Global Cataract Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.08 Billion

USD

13.82 Billion

2025

2033

USD

10.08 Billion

USD

13.82 Billion

2025

2033

| 2026 –2033 | |

| USD 10.08 Billion | |

| USD 13.82 Billion | |

|

|

|

|

Cataract Surgery Devices Market Size

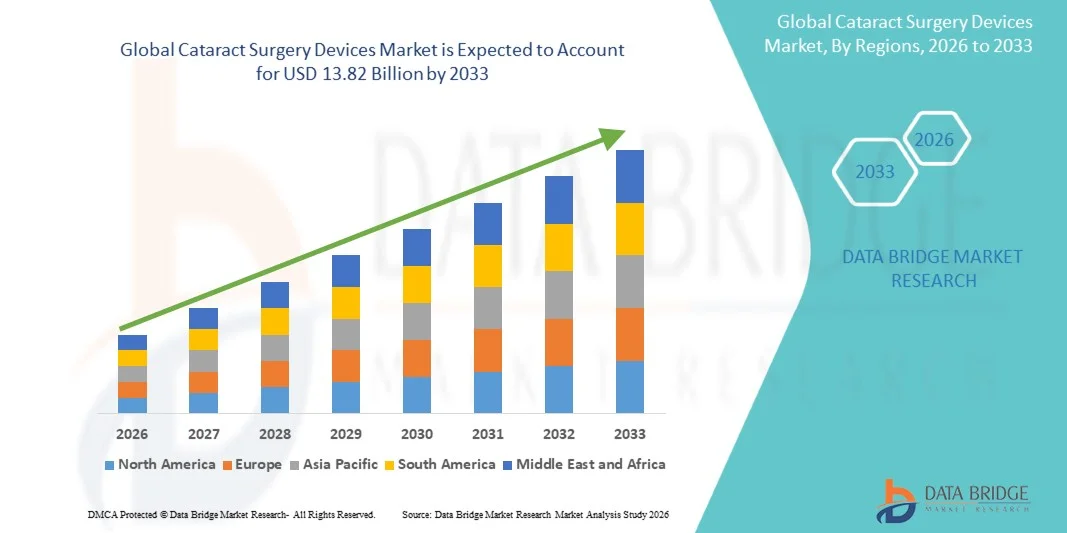

- The global cataract surgery devices market size was valued at USD 10.08 billion in 2025 and is expected to reach USD 13.82 billion by 2033, at a CAGR of 4.03% during the forecast period

- The market growth is largely driven by the rising prevalence of cataracts, an expanding geriatric population, and continuous technological advancements in ophthalmic surgical devices, improving procedural precision and outcomes across healthcare settings

- Furthermore, increasing demand for minimally invasive procedures, faster recovery times, and enhanced visual outcomes is establishing advanced cataract surgery devices as the standard of care. These converging factors are accelerating adoption, thereby significantly boosting the industry’s growth

Cataract Surgery Devices Market Analysis

- Cataract surgery devices, encompassing intraocular lenses, phacoemulsification systems, and surgical instruments, are essential components of modern ophthalmic care, enabling precise, minimally invasive cataract removal procedures that significantly improve visual outcomes and quality of life across diverse patient populations

- The growing demand for cataract surgery devices is primarily driven by the increasing global prevalence of cataracts, a rapidly aging population, and continuous technological advancements that enhance surgical efficiency, safety, and postoperative outcomes

- North America dominated the cataract surgery devices market with the largest revenue share of 38.4% in 2025, supported by advanced healthcare infrastructure, high procedure volumes, and strong adoption of premium intraocular lenses, with the U.S. witnessing sustained growth in cataract surgeries due to favorable reimbursement policies and ongoing innovation by leading ophthalmic device manufacturers

- Asia-Pacific is expected to be the fastest growing region in the cataract surgery devices market during the forecast period owing to a large untreated cataract population, improving access to eye care services, and increasing healthcare expenditure across emerging economies

- The Intraocular lens (IOL) segment dominated the cataract surgery devices market with a market share of 41.5% in 2025, driven by rising demand for premium and multifocal lenses that offer improved visual acuity and reduced dependence on corrective eyewear

Report Scope and Cataract Surgery Devices Market Segmentation

|

Attributes |

Cataract Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cataract Surgery Devices Market Trends

“Technological Advancements in Minimally Invasive and Premium Cataract Solutions”

- A significant and accelerating trend in the global cataract surgery devices market is the rapid advancement of minimally invasive surgical technologies and the growing adoption of premium intraocular lenses (IOLs), which are enhancing surgical precision, patient comfort, and postoperative visual outcomes

- For instance, Alcon’s CENTURION Vision System integrates advanced fluidics technology to provide greater chamber stability during phacoemulsification, while Johnson & Johnson Vision’s TECNIS Symfony IOL offers extended depth of focus, reducing patients’ dependence on spectacles

