Global Carnauba Wax Market

Market Size in USD Million

CAGR :

%

USD

315.48 Million

USD

433.41 Million

2024

2032

USD

315.48 Million

USD

433.41 Million

2024

2032

| 2025 –2032 | |

| USD 315.48 Million | |

| USD 433.41 Million | |

|

|

|

|

Global Carnauba Wax Market Size

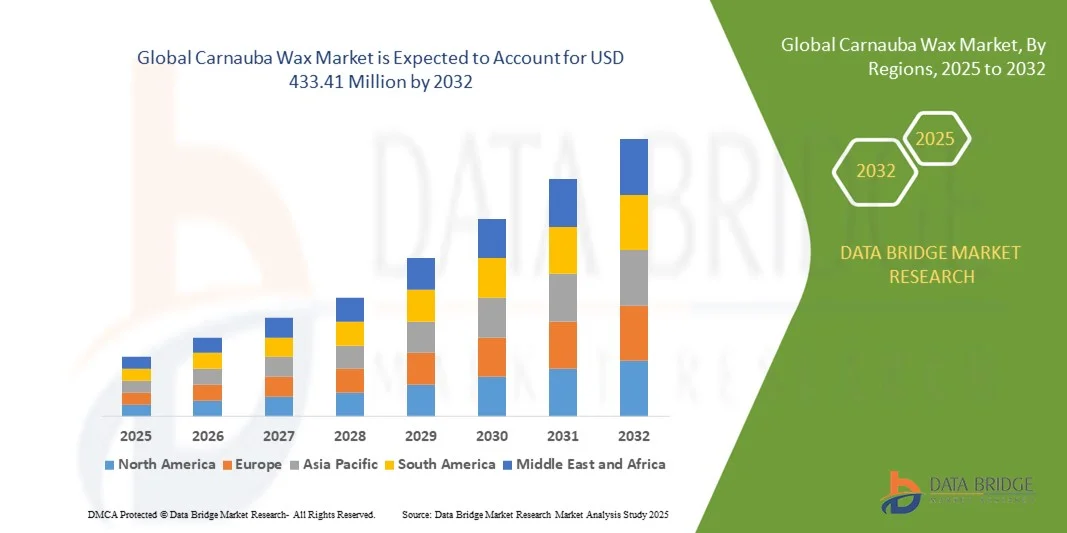

- The global Carnauba Wax Market size was valued at USD 315.48 million in 2024 and is projected to reach USD 433.41 million by 2032, growing at a CAGR of 4.05% during the forecast period

- Market expansion is primarily driven by the rising demand for natural and sustainable ingredients across industries such as cosmetics, food, and pharmaceuticals, where carnauba wax serves as a key component due to its non-toxic and hypoallergenic properties

- Additionally, increasing consumer preference for eco-friendly and plant-based products is pushing manufacturers to incorporate carnauba wax into various formulations, thereby fueling consistent growth across the global market

Global Carnauba Wax Market Analysis

- Carnauba wax, a natural plant-based wax derived from the leaves of the Copernicia prunifera palm, is becoming increasingly essential across industries including cosmetics, food processing, automotive, and pharmaceuticals due to its exceptional gloss, emulsifying, and hypoallergenic properties

- The growing demand for carnauba wax is primarily fueled by the global shift toward sustainable and organic products, rising awareness of natural ingredient benefits, and stricter regulations against synthetic additives in consumer goods

- North America dominated the Global Carnauba Wax Market with the largest revenue share of 34.6% in 2024, supported by strong demand from the automotive, cosmetics, and confectionery sectors, alongside increasing consumer preference for plant-based and biodegradable products

- Asia-Pacific is expected to be the fastest-growing region in the Global Carnauba Wax Market during the forecast period due to rapid industrialization, expansion of manufacturing capabilities, and rising disposable incomes in countries such as China and India

- The natural segment dominated the market with the largest revenue share of 68.4% in 2024, owing to the widespread availability of conventionally harvested carnauba wax and its extensive application across industries such as food, automotive, and cosmetics.

