Global Cbd Infused Snacks Market

Market Size in USD Billion

CAGR :

%

USD

1.94 Billion

USD

4.19 Billion

2025

2033

USD

1.94 Billion

USD

4.19 Billion

2025

2033

| 2026 –2033 | |

| USD 1.94 Billion | |

| USD 4.19 Billion | |

|

|

|

|

What is the Global CBD Infused Snacks Market Size and Growth Rate?

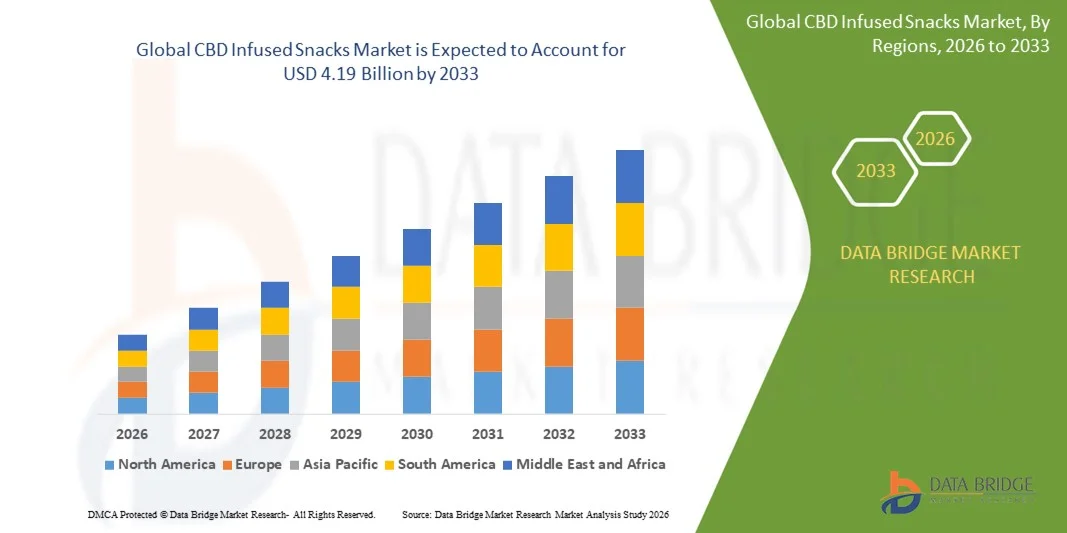

- The global CBD infused snacks market size was valued at USD 1.94 billion in 2025 and is expected to reach USD 4.19 billion by 2033, at a CAGR of 10.10% during the forecast period

- The increasing preference towards natural organic products over pharmaceuticals among consumers across the globe acts as one of the major factors driving the growth of CBD infused snacks market

- The rise in the production of industrial hemp and the increasing demand for cannabidiol (CBD) for the production of snacks and wellness products because of its healing abilities accelerate the CBD infused snacks market growth

- The growing trend of CBD infused snacks because of their therapeutic properties and shift in consumer food habits further influence the CBD infused snacks market

What are the Major Takeaways of CBD Infused Snacks Market?

- Emerging consumer trend owning to the rise in number of social media influencers promoting the benefits of the product merges and acquisitions among key players, research and development activities, change in lifestyle and surge in disposable income positively affect the CBD infused snacks market

- Furthermore, increase in research and development activities, product launches and the legalization of the product across nations extend profitable opportunities to the CBD infused snacks market players

- Europe dominated the CBD Infused Snacks market with a 39.4% revenue share in 2025, supported by rising consumer demand for plant-based, functional, and wellness-oriented snack options across the U.K., Germany, France, Italy, and the Netherlands

- Asia-Pacific is projected to register the fastest CAGR of 10.4% from 2026 to 2033, supported by growing wellness trends, rising disposable incomes, and expanding interest in CBD-infused edibles across Japan, China, India, South Korea, and Australia

- The Hemp segment dominated the market with a revenue share of 71.3% in 2025, driven by its legal acceptance across a wider number of countries, lower THC content, and suitability for mainstream food formulations

Report Scope and CBD Infused Snacks Market Segmentation

|

Attributes |

CBD Infused Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the CBD Infused Snacks Market?

