Global Cell Culture Reagents And Supplements Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

6.44 Billion

2025

2033

USD

2.90 Billion

USD

6.44 Billion

2025

2033

| 2026 –2033 | |

| USD 2.90 Billion | |

| USD 6.44 Billion | |

|

|

|

|

Cell Culture Reagents and Supplements Market Size

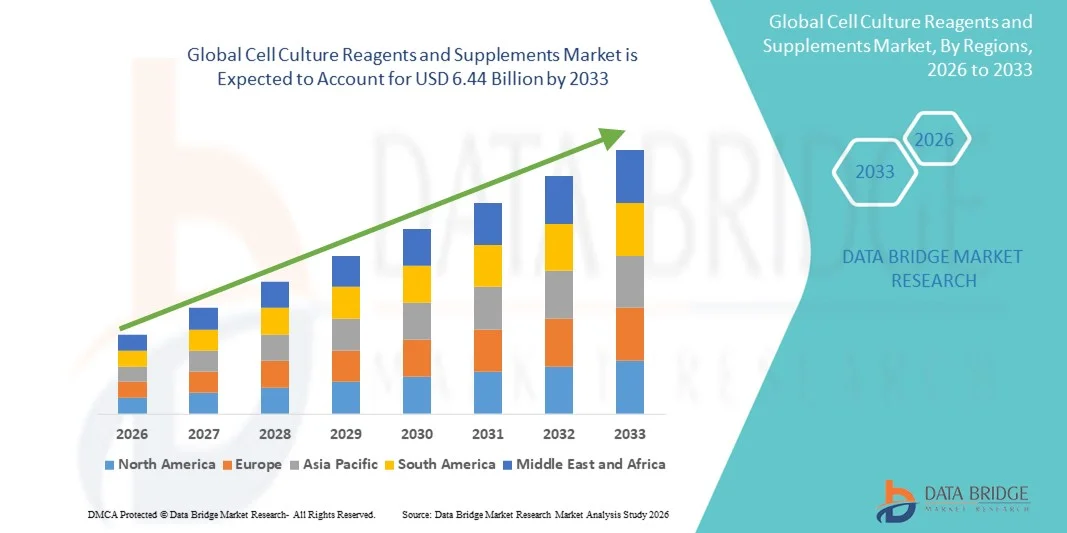

- The global cell culture reagents and supplements market size was valued at USD 2.90 billion in 2025 and is expected to reach USD 6.44 billion by 2033, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced cell-based research and biopharmaceutical production processes, leading to higher demand for high-quality and specialized cell culture reagents and supplements

- Furthermore, rising investments in regenerative medicine, stem cell research, and personalized medicine are driving the need for reliable, efficient, and scalable solutions in laboratories and biomanufacturing facilities

Cell Culture Reagents and Supplements Market Analysis

- Cell culture reagents and supplements are increasingly vital components of modern life sciences research and biopharmaceutical production in both academic and industrial settings due to their critical role in supporting cell growth, differentiation, and viability across diverse applications

- The escalating demand for cell culture reagents and supplements is primarily fueled by the widespread adoption of advanced cell-based research techniques, rising investments in biopharmaceuticals, and growing emphasis on regenerative medicine and personalized therapies

- North America dominated the cell culture reagents and supplements market, accounting for approximately 42.5% of the global revenue share in 2025. The U.S. leads due to a well-established biotechnology and pharmaceutical ecosystem, advanced research infrastructure, and widespread adoption of innovative cell culture solutions such as serum-free media, growth factors, and chemically defined supplements

- Asia-Pacific is expected to be the fastest-growing region in the cell culture reagents and supplements market during the forecast period, with an estimated CAGR of 8.3%. Growth is driven by increasing investments in biotechnology research, expanding pharmaceutical R&D activities, and rising adoption of advanced cell culture techniques in countries such as China, India, and Japan

- The Biopharmaceutical/Therapeutics segment accounted for the largest market revenue share of 42.6% in 2025, due to its extensive use in biologics development, vaccine manufacturing, and cell-based therapy production

Report Scope and Cell Culture Reagents and Supplements Market Segmentation

|

Attributes |

Cell Culture Reagents and Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cell Culture Reagents and Supplements Market Trends

Rising Adoption of Advanced Cell Culture Systems

- A significant trend in the global cell culture reagents and supplements market is the increasing adoption of advanced cell culture platforms, including 3D cell culture, organoids, and stem cell-derived systems, which require specialized reagents and supplements for optimized growth and differentiation