Report Scope and Global Carnauba Wax Market Segmentation

|

Attributes |

Carnauba Wax Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Carnauba Wax Market Trends

Rising Utilization of Carnauba Wax in High-Performance and Eco-Friendly Applications

- A significant and accelerating trend in the global Carnauba Wax Market is the rising adoption of carnauba wax in high-performance, sustainable, and eco-friendly formulations across industries such as cosmetics, food, automotive care, and pharmaceuticals. Its natural origin, hypoallergenic properties, and biodegradability make it a preferred alternative to synthetic waxes and petroleum-based ingredients.

- For Instance, in cosmetics, major brands are increasingly formulating lipsticks, balms, and mascaras with carnauba wax due to its glossy finish, stability, and vegan appeal. Similarly, the food industry continues to expand its use of carnauba wax in candy coatings, fruits, and pharmaceutical tablet polishes for its safe and inert characteristics.

- In automotive and surface care, carnauba wax is widely recognized for its superior shine, water repellency, and protective qualities. High-end detailing products use premium-grade (Type 1) carnauba wax to deliver long-lasting surface finishes. This trend is especially prominent in luxury vehicle maintenance and detailing services.

- Moreover, regulatory pressure and growing environmental awareness are driving industries to phase out microplastics and non-biodegradable ingredients. As a result, manufacturers are integrating carnauba wax into sustainable packaging, polishing agents, and biodegradable coatings. This shift supports clean-label product development and aligns with global sustainability goals.

- Innovations are also emerging in the pharmaceutical and nutraceutical sectors, where carnauba wax is used to coat capsules and tablets, improving shelf life and appearance while ensuring safety and digestibility. Companies are exploring nano-emulsion and microencapsulation techniques involving carnauba wax for advanced drug delivery systems.

- The demand for carnauba wax-based, eco-conscious solutions is growing rapidly across both developed and emerging markets, as consumers and industries increasingly value natural ingredients, performance, and environmental responsibility in product development and daily use.

Global Carnauba Wax Market Dynamics

Driver

Growing Demand Driven by Sustainability, Regulatory Compliance, and Industry Diversification

- The increasing global focus on sustainability, health consciousness, and eco-friendly production practices is a major driver fueling demand in the Global Carnauba Wax Market. Consumers and manufacturers alike are shifting towards natural, plant-based alternatives, positioning carnauba wax as a key ingredient across various industries.

- For instance, regulatory bodies such as the FDA (U.S.) and EFSA (Europe) have approved carnauba wax as a food-grade additive (E903), encouraging its use in coatings for fruits, candies, and pharmaceutical tablets. This compliance boosts its appeal as a safe, biodegradable substitute for synthetic waxes in regulated sectors.

- As personal care and cosmetics brands commit to “clean label” and vegan formulations, carnauba wax is being increasingly incorporated into products like lipsticks, mascaras, lotions, and balms for its glossy texture, skin-safe properties, and durability. Major cosmetics manufacturers are investing in R&D to replace synthetic thickeners and gloss agents with sustainable alternatives like carnauba wax.

- Additionally, the automotive and packaging industries are expanding their usage of carnauba wax in polishes, sealants, and biodegradable coatings to meet eco-regulatory standards and consumer expectations for greener solutions. Carnauba’s superior hardness and high melting point also make it suitable for industrial lubricants and electronics coatings.

- The increasing awareness around the environmental and health impact of petroleum-based products is also influencing procurement decisions, with carnauba wax emerging as a strategic alternative. The rising availability of premium-grade (Type 1) wax and ongoing innovations in extraction and refining are improving quality and scalability, further contributing to the growth in global demand.

- Growth is especially notable in emerging markets such as Asia-Pacific and Latin America, where rising disposable incomes and growing industrialization are driving uptake in food processing, cosmetics, and surface care applications.

Restraint/Challenge

Supply Chain Vulnerabilities and Price Volatility Due to Agricultural Dependency

- One of the primary challenges limiting the growth of the Global Carnauba Wax Market is its dependence on a single geographical source—the leaves of the Copernicia prunifera palm, native primarily to northeastern Brazil. This limited supply base creates vulnerability to environmental, political, and labor-related disruptions that can impact production volumes and pricing stability.

- For instance, fluctuations in rainfall, drought conditions, and deforestation directly affect palm tree health and leaf yield, leading to inconsistent supply. In 2023, lower-than-expected harvests due to climate variations led to supply shortages and increased global prices, impacting downstream manufacturers.

