Global Cath Lab Services Market

Market Size in USD Billion

CAGR :

%

USD

52.20 Billion

USD

82.51 Billion

2024

2032

USD

52.20 Billion

USD

82.51 Billion

2024

2032

| 2025 –2032 | |

| USD 52.20 Billion | |

| USD 82.51 Billion | |

|

|

|

|

Cath Lab Services Market Size

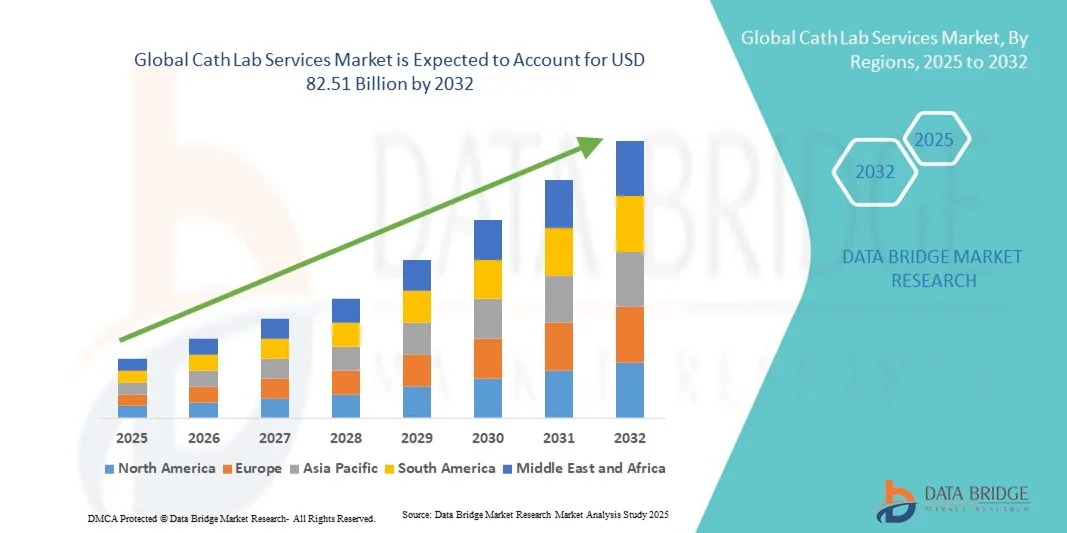

- The global cath lab services market size was valued at USD 52.20 billion in 2024 and is expected to reach USD 82.51 billion by 2032, at a CAGR of 5.89% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cardiovascular diseases, rising geriatric population, and growing demand for minimally invasive cardiac procedures across both developed and emerging economies

- Furthermore, advancements in imaging technologies, strategic hospital partnerships with specialized service providers, and the expansion of mobile cath lab facilities are enhancing accessibility and efficiency significantly accelerating the adoption of cath lab services globally

Cath Lab Services Market Analysis

- Cath lab services, which provide diagnostic and interventional cardiac procedures such as angiography and angioplasty, are becoming increasingly essential in modern cardiovascular care due to their role in early disease detection, minimally invasive treatment options, and improved patient outcomes across hospital and outpatient settings

- The rising global burden of cardiovascular diseases, growing aging population, and continuous advancements in interventional cardiology are the key factors fueling the demand for cath lab services worldwide

- North America dominated the cath lab services market with the largest revenue share of 39.1% in 2024, supported by a well-established healthcare infrastructure, high prevalence of coronary artery diseases, and strong presence of specialized cardiac centers and service providers

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rapid healthcare infrastructure development, increasing healthcare expenditure, and expanding access to advanced cardiac care in countries such as China and India

- The hospital segment dominated the market with market share of 55.9% in 2024, attributed to the availability of skilled cardiologists, comprehensive emergency support, and advanced imaging and interventional equipment integrated within hospital facilities

Report Scope and Cath Lab Services Market Segmentation

|

Attributes |

Cath Lab Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cath Lab Services Market Trends

Expansion of Mobile and Hybrid Cath Labs Enhancing Accessibility

- A major and accelerating trend in the global cath lab services market is the rapid expansion of mobile and hybrid cath labs, designed to deliver advanced cardiac diagnostics and interventional care to underserved and remote regions. This approach is improving accessibility and reducing patient travel time for critical cardiac procedures

- For instance, Alliance HealthCare Services and TridentCare have introduced mobile cath lab units equipped with advanced imaging systems, enabling hospitals and diagnostic centers to expand service coverage without major infrastructure investments