- For instance, in 2024, Thermo Fisher Scientific launched a line of advanced serum-free media and supplements specifically designed for 3D organoid cultures, enabling more physiologically relevant results

- Researchers are increasingly focusing on developing human-relevant models for drug discovery, regenerative medicine, and disease modeling, which is fueling demand for high-quality reagents such as growth factors, cytokines, and specialized media

- The trend is also driven by the shift from traditional serum-based systems to chemically defined and xeno-free reagents to improve reproducibility, reduce variability, and comply with regulatory standards for clinical and industrial applications

- Growing interest in personalized medicine and precision oncology is boosting demand for patient-specific culture systems that require custom reagent formulations. In addition, the expansion of biopharmaceutical production using cell-based platforms has led to an increased requirement for supplements that support high-density and high-yield cultures

- Companies such as Merck KGaA and Corning are investing in R&D for next-generation culture reagents to support 3D bioprinting and organ-on-chip technologies. Increasing government and private funding for stem cell research and regenerative medicine is further accelerating the uptake of high-performance reagents and supplements

- The availability of modular kits and pre-formulated supplements is simplifying workflows for academic and industrial laboratories, contributing to wider adoption. Emerging markets are witnessing rapid adoption due to growing biotech and pharmaceutical research infrastructure

- Regulatory encouragement for the use of animal-free reagents in clinical research is also pushing the market towards defined supplements. Overall, the trend reflects a strong move towards more efficient, reproducible, and scalable cell culture systems, driving sustained growth in the reagents and supplements segment globally

Cell Culture Reagents and Supplements Market Dynamics

Driver

Expansion of Biopharmaceutical R&D and Cell-Based Therapies

- The increasing demand for biopharmaceutical research, including monoclonal antibodies, vaccines, and gene and cell therapies, is a primary driver of the Cell Culture Reagents and Supplements market

- For instance, in 2025, Lonza announced an expansion of its mammalian cell culture media production to meet rising demand from gene therapy developers, highlighting the growing market requirement for specialized reagents

- Cell-based assays, high-throughput screening, and drug discovery processes require highly specific and reliable supplements to maintain cell viability and functionality, driving consistent market growth

- The growing prevalence of chronic diseases, cancer, and infectious diseases has intensified R&D activities, requiring more robust and reproducible culture systems. Increasing adoption of 3D cell culture models and co-culture systems in pharmaceutical research and toxicity testing is enhancing demand for specialized reagents and media

- Academic and research institutions are expanding their cell culture capabilities to meet evolving research objectives, contributing to reagent consumption. Biopharmaceutical companies are focusing on optimizing production efficiency and quality, which increases the use of high-performance supplements for scalable cell cultures

- Government initiatives promoting biotech innovation and stem cell research further stimulate the market

- Emerging applications in regenerative medicine, tissue engineering, and personalized medicine also drive the need for tailored culture supplements

- Supply agreements and partnerships between reagent manufacturers and biotech companies ensure availability and adoption, reinforcing growth

- The integration of automated culture systems and bioreactors in R&D facilities has increased dependency on standardized supplements for reproducibility

- Overall, rising biopharma R&D investments, expansion of cell-based therapy pipelines, and evolving drug discovery models are the key drivers sustaining market growth

Restraint/Challenge

High Costs and Complex Regulatory Requirements

- The relatively high cost of specialized cell culture reagents and supplements can hinder adoption, particularly among small research labs and startups

- For instance, premium serum-free media and growth factor supplements can cost several times more than traditional serum-based formulations, limiting accessibility for cost-sensitive institutions

- Strict regulatory standards for clinical and industrial applications, including compliance with cGMP, ISO, and animal-free requirements, create complexity and slow product approvals

- Variability in cell culture outcomes and the need for extensive validation before use in critical experiments can also discourage adoption among new users

- The dependence on high-quality raw materials, such as recombinant proteins and purified growth factors, increases production costs and affects pricing

- Shipping, storage, and shelf-life challenges of temperature-sensitive reagents add logistical hurdles for laboratories worldwide

- Limited standardization across products from different manufacturers can lead to reproducibility issues, impacting user confidence

- Intellectual property protections and patent restrictions for certain recombinant proteins or supplements can further limit market access

- In emerging markets, lower infrastructure and lack of trained personnel hinder adoption of advanced reagents and supplements

- Price sensitivity and competition from generic or in-house formulations can constrain growth in certain segments

- Companies need to balance innovation with cost-effectiveness to ensure widespread adoption. Overall, high costs, regulatory complexity, and operational challenges are the main restraints impacting the Cell Culture Reagents and Supplements market despite strong demand trends

Cell Culture Reagents and Supplements Market Scope

The market is segmented on the basis of product, end-user, and application.

