Global Cattle Feed Non Protein Nitrogen Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.17 Billion

2024

2032

USD

1.52 Billion

USD

2.17 Billion

2024

2032

| 2025 –2032 | |

| USD 1.52 Billion | |

| USD 2.17 Billion | |

|

|

|

|

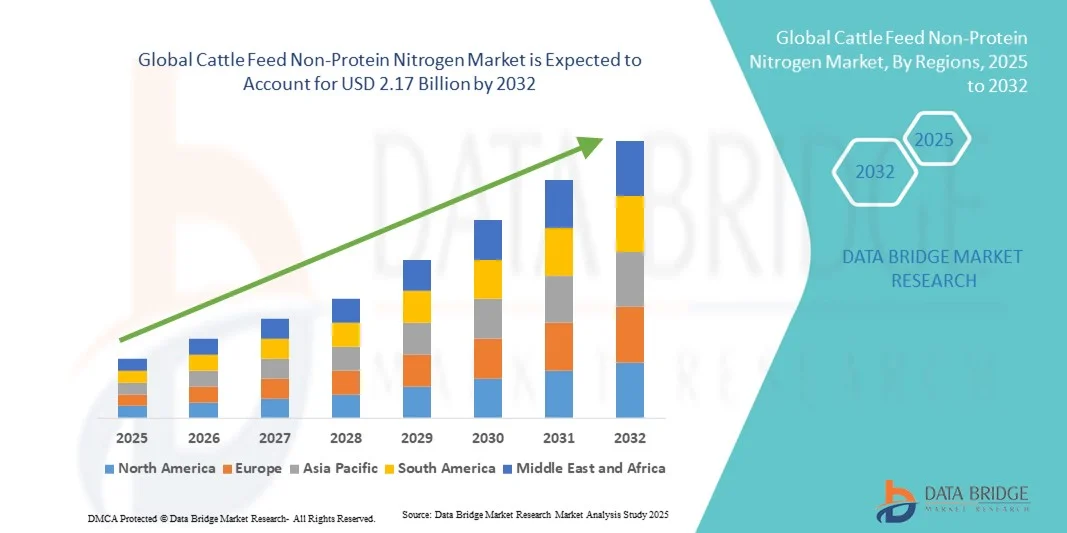

What is the Global Cattle Feed Non-Protein Nitrogen Market Size and Growth Rate?

- The global cattle feed non-protein nitrogen market size was valued at USD 1.52 billion in 2024 and is expected to reach USD 2.17 billion by 2032, at a CAGR of 4.60% during the forecast period

- Increasing demand for urea is the vital factor escalating the market growth, also rising cost of alternatives, rising growth of dairy industry, extreme rise in demand for animal products, increased rise in meat and cattle consumption, very cost effective, easy availability of non-protein nitrogen in the market, rising cattle population, rising cold chain development

- increased presence of protein when compared to other sources of feed, increased cooperative and private investment and changing market mechanisms, rising improvement in milk processing technologies and rising farmer's training and strict food safety norms by the government are the major factors among others driving the growth of cattle feed non-protein nitrogen market

What are the Major Takeaways of Cattle Feed Non-Protein Nitrogen Market?

- Rising demand from the emerging economies and rising technological advancements in the farming equipment will further create new opportunities for cattle feed non-protein nitrogen market

- However, rising stringent regulatory structure, rising toxicity of non-protein nitrogen in ruminants and rising causes of non-protein nitrogen toxicity are the major factors among others acting as restraints, while it is not recommended by nutritionists which will further challenge the growth of cattle feed non-protein nitrogen market in the forecast period mentioned above

- Asia-Pacific dominated the cattle feed non-protein nitrogen market with the largest revenue share of 42.6% in 2024, driven by the growing livestock population, expanding dairy and meat production, and rising awareness about livestock nutrition

- The North America cattle feed non-protein nitrogen market is poised to grow at the fastest CAGR of 9.5% from 2025 to 2032, driven by the region’s technological advancements in feed formulation, increasing emphasis on cost efficiency, and rising meat and dairy consumption

- The urea segment dominated the market with the largest revenue share of 64.3% in 2024, driven by its high nitrogen content, cost-effectiveness, and widespread use as a protein substitute in ruminant feed formulations

Report Scope and Cattle Feed Non-Protein Nitrogen Market Segmentation

|

Attributes |

Cattle Feed Non-Protein Nitrogen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cattle Feed Non-Protein Nitrogen Market?

