Global Ceiling Tiles Market

Market Size in USD Billion

CAGR :

%

USD

8.76 Billion

USD

13.96 Billion

2025

2033

USD

8.76 Billion

USD

13.96 Billion

2025

2033

| 2026 –2033 | |

| USD 8.76 Billion | |

| USD 13.96 Billion | |

|

|

|

|

Global Ceiling Tiles Market Size

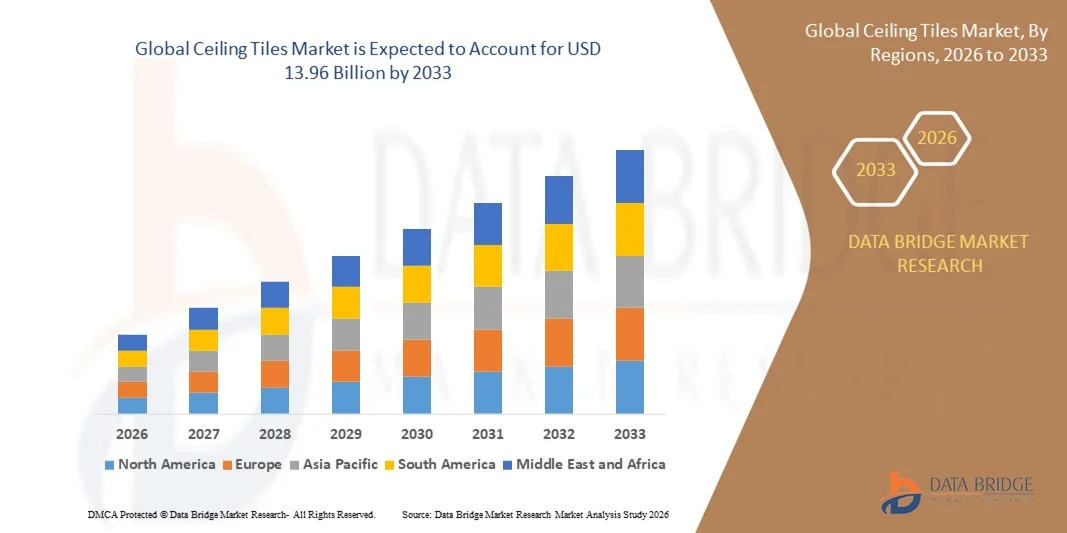

- The global Ceiling Tiles Market was valued at USD 8.76 billion in 2025 and is projected to reach USD 13.96 billion by 2033, registering a CAGR of 6.00% over the forecast period.

- Market expansion is primarily driven by increasing construction activity and the rising emphasis on aesthetic interior design and acoustic performance across residential, commercial, and institutional buildings.

- Additionally, growing demand for lightweight, durable, and energy-efficient ceiling solutions, supported by advancements in material technologies and sustainable building practices, is accelerating the adoption of ceiling tiles and strengthening overall industry growth.

Global Ceiling Tiles Market Analysis

- Ceiling tiles, widely used for enhanced acoustics, insulation, and aesthetic appeal, are becoming essential components in modern residential, commercial, and institutional infrastructure due to their design versatility, ease of installation, and compatibility with sustainable building solutions.

- The rising demand for ceiling tiles is primarily driven by rapid construction activities, growing emphasis on interior décor, and heightened need for noise-reduction materials, along with increasing adoption of lightweight and energy-efficient building products.

- North America dominated the Global Ceiling Tiles Market with a 34.1% revenue share in 2025, supported by strong renovation trends, high spending on commercial interiors, and the presence of major industry manufacturers, with the U.S. witnessing significant demand from office spaces, hospitality projects, and educational institutions.

- Asia-Pacific is expected to be the fastest-growing region in the Global Ceiling Tiles Market during the forecast period, fueled by rapid urbanization, expanding commercial infrastructure, and rising disposable incomes across emerging economies.

- The Mineral Fiber/Gypsum segment dominated the market with the largest revenue share of 46.5% in 2025, driven by its superior acoustic properties, fire resistance, cost-effectiveness, and broad suitability across commercial, institutional, and residential buildings.

