that selectively protect cardiac tissue while allowing effective cancer treatment

- Integration of these therapies into standard oncology protocols enables physicians to proactively manage cardiotoxicity, offering tailored treatment plans based on individual patient risk profiles. This proactive approach is particularly important for patients receiving multiple cardiotoxic agents or those with pre-existing cardiovascular conditions

- The trend also includes increased research and development of adjunct therapies such as ACE inhibitors, beta-blockers, and statins specifically tested for cardioprotective effects in oncology settings. Evidence-based adoption of these interventions is helping to standardize cardiotoxicity prevention across hospitals and specialty clinics globally

- Companies such as Pfizer, Novartis, and Roche are investing in research partnerships and clinical studies to expand the availability and efficacy of targeted cardioprotective agents. Their work is driving broader awareness among healthcare providers regarding early intervention strategies and improving patient adherence to therapy

- The growing demand for personalized, risk-based cardioprotection is reshaping treatment protocols, as oncology centers increasingly emphasize monitoring cardiac biomarkers and implementing prophylactic therapies. This trend is expected to accelerate across both developed and emerging markets, driven by rising cancer prevalence, increasing awareness of long-term cardiac risks, and ongoing advancements in therapeutic options

Cardiotoxicity Treatment Market Dynamics

Driver

Growing Need for Targeted Cardioprotection in Oncology Patients

- The rising incidence of cardiotoxic side effects in cancer patients, coupled with increasing awareness of long-term cardiovascular complications, is driving demand for targeted cardioprotective therapies.

- For instance, in March 2023, Novartis expanded its research program on dexrazoxane derivatives to improve cardioprotection in pediatric and adult oncology patients, emphasizing safer chemotherapy regimens. Such strategic initiatives by key players are expected to propel the Cardiotoxicity Treatment market in the forecast period

- As healthcare providers prioritize patient safety and long-term outcomes, adoption of therapies aimed at minimizing cardiac risks is becoming a key differentiator in oncology treatment protocols

- Furthermore, the trend toward integrating cardioprotective strategies with precision medicine approaches is fostering increased use of risk assessment tools, biomarker monitoring, and individualized treatment plans

- The convenience of implementing adjunct cardioprotective therapies, alongside standard chemotherapy regimens, enables better patient compliance and improved clinical outcomes, thereby expanding market growth opportunities

Restraint/Challenge

Limited Awareness and High Cost of Novel Cardioprotective Therapies

- Limited awareness among certain healthcare providers and patients regarding available cardioprotective options remains a key challenge, potentially delaying adoption of these therapies

- For instance, despite demonstrated efficacy, the high cost of agents such as dexrazoxane and other investigational drugs may restrict widespread use in budget-constrained healthcare systems, particularly in developing regions

- Addressing these challenges through educational initiatives, clinical guidelines, and health insurance coverage is crucial to building adoption momentum. Companies are also exploring cost-effective formulations and combination therapies to make cardioprotection more accessible

- While ongoing clinical research continues to validate the benefits of these therapies, perceived complexity in patient selection and monitoring can hinder uptake, particularly in smaller clinics lacking specialized oncology-cardiology integration

- Overcoming these barriers through awareness campaigns, robust clinical evidence dissemination, and reimbursement support will be vital for sustained market growth

- Regulatory hurdles and lengthy approval processes for new cardioprotective agents can delay market entry, limiting the availability of novel therapies in certain regions and slowing adoption among healthcare providers

- Variability in clinical guidelines across countries and institutions may result in inconsistent implementation of cardioprotective strategies, creating uncertainty for physicians and affecting patient access to optimized treatment plans

Cardiotoxicity Treatment Market Scope

The market is segmented on the basis of type, causes, diagnosis, treatment, end-users, and distribution channel.

- By Type

On the basis of type, the Cardiotoxicity Treatment market is segmented into Cardiomyopathy, Myocarditis, Pericarditis, Acute Coronary Syndromes, Congestive Heart Failure, and Others. The Cardiomyopathy segment dominated the market with a revenue share of 36.5% in 2024, driven by the increasing prevalence of chemotherapy- and targeted therapy-induced cardiomyopathy. Hospitals and specialty clinics prioritize early diagnosis and treatment to prevent long-term cardiac complications. Standardized protocols, guideline-recommended interventions, and availability of cardioprotective drugs strengthen market adoption. Rising awareness among oncologists and cardiologists ensures timely intervention. Access to diagnostic facilities and advanced monitoring devices supports dominance. Chronic and progressive nature of cardiomyopathy requires continuous management, increasing treatment volumes. Combination therapy with supportive medications enhances outcomes. High patient volume in North America and Europe reinforces revenue share. Insurance coverage and reimbursement policies further consolidate dominance. Availability of both adult and pediatric treatments broadens the patient base. Hospital-based treatment programs and clinical follow-ups support sustained revenue.

