Global Cart Batteries Market

Market Size in USD Billion

CAGR :

%

USD

4.67 Billion

USD

7.02 Billion

2025

2033

USD

4.67 Billion

USD

7.02 Billion

2025

2033

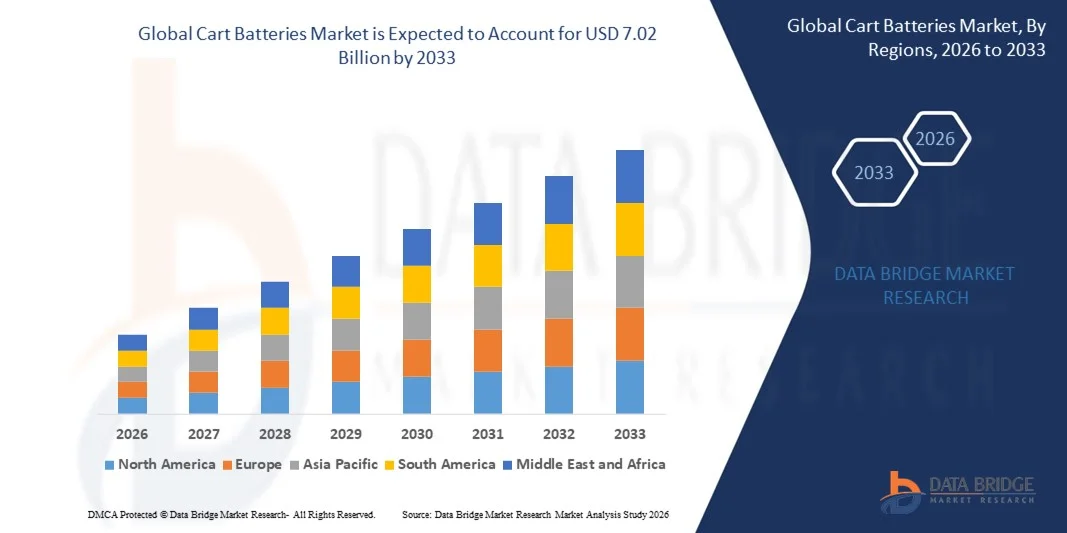

| 2026 –2033 | |

| USD 4.67 Billion | |

| USD 7.02 Billion | |

|

|

|

|

Global Cart Batteries Market Size

- The global Cart Batteries Market size was valued at USD 4.67 billion in 2025 and is expected to reach USD 7.02 billion by 2033, at a CAGR of 5.20% during the forecast period.

- The market growth is primarily driven by the increasing demand for electric vehicles, automated material handling systems, and sustainable energy solutions, which are fueling the need for high-performance and long-lasting battery technologies.

- Additionally, advancements in battery chemistry, energy density, and fast-charging capabilities, combined with government initiatives supporting clean energy and green transportation, are propelling the adoption of cart batteries across commercial and industrial sectors, thereby significantly enhancing market growth.

Global Cart Batteries Market Analysis

- Cart batteries, providing reliable energy storage for electric carts, forklifts, and automated material handling equipment, are increasingly critical components in industrial, commercial, and recreational applications due to their high performance, durability, and efficiency in supporting electrification and automation.

- The rising demand for cart batteries is primarily driven by the rapid adoption of electric vehicles, growth in e-commerce and warehouse automation, and the shift toward sustainable energy solutions across various industries.

- North America dominated the Global Cart Batteries Market with the largest revenue share of 32% in 2025, supported by early adoption of electric material handling equipment, strong industrial infrastructure, and the presence of leading battery manufacturers, with the U.S. witnessing significant investments in electric fleets and warehouse automation solutions.

- Asia-Pacific is expected to be the fastest-growing region in the Global Cart Batteries Market during the forecast period, fueled by rapid industrialization, increasing urbanization, and rising demand for electric vehicles and automated logistics solutions.

- The Li-Ion segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its superior energy density, longer lifespan, lower maintenance requirements, and faster charging capabilities.

Report Scope and Global Cart Batteries Market Segmentation

|

Attributes |

Cart Batteries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Exide Industries Ltd. (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Cart Batteries Market Trends

Enhanced Efficiency Through AI and Predictive Battery Management

- A significant and accelerating trend in the global Cart Batteries Market is the growing integration of artificial intelligence (AI) and predictive analytics into battery management systems for electric carts, automated guided vehicles (AGVs), and material handling equipment. This technological integration is substantially enhancing operational efficiency, uptime, and lifespan of batteries.

