Global Cbd Infused Pet Food Market

Market Size in USD Million

CAGR :

%

USD

277.54 Million

USD

476.56 Million

2025

2033

USD

277.54 Million

USD

476.56 Million

2025

2033

| 2026 –2033 | |

| USD 277.54 Million | |

| USD 476.56 Million | |

|

|

|

|

What is the Global CBD Infused Pet Food Market Size and Growth Rate?

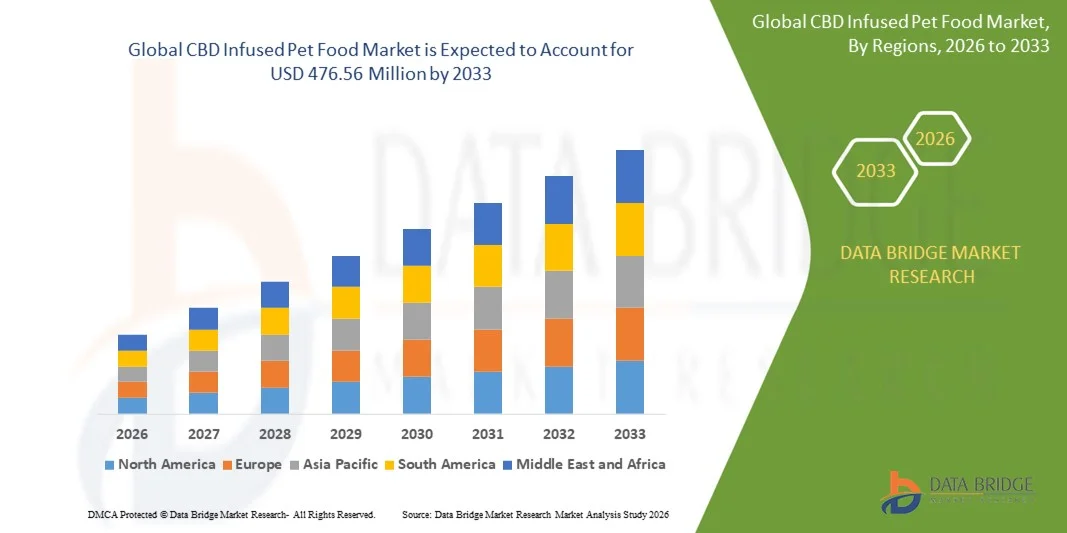

- The global CBD infused pet food market size was valued at USD 277.54 million in 2025 and is expected to reach USD 476.56 million by 2033, at a CAGR of7.00% during the forecast period

- Factors such as the increasing number of organic healthcare products which are favoured by pet owners have less side effects than conventional medication. It is effective in several diseases such as osteoarthritis for which the only current substitute is expensive drugs. CBD is known to handle and ease pain, anxiety, and seizures in pets

- The comparatively new and available market, the increasing number of household pets, the growing readiness to employ on the pet healthcare, small application costs and Different from the predictable medication for the pets the CBD healthcare products do not need to be customised for each separate pet species which in turn are expected to boost the growth of the CBD infused pet food market

What are the Major Takeaways of CBD Infused Pet Food Market?

- The uncertain governing atmosphere for the use of CBD infused pet food and manufacturing of the source product, the legal payments and limitations vary not only from country to country but also within different regions of the same country are the factors most such asly anticipated to further impede the growth of the CBD infused pet food market in the near future

- North America dominated the CBD Infused Pet Food market with a 42.1% revenue share in 2025, driven by strong growth in pet wellness awareness, rising pet adoption rates, and increasing consumer preference for natural and functional supplements across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, driven by rapid urbanization, rising disposable income, and increasing pet humanization across China, Japan, India, South Korea, and Southeast Asia

- The Therapeutic Grade segment dominated the market with a 55.4% share in 2025, driven by rising demand for high-potency formulations aimed at addressing pet health concerns such as anxiety, joint pain, and inflammation

Report Scope and CBD Infused Pet Food Market Segmentation

|

Attributes |

CBD Infused Pet Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the CBD Infused Pet Food Market?

