Global Cardiovascular Genetic Testing Market

Market Size in USD Billion

CAGR :

%

USD

11.21 Billion

USD

26.22 Billion

2025

2033

USD

11.21 Billion

USD

26.22 Billion

2025

2033

| 2026 –2033 | |

| USD 11.21 Billion | |

| USD 26.22 Billion | |

|

|

|

|

Cardiovascular Genetic Testing Market Size

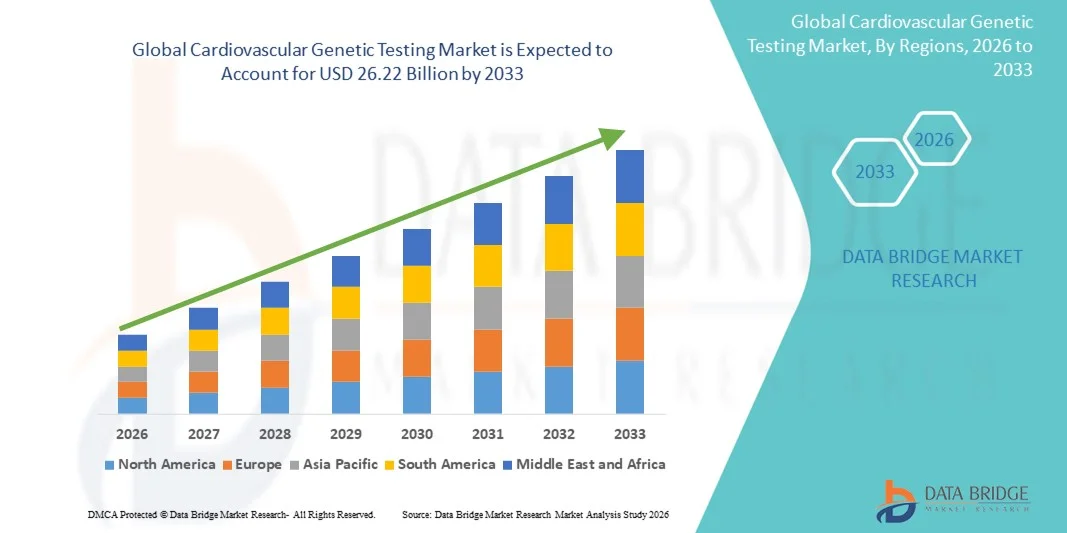

- The global cardiovascular genetic testing market size was valued at USD 11.21 billion in 2025 and is expected to reach USD 26.22 billion by 2033, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by increasing awareness of hereditary cardiovascular conditions, advancements in genetic testing technologies, and integration of precision medicine approaches in clinical practice, leading to more personalized patient care

- Furthermore, rising demand from healthcare providers and patients for early detection, risk assessment, and tailored treatment strategies is positioning cardiovascular genetic testing as a critical component of preventive cardiology. These converging factors are driving the adoption of genetic testing solutions, thereby significantly boosting the industry's growth

Cardiovascular Genetic Testing Market Analysis

- Cardiovascular genetic testing, providing insights into inherited heart conditions and susceptibility to cardiovascular diseases, is increasingly becoming a crucial tool in personalized medicine and preventive cardiology for both clinical and research applications due to its ability to enable early detection, risk stratification, and targeted interventions

- The rising demand for cardiovascular genetic testing is primarily driven by growing awareness of hereditary heart conditions, advancements in genomic technologies, and increasing integration of precision medicine approaches in routine healthcare practice

- North America dominated the cardiovascular genetic testing market with the largest revenue share of 42.9% in 2025, characterized by high healthcare expenditure, early adoption of advanced genetic technologies, and the presence of key industry players, with the U.S. experiencing significant uptake in testing for familial hypercholesterolemia, cardiomyopathies, and arrhythmia-related genetic disorders, supported by innovations from both established diagnostic companies and emerging biotech startups

- Asia-Pacific is expected to be the fastest-growing region in the cardiovascular genetic testing market during the forecast period due to increasing awareness of genetic testing, growing prevalence of cardiovascular diseases, and expanding healthcare infrastructure

- Predictive testing segment dominated the cardiovascular genetic testing market with a market share of 46.8% in 2025, driven by its critical role in early risk assessment and guiding preventive or therapeutic interventions for at-risk populations