The Acute Coronary Syndromes segment is expected to witness the fastest CAGR of 8.4% from 2025 to 2032, driven by the increasing use of targeted therapies and chemotherapeutic regimens that elevate cardiovascular risk. Early detection initiatives and interventional cardiology adoption accelerate growth. Expansion of emergency cardiac care units ensures timely treatment. Rising prevalence of comorbidities in cancer patients necessitates immediate management. Hospitals and specialty clinics implement risk stratification and monitoring programs. Development of novel cardioprotective drugs supports segment expansion. Awareness campaigns among healthcare providers enhance early intervention. Adoption of combination therapy improves clinical outcomes. Availability of rapid diagnostics and intervention tools strengthens uptake. Increasing clinical research and real-world studies drive physician confidence. Growing patient demand in emerging markets contributes to growth. Telemedicine and remote monitoring integration enhances follow-up care.

- By Causes

On the basis of causes, the market is segmented into Chemotherapy, Targeted Therapy, Radiation Therapy, and Others. The Chemotherapy segment dominated the market with a revenue share of 41.8% in 2024, due to its widespread use in oncology and the known cardiotoxic potential of anthracyclines and other agents. Hospitals and specialty clinics prioritize early monitoring and intervention. Availability of cardioprotective drugs and protocols strengthens adoption. Long-term management programs and follow-up visits contribute to market revenue. Awareness campaigns and guideline-based recommendations reinforce treatment uptake. Insurance coverage facilitates patient access to therapy. Multi-disciplinary collaboration between oncology and cardiology departments enhances outcomes. Patient education programs increase adherence to cardiotoxicity monitoring. Combination with imaging and biomarker assessments ensures early detection. High prevalence in North America and Europe supports revenue dominance. Advanced hospital infrastructure enables early interventions. Government and private initiatives for patient safety further consolidate market share.

The Targeted Therapy segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by the increasing adoption of novel biologics and kinase inhibitors in oncology. Rising awareness of associated cardiac risks accelerates monitoring and treatment. Specialty clinics implement cardiac risk assessment programs. Growth of targeted therapy usage in emerging markets supports segment expansion. Collaboration between pharmaceutical companies and hospitals enhances access. Availability of real-world data strengthens physician confidence. Regulatory approvals of new targeted drugs contribute to adoption. Integration of predictive diagnostics improves patient outcomes. Educational initiatives for oncologists drive proactive management. Telehealth programs support follow-up and monitoring. Market penetration is increased by guideline-based therapy adoption. Clinical trials and post-marketing studies expand the treatment base.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Physical Examination, Chest X-Ray, Echocardiogram, ECG, MUGA, Troponin Blood Tests, and Others. The Echocardiogram segment dominated with a revenue share of 38.7% in 2024, due to its non-invasive nature and high accuracy in detecting early cardiac dysfunction. Widely used in hospitals and specialty clinics, it allows timely intervention. Availability of advanced imaging devices strengthens adoption. Guideline-recommended use ensures consistent implementation. Multi-disciplinary monitoring programs in oncology reinforce dominance. Accessibility in both adult and pediatric populations enhances usage. Insurance coverage improves patient affordability. Integration into routine cardiac monitoring supports high revenue. Echocardiography aids risk stratification and therapy adjustment. Hospitals conduct serial echocardiograms to track cardiotoxicity progression. Collaboration with cardiology specialists enhances diagnostic reliability. Clinical training ensures standardized imaging and interpretation.

The Troponin Blood Tests segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by the need for early detection of myocardial injury in oncology patients. Rising adoption of biomarker-based monitoring supports growth. Specialty clinics and hospitals use troponin tests to guide therapy adjustments. Increasing clinical evidence highlights prognostic value. Easy sample collection and rapid turnaround enhance adoption. Expansion of lab facilities in emerging markets accelerates uptake. Physician awareness programs improve proactive testing. Integration with echocardiography and imaging enhances diagnostic accuracy. Health insurance coverage increases patient access. Use in combination with ECG and MUGA strengthens treatment decisions. Growth in research and clinical trials supports adoption. Telemedicine labs offer remote monitoring options. Rising incidence of high-risk cardiotoxicity cases fuels segment expansion.

- By Treatment

On the basis of treatment, the market is segmented into Medication and Others. The Medication segment dominated with a revenue share of 52.3% in 2024, due to the extensive use of cardioprotective drugs such as beta-blockers, ACE inhibitors, and dexrazoxane. Hospitals and specialty clinics implement guideline-based therapy. High patient volume and chronic management requirements support dominance. Combination with supportive care increases efficacy. Multi-disciplinary programs strengthen adoption. Availability of both oral and parenteral formulations enhances accessibility. Insurance coverage facilitates treatment affordability. Clinical recommendations encourage consistent use. Adoption in both adult and pediatric populations reinforces market share. Emerging research on novel medications supports sustained growth. Hospitals stock standardized treatment regimens. Training programs ensure correct administration and monitoring.