- Labor-intensive harvesting practices, combined with increased scrutiny of working conditions in carnauba wax plantations, have also drawn international attention. Several consumer goods companies now require certified sustainable sourcing (e.g., via RSPO or UEBT standards), which can increase operational costs and limit sourcing options for non-compliant suppliers.

- Additionally, the refining and bleaching processes required to produce cosmetic or food-grade carnauba wax can be capital intensive and require technological expertise, posing a barrier for small-scale producers and creating bottlenecks in quality-controlled supply chains.

- Price volatility remains a concern for manufacturers seeking to scale their use of carnauba wax. Competing natural alternatives such as beeswax and synthetic waxes often offer more predictable pricing, pushing some formulators to limit carnauba use despite its performance advantages.

- Overcoming these challenges will require greater investment in sustainable farming practices, supply chain diversification, transparency, and technological innovation in processing methods to improve yield efficiency and quality control.

Global Carnauba Wax Market Scope

The carnauba wax market is segmented on the basis of source, form, product type, application and end- user.

- By Source

On the basis of source, the Global Carnauba Wax Market is segmented into natural and organic. The natural segment dominated the market with the largest revenue share of 68.4% in 2024, owing to the widespread availability of conventionally harvested carnauba wax and its extensive application across industries such as food, automotive, and cosmetics. Natural carnauba wax is considered safe, cost-effective, and well-established in both industrial and commercial settings, making it the most widely adopted variant.

The organic segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for clean-label, chemical-free, and sustainably sourced ingredients. Stringent regulatory norms and rising environmental awareness are pushing manufacturers to seek certified organic wax solutions, particularly for applications in personal care, pharmaceuticals, and food coatings where traceability and purity are essential.

- By Form

On the basis of form, the market is segmented into powder, flakes, and pellet forms. The flakes segment held the largest market share of 46.7% in 2024, owing to its ease of handling, storage stability, and suitability for direct blending in formulations for cosmetics, automotive polishes, and food glazing. Flake-form carnauba wax is preferred in industrial processes due to its efficient melting behavior and consistent performance.

The powder segment is anticipated to register the fastest CAGR during the forecast period (2025–2032), propelled by its rising usage in pharmaceutical tablets, coatings, and fine dispersion systems. Powdered carnauba wax enables better texture control, faster solubility, and enhanced uniformity in application, making it ideal for high-precision product formulations in cosmetics and food sectors.

- By Product Type

on the basis of product type, the Global Carnauba Wax Market is segmented into Type 1, Type 3, and Type 4. The Type 1 segment dominated the market with the largest share of 43.2% in 2024, as it represents the purest and highest quality grade of carnauba wax. It is widely used in premium cosmetic, pharmaceutical, and food applications due to its light color, high melting point, and minimal impurities.

The Type 3 segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its broader industrial use and cost-effectiveness. Type 3 wax, while slightly lower in purity compared to Type 1, still meets the performance standards for many surface care, packaging, and polish products, offering a more economical option without compromising functionality.

- By Application

On the basis of application, the market is segmented into polish, gelling agent, thickening agent, and others. The polish segment held the dominant market share of 39.8% in 2024, driven by the high usage of carnauba wax in automotive, furniture, and shoe polishes due to its superior gloss, hardness, and water-resistant properties. Its natural shine and durability make it the gold standard for high-quality surface finishing products.

The gelling agent segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its increasing adoption in cosmetics and pharmaceutical products. Carnauba wax’s ability to stabilize emulsions and form uniform gels is making it a preferred natural thickener and stabilizer in a wide range of formulations, from lipsticks to ointments.

- By End-User

On the basis of end-user, the market is segmented into food and beverages, semiconductor, wood, polymer, leather, automobiles, personal care and cosmetics, pharmaceutical, and others. The personal care and cosmetics segment dominated the market with the largest revenue share of 28.5% in 2024, supported by rising demand for natural and vegan beauty products. Carnauba wax is used extensively in lipsticks, mascaras, and lotions for its film-forming, emollient, and stabilizing properties.

The pharmaceutical segment is projected to experience the fastest growth rate from 2025 to 2032, fueled by increasing demand for natural excipients and coating agents. Carnauba wax’s inertness, safety profile, and excellent polishing capability make it ideal for tablet coatings and controlled-release formulations.