Shift Towards Sustainable and Bio-based Nitrogen Sources

- A major and rapidly emerging trend in the cattle feed non-protein nitrogen market is the transition towards eco-friendly, bio-based nitrogen compounds derived from renewable sources. This shift is driven by the growing global emphasis on sustainability, reduced environmental footprint, and circular economy practices

- For instance, companies are increasingly investing in natural ammonia alternatives and fermentation-based nitrogen ingredients to enhance animal nutrition efficiency while reducing greenhouse gas emissions. BASF SE and Yara International ASA, for example, are focusing on developing lower-carbon nitrogen solutions for livestock feed

- This trend supports the global movement toward sustainable agriculture by minimizing dependency on synthetic fertilizers and optimizing nitrogen utilization in ruminant diets. Additionally, innovations in controlled-release and slow-acting nitrogen formulations are improving feed efficiency and reducing nitrogen waste

- The adoption of bio-based non-protein nitrogen (NPN) compounds is transforming cattle feed formulations, helping producers meet both environmental and productivity goals. As consumer awareness of sustainable food production grows, manufacturers are prioritizing eco-friendly nitrogen sources to align with market expectations and regulatory standards

- In summary, this trend marks a pivotal shift in the industry toward green feed additives, enhancing both productivity and sustainability while opening new avenues for innovation in livestock nutrition

What are the Key Drivers of Cattle Feed Non-Protein Nitrogen Market?

- The rising global demand for high-quality animal protein and the need for cost-effective feed solutions are major drivers of the Cattle Feed Non-Protein Nitrogen (NPN) market. NPN sources such as urea and biuret provide an economical way to enhance protein supply in cattle diets, promoting efficient rumen microbial activity and improved milk and meat yield

- For instance, in April 2024, Yara International ASA expanded its nitrogen-based feed additive production capacity to meet rising global demand, particularly in Asia-Pacific and Latin America, where livestock production is rapidly increasing

- The growing focus on ruminant productivity, coupled with the need to reduce feed costs, is pushing farmers and feed manufacturers to adopt NPN-based solutions. These additives provide a sustainable alternative to traditional protein sources like soybean meal, which are becoming increasingly expensive and resource-intensive

- Furthermore, the advancement of precision nutrition technologies enables accurate dosage and efficient utilization of non-protein nitrogen in cattle feed, minimizing waste and improving animal performance. Companies are developing innovative formulations to ensure optimal nitrogen assimilation and rumen health

- The global shift towards sustainable agriculture and the integration of NPN products into balanced feed strategies are fueling market growth, making these solutions indispensable for modern cattle farming systems

Which Factor is Challenging the Growth of the Cattle Feed Non-Protein Nitrogen Market?

- A major challenge hindering the growth of the cattle feed non-protein nitrogen market is the risk of ammonia toxicity and improper nitrogen utilization in cattle due to incorrect feed formulation or overuse. Mismanagement of NPN inclusion rates can lead to reduced feed efficiency and health issues among livestock, discouraging adoption among small-scale farmers

- For instance, several regulatory bodies, including the European Food Safety Authority (EFSA), have issued strict guidelines on urea inclusion limits in ruminant diets to prevent nitrogen poisoning and ensure animal welfare

- Another significant restraint is the lack of awareness and technical knowledge among livestock farmers in developing regions regarding the proper handling and use of NPN additives. Without adequate training, the benefits of these products remain underutilized, limiting market penetration

- Additionally, fluctuating raw material prices and stringent environmental regulations related to nitrogen emissions pose challenges for manufacturers, impacting profitability and production scalability

- Overcoming these challenges through farmer education programs, innovative safety-enhanced formulations, and regulatory alignment will be vital for long-term market expansion. As industry players invest in safer, more efficient NPN solutions, the market is expected to achieve steady growth, balancing productivity with animal health and environmental sustainability

How is the Cattle Feed Non-Protein Nitrogen Market Segmented?

The market is segmented on the basis of type and form.

