Global Cd20 Monoclonal Antibodies Market

Market Size in USD Billion

CAGR :

%

USD

10.60 Billion

USD

20.20 Billion

2024

2032

USD

10.60 Billion

USD

20.20 Billion

2024

2032

| 2025 –2032 | |

| USD 10.60 Billion | |

| USD 20.20 Billion | |

|

|

|

|

CD20 Monoclonal Antibodies Market Size

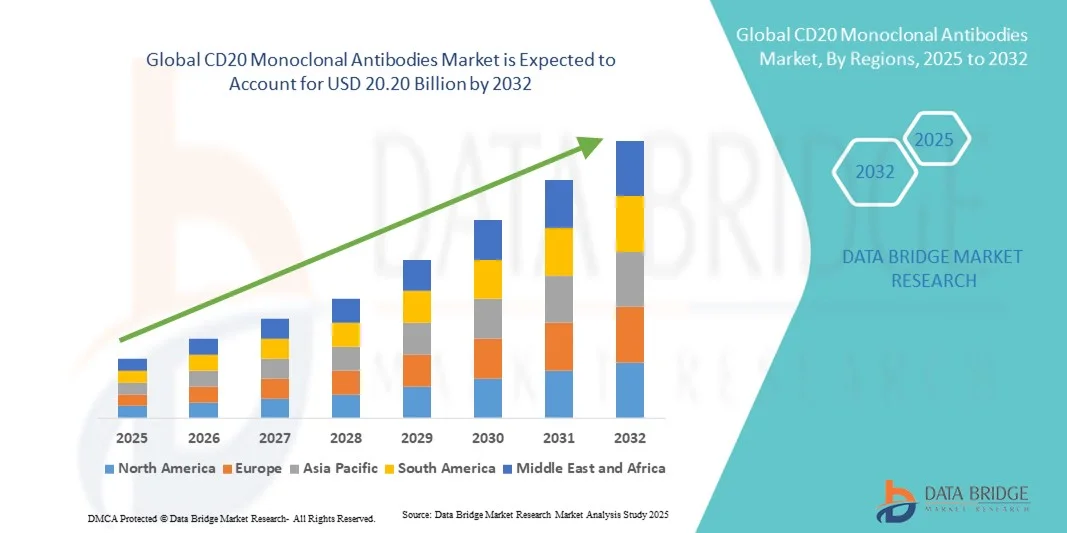

- The global CD20 monoclonal antibodies market size was valued at USD 10.60 billion in 2024 and is expected to reach USD 20.20 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the rising prevalence of autoimmune diseases and various types of cancers, such as non-Hodgkin’s lymphoma and chronic lymphocytic leukemia, leading to increased demand for effective monoclonal antibody-based therapies

- Furthermore, growing investments in biopharmaceutical research and development, along with advancements in targeted therapy and antibody engineering technologies, are accelerating the uptake of CD20 Monoclonal Antibodies solutions, thereby significantly boosting the industry's growth

CD20 Monoclonal Antibodies Market Analysis

- CD20 Monoclonal Antibodies, a class of targeted therapies that bind specifically to the CD20 antigen on B lymphocytes, are increasingly vital components in the treatment of hematologic malignancies and autoimmune disorders due to their high efficacy, reduced off-target toxicity, and improved patient outcomes compared to traditional chemotherapies

- The escalating demand for CD20 monoclonal antibodies is primarily driven by the rising prevalence of non-Hodgkin’s lymphoma, chronic lymphocytic leukemia, and rheumatoid arthritis, coupled with advancements in antibody engineering, biosimilar approvals, and the growing adoption of personalized medicine

- North America dominated the CD20 monoclonal antibodies market with the largest revenue share of 41.8% in 2024, supported by a strong clinical research infrastructure, high healthcare expenditure, and early adoption of advanced biologics. The U.S. contributed significantly to this growth through the widespread use of established products like rituximab and ocrelizumab, coupled with the introduction of novel biosimilars and next-generation antibody therapies enhancing accessibility and cost-effectiveness

- Asia-Pacific is expected to be the fastest-growing region in the CD20 monoclonal antibodies market during the forecast period, attributed to rapid healthcare expansion, increasing cancer diagnosis rates, and government initiatives promoting biologic drug manufacturing. Expanding biotechnology sectors in countries such as China, India, and South Korea are also fostering local production and clinical adoption of biosimilar CD20 antibodies

- The first generation CD20 monoclonal antibodies segment dominated the largest market revenue share of 48.6% in 2024, primarily driven by the wide clinical adoption of Rituximab (MabThera/Rituxan), which has become the gold standard in treating non-Hodgkin’s lymphoma, chronic lymphocytic leukemia, and rheumatoid arthritis