- For instance, some lithium-ion cart batteries now incorporate AI-driven battery management systems (BMS) that monitor real-time performance, optimize charging cycles, and prevent over-discharge, thereby extending battery life and improving overall fleet productivity. Similarly, companies such as Trojan Battery and LG Chem are developing smart BMS solutions that provide detailed usage insights and predictive maintenance alerts.

- AI integration in cart batteries enables features such as adaptive charging schedules based on usage patterns, temperature optimization, and predictive failure alerts. For example, advanced BMS solutions can notify warehouse managers of potential battery degradation before it impacts operations, allowing preemptive maintenance. Predictive analytics also help reduce downtime, improve energy efficiency, and lower operational costs.

- The seamless integration of AI-enabled cart batteries with warehouse management systems (WMS) and IoT-enabled industrial equipment allows centralized monitoring and control of fleet operations. Managers can track battery health, schedule maintenance, and optimize vehicle deployment from a single platform, creating a more automated and efficient operational environment.

- This trend towards smarter, data-driven, and interconnected battery systems is fundamentally reshaping expectations for industrial power solutions. As a result, companies such as BYD, Exide, and Johnson Controls are actively developing AI-enhanced battery solutions with predictive maintenance capabilities and cloud-connected monitoring platforms.

- The demand for cart batteries with advanced AI and predictive management features is growing rapidly across logistics, warehousing, and manufacturing sectors, as operators increasingly prioritize reliability, cost efficiency, and uninterrupted operations.

Global Cart Batteries Market Dynamics

Driver

Growing Need Due to Rising Electrification and Warehouse Automation

- The increasing adoption of electric material handling equipment, coupled with the accelerating implementation of automated warehouse and logistics systems, is a significant driver for the heightened demand for advanced cart batteries.

- For instance, in March 2025, BYD announced a new line of lithium-ion batteries for electric forklifts and AGVs designed to support 24/7 operations with minimal downtime. Such initiatives by key companies are expected to drive the cart batteries market growth during the forecast period.

- As industries aim to improve operational efficiency, reduce emissions, and lower maintenance costs, advanced cart batteries provide benefits such as longer runtime, faster charging, and improved energy efficiency, offering a compelling upgrade over traditional lead-acid batteries.

- Furthermore, the growing popularity of automated and IoT-enabled industrial systems is making smart battery solutions an integral component of these operations, enabling seamless integration with fleet management systems and predictive maintenance platforms.

- The convenience of reduced maintenance, real-time battery monitoring, and the ability to optimize fleet usage through smart battery management systems are key factors propelling the adoption of advanced cart batteries in warehouses, logistics hubs, and manufacturing facilities. Increasing availability of modular and plug-and-play battery solutions further contributes to market growth.

Restraint/Challenge

Concerns Regarding High Initial Costs and Technological Complexity

- The relatively high upfront cost of advanced lithium-ion or AI-enabled cart batteries poses a significant challenge to broader market adoption, particularly for small- and medium-sized enterprises with limited capital budgets.

- For instance, the premium pricing of lithium-ion battery systems compared to traditional lead-acid options can deter adoption in cost-sensitive regions or for smaller fleet operators.

- Addressing these challenges through financing solutions, leasing models, and government incentives is crucial for encouraging broader adoption. Companies such as Exide Technologies and Trojan Battery are emphasizing total cost of ownership benefits and long-term operational savings in their marketing to justify the higher initial investment.

- Additionally, technological complexity and the need for integration with smart fleet management systems can be a barrier for operators unfamiliar with AI-driven battery monitoring and predictive maintenance tools.

- Overcoming these challenges through user-friendly interfaces, training programs, and modular battery solutions, along with gradual reductions in battery costs, will be vital for sustained market growth in the global cart batteries sector.

Global Cart Batteries Market Scope

The cart batteries market is segmented on the basis of type, battery voltage, drive type and seating capacity.

- By Type

On the basis of type, the Global Cart Batteries Market is segmented into Lead-Acid Batteries and Li-Ion Batteries. The Li-Ion segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its superior energy density, longer lifespan, lower maintenance requirements, and faster charging capabilities. These attributes make Li-Ion batteries highly suitable for electric carts used in industrial, commercial, and recreational applications. The increasing adoption of environmentally friendly and sustainable battery technologies further supports the dominance of Li-Ion batteries.

The Lead-Acid segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, owing to its cost-effectiveness, wide availability, and proven reliability in traditional electric carts and utility vehicles. Lead-Acid batteries remain popular for small-scale operations and regions where upfront cost considerations outweigh performance metrics.

