Global Ccd Imagers Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

4.61 Billion

2024

2032

USD

3.10 Billion

USD

4.61 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 4.61 Billion | |

|

|

|

|

Charge-Coupled Device (CCD) Imagers Market Size

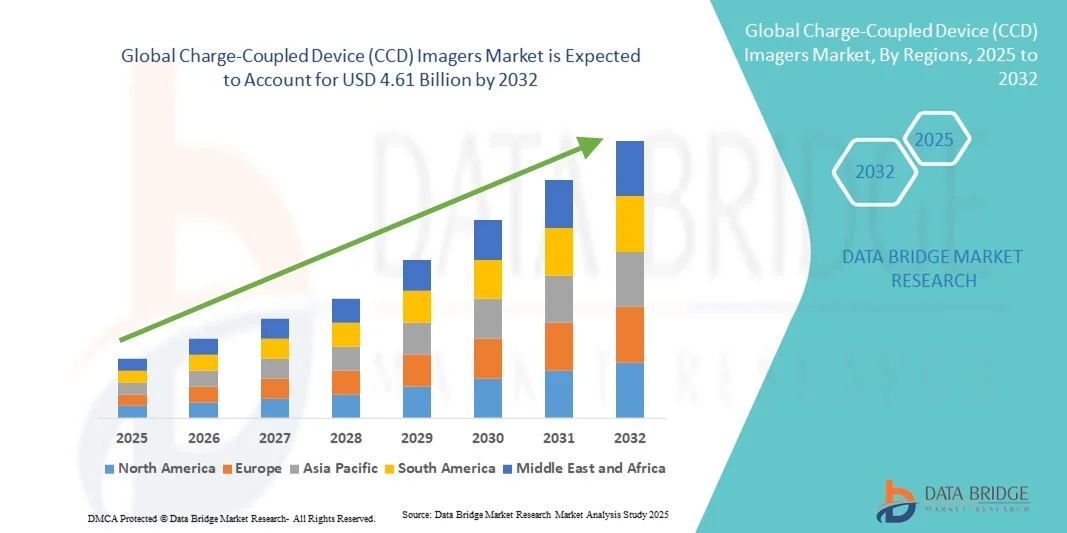

- The global Charge-Coupled Device (CCD) Imagers market size was valued at USD 3.10 billion in 2024 and is expected to reach USD 4.61 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within imaging technologies and optical devices, leading to increased digitalization in sectors such as healthcare, automotive, industrial automation, and consumer electronics

- Furthermore, rising consumer and industry demand for high-resolution, reliable, and energy-efficient imaging solutions is establishing Charge-Coupled Device (CCD) Imagers as a preferred choice for precision imaging applications. These converging factors are accelerating the uptake of CCD Imager solutions, thereby significantly boosting the industry's growth

Charge-Coupled Device (CCD) Imagers Market Analysis

- Charge-Coupled Device (CCD) Imagers, widely used in medical imaging, astronomy, industrial inspection, and consumer electronics, are increasingly vital due to their superior sensitivity, low noise levels, and high image quality compared to alternative imaging technologies. Their applications across healthcare diagnostics, scientific research, and advanced surveillance systems make them an indispensable component of modern imaging solutions

- The escalating demand for CCD imagers is primarily fueled by the rising adoption of digital imaging in healthcare and life sciences, growing investments in space exploration and astronomy, and the expanding use of high-resolution imaging in industrial quality control and defense applications

- North America dominated the charge-coupled device (CCD) imagers market with the largest revenue share of 38.5% in 2024, characterized by strong adoption across medical imaging, robust R&D investments, and the presence of leading industry players. The U.S. experienced substantial growth in CCD imager adoption within diagnostic imaging systems, space research programs, and advanced microscopy, supported by continuous innovations from both established companies and emerging startups

- Asia-Pacific is expected to be the fastest growing region in the charge-coupled device (CCD) imagers market during the forecast period, with a projected CAGR from 2025 to 2032, driven by rapid industrialization, rising disposable incomes, and increasing investments in semiconductor and imaging technologies in countries such as China, Japan, and India

