Global Cell Permeabilization Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

1.74 Billion

2024

2032

USD

1.21 Billion

USD

1.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 1.74 Billion | |

|

|

|

|

Cell Permeabilization Market Size

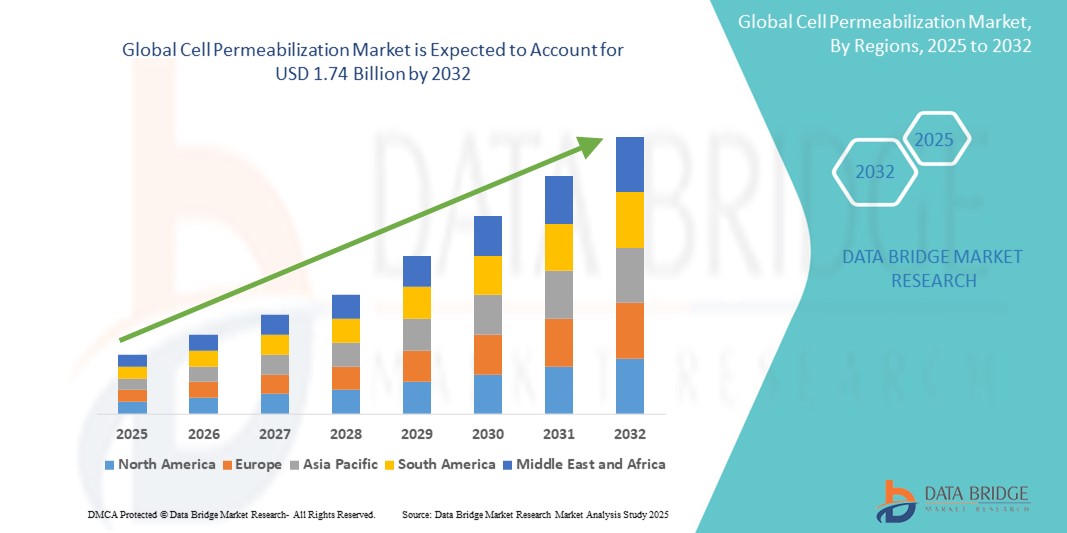

- The global cell permeabilization market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 1.74 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is primarily driven by the expanding use of cell-based assays, drug discovery research, and diagnostic testing, which require efficient cell membrane disruption for molecular analysis and intracellular delivery

- In addition, increasing investment in biotechnology and pharmaceutical R&D, alongside the rising demand for advanced cell imaging and flow cytometry applications, is reinforcing the relevance of cell permeabilization techniques. These synergistic factors are propelling the global adoption of permeabilization reagents and protocols, thereby contributing to robust market expansion

Cell Permeabilization Market Analysis

- Cell permeabilization, a crucial technique enabling the controlled disruption of cellular membranes to allow intracellular access, plays a vital role in cell-based assays, drug delivery research, and diagnostic applications across pharmaceutical, biotechnology, and academic research settings

- The rising demand for high-throughput screening, flow cytometry, and molecular biology studies is driving the adoption of permeabilization reagents and protocols, particularly for applications in immunostaining, intracellular enzyme assays, and nucleic acid analysis

- North America dominated the cell permeabilization market with the largest revenue share of 39.2% in 2024, characterized by robust R&D investments, a strong biotechnology infrastructure, and the presence of major pharmaceutical and life sciences companies. The U.S. has been at the forefront due to its advanced research facilities and increasing adoption of precision medicine

- Asia-Pacific is expected to be the fastest growing region in the cell permeabilization market during the forecast period due to expanding biotech sectors, increased government funding for life sciences research, and growing academic-industry collaborations, particularly in China and India

- Detergent segment dominated the cell permeabilization market with a market share of 52.8% in 2024, driven by its high efficiency in selectively disrupting cell membranes and its widespread compatibility with immunostaining and flow cytometry applications

Report Scope and Cell Permeabilization Market Segmentation

|

Attributes |

Cell Permeabilization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell Permeabilization Market Trends

“Automation and High-Throughput Compatibility in Permeabilization Protocols”

- A key and rapidly advancing trend in the global cell permeabilization market is the growing integration of automation and high-throughput compatibility in permeabilization protocols, aimed at enhancing efficiency and reproducibility in research and clinical laboratories

- For instance, BD Biosciences and Thermo Fisher Scientific offer permeabilization reagents specifically designed for use in automated systems, enabling seamless processing of large sample volumes in flow cytometry and cell imaging workflows

- These automated protocols reduce manual handling, minimize variability, and accelerate assay timelines, making them ideal for large-scale drug discovery and molecular diagnostics applications

- Integration with robotic liquid handling systems ensures consistency across experiments, supporting the needs of high-throughput screening in pharmaceutical and biotechnology companies

- In addition, automated permeabilization enhances compatibility with multiplex assays, allowing simultaneous analysis of multiple intracellular markers, which is increasingly valuable in complex disease research and personalized medicine

- This shift towards scalable, automation-ready solutions is reshaping lab workflows and positioning permeabilization as a critical component in modern high-throughput research environments, driving widespread adoption in CROs, academic institutions, and biopharma R&D centers