Report Scope and Cardiovascular Genetic Testing Market Segmentation

|

Attributes |

Cardiovascular Genetic Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cardiovascular Genetic Testing Market Trends

Integration of AI and Predictive Analytics in Genetic Testing

- A notable trend in the global cardiovascular genetic testing market is the increasing integration of artificial intelligence (AI) and predictive analytics with genomic testing platforms, significantly improving risk assessment, early diagnosis, and personalized treatment strategies

- For instance, AI-driven platforms such as CardiAI can analyze complex genetic data to identify variants associated with inherited cardiovascular diseases, assisting clinicians in developing tailored intervention plans for at-risk patients

- AI algorithms can also learn patient-specific patterns, enhancing predictive accuracy for conditions such as cardiomyopathies and arrhythmias, while providing actionable insights for preventive care

- The seamless combination of genetic testing results with electronic health records and digital health platforms enables clinicians to manage cardiovascular risk more holistically, integrating lifestyle, biomarker, and genomic data in a single interface

- This trend toward smarter, data-driven, and predictive cardiovascular care is reshaping clinical practice, with companies such as Invitae developing AI-enhanced genetic tests to deliver more accurate diagnostics and actionable recommendations

- The demand for cardiovascular genetic testing platforms that leverage AI and predictive analytics is growing rapidly, as healthcare providers and patients increasingly seek early, precise, and personalized cardiovascular risk management solutions

- Integration with telemedicine platforms is emerging as a trend, allowing patients to receive genetic counseling and test interpretations remotely, improving access in rural and underserved regions

- Collaborations between diagnostic companies and pharmaceutical firms for genotype-guided drug therapy development are gaining momentum, providing new opportunities for precision therapeutics in cardiovascular care

Cardiovascular Genetic Testing Market Dynamics

Driver

Rising Awareness of Hereditary Cardiovascular Conditions and Precision Medicine

- The growing awareness of inherited heart diseases and the increasing adoption of precision medicine are key drivers propelling the demand for cardiovascular genetic testing

- For instance, in March 2025, Myriad Genetics launched a new cardiovascular gene panel to enable early detection and risk stratification for familial hypercholesterolemia and cardiomyopathies, highlighting the role of targeted testing in preventive care

- As healthcare providers and patients prioritize early detection, genetic testing offers actionable insights for risk management, therapy selection, and lifestyle interventions

- Furthermore, the expanding availability of next-generation sequencing (NGS) technologies and cost-effective testing options is making genetic screening more accessible and clinically relevant

- The ability to integrate genetic data into personalized care plans, guide pharmacogenomic decisions, and inform family-based risk assessment is reinforcing the adoption of cardiovascular genetic testing globally

- Increasing investments in genetic research, awareness campaigns, and precision medicine programs are driving uptake among healthcare institutions, cardiologists, and patients seeking advanced, individualized cardiovascular care

- The rising incidence of cardiovascular diseases worldwide is pushing hospitals and clinics to adopt genetic testing as part of preventive cardiology programs to reduce long-term healthcare costs

- Government and insurance initiatives supporting reimbursement for genetic tests are further incentivizing adoption, particularly in regions with high prevalence of hereditary heart conditions

Restraint/Challenge

Data Privacy Concerns and High Cost of Advanced Testing

- Privacy and data security concerns regarding sensitive genetic information pose a significant challenge to the broader adoption of cardiovascular genetic testing

- For instance, reported data breaches involving genomic databases have made some patients hesitant to share their genetic data for testing or research purposes

- Ensuring secure storage, encrypted transmission, and strict regulatory compliance is essential to maintain patient trust and facilitate adoption of genetic testing

- In addition, the relatively high cost of comprehensive genetic tests, especially those employing whole-genome or multi-gene panels, can limit accessibility for price-sensitive patients or healthcare systems in developing regions

- While targeted or single-gene tests are becoming more affordable, advanced testing platforms with predictive analytics or AI integration often come with premium pricing, restricting widespread adoption

- Addressing these challenges through stronger data protection measures, regulatory alignment, patient education, and cost-reduction strategies will be critical to sustaining growth in the cardiovascular genetic testing market

- Variability in regulatory frameworks across countries creates complexity for companies seeking global market expansion, potentially delaying product launches or increasing compliance costs

- Limited awareness among patients and some healthcare providers about the clinical utility and benefits of cardiovascular genetic testing can hinder adoption, underscoring the need for education and outreach programs

Cardiovascular Genetic Testing Market Scope

The market is segmented on the basis of disease, technology, testing type, and application.