Report Scope and Global Ceiling Tiles Market Segmentation

|

Attributes |

Ceiling Tiles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Ceiling Tiles Market Trends

Advancements in Acoustic, Aesthetic, and Sustainable Ceiling Solutions

- A significant and accelerating trend in the Global Ceiling Tiles Market is the growing integration of advanced materials, acoustic technologies, and sustainable design innovations, which is transforming modern interior environments across residential, commercial, and institutional buildings. These advancements are greatly enhancing performance, aesthetics, and environmental efficiency.

- For instance, leading manufacturers now offer high-performance acoustic ceiling tiles engineered with enhanced sound absorption and noise-control capabilities, supporting the needs of offices, educational facilities, and healthcare environments. Similarly, metal and wood-look ceiling systems provide premium aesthetic options while maintaining durability and easy maintenance.

- Innovations in ceiling tile technology are enabling features such as improved thermal insulation, fire resistance, and moisture resistance, ensuring optimal indoor comfort and safety. For example, mineral fiber and fiberglass tiles are increasingly developed with advanced formulations to boost acoustic ratings, while metal and PVC tiles offer longevity and versatility in high-humidity areas. Furthermore, sustainable manufacturing practices—such as using recycled materials or low-VOC coatings—are gaining prominence as green building certifications become more widespread.

- The seamless integration of modern ceiling tiles with modular building systems and contemporary architectural designs supports centralized planning of lighting, HVAC diffusers, and other ceiling-mounted elements, creating a cohesive and efficient interior infrastructure.

- This shift toward more intelligent, high-performance, and design-driven ceiling systems is reshaping expectations for commercial and residential interiors. Consequently, companies such as Armstrong World Industries and Knauf Ceiling Solutions are developing next-generation tile solutions featuring enhanced acoustics, eco-friendly materials, and flexible design formats.

- The demand for ceiling tiles offering superior acoustics, sustainable composition, and advanced aesthetic customization is rapidly increasing across both developed and emerging markets, as consumers and businesses prioritize comfort, performance, and modern interior design.

Global Ceiling Tiles Market Dynamics

Driver

Growing Need Due to Expansion of Construction Activities and Demand for Modern Interior Solutions

- The rising global demand for improved interior environments, along with rapid growth in residential, commercial, and institutional construction, is a major driver fueling the adoption of ceiling tiles.

- For instance, in 2025, several manufacturers introduced next-generation acoustic and fire-resistant ceiling panels designed to meet evolving building safety standards, reflecting the industry’s continuous push for better-performing, regulation-compliant materials—an approach expected to drive the ceiling tiles market throughout the forecast period.

- As consumers and businesses increasingly prioritize enhanced comfort, aesthetics, and noise control, ceiling tiles offer advantages such as effective sound absorption, thermal insulation, fire resistance, and broad design flexibility, making them a preferred material over traditional ceiling finishes.

- Furthermore, the rapid growth of smart buildings and modern commercial spaces—such as offices, hospitals, and retail centers—is increasing the integration of ceiling tiles with lighting, HVAC diffusers, and other modular systems, enhancing overall operational efficiency and design cohesion.

- The ease of installation, availability of customizable designs, and suitability for both new construction and renovation projects are additional factors driving widespread adoption across global markets. Growing DIY renovation trends and improved access to cost-effective ceiling tile options also contribute to market expansion.

Restraint/Challenge

Fluctuating Raw Material Costs and Installation Complexity

- Fluctuating prices of key raw materials—such as mineral fiber, gypsum, metal, and fiberglass—pose challenges for manufacturers and end users. These variations can impact production costs and, in turn, affect the final pricing of ceiling tile products, particularly in cost-sensitive construction markets.

- For instance, periods of volatility in mineral fiber and metal markets have historically increased production expenses for ceiling tile manufacturers, making procurement more difficult for budget-constrained builders.

- Addressing these cost pressures through efficient sourcing strategies, recycling initiatives, and advanced manufacturing processes is critical for maintaining affordability. Several leading companies emphasize sustainable sourcing and recycled content to mitigate material cost impacts and meet environmental standards. Additionally, the relatively complex installation requirements of certain premium ceiling tile systems—especially metal or specialty acoustic tiles—can act as a barrier for some users, increasing labor expenses or requiring professional installation.

