Global Carrier Based Biofertilizer Market

Market Size in USD Billion

CAGR :

%

USD

3.24 Billion

USD

7.35 Billion

2024

2032

USD

3.24 Billion

USD

7.35 Billion

2024

2032

| 2025 –2032 | |

| USD 3.24 Billion | |

| USD 7.35 Billion | |

|

|

|

|

Carrier Based Biofertilizer Market Size

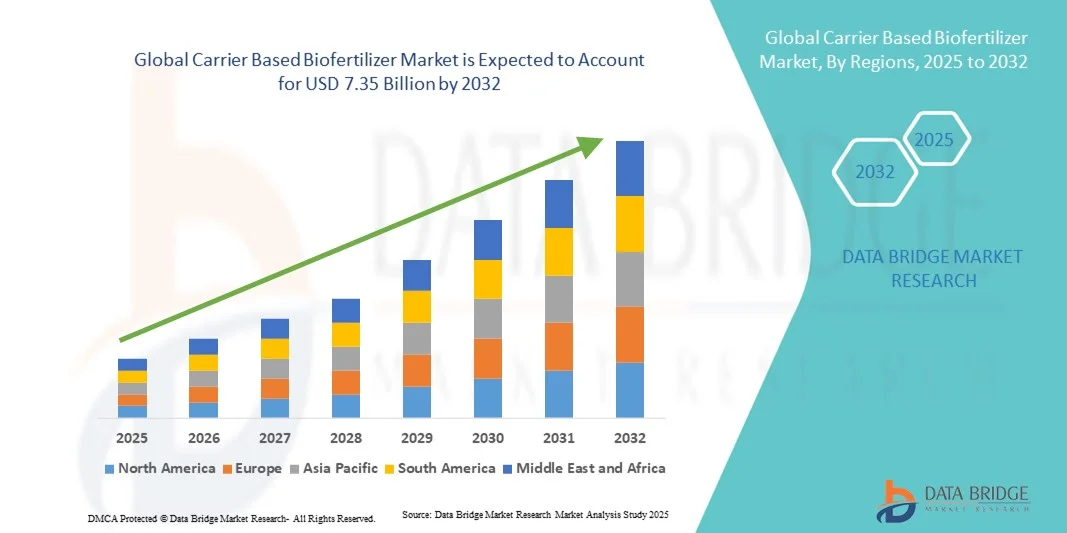

- The global carrier based biofertilizer market size was valued at USD 3.24 billion in 2024 and is expected to reach USD 7.35 billion by 2032, at a CAGR of 10.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of sustainable and eco-friendly agricultural practices, rising demand for organic farming inputs, and awareness about soil health and crop productivity

- The surge in government initiatives and subsidies promoting biofertilizers across developing and developed countries is further supporting market expansion

Carrier Based Biofertilizer Market Analysis

- The market is witnessing robust growth due to the multifunctional benefits of carrier based biofertilizers, including improved nutrient availability, enhanced crop yield, and environmental sustainability

- Increasing global focus on reducing chemical fertilizer usage and mitigating soil degradation is driving demand across major agricultural regions

- North America dominated the carrier-based biofertilizer market with the largest revenue share of 38.75% in 2024, driven by the growing adoption of sustainable and organic farming practices, along with increasing awareness of soil health and environmental conservation

- Asia-Pacific region is expected to witness the highest growth rate in the global carrier based biofertilizer market, driven by rapid agricultural modernization, rising awareness of eco-friendly farming practices, and supportive policies encouraging biofertilizer use across developing countries

- The nitrogen-fixing segment held the largest market revenue share in 2024, driven by its ability to enhance soil fertility, improve crop yield, and reduce dependence on chemical nitrogen fertilizers. These biofertilizers are widely adopted across cereals, pulses, and vegetable crops, making them a preferred choice for farmers globally

Report Scope and Carrier Based Biofertilizer Market Segmentation

|

Attributes |

Carrier Based Biofertilizer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carrier Based Biofertilizer Market Trends