- By Disease

On the basis of disease, the cardiovascular genetic testing market is segmented into inherited cardiomyopathies, hypertrophic cardiomyopathy (HCM), dilated cardiomyopathy (DCM), arrhythmia, aortopathies, and others. The inherited cardiomyopathies segment dominated the market with the largest market revenue share of 38.5% in 2025, driven by the high prevalence of genetic heart conditions and the critical need for early risk identification. Patients and clinicians increasingly rely on genetic testing to detect mutations that predispose to severe cardiac events, enabling timely interventions and personalized treatment. This segment benefits from robust awareness campaigns and established diagnostic guidelines, making inherited cardiomyopathies a key focus for genetic testing providers. In addition, technological advancements in multi-gene panels and next-generation sequencing have enhanced the detection accuracy for this disease group. Genetic counseling services accompanying testing further reinforce market adoption. The growing emphasis on preventive cardiology and family-based screening programs ensures continued demand for inherited cardiomyopathy testing.

The arrhythmia segment is anticipated to witness the fastest growth rate of 22.1% from 2026 to 2033, fueled by rising awareness of sudden cardiac death risks and the critical role of genetic mutations in arrhythmic disorders. Testing for arrhythmias allows physicians to identify at-risk individuals early and implement preventive or therapeutic measures, such as implantable cardioverter-defibrillators (ICDs) or lifestyle interventions. The segment growth is further supported by increasing adoption in cardiac specialty clinics and hospitals and by emerging AI-assisted diagnostic platforms that enhance mutation detection and interpretation. Patients’ interest in early diagnosis and personalized management of arrhythmias is also boosting market uptake. Moreover, regulatory approvals for new arrhythmia-focused genetic tests are encouraging broader clinical adoption. Research collaborations between academic institutions and biotech companies are expanding the range of arrhythmia-related genetic panels available globally.

- By Technology

On the basis of technology, the cardiovascular genetic testing market is segmented into cytogenetic testing, biochemical testing, and molecular testing. The molecular testing segment dominated the market with the largest market revenue share of 45.7% in 2025, driven by its high accuracy in detecting specific gene mutations linked to cardiovascular disorders. Molecular testing techniques, including PCR and next-generation sequencing, enable clinicians to identify rare variants and tailor interventions accordingly. The segment is favored due to its versatility, reliability, and compatibility with multi-gene panels for comprehensive cardiac risk assessment. Molecular testing is widely adopted in specialized cardiac genetics labs and tertiary hospitals. Continuous technological advancements and decreasing costs are also driving wider adoption. Furthermore, molecular testing is increasingly integrated with AI platforms to provide predictive insights for patient management.

The biochemical testing segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, fueled by growing interest in functional assays that measure protein or enzyme activity associated with cardiovascular genetic disorders. Biochemical tests provide complementary information to molecular testing, offering insights into gene expression and pathway dysregulation. The rise of point-of-care biochemical testing devices and their ease of use is further supporting market growth. Hospitals and diagnostic centers are increasingly incorporating biochemical testing for rapid and cost-effective assessment. Emerging applications in pharmacogenomics also contribute to the growth of this segment. Collaborations with research institutions are expanding the development of novel biochemical markers for cardiovascular risk prediction.

- By Testing Type

On the basis of testing type, the cardiovascular genetic testing market is segmented into predictive testing, carrier testing, prenatal and newborn testing, diagnostic testing, pharmacogenomic testing, and others. The predictive testing segment dominated the market with a market share of 46.8% in 2025, driven by its critical role in early risk assessment and guiding preventive interventions for genetically predisposed individuals. Predictive testing enables clinicians to implement lifestyle modifications, targeted surveillance, or prophylactic therapies, reducing the burden of cardiovascular events. The segment benefits from growing patient awareness and expanding preventive cardiology programs. In addition, integration with electronic health records and telemedicine platforms enhances accessibility and utility. Predictive testing is often recommended in family-based genetic counseling, further boosting market adoption. Regulatory support and reimbursement policies in developed countries also favor predictive testing uptake.

