Global Care Services Market

Market Size in USD Million

CAGR :

%

USD

163.56 Million

USD

321.16 Million

2024

2032

USD

163.56 Million

USD

321.16 Million

2024

2032

| 2025 –2032 | |

| USD 163.56 Million | |

| USD 321.16 Million | |

|

|

|

|

Care Services Market Size

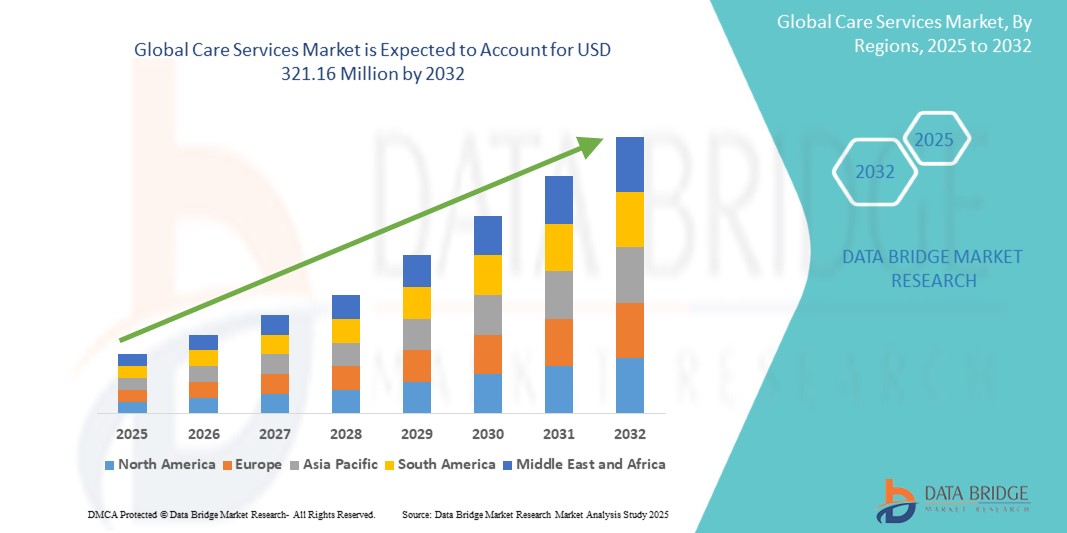

- The global care services market was valued at USD 163.56 million in 2024 and is expected to reach USD 321.16 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.80%, primarily driven by factors such as the aging global population and technological advancements

- This growth is fueled by the increasing demand for elderly care, especially home care and nursing services, as well as innovations like telemedicine and remote monitoring technologies

Care Services Market Analysis

- The global care services market encompasses a broad range of healthcare services, including home healthcare, elderly care, palliative care, and rehabilitation services. These services are essential for managing chronic diseases, post-surgical recovery, and long-term healthcare needs

- Demand for care services is primarily driven by the growing aging population, increasing prevalence of chronic diseases, and a shift towards value-based care models. Governments and healthcare organizations worldwide are focusing on expanding care services to reduce hospital readmissions and improve patient outcomes

- The North America region leads in care services market growth, supported by strong healthcare policies, insurance coverage, and an increasing preference for home-based care solutions

- For instance, in the U.S., the home healthcare market has experienced significant expansion due to Medicare and private insurance reimbursements, enabling more patients to receive care outside of hospital settings

- Globally, home healthcare services rank among the fastest-growing segments in the care services market, driven by advancements in telehealth, remote monitoring, and caregiver support technologies. These innovations enhance accessibility, affordability, and efficiency in delivering healthcare services

Report Scope and Care Services Market Segmentation

|

Attributes |

Care Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Care Services Market Trends

“Increased Adoption of Telemedicine and Remote Monitoring Technologies”

- One prominent trend in the global care services market is the growing adoption of telemedicine and remote monitoring technologies

- These advancements enhance the accessibility and efficiency of care services by enabling healthcare providers to monitor patients remotely and deliver consultations through digital platforms

- For instance, telemedicine allows patients to receive medical advice and treatment from the comfort of their homes, reducing the need for physical visits and improving convenience

- Remote monitoring technologies facilitate continuous tracking of patients' health metrics, such as heart rate, blood pressure, and glucose levels, which is crucial for managing chronic conditions

- This trend is revolutionizing the way ophthalmic surgeries are performed, improving patient outcomes and increasing the demand for technologically advanced microscopes in the This trend is transforming the delivery of care services, improving patient outcomes, and increasing the demand for innovative digital solutions in the market