- The stationary segment dominated the charge-coupled device (CCD) imagers market with the largest revenue share of 64.3% in 2024, driven by its integration in high-end medical imaging systems, astronomy equipment, and industrial testing devices. Stationary CCD systems are widely valued for their superior stability, precision, and ability to operate under controlled conditions

Report Scope and Charge-Coupled Device (CCD) Imagers Market Segmentation

|

Attributes |

Charge-Coupled Device (CCD) Imagers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Charge-Coupled Device (CCD) Imagers Market Trends

Enhanced Convenience Through AI and Advanced Integration

- A significant and accelerating trend in the global charge-coupled device (CCD) imagers market is the deepening integration of artificial intelligence (AI) with imaging systems. AI-powered CCD imagers are being increasingly used to enhance image quality, automate data analysis, and improve diagnostic accuracy across industries such as healthcare, astronomy, and industrial inspection. This convergence of technologies is redefining user experience by enabling faster, smarter, and more reliable imaging solutions

- For instance, AI-enabled CCD imagers in medical diagnostics now offer advanced noise reduction, improved low-light sensitivity, and automated detection of anomalies in X-ray and ophthalmology imaging. Similarly, in astronomical research, CCD imagers integrated with AI algorithms enhance the clarity of deep-space images, enabling scientists to detect faint celestial objects with higher precision

- AI integration also plays a critical role in industrial applications, where CCD imagers are used in automated quality inspection systems. By learning patterns and identifying even the smallest defects in semiconductor wafers or automotive parts, these systems ensure higher accuracy and efficiency in manufacturing environments

- The seamless integration of CCD imagers with advanced digital platforms facilitates real-time monitoring, cloud-based data analysis, and connectivity with broader imaging ecosystems. This enables researchers, clinicians, and engineers to analyze imaging results from multiple devices through centralized systems, improving workflow efficiency and decision-making

- This trend toward intelligent, adaptive, and interconnected imaging systems is fundamentally reshaping expectations in sectors that rely heavily on high-resolution imaging. Consequently, companies are increasingly developing AI-enabled CCD imagers with enhanced sensitivity, automated calibration, and compatibility with advanced analytics platforms

- The demand for CCD imagers that combine AI-driven automation, enhanced accuracy, and seamless integration with digital ecosystems is growing rapidly across both research and commercial sectors, as industries prioritize precision, efficiency, and advanced imaging functionality

Charge-Coupled Device (CCD) Imagers Market Dynamics

Driver

Growing Need Due to Rising Security Concerns and Smart System Adoption

- The increasing prevalence of security concerns in sensitive applications such as defense, aerospace, medical imaging, and industrial inspection, coupled with the accelerating adoption of smart monitoring ecosystems, is a significant driver for the heightened demand for Charge-Coupled Device (CCD) Imagers

- For instance, in February 2023, Gpixel Inc. announced the launch of a high-speed global shutter image sensor (the GSPRINT4502), offering 2.5 megapixels at 3460 frames-per-second, aimed at industrial inspection and high-speed imaging applications. Such developments by leading companies are expected to drive growth in the CCD Imagers market over the forecast period

- As organizations and consumers become more aware of potential security and monitoring threats, CCD imagers provide advanced features such as high-resolution surveillance, low-light performance, and tamper-resistant image capture, offering a compelling upgrade over older imaging technologies

- Furthermore, the growing popularity of smart security devices and interconnected ecosystems is making CCD imagers an integral component of these systems, ensuring seamless integration with AI-driven analytics, cloud-based platforms, and other smart imaging solutions

- The ability to provide real-time monitoring, remote data access, and automated analysis are key factors propelling the adoption of CCD imagers across residential, commercial, and industrial sectors. The trend toward DIY installations and the increasing availability of user-friendly CCD-based imaging devices further contribute to market expansion

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns surrounding the cybersecurity vulnerabilities of connected imaging devices, including CCD-based systems, pose a significant challenge to broader market penetration. As CCD imagers are increasingly networked for remote access and cloud connectivity, they can be susceptible to hacking attempts and data breaches, raising anxieties among potential users regarding the safety of sensitive information and surveillance data

- For instance, high-profile reports of vulnerabilities in IoT-enabled imaging systems have made some enterprises cautious about adopting advanced CCD-based monitoring and diagnostic solutions