The pharmacogenomic testing segment is expected to witness the fastest growth rate of 23.4% from 2026 to 2033, fueled by increasing demand for genotype-guided therapy optimization in cardiovascular disease management. Pharmacogenomic testing helps physicians personalize drug selection and dosage, improving treatment efficacy and reducing adverse effects. Rising adoption in hospital-based cardiology departments and specialty clinics is accelerating growth. Integration with molecular and biochemical testing platforms enhances predictive accuracy. Moreover, partnerships between diagnostic companies and pharmaceutical firms are expanding the availability of pharmacogenomic tests globally. Increasing awareness among healthcare providers and patients about the benefits of personalized medicine further drives market expansion.

- By Application

On the basis of application, the cardiovascular genetic testing market is segmented into chromosome analysis, genetic disease diagnosis, cardiovascular disease diagnosis, and others. The cardiovascular disease diagnosis segment dominated the market with the largest market revenue share of 41.2% in 2025, driven by the increasing prevalence of heart disease and the necessity for early genetic screening to prevent life-threatening events. Clinicians leverage genetic testing to identify mutations responsible for cardiomyopathies, arrhythmias, and aortopathies, enabling personalized treatment strategies. The segment benefits from growing healthcare infrastructure and the integration of genetic testing into preventive cardiology programs. Advanced sequencing technologies and multi-gene panels are enhancing diagnostic accuracy. Increased patient awareness and family-based screening initiatives further support adoption. Healthcare providers are incorporating genetic data into treatment planning, further solidifying market growth.

The chromosome analysis segment is expected to witness the fastest CAGR of 21.9% from 2026 to 2033, fueled by rising demand for cytogenetic testing to detect structural and numerical chromosomal abnormalities associated with congenital cardiovascular disorders. Chromosome analysis supports prenatal and newborn screening, allowing early intervention and management strategies. Growth is supported by the integration of high-resolution imaging and molecular cytogenetics techniques. Hospitals and diagnostic labs are expanding capabilities to offer chromosomal testing as part of comprehensive cardiovascular diagnostics. Regulatory approvals and clinical guidelines recommending chromosomal assessment for at-risk populations drive adoption. Ongoing research initiatives are improving the speed and accuracy of chromosome analysis, making it increasingly accessible globally.

Cardiovascular Genetic Testing Market Regional Analysis

- North America dominated the cardiovascular genetic testing market with the largest revenue share of 42.9% in 2025, characterized by high healthcare expenditure, early adoption of advanced genetic technologies, and the presence of key industry players

- Healthcare providers and patients in the region increasingly rely on genetic testing for early detection, risk assessment, and personalized treatment strategies for conditions such as cardiomyopathies, arrhythmias, and familial hypercholesterolemia

- This widespread adoption is further supported by high healthcare expenditure, strong research and development activities, and favorable reimbursement policies, establishing cardiovascular genetic testing as a critical tool in preventive cardiology and clinical decision-making

U.S. Cardiovascular Genetic Testing Market Insight

The U.S. cardiovascular genetic testing market captured the largest revenue share of 78% in 2025 within North America, fueled by the rapid adoption of advanced genomic technologies and precision medicine. Patients and healthcare providers are increasingly prioritizing early detection and personalized management of inherited cardiovascular conditions. The growing demand for predictive testing, integration with electronic health records, and telemedicine platforms further propels market growth. Moreover, strong investments in research, favorable reimbursement policies, and collaborations between diagnostic companies and healthcare providers are significantly contributing to the market’s expansion.

Europe Cardiovascular Genetic Testing Market Insight

The Europe cardiovascular genetic testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of hereditary cardiovascular diseases and supportive healthcare policies. The region is witnessing growing adoption of genetic testing in both preventive cardiology and clinical diagnostics. Urbanization, technological advancement, and a focus on personalized medicine are fostering the use of cardiovascular genetic tests. European healthcare providers are integrating testing into routine care, enhancing patient outcomes. In addition, regulatory frameworks and reimbursement programs are promoting broader market acceptance.

U.K. Cardiovascular Genetic Testing Market Insight

The U.K. cardiovascular genetic testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of inherited heart conditions and the increasing trend of precision medicine. Healthcare providers and patients are emphasizing early risk assessment and preventive interventions. Moreover, concerns regarding familial cardiovascular risks are encouraging widespread adoption of predictive and diagnostic testing. The U.K.’s robust healthcare infrastructure and adoption of digital health technologies are expected to continue stimulating market growth. Integration with telehealth and genomic counseling services further enhances accessibility and utilization.