- While manufacturers are introducing more user-friendly installation systems, the perceived higher cost of advanced ceiling solutions can still slow adoption among budget-conscious buyers and in emerging regions.

- Overcoming these challenges through cost-optimized product development, contractor education, and broader availability of affordable ceiling tile solutions will be essential for sustained market growth.

Global Ceiling Tiles Market Scope

Ceiling tiles market is segmented on the basis of material type, foam, installation type, property type and application.

- By Material Type

On the basis of material type, the Global Ceiling Tiles Market is segmented into Aluminium, Fiber Glass, Mineral Fiber/Gypsum, PVC, Steel, Wood, and Other Material Types. The Mineral Fiber/Gypsum segment dominated the market with the largest revenue share of 46.5% in 2025, driven by its superior acoustic properties, fire resistance, cost-effectiveness, and broad suitability across commercial, institutional, and residential buildings. These tiles are widely preferred in suspended ceiling systems due to their lightweight structure, ease of installation, and compliance with global building standards.

The Fiber Glass segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by its high sound absorption capability, moisture resistance, and increasing use in modern office interiors, healthcare facilities, and specialized acoustic environments. Growing demand for premium performance materials and energy-efficient architectural solutions continues to propel the fiberglass segment forward.

- By Form

On the basis of form, the Global Ceiling Tiles Market is segmented into Laminated Ceiling Tiles, Fissured Ceiling Tiles, Patterned Ceiling Tiles, Plain Ceiling Tiles, Textured Ceiling Tiles, Coffered Ceiling Tiles, and Other Forms. The Plain Ceiling Tiles segment dominated the market with a revenue share of 39.8% in 2025, attributed to their widespread use in residential, commercial, and institutional applications where functionality, affordability, and clean aesthetics are prioritized. Their compatibility with modular lighting and HVAC systems also enhances their adoption in modern infrastructure projects.

The Textured Ceiling Tiles segment is expected to register the fastest growth from 2026 to 2033, driven by rising demand for visually appealing and design-centric interiors in hospitality, luxury residential, and commercial spaces. Textured, patterned, and coffered designs are increasingly popular for their ability to deliver both decorative and acoustic advantages, aligning with contemporary architectural and aesthetic trends.

- By Application

On the basis of application, the Global Ceiling Tiles Market is segmented into Residential, Hospitality, Commercial, Institutional, and Industrial. The Commercial segment dominated the market with a revenue share of 41.2% in 2025, driven by strong demand from office spaces, retail environments, corporate buildings, and educational institutions that prioritize acoustics, energy efficiency, and modern design. Increasing renovation activities and workplace modernization initiatives further boost adoption.

The Hospitality segment is anticipated to exhibit the fastest growth rate from 2026 to 2033, fueled by expanding hotel construction, resort development, and the sector’s growing focus on premium aesthetics and acoustic comfort. Ceiling tiles offering distinctive textures, design flexibility, and moisture-resistant properties are gaining popularity in lobbies, corridors, banquet halls, and guest rooms. Rising tourism and international brand expansion continue to drive segment growth.

- By Installation Type

On the basis of installation type, the Global Ceiling Tiles Market is segmented into Drop/Suspended and Surface Mount systems. The Drop/Suspended Ceiling segment dominated the market with the largest revenue share of 58.9% in 2025, owing to its extensive use in commercial, institutional, and industrial facilities. These systems offer excellent acoustic performance, easy maintenance, and convenient access to wiring, ductwork, and plumbing, making them a standard choice for large buildings.

The Surface Mount segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing adoption in residential environments and low-ceiling structures where space optimization is essential. Surface-mounted tiles are favored for their sleek aesthetics, ease of installation, and suitability for renovation projects, particularly in retail stores, apartments, and small commercial units.

- By Property Type

On the basis of property type, the Global Ceiling Tiles Market is segmented into Acoustic Ceiling Tiles and Non-Acoustic Ceiling Tiles. The Acoustic Ceiling Tiles segment dominated the market with a revenue share of 62.4% in 2025, supported by high demand for noise control in offices, hospitals, schools, theaters, and hospitality venues. Superior sound absorption, speech privacy, and enhanced occupant comfort make acoustic tiles the preferred choice in environments where acoustic performance is mission-critical.

