Global Cell Banking Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

13.66 Billion

USD

39.26 Billion

2024

2032

USD

13.66 Billion

USD

39.26 Billion

2024

2032

| 2025 –2032 | |

| USD 13.66 Billion | |

| USD 39.26 Billion | |

|

|

|

|

Cell Banking Outsourcing Market Size

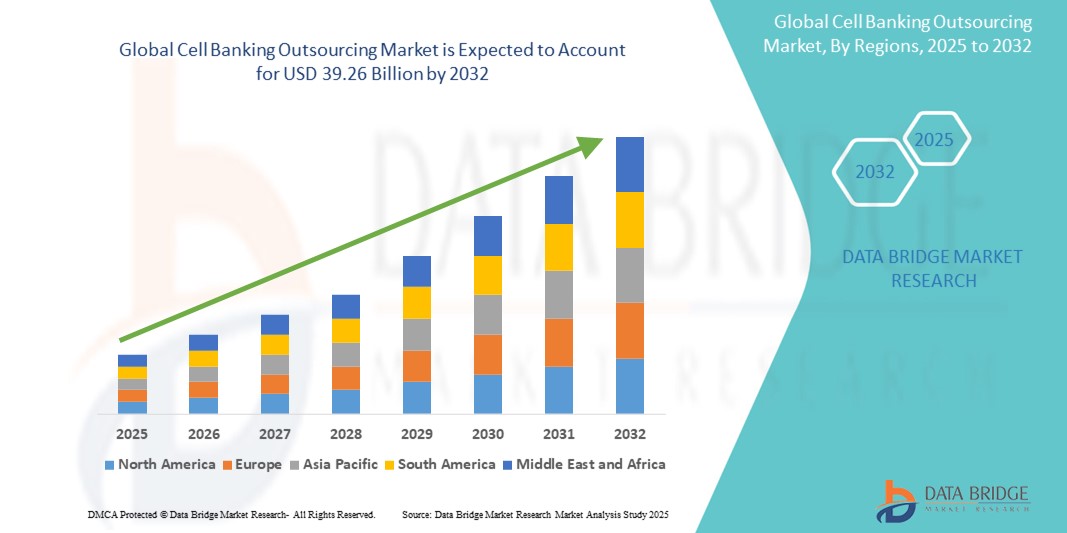

- The global cell banking outsourcing market size was valued at USD 13.66 billion in 2024 and is expected to reach USD 39.26 billion by 2032, at a CAGR of 14.10% during the forecast period

- The market growth is largely fuelled by the rising demand for biopharmaceuticals, increasing investments in cell-based research, and the growing adoption of outsourcing to enhance efficiency and reduce operational costs

- Advancements in cryopreservation techniques and increasing regulatory support for biologics and stem cell therapies are also contributing to the expansion of the market

Cell Banking Outsourcing Market Analysis

- Cell banking outsourcing involves the storage and maintenance of cell lines by third-party service providers to ensure a continuous supply of authenticated and contamination-free cells for research and production purposes.

- The market is witnessing significant expansion due to the rising use of stem cells and cell therapies in personalized medicine, regenerative treatments, and cancer research

- North America dominated the cell banking outsourcing market with the largest revenue share of 41.2% in 2024, driven by the robust presence of biopharmaceutical companies and increasing R&D investments in advanced therapeutics, including cell and gene therapies

- Asia-Pacific region is expected to witness the highest growth rate in the global cell banking outsourcing market, driven by increasing investments in biotechnology, expanding clinical research activities, and the growing presence of cost-effective contract service providers

- The master cell banking segment dominated the market with the largest revenue share of 46.8% in 2024, attributed to its critical role in establishing a single-source, high-quality cell line for large-scale manufacturing. Master cell banks serve as the foundation for all future cell production, ensuring genetic consistency, stability, and regulatory compliance throughout the product lifecycle. Their significance in biopharmaceutical development and regulatory submissions further reinforces their market dominance

Report Scope and Cell Banking Outsourcing Market Segmentation

|

Attributes |

Cell Banking Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Cell and Gene Therapies in Emerging Markets • Increasing Collaboration Between Biotech Firms and CDMOs for Advanced Cell Line Development |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cell Banking Outsourcing Market Trends

“Growing Demand for Stem Cell Banking and Personalized Medicine”

• Increased focus on patient-specific treatments is driving the demand for stem cell banking services

• Stem cells, particularly iPSCs and MSCs, are widely used in regenerative therapies and precision medicine

• Outsourcing stem cell banking helps ensure regulatory compliance, scalability, and cost-efficiency

• Rising R&D investments and clinical trials in stem-cell-based therapeutics are accelerating market growth