Increasing Shift Toward Natural, Functional, and Health-Oriented CBD Infused Pet Foods

- The CBD Infused Pet Food market is witnessing strong adoption of functional formulations, natural ingredients, and dosage-controlled products designed to support pet health, stress relief, joint care, and overall wellness

- Manufacturers are introducing multi-functional, flavor-enhanced, and nutritionally balanced pet foods that offer precise CBD content, improved palatability, and compatibility with various pet dietary requirements

- Growing demand for affordable, high-quality, and convenient CBD-infused pet foods is driving adoption across pet owners, specialty pet stores, and online retail channels

- For instance, companies such as Honest Paws, Canna-Pet, Joy Organics, Pet Releaf, and Charlotte’s Web have upgraded their product portfolios with enhanced CBD concentrations, organic ingredients, and chewable or soft-bite formats

- Increasing focus on managing pet anxiety, improving joint health, and supporting immune function is accelerating the shift toward premium, functional CBD pet foods

- As pet owners seek natural and effective wellness solutions, CBD-infused pet foods will remain vital for holistic pet care, stress management, and long-term health support

What are the Key Drivers of CBD Infused Pet Food Market?

- Rising demand for safe, effective, and veterinarian-approved CBD pet foods to support stress reduction, mobility, pain relief, and overall wellness in cats and dogs

- For instance, in 2025, leading companies such as Charlotte’s Web, Pet Releaf, and Joy Organics expanded their portfolios with higher CBD concentrations, organic formulations, and flavor-enhanced options

- Growing awareness of pet health, rising pet adoption rates, and the humanization of pets are boosting demand for functional pet nutrition across the U.S., Europe, and Asia-Pacific

- Advancements in precise CBD dosing, natural ingredient sourcing, and palatability enhancements have strengthened product efficacy, consumer confidence, and repeat purchase behavior

- Rising prevalence of pet anxiety, joint disorders, skin issues, and chronic conditions is creating demand for specialized CBD-infused pet foods with targeted health benefits

- Supported by steady investments in R&D, regulatory clarity, and e-commerce distribution channels, the CBD Infused Pet Food market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the CBD Infused Pet Food Market?

- High costs associated with premium, organic, and high-concentration CBD pet foods restrict adoption among price-sensitive pet owners

- For instance, during 2024–2025, regulatory hurdles, limited ingredient availability, and compliance with country-specific CBD laws increased production costs for global brands

- Complexity in standardizing CBD dosing, ensuring consistent product quality, and meeting veterinary and consumer safety standards increases operational challenges

- Limited awareness in emerging markets regarding CBD benefits, dosage guidance, and safe consumption slows adoption

- Competition from herbal supplements, functional treats without CBD, and traditional pet food products creates price pressure and reduces differentiation for CBD-infused offerings

- To address these challenges, companies are focusing on cost-effective formulations, consumer education programs, quality certifications, and enhanced distribution to increase global adoption of CBD Infused Pet Foods

How is the CBD Infused Pet Food Market Segmented?

The market is segmented on the basis of product, application, and end-use.

- By Product

The CBD Infused Pet Food market is segmented into Therapeutic Grade and Food Grade products. The Therapeutic Grade segment dominated the market with a 55.4% share in 2025, driven by rising demand for high-potency formulations aimed at addressing pet health concerns such as anxiety, joint pain, and inflammation. These products provide standardized CBD concentrations, veterinary-approved ingredients, and enhanced bioavailability, making them the preferred choice for pet owners seeking clinically effective solutions. The segment’s popularity is further fueled by increased awareness of preventive and corrective pet healthcare, as well as regulatory approvals supporting high-quality therapeutic formulations.

The Food Grade segment is projected to grow at the fastest CAGR from 2026 to 2033, due to increasing consumer interest in everyday wellness-oriented treats, flavored snacks, and functional supplements for pets. Rising adoption of holistic nutrition, natural ingredients, and palatable snack formats drives growth across small-to-medium pets and urban markets.