- The adoption of mobile and hybrid cath labs is allowing healthcare providers to manage higher patient volumes and respond swiftly to emergency cardiac cases, particularly in areas lacking permanent cath lab infrastructure. These setups also support flexible deployment during hospital renovations or high-demand periods

- The trend is also accelerating due to the increasing collaboration between hospital networks, diagnostic chains, and private service providers to expand regional access to interventional cardiology services

- Mobile and hybrid labs are being integrated with real-time telemedicine capabilities, allowing remote monitoring, virtual specialist consultations, and faster decision-making, which further enhances operational efficiency and patient care outcomes

- This growing trend towards portable, accessible, and technologically advanced cath lab setups is transforming the service delivery landscape and enabling equitable access to life-saving cardiac care worldwide

- Advancements in AI-powered imaging and cloud-based data storage are improving diagnostic precision and allowing secure sharing of angiographic data between institutions, strengthening collaborative treatment models

Cath Lab Services Market Dynamics

Driver

Rising Cardiovascular Disease Burden and Demand for Minimally Invasive Procedures

- The increasing global prevalence of cardiovascular diseases (CVDs) and the rising aging population are major drivers fueling demand for cath lab services across hospitals and diagnostic centers

- For instance, in March 2024, Philips Healthcare expanded its interventional cardiology solutions with next-generation imaging systems designed to support precise and minimally invasive cardiac procedures, reinforcing market growth potential

- As more patients and clinicians prefer minimally invasive interventions due to shorter recovery times and reduced complication risks, cath labs have become central to modern cardiac care delivery models

- Furthermore, the growing number of public–private partnerships and healthcare modernization programs in emerging economies is driving investments in advanced cath lab facilities

- The ability to provide accurate, real-time cardiac imaging, quick intervention turnaround, and high diagnostic accuracy makes cath labs indispensable in both emergency and planned cardiac treatments

- The increasing integration of AI-based analytics and robotic-assisted catheterization systems is further enhancing procedural efficiency, safety, and outcomes—contributing significantly to market expansion

- Governments and health organizations are increasingly funding cardiac awareness and screening programs, which in turn increase the demand for diagnostic cath lab procedures

- The rise of multi-specialty hospitals integrating dedicated cardiac wings is expanding the global capacity for interventional cardiology services, boosting overall market growth

Restraint/Challenge

High Operational Costs and Shortage of Skilled Cardiologists

- The significant capital and operational expenses associated with establishing and maintaining cath lab facilities pose a major challenge for smaller hospitals and healthcare providers, especially in developing regions

- For instance, cath lab setup costs involving imaging systems, radiation shielding, and maintenance can exceed USD 2–3 million per unit, which restricts market penetration in cost-sensitive markets

- Moreover, the shortage of skilled interventional cardiologists and trained technicians limits the ability of many healthcare centers to operate cath labs efficiently, leading to underutilization of existing infrastructure

- The requirement for strict compliance with radiation safety and healthcare regulations adds further complexity, increasing administrative and training costs for operators. While telecardiology and remote-assisted interventions are emerging solutions, adoption remains limited due to connectivity and technology integration challenges in rural and low-resource settings

- Overcoming these barriers through cost-efficient mobile lab models, workforce training programs, and government-funded cardiac care initiatives will be crucial for sustainable market growth

- In addition, limited reimbursement frameworks for interventional cardiac procedures in certain regions hinder hospitals’ ability to recover operational expenses, restricting service expansion

- The growing equipment maintenance and upgrade costs associated with rapid technological advancements also pressure smaller healthcare institutions to delay modernization, impacting service quality

Cath Lab Services Market Scope

The market is segmented on the basis of type, service type, and application.

- By Type

On the basis of type, the cath lab services market is segmented into cardiac catheterization, vascular angiogram, vascular angioplasty and stenting, and carotid artery stenting. The Cardiac Catheterization segment dominated the market with the largest revenue share of 35.4% in 2024, driven by its essential role in diagnosing coronary artery diseases, evaluating heart function, and detecting blockages. Hospitals and specialized cardiac centers widely adopt cardiac catheterization due to its minimally invasive nature and ability to guide treatment planning effectively. The increasing prevalence of cardiovascular diseases and early screening initiatives further reinforce the demand for cardiac catheterization procedures. Technological advancements such as 3D imaging, AI-assisted diagnostics, and robotic catheter navigation enhance procedural accuracy and safety, increasing adoption in developed and emerging markets.

