Global Cargo Drones Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

50.53 Billion

2024

2032

USD

4.50 Billion

USD

50.53 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 50.53 Billion | |

|

|

|

Cargo Drones Market Size

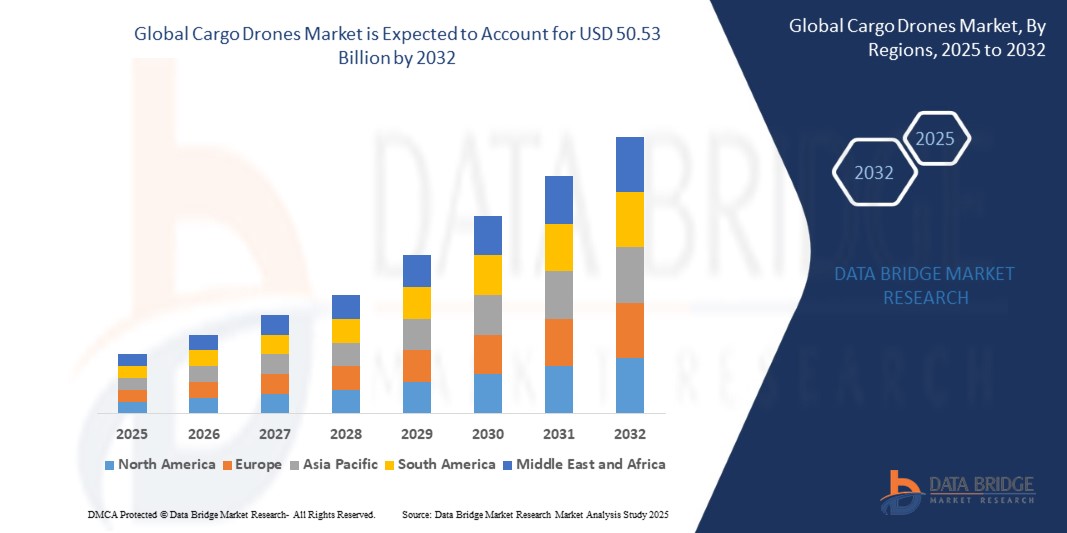

- The global cargo drones market was valued at USD 4.50 billion in 2024 and is expected to reach USD 50.53 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 35.30%, primarily driven by rising demand for efficient last-mile delivery

- This growth is driven by increasing adoption of drones for medical supply transportation and growing investments in drone logistics infrastructure

Cargo Drones Market Analysis

- Cargo Drones have gained widespread popularity due to the rising demand for efficient logistics, increasing adoption in e-commerce deliveries, and advancements in autonomous flight technology. Modern innovations, such as AI-powered navigation and long-range battery systems, have made cargo drones a preferred alternative for last-mile delivery, medical supply transport, and industrial logistics, boosting market growth

- The demand for cargo drones is significantly driven by growing investments in drone-based logistics, increasing government approvals for BVLOS operations, and a rising shift toward cost-effective and sustainable transportation solutions

- North America dominates the cargo drones market, primarily due to strong regulatory support for drone operations, the presence of leading drone manufacturers, and increasing partnerships between logistics providers and drone companies

- For instance, in 2023, Zipline expanded its medical drone delivery services across the U.S., enhancing access to critical healthcare supplies in remote areas

- Globally, cargo drones are witnessing rapid adoption, with innovations such as heavy-lift drone models, AI-driven route optimization, and hybrid power systems playing a pivotal role in market growth

Report Scope and Cargo Drones Market Segmentation

|

Attributes |

Cargo Drones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Cargo Drones Market Trends

“Growing Adoption of Autonomous and Long-Range Cargo Drones”

- One of the key trends in the global Cargo Drones market is the increasing preference for autonomous and long-range drones, driven by growing demand for faster and more efficient logistics solutions

- These innovations include AI-powered navigation systems and advanced battery technology, enhancing flight endurance and payload capacity while reducing operational costs, making them ideal for e-commerce, healthcare, and industrial deliveries

- For instance, many logistics companies are launching drone delivery networks with fully autonomous operations, catering to the rising demand for cost-effective and sustainable cargo transport

- Manufacturers are also integrating real-time tracking and collision-avoidance systems, ensuring safer and more reliable deliveries across various industries

- This trend is reshaping the logistics and transportation sector, making cargo drones more scalable, efficient, and widely adopted across global supply chains

Cargo Drones Market Dynamics

Driver

“Advancements in Autonomous Drone Technology”

- One of the primary drivers of the cargo drones market is the rapid advancement of autonomous drone technology, enabling efficient and cost-effective delivery for both urban and remote areas

For instance,

- In 2023, UPS Flight Forward expanded its drone delivery services, significantly reducing delivery time for healthcare products

- As technology improves and regulatory frameworks become more favorable, cargo drones are poised to revolutionize the global logistics and e-commerce industries, providing faster, greener, and more efficient solutions

Opportunity

“Expansion of Drone Logistics in Emerging Markets”

- One of the significant opportunities in the Cargo Drones market is the expansion of drone logistics in emerging markets, driven by increasing demand for efficient delivery solutions in remote or hard-to-reach areas

- As e-commerce continues to grow globally, there is a rising need for faster, cost-effective last-mile delivery solutions in regions with poor infrastructure or challenging geographical conditions, making cargo drones an attractive alternative

- In addition, governments in emerging markets are increasingly adopting favorable policies and regulations to promote drone-based delivery systems, creating new growth avenues for manufacturers and logistics providers