Care Services Market Dynamics

Driver

“Growing Need Due to Aging Population and Chronic Disease Prevalence”

- The rising global elderly population is a significant factor driving the demand for care services, including home healthcare, assisted living, nursing care, and palliative car

- With advancements in healthcare prolonging life expectancy, a growing number of individuals require long-term care and specialized medical attention, leading to an expansion in the care services sector

- Chronic diseases such as Alzheimer's, Parkinson’s, cardiovascular diseases, and diabetes are becoming more prevalent, necessitating continuous medical and non-medical care, thus increasing the demand for professional caregiving services

- Technological advancements in healthcare delivery, such as telehealth, remote monitoring, and AI-assisted care management, further enhance the quality and accessibility of care services

- The shortage of skilled caregivers and nurses in many regions has led to higher investments in training programs and recruitment efforts to meet the growing demand for professional care services

For instance,

- In July 2022, according to an article published by the National Center for Biotechnology Information (NCBI), the proportion of the elderly population is increasing rapidly, with individuals aged 65 years and older projected to account for 16% of the global population by 2050. This demographic shift highlights the growing need for elderly care services, including home-based and institutional care, driving market expansion

- In December 2021, an NCBI article reported that in countries such as the U.S., Japan, and Germany, the number of individuals aged 80 years and older is expected to double by 2050, significantly increasing healthcare needs and long-term care requirements. This trend acts as a key driver for the global care services market, emphasizing the need for sustainable care solutions to cater to the aging population

- As the aging population and prevalence of chronic diseases continue to rise, the demand for comprehensive care services, including home healthcare, nursing homes, and elderly assistance programs, is expected to experience significant growth

Opportunity

“Revolutionizing Care Services with Artificial Intelligence Integration”

- AI-powered solutions in the care services market are transforming patient care, improving efficiency, and enhancing personalized healthcare delivery. AI-driven analytics can predict patient deterioration, optimize care plans, and assist caregivers in providing better, more targeted support

- AI-based virtual assistants and chatbots are increasingly being used in elder care and home healthcare settings to monitor patients, remind them to take medications, and provide instant medical guidance

- Predictive analytics powered by AI can help healthcare providers anticipate health declines in elderly patients, enabling early interventions that improve long-term health outcomes

- AI-driven robotic caregivers and smart monitoring systems are improving patient mobility, ensuring safety, and reducing the workload for human caregivers, leading to better quality care

- The integration of AI in electronic health records (EHR) and remote patient monitoring (RPM) allows for real-time data analysis, ensuring timely medical decisions and reducing hospital readmissions

For instance,

- In January 2025, according to an article published in the JMA Journal, AI-based predictive models have demonstrated the ability to assess patient health data in real time, allowing care providers to anticipate health declines in elderly patients and prevent hospitalizations. The use of AI in care services is revolutionizing chronic disease management, enabling proactive interventions

- In November 2023, according to an article published in the National Library of Medicine, AI-powered virtual assistants have been shown to enhance elderly care by providing medication reminders, monitoring vital signs, and detecting emergencies such as falls. These systems have improved response times and reduced health risks for elderly individuals receiving home care

- The adoption of AI in the care services market is driving improved patient outcomes, enhanced operational efficiency, and reduced caregiver burden. By leveraging AI-powered predictive analytics, robotic assistance, and smart monitoring tools, care providers can deliver more effective, personalized, and proactive care, ultimately enhancing the quality of life for aging populations and individuals with chronic conditions

Restraint/Challenge

“High Service Costs Hindering Market Accessibility”

- The high cost of care services poses a significant challenge for market expansion, particularly affecting the affordability of services for lower-income individuals and families

- Long-term care services, including nursing homes, assisted living, and home healthcare, require substantial financial investment, making them inaccessible for many individuals without adequate insurance or government support

- The rising costs of skilled nursing care, home health aides, and specialized medical services further contribute to financial burdens on both patients and caregivers, limiting the widespread adoption of professional care services

- Many elderly individuals rely on fixed incomes, making it difficult to afford quality care without significant financial assistance, leading to disparities in access to essential services

For instance,

- In November 2024, according to an article published by the World Health Organization (WHO), one of the main concerns surrounding the rising cost of care services is its potential impact on accessibility and affordability. The financial burden associated with long-term care services, particularly in private facilities, often prevents lower-income individuals from receiving adequate care, thereby exacerbating healthcare inequalities