Rising Demand for Nutrient-Enriched, Functional, and Wellness-Driven CBD Snack Products

- The CBD infused snacks market is witnessing strong growth toward nutrient-enriched, multifunctional, and clean-label snack formulations infused with CBD, adaptogens, proteins, and plant-based ingredients to enhance relaxation, stress relief, and overall wellness

- Manufacturers are introducing multi-purpose CBD snack innovations such as CBD-infused bars, gummies, trail mixes, chocolates, and protein bites designed to support mood balance, pain management, sleep enhancement, and daily nutrition

- Consumers are increasingly choosing natural, safe, and lab-tested CBD snacks to replace traditional high-sugar or chemically processed snack options, supporting demand across retail, online, and wellness-focused channels

- For instance, companies such as Green Roads, CBD American Shaman, Aurora Cannabis, and NatureBox have expanded their CBD snack portfolios with fortified blends targeting stress reduction, energy support, and post-workout recovery

- Growing awareness of holistic health, clean-label consumption, and functional snacking is accelerating global market adoption

- As consumers increasingly seek natural, multifunctional, and wellness-driven snack alternatives, CBD Infused Snacks are expected to remain central to innovation within the global functional foods and nutraceutical snacks market

What are the Key Drivers of CBD Infused Snacks Market?

- Rising consumer preference for natural, plant-based, nutrient-dense, and functionally enhanced CBD snack products is driving widespread adoption globally

- For instance, in 2025, companies such as Premium Jane, PureKana, and CBD American Shaman expanded their CBD snack product lines used in fitness nutrition, stress-relief formulations, and daily wellness snack packs

- Growing global awareness of stress management, anxiety reduction, sleep improvement, and wellness-focused diets is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in CBD extraction, nano-emulsion, flavor optimization, and infusion technologies have improved taste, bioavailability, and product consistency across various snack formats

- Rising demand for organic, vegan, gluten-free, clean-label, and non-GMO snack products is further contributing to market expansion, supported by increasing focus on sustainable and ethical ingredient sourcing

- With ongoing investments in R&D, product innovation, regulatory approvals, and global distribution partnerships, the CBD Infused Snacks market is expected to maintain strong growth in the coming years

Which Factor is Challenging the Growth of the CBD Infused Snacks Market?

- High extraction, purification, testing, and infusion costs associated with premium CBD isolates and broad-spectrum formulations limit affordability in price-sensitive regions

- For instance, during 2024–2025, fluctuations in hemp supply, CBD biomass quality, and processing chemical costs affected production volumes for several manufacturers

- Strict regulatory requirements for CBD classification, food safety certification, THC-limit compliance, and cross-border approval increase operational complexities

- Limited consumer awareness in emerging markets regarding CBD benefits, safety standards, and legal status restricts widespread adoption of CBD snack products.

- Strong competition from functional snacks infused with herbs, proteins, vitamins, and non-CBD adaptogens creates pricing and differentiation pressure for CBD snack brands

- To overcome these challenges, companies are focusing on cost-efficient extraction, regulatory compliance, transparent labeling, and consumer education to expand global adoption of high-quality CBD Infused Snacks

How is the CBD Infused Snacks Market Segmented?

The market is segmented on the basis of source, product, and distribution channel.

- By Source

On the basis of source, the CBD infused snacks market is segmented into Marijuana and Hemp. The Hemp segment dominated the market with a revenue share of 71.3% in 2025, driven by its legal acceptance across a wider number of countries, lower THC content, and suitability for mainstream food formulations. Hemp-derived CBD is more widely used in snacks such as gummies, cookies, protein bars, and granola clusters due to easier sourcing, predictable potency, and compliance with global regulatory standards. Its mild flavor, high nutritional profile, and compatibility with clean-label product development further strengthen its demand among manufacturers.