- By Battery Voltage

On the basis of battery voltage, the Global Cart Batteries Market is segmented into 6 Volts, 8 Volts, and 12 Volts. The 12 Volts segment held the largest market revenue share of 45.0% in 2025, owing to its compatibility with a wide range of electric carts, superior power output, and suitability for heavier loads and longer operational cycles. This voltage rating is commonly used in both recreational and industrial carts, providing a balance of performance and cost-efficiency.

The 6 Volts segment is expected to register the fastest CAGR of 20.8% from 2026 to 2033, driven by its adoption in lightweight carts, golf carts, and low-speed utility vehicles. Increasing demand for compact, efficient battery systems in urban mobility solutions is supporting the growth of lower-voltage batteries.

- By Drive Type

On the basis of drive type, the Global Cart Batteries Market is segmented into 36V Electric Drive and 48V Electric Drive. The 48V Electric Drive segment dominated the market with the largest revenue share of 52.3% in 2025, attributed to its ability to deliver higher torque, enhanced efficiency, and longer operational range, which are critical for industrial and commercial applications. This drive type is increasingly preferred in fleet operations, large golf courses, and resort transportation due to its reliability and performance under heavy loads.

The 36V Electric Drive segment is anticipated to witness the fastest CAGR of 19.7% from 2026 to 2033, fueled by growing adoption in small- to medium-sized electric carts for residential, recreational, and short-distance transportation, where cost efficiency and adequate performance are primary considerations.

- By Seating Capacity

On the basis of seating capacity, the Global Cart Batteries Market is segmented into 2–4 Seater, 6–8 Seater, and 10+ Seater. The 2–4 Seater segment accounted for the largest market revenue share of 48.1% in 2025, driven by widespread use in golf courses, resorts, private estates, and small industrial facilities, where compact and efficient electric carts are preferred. Smaller seating capacity carts require batteries that optimize space while providing sufficient power for daily operations, making this segment dominant.

The 6–8 Seater segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, owing to rising demand in hospitality, campus transportation, and urban shuttle services, where medium-sized carts provide an ideal balance of passenger capacity and energy efficiency.

Global Cart Batteries Market Regional Analysis

- North America dominated the Global Cart Batteries Market with the largest revenue share of 32% in 2025, driven by increasing adoption of electric carts in industrial, commercial, and recreational sectors, along with strong investments in warehouse automation and material handling solutions.

- Businesses and consumers in the region highly value the efficiency, reliability, and low maintenance offered by advanced battery technologies such as Li-Ion batteries, which support longer operational cycles and faster charging for electric carts.

- This widespread adoption is further supported by high industrial activity, a technologically inclined population, and favorable government incentives for electric mobility and sustainable energy solutions, establishing high-performance cart batteries as the preferred choice for industrial fleets, golf courses, resorts, and urban transportation systems.

U.S. Cart Batteries Market Insight

The U.S. cart batteries market captured the largest revenue share of 81% in 2025 within North America, driven by the growing adoption of electric carts in industrial, commercial, and recreational sectors. Fleet operators and businesses are increasingly prioritizing efficient, long-lasting battery solutions to reduce downtime and operational costs. The rising focus on sustainability and government incentives for electric mobility further propel the adoption of advanced battery technologies, particularly Li-Ion batteries. Additionally, integration of battery management systems (BMS) for performance optimization and remote monitoring is gaining traction across warehouses, golf courses, resorts, and urban shuttle services, contributing significantly to market expansion.

Europe Cart Batteries Market Insight

The Europe cart batteries market is projected to expand at a substantial CAGR during the forecast period, driven by stringent environmental regulations, the push for electrification of vehicles, and rising adoption of automated material handling solutions. Increasing urbanization and industrial modernization are boosting demand for electric carts, while consumers and businesses alike are gravitating toward energy-efficient, low-maintenance battery options. Residential, commercial, and industrial applications are all contributing to growth, with both new installations and retrofits benefiting from technological advancements in battery performance.

U.K. Cart Batteries Market Insight

The U.K. cart batteries market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising adoption of electric carts for commercial, recreational, and industrial applications. Businesses are increasingly focusing on fleet electrification to reduce emissions and operational costs, while the commercial and hospitality sectors demand reliable battery solutions for golf carts, shuttle vehicles, and utility carts. Government support for green mobility and the growing awareness of sustainable energy storage solutions are expected to further stimulate market growth in the country.

Germany Cart Batteries Market Insight

The Germany cart batteries market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s focus on energy efficiency, digitalization, and industrial automation. High demand for electric carts in manufacturing, logistics, and industrial facilities requires high-performance battery systems, particularly Li-Ion and advanced lead-acid batteries. Integration with battery management systems for monitoring and maintenance, coupled with Germany’s emphasis on innovation and sustainability, is promoting the adoption of modern cart battery technologies in both residential and commercial applications.