- By Type

On the basis of type, the cattle feed non-protein nitrogen market is segmented into urea, ammonia, and others. The urea segment dominated the market with the largest revenue share of 64.3% in 2024, driven by its high nitrogen content, cost-effectiveness, and widespread use as a protein substitute in ruminant feed formulations. Urea enhances microbial protein synthesis in the rumen, supporting optimal growth and productivity in dairy and beef cattle. Its easy availability and low production cost further strengthen its dominance in the market.

The ammonia segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its increasing adoption as a sustainable non-protein nitrogen (NPN) source. Liquid ammonia offers advantages such as quick nitrogen release, easy blending with other feed ingredients, and reduced feed cost. As producers seek more efficient and controlled nitrogen utilization, ammonia-based NPN solutions are expected to gain significant traction during the forecast period

- By Form

On the basis of form, the cattle feed non-protein nitrogen market is segmented into dry, liquid, and pellets. The dry form segment accounted for the largest market revenue share of 57.6% in 2024, primarily due to its ease of storage, long shelf life, and suitability for blending with other feed ingredients. Dry NPN products, such as prilled urea and coated granules, are widely used by farmers and feed manufacturers due to their stability and compatibility with conventional feed processing methods.

The liquid form segment is projected to record the fastest CAGR from 2025 to 2032, fueled by the growing demand for easy-to-mix formulations and improved nutrient absorption efficiency. Liquid NPN forms offer better dispersion and consistency in feed, ensuring uniform nutrient intake and reduced wastage. With advancements in feed processing technologies and automated mixing systems, liquid formulations are gaining popularity across intensive livestock operations, particularly in large-scale dairy farms.

Which Region Holds the Largest Share of the Cattle Feed Non-Protein Nitrogen Market?

- Asia-Pacific dominated the cattle feed non-protein nitrogen market with the largest revenue share of 42.6% in 2024, driven by the growing livestock population, expanding dairy and meat production, and rising awareness about livestock nutrition. The region’s large cattle base, particularly in China, India, and Australia, has resulted in significant demand for non-protein nitrogen supplements like urea and ammonia to enhance feed efficiency and productivity

- Farmers in Asia-Pacific are increasingly adopting cost-effective protein alternatives to meet the growing feed demand, supported by government programs promoting sustainable livestock farming

- This dominance is further reinforced by strong agricultural infrastructure, technological advancements in feed formulation, and rising investments by key feed manufacturers to improve ruminant nutrition and optimize yield, cementing Asia-Pacific’s leading position in the global market

China Cattle Feed Non-Protein Nitrogen Market Insight

The China cattle feed non-protein nitrogen market accounted for the largest revenue share within Asia-Pacific in 2024, supported by its extensive cattle population and strong government initiatives to improve animal productivity. The growing focus on feed efficiency and nutrient utilization in China’s dairy and beef sectors is fostering the adoption of non-protein nitrogen sources like urea-based feed. Rapid industrialization of cattle farms and rising consumer demand for high-quality milk and meat products are further driving market expansion. Domestic manufacturers are also contributing by providing affordable, high-nitrogen formulations tailored to regional needs.

India Cattle Feed Non-Protein Nitrogen Market Insight

The India cattle feed non-protein nitrogen market is expected to witness robust growth throughout the forecast period, driven by the country’s increasing livestock population and the expanding dairy industry. Indian farmers are increasingly adopting urea-treated crop residues and ammonia-based supplements to compensate for protein deficiencies in traditional feed. Government programs supporting livestock productivity and rural development, alongside the expansion of organized feed mills, are strengthening market growth. India’s focus on cost-efficient, sustainable feeding solutions further enhances its share in the regional market.

Australia Cattle Feed Non-Protein Nitrogen Market Insight

The Australia cattle feed non-protein nitrogen market is projected to grow steadily, supported by a mature cattle sector focused on pasture-based feeding systems. The integration of non-protein nitrogen additives into feed blocks and dry supplements is helping enhance rumen microbial activity and digestion efficiency. Growing emphasis on export-oriented beef production, coupled with efforts to improve feed conversion ratios, continues to fuel demand for high-quality nitrogen supplements across the Australian cattle industry.

Which Region is the Fastest Growing Region in the Cattle Feed Non-Protein Nitrogen Market?

The North America cattle feed non-protein nitrogen market is poised to grow at the fastest CAGR of 9.5% from 2025 to 2032, driven by the region’s technological advancements in feed formulation, increasing emphasis on cost efficiency, and rising meat and dairy consumption. The region’s well-established cattle farming sector, coupled with growing awareness about rumen health and protein supplementation, is accelerating the adoption of non-protein nitrogen feed solutions.