- Addressing these concerns through robust encryption, secure data transfer protocols, and frequent firmware updates is crucial for building user trust. Companies in the CCD imagers market are emphasizing end-to-end encryption, enhanced authentication systems, and compliance with global cybersecurity standards in their product strategies

- In addition, the relatively high initial cost of advanced CCD imagers compared to conventional imaging technologies can be a barrier to adoption for cost-sensitive industries, particularly in developing regions or small-scale research facilities. While more affordable options are emerging, premium models with features such as integrated AI processors, advanced low-light sensitivity, or multispectral imaging often carry a higher price tag

- Although prices are gradually decreasing with technological maturity, the perceived premium for advanced CCD imaging systems can still hinder widespread adoption, especially among users who do not immediately require cutting-edge features

- Overcoming these challenges through enhanced cybersecurity, increased awareness of imaging benefits, and the development of cost-effective CCD solutions will be vital for ensuring sustainable market growth

Charge-Coupled Device (CCD) Imagers Market Scope

The market is segmented on the basis of image processing, application, mobility, and end use.

- By Image Processing

On the basis of image processing, the Charge-Coupled Device (CCD) Imagers market is segmented into 2D and 3D. The 2D segment dominated the largest market revenue share of 62.5% in 2024, driven by its widespread application in medical imaging, astronomy, industrial inspection, and consumer electronics. Its ability to deliver high-quality, low-noise images has made 2D CCD imagers a preferred choice across diagnostic imaging and scientific research. Their proven reliability, cost-effectiveness, and established presence in various imaging systems continue to fuel market demand. The large installed base of 2D imaging devices also supports consistent replacement and upgrade cycles, contributing to sustained revenue growth. Increasing investments in R&D to enhance resolution and sensitivity in 2D CCD technology further reinforce its dominant position. Moreover, healthcare institutions and research centers continue to rely on 2D imaging for routine analysis, ensuring its market leadership.

The 3D segment is anticipated to witness the fastest growth rate of 19.8% CAGR from 2025 to 2032, propelled by rising adoption in advanced medical diagnostics, robotics, and industrial automation. 3D CCD imagers enable more precise depth perception and structural analysis, making them vital in applications such as endoscopy, minimally invasive surgeries, and advanced X-ray imaging. In industrial settings, they support quality control processes with higher accuracy, reducing errors in automated production lines. The demand is also expanding in sectors like security surveillance and aerospace, where 3D imaging enhances situational awareness. Growing integration with artificial intelligence and machine learning systems further drives uptake of 3D imaging solutions. Increasing focus on improving accuracy in healthcare diagnostics is also fostering adoption. Collectively, these factors are positioning the 3D segment as the fastest-growing area of the CCD Imagers market.

- By Application

On the basis of application, the Charge-Coupled Device (CCD) Imagers market is segmented into endoscopy, X-ray, and others. The X-ray segment accounted for the largest market revenue share of 55.1% in 2024, supported by extensive use of CCD imagers in medical radiography, dental imaging, and industrial non-destructive testing. Their high sensitivity and ability to capture detailed images make CCDs highly suitable for diagnostic X-ray systems. Hospitals and diagnostic centers prefer CCD-based X-ray imaging for its superior contrast resolution and consistent performance. The rising global burden of chronic diseases and demand for advanced diagnostic solutions are driving steady adoption. Furthermore, government initiatives to modernize healthcare infrastructure and expand access to diagnostic imaging reinforce the segment’s leading role. Investments in upgrading existing radiology equipment with CCD-based detectors also contribute to its dominance.

The endoscopy segment is projected to record the fastest CAGR of 20.6% from 2025 to 2032, fueled by the growing prevalence of gastrointestinal, urological, and gynecological disorders requiring minimally invasive procedures. CCD imagers provide clear, high-resolution images in endoscopic devices, enabling more accurate diagnosis and treatment. Advances in miniaturization have enhanced their integration into compact, flexible endoscopes, expanding usage across both hospitals and outpatient facilities. Rising patient preference for less invasive diagnostic methods is accelerating demand for CCD-based endoscopes. In addition, expanding adoption in emerging economies due to rising healthcare awareness and infrastructure development is further supporting growth. The incorporation of advanced features like real-time imaging and enhanced color reproduction strengthens their appeal in clinical settings. Overall, endoscopy stands out as the fastest-growing application segment.