The Others segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, driven by alternative therapies, combination interventions, and investigational drugs under clinical development. Specialty clinics and research hospitals adopt these novel options early. Expansion in emerging markets supports uptake. Awareness campaigns enhance physician adoption. Real-world data demonstrate efficacy and safety. Early intervention strategies drive treatment demand. Integration with multi-modal therapy programs strengthens growth. Telemedicine and remote monitoring facilitate adherence. Collaboration with pharmaceutical companies accelerates availability. Patient education programs improve uptake. Emerging clinical trials expand access. Regulatory approvals for innovative therapies support market expansion.

- By End Users

On the basis of end users, the market is segmented into Hospitals, Specialty Clinics, Home Healthcare, and Others. The Hospitals segment dominated with a revenue share of 58.9% in 2024, due to comprehensive facilities, specialist availability, and capacity to manage complex cases. High patient volume and guideline-based treatment programs reinforce dominance. Integration of diagnostic, monitoring, and therapeutic services supports adoption. Chronic patient management requires hospital infrastructure. Insurance coverage facilitates patient access. Multi-disciplinary collaboration improves outcomes. Training and research initiatives increase expertise. Hospitals adopt both first-line and second-line medications. Government support and NGO programs ensure broad coverage. Referral networks strengthen patient inflow. Access to advanced diagnostic tools enhances treatment accuracy. Hospital pharmacies maintain continuous drug supply.

The Specialty Clinics segment is expected to witness the fastest CAGR of 9.3% from 2025 to 2032, driven by targeted cardiac care, personalized treatment plans, and expansion in oncology-cardiology collaboration. Adoption of specialized monitoring and early intervention programs supports growth. Clinics in Europe, North America, and Asia-Pacific are increasing in number. Telemedicine and home monitoring integration enhance patient management. Physician awareness and guideline-based protocols drive adoption. Emerging markets expansion contributes to segment growth. Combination therapies are more accessible in specialty centers. Private funding and public-private partnerships facilitate infrastructure development. Clinical trial participation increases access to novel therapies. Multi-disciplinary expertise accelerates patient trust. Adoption of innovative treatment modalities drives revenue. Patient education programs enhance compliance and outcomes.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. The Hospital Pharmacy segment dominated with a revenue share of 54.6% in 2024, due to direct integration with hospital treatment programs, availability of essential medications, and adherence to guideline-based therapy. Hospitals maintain continuous supply to manage chronic and acute cardiotoxicity cases. Bulk procurement and government initiatives reduce costs. Insurance coverage ensures patient access. Clinical monitoring ensures appropriate usage. High patient throughput reinforces revenue. Hospitals provide both adult and pediatric formulations. Collaboration with pharmaceutical companies strengthens supply chains. Multi-disciplinary teams optimize treatment delivery. Hospitals adopt both medication and alternative therapy programs. Professional staff ensure correct dispensing and counseling. Integration with electronic medical records supports continuity of care.

The Online Pharmacy segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by increasing adoption of e-pharmacy services, telemedicine consultations, and home delivery of medications. Online channels expand access to patients in remote areas. Digital health initiatives support monitoring and adherence. Regulatory approvals for e-pharmacy services facilitate growth. Convenience and accessibility accelerate adoption. Emerging markets penetration increases patient base. Mobile app platforms enhance ordering and tracking. Collaboration with logistics providers ensures timely delivery. Awareness campaigns increase visibility and trust. Cost-effective access to essential medications drives adoption. Availability of both first-line and second-line drugs enhances convenience. Telepharmacy programs provide counseling and guidance. Rising internet penetration supports sustained segment growth

Cardiotoxicity Treatment Market Regional Analysis

- North America dominated the cardiotoxicity treatment market with the largest revenue share of 41.5% in 2024, driven by a well-established healthcare infrastructure, high patient awareness, and strong adoption of advanced diagnostic and therapeutic solutions. The region benefits from the presence of leading pharmaceutical and medical device companies actively developing novel cardioprotective therapies and protocols

- Hospitals, specialty clinics, and oncology centers in the U.S. and Canada are increasingly implementing cardio-oncology programs to monitor and manage therapy-induced cardiac risks, further boosting market growth

- In addition, strong government initiatives promoting early detection, patient education, and research funding in cardiovascular complications associated with cancer therapies contribute significantly to market expansion

U.S. Cardiotoxicity Treatment Market Insight

The U.S. cardiotoxicity treatment market captured the largest revenue share within North America in 2024, driven by increasing awareness of therapy-induced cardiac risks, availability of advanced cardioprotective treatments, and the adoption of standardized monitoring and management protocols across hospitals, specialty clinics, and oncology centers. Strong clinical adoption and research initiatives further accelerate market growth.