U.S. Cattle Feed Non-Protein Nitrogen Market Insight

The U.S. accounted for the largest share of 83% within North America in 2024, owing to the country’s large-scale cattle operations and high demand for nutritionally balanced feed. Increasing adoption of precision nutrition practices and the integration of non-protein nitrogen sources like urea and biuret to enhance protein efficiency are propelling market growth. Additionally, the U.S. feed industry’s shift toward sustainability and improved nutrient utilization aligns with the growing use of non-protein nitrogen additives.

Canada Cattle Feed Non-Protein Nitrogen Market Insight

The Canada cattle feed non-protein nitrogen market is expected to witness substantial growth, driven by expanding dairy and beef industries and a rising focus on sustainable livestock nutrition. The adoption of nitrogen-enriched feeds helps Canadian farmers optimize production costs while maintaining animal health. Increasing collaboration between feed producers and research institutions is promoting the development of innovative feed formulations that incorporate controlled-release non-protein nitrogen products.

Mexico Cattle Feed Non-Protein Nitrogen Market Insight

The Mexico cattle feed non-protein nitrogen market is expanding rapidly, supported by rising livestock numbers and growing demand for cost-effective, high-nitrogen feed solutions. With increased government support for improving feed efficiency and livestock output, Mexico’s farmers are adopting urea-based feed additives to enhance rumen fermentation and productivity. The country’s proximity to major feed suppliers in the U.S. also facilitates access to advanced non-protein nitrogen formulations, accelerating market growth across the region.

Which are the Top Companies in Cattle Feed Non-Protein Nitrogen Market?

The cattle feed non-protein nitrogen industry is primarily led by well-established companies, including:

- ADM Animal Nutrition (U.S.)

- Yara International ASA (Norway)

- Antonio Tarazona (Spain)

- Alltech (U.S.)

- Fertiberia, S.A. (Spain)

- Kemin Industries, Inc. (U.S.)

- CF Industries Holdings, Inc. (U.S.)

- Nutrien Ltd. (Canada)

- GROUP DF (Ukraine)

- OCI N.V. (Netherlands)

- EuroChem (Switzerland)

- SABIC (Saudi Arabia)

- Orica Limited (Australia)

- URALCHEM JSC (Russia)

- IFFCO (India)

- Qatar Fertiliser Company (Qatar)

- Koch Fertilizer, LLC (U.S.)

- Haldor Topsoe A/S (Denmark)

- Trammo, Inc. (U.S.)

- OCI Nitrogen (Netherlands)

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

- Praxair Technology, Inc. (U.S.)

- Linde plc (Ireland)

What are the Recent Developments in Global Cattle Feed Non-Protein Nitrogen Market?

- In June 2025, agrochemical leaders such as Nutrien Ltd. and Yara International launched precision-integrated Non-Protein Nitrogen (NPN) formulations, merging slow-release urea and ammonia compounds with advanced digital feed-management systems. These innovations enhanced targeted dosing, minimized nitrogen runoff, and boosted rumen protein synthesis efficiency while supporting global sustainability and environmental compliance goals. This initiative marked a major step toward technologically advanced and eco-conscious livestock nutrition practices

- In January 2025, Nutrien Ltd. expanded its NPN product line through the acquisition of Actagro, integrating eco-friendly nutrient-use efficiency technologies to improve soil and feed productivity. During the same period, Alltech and Novozymes formed a joint venture to develop microbial inoculants tailored for NPN formulations, designed to enhance nutrient cycling, optimize rumen protein synthesis, and promote sustainable livestock farming. These strategic collaborations strengthened the global shift toward greener, innovation-driven feed solutions.

- In September 2021, Archer Daniels Midland Company (ADM) acquired a 75% stake in Pedigree Ovens, PetDine, NutraDine, and The Pound Bakery, key players in the pet treat and supplement sector. This acquisition expanded ADM’s footprint in the specialized animal nutrition segment, aligning with its long-term vision of integrating high-quality feed solutions and enhancing value across animal health and nutrition markets. The move underscored ADM’s commitment to diversification and sustainable growth in the animal nutrition industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.