Global Catalyst Handling Services Market

Market Size in USD Million

CAGR :

%

USD

157.30 Million

USD

222.00 Million

2025

2033

USD

157.30 Million

USD

222.00 Million

2025

2033

| 2026 –2033 | |

| USD 157.30 Million | |

| USD 222.00 Million | |

|

|

|

|

Catalyst Handling Services Market Size

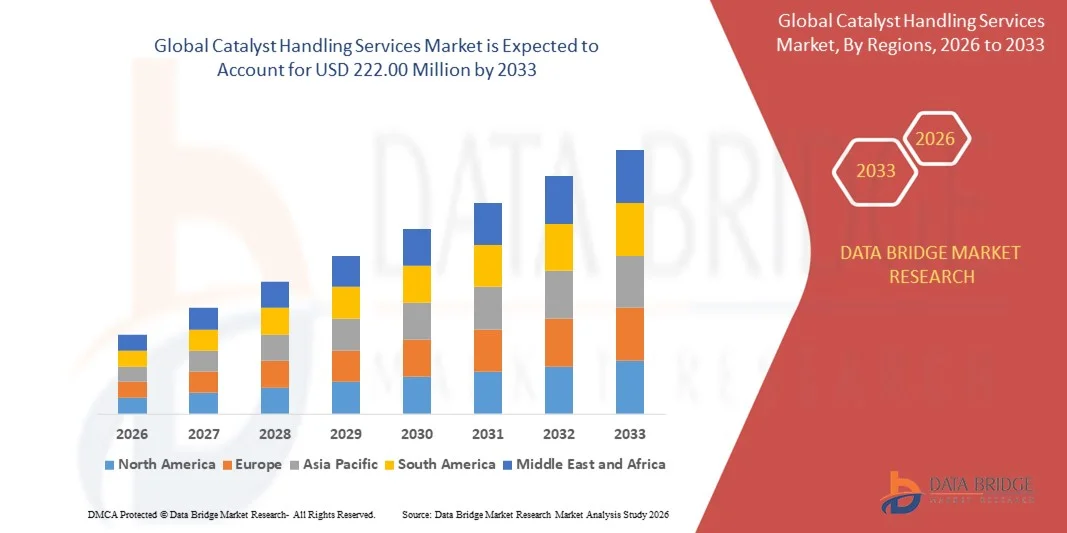

- The global catalyst handling services market size was valued at USD 157.30 million in 2025 and is expected to reach USD 222.00 million by 2033, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for safe and efficient handling of catalysts in petrochemical, refining, and chemical processing industries

- Rising industrial safety regulations, stringent environmental norms, and the need to minimize operational downtime are further driving the adoption of specialized catalyst handling services

Catalyst Handling Services Market Analysis

- The market is witnessing increased adoption of automated and mechanized catalyst handling solutions to enhance operational efficiency, safety, and precision in industrial processes

- Demand is further supported by rising awareness of the hazards associated with manual catalyst handling, such as exposure to toxic chemicals, dust, and the risk of fire or explosion in chemical plants

- North America dominated the catalyst handling services market with the largest revenue share in 2025, driven by the presence of advanced refining and petrochemical industries, as well as increasing adoption of automated catalyst handling solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global catalyst handling services market, driven by increasing industrial activity, infrastructure development, and rising investments in automated and safety-compliant catalyst handling systems

- The Catalyst Loading/Unloading segment held the largest market revenue share in 2025, driven by its critical role in ensuring precise catalyst transfer, reducing downtime, and minimizing safety risks. These services are widely adopted across refineries and petrochemical plants to maintain consistent process efficiency and compliance with operational standards

Report Scope and Catalyst Handling Services Market Segmentation

|

Attributes |

Catalyst Handling Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Catalyst Handling Services Market Trends

Rise of Automated Catalyst Handling Solutions

- The growing shift toward automated catalyst handling systems is transforming refinery and petrochemical operations by enabling safer and more efficient catalyst transfer, storage, and loading. These systems reduce manual intervention, minimize human error, and improve overall operational efficiency, while also helping meet stricter environmental and workplace safety regulations. Adoption is further supported by increasing demand for process optimization and reduced downtime across high-volume operations

- The high demand for flexible and modular catalyst handling solutions is accelerating adoption in both new and existing facilities. Automated systems help maintain precise process conditions, ensuring optimal catalyst performance and consistent product quality, while allowing quick adaptation to different catalyst types and plant requirements. These solutions also enhance operational scalability and improve throughput, driving efficiency and profitability

- The scalability and integration capabilities of modern handling equipment are making them attractive for large-scale operations and specialty processes, leading to reduced downtime and improved throughput. Companies benefit from enhanced safety compliance, streamlined workflow, and easier maintenance schedules. Integration with monitoring systems enables predictive maintenance, further improving operational reliability and minimizing unplanned interruptions

- For instance, in 2023, several North American refineries reported improved operational efficiency and reduced downtime after implementing automated catalyst loading and unloading systems, supporting safer and faster operations. These refineries also noted lower labor costs and fewer incidents of catalyst contamination, highlighting both economic and safety benefits. The trend is expected to influence adoption in other high-capacity facilities globally