Global Carnauba Wax Market Regional Analysis

- North America dominated the Global Carnauba Wax Market with the largest revenue share of 34.6% in 2024, driven by strong demand across key industries such as automotive care, personal care, and food processing, alongside a rising consumer shift toward natural and sustainable ingredients

- Manufacturers and consumers in the region increasingly value carnauba wax for its plant-based origin, high performance, and regulatory acceptance in food and cosmetic applications, making it a preferred alternative to synthetic additives and petroleum-based waxes

- The region’s dominance is further supported by established supply chain infrastructure, higher consumer awareness of clean-label products, and significant investment in product innovation by leading players, positioning carnauba wax as a key ingredient across a diverse range of industrial and consumer goods

U.S. Carnauba Wax Market Insight

The U.S. carnauba wax market captured the largest revenue share of 81% in 2024 within North America, driven by strong demand across food, cosmetics, pharmaceuticals, and automotive care sectors. Consumers and manufacturers increasingly prefer carnauba wax for its plant-based, hypoallergenic, and biodegradable properties. The growing demand for vegan and clean-label beauty products has significantly boosted its use in cosmetics and personal care. In the food industry, it is widely adopted as a glazing agent for confections and fruits, benefiting from FDA approval. Moreover, the U.S. automotive aftermarket shows a consistent need for premium carnauba-based polishes due to consumer preference for natural shine and surface protection. Ongoing product innovations and investments in sustainable sourcing by major players are also propelling market growth.

Europe Carnauba Wax Market Insight

The Europe carnauba wax market is projected to expand at a substantial CAGR during the forecast period, driven by stringent environmental regulations and increasing consumer awareness about sustainable and natural ingredients. European industries are phasing out synthetic waxes and petroleum derivatives in favor of biodegradable alternatives like carnauba wax. This trend is especially prominent in personal care, food, and packaging sectors. Moreover, clean-label product demand and EU directives limiting microplastics have made carnauba wax a preferred ingredient. Widespread applications in confectionery glazing, tablet coatings, and natural cosmetics are contributing to market growth. The region is also seeing rising demand from industrial sectors such as wood and leather care, driven by a growing emphasis on non-toxic, renewable raw materials.

U.K. Carnauba Wax Market Insight

The U.K. carnauba wax market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by rising demand for organic and plant-based alternatives in cosmetics, food, and pharmaceutical applications. Increasing consumer awareness of sustainable products and cruelty-free labeling supports its widespread use in skincare and hair care formulations. Additionally, British confectionery and bakery producers are using carnauba wax as a natural glazing and coating agent to meet clean-label and allergen-free standards. Regulatory alignment with EU safety standards and the push for environmentally responsible packaging and product formulations are further accelerating market growth in the country.

Germany Carnauba Wax Market Insight

The Germany carnauba wax market is expected to expand at a considerable CAGR, fueled by its robust manufacturing base and emphasis on sustainability and quality standards. German industries are actively seeking plant-derived, biodegradable ingredients for use in high-end applications such as cosmetics, automotive care, and pharmaceuticals. Demand for carnauba wax is rising in premium car polishes and eco-friendly packaging solutions. Moreover, Germany's strong pharmaceutical and confectionery industries utilize carnauba wax for tablet coatings and food glazing, driven by strict compliance with EU health and safety standards. The country’s focus on green innovation and high consumer standards continues to make it a strong market for carnauba wax.

Asia-Pacific Carnauba Wax Market Insight

The Asia-Pacific carnauba wax market is poised to grow at the fastest CAGR of 24% during the forecast period (2025–2032), driven by rapid urbanization, industrial growth, and increasing disposable incomes in emerging economies such as China, India, and Southeast Asia. As consumer demand for natural and organic products rises, industries in the region are increasingly incorporating carnauba wax into cosmetics, personal care, food coatings, and polishes. Government support for sustainable materials and clean-label products also contributes to market expansion. Additionally, as the region develops its manufacturing capabilities, especially in pharmaceuticals and packaged foods, the demand for safe, functional, and plant-based ingredients like carnauba wax is set to accelerate significantly.