Report Scope and CD20 Monoclonal Antibodies Market Segmentation

|

Attributes |

CD20 Monoclonal Antibodies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CD20 Monoclonal Antibodies Market Trends

Advancements in Targeted Therapy and Precision Medicine

- A major and accelerating trend in the global CD20 monoclonal antibodies market is the growing integration of precision medicine and next-generation biologics to enhance treatment outcomes for autoimmune diseases and cancers. Pharmaceutical companies are increasingly focusing on developing novel monoclonal antibodies that offer improved efficacy, longer half-life, and reduced immunogenicity compared to earlier generations

- For instance, in June 2023, Biogen and Genentech advanced the clinical evaluation of ocrelizumab for broader autoimmune indications beyond multiple sclerosis, showcasing the industry’s commitment to expanding therapeutic reach. Similarly, in March 2024, Novartis announced progress in developing a new subcutaneous formulation of ofatumumab, offering improved patient compliance through self-administration

- The trend toward precision-targeted therapies is supported by advances in biomarker research and genetic profiling, allowing clinicians to better identify patient subgroups most likely to benefit from CD20-targeted therapies. Companies are increasingly investing in companion diagnostics and data-driven approaches to optimize dosage and reduce adverse effects

- Furthermore, next-generation CD20 antibodies are being engineered with enhanced binding affinities and lower toxicity profiles. For example, Roche’s mosunetuzumab, approved for relapsed or refractory follicular lymphoma, represents a significant advancement in bispecific antibody design that redirects immune cells for selective tumor targeting

- The industry is also witnessing a shift toward combination therapies, where CD20 monoclonal antibodies are being studied alongside immune checkpoint inhibitors and novel kinase inhibitors to overcome resistance mechanisms and improve long-term outcomes

- This evolution in biologic innovation, combined with rising demand for personalized treatment regimens, is transforming the therapeutic landscape of hematologic malignancies and autoimmune disorders, positioning CD20 monoclonal antibodies as a cornerstone of modern immunotherapy

CD20 Monoclonal Antibodies Market Dynamics

Driver

Rising Prevalence of Autoimmune Diseases and Lymphomas

- The increasing global incidence of autoimmune disorders such as rheumatoid arthritis, systemic lupus erythematosus, and multiple sclerosis, along with a growing burden of B-cell malignancies, is significantly driving demand for CD20 monoclonal antibodies. These therapeutics offer highly targeted mechanisms of action that minimize systemic side effects and deliver sustained disease control

- For instance, in April 2024, Roche reported strong sales growth of rituximab and ocrelizumab driven by expanded indications and rising use in early-stage autoimmune disease management. Similarly, in October 2023, GlaxoSmithKline (GSK) announced the initiation of a Phase III clinical trial for a next-generation anti-CD20 candidate aimed at improving efficacy in multiple sclerosis

- As awareness of biologic therapies grows, patients and physicians are increasingly opting for targeted antibody treatments over traditional immunosuppressants and chemotherapies, due to their superior safety profiles and durable remission rates

- In addition, the increasing availability of biosimilars, such as Truxima and Ruxience, has expanded patient access to affordable treatment options, especially in emerging markets, further fueling global market growth

Restraint/Challenge

High Treatment Costs and Risk of Adverse Immunogenic Reactions

- The high cost associated with monoclonal antibody therapies poses a significant restraint to the widespread adoption of CD20-targeted drugs, particularly in low- and middle-income countries. Manufacturing complexity, cold-chain logistics, and extended treatment regimens contribute to the overall expense of these biologics

- Furthermore, despite advancements in antibody engineering, the risk of infusion-related reactions and immunogenic responses remains a clinical concern, especially in patients undergoing long-term treatment. For instance, mild-to-moderate infusion reactions have been reported with rituximab and ofatumumab, leading to premedication requirements and extended monitoring during administration

- Another key challenge lies in the emergence of therapeutic resistance, where certain patient populations develop reduced responsiveness to CD20-directed therapy over time. Researchers are addressing this issue through the development of bispecific and glycoengineered antibodies that retain efficacy against resistant cell lines

- In addition, reimbursement limitations and regulatory complexities in biologic drug approval processes may hinder market access in some regions

- To overcome these challenges, companies are focusing on developing cost-effective biosimilars, improving subcutaneous delivery systems, and expanding clinical validation for combination regimens, thereby promoting broader adoption and affordability of CD20 monoclonal antibodies worldwide

CD20 Monoclonal Antibodies Market Scope

The market is segmented on the basis of product type and end-users.