Europe Cardiotoxicity Treatment Market Insight

The Europe cardiotoxicity treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising prevalence of cancer, increasing use of chemotherapy and targeted therapies, and growing awareness of cardiotoxicity monitoring. Early detection and preventive strategies are leading to higher adoption of cardioprotective treatments across hospitals and specialty clinics.

U.K. Cardiotoxicity Treatment Market Insight

The U.K. cardiotoxicity treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the adoption of cardio-oncology guidelines, increasing awareness of chemotherapy-induced cardiac risks, and growing investments in diagnostic and therapeutic facilities. Enhanced focus on patient safety and treatment optimization continues to support market expansion.

Germany Cardiotoxicity Treatment Market Insight

The Germany cardiotoxicity treatment market is expected to expand at a considerable CAGR during the forecast period, driven by advanced healthcare infrastructure, well-established oncology centers, and initiatives promoting early detection and management of cardiotoxicity. Strong R&D and growing adoption of evidence-based cardioprotective protocols contribute to market growth.

Asia-Pacific Cardiotoxicity Treatment Market Insight

The Asia-Pacific cardiotoxicity treatment market is poised to grow at the fastest CAGR during the forecast period, driven by improving healthcare access, increasing awareness of therapy-induced cardiac risks, and rising investments in oncology and cardiology facilities in countries such as China, India, and Australia. Expansion of diagnostic and monitoring infrastructure is accelerating regional adoption.

Japan Cardiotoxicity Treatment Market Insight

The Japan Cardiotoxicity Treatment market is gaining momentum due to rising prevalence of cancer, increasing awareness of cardiotoxicity associated with cancer therapies, and strong healthcare infrastructure. Hospitals and specialty clinics are adopting advanced cardioprotective strategies and patient monitoring protocols, supporting market growth.

China Cardiotoxicity Treatment Market Insight

The China Cardiotoxicity Treatment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to expanding healthcare and oncology infrastructure, increasing number of hospitals and specialty clinics, rising awareness of therapy-induced cardiac risks, and growing government initiatives supporting cardio-oncology programs.

Cardiotoxicity Treatment Market Share

The Cardiotoxicity Treatment industry is primarily led by well-established companies, including:

• Novartis AG (Switzerland)

• Pfizer Inc. (U.S.)

• Roche Holding AG (Switzerland)

• Johnson & Johnson and its affiliates (U.S.)

• Bristol-Myers Squibb Company (U.S.)

• AbbVie Inc. (U.S.)

• Amgen Inc. (U.S.)

• Bayer AG (Germany)

• Sanofi (France)

• GSK plc (U.K.)

• Takeda Pharmaceutical Company Limited (Japan)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Merck & Co., Inc. (U.S.)

• Daiichi Sankyo Company, Limited (Japan)

• Lundbeck A/S (Denmark)

Latest Developments in Global Cardiotoxicity Treatment Market

- In April 2025, the International Society of Cardio-Oncology (ISCO) published updated global guidelines for the prevention and management of cancer therapy-related cardiotoxicity. These guidelines emphasize early screening, personalized treatment plans, and the integration of cardio-oncology teams into cancer care protocols. The updated guidelines aim to standardize practices across healthcare systems and improve patient outcomes

- In August 2024, the U.S. Food and Drug Administration (FDA) approved the expanded use of dexrazoxane hydrochloride for the prevention of chemotherapy-induced cardiotoxicity in pediatric patients. This approval was based on clinical trial data demonstrating the drug's efficacy in reducing the incidence of heart failure in children undergoing anthracycline-based chemotherapy

- In November 2024, a collaborative research initiative between the National Cancer Institute (NCI) and the American Heart Association (AHA) launched a nationwide registry to track long-term cardiovascular outcomes in cancer survivors. The registry aims to collect data on the incidence of cardiotoxicity and inform future treatment guidelines

- In February 2025, the European Society of Cardiology (ESC) released a position paper on the role of artificial intelligence (AI) in cardiotoxicity screening. The paper highlights the potential of AI algorithms to enhance early detection of cardiac dysfunction in cancer patients, leading to timely interventions and improved prognosis

- In July 2023, a multinational study published in the Journal of Clinical Oncology reported the successful use of a novel biomarker panel for early detection of cardiotoxicity in breast cancer patients receiving trastuzumab therapy. The study's findings suggest that this biomarker panel can identify at-risk patients before the onset of clinical symptoms, allowing for preemptive cardioprotective strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CARDIOTOXICITY TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CARDIOTOXICITY TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY BASED MODELLING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CARDIOTOXICITY TREATMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 EPIDEMIOLOGY

