Global Cardiovascular Biomaterial Market

Market Size in USD Billion

CAGR :

%

USD

14.49 Billion

USD

24.38 Billion

2024

2032

USD

14.49 Billion

USD

24.38 Billion

2024

2032

| 2025 –2032 | |

| USD 14.49 Billion | |

| USD 24.38 Billion | |

|

|

|

|

Cardiovascular Biomaterial Market Size

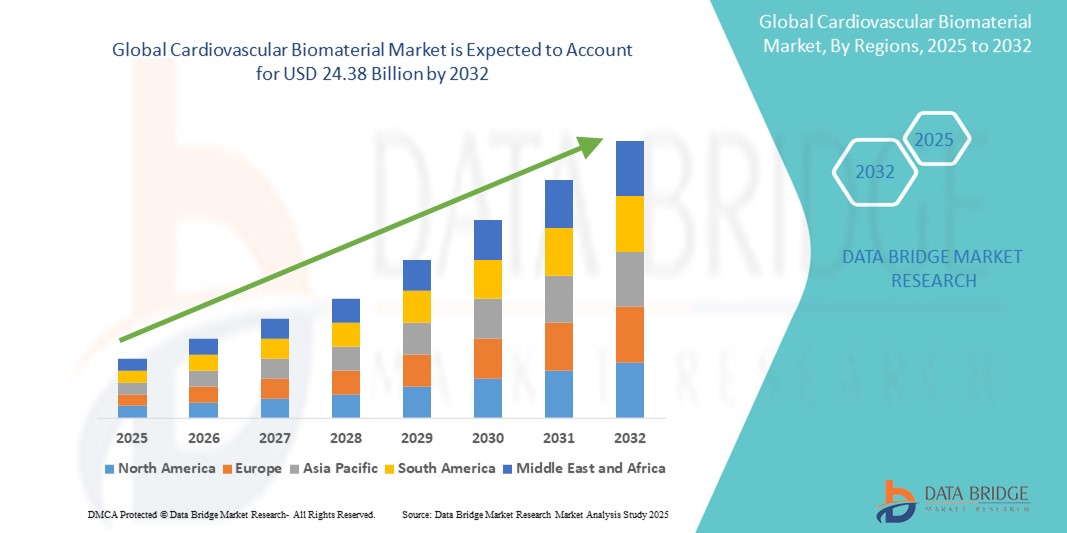

- The global cardiovascular biomaterial market size was valued at USD 14.49 billion in 2024 and is expected to reach USD 24.38 billion by 2032, at a CAGR of 6.72% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within cardiovascular implants and devices, including stents, grafts, and heart valves, which increasingly rely on advanced biomaterials for improved performance and biocompatibility

- Furthermore, rising consumer demand for safer, durable, and tissue-compatible solutions for cardiovascular surgeries is establishing biomaterials as the modern standard in cardiac care. These converging factors are accelerating the uptake of cardiovascular biomaterial solutions, thereby significantly boosting the industry's growth

Cardiovascular Biomaterial Market Analysis

- Cardiovascular biomaterials, which include synthetic and natural materials used in the development of implants, stents, grafts, and heart valves, are increasingly becoming essential components in cardiovascular treatments owing to their improved biocompatibility, durability, and ability to restore or support cardiovascular function

- The growing prevalence of cardiovascular diseases (CVDs), rising demand for minimally invasive procedures, and continuous advancements in material sciences are key factors fueling the adoption of cardiovascular biomaterials in both surgical and interventional cardiology applications

- North America dominated the cardiovascular biomaterial market with the largest revenue share of 39.7% in 2024, supported by a robust healthcare infrastructure, early adoption of innovative cardiovascular technologies, and the presence of leading medical device manufacturers. The U.S., in particular, leads the region due to strong R&D investment, favorable reimbursement policies, and a high incidence of heart-related conditions driving biomaterial-based treatment adoption

- Asia-Pacific is expected to be the fastest-growing region in the cardiovascular biomaterial market during the forecast period due to increasing urbanization, rising disposable incomes, growing geriatric population, and greater awareness regarding advanced cardiovascular treatment options in countries such as China, Japan, and India