- By Product

On the basis of product, the Cell Culture Reagents and Supplements market is segmented into Supplements and Growth Factors, Buffers and Chemicals, Cell Dissociation Reagents, Balanced Salt Solution, Contamination Detection Kits, Cryoprotective Agents, Antibiotics/Antimycotics, and Others. The Supplements and Growth Factors segment dominated the market with a largest revenue share of 38.5% in 2025, driven by their critical role in supporting cell proliferation, differentiation, and viability in both research and industrial applications. High demand arises from the growing adoption of stem cell culture, organoid research, and biopharmaceutical production processes requiring high-quality and reproducible growth conditions. Companies are increasingly offering ready-to-use, serum-free, and chemically defined supplements to enhance reproducibility and reduce variability in experiments. The segment benefits from technological advancements in recombinant growth factors, cytokines, and specialized supplements that optimize culture performance. Increased use in regenerative medicine, tissue engineering, and personalized medicine research further supports segment growth. Strategic collaborations and new product launches by leading companies such as Thermo Fisher Scientific and Merck KGaA strengthen market dominance. Moreover, rising investments in preclinical and clinical research globally are driving consistent demand. Strong preference for animal-free and xeno-free formulations in clinical and commercial applications also fuels adoption. Increasing applications in biopharmaceutical R&D, 3D culture systems, and organ-on-chip platforms contribute to sustained growth. Ongoing innovations in modular and high-throughput kits enhance convenience for end users, maintaining market leadership.

The Balanced Salt Solution segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by its essential role in maintaining physiological conditions during cell culture, cryopreservation, and transport. Rising adoption in automated culture systems, stem cell research, and high-throughput screening applications is accelerating demand. Increasing preference for defined and ready-to-use salt solutions to improve reproducibility is supporting growth. Expansion of tissue engineering and regenerative medicine applications, where balanced salt solutions are critical for maintaining cell viability, further fuels market adoption. Companies are focusing on product innovation to provide enhanced stability and compatibility with diverse culture platforms. The segment also benefits from the growing prevalence of cell-based therapeutics and the need for standardized reagents in clinical research. Emerging biotech hubs in Asia-Pacific and Latin America are contributing to increasing sales. Rising academic and industrial research activities globally drive the requirement for high-quality salt solutions. Continuous supply agreements between suppliers and end-users strengthen adoption. Additionally, balanced salt solutions are increasingly used in quality control and contamination detection workflows. Regulatory encouragement for standardized, GMP-compliant reagents supports segment growth. Overall, this segment is set to witness rapid adoption due to its essential application across multiple cell culture processes.

- By End-User

On the basis of end-user, the market is segmented into Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostic Laboratories, Research Institutes, and Cell Banks. Pharmaceutical and Biotechnology Companies dominated the largest market share of 41.8% in 2025, owing to their extensive use of cell culture reagents in drug discovery, biologics development, vaccine production, and cell-based therapeutics. These companies require high-quality supplements and reagents to maintain reproducibility, efficacy, and regulatory compliance across preclinical and clinical research activities. Rising R&D investments, especially in monoclonal antibodies, gene therapy, and regenerative medicine, are driving significant consumption. The growing adoption of 3D culture systems and organoid models in pharma R&D further supports segment dominance. Strategic partnerships with reagent suppliers and in-house optimization of culture workflows also contribute to revenue growth. Expansion of biopharmaceutical manufacturing facilities globally is increasing demand for large-scale reagent supply. Technological innovations in serum-free and xeno-free formulations ensure enhanced safety and reproducibility. Pharmaceutical companies are increasingly leveraging automation in cell culture workflows, boosting the need for standardized reagents. Robust regulatory oversight for clinical-grade reagents ensures consistent quality, further strengthening adoption. Increasing focus on personalized medicine and patient-derived models is driving additional usage.