7 INDUSTRY INSIGHTS

8 REGULATORY FRAMEWORK

9 PIPELINE ANALYSIS

9.1 PHASE III CANDIDATES

9.2 PHASE II CANDIDATES

9.3 PHASE I CANDIDATES

9.4 OTHERS (PRE-CLINICAL AND RESEARCH)

10 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY CAUSE

10.1 OVERVIEW

10.2 CHEMOTHERAPY INDUCED CARDIOTOXICITY

10.2.1 ANTHRACYCLINES

10.2.2 NON-ANTHRACYCLINES

10.3 NON-CHEMOTHERAPY CARDIOTOXICITY

11 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 DIAGNOSIS

11.2.1 IN VIVO DIAGNOSIS

11.2.1.1. ELECTROCARDIOGRAM

11.2.1.2. ECHOCARDIOGRAM

11.2.1.3. CARDIAC BIOPSY

11.2.1.4. MULTI GATED ACQUISITION (MUGA) SCAN

11.2.1.5. OTHERS

11.2.2 IN VITRO DIAGNOSIS

11.2.2.1. INSTRUMENTS

11.2.2.2. ASSAYS & REAGENTS

11.2.2.2.1. HERG ASSAYS

11.2.2.2.2. QT PROLONGATION ASSAYS

11.2.2.2.3. CALCIUM TRANSIENT ASSAY

11.2.2.2.4. COMPREHENSIVE IN VITRO PROARRHYTMIA ASSAY (CIPA)

11.2.2.2.5. CARDIAC BIOMARKER

11.2.2.2.5.1 TROPININ I & T

11.2.2.2.5.2 B-TYPE NATRIURETIC PEPTIDE (BNP)

11.2.2.2.6. OTHERS

11.2.2.3. OTHERS

11.3 TREATMENT

11.3.1 DEXRAZOXANE HYDROCHLORIDE

11.3.2 ACE INHIBITORS

11.3.2.1. BENAZEPRIL

11.3.2.1.1. MARKET VALUE (USD MN)

11.3.2.1.2. MARKET VOLUME (SU)

11.3.2.1.3. AVERAGE SELLING PRICE (USD)

11.3.2.2. CAPTOPRIL

11.3.2.2.1. MARKET VALUE (USD MN)

11.3.2.2.2. MARKET VOLUME (SU)

11.3.2.2.3. AVERAGE SELLING PRICE (USD)

11.3.2.3. ENALAPRIL

11.3.2.3.1. MARKET VALUE (USD MN)

11.3.2.3.2. MARKET VOLUME (SU)

11.3.2.3.3. AVERAGE SELLING PRICE (USD)

11.3.2.4. LISINOPRIL

11.3.2.4.1. MARKET VALUE (USD MN)

11.3.2.4.2. MARKET VOLUME (SU)

11.3.2.4.3. AVERAGE SELLING PRICE (USD)

11.3.2.5. OTHERS

11.3.3 ANGIOTENSIN II RECEPTOR ANTAGONISTS (ARBS)

11.3.3.1. CANDESARTAN CILEXETIL

11.3.3.1.1. MARKET VALUE (USD MN)

11.3.3.1.2. MARKET VOLUME (SU)

11.3.3.1.3. AVERAGE SELLING PRICE (USD)

11.3.3.2. EPROSARTAN MESYLATE

11.3.3.2.1. MARKET VALUE (USD MN)

11.3.3.2.2. MARKET VOLUME (SU)

11.3.3.2.3. AVERAGE SELLING PRICE (USD)

11.3.3.3. IRBESARTAN

11.3.3.3.1. MARKET VALUE (USD MN)

11.3.3.3.2. MARKET VOLUME (SU)

11.3.3.3.3. AVERAGE SELLING PRICE (USD)

11.3.3.4. LOSARTAN

11.3.3.4.1. MARKET VALUE (USD MN)

11.3.3.4.2. MARKET VOLUME (SU)

11.3.3.4.3. AVERAGE SELLING PRICE (USD)

11.3.3.5. OTHERS

11.3.4 BETA BLOCKERS

11.3.4.1. ACEBUTOLOL

11.3.4.1.1. MARKET VALUE (USD MN)

11.3.4.1.2. MARKET VOLUME (SU)

11.3.4.1.3. AVERAGE SELLING PRICE (USD)

11.3.4.2. BISOPROLOL