- Consequently, such financial barriers contribute to disparities in the availability and quality of care, particularly in underprivileged communities. The high cost of care services hinders market growth, limiting access to essential healthcare for aging populations and individuals with chronic conditions

Care Services Market Scope

The market is segmented on the basis components, delivery model, application, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Components |

|

|

By Delivery Mode |

|

|

By Application |

|

|

By End Use |

|

Care Services Market Regional Analysis

“North America is the Dominant Region in the Care Services Market”

- North America leads the global care services market, driven by a well-developed healthcare system, increasing aging population, and high demand for long-term and home-based care services

- The U.S. holds a significant market share due to its growing elderly population, rising prevalence of chronic diseases, and increasing government support for elderly and disability care programs

- Favorable reimbursement policies and strong insurance coverage for long-term care services further contribute to market growth, enabling more individuals to access professional care

- The presence of key industry players, along with continuous investments in healthcare infrastructure and technological advancements such as AI-driven monitoring systems and telehealth solutions, supports market expansion

- Additionally, the rising adoption of personalized and home-based care solutions, coupled with a preference for aging in place, is fueling the growth of home healthcare services across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to experience the highest growth in the care services market, driven by the rapid expansion of healthcare infrastructure, increasing awareness about elderly and chronic disease management, and rising demand for long-term care services

- Countries like China, India, and Japan are becoming significant markets due to their aging populations, which are more vulnerable to conditions requiring continuous care and support, such as dementia, cardiovascular diseases, and mobility issues

- Japan continues to lead in the adoption of advanced care technologies, including robotic caregivers and AI-powered monitoring systems, to support elderly care and improve patient outcomes

- In China and India, the growing demand for elderly care services is supported by both government initiatives and private sector investments. The expansion of healthcare facilities and increased access to care services are contributing to market growth in these countries

Care Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ExlService Holdings, Inc. (U.S.)

- Casenet, LLC (U.S.)

- Medecision (U.S.)

- ZeOmega (U.S.)

- Cognizant (U.S.)

- Oracle (U.S.)

- Allscripts Healthcare, LLC (U.S.)

- Tata Consultancy Services Limited (India)

- Koninklijke Philips N.V (Netherlands)

- Axispoint, Inc. (U.S.)

- McKesson Corporation (U.S.)

- i2i Systems (U.S.)

- Epic Systems Corporation (U.S.)

- IBM Corporation (U.S.)

- Health Catalyst (U.S.)

- Pegasystems Inc. (U.S.)

- A&D Company Limited (Japan)

Latest Developments in Global Care Services Market

- In July 2024, Genesis HealthCare, Inc., one of the largest post-acute care providers in the nation, announced that three of its affiliated locations were recognized as 2024 recipients of the Silver–Commitment to Quality Award by the American Health Care Association and National Center for Assisted Living (AHCA/NCAL). This award honors their dedication to improving the lives of residents through quality care. The Silver Award is the second of three distinctions available through the AHCA/NCAL National Quality Award Program, which recognizes organizations that meet increasingly rigorous standards of performance to enhance the lives of both residents and staff in long-term care and senior living settings

- In January 2024, McKesson acquired Compile, a healthcare data platform that integrates data from across the U.S. healthcare system. This acquisition is expected to assist McKesson in commercializing data and providing valuable insights to its biopharma customers.

- In September 2024, Baxter International Inc. introduced its next-generation airway clearance system, the Vest Advanced Pulmonary Experience (APX) System, at the North American Cystic Fibrosis Conference. Designed for adults and children with chronic lung conditions, the APX system retains reliable airflow technology while improving comfort and integrating feedback from clinicians and patients

- In 2024, Health Catalyst announced its acquisition of Lumeon, a digital health company that assists provider organizations in improving care coordinatio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CARE SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NUCLEIC ACID BASED DRUGS SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CARE SERVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 MERGERS AND ACQUISITION