- By Application

The market is segmented into Joint Pain, Anxiety or Stress, Epilepsy, General Health or Wellness, and Others. The Anxiety or Stress segment dominated the market with a 38.7% share in 2025, supported by a growing number of pets exhibiting behavioral stress, separation anxiety, and noise sensitivity. CBD-infused formulations targeting stress relief have gained rapid adoption due to their efficacy, safety, and convenience in daily pet care routines. Pet owners increasingly prefer chewables, soft bites, and oils that reduce nervousness while supporting overall emotional wellbeing.

The Joint Pain segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising incidence of arthritis, hip dysplasia, and age-related mobility issues in cats and dogs. Demand is rising for high-potency, veterinary-endorsed CBD products designed to support inflammation reduction and enhance joint flexibility. Growth in older pet populations and premium pet wellness spending further accelerates segment adoption globally.

- By End-Use

On the basis of end-use, the CBD Infused Pet Food market is segmented into Pet Specialty Stores, Online Retail Channel, Retail Pharmacies, Veterinary Clinics, E-Commerce, and Others. The Online Retail Channel segment dominated the market with a 46.2% share in 2025, owing to the convenience, broad product selection, competitive pricing, and doorstep delivery offered to pet owners. The surge in e-commerce platforms, subscription-based wellness products, and direct-to-consumer marketing strategies has strengthened this channel’s dominance.

The Veterinary Clinics segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising trust in vet-recommended CBD products, clinical guidance on dosage, and growing awareness of targeted health applications. Adoption of prescription-strength, therapeutic CBD products for mobility, anxiety, and chronic conditions is increasing, particularly in regions with well-established veterinary networks and regulatory frameworks for pet wellness products.

Which Region Holds the Largest Share of the CBD Infused Pet Food Market?

- North America dominated the CBD Infused Pet Food market with a 42.1% revenue share in 2025, driven by strong growth in pet wellness awareness, rising pet adoption rates, and increasing consumer preference for natural and functional supplements across the U.S. and Canada. High adoption of premium, therapeutic-grade, and flavor-enhanced CBD products continues to fuel demand across pet specialty stores, veterinary clinics, e-commerce platforms, and retail pharmacies

- Leading companies in North America are introducing high-potency, veterinarian-recommended, and palatable CBD-infused pet foods with precise dosing, organic ingredients, and multi-functional health benefits, strengthening the region’s product innovation and market leadership. Continuous investment in marketing, R&D, and e-commerce penetration further drives long-term expansion.

- Strong consumer education programs, established regulatory frameworks, and high disposable income among pet owners reinforce North America’s dominance in the global market

U.S. CBD Infused Pet Food Market Insight

The U.S. is the largest contributor in North America, supported by rising consumer demand for pet wellness solutions, high spending on premium pet foods, and extensive availability of online and offline retail channels. Increasing awareness of stress management, joint support, and general wellness for cats and dogs intensifies demand for therapeutic-grade CBD pet foods. Presence of major brands, subscription-based product models, and robust e-commerce adoption further drives market growth, reinforcing the U.S. as the epicenter of CBD pet food consumption and innovation.

Canada CBD Infused Pet Food Market Insight

Canada contributes significantly to regional growth, driven by rising pet ownership, growing veterinary endorsement of CBD products, and increasing adoption of functional and natural pet foods. Specialty pet stores, online retailers, and veterinary clinics are actively stocking CBD-infused formulations to meet growing consumer demand. Supportive regulations, awareness campaigns, and interest in holistic pet wellness are boosting adoption across the country, making Canada a key growth contributor in North America.

Asia-Pacific CBD Infused Pet Food Market

Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, driven by rapid urbanization, rising disposable income, and increasing pet humanization across China, Japan, India, South Korea, and Southeast Asia. Growing demand for stress-relief, joint-care, and general wellness products is fueling adoption of therapeutic and functional CBD-infused pet foods. Expanding e-commerce channels, veterinary recommendations, and rising awareness of natural pet care solutions continue to accelerate market penetration across the region.