11.3.4.2.1. MARKET VALUE (USD MN)

11.3.4.2.2. MARKET VOLUME (SU)

11.3.4.2.3. AVERAGE SELLING PRICE (USD)

11.3.4.3. CARVEDILOL

11.3.4.3.1. MARKET VALUE (USD MN)

11.3.4.3.2. MARKET VOLUME (SU)

11.3.4.3.3. AVERAGE SELLING PRICE (USD)

11.3.4.4. METOPROLOL

11.3.4.4.1. MARKET VALUE (USD MN)

11.3.4.4.2. MARKET VOLUME (SU)

11.3.4.4.3. AVERAGE SELLING PRICE (USD)

11.3.4.5. OTHERS

11.3.5 CALCIUM CHANNEL BLOCKERS

11.3.5.1. AMLODIPINE

11.3.5.1.1. MARKET VALUE (USD MN)

11.3.5.1.2. MARKET VOLUME (SU)

11.3.5.1.3. AVERAGE SELLING PRICE (USD)

11.3.5.2. FELODIPINE

11.3.5.3. NICARDIPINE

11.3.5.3.1. MARKET VALUE (USD MN)

11.3.5.3.2. MARKET VOLUME (SU)

11.3.5.3.3. AVERAGE SELLING PRICE (USD)

11.3.5.4. NIFEDIPINE

11.3.5.4.1. MARKET VALUE (USD MN)

11.3.5.4.2. MARKET VOLUME (SU)

11.3.5.4.3. AVERAGE SELLING PRICE (USD)

11.3.5.5. VERAPAMIL

11.3.5.5.1. MARKET VALUE (USD MN)

11.3.5.5.2. MARKET VOLUME (SU)

11.3.5.5.3. AVERAGE SELLING PRICE (USD)

11.3.5.6. OTHERS

11.3.6 DIURETICS

11.3.6.1. AMILORIDE

11.3.6.1.1. MARKET VALUE (USD MN)

11.3.6.1.2. MARKET VOLUME (SU)

11.3.6.1.3. AVERAGE SELLING PRICE (USD)

11.3.6.2. BUMETANIDE

11.3.6.2.1. MARKET VALUE (USD MN)

11.3.6.2.2. MARKET VOLUME (SU)

11.3.6.2.3. AVERAGE SELLING PRICE (USD)

11.3.6.3. FUROSEMIDE

11.3.6.3.1. MARKET VALUE (USD MN)

11.3.6.3.2. MARKET VOLUME (SU)

11.3.6.3.3. AVERAGE SELLING PRICE (USD)

11.3.6.4. OTHERS

11.3.7 OTHERS

12 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY STAGES

12.1 OVERVIEW

12.2 ACUTE CARDIOTOXICITY

12.2.1 ECG CHANGES

12.2.2 ARRYTHMIAS

12.3 SUBACUTE CARDIOTOXICITY

12.3.1 PERICARDITIS

12.3.2 MYOCARDITIS

12.4 CHRONIC CARDIOTOXICITY

12.4.1 CONTRACTILE DYSFUNCTION

12.4.2 HEART FAILURE

13 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY ROUT OF ADMINISTRATION

13.1 OVERVIEW

13.2 ORAL

13.2.1 TABLETS

13.2.2 CAPSULES

13.2.3 OTHERS

13.3 PARENTERAL

13.3.1 INTRAVENOUS

13.3.2 SUBCUTANEOUS

13.3.3 OTHERS

13.4 OTHERS

14 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY AGE GROUP

14.1 OVERVIEW

14.2 PEDIATRICS

14.3 ADULTS

15 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 CLINICS

15.4 HOME HEALTHCARE

15.5 OTHERS

16 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 PHARMACIES

16.4 OTHERS

17 GLOBAL CARDIOTOXICITY TREATMENT MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL CARDIOTOXICITY TREATMENT MARKET, BY GEOGRAPHY