6.1 LICENSING

6.2 COMMERCIALIZATION AGREEMENTS

7 REGULATORY FRAMEWORK

7.1 REGULATORY APPROVAL PROCESS

7.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

7.3 REGULATORY APPROVAL PATHWAYS

7.4 LICENSING AND REGISTRATION

7.5 POST-MARKETING SURVEILLANCE

8 MARKET OVERVIEW

8.1 DRIVERS

8.2 RESTRAINTS

8.3 OPPORTUNITIES

8.4 CHALLENGES

9 GLOBAL CARE SERVICES MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 SOFTWARE

9.2.1 BY TYPE

9.2.1.1. CARE MANAGEMENT PLATFORMS

9.2.1.2. PATIENT ENGAGEMENT SOLUTIONS

9.2.1.3. ANALYTICS AND REPORTING TOOLS

9.2.1.4. WORKFLOW AUTOMATION TOOLS

9.2.1.5. OTHERS

9.2.2 BY MODE

9.2.2.1. INTEGRATED

9.2.2.2. STANDALONE

9.2.3 BY OPERATING SYSTEM

9.2.3.1. ANDROID

9.2.3.2. WINDOWS

9.2.3.3. IOS

9.2.3.4. OTHERS

9.3 SERVICES

9.3.1 CONSULTING AND TRAINING

9.3.2 IMPLEMENTATION SERVICES

9.3.3 SUPPORT AND MAINTENANCE

9.3.4 MANAGED SERVICES

9.3.5 OTHERS

10 GLOBAL CARE SERVICES MARKET, BY DELIVERY MODE

10.1 OVERVIEW

10.2 ON-PREMISE

10.3 CLOUD-BASED

10.3.1 PUBLIC CLOUD

10.3.2 PRIVATE CLOUD

10.3.3 HYBRID CLOUD

10.4 OTHERS

11 GLOBAL CARE SERVICES MARKET , BY APPLICATION

11.1 OVERVIEW

11.2 DISEASE MANAGEMENT

11.2.1 CHRONIC DISEASE MANAGEMENT

11.2.1.1. DIABETES MANAGEMENT PROGRAMS

11.2.1.1.1. INSULIN THERAPY OPTIMIZATION

11.2.1.1.2. CONTINUOUS GLUCOSE MONITORING (CGM) TRAINING

11.2.1.1.3. DIABETIC DIET AND NUTRITION COUNSELING

11.2.1.1.4. OTHERS

11.2.1.2. HYPERTENSION CONTROL INITIATIVES

11.2.1.2.1. MEDICATION ADHERENCE SUPPORT

11.2.1.2.2. BLOOD PRESSURE MONITORING WORKSHOPS

11.2.1.2.3. SALT-INTAKE REDUCTION EDUCATION

11.2.1.2.4. OTHERS

11.2.1.3. COPD AND ASTHMA CARE PLANS

11.2.1.3.1. INHALER USAGE TRAINING

11.2.1.3.2. PULMONARY REHABILITATION PROGRAMS

11.2.1.3.3. EMERGENCY ACTION PLANS FOR EXACERBATIONS

11.2.1.4. OTHERS

11.2.2 PREVENTIVE CARE

11.2.2.1. VACCINATION CAMPAIGNS

11.2.2.1.1. FLU VACCINATION DRIVES

11.2.2.1.2. SCHOOL-BASED IMMUNIZATION PROGRAMS

11.2.2.1.3. ADULT VACCINATION AWARENESS CAMPAIGNS

11.2.2.1.4. OTHERS

11.2.2.2. HEALTH SCREENINGS AND ASSESSMENTS

11.2.2.2.1. ANNUAL PHYSICAL EXAMS

11.2.2.2.2. CANCER SCREENING INITIATIVES

11.2.2.2.3. CARDIOVASCULAR RISK ASSESSMENTS

11.2.2.2.4. OTHERS

11.2.2.3. LIFESTYLE MODIFICATION PROGRAMS

11.2.2.3.1. SMOKING CESSATION PROGRAMS

11.2.2.3.2. WEIGHT MANAGEMENT CLINICS

11.2.2.3.3. STRESS MANAGEMENT TECHNIQUES

11.2.2.3.4. OTHERS

11.2.2.4. OTHERS

11.2.3 POST-ACUTE CARE MANAGEMENT

11.2.3.1. REHABILITATION SERVICES

11.2.3.1.1. PHYSICAL THERAPY SESSIONS

11.2.3.1.2. SPEECH AND LANGUAGE THERAPY

11.2.3.1.3. OCCUPATIONAL THERAPY FOR DAILY LIVING

11.2.3.1.4. OTHERS

11.2.3.2. HOME-BASED RECOVERY PROGRAMS

11.2.3.2.1. POST-SURGICAL CARE AT HOME

11.2.3.2.2. NUTRITIONAL SUPPORT SERVICES

11.2.3.2.3. REMOTE PHYSIOTHERAPY ASSISTANCE

11.2.3.2.4. OTHERS

11.2.3.3. TRANSITIONAL CARE COORDINATION

11.2.3.3.1. DISCHARGE PLANNING SERVICES

11.2.3.3.2. FOLLOW-UP APPOINTMENT SCHEDULING

11.2.3.3.3. MEDICATION RECONCILIATION AND EDUCATION

11.2.3.3.4. OTHERS

11.2.3.4. OTHERS

11.3 CASE MANAGEMENT

11.3.1 INDIVIDUAL CASE MANAGEMENT

11.3.1.1. PERSONALIZED CARE PLANS