China CBD Infused Pet Food Market Insight

China is the largest contributor to Asia-Pacific due to rising pet adoption, growing awareness of holistic pet care, and increasing presence of premium CBD brands. Rising demand for anxiety-relief, mobility support, and general wellness formulations drives adoption of high-quality, dosage-controlled CBD products. Expanding e-commerce channels and competitive pricing enhance domestic and cross-border market penetration, making China a key growth hub in the region.

Japan CBD Infused Pet Food Market Insight

Japan shows steady growth supported by high pet ownership, advanced retail infrastructure, and increasing consumer preference for natural and functional wellness products. Strong focus on product quality, safety, and veterinarian endorsement drives adoption of premium CBD-infused pet foods. Rising interest in stress management, cognitive support, and joint health for aging pets reinforces long-term market expansion.

India CBD Infused Pet Food Market Insight

India is emerging as a key growth hub, fueled by rising pet adoption, growing middle-class spending, and increasing awareness of natural wellness products. Rising e-commerce penetration, veterinary recommendations, and demand for stress relief, joint care, and general health supplements drive adoption of CBD-infused pet foods. Expansion of urban retail channels and digital marketing campaigns further accelerates market growth.

South Korea CBD Infused Pet Food Market Insight

South Korea contributes significantly due to increasing pet humanization, premiumization of pet products, and rising consumer awareness of functional pet foods. Demand for anxiety relief, joint support, and wellness-focused CBD products is growing across e-commerce, specialty pet stores, and veterinary clinics. Technological innovation, high-quality product offerings, and expanding retail channels support sustained market growth in the region.

Which are the Top Companies in CBD Infused Pet Food Market?

The CBD infused pet food industry is primarily led by well-established companies, including:

- Honest Paws, LLC (U.S.)

- Canna-Pet (U.S.)

- Fomo Bones (U.S.)

- Pet Releaf (U.S.)

- HolistaPet (U.S.)

- Joy Organics (U.S.)

- Wet Noses Inc. (U.S.)

- CBD Living (Canada)

- PET stock (U.S.)

- Petco Animal Supplies, Inc. (U.S.)

- Charlotte’s Web (U.S.)

- Nestle Purina (U.S.)

- GCH, Inc (U.S.)

- HempMy Pet (U.S.)

- SCHELL & KAMPETER, INC. (U.S.)

- Mars, Incorporated (U.S.)

- The J.M. Smucker Company (U.S.)

- Green Roads (U.S.)

- Colgate-Palmolive Company (U.S.)

What are the Recent Developments in Global CBD Infused Pet Food Market?

- In November 2025, Fusion CBD Products highlighted ongoing research demonstrating CBD’s therapeutic potential for anxiety, sleep disorders, psychosis, and other conditions, emphasizing the need for further clinical trials. This continued research supports product development and reinforces market credibility, driving investor and consumer confidence

- In March 2025, Fusion CBD Products launched Wiggles and Paws Dog Treats and Pet Drops to support aging pets experiencing arthritis, anxiety, and reactivity, formulated with organic, GMO-free hemp extract. The launch reflects rising demand for pet wellness solutions and fuels innovation in the CBD pet food segment

- In June 2024, Awaken CBD expanded its portfolio with CBD-infused pet treats and drops designed to reduce stress and promote calmness in dogs. This product introduction strengthened the company’s presence in the CBD pet care market and enhanced its competitive positioning

- In March 2024, CV Sciences, Inc. introduced +PlusCBD Pet Hip and Joint Health Chews and Calming Care Chews for dogs, combining CBD with antioxidants and anti-inflammatory agents and supported by NASC safety studies. These evidence-backed products enhanced consumer trust and drove adoption in the growing CBD pet food market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cbd Infused Pet Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cbd Infused Pet Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cbd Infused Pet Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.