18.1 GLOBAL CARDIOTOXICITY TREATMENT MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1.1 NORTH AMERICA

18.1.1.1. U.S.

18.1.1.2. CANADA

18.1.1.3. MEXICO

18.1.2 EUROPE

18.1.2.1. GERMANY

18.1.2.2. FRANCE

18.1.2.3. U.K.

18.1.2.4. HUNGARY

18.1.2.5. LITHUANIA

18.1.2.6. AUSTRIA

18.1.2.7. IRELAND

18.1.2.8. NORWAY

18.1.2.9. POLAND

18.1.2.10. ITALY

18.1.2.11. SPAIN

18.1.2.12. RUSSIA

18.1.2.13. TURKEY

18.1.2.14. NETHERLANDS

18.1.2.15. SWITZERLAND

18.1.2.16. REST OF EUROPE

18.1.3 ASIA-PACIFIC

18.1.3.1. JAPAN

18.1.3.2. CHINA

18.1.3.3. SOUTH KOREA

18.1.3.4. INDIA

18.1.3.5. AUSTRALIA

18.1.3.6. SINGAPORE

18.1.3.7. THAILAND

18.1.3.8. MALAYSIA

18.1.3.9. INDONESIA

18.1.3.10. PHILIPPINES

18.1.3.11. VIETNAM

18.1.3.12. REST OF ASIA-PACIFIC

18.1.4 SOUTH AMERICA

18.1.4.1. BRAZIL

18.1.4.2. ARGENTINA

18.1.4.3. PERU

18.1.4.4. REST OF SOUTH AMERICA

18.1.5 MIDDLE EAST AND AFRICA

18.1.5.1. SOUTH AFRICA

18.1.5.2. SAUDI ARABIA

18.1.5.3. UAE

18.1.5.4. EGYPT

18.1.5.5. KUWAIT

18.1.5.6. ISRAEL

18.1.5.7. REST OF MIDDLE EAST AND AFRICA

18.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL CARDIOTOXICITY TREATMENT MARKET, SWOT AND DBMR ANALYSIS

20 GLOBAL CARDIOTOXICITY TREATMENT MARKET, COMPANY PROFILE

20.1 DIAGNOSIS

20.1.1 CREATIVE BIOARRAY

20.1.1.1. COMPANY OVERVIEW

20.1.1.2. REVENUE ANALYSIS

20.1.1.3. GEOGRAPHIC PRESENCE

20.1.1.4. PRODUCT PORTFOLIO

20.1.1.5. RECENT DEVELOPMENTS

20.1.2 MOLECULAR DEVICES, LLC.

20.1.2.1. COMPANY OVERVIEW

20.1.2.2. REVENUE ANALYSIS

20.1.2.3. GEOGRAPHIC PRESENCE

20.1.2.4. PRODUCT PORTFOLIO

20.1.2.5. RECENT DEVELOPMENTS

20.1.3 MERCK KGAA

20.1.3.1. COMPANY OVERVIEW

20.1.3.2. REVENUE ANALYSIS

20.1.3.3. GEOGRAPHIC PRESENCE

20.1.3.4. PRODUCT PORTFOLIO

20.1.3.5. RECENT DEVELOPMENTS

20.1.4 AGILENT TECHNOLOGIES, INC.

20.1.4.1. COMPANY OVERVIEW

20.1.4.2. REVENUE ANALYSIS

20.1.4.3. GEOGRAPHIC PRESENCE

20.1.4.4. PRODUCT PORTFOLIO

20.1.4.5. RECENT DEVELOPMENTS

20.1.5 HAMAMATSU PHOTONICS K.K.

20.1.5.1. COMPANY OVERVIEW

20.1.5.2. REVENUE ANALYSIS

20.1.5.3. GEOGRAPHIC PRESENCE

20.1.5.4. PRODUCT PORTFOLIO

20.1.5.5. RECENT DEVELOPMENTS

20.1.6 CREATIVE BIOLABS.

20.1.6.1. COMPANY OVERVIEW

20.1.6.2. REVENUE ANALYSIS

20.1.6.3. GEOGRAPHIC PRESENCE

20.1.6.4. PRODUCT PORTFOLIO

20.1.6.5. RECENT DEVELOPMENTS

20.1.7 EUROFINS DISCOVERX PRODUCTS.

20.1.7.1. COMPANY OVERVIEW

20.1.7.2. REVENUE ANALYSIS

20.1.7.3. GEOGRAPHIC PRESENCE

20.1.7.4. PRODUCT PORTFOLIO

20.1.7.5. RECENT DEVELOPMENTS

20.1.8 CREATIVE DIAGNOSTICS

20.1.8.1. COMPANY OVERVIEW

20.1.8.2. REVENUE ANALYSIS

20.1.8.3. GEOGRAPHIC PRESENCE

20.1.8.4. PRODUCT PORTFOLIO

20.1.8.5. RECENT DEVELOPMENTS

20.1.9 LIFE DIAGNOSTICS

20.1.9.1. COMPANY OVERVIEW

20.1.9.2. REVENUE ANALYSIS

20.1.9.3. GEOGRAPHIC PRESENCE

20.1.9.4. PRODUCT PORTFOLIO

20.1.9.5. RECENT DEVELOPMENTS

20.1.10 HYTEST LTD.