- The Polymer segment dominated the cardiovascular biomaterial market with the largest revenue share of 38.5% in 2024, attributed to its flexibility, biocompatibility, and wide applicability in cardiovascular devices such as catheters, heart valves, and vascular grafts. Polymer-based materials offer ease of customization and lower immune rejection, driving their adoption

Report Scope and Cardiovascular Biomaterial Market Segmentation

|

Attributes |

Cardiovascular Biomaterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cardiovascular Biomaterial Market Trends

“Advancements in Biocompatibility and Material Innovation”

- A significant and accelerating trend in the global cardiovascular biomaterial Market is the continuous innovation in biomaterials used for cardiovascular applications. Companies and research institutions are increasingly focusing on improving biocompatibility, durability, and mechanical strength to ensure better integration with the human body and minimize the risk of complications such as thrombosis or immune response

- For instance, new-generation bioresorbable polymers and hybrid composites are being adopted in stents, grafts, and cardiac patches to provide temporary support while allowing natural tissue regeneration. These materials dissolve harmlessly in the body after fulfilling their function, reducing the need for secondary surgeries

- The use of polymeric and metallic biomaterials in manufacturing vascular grafts, heart valves, and pacemaker leads is enabling enhanced flexibility and performance. Titanium and nitinol are gaining popularity for their strength, fatigue resistance, and shape memory properties, making them ideal for stents and minimally invasive devices

- Moreover, ceramic and natural biomaterials are being explored for their anticoagulant properties, improving patient outcomes in procedures involving blood-contacting surfaces. Their ability to reduce the risk of clot formation is particularly valuable in high-risk cardiovascular patients

- As cardiovascular diseases remain one of the leading causes of morbidity and mortality worldwide, the demand for safe, effective, and long-lasting biomaterials is growing. The integration of such innovative materials into next-generation cardiovascular implants and delivery systems is expected to drive market growth across both developed and emerging regions

- These developments are not only enhancing the safety and functionality of cardiovascular devices but also aligning with global trends toward personalized and minimally invasive treatment strategies, thus expanding the market potential over the coming years

Cardiovascular Biomaterial Market Dynamics

Driver

“Growing Need Due to Increasing Cardiovascular Disease Prevalence and Technological Advancements”

- The rising global burden of cardiovascular diseases (CVDs), coupled with advancements in medical materials and implant technologies, is significantly driving the demand for cardiovascular biomaterials

- For instance, in April 2024, DSM-Firmenich announced an innovation in bioresorbable polymers for use in cardiovascular stents, aiming to reduce complications and improve long-term patient outcomes. Such strategic initiatives by leading companies are expected to fuel the cardiovascular biomaterial industry growth during the forecast period

- As healthcare providers and patients increasingly seek solutions that enhance healing, minimize post-operative complications, and improve the durability of implants, cardiovascular biomaterials provide a robust upgrade over traditional materials

- Furthermore, the increasing adoption of minimally invasive surgeries and the need for biocompatible, long-lasting materials are making cardiovascular biomaterials a cornerstone in modern cardiac care, with seamless integration into stents, grafts, pacemakers, and valves

- The convenience of reduced surgical complications, improved patient recovery, and enhanced therapeutic outcomes are major factors propelling the adoption of these biomaterials in hospitals, cardiac centers, and research institutions. The trend toward personalized medicine and advanced regenerative therapies also contributes to sustained market demand

Restraint/Challenge

“High Manufacturing Costs and Stringent Regulatory Approvals”

- The complex manufacturing processes and high-quality standards required for cardiovascular biomaterials lead to elevated production costs, posing a major barrier to wider adoption, especially in price-sensitive markets

- For instance, obtaining regulatory clearance from bodies such as the FDA or EMA requires extensive clinical validation and testing, which increases development timelines and costs, discouraging small or new entrants from investing in the sector

- Addressing these concerns through the adoption of cost-effective biopolymers, innovations in material science, and improved manufacturing scalability is vital for market expansion

- In addition, while the long-term benefits of cardiovascular biomaterials are widely acknowledged, the high upfront cost associated with devices made from these materials can limit accessibility in emerging markets

- Overcoming these challenges through greater R&D funding, faster regulatory pathways, and strategic collaborations between biotech firms and healthcare providers will be essential to sustain growth in the cardiovascular biomaterial industry

Cardiovascular Biomaterial Market Scope

The market is segmented on the basis of type and product.