- By Mobility

On the basis of mobility, the Charge-Coupled Device (CCD) Imagers market is segmented into portable and stationary. The stationary segment held the largest revenue share of 64.3% in 2024, driven by its integration in high-end medical imaging systems, astronomy equipment, and industrial testing devices. Stationary CCD systems are widely valued for their superior stability, precision, and ability to operate under controlled conditions. Hospitals and laboratories prefer stationary devices for advanced imaging tasks such as radiology and research-grade microscopy. Their long operational lifespan and compatibility with high-performance imaging software support their dominant market share. In addition, stationary CCD imagers are used extensively in aerospace and defense for critical imaging applications. Growing funding for space exploration and scientific research continues to strengthen this segment’s revenue contribution.

The portable segment is expected to witness the fastest growth rate of 18.7% CAGR from 2025 to 2032, fueled by the rising demand for mobile diagnostic devices and point-of-care imaging solutions. Portable CCD imagers are increasingly utilized in handheld X-ray systems, endoscopes, and field-based scientific research. Their lightweight design and flexibility make them highly suitable for rural and resource-limited healthcare environments. The growing emphasis on early disease detection and accessibility of medical imaging is driving adoption in developing regions. Advancements in battery efficiency and compact optics are also improving the functionality of portable CCD devices. Moreover, their use is expanding in security and industrial inspection, where on-site, real-time imaging is critical. These factors collectively contribute to the rapid growth of portable CCD imagers.

- By End Use

On the basis of end use, the Charge-Coupled Device (CCD) Imagers market is segmented into hospitals, diagnostic centres, and others. The hospitals segment dominated the market with a revenue share of 58.4% in 2024, attributed to high patient inflows and the extensive use of CCD imagers in diagnostic imaging procedures such as X-rays, endoscopies, and specialized microscopy. Hospitals often prioritize advanced imaging equipment to ensure accurate diagnostics and treatment planning. Their larger budgets allow for significant investments in high-performance CCD-based systems, reinforcing their market leadership. Growing emphasis on digital healthcare transformation and adoption of AI-enhanced imaging further fuels demand within hospitals. Government funding and private investment in hospital infrastructure also contribute significantly to this segment’s dominance.

The diagnostic centres segment is expected to grow at the fastest CAGR of 21.1% from 2025 to 2032, driven by rising demand for cost-effective, high-quality imaging services outside hospital settings. Increasing preference for outpatient diagnostic services, combined with growing healthcare consumerism, supports this trend. Diagnostic centres benefit from the scalability and versatility of CCD-based systems, enabling them to offer specialized imaging at lower costs. The rapid rise of standalone diagnostic chains and partnerships with healthcare providers are further propelling growth. In addition, the convenience and shorter turnaround times offered by diagnostic centres attract a growing patient base. Technological advancements in CCD imagers, such as improved resolution and efficiency, make them well-suited for independent diagnostic providers aiming to expand services. This positions diagnostic centres as the fastest-growing end-use segment.

Charge-Coupled Device (CCD) Imagers Market Regional Analysis

- North America dominated the charge-coupled device (CCD) imagers market with the largest revenue share of 38.5% in 2024, characterized by strong adoption across medical imaging, astronomy, and advanced microscopy applications

- The region benefits from robust R&D investments, particularly in life sciences and space research programs, where CCD imagers are preferred for their high sensitivity and resolution

- The presence of leading companies, cutting-edge semiconductor manufacturers, and advanced research institutions further strengthens North America’s market leadership

U.S. Charge-Coupled Device (CCD) Imagers Market Insight

The U.S. charge-coupled device (CCD) imagers market captured the largest share within North America in 2024, driven by their extensive use in diagnostic imaging systems, space exploration projects, and industrial quality control solutions. Continuous innovation in CCD sensor performance, such as enhanced quantum efficiency and low-noise capabilities, supports market expansion. In addition, collaborations between research laboratories, NASA projects, and private imaging technology companies are fueling advancements, ensuring the U.S. remains a hub for CCD imager innovation and commercialization.