Cell Permeabilization Market Dynamics

Driver

“Rising Demand from Drug Discovery and Cellular Analysis Applications”

- The increasing emphasis on drug discovery, personalized medicine, and advanced cellular analysis is a major driver for the growing demand in the global cell permeabilization market

- For instance, in March 2024, Thermo Fisher Scientific expanded its portfolio of permeabilization reagents optimized for use in high-throughput drug screening workflows, aiming to enhance intracellular target access and assay precision—an innovation expected to boost market growth over the forecast period

- As pharmaceutical and biotechnology companies intensify their focus on high-content screening and intracellular biomarker detection, cell permeabilization becomes a critical step in enabling effective molecular penetration and analysis

- In addition, the growing adoption of flow cytometry, immunofluorescence, and single-cell analysis techniques in research and diagnostics is increasing the demand for reliable and consistent permeabilization protocols

- The ability of permeabilization methods to facilitate antibody or dye entry into the cell for intracellular analysis, while preserving cell structure, makes them essential tools in functional genomics, cancer research, and vaccine development

- With advancements in reagent formulation and protocol automation, coupled with rising R&D investments across the life sciences sector, the use of cell permeabilization techniques is set to expand significantly, especially in academic research labs and contract research organizations

Restraint/Challenge

“Skin Irritation Issues and Regulatory Compliance Hurdle”

- A notable challenge in the global cell permeabilization market is the potential for skin irritation and toxicity associated with commonly used reagents, as well as the regulatory complexities involved in ensuring safe and compliant usage across research and clinical settings

- For instance, permeabilization agents such as Triton X-100 and methanol are known to cause skin and respiratory irritation, necessitating strict laboratory safety protocols, including the use of gloves, lab coats, and fume hoods, which can limit ease of use in some environments

- The hazardous nature of certain chemicals also poses risks during storage and disposal, increasing operational burdens and making them less suitable for use in resource-limited or educational settings

- Furthermore, permeabilization products must comply with regulatory requirements regarding chemical safety, environmental impact, and clinical validation, particularly in regions with stringent frameworks such as the U.S. FDA and the European Medicines Agency

- These regulatory compliance demands can delay product development, increase costs for manufacturers, and restrict market access for newer or smaller players aiming to innovate in this space

- Overcoming these barriers through the development of safer, non-toxic reagent alternatives, clearer regulatory guidance, and enhanced safety labeling will be essential to broaden market accessibility and ensure responsible usage across the life sciences ecosystem

Cell Permeabilization Market Scope

The market is segmented on the basis of process type, modality, and end-user.

- By Process Type

On the basis of process type, the cell permeabilization market is segmented into detergent, organic solvent, and others. The detergent segment dominated the market with the largest revenue share of 52.8% in 2024, driven by its ability to selectively disrupt cellular membranes without significantly altering cell morphology. Detergents such as Triton X-100 and saponin are widely used in immunocytochemistry and flow cytometry for their compatibility with intracellular staining procedures

The organic solvent segment is expected to witness significant growth during the forecast period, particularly in fixed-cell applications requiring deeper penetration of intracellular targets. Solvents such as methanol and ethanol are extensively used in protocols where membrane rigidity must be preserved post-fixation, making them suitable for applications involving morphological and structural analysis of cellular components.

- By Modality

On the basis of modality, the market is segmented into specific and non-specific permeabilization. The non-specific modality held the largest market share of 57.4% in 2024, driven by its extensive use in general laboratory assays where complete or partial membrane disruption is sufficient for molecule delivery or intracellular analysis. This modality is favored in high-throughput environments and standard protocols for immunostaining and enzyme detection.

The specific modality segment is projected to grow at a faster rate through 2032, owing to its increasing application in precision research, including targeted drug delivery, organelle-specific staining, and controlled molecular transport. This approach enables selective permeabilization of specific cellular compartments, allowing for more refined experimental control and detailed biological insights.

- By End User

On the basis of end-user, the market is segmented into pharmaceutical and biotechnology companies, contract research organizations (CROs), and others. The pharmaceutical and biotechnology companies segment dominated the market with a revenue share of 48.9% in 2024, attributed to the growing use of permeabilization protocols in drug discovery, high-content screening, and molecular profiling. The increasing demand for reproducible and scalable intracellular analysis tools supports strong market demand from biopharma R&D pipelines.

The CROs segment is expected to exhibit the fastest growth rate from 2025 to 2032 due to the rising trend of outsourced research activities, particularly in early-stage drug development and toxicological studies. CROs rely heavily on standardized, efficient cell-based assays, further driving demand for permeabilization products.