- Technological innovation in cataract surgery devices enables features such as improved ultrasound energy modulation, enhanced lens delivery systems, and better refractive accuracy. For instance, femtosecond laser-assisted cataract surgery systems improve incision precision and capsulotomy consistency, contributing to better clinical outcomes and reduced complication rates

- The seamless integration of diagnostic devices, surgical systems, and advanced IOLs allows ophthalmic surgeons to plan and execute cataract procedures with higher accuracy and efficiency. Through a coordinated surgical workflow, surgeons can optimize lens selection, surgical performance, and postoperative vision correction

- This trend toward more advanced, patient-centric, and outcome-driven cataract solutions is reshaping expectations in ophthalmic care. Consequently, companies such as ZEISS are developing integrated cataract surgery platforms combining diagnostics, surgical microscopes, and digital visualization technologies

- The demand for technologically advanced cataract surgery devices is growing steadily across hospitals, ambulatory surgical centers, and specialty eye clinics, as healthcare providers increasingly prioritize efficiency, safety, and superior visual outcomes

Cataract Surgery Devices Market Dynamics

Driver

“Rising Cataract Prevalence and Growing Geriatric Population”

- The increasing global prevalence of cataracts, coupled with the rapid expansion of the aging population, is a major driver fueling demand for cataract surgery devices worldwide

- For instance, in June 2025, Alcon announced continued investments in expanding its ophthalmic surgical portfolio to address the growing volume of age-related eye disorders, including cataracts, reflecting strong long-term demand fundamentals

- As cataracts remain one of the leading causes of visual impairment globally, healthcare systems are prioritizing timely surgical intervention, driving higher procedure volumes and sustained demand for reliable and efficient cataract surgery devices

- Furthermore, improvements in healthcare infrastructure, reimbursement coverage, and access to eye care services are encouraging more patients to undergo cataract surgery, particularly in developed economies

- Increasing government and non-government initiatives focused on eliminating preventable blindness are driving higher cataract surgery volumes, particularly through national eye health programs and public–private partnerships in emerging economies

- The rising preference for outpatient and ambulatory surgical centers, supported by advancements in compact and efficient cataract surgery systems, is further accelerating procedural adoption and device demand globally

- The availability of advanced devices that reduce surgical time, improve safety, and deliver predictable visual outcomes is motivating both surgeons and patients to opt for cataract surgery at earlier stages, further accelerating market growth

Restraint/Challenge

“High Device Costs and Regulatory Approval Complexity”

- The high cost of advanced cataract surgery devices and premium intraocular lenses presents a significant challenge to market expansion, particularly in cost-sensitive and developing regions

- For instance, regulatory requirements for ophthalmic surgical devices, including stringent clinical validation and approval processes, can delay product launches and increase development costs for manufacturers

- Addressing these challenges requires continuous investment in clinical research, compliance with evolving regulatory standards, and pricing strategies that balance innovation with affordability. Companies such as Bausch + Lomb emphasize regulatory compliance and phased product introductions to mitigate approval-related risks. In addition, premium cataract solutions often remain inaccessible to large patient populations due to limited reimbursement coverage

- While technological advancements continue to improve outcomes, the higher price of femtosecond laser systems and premium IOLs can restrict adoption among smaller hospitals and clinics with constrained budgets

- Limited availability of skilled ophthalmic surgeons and trained technicians in low- and middle-income countries can restrict the effective utilization of advanced cataract surgery devices, slowing market penetration despite rising patient need

- Variability in reimbursement policies and limited insurance coverage for premium intraocular lenses across regions can reduce patient affordability, thereby constraining the adoption of high-value cataract surgery technologies

- Overcoming these barriers through cost-optimized device development, expanded reimbursement support, and broader surgeon training programs will be essential for ensuring sustained and inclusive growth of the cataract surgery devices market

Cataract Surgery Devices Market Scope

The market is segmented on the basis of device type and end users.

- By Device Type

On the basis of device type, the cataract surgery devices market is segmented into intraocular lenses (IOL), ophthalmic viscoelastic devices (OVD), phacoemulsification equipment, and femtosecond laser equipment. The intraocular lens (IOL) segment dominated the market with the largest revenue share of 41.5% in 2025, driven by the indispensable role of IOLs in every cataract surgery procedure. The consistent rise in cataract surgeries globally directly translates into sustained demand for IOLs across all healthcare settings. Surgeons increasingly prefer advanced monofocal, multifocal, toric, and extended depth-of-focus lenses to improve postoperative visual outcomes. Continuous innovation in lens materials and designs enhances biocompatibility and refractive accuracy, supporting widespread adoption. In addition, repeat purchases for each procedure ensure steady revenue generation for manufacturers. The growing patient willingness to opt for premium lenses further reinforces the dominance of the IOL segment.