Europe Charge-Coupled Device (CCD) Imagers Market Insight

The Europe charge-coupled device (CCD) imagers market is projected to grow steadily during the forecast period, supported by stringent regulatory standards for medical diagnostics, advanced research programs, and strong demand from academic institutions. Europe’s focus on enhancing imaging quality in both life sciences and industrial inspection applications is fostering adoption. Investments in semiconductor innovation and sustainability-driven product development are also boosting regional growth.

U.K. Charge-Coupled Device (CCD) Imagers Market Insight

The U.K. charge-coupled device (CCD) imagers market is anticipated to expand at a notable CAGR, fueled by the rising demand for astronomical research imaging, medical diagnostics, and semiconductor inspection tools. The country’s robust research ecosystem, including leading universities and space research facilities, is driving continuous adoption of CCD technology. Government support for innovation and R&D in high-resolution imaging also provides strong momentum for the market.

Germany Charge-Coupled Device (CCD) Imagers Market Insight

The Germany charge-coupled device (CCD) imagers market is expected to expand significantly during the forecast period, driven by the country’s emphasis on precision engineering, digital research infrastructure, and industrial automation. CCD imagers are being widely deployed in microscopy, medical diagnostics, and automotive inspection systems, reflecting Germany’s reputation for technological advancement and quality manufacturing. Sustainability initiatives and demand for eco-conscious imaging solutions further reinforce growth.

Asia-Pacific Charge-Coupled Device (CCD) Imagers Market Insight

The Asia-Pacific charge-coupled device (CCD) imagers market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, growing semiconductor investments, and expanding healthcare infrastructure. Countries like China, Japan, and India are making significant contributions, with rising adoption of CCD sensors in diagnostic imaging, electronics, and research. Government initiatives promoting digitalization and local manufacturing capabilities are further enhancing accessibility and affordability across the region.

Japan Charge-Coupled Device (CCD) Imagers Market Insight

The Japan charge-coupled device (CCD) imagers market is gaining strong momentum due to the country’s technological leadership in imaging and sensor innovation. Japan’s growing demand for CCDs is linked to biomedical imaging, microscopy, and high-precision electronics manufacturing. The country’s well-established semiconductor ecosystem, coupled with R&D initiatives in nanotechnology and photonics, ensures continuous product innovation and market expansion.

China Charge-Coupled Device (CCD) Imagers Market Insight

The China charge-coupled device (CCD) imagers market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s expanding middle class, advanced manufacturing ecosystem, and rapid technological adoption. China is a major hub for semiconductor production and is investing heavily in CCD imaging for medical devices, industrial inspection, and security surveillance systems. Strong domestic players, combined with government-backed smart city initiatives and global partnerships, are propelling China’s position in the global CCD imagers industry.

Charge-Coupled Device (CCD) Imagers Market Share

The Charge-Coupled Device (CCD) Imagers industry is primarily led by well-established companies, including:

- Sony Corporation (Japan)

- Teledyne Technologies Incorporated (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- OMNIVISION (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- Toshiba Corporation (Japan)

- Fairchild Imaging (U.S.)

- Thorlabs, Inc. (U.S.)

- DataRay Inc. (U.S.)

- BaySpec, Inc. (U.S.)

- Canon Inc. (Japan)

- Oxford Instruments (U.K.)

- Teledyne Technologies Incorporated (U.S.)

- Thorlabs, Inc. (U.S.)

- AMS Technologies (Germany)

Latest Developments in Global Charge-Coupled Device (CCD) Imagers Market

- In May 2023, Teledyne e2v delivered a custom-designed CMOS image sensor for the European Space Agency's (ESA) and EUMETSAT's Meteosat Third Generation (MTG-I) imaging satellite. This sensor is part of a mission to enhance weather forecasting capabilities

- In December 2024, Teledyne Space Imaging was awarded a payload contract for the Constellation Acquisition Sensor (CAS) instrument on the Laser Interferometer Space Antenna (LISA) mission, a European Space Agency (ESA) space observatory mission

- In November 2024, Hamamatsu Photonics acquired BAE Systems Imaging Solutions, Inc., a U.S.-based manufacturer specializing in high-sensitivity imaging sensors. The acquisition aims to strengthen Hamamatsu's opto-semiconductor segment and accelerate value-added growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.