11.3.1.1.1. TAILORED TREATMENT PROTOCOLS

11.3.1.1.2. HOLISTIC WELLNESS APPROACHES

11.3.1.1.3. BEHAVIORAL HEALTH INTEGRATION

11.3.1.1.4. OTHERS

11.3.1.2. ONE-ON-ONE COUNSELING SERVICES

11.3.1.2.1. PSYCHOLOGICAL SUPPORT FOR CHRONIC ILLNESS

11.3.1.2.2. FINANCIAL AND INSURANCE GUIDANCE

11.3.1.2.3. CAREGIVER EDUCATION SESSIONS

11.3.1.2.4. OTHERS

11.3.1.3. FINANCIAL ASSISTANCE COORDINATION

11.3.1.3.1. CHARITY AND GRANT APPLICATION ASSISTANCE

11.3.1.3.2. PAYMENT PLAN NEGOTIATIONS

11.3.1.3.3. EXPENSE TRACKING AND BUDGETING TOOLS

11.3.1.3.4. OTHERS

11.3.1.4. OTHERS

11.3.2 GROUP CASE MANAGEMENT

11.3.2.1. SUPPORT GROUP COORDINATION

11.3.2.1.1. PEER-TO-PEER COUNSELING PROGRAMS

11.3.2.1.2. SHARED DECISION-MAKING WORKSHOPS

11.3.2.1.3. CHRONIC ILLNESS RESOURCE HUBS

11.3.2.1.4. OTHERS

11.3.2.2. DISEASE-SPECIFIC COMMUNITY PROGRAMS

11.3.2.2.1. CANCER SURVIVOR NETWORKS

11.3.2.2.2. DIABETES PREVENTION ALLIANCES

11.3.2.2.3. CARDIAC REHAB SUPPORT GROUPS

11.3.2.2.4. OTHERS

11.3.2.3. RESOURCE SHARING PLATFORMS

11.3.2.3.1. DIGITAL HEALTH LIBRARIES

11.3.2.3.2. COMMUNITY CARE APPS

11.3.2.3.3. VIRTUAL COLLABORATION PORTALS

11.3.2.3.4. OTHERS

11.3.2.4. OTHERS

11.4 UTILIZATION MANAGEMENT

11.4.1 MEDICAL NECESSITY REVIEW

11.4.1.1. PRE-AUTHORIZATION PROCEDURES

11.4.1.1.1. SPECIALIST REFERRAL VERIFICATION

11.4.1.1.2. TREATMENT PLAN APPROVALS

11.4.1.1.3. COVERAGE ELIGIBILITY ASSESSMENTS

11.4.1.1.4. OTHERS

11.4.1.2. CONCURRENT REVIEW PROCESSES

11.4.1.2.1. INPATIENT STAY EVALUATIONS

11.4.1.2.2. LENGTH OF STAY OPTIMIZATION

11.4.1.2.3. THERAPY PROGRESS MONITORING

11.4.1.2.4. OTHERS

11.4.1.3. RETROSPECTIVE REVIEW MECHANISMS

11.4.1.3.1. CLAIMS ANALYSIS FOR PAST TREATMENTS

11.4.1.3.2. AUDIT AND FRAUD DETECTION

11.4.1.3.3. OUTCOME-BASED REIMBURSEMENT MODELS

11.4.1.3.4. OTHERS

11.4.1.4. OTHERS

11.4.2 COST CONTAINMENT ANALYSIS

11.4.2.1. COMPARATIVE COST ANALYTICS

11.4.2.1.1. BENCHMARKING AGAINST INDUSTRY STANDARDS

11.4.2.1.2. PRICING TRANSPARENCY TOOLS

11.4.2.1.3. DATA-DRIVEN CONTRACT NEGOTIATIONS

11.4.2.1.4. OTHERS

11.4.2.2. ALTERNATIVE TREATMENT EVALUATIONS

11.4.2.2.1. GENERIC VS. BRAND MEDICATION STUDIES

11.4.2.2.2. HOME-BASED VS. FACILITY-BASED CARE ANALYSES

11.4.2.2.3. EMERGING THERAPY COST ASSESSMENTS

11.4.2.2.4. OTHERS

11.4.2.3. NETWORK OPTIMIZATION STRATEGIES

11.4.2.3.1. PROVIDER NETWORK TIERING

11.4.2.3.2. CONTRACT RENEGOTIATION STRATEGIES

11.4.2.3.3. REGIONAL CARE COORDINATION MODELS

11.4.2.3.4. OTHERS

11.4.2.4. OTHERS

11.5 OTHERS

12 GLOBAL CARE SERVICES MARKET , BY PURCHASE MODE

12.1 OVERVIEW

12.1.1 GROUP PURCHASE ORGANIZATION

12.1.2 INDIVIDUAL PURCHASE

13 GLOBAL CARE SERVICES MARKET , BY END USER

13.1 OVERVIEW

13.2 PAYERS

13.3 PROVIDERS

13.3.1 HOSPITAL

13.3.2 SPECIALITY CLINICS

13.3.3 OTHERS

13.4 OTHERS

14 GLOBAL CARE SERVICES MARKET , SWOT AND DBMR ANALYSIS

15 GLOBAL CARE SERVICES MARKET , COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL CARE SERVICES MARKET , BY REGION

GLOBAL CARE SERVICES MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 RUSSIA

16.2.7 SWITZERLAND

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 NETHERLANDS