- By Type

On the basis of type, the cardiovascular biomaterial market is segmented into natural, ceramic, metallic, and polymer. The Polymer segment dominated the market with the largest revenue share of 38.5% in 2024, attributed to its flexibility, biocompatibility, and wide applicability in cardiovascular devices such as catheters, heart valves, and vascular grafts. Polymer-based materials offer ease of customization and lower immune rejection, driving their adoption.

The Metallic segment is expected to witness the fastest CAGR of 24.2% from 2025 to 2032, due to its superior mechanical strength, corrosion resistance, and growing use in stents, pacemakers, and defibrillators. Advancements in materials such as nitinol and titanium further support segment growth by improving long-term implant performance.

- By Product

On the basis of product, the cardiovascular biomaterial market is segmented into catheters, stents, implantable cardiac defibrillators, pacemakers, sensors, heart valves, vascular grafts, guidewires, and ventricular assist devices. The stents segment accounted for the largest revenue share of 26.7% in 2024, driven by the increasing prevalence of coronary artery disease and the widespread use of cardiovascular stents in minimally invasive surgeries. The development of drug-eluting and bioresorbable stents further accelerates growth.

The heart valves segment is anticipated to register the fastest CAGR of 23.1% from 2025 to 2032, fueled by the growing elderly population, rising cases of valvular disorders, and innovations in transcatheter valve replacement (TAVR) procedures using advanced biomaterials.

Cardiovascular Biomaterial Market Regional Analysis

- North America dominated the cardiovascular biomaterial market with the largest revenue share of 39.7% in 2024, driven by a high prevalence of cardiovascular diseases, strong healthcare infrastructure, and advanced adoption of innovative biomaterials for cardiac devices and surgeries

- The region benefits from robust R&D investments, favorable reimbursement policies, and the presence of leading market players focused on developing next-generation cardiovascular implants and prosthetics

- This dominance is further supported by the growing elderly population, rising number of heart surgeries, and increasing preference for minimally invasive procedures utilizing biocompatible materials in both hospital and ambulatory settings

U.S. Cardiovascular Biomaterial Market Insight

The U.S. cardiovascular biomaterial market captured the largest revenue share of 80.3% in 2024 within North America, driven by rising incidences of heart-related ailments and strong clinical research initiatives. The U.S. leads in the adoption of biomaterials such as polymers, ceramics, and composites used in stents, heart valves, and vascular grafts. Continuous FDA approvals, strategic partnerships between medtech firms and research institutions, and public awareness regarding early diagnosis and surgical interventions are further fueling the growth.

Europe Cardiovascular Biomaterial Market Insight

The Europe cardiovascular biomaterial market is projected to grow at a CAGR of 10.8% during the forecast period, propelled by increasing regulatory support for innovative biomaterial use and a steady rise in cardiovascular disorders. The region’s push toward biocompatible and sustainable materials, along with growing investments in healthcare infrastructure, is facilitating adoption across both public and private healthcare settings. Germany, France, and the U.K. remain key contributors to market growth due to their advanced surgical capabilities and presence of leading academic research hubs.

U.K. Cardiovascular Biomaterial Market Insight

The U.K. cardiovascular biomaterial market is expected to grow at a CAGR of 9.6% during the forecast period, driven by a surge in demand for advanced cardiovascular implants and growing collaborations between the NHS and biotech firms. Increased health awareness, along with rising cases of heart disease and government emphasis on enhancing cardiac care, is stimulating the need for biomaterials designed for better patient outcomes and reduced procedural complications.

Germany Cardiovascular Biomaterial Market Insight

The Germany cardiovascular biomaterial market is forecast to expand at a CAGR of 10.2%, owing to the country’s strong manufacturing base in medical devices and its focus on eco-friendly, high-performance materials. Germany’s progressive research in nanotechnology, biodegradable polymers, and tissue engineering, coupled with high patient volumes in cardiovascular interventions, is bolstering the market.