• For instance, Thermo Fisher Scientific provides GMP-grade iPSC banking solutions to support personalized medicine development

Cell Banking Outsourcing Market Dynamics

Driver

“Rising Biopharmaceutical R&D and Cost-Efficiency of Outsourcing”

• Biopharma firms increasingly rely on cell banks for consistent and validated cell lines during drug development

• Outsourcing helps reduce the need for in-house infrastructure, staff, and compliance management

• CDMOs offer advanced storage, validated protocols, and GMP-certified facilities for secure cell preservation

• Small and mid-sized companies benefit from faster time-to-market through strategic outsourcing

• For instance, Lonza’s integrated cell banking and manufacturing services help clients accelerate biologic launches while reducing operational burdens

Restraint/Challenge

“Regulatory Complexity and Quality Control Issues in Cell Banking”

• Strict international regulations require compliance with GMP, FDA, and EMA guidelines

• Quality control demands precision in sterility, viability, traceability, and storage of cell lines

• Failures in cold chain logistics or contamination can halt product development and clinical trials

• High operational standards and audits are often difficult for smaller providers to maintain

• For instance, A stem cell trial in Europe was delayed due to compromised storage conditions during outsourced transit, raising concerns about vendor reliability

Cell Banking Outsourcing Market Scope

The market is segmented on the basis of type, product, cell type, and phase.

• By Type

On the basis of type, the cell banking outsourcing market is segmented into master cell banking, viral cell banking, and working cell banking. The master cell banking segment dominated the market with the largest revenue share of 46.8% in 2024, attributed to its critical role in establishing a single-source, high-quality cell line for large-scale manufacturing. Master cell banks serve as the foundation for all future cell production, ensuring genetic consistency, stability, and regulatory compliance throughout the product lifecycle. Their significance in biopharmaceutical development and regulatory submissions further reinforces their market dominance.

The working cell banking segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing volume of cell-based clinical trials and commercial biologics production. Working cell banks are derived from master cell banks and support routine manufacturing activities, making them essential in scaling biopharma operations. The growing demand for efficient downstream processing also contributes to their rising adoption.

• By Product

On the basis of product, the market is segmented into cord cell banking, adult stem cell banking, induced pluripotent stem cell (iPSC) banking, and embryonic stem cell banking. The adult stem cell banking segment accounted for the largest revenue share in 2024, owing to its widespread clinical use, established safety profile, and ethical acceptability. Adult stem cells are primarily utilized in regenerative medicine and hematopoietic therapies, making them a reliable option for various therapeutic applications.

The iPSC banking segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its potential in disease modeling, drug discovery, and personalized therapies. Induced pluripotent stem cells offer versatility in differentiating into multiple cell types and are gaining momentum for their use in advanced research and cell therapy trials. The scalability and non-invasive sourcing of iPSCs further amplify their market growth.

• By Cell Type

On the basis of cell type, the market is segmented into stem cell and non-stem cell. The stem cell segment dominated the market in 2024, driven by its increasing application in regenerative medicine, chronic disease treatment, and cellular therapies. Stem cells offer the ability to regenerate and repair tissues, positioning them as a cornerstone in next-generation medical advancements. Their compatibility with both autologous and allogeneic applications enhances their utility in clinical and commercial settings.

The non-stem cell segment is expected to witness the fastest growth rate from 2025 to 2032, due to their use in vaccine production, toxicity testing, and biopharmaceutical manufacturing. Non-stem cells such as CHO and HEK293 are widely utilized in recombinant protein production, supporting the growth of therapeutic biologics and biosimilars.

• By Phase

On the basis of phase, the market is segmented into bank storage, cell storage stability testing, bank preparation, and bank characterization and testing. The bank storage segment led the market with the highest revenue share in 2024, supported by the increasing number of cell lines stored for long-term use in research, clinical development, and commercial production. Outsourcing bank storage ensures controlled environments, regulatory compliance, and optimized inventory management, making it a preferred solution among biopharma firms.

The bank characterization and testing segment is expected to witness the fastest growth rate from 2025 to 2032, owing to stringent regulatory requirements and the need for validated, contamination-free cell lines. Characterization ensures the identity, purity, viability, and genetic stability of cell banks, essential for GMP-grade applications. Increasing emphasis on quality assurance and risk mitigation in biologic development is driving demand for comprehensive testing services.

Cell Banking Outsourcing Market Regional Analysis

• North America dominated the cell banking outsourcing market with the largest revenue share of 41.2% in 2024, driven by the robust presence of biopharmaceutical companies and increasing R&D investments in advanced therapeutics, including cell and gene therapies.

• The region benefits from a highly developed healthcare infrastructure, strict regulatory standards, and well-established CDMOs offering GMP-compliant cell banking services.