- While automation is accelerating efficiency and safety, sustained adoption depends on continued technological upgrades, operator training, and cost optimization. Manufacturers must focus on tailored solutions for various catalyst types and process requirements, while also integrating real-time monitoring and control systems to maximize productivity and compliance

Catalyst Handling Services Market Dynamics

Driver

Growing Demand for Safety and Operational Efficiency in Refineries and Petrochemical Plants

- The increasing emphasis on workplace safety and environmental compliance is pushing companies to adopt advanced catalyst handling services. Automated systems minimize exposure to hazardous materials and reduce the risk of accidents, enhancing overall safety. These solutions also support compliance with global regulations, which is becoming critical for international operations and plant certifications

- Plants are focusing on improving operational efficiency, reducing downtime, and ensuring consistent catalyst performance. Advanced handling solutions enable precise loading, unloading, and storage, helping maintain process continuity and product quality. Companies benefit from optimized workflow management, lower operational costs, and reduced energy consumption, which collectively enhance competitiveness

- Regulatory standards and industry best practices further drive adoption, as companies seek solutions that meet stringent safety and environmental requirements. Automation also reduces labor dependency and operational risks, while enabling the deployment of advanced analytics to monitor catalyst performance. This contributes to improved decision-making and enhanced long-term process reliability

- For instance, in 2022, several European and Middle Eastern petrochemical facilities upgraded to fully automated catalyst handling systems, improving safety standards and operational throughput while reducing manual intervention. The implementation also allowed plants to handle a broader variety of catalysts with precision, boosting product consistency and market reputation

- While safety and efficiency are key drivers, the market still requires continuous innovation, cost-effective solutions, and customized services to address diverse catalyst types and plant configurations. Investment in R&D for modular and retrofittable systems is becoming essential to meet evolving operational demands

Restraint/Challenge

High Capital Investment and Complexity of Advanced Handling Systems

- The high cost of advanced catalyst handling equipment, including automated loaders, conveyors, and storage systems, limits adoption for smaller refineries and chemical plants. Capital expenditure remains a major barrier to market growth, and companies must carefully justify ROI before implementation. Long payback periods can deter mid-sized operators from investing in these solutions

- In many regions, there is a lack of trained personnel capable of operating or maintaining sophisticated handling systems. Without skilled operators, facilities face risks of suboptimal performance and potential safety hazards. Training programs and specialized support services are required to ensure effective utilization, which can add additional operational costs

- Integration complexity with existing plant infrastructure can also hinder adoption, requiring tailored engineering solutions and additional project timelines. Retrofitting older facilities is often costly and time-consuming, and operational interruptions during installation can impact production schedules. Companies may also face challenges in sourcing compatible components and managing logistics across multiple sites

- For instance, in 2023, several refinery operators in Asia-Pacific postponed full-scale adoption due to high implementation costs and the need for extensive operator training, slowing market penetration. This also highlighted the need for local service providers and technical expertise to support complex installations

- While technological advancements are improving efficiency and safety, addressing cost, skill gaps, and integration challenges remains critical for long-term scalability and widespread adoption of automated catalyst handling services. Companies are exploring modular solutions, leasing models, and hybrid approaches to reduce upfront costs and facilitate easier adoption across diverse operational environments

Catalyst Handling Services Market Scope

The market is segmented on the basis of service type and end-use industry.

- By Service Type

On the basis of service type, the catalyst handling services market is segmented into Catalyst Loading/Unloading, Catalyst Screening, Segregation & Storage, Catalyst Transport & Handling, Spent Catalyst Handling, and Others. The Catalyst Loading/Unloading segment held the largest market revenue share in 2025, driven by its critical role in ensuring precise catalyst transfer, reducing downtime, and minimizing safety risks. These services are widely adopted across refineries and petrochemical plants to maintain consistent process efficiency and compliance with operational standards.

The Catalyst Screening, Segregation & Storage segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for organized catalyst management and safe storage solutions. These services help in optimizing catalyst lifecycle, reducing contamination, and enabling smoother handling for large-scale and specialty processes, making them increasingly essential for modern refinery and chemical operations.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into Petroleum Refining, Chemical & Fertilizer, Petrochemical, and Others. The Petroleum Refining segment held the largest market revenue share in 2025, fueled by the continuous need for safe and efficient catalyst handling in high-volume refining operations. These services ensure uninterrupted production, regulatory compliance, and enhanced operational safety.

The Petrochemical segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the expanding demand for specialty chemicals, growing production capacities, and the adoption of automated and modular catalyst handling solutions. These services support improved throughput, reduced downtime, and consistent product quality, making them a critical component of modern petrochemical facilities.