The Vascular Angioplasty and Stenting segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, fueled by the rising preference for minimally invasive interventions to restore blood flow in patients with coronary and peripheral artery diseases. The procedure’s effectiveness in reducing recovery times and hospital stays makes it highly attractive for patients and healthcare providers. Moreover, innovations in drug-eluting stents, bioresorbable scaffolds, and robotic-assisted deployment are driving increased adoption. The segment is witnessing growing demand in Asia-Pacific and Latin America due to expanding healthcare infrastructure and rising awareness about interventional cardiology.

- By Service Type

On the basis of service type, the market is segmented into therapeutic cath lab services and diagnostic cath lab services. The Diagnostic Cath Lab Services segment dominated the market with a revenue share of 54.1% in 2024, as these services are essential for identifying cardiovascular abnormalities, evaluating disease severity, and guiding treatment planning. Hospitals and outpatient centers prioritize diagnostic cath lab procedures to ensure timely and accurate interventions. The rise of preventive healthcare programs, cardiovascular screening initiatives, and early detection strategies is contributing significantly to segment growth. Integration of AI-powered imaging and advanced hemodynamic monitoring enhances diagnostic precision, attracting more healthcare providers to adopt these services.

The Therapeutic Cath Lab Services segment is expected to witness the fastest growth rate of 8.2% from 2025 to 2032, driven by the increasing adoption of minimally invasive procedures such as angioplasty, stenting, and percutaneous valve interventions. These services reduce patient hospitalization time and offer better post-procedure outcomes compared to traditional surgical methods. Innovations in robotic-assisted interventions, real-time imaging, and hybrid procedure approaches are further boosting adoption across developed and emerging regions. Rising demand for elective and emergency therapeutic procedures also contributes to rapid market growth.

- By Application

On the basis of application, the market is segmented into hospitals, clinics, and others. The Hospitals segment dominated the market with a revenue share of 55.9% in 2024, attributed to the availability of advanced imaging systems, skilled interventional cardiologists, and emergency support for high-risk patients. Hospitals provide comprehensive cardiac care, including diagnostic and therapeutic procedures, making them the preferred choice for cath lab services. The growing trend of multi-specialty hospitals integrating dedicated cardiac wings and adopting cutting-edge technologies further strengthens this segment. For instance, large hospitals increasingly deploy hybrid cath labs to perform complex interventions efficiently while maintaining high patient throughput.

The Clinics segment is expected to witness the fastest growth rate of 9.1% from 2025 to 2032, fueled by the expansion of outpatient cardiology centers and ambulatory surgical units that provide cost-effective and accessible cath lab services. Clinics are increasingly equipped with advanced imaging and interventional tools, allowing for quick diagnosis and minor procedures. The rising prevalence of outpatient procedures, patient preference for shorter hospital visits, and expanding healthcare access in emerging regions are key factors driving segment growth. Clinics also benefit from partnerships with mobile cath lab providers to enhance service coverage.

Cath Lab Services Market Regional Analysis

- North America dominated the cath lab services market with the largest revenue share of 39.1% in 2024, supported by a well-established healthcare infrastructure, high prevalence of coronary artery diseases, and strong presence of specialized cardiac centers and service providers

- Healthcare providers in the region focus on early diagnosis and minimally invasive treatments, increasing the demand for both diagnostic and therapeutic cath lab services across hospitals and specialized cardiac centers

- This strong market presence is further supported by substantial healthcare expenditure, the availability of skilled interventional cardiologists, and the integration of cutting-edge imaging technologies and robotic-assisted systems, establishing North America as a key hub for high-quality cardiac care

U.S. Cath Lab Services Market Insight

The U.S. cath lab services market captured the largest revenue share of 42% in 2024 within North America, fueled by the high prevalence of cardiovascular diseases and advanced healthcare infrastructure. Hospitals and specialized cardiac centers are increasingly adopting minimally invasive diagnostic and interventional procedures, including angiography, angioplasty, and stenting. The growing demand for early detection of heart conditions, combined with technological advancements such as AI-assisted imaging and robotic catheter systems, further propels the market. Moreover, strong healthcare expenditure, skilled interventional cardiologists, and government initiatives supporting cardiovascular care contribute significantly to market growth.

Europe Cath Lab Services Market Insight

The Europe cath lab services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cardiovascular disease incidence and increasing demand for minimally invasive procedures. Enhanced hospital infrastructure and advanced imaging technologies are fostering the adoption of cath lab services across residential and commercial healthcare facilities. European healthcare providers are emphasizing preventive care and early diagnosis, increasing the utilization of diagnostic cath lab procedures. The region is witnessing significant growth across hospitals, outpatient clinics, and specialized cardiac centers, supported by favorable reimbursement policies and government healthcare initiatives.