The femtosecond laser equipment segment is expected to witness the fastest growth during the forecast period, fueled by increasing adoption of laser-assisted cataract surgery. These systems offer superior precision in corneal incisions, capsulotomy, and lens fragmentation, leading to improved surgical consistency and safety. Rising demand for minimally invasive and technologically advanced procedures is encouraging hospitals and specialty eye centers to invest in femtosecond platforms. Growing surgeon preference for automation and reproducibility is accelerating uptake in developed markets. Furthermore, improving affordability and expanding clinical evidence supporting better outcomes are enhancing adoption rates. As patient awareness of premium surgical options increases, femtosecond laser systems are expected to experience rapid growth.

- By End Users

On the basis of end users, the cataract surgery devices market is segmented into ophthalmology centers, hospitals, and clinics. The hospitals segment dominated the market in 2025, supported by high surgical volumes and the availability of advanced ophthalmic infrastructure. Hospitals typically handle complex and high-risk cataract cases, necessitating the use of sophisticated surgical devices and premium consumables. The presence of experienced ophthalmic surgeons and access to advanced diagnostic and surgical technologies strengthen hospital-based procedures. Favorable reimbursement policies in developed regions further support high adoption rates. In addition, hospitals often act as early adopters of innovative cataract surgery equipment. Their ability to invest in high-cost systems contributes significantly to overall market revenue.

The ophthalmology centers segment is anticipated to register the fastest growth over the forecast period, driven by the increasing shift toward specialized and outpatient eye care services. These centers focus exclusively on ophthalmic procedures, enabling higher efficiency, faster patient turnaround, and cost-effective surgical delivery. Growing patient preference for dedicated eye care facilities is accelerating procedure volumes in these settings. Technological advancements have enabled compact and efficient cataract surgery systems suitable for standalone centers. Furthermore, expanding private investments and chain-based ophthalmology centers in emerging markets are boosting demand. The rising emphasis on ambulatory and day-care cataract surgeries positions ophthalmology centers as a key growth driver.

Cataract Surgery Devices Market Regional Analysis

- North America dominated the cataract surgery devices market with the largest revenue share of 38.4% in 2025, supported by advanced healthcare infrastructure, high procedure volumes, and strong adoption of premium intraocular lenses

- Patients and healthcare providers in the region place significant emphasis on superior visual outcomes, surgical precision, and the availability of premium intraocular lenses and minimally invasive surgical systems

- This widespread adoption is further supported by favorable reimbursement frameworks, a well-established network of ophthalmology centers and hospitals, and continuous innovation by leading medical device manufacturers, positioning North America as a key revenue-generating region

U.S. Cataract Surgery Devices Market Insight

The U.S. cataract surgery devices market captured the largest revenue share in North America in 2025, driven by a high prevalence of cataracts, advanced healthcare infrastructure, and early adoption of premium surgical technologies. Patients increasingly prefer minimally invasive procedures with better visual outcomes, encouraging hospitals and ambulatory surgical centers to invest in state-of-the-art devices. The widespread availability of reimbursement programs and insurance coverage further supports procedure volumes. Moreover, the growing focus on outpatient and day-care cataract surgeries is contributing to market expansion. Continuous innovation in intraocular lenses, phacoemulsification systems, and femtosecond laser technologies is further strengthening adoption.

Europe Cataract Surgery Devices Market Insight

The Europe cataract surgery devices market is projected to expand at a substantial CAGR during the forecast period, fueled by rising demand for high-precision cataract surgeries and advanced intraocular lens technologies. Increasing urbanization, improved healthcare access, and growing awareness of vision correction options are driving procedure volumes. European patients are also attracted to the convenience, faster recovery, and superior visual outcomes offered by modern cataract surgery devices. Hospitals and specialty eye clinics are investing in advanced surgical systems, including femtosecond lasers and premium IOLs. The region’s focus on innovation and adherence to regulatory standards supports market growth across both developed and emerging European countries.

U.K. Cataract Surgery Devices Market Insight

The U.K. cataract surgery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing patient awareness and demand for improved surgical outcomes. The rising prevalence of age-related cataracts and a well-established healthcare system encourage timely surgical interventions. Adoption of premium intraocular lenses and technologically advanced phacoemulsification systems is increasing across hospitals and ophthalmology centers. In addition, NHS initiatives and private healthcare investments in ophthalmic care are supporting procedure accessibility. Growing focus on minimally invasive and outpatient surgeries further stimulates the market. Integration of digital surgical planning and imaging technologies is enhancing adoption rates in both urban and semi-urban areas.