The Marijuana segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising legalization across the U.S., Canada, parts of Europe, and evolving reforms in Asia-Pacific. Increasing adoption of high-CBD marijuana extracts for premium wellness snacks, therapeutic edibles, and functional nutrition products is accelerating growth globally.

- By Product

On the basis of product, the CBD infused snacks market is segmented into Gummies, Bars, Cookies, and Others. The Gummies segment dominated the market with a revenue share of 46.8% in 2025, attributed to their convenience, precise dosage control, wide flavor availability, and high consumer acceptance across wellness and recreational categories. Gummies are easy to formulate with CBD isolates, broad-spectrum, and full-spectrum extracts, making them suitable for daily stress relief, sleep support, and relaxation-driven functional snacking. Their portability, longer shelf life, and strong retail presence further enhance category leadership.

The Bars segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for protein-rich, plant-based, and energy-boosting CBD snack bars. Growing adoption among fitness consumers, busy professionals, and health-conscious millennials is expanding opportunities for CBD-infused granola bars, energy bars, and nutrition bars across global markets.

- By Distribution Channel

On the basis of distribution channel, the CBD infused snacks market is segmented into Hypermarkets/Supermarkets, Convenience Stores, Discount Stores, Pharmacy/Drug Stores, Food & Drink Specialty Stores, Independent Small Groceries, and E-Retailers. The Hypermarkets/Supermarkets segment dominated the market with a revenue share of 44.2% in 2025, supported by strong product visibility, trusted retail environments, and expanded CBD sections offering gummies, bars, cookies, and specialty snacks. These outlets enable brand promotions, in-store sampling, and wide assortment availability for both premium and mass-market CBD snacks.

The E-Retailers segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising online CBD purchases, subscription-based models, doorstep delivery, and availability of detailed product descriptions with lab-test transparency. E-commerce platforms allow easy comparison of potency, ingredients, and price, accelerating global adoption—particularly among tech-savvy and wellness-focused consumers.

Which Region Holds the Largest Share of the CBD Infused Snacks Market?

- Europe dominated the CBD Infused Snacks market with a 39.4% revenue share in 2025, supported by rising consumer demand for plant-based, functional, and wellness-oriented snack options across the U.K., Germany, France, Italy, and the Netherlands. Strong awareness of natural health products, stress-relief formulations, and clean-label CBD-infused foods is driving high adoption in gummies, bars, cookies, and premium functional snacks

- Regional manufacturers are introducing advanced CBD extraction technologies, flavor-enhanced formulations, THC-free offerings, and organic-certified snack lines to meet regulatory compliance and quality expectations. Supportive regulations for hemp-derived CBD, combined with rising mental wellness and relaxation-focused consumption trends, further strengthen Europe’s leadership

U.K. CBD Infused Snacks Market Insight

The U.K. is the largest contributor within Europe, driven by high consumer acceptance of CBD edibles, gummies, and functional snacks targeted at anxiety relief, sleep improvement, and daily wellness. Manufacturers are expanding premium CBD snack offerings with vegan, sugar-free, gluten-free, and organic variants. Strong e-commerce adoption, transparent lab testing, and evolving regulatory clarity continue to support market growth.

Germany CBD Infused Snacks Market Insight

Germany contributes significantly to regional expansion, supported by rising demand for CBD-infused functional foods, mood-enhancing snacks, and natural wellness supplements. Food manufacturers are launching CBD gummies, protein bars, and infused cookies using broad-spectrum and isolate-based formulations. Increasing adoption of clean-label, safe, and non-psychoactive CBD snacks supports strong retail and pharmacy-driven sales.

France CBD Infused Snacks Market Insight

France shows steady growth, driven by increasing acceptance of hemp-derived products, interest in stress-relief foods, and a shift toward healthier snacking habits. CBD-infused gummies, premium chocolates, and pastries are gaining visibility across supermarkets, specialty stores, and online channels. Strong consumer inclination toward natural calming products reinforces market momentum.