16.2.11 DENMARK

16.2.12 SWEDEN

16.2.13 POLAND

16.2.14 NORWAY

16.2.15 FINLAND

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 SINGAPORE

16.3.6 THAILAND

16.3.7 INDONESIA

16.3.8 MALAYSIA

16.3.9 PHILIPPINES

16.3.10 AUSTRALIA

16.3.11 NEW ZEALAND

16.3.12 VIETNAM

16.3.13 TAIWAN

16.3.14 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 BAHRAIN

16.5.4 UNITED ARAB EMIRATES

16.5.5 KUWAIT

16.5.6 OMAN

16.5.7 QATAR

16.5.8 SAUDI ARABIA

16.5.9 REST OF MEA

16.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL CARE SERVICES MARKET , COMPANY PROFILE

17.1 EXLSERVICE HOLDINGS, INC.

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 ZYTER

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MEDECISION

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 ZEOMEGA

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 COGNIZANT

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ORACLE

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 DXC TECHNOLOGY

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 CERNER CORPORATION

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 MEDTRONIC

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 SIEMENS HEALTHINEERS

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 GE HEALTHCARE

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 VERINT SYSTEMS

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 CHANGE HEALTHCARE

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 INTELLISOFT GROUP

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 OPTUM

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 NEXTGEN HEALTHCARE

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 LUMEN TECHNOLOGIES

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 INFOR HEALTHCARE

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 ATOS

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 MEDISOLV

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 CIGNA HEALTH SERVICES

17.21.1 COMPANY OVERVIEW

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 WIPRO

17.22.1 COMPANY OVERVIEW

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 ACCUHEALTH

17.23.1 COMPANY OVERVIEW

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 PHILIPS HEALTHCARE

17.24.1 COMPANY OVERVIEW

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 IBM

17.25.1 COMPANY OVERVIEW

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

17.26 TATA CONSULTANCY SERVICES

17.26.1 COMPANY OVERVIEW

17.26.2 REVENUE ANALYSIS

17.26.3 GEOGRAPHIC PRESENCE

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENTS

17.27 MCKESSON CORPORATION

17.27.1 COMPANY OVERVIEW

17.27.2 REVENUE ANALYSIS

17.27.3 GEOGRAPHIC PRESENCE

17.27.4 PRODUCT PORTFOLIO

17.27.5 RECENT DEVELOPMENTS

17.28 HEALTH CATALYST

17.28.1 COMPANY OVERVIEW

17.28.2 REVENUE ANALYSIS

17.28.3 GEOGRAPHIC PRESENCE

17.28.4 PRODUCT PORTFOLIO

17.28.5 RECENT DEVELOPMENTS

17.29 PEGASYSTEMS INC

17.29.1 COMPANY OVERVIEW

17.29.2 REVENUE ANALYSIS

17.29.3 GEOGRAPHIC PRESENCE

17.29.4 PRODUCT PORTFOLIO

17.29.5 RECENT DEVELOPMENTS

17.3 A&D COMPANY LIMITED

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.