- By Product Type

On the basis of product type, the CD20 Monoclonal Antibodies market is segmented into First Generation CD20 Monoclonal Antibodies, Second Generation CD20 Monoclonal Antibodies, and Third Generation CD20 Monoclonal Antibodies. The First Generation CD20 Monoclonal Antibodies segment dominated the largest market revenue share of 48.6% in 2024, primarily driven by the wide clinical adoption of Rituximab (MabThera/Rituxan), which has become the gold standard in treating non-Hodgkin’s lymphoma, chronic lymphocytic leukemia, and rheumatoid arthritis. Its strong safety profile, well-established efficacy, and broad therapeutic applications have sustained its market leadership. Furthermore, the availability of biosimilars across key markets, such as the U.S., Europe, and Asia-Pacific, has enhanced accessibility and affordability, bolstering patient uptake. Continuous clinical research validating its combination use with chemotherapy and immunotherapy agents further contributes to its dominance.

The Third Generation CD20 Monoclonal Antibodies segment is expected to witness the fastest CAGR of 12.4% from 2025 to 2032, owing to advancements in antibody engineering and enhanced antibody-dependent cellular cytotoxicity (ADCC). Products like Obinutuzumab (Gazyva) and Ublituximab offer improved target binding, higher potency, and reduced infusion-related reactions, driving their growing preference among clinicians. Increasing regulatory approvals, coupled with ongoing trials exploring new autoimmune and oncology indications, are anticipated to further accelerate market penetration. In addition, favorable reimbursement frameworks and rising physician awareness of next-generation therapies will support sustained growth in this segment.

- By End-Users

On the basis of end-users, the CD20 Monoclonal Antibodies market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centres, and Others. The Hospitals segment dominated the largest market revenue share of 54.2% in 2024, attributed to the high volume of oncology and autoimmune disease treatments administered in inpatient hospital settings. Hospitals possess advanced infusion facilities, skilled oncology specialists, and access to multiple therapeutic regimens involving CD20 monoclonal antibodies, ensuring safe administration and continuous patient monitoring. Large-scale procurement programs and collaborations with pharmaceutical manufacturers further strengthen hospital dominance in developed and emerging markets. The presence of specialized oncology wards and clinical research units conducting antibody trials also contributes significantly to the segment’s leadership.

The Ambulatory Surgical Centres segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the global shift toward outpatient-based infusion therapy and the increasing preference for cost-efficient healthcare delivery models. Ambulatory centers offer reduced hospitalization costs, shorter treatment times, and greater patient convenience, making them ideal for maintenance therapies and follow-up infusions of CD20 antibodies. The growing expansion of ambulatory facilities in urban and semi-urban areas, combined with advanced infusion technologies and supportive reimbursement policies, is boosting this segment’s adoption. In addition, partnerships between biotech firms and outpatient care networks for biologic therapy distribution are anticipated to further accelerate growth over the forecast period.

CD20 Monoclonal Antibodies Market Regional Analysis

- North America dominated the CD20 monoclonal antibodies market with the largest revenue share of 41.8% in 2024, supported by a strong clinical research infrastructure, high healthcare expenditure, and early adoption of advanced biologics

- The region continues to lead in the development and commercialization of targeted antibody therapies for oncology and autoimmune diseases. A well-established regulatory framework, coupled with the presence of leading pharmaceutical companies such as Roche, Biogen, and Genentech, contributes to consistent innovation and clinical advancement

- The market in particular has been a major growth contributor, driven by the widespread use of approved CD20 antibodies such as rituximab and ocrelizumab, alongside the introduction of biosimilars that enhance affordability and treatment access. Increasing collaborations between research institutions and biotechnology firms, as well as a strong focus on expanding indications for existing therapies, are further strengthening market dominance

U.S. CD20 Monoclonal Antibodies Market Insight

The U.S. CD20 monoclonal antibodies market captured the largest revenue share within North America in 2024, fueled by growing utilization of biologic therapies in both oncology and autoimmune disease management. Robust investments in clinical research, coupled with a high diagnosis rate of B-cell malignancies and multiple sclerosis, have spurred significant demand.

Furthermore, the expansion of biosimilar portfolios—such as Truxima (Celltrion) and Ruxience (Pfizer)—has improved patient access and affordability. The U.S. also benefits from strong insurance coverage and an advanced healthcare delivery network, enabling broad clinical adoption of monoclonal antibody therapies. Continuous R&D efforts by key market players are expected to sustain the country's leadership position over the forecast period.

Europe CD20 Monoclonal Antibodies Market Insight

The Europe CD20 monoclonal antibodies market is projected to expand at a substantial CAGR throughout the forecast period, driven by an increasing focus on personalized medicine, supportive government healthcare programs, and the growing penetration of biosimilars. The region's well-established biopharmaceutical sector, particularly in countries like Germany, France, and the U.K., is facilitating innovation in antibody engineering and large-scale manufacturing.

Additionally, regulatory support for biosimilar approval under the European Medicines Agency (EMA) has encouraged broader market access and reduced treatment costs. Rising awareness among clinicians regarding biologic therapies and improved healthcare infrastructure are further strengthening the European market outlook.