Rise of Advanced Biofertilizer Formulations

- The increasing adoption of carrier-based biofertilizers is transforming modern agriculture by providing targeted nutrient delivery and enhanced soil health. These biofertilizers improve crop productivity, reduce dependency on chemical fertilizers, and support sustainable farming practices, particularly in regions with intensive agriculture. In addition, they help restore degraded soils, promote beneficial microbial activity, and improve long-term soil fertility for successive cropping cycles

- Growing demand for high-value crops and organic produce is accelerating the use of biofertilizers among commercial farms and smallholder farmers alike. Carrier-based formulations, including solid, liquid, and granular forms, allow for easier handling, storage, and application, improving operational efficiency. Farmers are increasingly integrating these biofertilizers with conventional fertilizers for balanced nutrition and improved crop quality

- The affordability and ease of application of modern carrier-based biofertilizers are making them attractive for widespread adoption. Farmers benefit from improved crop yield and soil fertility without incurring excessive costs or operational complexity. These biofertilizers also reduce chemical runoff, support eco-friendly farming, and enhance market competitiveness for organic products

- For instance, in 2023, agricultural cooperatives in India and Brazil reported a notable increase in crop yield and soil microbial activity after applying carrier-based biofertilizers containing nitrogen-fixing and phosphate-solubilizing bacteria, enhancing sustainability and farm profitability. The successful results encouraged broader adoption across neighboring regions, increasing local awareness and demand

- While carrier-based biofertilizers are gaining traction, their success depends on strain quality, compatibility with different soil types, and regulatory compliance. Manufacturers must focus on innovative carrier materials, eco-friendly formulations, and scalable production to meet growing global demand. Continuous R&D is also critical to develop multi-strain products and region-specific biofertilizer blends

Carrier Based Biofertilizer Market Dynamics

Driver

Rising Demand for Sustainable and Organic Farming Practices

- The increasing awareness of soil health, environmental sustainability, and reduction in chemical fertilizer usage is driving the adoption of carrier-based biofertilizers. These products help maintain nutrient balance, reduce soil degradation, and enhance crop productivity. In addition, farmers are motivated by global consumer demand for chemical-free and organic produce, encouraging wider use of biofertilizers

- Innovations in microbial strains, nutrient carriers, and synergistic formulations are improving effectiveness and shelf life, boosting confidence among farmers and agribusinesses. This has strengthened market penetration across diverse geographies. Manufacturers are also focusing on cost-effective production methods to make biofertilizers more accessible to smallholder farmers

- Government initiatives and subsidies promoting organic and sustainable farming practices are further supporting market growth. Policies favoring biofertilizer adoption in developing and developed countries are encouraging wider use. Public-private partnerships, training programs, and financial incentives are enabling farmers to integrate biofertilizers into mainstream agricultural practices

- For instance, in 2022, several Southeast Asian governments implemented programs supporting biofertilizer application for rice and vegetable crops, significantly increasing adoption rates among small and medium-scale farmers. These initiatives also included capacity-building workshops, improving farmer knowledge and ensuring correct application techniques

- As sustainability becomes a priority in global agriculture, demand for carrier-based biofertilizers is expected to continue growing, particularly in regions focused on organic and eco-friendly farming. This trend is further supported by growing awareness of climate-resilient agriculture and the need for soil restoration

Restraint/Challenge

High Production Costs and Limited Awareness Among Farmers

- The production of high-quality carrier-based biofertilizers requires specialized microbial strains and sterilized carrier materials, leading to higher manufacturing costs. These costs can hinder adoption, especially in price-sensitive agricultural regions. Small-scale manufacturers often struggle to compete with large producers, affecting market penetration in certain areas

- Limited awareness and knowledge about proper application techniques restrict widespread usage, particularly among smallholder farmers. Incorrect application can reduce efficacy and discourage adoption, limiting market growth. Training gaps and insufficient extension services further exacerbate challenges in achieving consistent results