U.K. Cath Lab Services Market Insight

The U.K. cath lab services market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of coronary artery diseases and the expanding adoption of interventional cardiology procedures. In addition, healthcare providers’ focus on minimally invasive procedures and faster patient recovery is encouraging the use of advanced cath lab services. The U.K.’s emphasis on high-quality healthcare infrastructure, coupled with skilled interventional cardiologists and growing investments in hospital upgrades, is expected to continue stimulating market growth.

Germany Cath Lab Services Market Insight

The Germany cath lab services market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of cardiovascular health and the growing demand for technologically advanced interventions. Germany’s well-established healthcare infrastructure, emphasis on medical innovation, and high patient expectations promote the adoption of diagnostic and therapeutic cath lab procedures. Hospitals and specialty cardiac centers are integrating advanced imaging systems and robotic-assisted intervention technologies, enhancing efficiency and patient outcomes. Regulatory support and reimbursement schemes further strengthen market adoption in the country.

Asia-Pacific Cath Lab Services Market Insight

The Asia-Pacific cath lab services market is poised to grow at the fastest CAGR of 9.5% during 2025–2032, driven by rising cardiovascular disease prevalence, increasing urbanization, and expanding healthcare infrastructure in countries such as China, India, and Japan. The region’s growing focus on early diagnosis, preventive care, and minimally invasive procedures is driving the adoption of cath lab services. Furthermore, government initiatives promoting healthcare modernization and the increasing availability of cost-effective interventional solutions are expanding access to advanced cardiac care. Asia-Pacific is also witnessing growing collaborations between hospitals and mobile cath lab providers, improving regional healthcare coverage.

Japan Cath Lab Services Market Insight

The Japan cath lab services market is gaining momentum due to the country’s aging population, high prevalence of cardiovascular diseases, and focus on preventive cardiac care. Hospitals and outpatient cardiac centers are increasingly adopting diagnostic and interventional procedures to improve patient outcomes. Integration of AI-based imaging, telecardiology, and robotic-assisted interventions is fueling growth, while government healthcare initiatives supporting early diagnosis and advanced cardiac care further strengthen market expansion.

India Cath Lab Services Market Insight

The India cath lab services market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing cardiovascular disease burden, and rising healthcare expenditure. India is witnessing significant adoption of diagnostic and interventional cath lab procedures in both hospitals and outpatient clinics. The expansion of private cardiac care networks, government health initiatives, and availability of cost-effective solutions are key factors propelling market growth. In addition, growing awareness of minimally invasive procedures and preventive healthcare is further accelerating demand for cath lab services across the country.

Cath Lab Services Market Share

The Cath Lab Services industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Shimadzu Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Stryker (U.S.)

- Ziehm Imaging GmbH (Germany)

- Agfa-Gevaert Group (Belgium)

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Cardinal Health, Inc. (U.S.)

What are the Recent Developments in Global Cath Lab Services Market?

- In September 2025, Allen Hospital in Iowa commenced construction on its third cardiac catheterization lab. This expansion aims to meet the increasing demand for diagnostic and treatment procedures, with projections indicating over 3,800 cath lab patients annually within five years. The new lab is expected to be operational by the end of the year, reinforcing the hospital's commitment to providing comprehensive heart care to the Cedar Valley community

- In October 2024, Baptist Health unveiled a state-of-the-art cardiac catheterization lab at Bethesda Hospital East in Boynton Beach, Florida. This facility enhances the hospital's ability to perform advanced cardiac procedures, including angiograms and stent placements, thereby improving access to critical heart care services for the local population

- In September 2024, Wenlock District Hospital in Mangaluru inaugurated its first-ever cath lab, performing its first angioplasty and angiogram procedures. This initiative, supported by the Manipal Academy of Higher Education, aims to provide free cardiac treatment under the Ayushman Bharat scheme, specifically for individuals holding Below Poverty Line (BPL) cards

- In April 2024, Andhra Pradesh Health Minister Y. Satya Kumar Yadav approved a proposal to enhance diagnostic facilities in government general hospitals (GGHs) across the state. The initiative includes the installation of six new CT scan machines and three cath lab machines, with a total investment of nearly Rs 50 crore. These facilities aim to improve healthcare access and diagnostic capabilities for economically disadvantaged patients in Andhra Pradesh

- In March 2024, the Chamarajanagar Institute of Medical Sciences (CIMS) in Karnataka proposed the establishment of a cath lab at its critical-care block in Yedapura, near completion. The unit would require an investment of ₹10 crore and aims to provide advanced, minimally invasive cardiac procedures such as angiography and angioplasty. This initiative seeks to enhance cardiac emergency care and reduce mortality in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.