The Research Institutes segment is expected to witness the fastest CAGR of 23.5% from 2026 to 2033, propelled by rising academic and governmental research activities in stem cell biology, cancer biology, and regenerative medicine. Funding initiatives for basic and translational research are boosting demand for specialized reagents and supplements. High adoption of advanced culture systems such as 3D spheroids, organ-on-chip platforms, and co-culture models supports growth. The segment benefits from the need for reproducible, scalable, and high-quality reagents to support cutting-edge research. Increasing collaboration with biotech and pharma firms for translational studies further enhances reagent utilization. Adoption of automated and high-throughput workflows in research laboratories accelerates the need for consistent reagents. Additionally, regulatory and compliance requirements for in vitro models are driving standardized reagent consumption. Expansion of research infrastructure in emerging regions, including Asia-Pacific and Latin America, is contributing to growth. Rising focus on disease modeling, drug discovery, and toxicity testing reinforces demand. Technological advancements in cryopreservation, contamination detection, and serum-free systems also support adoption.

- By Application

On the basis of application, the market is segmented into Biopharmaceutical/Therapeutics, Stem Cell Technology, Cancer Research, Drug Screening and Development, Tissue Engineering and Regenerative Medicine, and Others. The Biopharmaceutical/Therapeutics segment accounted for the largest market revenue share of 42.6% in 2025, due to its extensive use in biologics development, vaccine manufacturing, and cell-based therapy production. Demand is driven by the need for high-quality, reproducible culture conditions that ensure product safety and efficacy. Increased focus on monoclonal antibody production, gene therapy, and personalized medicine has further fueled growth. Biopharmaceutical companies’ reliance on standardized reagents and supplements for regulatory compliance enhances market share. Expansion of manufacturing and R&D facilities worldwide, especially in North America and Europe, supports segment dominance. Adoption of serum-free, xeno-free, and chemically defined supplements in therapeutic applications strengthens demand. Technological advances in high-density culture systems and automation in biologics production also contribute to growth. Strategic partnerships between reagent suppliers and pharma companies ensure consistent supply. Regulatory pressure for GMP-compliant reagents drives standardized usage. Ongoing product innovations and new formulations for enhanced yield and cell viability further sustain growth.

The Stem Cell Technology segment is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, driven by rapid advancements in stem cell research, organoid development, and regenerative medicine. Rising global investment in stem cell therapy pipelines, tissue engineering, and personalized medicine applications is boosting demand for specialized culture reagents. The segment benefits from the increasing adoption of 3D culture models and co-culture systems that require precise and optimized reagents. Academic, clinical, and commercial research programs focusing on regenerative medicine are further enhancing adoption. Emerging markets are witnessing faster adoption due to increasing research infrastructure and government funding. The segment also sees growth from biopharma companies exploring stem cell-derived therapeutics. Innovations in chemically defined, xeno-free, and serum-free supplements tailored for stem cell expansion and differentiation drive growth. Increasing use in high-throughput screening and disease modeling accelerates market uptake. Continuous improvements in cryopreservation and contamination detection technologies support segment adoption.

Cell Culture Reagents and Supplements Market Regional Analysis

- North America dominated the cell culture reagents and supplements market with the largest revenue share of 42.5% in 2025

- Supported by a well-established biotechnology and pharmaceutical ecosystem, advanced research infrastructure, and widespread adoption of innovative cell culture solutions such as serum-free media, growth factors, and chemically defined supplements

- The widespread adoption is further supported by high research spending, strong collaborations between academia and industry, and the presence of leading cell culture reagent manufacturers, establishing the region as a key hub for life sciences research

U.S. Cell Culture Reagents and Supplements Market Insight

The U.S. cell culture reagents and supplements market captured the largest revenue share in North America in 2025, driven by the rapid adoption of advanced cell culture solutions for drug discovery, regenerative medicine, and biopharmaceutical production. Increasing R&D investments, high adoption of serum-free and chemically defined media, and expanding biopharma manufacturing capabilities further propel market growth. Additionally, collaborations between contract research organizations (CROs) and research institutes are enhancing the development and utilization of high-quality reagents and supplements.

Europe Cell Culture Reagents and Supplements Market Insight

The Europe cell culture reagents and supplements market is projected to expand at a substantial CAGR during the forecast period, fueled by increasing biopharmaceutical research, growing demand for stem cell and regenerative medicine studies, and regulatory support for innovative cell culture techniques. Countries like Germany, the U.K., and France are witnessing rising adoption of serum-free media, growth factors, and chemically defined supplements in research and industrial applications.