- Supply chain challenges, including storage, transportation, and shelf-life maintenance, further impact availability in remote and rural areas, affecting consistent use across farms. Temperature-sensitive strains may lose effectiveness during transit, and lack of cold storage facilities can reduce shelf life and overall adoption

- For instance, in 2023, surveys in Sub-Saharan Africa and South Asia revealed that over 60% of small-scale farmers lacked access to quality biofertilizers and guidance on their effective use, highlighting gaps in education and distribution networks. These issues often lead farmers to rely on conventional chemical fertilizers instead

- While carrier-based biofertilizers continue to advance, addressing cost, awareness, and distribution challenges is crucial to ensure sustained market growth and widespread adoption. Strategic partnerships, localized production, and farmer education programs are essential to overcome these barriers and expand market reach

Carrier Based Biofertilizer Market Scope

The market is segmented on the basis of type, crop, and application.

- By Type

On the basis of type, the carrier-based biofertilizer market is segmented into nitrogen-fixing biofertilizers, phosphate solubilizing and mobilizing biofertilizers, and potassium solubilizing and mobilizing biofertilizers. The nitrogen-fixing segment held the largest market revenue share in 2024, driven by its ability to enhance soil fertility, improve crop yield, and reduce dependence on chemical nitrogen fertilizers. These biofertilizers are widely adopted across cereals, pulses, and vegetable crops, making them a preferred choice for farmers globally.

The phosphate solubilizing and mobilizing biofertilizers segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing awareness of the benefits of phosphorus bioavailability, improved soil nutrient management, and rising demand for sustainable farming practices. These biofertilizers are particularly effective in enhancing root development and overall crop productivity, supporting both smallholder and commercial agricultural operations.

- By Crop

On the basis of crop, the carrier-based biofertilizer market is segmented into cereals and grains, pulses and oilseeds, fruits and vegetables, and others. The cereals and grains segment held the largest market revenue share in 2024, driven by the extensive cultivation of rice, wheat, and maize globally and the high demand for yield improvement and soil fertility management.

The fruits and vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing adoption of sustainable practices in horticulture and greenhouse farming. Carrier-based biofertilizers are favored for these crops because they improve nutrient uptake, enhance plant health, and reduce dependency on chemical inputs, meeting consumer demand for organic and safe produce.

- By Application

On the basis of application, the carrier-based biofertilizer market is segmented into soil treatment, seed treatment, and others. The soil treatment segment held the largest market revenue share in 2024, driven by its ability to improve soil microbial activity, enhance nutrient availability, and support long-term soil fertility management across various crop types.

The seed treatment segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising awareness of its effectiveness in promoting germination, protecting seedlings from pathogens, and increasing early-stage crop vigor. This approach is increasingly adopted in high-value crops, organic farming, and precision agriculture systems.

Carrier Based Biofertilizer Market Regional Analysis

- North America dominated the carrier-based biofertilizer market with the largest revenue share of 38.75% in 2024, driven by the growing adoption of sustainable and organic farming practices, along with increasing awareness of soil health and environmental conservation

- Farmers and agribusinesses in the region highly value the benefits of improved crop yield, enhanced soil fertility, and reduced dependency on chemical fertilizers provided by carrier-based biofertilizers

- This widespread adoption is further supported by government incentives, strong agricultural infrastructure, and a focus on eco-friendly farming practices, establishing carrier-based biofertilizers as a preferred solution for both large-scale and smallholder farms

U.S. Carrier-Based Biofertilizer Market Insight

The U.S. carrier-based biofertilizer market captured the largest revenue share in 2024 within North America, fueled by the rapid uptake of organic and sustainable farming initiatives. Farmers are increasingly prioritizing soil enrichment and eco-friendly nutrient management to improve crop productivity. The growing preference for biofertilizers over chemical fertilizers, combined with supportive government policies and subsidies, further propels the market. In addition, increasing awareness about long-term soil sustainability and regulatory frameworks promoting eco-friendly inputs is significantly contributing to market expansion.