• The growing demand for stem cell-based research, personalized medicine, and biologics manufacturing, along with the rise in government funding and innovation-friendly policies, continues to reinforce North America’s leadership in this market.

U.S. Cell Banking Outsourcing Market Insight

The U.S. cell banking outsourcing market captured the largest revenue share of 79% in 2024 within North America, driven by an advanced biotech ecosystem and significant pharmaceutical outsourcing trends. The rapid pace of clinical trials, strong FDA regulatory oversight, and a focus on precision medicine contribute to outsourcing growth. Moreover, leading service providers in the U.S. are expanding capabilities in master and working cell banking to meet rising client demands for speed, safety, and scalability in biologic development.

Europe Cell Banking Outsourcing Market Insight

The Europe cell banking outsourcing market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising adoption of biologics and biosimilars and the push for innovation in stem cell research. Growing investment in regenerative medicine and increasing demand for GMP-compliant storage and characterization services are key factors driving market expansion. Countries across the EU are also enhancing their regulatory frameworks to support safe and effective outsourced cell banking operations.

U.K. Cell Banking Outsourcing Market Insight

The U.K. cell banking outsourcing market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing academic and commercial research in cell and gene therapies. Government-backed initiatives in biotech innovation, combined with strong collaboration between academia and industry, are encouraging the outsourcing of key activities such as cell line development and long-term storage. In addition, the country’s focus on establishing itself as a leader in advanced therapy medicinal products (ATMPs) is further accelerating market growth.

Germany Cell Banking Outsourcing Market Insight

The Germany cell banking outsourcing market is expected to witness the fastest growth rate from 2025 to 2032, driven by its leadership in biopharma manufacturing and commitment to innovation in biologics. Germany’s advanced laboratory infrastructure, skilled workforce, and adherence to EU GMP standards make it an attractive destination for outsourced cell banking. Increased investment in stem cell research and the country’s strong position in clinical development pipelines are further supporting market expansion.

Asia-Pacific Cell Banking Outsourcing Market Insight

The Asia-Pacific cell banking outsourcing market is expected to witness the fastest growth rate from 2025 to 2032, supported by increased clinical research, government funding, and rapidly developing biopharma sectors in countries such as China, Japan, and India. The cost advantages of outsourcing to APAC, combined with a growing pool of qualified CROs and CDMOs, are making the region an outsourcing hotspot for global players. Rising demand for stem cell therapies and regenerative medicine is also propelling market momentum.

Japan Cell Banking Outsourcing Market Insight

The Japan cell banking outsourcing market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong investment in regenerative medicine and aging population's demand for advanced healthcare solutions. With the government actively promoting the development of iPSC-based therapies and fast-track regulatory pathways, outsourcing services for cell banking are seeing increased traction. Japan’s emphasis on high-quality, technologically advanced infrastructure further boosts the adoption of outsourced cell line management and storage.

China Cell Banking Outsourcing Market Insight

The China cell banking outsourcing market held the largest revenue share in Asia-Pacific in 2024, driven by its rapidly expanding biotech industry, government incentives, and substantial investment in cell therapy research. China’s large patient population, favorable regulatory reforms, and emergence of domestic CDMOs offering cost-effective GMP services are fostering market growth. The country is becoming a critical hub for outsourced services involving stem cell banking, biologics manufacturing, and personalized medicine development.

Cell Banking Outsourcing Market Share

The Cell Banking Outsourcing industry is primarily led by well-established companies, including:

- Merck KGaA (U.S.)

- Sartorius AG (Germany)

- BSL Bioservice (Germany)

- Charles River Laboratories (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Lonza (Switzerland)

- SGS Société Générale de Surveillance SA (Switzerland)

- WuXi AppTec (China)

- Reliance Life Sciences (India)

- LifeCell (India)

- Cryoviva Botech Private Limited (India)

- Cordlife (Singapore)

- Texcell (France)

- GBI (U.S.)

- TRANSCELL BIOLIFE (India)

- Cryo-Cell International, Inc. (U.S.)

- STEMCELL Technologies (U.S.)

Latest Developments in Global Cell Banking Outsourcing Market

- In May 2022, Anja Health secured USD4.5 million in seed funding to enhance access to cord blood stem cell banking for all individuals, regardless of race, socioeconomic status, or income. This funding will bolster the company's leadership team, drive strategic growth, and strengthen community engagement

- In April 2022, Pluristyx, a biotechnology company specializing in advanced therapeutic tools and services, partnered with Accelerated Biosciences, a leader in regenerative medicine known for its proprietary human trophoblast stem cells (hTSCs), to create clinical-grade hESC banks following GMP guidelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.