U.K. Cell Culture Reagents and Supplements Market Insight

The U.K. cell culture reagents and supplements market is anticipated to grow steadily, supported by a robust life sciences research ecosystem, increasing investment in regenerative medicine, and expanding biopharmaceutical R&D activities. Demand for advanced reagents and supplements in drug discovery, cell therapy, and stem cell research is driving market expansion.

Germany Cell Culture Reagents and Supplements Market Insight

Germany cell culture reagents and supplements market is expected to witness considerable market growth, driven by well-developed biotechnology infrastructure, strong academic-industry collaborations, and increasing adoption of advanced cell culture techniques in biopharmaceutical production. Regulatory support for innovation and quality control further boosts the market.

Asia-Pacific Cell Culture Reagents and Supplements Market Insight

The Asia-Pacific cell culture reagents and supplements market is poised to grow at the fastest CAGR of 8.3% during the forecast period, driven by increasing investments in biotechnology research, expanding pharmaceutical R&D activities, and rising adoption of advanced cell culture techniques in countries such as China, India, and Japan. Government initiatives promoting life sciences research, along with the establishment of advanced cell culture laboratories and biopharma manufacturing facilities, further accelerate growth.

Japan Cell Culture Reagents and Supplements Market Insight

Japan’s cell culture reagents and supplements market growth is fueled by the country’s strong focus on regenerative medicine, stem cell research, and biopharmaceutical innovation. Adoption of serum-free and chemically defined media, along with increasing collaborations between research institutes and biopharma companies, is driving market expansion.

China Cell Culture Reagents and Supplements Market Insight

China cell culture reagents and supplements market accounted for the largest revenue share in the Asia-Pacific region in 2025, attributed to expanding biotechnology sectors, growing pharmaceutical R&D investments, and the increasing number of academic and clinical research facilities. The availability of high-quality reagents and supplements, combined with government support for biopharmaceutical research, is accelerating market growth.

Cell Culture Reagents and Supplements Market Share

The Cell Culture Reagents and Supplements industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Merck KGaA (Germany)

• Lonza Group (Switzerland)

• Corning Incorporated (U.S.)

• Sigma-Aldrich (U.S.)

• STEMCELL Technologies (Canada)

• Bio-Techne Corporation (U.S.)

• GE Healthcare Life Sciences (U.S.)

• Cytiva (U.S.)

• PromoCell GmbH (Germany)

• Takara Bio Inc. (Japan)

• Miltenyi Biotec (Germany)

• ATCC (U.S.)

• VWR International (U.S.)

• Fujifilm Wako Chemicals (Japan)

• Cayman Chemical (U.S.)

• Biological Industries (Israel)

• PeproTech (U.S.)

• Charles River Laboratories (U.S.)

• Lonza Walkersville (U.S.)

Latest Developments in Global Cell Culture Reagents and Supplements Market

- In September 2023, Thermo Fisher Scientific unveiled its latest recombinant cell culture supplement tailored for stem cell research, addressing the rising global demand for high‑quality culture media that enhance growth and differentiation outcomes

- In June 2024, Sartorius AG completed the acquisition of Polyplus‑transfection for approximately EUR 2.1 billion, expanding its cell culture portfolio to include advanced transfection reagents and recombinant supplements used in gene therapy and related applications

- In August 2024, Cytiva partnered with WuXi Biologics to establish a joint development program for customized recombinant supplements tailored for contract biomanufacturing, combining Cytiva’s biochemical expertise with WuXi’s manufacturing scale

- In November 2024, Fujifilm Irvine Scientific opened a new innovation center in the Netherlands aimed at customizing culture media and reagent solutions—supporting European cell therapy development and strengthening global supply chains

- In June 2024, Corning Incorporated launched its latest CellSTACK culture vessels with improved gas exchange design, enhancing high‑density adherent cell expansion in vaccine production and tissue engineering workflows that rely on optimized reagent use

- In April 2025, PL BioScience announced the first‑ever production of an artificial human platelet lysate (HPL) as a scalable, animal‑free cell culture supplement, providing a sustainable alternative to fetal bovine serum (FBS) and supporting safer, more reproducible cell growth for regenerative medicine and biopharmaceutical applications

- In 2025, Cytiva entered a strategic partnership with CellGenix, focusing on the development of recombinant cytokine reagents for regenerative medicine applications—enhancing global supply of specialized reagents and supplements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.