Asia-Pacific Cardiovascular Biomaterial Market Insight

The Asia-Pacific cardiovascular biomaterial market is poised to grow at the fastest CAGR of 13.4% from 2025 to 2032, driven by rapid urbanization, rising disposable income, and a growing geriatric population in countries such as China, Japan, and India. Government initiatives aimed at improving cardiovascular care, along with the increasing availability of cost-effective biomaterial solutions, are boosting adoption. Additionally, local manufacturing capabilities and clinical trials are further strengthening the regional market presence.

Japan Cardiovascular Biomaterial Market Insight

The Japan cardiovascular biomaterial market is expanding rapidly due to its high-tech infrastructure, aging demographics, and increased prevalence of ischemic heart diseases. The country is focusing on the integration of next-generation biomaterials in cardiovascular surgeries, supported by strong government investments in medical innovation and public health campaigns promoting early intervention and minimally invasive treatments.

China Cardiovascular Biomaterial Market Insight

The China cardiovascular biomaterial market held the largest revenue share in the Asia-Pacific region in 2024, attributed to increasing cardiovascular disease incidence, growing medical tourism, and extensive investment in smart healthcare infrastructure. Domestic production of stents and vascular grafts using advanced biomaterials, as well as favorable policies supporting biotech innovations, are accelerating market growth. In addition, collaborations with Western companies are improving product quality and expanding access in rural and urban areas alike.

Cardiovascular Biomaterial Market Share

The cardiovascular biomaterial industry is primarily led by well-established companies, including:

- DSM-Firmenich (Netherlands)

- Wright Medical Group N.V. (U.S.)

- Zimmer Biomet (U.S.)

- Bayer AG (Germany)

- BASF (Germany)

- CRS Holdings LLC. (U.S.)

- Invibio Ltd. (U.K.)

- Foster Corporation (U.S.)

- CVD Equipment Corporation (U.S.)

- Abbott (U.S.)

- Baxter (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- BD (U.S.)

- Molnlycke AB (Sweden)

- Smith+Nephew (U.K.)

- Integra LifeSciences Corporation (U.S.)

- Messe-Düsseldorf GmbH (Germany)

- AnteoTech (Australia)

- ANYGEN (South Korea)

Latest Developments in Global Cardiovascular Biomaterial Market

- In October 2023, Abbott, a leader in medical technology, announced its acquisition of Tendyne Holding, Inc. This strategic acquisition strengthens Abbott's structural heart portfolio by incorporating transcatheter mitral valve replacement (TMVR) therapies. The move enhances Abbott’s ability to offer advanced heart valve solutions and expand its presence in the structural heart market

- In August 2023, Zimmer Biomet introduced the Persona Q-Fix Femoral System, a significant advancement in minimally invasive total hip arthroplasty (THA). This innovative system is designed to enhance surgical efficiency and offer surgeons better control with a more streamlined approach. The launch marks a key development in improving patient outcomes and simplifying the THA procedure

- In May 2023, Johnson & Johnson's Medical Devices segment announced a partnership with Cardiovascular Imaging Solutions (CIS) to develop and commercialize a next-generation intravascular imaging system for peripheral vascular interventions. The collaboration leverages CIS’s expertise in optical coherence tomography (OCT) technology alongside Johnson & Johnson’s strengths in medical device development and commercialization. This alliance aims to advance imaging capabilities and improve patient outcomes in peripheral vascular procedures

- In April 2023, CRS Holdings Inc. and Bioventus LLC merged to form a single entity under the Bioventus name, marking a significant milestone in the biomaterials market. This merger is set to create a global leader in orthobiologic and soft tissue solutions, capitalizing on synergies in R&D, manufacturing, and distribution. The unified company aims to drive innovation, particularly in the cardiovascular biomaterial sector

- In February 2023, Covestro introduced Makrolon 3638 polycarbonate, designed for healthcare and life science applications. This durable polycarbonate grade is engineered to withstand daily use while maintaining its structural integrity. The launch highlights Covestro's commitment to providing high-performance materials for critical medical and scientific uses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.