20.1.10.1. COMPANY OVERVIEW

20.1.10.2. REVENUE ANALYSIS

20.1.10.3. GEOGRAPHIC PRESENCE

20.1.10.4. PRODUCT PORTFOLIO

20.1.10.5. RECENT DEVELOPMENTS

20.2 THERAPEUTICS

20.2.1 PFIZER INC.

20.2.1.1. COMPANY OVERVIEW

20.2.1.2. REVENUE ANALYSIS

20.2.1.3. GEOGRAPHIC PRESENCE

20.2.1.4. PRODUCT PORTFOLIO

20.2.1.5. RECENT DEVELOPMENTS

20.2.2 HIKMA PHARMACEUTICALS PLC

20.2.2.1. COMPANY OVERVIEW

20.2.2.2. REVENUE ANALYSIS

20.2.2.3. GEOGRAPHIC PRESENCE

20.2.2.4. PRODUCT PORTFOLIO

20.2.2.5. RECENT DEVELOPMENTS

20.2.3 AUROMEDICS PHARMA LLC PHARMA LLC

20.2.3.1. COMPANY OVERVIEW

20.2.3.2. REVENUE ANALYSIS

20.2.3.3. GEOGRAPHIC PRESENCE

20.2.3.4. PRODUCT PORTFOLIO

20.2.3.5. RECENT DEVELOPMENTS

20.2.4 ASTRAZENECA

20.2.4.1. COMPANY OVERVIEW

20.2.4.2. REVENUE ANALYSIS

20.2.4.3. GEOGRAPHIC PRESENCE

20.2.4.4. PRODUCT PORTFOLIO

20.2.4.5. RECENT DEVELOPMENTS

20.2.5 BRISTOL-MYERS SQUIBB

20.2.5.1. COMPANY OVERVIEW

20.2.5.2. REVENUE ANALYSIS

20.2.5.3. GEOGRAPHIC PRESENCE

20.2.5.4. PRODUCT PORTFOLIO

20.2.5.5. RECENT DEVELOPMENTS

20.2.6 NOVARTIS AG

20.2.6.1. COMPANY OVERVIEW

20.2.6.2. REVENUE ANALYSIS

20.2.6.3. GEOGRAPHIC PRESENCE

20.2.6.4. PRODUCT PORTFOLIO

20.2.6.5. RECENT DEVELOPMENTS

20.2.7 SANOFI

20.2.7.1. COMPANY OVERVIEW

20.2.7.2. REVENUE ANALYSIS

20.2.7.3. GEOGRAPHIC PRESENCE

20.2.7.4. PRODUCT PORTFOLIO

20.2.7.5. RECENT DEVELOPMENTS

20.2.8 BAYER AG

20.2.8.1. COMPANY OVERVIEW

20.2.8.2. REVENUE ANALYSIS

20.2.8.3. GEOGRAPHIC PRESENCE

20.2.8.4. PRODUCT PORTFOLIO

20.2.8.5. RECENT DEVELOPMENTS

20.2.9 ALLERGAN ( A PART OF ABBVIE INC.)

20.2.9.1. COMPANY OVERVIEW

20.2.9.2. REVENUE ANALYSIS

20.2.9.3. GEOGRAPHIC PRESENCE

20.2.9.4. PRODUCT PORTFOLIO

20.2.9.5. RECENT DEVELOPMENTS

20.2.10 TEVA PHARMACEUTICAL INDUSTRIES LTD.

20.2.10.1. COMPANY OVERVIEW

20.2.10.2. REVENUE ANALYSIS

20.2.10.3. GEOGRAPHIC PRESENCE

20.2.10.4. PRODUCT PORTFOLIO

20.2.10.5. RECENT DEVELOPMENTS

20.2.11 MERCK & CO.

20.2.11.1. COMPANY OVERVIEW

20.2.11.2. REVENUE ANALYSIS

20.2.11.3. GEOGRAPHIC PRESENCE

20.2.11.4. PRODUCT PORTFOLIO

20.2.11.5. RECENT DEVELOPMENTS

20.2.12 UCB, INC.

20.2.12.1. COMPANY OVERVIEW

20.2.12.2. REVENUE ANALYSIS

20.2.12.3. GEOGRAPHIC PRESENCE

20.2.12.4. PRODUCT PORTFOLIO

20.2.12.5. RECENT DEVELOPMENTS

20.2.13 VIATRIS INC.

20.2.13.1. COMPANY OVERVIEW

20.2.13.2. REVENUE ANALYSIS

20.2.13.3. GEOGRAPHIC PRESENCE

20.2.13.4. PRODUCT PORTFOLIO

20.2.13.5. RECENT DEVELOPMENTS

20.2.14 F. HOFFMANN-LA ROCHE LTD

20.2.14.1. COMPANY OVERVIEW

20.2.14.2. REVENUE ANALYSIS

20.2.14.3. GEOGRAPHIC PRESENCE

20.2.14.4. PRODUCT PORTFOLIO

20.2.14.5. RECENT DEVELOPMENTS

20.2.15 ELI LILLY AND COMPANY

20.2.15.1. COMPANY OVERVIEW

20.2.15.2. REVENUE ANALYSIS

20.2.15.3. GEOGRAPHIC PRESENCE

20.2.15.4. PRODUCT PORTFOLIO

20.2.15.5. RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.