Japan Carnauba Wax Market Insight

The Japan carnauba wax market is gaining momentum, driven by consumer demand for high-quality, multifunctional, and eco-friendly ingredients in cosmetics, personal care, and food sectors. Japanese manufacturers value carnauba wax for its glossy finish, stability, and compatibility with traditional formulations. The country’s aging population and preference for non-irritant, natural products are increasing the use of carnauba wax in skincare and pharmaceutical coatings. Moreover, Japan’s cultural emphasis on quality and precision aligns well with carnauba wax’s functional benefits in polishes, coatings, and high-end cosmetics. The integration of carnauba wax in minimalist, sustainable product lines is further promoting market growth.

China Carnauba Wax Market Insight

The China carnauba wax market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid industrialization, a growing middle class, and increasing awareness of natural and sustainable products. China is a major consumer of carnauba wax in automotive, packaging, and personal care sectors. The rise of domestic beauty brands focusing on clean and vegan formulations has boosted demand for carnauba wax as a natural thickener and emulsifier. Additionally, the country's massive food processing industry uses carnauba wax in candy coatings and fruit polishing. With strong domestic production, rising environmental consciousness, and evolving regulatory frameworks, China remains a key growth engine in the regional market.

Global Carnauba Wax Market Share

The Carnauba Wax industry is primarily led by well-established companies, including:

- Strahl & Pitsch Inc. (U.S.)

- Koster Keunen (U.S.)

- Foncepi Group (Brazil)

- Brasil Ceras (Brazil)

- TMC Industries Inc. (U.S.)

- Carnauba do Brasil Ltda. (Brazil)

- Pontes Industria de Cera Ltda. (Brazil)

- Akrochem Corporation (U.S.)

- Poth Hille & Co Ltd. (U.K.)

- Frank B. Ross Co., Inc. (U.S.)

- Norevo GmbH (Germany)

- Ter Hell & Co. GmbH (Germany)

- J. Allcock & Sons Ltd. (U.K.)

- Kahl GmbH & Co. KG (Germany)

- The International Group, Inc. (Canada)

- Tropical Ceras Do Brasil Ltda. (Brazil)

- Sasol Performance Chemicals (South Africa)

- Manta Wax Inc. (U.S.)

- Clariant AG (Switzerland)

What are the Recent Developments in Global Carnauba Wax Market?

- In April 2023, Sasol Performance Chemicals, a global leader in specialty chemicals, announced the launch of a new sustainable carnauba wax product line aimed at meeting increasing demand for eco-friendly raw materials in personal care and food applications. This initiative highlights Sasol’s commitment to innovation and sustainability, leveraging its advanced processing technologies to deliver high-purity, natural waxes tailored to regional and global market needs. The move strengthens Sasol’s position as a key supplier in the rapidly expanding Global Carnauba Wax Market.

- In March 2023, Manta Wax Inc., a specialist in natural wax products, introduced a new formulation of carnauba wax flakes designed specifically for use in the pharmaceutical and cosmetics industries. This product enhances product stability and performance while aligning with growing regulatory emphasis on natural and non-toxic ingredients. Manta Wax’s innovation reflects its dedication to supporting manufacturers seeking clean-label solutions and underscores the increasing role of carnauba wax in health-conscious product development.

- In March 2023, Koster Keunen, a leading supplier of natural ingredients, expanded its carnauba wax production capacity in Brazil to meet surging global demand, particularly from the food and packaging sectors. This expansion is part of Koster Keunen’s strategy to secure sustainable supply chains and reinforce its market leadership. The investment also supports the rising adoption of carnauba wax as a preferred natural alternative to synthetic waxes in environmentally friendly packaging materials.

- In February 2023, Akrochem Corporation, a prominent chemical distributor, announced a strategic partnership with several cosmetic manufacturers to develop customized carnauba wax blends that optimize texture and stability in skincare formulations. This collaboration aims to accelerate innovation and meet the growing consumer demand for natural, plant-based cosmetics. The partnership highlights Akrochem’s role in driving tailored solutions and enhancing the application versatility of carnauba wax across industries.

- In January 2023, Frank B. Ross Co., Inc., a key player in wax distribution, launched a new line of premium-grade carnauba wax pellets targeted at the automotive and wood polishing industries. The product offers superior shine and durability, catering to professional detailers and manufacturers prioritizing high-performance, sustainable waxes. This launch demonstrates Frank B. Ross’s commitment to expanding its product portfolio with natural ingredients that meet evolving industry standards for quality and environmental responsibility.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carnauba Wax Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carnauba Wax Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carnauba Wax Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.