U.K. CD20 Monoclonal Antibodies Market Insight

The U.K. CD20 monoclonal antibodies market anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investment in biologic research and favorable reimbursement frameworks under the National Health Service (NHS). The country’s emphasis on expanding oncology and autoimmune therapy programs is supporting higher adoption of CD20 monoclonal antibodies.

Collaborative R&D initiatives between academic institutions and pharmaceutical companies, along with rapid biosimilar approvals, are making treatments more accessible. Moreover, the growing prevalence of hematological malignancies such as lymphoma is expected to further boost market growth.

Germany CD20 Monoclonal Antibodies Market Insight

The Germany CD20 monoclonal antibodies market expected to expand at a considerable CAGR during the forecast period, supported by its advanced healthcare infrastructure and strong focus on biotechnology innovation. The country hosts several biopharmaceutical manufacturing facilities and research collaborations aimed at developing next-generation monoclonal antibodies.

Germany’s robust clinical trial ecosystem and patient access to biologic therapies have made it one of Europe’s leading markets. Increasing biosimilar adoption, combined with high physician confidence in antibody-based treatments, continues to drive demand across hospital and specialty care settings.

Asia-Pacific CD20 Monoclonal Antibodies Market Insight

The Asia-Pacific CD20 monoclonal antibodies market is projected to grow at the fastest CAGR during the forecast period of 2025–2032, driven by rapid healthcare infrastructure expansion, rising awareness of cancer immunotherapies, and growing biologics manufacturing capacity. Countries such as China, Japan, and India are witnessing accelerated clinical adoption due to improving diagnostic rates and affordability of biosimilars.

Government initiatives encouraging local production of biologic drugs, along with partnerships between domestic and multinational firms, are enhancing accessibility across both urban and rural healthcare centers. Increasing investment in biotechnology research and the rising burden of autoimmune diseases further contribute to regional growth momentum.

Japan CD20 Monoclonal Antibodies Market Insight

The Japan CD20 monoclonal antibodies market is gaining momentum owing to the country’s advanced healthcare system, strong emphasis on clinical research, and growing prevalence of hematological malignancies. Japan’s focus on integrating precision medicine and rapid regulatory approval pathways for innovative biologics supports continuous product introductions.

Additionally, the presence of leading pharmaceutical manufacturers and government programs aimed at reducing the burden of chronic autoimmune conditions are driving consistent growth. The adoption of subcutaneous and patient-friendly formulations is also expected to boost treatment compliance and expand the patient base.

China CD20 Monoclonal Antibodies Market Insight

The China CD20 monoclonal antibodies market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding biotechnology industry, growing healthcare spending, and increasing domestic production of biosimilars. Local companies such as Henlius Biotech and Innovent Biologics are driving market growth through cost-effective antibody therapies targeting lymphoma and autoimmune diseases.

The Chinese government’s push for healthcare modernization and investment in biologic drug R&D is fostering a favorable environment for CD20 antibody adoption. Moreover, the high prevalence of cancers and autoimmune disorders, combined with improving healthcare access, is expected to make China a key driver of regional market expansion.

CD20 Monoclonal Antibodies Market Share

The CD20 Monoclonal Antibodies industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Genentech, Inc. (U.S.)

- Biogen Inc. (U.S.)

- Novartis AG (Switzerland)

- GSK plc (U.K.)

- Amgen Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (China)

- MabThera (Switzerland)

- Celgene Corporation (U.S.)

Latest Developments in Global CD20 Monoclonal Antibodies Market

- In June 2022, the U.S. Food and Drug Administration (FDA) approved mosunetuzumab (Lunsumio), a first-in-class CD20×CD3 bispecific T-cell engager developed by Genentech, for the treatment of adults with relapsed or refractory follicular lymphoma. This approval marked a significant advancement in immunotherapy, offering a novel treatment option for patients with this challenging condition

- In December 2022, the FDA granted accelerated approval to epcoritamab (Epkinly), co-developed by Genmab and AbbVie. This bispecific antibody targets CD20 and CD3 and is indicated for relapsed or refractory diffuse large B-cell lymphoma (DLBCL). The approval underscored the growing role of bispecific antibodies in treating hematologic malignancies

- In March 2023, the FDA approved glofitamab (Columvi), another bispecific antibody targeting CD20 and CD3, developed by Genentech. Glofitamab is indicated for relapsed or refractory DLBCL, providing an additional treatment option for patients with this aggressive form of lymphoma

- In June 2025, the FDA approved tafasitamab (Monjuvi) in combination with lenalidomide and rituximab for adults with relapsed or refractory follicular lymphoma. This approval highlights the potential of combination therapies in enhancing treatment efficacy for patients with this indolent lymphoma subtype

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.