The Non-Acoustic Ceiling Tiles segment is projected to experience the fastest growth from 2026 to 2033, driven by rising demand in residential buildings, retail spaces, and decorative interior applications where aesthetics and cost-effectiveness outweigh acoustic requirements. Increasing availability of visually appealing, lightweight, and durable non-acoustic options further supports this segment’s rapid adoption.

Global Ceiling Tiles Market Regional Analysis

- North America dominated the Global Ceiling Tiles Market with the largest revenue share of 34.1% in 2025, driven by strong construction and renovation activities across commercial, institutional, and residential sectors. The region’s emphasis on modern interior design, energy-efficient buildings, and advanced acoustic solutions continues to propel demand for ceiling tiles.

- Consumers and businesses in the region place high value on ceiling systems that offer superior acoustic performance, aesthetic versatility, fire resistance, and seamless integration with lighting, HVAC, and other building infrastructure. This preference supports the adoption of mineral fiber, metal, and fiberglass ceiling tiles in offices, healthcare facilities, schools, and retail spaces.

- The widespread use of innovative building materials is further supported by high disposable incomes, strict building regulations, and the presence of leading ceiling tile manufacturers. Additionally, the ongoing trend toward sustainable and modular construction strengthens the region’s position as a key market for ceiling tile solutions across both new construction and renovation projects.

U.S. Ceiling Tiles Market Insight

The U.S. ceiling tiles market captured the largest revenue share of 81% in 2025 within North America, driven by strong commercial construction, renovation activities, and increasing demand for high-performance acoustic and aesthetic ceiling solutions. Growing investments in office modernizations, retail upgrades, and healthcare infrastructure are fueling widespread adoption of mineral fiber, metal, and fiberglass ceiling systems. The demand for modular ceiling tiles is further supported by the popularity of integrated lighting and HVAC systems, enabling enhanced energy efficiency and architectural flexibility. Additionally, rising interest in sustainable building materials and compliance with stringent U.S. building codes continues to accelerate market growth across both new construction and renovation projects.

Europe Ceiling Tiles Market Insight

The Europe ceiling tiles market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict building regulations, a strong emphasis on energy efficiency, and increasing adoption of acoustic solutions in commercial and institutional spaces. Rising urbanization, investment in modern workplaces, and the need for noise-controlled environments in educational and healthcare facilities are contributing to growing demand. European consumers and businesses also prioritize eco-friendly materials, promoting the use of recyclable and low-VOC ceiling tiles. The region is experiencing notable growth across residential, commercial, and hospitality sectors, with ceiling tiles being integrated extensively in both new buildings and large-scale renovation programs.

U.K. Ceiling Tiles Market Insight

The U.K. ceiling tiles market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the increasing focus on workplace modernization, architectural refurbishment, and enhanced indoor acoustic comfort. Rising concerns around noise pollution in urban settings are driving adoption across offices, educational institutions, and residential buildings. Additionally, the U.K.’s strong construction pipeline—particularly in commercial real estate and hospitality—continues to stimulate demand for gypsum, mineral fiber, and metal ceiling tiles. The region’s expanding renovation activities, combined with sustainability-oriented building initiatives, are expected to further support market growth.

Germany Ceiling Tiles Market Insight

The Germany ceiling tiles market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong emphasis on sustainability, advanced engineering standards, and rising adoption of energy-efficient building materials. Germany’s modern infrastructure, combined with high demand for acoustic optimization in office and industrial environments, supports broad usage of mineral fiber, metal, and fiberglass ceiling tiles. The integration of modular ceiling systems with smart building technologies is also growing, aligning with Germany’s preference for precision, performance, and environmentally responsible construction solutions.

Asia-Pacific Ceiling Tiles Market Insight

The Asia-Pacific ceiling tiles market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding commercial and residential construction in countries such as China, Japan, India, and South Korea. Government-supported infrastructure programs, coupled with increasing awareness of modern interior design and acoustic requirements, are amplifying demand across the region. As APAC continues to emerge as a key manufacturing hub for ceiling materials, the affordability and accessibility of advanced ceiling tiles—particularly mineral fiber and PVC—are expanding among mid-income consumers and developers.