Asia-Pacific Cart Batteries Market Insight

The Asia-Pacific cart batteries market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, fueled by rapid industrialization, urbanization, and rising disposable incomes in countries such as China, Japan, and India. Increasing investments in logistics, e-commerce, and electric mobility infrastructure are driving the adoption of electric carts equipped with high-performance batteries. Moreover, the region’s role as a manufacturing hub for battery components enhances affordability and accessibility, expanding the consumer base for both lead-acid and Li-Ion cart batteries.

Japan Cart Batteries Market Insight

The Japan cart batteries market is gaining momentum due to the country’s advanced industrial infrastructure, high technological adoption, and focus on automation. The market is driven by demand for electric carts in industrial facilities, resorts, and urban transport services. Aging populations and labor shortages are encouraging automation solutions, increasing reliance on reliable battery-powered carts. Integration of battery management systems and compact Li-Ion batteries in fleet operations is further fueling growth across both commercial and residential applications.

China Cart Batteries Market Insight

The China cart batteries market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, industrial expansion, and a growing middle class. Electric carts are widely adopted across logistics, industrial, and recreational sectors, creating strong demand for efficient, long-life battery solutions. The push toward smart cities, coupled with government incentives for electric mobility and domestic manufacturing capabilities, has made batteries more affordable and accessible, driving significant growth in both commercial and residential applications across the country.

Global Cart Batteries Market Share

The Cart Batteries industry is primarily led by well-established companies, including:

• Exide Industries Ltd. (India)

• Trojan Battery Company (U.S.)

• Johnson Controls Inc. (U.S.)

• Clarios LLC (U.S.)

• Enersys Inc. (U.S.)

• East Penn Manufacturing Co., Inc. (U.S.)

• Hitachi Chemical Co., Ltd. (Japan)

• Panasonic Corporation (Japan)

• GS Yuasa Corporation (Japan)

• BYD Company Ltd. (China)

• CATL (Contemporary Amperex Technology Co., Ltd.) (China)

• Leoch International Technology Ltd. (China)

• C&D Technologies, Inc. (U.S.)

• Vision Group (Vision Battery Co., Ltd.) (China)

• B.B. Battery Co., Ltd. (Thailand)

• Narada Power Source Co., Ltd. (China)

• Power-Sonic Corporation (U.S.)

• Lishen Battery Co., Ltd. (China)

• East Asia Battery Co., Ltd. (South Korea)

• Hoppecke Batterien GmbH & Co. KG (Germany)

What are the Recent Developments in Global Cart Batteries Market?

- In April 2024, Exide Industries Ltd., a leading global battery manufacturer, launched a strategic initiative in South Africa to expand its electric cart battery solutions for industrial, commercial, and recreational applications. This initiative emphasizes the company’s focus on providing reliable, long-life battery systems tailored to regional operational requirements. By leveraging advanced battery technologies and global expertise, Exide is addressing local market demands while strengthening its position in the rapidly growing Global Cart Batteries Market.

- In March 2024, Trojan Battery Company, a U.S.-based leader in deep-cycle batteries, introduced the new Trojan Li-Ion Industrial Series designed specifically for warehouse and logistics electric carts. The product offers longer runtime, faster charging, and enhanced durability under heavy usage, reflecting Trojan’s commitment to improving energy efficiency and operational productivity for commercial fleet operators.

- In March 2024, Johnson Controls Inc. successfully deployed a large-scale electric cart fleet in Bengaluru as part of a smart logistics initiative, utilizing high-performance Li-Ion and lead-acid batteries. This project highlights the role of advanced battery systems in improving urban material handling and sustainability, reinforcing Johnson Controls’ dedication to innovative energy storage solutions.

- In February 2024, Clarios LLC, a global leader in advanced battery solutions, announced a strategic partnership with major e-commerce logistics providers in North America to supply high-efficiency cart batteries for warehouse automation fleets. The collaboration aims to enhance operational reliability, reduce downtime, and optimize energy consumption, showcasing Clarios’ commitment to driving innovation and improving efficiency in material handling operations.

- In January 2024, Enersys Inc. unveiled its latest Genesis Lithium-Ion Battery Series at the International Battery Expo 2024. Designed for electric carts used in industrial and recreational sectors, these batteries offer extended cycle life, reduced maintenance requirements, and smart monitoring features. The launch underscores Enersys’ focus on integrating advanced technology into energy storage solutions, delivering higher efficiency, reliability, and convenience for fleet operators.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.