Germany Cardiovascular Genetic Testing Market Insight

The Germany cardiovascular genetic testing market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of genetic heart disorders and advancements in molecular testing technologies. Germany’s well-developed healthcare system, emphasis on innovation, and preventive care initiatives are promoting adoption. Hospitals and specialty clinics are increasingly implementing genetic testing in cardiovascular disease management. Integration with digital health platforms and AI-driven analysis is gaining traction. The demand for accurate, privacy-compliant testing solutions aligns with local patient expectations and regulatory requirements.

Asia-Pacific Cardiovascular Genetic Testing Market Insight

The Asia-Pacific cardiovascular genetic testing market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by increasing prevalence of cardiovascular diseases, rising awareness of hereditary risks, and expanding healthcare infrastructure in countries such as China, Japan, and India. Government initiatives promoting preventive healthcare and genomics research are accelerating adoption. Furthermore, growing disposable incomes and technological advancement are increasing accessibility of genetic testing services. The region is also witnessing the entry of international and domestic diagnostic providers, further boosting market growth.

Japan Cardiovascular Genetic Testing Market Insight

The Japan cardiovascular genetic testing market is gaining momentum due to high healthcare standards, technological adoption, and an aging population with rising cardiovascular disease prevalence. Genetic testing is increasingly used for early risk detection, disease management, and personalized therapeutic strategies. Integration with digital health records and telemedicine platforms enhances accessibility and patient monitoring. Growing focus on precision medicine and preventive cardiology is driving adoption across clinical and specialty cardiology centers. Collaborative initiatives between research institutions and biotech firms are expanding the range of available tests.

India Cardiovascular Genetic Testing Market Insight

The India cardiovascular genetic testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing cardiovascular disease prevalence, and a growing awareness of hereditary conditions. Expanding healthcare infrastructure, rising disposable incomes, and the emergence of domestic diagnostic companies are key growth drivers. Preventive healthcare initiatives and government programs promoting genetic testing are further boosting market adoption. Affordable testing solutions and integration with digital health platforms are improving accessibility across urban and semi-urban regions. The rising middle-class population is increasingly investing in early detection and personalized cardiovascular care.

Cardiovascular Genetic Testing Market Share

The Cardiovascular Genetic Testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Danaher (U.S.)

- Daan Gene Co., Ltd. (Canada)

- F. Hoffmann La Roche Ltd (Switzerland)

- Genentech, Inc. (U.S.)

- Genomictree, Inc. (South Korea)

- HTG Molecular Diagnostics, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Integragen (France)

- Laboratory Corporation of America Holdings (U.S.)

- Luminex Corporation (U.S.)

- Molecular MD Corp. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Natera, Inc. (U.S.)

- Oxford Biodynamics Plc (U.K.)

- PacBio (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (Germany)

- Thermo Fisher Scientific, Inc. (U.S.)

What are the Recent Developments in Global Cardiovascular Genetic Testing Market?

- In September 2025, Mass General Brigham (MGH) and Broad Clinical Labs jointly launched a genetic test for inherited risk across eight cardiovascular conditions, including atrial fibrillation, coronary artery disease, hypertension, and aortic aneurysm. The test uses integrated polygenic risk scores (PRS) derived from large-scale genomic data

- In July 2025, Everygene (a precision-health company) initiated a no-cost nationwide genetic testing program for cardiomyopathy, in collaboration with Broad Clinical Labs and the Laboratory for Molecular Medicine at Mass General Brigham. This program offers molecular testing and expert genetic counselling to patients suspected of genetic cardiomyopathy

- In October 2023, Cardio Diagnostics Holdings published a validation study of PrecisionCHD in the Journal of the American Heart Association, done in collaboration with Intermountain Healthcare and University of Iowa Hospitals & Clinics. The study demonstrated the clinical utility of the integrated genetic-epigenetic test

- In June 2023, Cardio Diagnostics Holdings, Inc. launched PrecisionCHD™, a novel AI-driven blood test that integrates genetic + epigenetic biomarkers to detect coronary heart disease (CHD), enabling remote and scalable deployment

- In April 2023, Illumina announced a collaboration with Henry Ford Health to launch “CardioSeq,” a study employing whole-genome sequencing (WGS) to evaluate how comprehensive genomic testing can influence clinical care in cardiovascular disease, particularly among underserved populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.