Europe Carrier-Based Biofertilizer Market Insight

The Europe carrier-based biofertilizer market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent agricultural regulations and a strong focus on organic farming. Rising demand for high-value crops and the adoption of eco-friendly farming practices are encouraging the use of biofertilizers. The region is experiencing substantial growth across cereals, vegetables, and horticultural crops, with carrier-based biofertilizers being increasingly integrated into both new and traditional farming practices.

U.K. Carrier-Based Biofertilizer Market Insight

The U.K. carrier-based biofertilizer market is expected to witness strong growth from 2025 to 2032, driven by increasing adoption of sustainable farming techniques and the need for enhanced soil fertility management. Farmers are adopting biofertilizers to meet regulatory requirements, improve crop yields, and reduce chemical fertilizer usage. The U.K.’s emphasis on organic agriculture, along with growing consumer demand for sustainable food products, is expected to continue supporting market growth.

Germany Carrier-Based Biofertilizer Market Insight

The Germany carrier-based biofertilizer market is expected to witness significant growth from 2025 to 2032, fueled by increasing awareness of soil health and the demand for sustainable agriculture solutions. Germany’s well-established agricultural practices, coupled with government initiatives promoting biofertilizer adoption, are driving market penetration. Carrier-based biofertilizers are increasingly being incorporated into conventional and organic farming systems, with a strong focus on nutrient management and environmental sustainability.

Asia-Pacific Carrier-Based Biofertilizer Market Insight

The Asia-Pacific carrier-based biofertilizer market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising population, increasing food demand, and adoption of modern farming techniques in countries such as India, China, and Japan. Government programs promoting organic agriculture and soil fertility improvement are accelerating market adoption. In addition, as APAC emerges as a major agricultural hub, affordability, accessibility, and awareness of carrier-based biofertilizers are expanding to a broader farmer base.

China Carrier-Based Biofertilizer Market Insight

The China carrier-based biofertilizer market captured the largest revenue share in 2024 due to the country’s large agricultural base, government subsidies, and rising adoption of sustainable farming practices. Chinese farmers are progressively incorporating biofertilizers into cereal, vegetable, and fruit cultivation to enhance yield and soil fertility. The increasing focus on reducing chemical fertilizer use and promoting eco-friendly agricultural inputs is significantly supporting market expansion.

Japan Carrier-Based Biofertilizer Market Insight

The Japan carrier-based biofertilizer market is expected to witness notable growth from 2025 to 2032, driven by the country’s focus on sustainable and precision agriculture. Farmers are adopting biofertilizers to improve soil fertility, crop yield, and reduce chemical fertilizer dependency in high-value horticultural and vegetable crops. In addition, government initiatives promoting organic farming, coupled with increasing awareness about eco-friendly agricultural practices, are supporting the expansion of carrier-based biofertilizers across both commercial and small-scale farms in Japan.

Carrier Based Biofertilizer Market Share

The Carrier Based Biofertilizer industry is primarily led by well-established companies, including:

• Novozymes (Denmark)

• National Fertilizers Limited (India)

• MADRAS FERTILIZERS LIMITED (India)

• Gujarat State Fertilizers & Chemicals Limited (India)

• Rashtriya Chemicals and Fertilizers Limited (India)

• Vegalab S.A. (Spain)

• Chr. Hansen Holding A/S (Denmark)

• Kiwa Bio-Tech Products Group Corporation (China)

• Rizobacter (Argentina)

• T.Stanes and Company Limited (India)

• IPL Biologicals Limited (India)

• Lallemand (Canada)

• Nutramax Laboratories (U.S.)

• Symborg (Spain)

• Som Phytopharma India Ltd (India)

• Mapleton Agri Biotec Pt Ltd (Australia)

• Manidharma Biotech Private Limited (India)

• biomaxnaturals (India)

• Seipasa (Spain)

• Jaipur Bio Fertilizers (India)

• CRIYAGEN (India)

• LKB BioFertilizer (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.