Germany Cataract Surgery Devices Market Insight

The Germany cataract surgery devices market is expected to expand at a considerable CAGR during the forecast period, supported by rising demand for technologically advanced surgical solutions and premium lens options. Patients and healthcare providers increasingly prioritize precision, safety, and better postoperative visual outcomes. Germany’s robust healthcare infrastructure, coupled with a high number of specialized ophthalmic centers, promotes adoption of modern cataract surgery devices. Hospitals are integrating advanced femtosecond laser systems and high-quality IOLs into their procedures. In addition, government support for eye health and strong insurance coverage further drive procedure volumes. The trend toward outpatient and minimally invasive cataract surgeries is further encouraging market growth.

Asia-Pacific Cataract Surgery Devices Market Insight

The Asia-Pacific cataract surgery devices market is poised to grow at the fastest CAGR during the forecast period, driven by a rising geriatric population, increasing prevalence of cataracts, and expanding access to advanced ophthalmic care. Rapid urbanization, growing disposable incomes, and awareness of modern vision correction solutions are boosting procedure volumes in countries such as China, Japan, and India. Governments in the region are promoting initiatives for vision care and reducing preventable blindness, increasing the adoption of cataract surgery devices. Expanding healthcare infrastructure, specialty eye hospitals, and affordable surgical solutions further support market growth. In addition, the region’s emergence as a manufacturing hub for ophthalmic devices is improving availability and cost-effectiveness of advanced surgical technologies.

Japan Cataract Surgery Devices Market Insight

The Japan cataract surgery devices market is gaining momentum due to the country’s aging population, high healthcare standards, and preference for advanced surgical techniques. Patients are increasingly seeking procedures that ensure faster recovery, better visual outcomes, and reduced reliance on corrective eyewear. Hospitals and ophthalmology centers are investing in premium intraocular lenses, femtosecond lasers, and advanced phacoemulsification equipment. Integration with digital surgical planning and imaging systems enhances procedural precision. The rising demand for outpatient and minimally invasive surgeries is further stimulating adoption. Moreover, awareness campaigns and technological literacy among patients are contributing to sustained growth in both residential and commercial healthcare settings.

India Cataract Surgery Devices Market Insight

The India cataract surgery devices market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing geriatric population, and increased healthcare awareness. Rising prevalence of cataracts, combined with expanding ophthalmology infrastructure, is encouraging higher surgical volumes. The push for affordable and high-quality cataract surgery devices, including premium IOLs and phacoemulsification systems, is further driving adoption. Government initiatives and smart city programs promoting vision care are facilitating access to surgical services. In addition, domestic device manufacturers and improving affordability of advanced devices are contributing to rapid market growth. Growing preference for outpatient and day-care cataract procedures is strengthening the overall adoption of surgical technologies.

Cataract Surgery Devices Market Share

The Cataract Surgery Devices industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Bausch + Lomb Corporation (Canada)

- Carl Zeiss Meditec AG (Germany)

- STAAR Surgical Company (U.S.)

- NIDEK Co., Ltd. (Japan)

- Topcon Corporation (Japan)

- HumanOptics AG (Germany)

- Oertli Instrumente AG (Switzerland)

- Oculentis GmbH (Germany)

- PhysIOL SA (Belgium)

- Biotech Healthcare Holding GmbH (Switzerland)

- Hanita Lenses (Israel)

- Medicontur Ltd. (Hungary)

- AST Products, Inc. (U.S.)

- Aurolab (India)

- Lenstec Inc. (U.S.)

- Rayner Intraocular Lenses Limited (U.K.)

- SIFI S.p.A. (Italy)

- Eagle Vision (U.S.)

What are the Recent Developments in Global Cataract Surgery Devices Market?

- In October 2025, Johnson & Johnson Vision announced that its TECNIS ODYSSEY intraocular lens (IOL) a next‑generation presbyopia‑correcting IOL had reached a milestone of 100,000 implants in the U.S., highlighting strong clinical adoption and reinforcing its role in expanding visual range outcomes for cataract patients

- In June 2025, Johnson & Johnson Vision expanded the roll‑out of its TECNIS Odyssey IOL into Europe, the Middle East, and Canada, offering cataract patients enhanced continuous vision from far to near with improved optics and reduced reliance on glasses

- In April 2025, Alcon launched the UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS) a next‑generation surgical platform offering innovations such as UNITY 4D Phaco and the HYPERVIT 30K vitrectomy probe designed to enhance surgical efficiency and patient outcomes in both cataract and vitreoretinal procedures

- In January 2025, Bausch + Lomb announced FDA approval of the enVista Envy intraocular lens, a continuous range‑of‑vision IOL designed to provide excellent visual outcomes with reduced dysphotopsia, broadening premium IOL options for U.S. cataract surgeons and patients

- In April 2023, ZEISS received U.S. FDA approval for its CT LUCIA 621P Monofocal IOL, expanding surgeon choices with aspheric optics designed to optimize visual outcomes and stability for a wide range of cataract patients in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.