Asia-Pacific CBD Infused Snacks Market Insight

Asia-Pacific is projected to register the fastest CAGR of 10.4% from 2026 to 2033, supported by growing wellness trends, rising disposable incomes, and expanding interest in CBD-infused edibles across Japan, China, India, South Korea, and Australia. Increasing acceptance of plant-based, stress-relief, and mood-support snacks is boosting consumption. Rapid expansion of e-commerce, digital health trends, and rising youth awareness of CBD functionality further accelerate regional growth.

China CBD Infused Snacks Market Insight

China is emerging as a key contributor, driven by rising demand for CBD gummies, chocolates, and infused foods among young adults seeking stress relief and wellness benefits. Growing interest in hemp-based food innovation and expanding retail availability support market growth. Investments in large-scale CBD processing and product innovation continue to enhance domestic and export opportunities.

Japan CBD Infused Snacks Market Insight

Japan shows strong growth due to rising consumption of CBD-infused gummies, functional foods, and relaxation-oriented snacks. High preference for low-sugar, premium-quality, and scientifically backed products drives adoption. Increasing retail visibility, professional endorsements, and wellness-driven marketing campaigns support steady expansion.

India CBD Infused Snacks Market Insight

India is emerging as a fast-growing market supported by growing awareness of stress management, sleep improvement, and natural wellness solutions. Rising consumer interest in CBD gummies, herbal snacks, and hemp-based nutrition bars is driving adoption. Strong e-commerce penetration and increasing familiarity with plant-based wellness trends are accelerating growth.

South Korea CBD Infused Snacks Market Insight

South Korea contributes significantly to Asia-Pacific growth due to high interest in functional snacks, beauty-from-within foods, and natural mood enhancers. CBD gummies and premium infused snack bars are gaining traction among younger consumers. Wellness trends, K-food branding, and social media influence continue to stimulate market expansion.

Which are the Top Companies in CBD Infused Snacks Market?

The CBD infused snacks industry is primarily led by well-established companies, including:

- Tilray (Canada)

- Aurora Cannabis (Canada)

- GW Pharmaceuticals plc (U.K.)

- NatureBox (U.S.)

- Medical Marijuana, Inc. (U.S.)

- Livity Foods (U.S.)

- Velobar (U.S.)

- Weller (U.S.)

- evo hemp (U.S.)

- CBD American Shaman (U.S.)

- Dixie (U.S.)

- Premium Jane (U.S.)

- PureKana (U.S.)

- Isodiol International Inc. (Canada)

- CV Sciences, Inc. (U.S.)

- NuLeaf Naturals, LLC (U.S.)

- Green Roads (U.S.)

- FOLIUM BIOSCIENCES (U.S.)

- Medterra (U.S.)

- Gaia Herbs (U.S.)

What are the Recent Developments in Global CBD Infused Snacks Market?

- In June 2023, Koios Beverage Corp. announced the expansion of its Fit Soda product line into 300 additional convenience stores across Florida, South Carolina, North Carolina, and Georgia. This strategic growth initiative strengthens the company’s retail footprint and enhances accessibility for a wider consumer base. This expansion reinforces Koios’ commitment to increasing market presence and meeting rising demand for functional beverage options

- In November 2022, Alkaline88 LLC extended the availability of its premium sports drink to more than 250 Harris Teeter stores, offering consumers enhanced hydration supported by essential electrolytes and minerals. Leveraging its proprietary electrolysis process, the company continues to deliver high pH water designed for superior hydration performance. This move demonstrates Alkaline88’s ongoing efforts to reach health-focused consumers through expanded retail distribution

- In April 2022, Dixie Brands Inc. and BR Brands, merged under BellRock, expanded their diverse product portfolio within the Michigan market. The company further strengthened its regional presence by entering the Ohio market through a strategic licensing partnership. This expansion highlights BellRock’s long-term strategy to accelerate growth across emerging cannabis markets and adapt to evolving consumer needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cbd Infused Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cbd Infused Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cbd Infused Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.