For Instance,

- In 2024, Zipline expanded its medical drone delivery network to Ghana, enabling faster delivery of vaccines and essential supplies to rural regions

- As the adoption of drone delivery networks continues to rise, particularly in Asia-Pacific and Africa, the cargo drones market is poised for significant growth, opening new opportunities for technology developers, logistics companies, and regulatory bodies worldwide

Restraint/Challenge

“Regulatory and Infrastructure Barriers”

- A significant challenge in the Cargo Drones market is the lack of standardized regulations across regions, hindering the large-scale adoption of drone delivery systems. Variations in regulatory frameworks, especially concerning beyond visual line of sight (BVLOS) operations, create barriers to global expansion and operational scalability

For Instance,

- In 2023, Amazon Prime Air faced delays in its drone delivery program due to regulatory approval issues and airspace management concerns

- Overcoming these challenges requires significant collaboration between governments, regulators, and drone technology companies to develop comprehensive frameworks and infrastructure that support safe, efficient, and scalable drone operations

Cargo Drones Market Scope

The market is segmented on the basis of drone type, load capacity, range, application, technology, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Drone Type |

|

|

By Load Capacity |

|

|

By Range |

|

|

By Application |

|

|

By Technology |

|

|

By End User |

|

Cargo Drones Market Regional Analysis

“North America is the Dominant Region in the Cargo Drones Market”

- North America holds the largest market share in the global cargo drones market, driven by increasing demand for autonomous delivery solutions, rising investments in drone logistics, and a growing preference for cost-effective air freight alternatives

- The U.S. leads the region due to strong government support for drone regulations, the presence of major aerospace manufacturers, and expanding applications in e-commerce and medical supply chains

- The availability of advanced UAV technologies, including AI-powered navigation systems and long-range battery innovations, has further fueled market expansion

- In addition, growing interest in urban air mobility, increasing partnerships between logistics providers and drone startups, and rising adoption of cargo drones for last-mile delivery contribute to the growth of the cargo drones market across North America

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to witness the highest CAGR in the global cargo drones market, driven by increasing demand for automated logistics solutions, rising investments in drone technology, and a growing shift toward efficient last-mile delivery services

- Countries such as China, Japan, and South Korea are leading the market due to strong government initiatives supporting drone regulations, expanding aerospace infrastructure, and the influence of e-commerce giants investing in drone-based logistics

- The rapid growth of urban air mobility networks, coupled with continuous advancements in AI-powered navigation and battery efficiency, is further accelerating market expansion

- In addition, government incentives for smart transportation, rising partnerships between drone manufacturers and logistics providers, and increasing adoption of cargo drones for industrial supply chains are contributing to the rapid development of the Cargo Drones market across Asia-Pacific

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Natilus (U.S.)

- Elray Air (U.S.)

- Dufour Aerospace (Switzerland)

- PIPISTREL (Slovenia)

- Kaman Corporation (U.S.)

- FlyingBasket SRL (Italy)

- Raphe (India)

- VTOL Aviation India Pvt. Ltd. (India)

- UAVOS INC. (U.S.)

- Dronamics Group Limited (U.K.)

- Silent Arrow (U.S.)

- Boeing (U.S.)

- EHang (China)

- BAE Systems (U.K.)

- Arc Aero Systems (U.K.)

- SKYPORTS INFRASTRUCTURE LIMITED (U.K.)

- Phoenix-Wings GmbH (Germany)

- Sabrewing Aircraft Company (U.S.)

- Volocopter GmbH (Germany)

- AIRBUS (Netherlands)

- Bell Textron Inc. (U.S.)

- Drone Delivery Canada Corp. (Canada)

- H3 Dynamics (Singapore)

- Steadicopter (Israel)

- Aeronet Worldwide, Inc. (U.S.)

Latest Developments in Global Cargo Drones Market

- In September 2024, Dufour Aerospace and Areion renewed their partnership, reinforcing Areion's commitment to purchase 40 Aero2 drones, with an option for 100 additional units. This collaboration aims to enhance drone-based solutions by focusing on innovation and scalability in aerial operations

- In May 2024, Kaman and Textron Systems entered into a Strategic Alliance Agreement to collaborate on advancements and opportunities for Kaman's KARGO UAV. With over 30 years of experience in unmanned aircraft systems (UAS), Textron Systems provides extensive technical expertise, along with insights into safety and airworthiness, positioning the team for accelerated production and scaling

- In April 2024, Natilus announced a strategic partnership with MONTE, an aircraft leasing company, to provide leasing and financing options for the Kona aircraft, Natilus' first commercially available, eco-friendly cargo plane

- In April 2024, Ehang signed a trilateral Memorandum of Understanding (MOU) with the Abu Dhabi Investment Office (ADIO) and Multi Level Group (MLG) to develop eVTOL operations in the U.A.E. and beyond

- In March 2024, Dronamics secured an investment from the European Innovation Council, building upon its previous USD 2.77 million grant received for expanding its drone logistics network

- In November 2023, Dronamics partnered with Qatar Airways Cargo to expand their delivery networks, improving accessibility to areas previously unreachable by traditional air freight

- In October 2023, European Medical Drone signed a development and purchase agreement with Dufour Aerospace for 11 Aero2 uncrewed tilt-wing aircraft. The deal includes one prototype for 2024 and ten production models starting in 2026, with facilitation from Savback Helicopters

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.