Japan Ceiling Tiles Market Insight

The Japan ceiling tiles market is gaining momentum due to the country’s technologically advanced construction practices, rapid urban development, and strong preference for high-quality interior environments. Acoustic comfort, space optimization, and minimalist design play major roles in driving adoption. Integration of ceiling tiles with advanced lighting systems, climate control infrastructure, and earthquake-resistant building standards further strengthens market growth. Additionally, Japan’s aging population is creating increased demand for safe, comfortable, and accessible indoor spaces in both residential and institutional sectors.

China Ceiling Tiles Market Insight

The China ceiling tiles market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the country’s expanding middle class, strong urbanization pace, and increasing acceptance of modern interior solutions. China remains one of the largest markets for construction and renovation, with ceiling tiles widely adopted across residential complexes, commercial buildings, educational institutions, and hospitality spaces. The government’s push toward smart cities, rapid infrastructure development, and the presence of numerous domestic manufacturers producing affordable yet high-quality ceiling tiles continue to propel market expansion throughout the country.

Global Ceiling Tiles Market Share

The Ceiling Tiles industry is primarily led by well-established companies, including:

• Armstrong World Industries (U.S.)

• USG Corporation (U.S.)

• Knauf AMF (Germany)

• Rockfon (Denmark)

• Saint-Gobain Ecophon (France)

• CertainTeed (U.S.)

• Hunter Douglas (Netherlands)

• OWA Group (Germany)

• Ceilume (Canada)

• Foshan Nanhai Guangyin Building Materials (China)

• Saint-Gobain Gyproc (France)

• Ecowood (India)

• USG Boral (Australia)

• SAS International (U.K.)

• Kaiser Aluminum & Chemical (U.S.)

• Vicoustic (Portugal)

• Knauf Ceiling Solutions (Germany)

• Continental Ceiling Solutions (China)

• Rockwool Ceiling Solutions (Denmark)

• MetalTech Ceilings (U.S.)

What are the Recent Developments in Global Ceiling Tiles Market?

- In April 2024, Armstrong World Industries, a global leader in ceiling solutions, launched a strategic initiative in South Africa to expand access to its high-performance acoustic and mineral fiber ceiling tiles for residential and commercial projects. This initiative emphasizes the company’s commitment to delivering innovative, durable, and sustainable ceiling solutions tailored to the region’s construction needs. By leveraging its global expertise and advanced product portfolio, Armstrong is reinforcing its position in the rapidly growing Global Ceiling Tiles Market while addressing local architectural and acoustic requirements.

- In March 2024, USG Corporation, a leading provider of gypsum-based ceiling tiles, introduced its next-generation eco-friendly ceiling tile series specifically designed for educational institutions and commercial spaces. The new product line offers enhanced acoustic performance, fire resistance, and sustainability features. This advancement highlights USG’s commitment to combining innovation, safety, and environmental responsibility in its ceiling solutions, catering to the evolving demands of modern construction and institutional requirements.

- In March 2024, Knauf AMF, a global building materials manufacturer, successfully completed the Bengaluru Smart Campus Project, installing advanced modular ceiling systems in commercial and institutional buildings. The project demonstrates Knauf AMF’s expertise in integrating aesthetic, acoustic, and sustainable solutions into urban infrastructure, highlighting the growing importance of high-quality ceiling systems in modern, smart, and energy-efficient buildings.

- In February 2024, Saint-Gobain Ecophon, a leading acoustic ceiling solutions provider, announced a strategic partnership with the European Green Building Council (EGBC) to promote the adoption of sustainable, high-performance ceiling tiles in commercial real estate projects. The collaboration is aimed at enhancing indoor environmental quality, improving acoustics, and supporting energy efficiency initiatives, underlining Saint-Gobain’s commitment to innovation and operational excellence in the construction sector.

- In January 2024, Rockfon, a subsidiary of ROCKWOOL Group, unveiled its Rockfon Color-All® Acoustic Ceiling Collection at the International Builders’ Show (IBS) 2024. The new product range, featuring vibrant color options and superior acoustic properties, enables architects and designers to enhance indoor aesthetics while maintaining performance and sustainability standards. The launch highlights Rockfon’s focus on integrating advanced technology and design flexibility into ceiling solutions, offering commercial and residential developers enhanced versatility and functional value.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ceiling Tiles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ceiling Tiles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ceiling Tiles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.