Catalyst Handling Services Market Regional Analysis

- North America dominated the catalyst handling services market with the largest revenue share in 2025, driven by the presence of advanced refining and petrochemical industries, as well as increasing adoption of automated catalyst handling solutions

- Companies in the region highly value operational efficiency, safety compliance, and process optimization offered by modern catalyst handling systems, reducing manual labor and mitigating workplace hazards

- This widespread adoption is further supported by well-established infrastructure, high investment capacity, and stringent environmental and safety regulations, establishing advanced catalyst handling services as a preferred solution for refineries and chemical plants

U.S. Catalyst Handling Services Market Insight

The U.S. catalyst handling services market captured the largest revenue share in 2025 within North America, fueled by ongoing investments in refinery modernization and petrochemical expansion projects. Operators are increasingly prioritizing safe, automated, and efficient handling of catalysts to minimize downtime and enhance productivity. The growing integration of advanced monitoring systems, robotics, and process automation is significantly contributing to market growth, while regulatory compliance continues to drive service adoption across commercial and industrial facilities.

Europe Catalyst Handling Services Market Insight

The Europe catalyst handling services market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety and environmental regulations in refineries and chemical plants. Rising demand for process optimization and energy-efficient operations is fostering adoption of automated handling solutions. The region is experiencing notable growth across petroleum refining, chemical, and petrochemical industries, with new installations and retrofits increasingly incorporating advanced catalyst handling systems.

U.K. Catalyst Handling Services Market Insight

The U.K. catalyst handling services market is expected to witness significant growth from 2026 to 2033, driven by the emphasis on refinery modernization, worker safety, and operational efficiency. Increasing investments in digitalization and automation, alongside strong regulatory frameworks, are encouraging companies to implement automated catalyst handling services. The U.K.’s established chemical and petrochemical infrastructure, combined with its focus on sustainability, further supports market expansion.

Germany Catalyst Handling Services Market Insight

The Germany catalyst handling services market is expected to witness robust growth from 2026 to 2033, fueled by rising awareness of industrial safety standards and the adoption of advanced process automation technologies. Germany’s well-developed industrial infrastructure, emphasis on sustainable operations, and focus on efficiency improvements are driving demand for automated catalyst handling solutions. Integration of these systems into existing refinery and chemical plant operations is increasing, with a strong preference for secure, environmentally compliant handling practices.

Asia-Pacific Catalyst Handling Services Market Insight

The Asia-Pacific catalyst handling services market is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding refining and petrochemical capacities in countries such as China, India, and Japan. Growing urbanization, rising industrial investments, and government initiatives promoting process safety and automation are accelerating adoption. The region’s emergence as a manufacturing hub for catalyst handling equipment also makes solutions more affordable and accessible to a wider range of industrial operators.

Japan Catalyst Handling Services Market Insight

The Japan catalyst handling services market is expected to witness significant growth from 2026 to 2033 due to the country’s focus on industrial safety, advanced automation, and efficient operational practices. High-tech adoption in refineries and chemical plants, coupled with strict environmental and safety standards, is driving demand for modern catalyst handling solutions. Moreover, Japan’s aging workforce is expected to increase the need for automated systems that reduce manual handling and enhance workplace safety.

China Catalyst Handling Services Market Insight

The China catalyst handling services market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, expansion of refining and petrochemical sectors, and strong adoption of automation technologies. China is becoming a key market for catalyst handling services, with increasing integration of automated systems in both new and existing facilities. Government initiatives supporting safety, environmental compliance, and industrial modernization are further propelling the market across the country.

Catalyst Handling Services Market Share

The Catalyst Handling Services industry is primarily led by well-established companies, including:

- ANABEEB (U.S.)

- Mourik (Netherlands)

- Cat Tech (U.S.)

- CR Asia (Singapore)

- Technivac (U.K.)

- Catalyst Handling Resources (U.S.)

- Dickinson Group of Companies (U.S.)

- REMONDIS SE & Co. KG (Germany)

- Kanooz (U.A.E.)

- Group Peeters (Belgium)

- TubeMaster (U.S.)

- Plant-Tech Group (U.K.)

- DrillDrop (U.K.)

- Veolia (France)

- Albadr Group (U.A.E.)

- Maviro Inc. (U.S.)

- DeBusk, LLC (U.S.)

- CELTIC VACUUM LIMITED (U.K.)

- Reactor Services Inc. (U.S.)

- The HCI Group (U.S.)

- Prior Industrial Services B.V. (Netherlands)

Latest Developments in Global Catalyst Handling Services Market

- In November 2022, Veolia launched a new industrial catalyst management service in the U.K., aimed at enhancing productivity and minimizing downtime for manufacturers in sectors such as petrochemicals, ammonia, hydrogen, and steel. The service leverages advanced catalyst loading technology to ensure safe unloading of spent catalysts and precise loading of new materials. By employing patented methods for uniform catalyst distribution and increased density, Veolia improves plant efficiency and operational reliability, strengthening its position in the industrial catalyst handling market

- In June 2023, CR3 completed a major project for a Sustainable Aviation Fuel (SAF) producer as part of its capacity expansion initiatives. The company managed the initial catalyst loading for 33 new vessels, handling all associated mechanical tasks. This development supported the client’s production scale-up, enhanced operational efficiency, and underscored CR3’s growing influence in the sustainable fuels and industrial catalyst services market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Catalyst Handling Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Catalyst Handling Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Catalyst Handling Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.