Cell Permeabilization Market Regional Analysis

- North America dominated the cell permeabilization market with the largest revenue share of 39.2% in 2024, driven by robust R&D investments, a strong biotechnology infrastructure, and the presence of major pharmaceutical and life sciences companies

- Researchers and institutions in the region prioritize high-throughput, reproducible solutions for applications in drug discovery, flow cytometry, and intracellular biomarker analysis, leading to a consistent demand for high-performance permeabilization reagents and protocols

- The market's growth is further supported by a high concentration of academic research centers, favorable government funding for biomedical research, and the rapid adoption of automated technologies in both clinical and research laboratories, positioning North America as a global leader in cell-based assay innovation and implementation

U.S. Cell Permeabilization Market Insight

The U.S. cell permeabilization market captured the largest revenue share of 79.2% in 2024 within North America, driven by its well-established biotechnology and pharmaceutical sectors and high levels of R&D spending. The country’s strong academic infrastructure and advanced laboratory facilities support widespread adoption of permeabilization techniques across both basic research and drug development. In addition, the increasing use of high-throughput screening and flow cytometry in clinical diagnostics and therapeutic research further propels demand for reliable and automated permeabilization solutions.

Europe Cell Permeabilization Market Insight

The Europe cell permeabilization market is projected to expand at a substantial CAGR throughout the forecast period, supported by significant investments in life sciences and growing demand for precision medicine. The region’s regulatory emphasis on product safety and research integrity is fostering the use of standardized, high-quality permeabilization reagents. Furthermore, the rise in cell-based research in oncology, immunology, and regenerative medicine across countries such as France, Germany, and the Netherlands is bolstering regional market growth.

U.K. Cell Permeabilization Market Insight

The U.K. cell permeabilization market is anticipated to grow at a noteworthy CAGR, underpinned by the country's strong life sciences ecosystem and government support for biomedical research. The widespread use of permeabilization in genomics, proteomics, and molecular diagnostics is accelerating adoption in both academic and commercial settings. In addition, partnerships between universities and biotech firms are contributing to the development of innovative reagents and techniques tailored to advanced research needs.

Germany Cell Permeabilization Market Insight

The Germany cell permeabilization market is expected to expand at a considerable CAGR, fueled by increasing investments in pharmaceutical R&D and a growing focus on automated laboratory solutions. Germany's emphasis on innovation, precision engineering, and regulatory compliance makes it a favorable environment for the adoption of standardized permeabilization protocols. Moreover, the country’s leadership in diagnostic technologies and life science instrumentation further supports market expansion.

Asia-Pacific Cell Permeabilization Market Insight

The Asia-Pacific cell permeabilization market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by the rapid growth of pharmaceutical and biotech industries in China, India, and Japan. Increasing government support for biomedical research, expanding academic infrastructure, and the proliferation of CROs are key growth drivers. The region’s cost-effective manufacturing capabilities and rising demand for high-throughput screening tools are further fueling market expansion.

Japan Cell Permeabilization Market Insight

The Japan cell permeabilization market is gaining traction due to the country’s advanced research capabilities and growing focus on molecular diagnostics and regenerative medicine. Japan’s commitment to technological innovation and precision research is encouraging the adoption of refined permeabilization reagents, particularly for use in complex cell-based assays. The country’s aging population is also contributing to increased biomedical research, boosting demand for reliable intracellular analysis tools.

India Cell Permeabilization Market Insight

The Japan cell permeabilization market is gaining traction due to the country’s advanced research capabilities and growing focus on molecular diagnostics and regenerative medicine. Japan’s commitment to technological innovation and precision research is encouraging the adoption of refined permeabilization reagents, particularly for use in complex cell-based assays. The country’s aging population is also contributing to increased biomedical research, boosting demand for reliable intracellular analysis tools.

Cell Permeabilization Market Share

The cell permeabilization industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- BD. (U.S.)

- Merck KGaA (Germany)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abcam plc (U.K.)

- PerkinElmer (U.S.)

- Promega Corporation (U.S.)

- Danaher Corporation (U.S.)

- Roche Diagnostics (Switzerland)

- Lonza Group Ltd. (Switzerland)

- Takara Bio Inc. (Japan)

- Enzo Life Sciences, Inc. (U.S.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Vector Laboratories, Inc. (U.S.)

- Tocris Bioscience (U.K.)

- GenScript (China)

- Biotium (U.S.)

- Abnova Corporation (Taiwan)

What are the Recent Developments in Global Cell Permeabilization Market?

- In May 2024, Thermo Fisher Scientific expanded its portfolio of cell analysis reagents by launching a new line of automation-compatible cell permeabilization kits. These kits are optimized for high-throughput screening platforms and designed to enhance consistency and reproducibility in intracellular staining protocols. This development reflects the company’s focus on streamlining cell-based workflows and meeting the growing demand for scalable solutions in pharmaceutical and academic research

- In April 2024, BD Biosciences introduced enhanced permeabilization reagents tailored for use in multicolor flow cytometry applications. These reagents allow for more precise intracellular target detection while minimizing background noise and preserving cell integrity. The launch aims to support researchers working in immunology, oncology, and infectious disease by improving assay sensitivity and reliability

- In February 2024, Merck KGaA (MilliporeSigma) unveiled a new non-toxic, biodegradable permeabilization agent developed specifically for use in educational and low-resource laboratory settings. This innovation addresses the challenge of chemical safety while maintaining performance standards in cell-based assays, aligning with global efforts toward greener lab practices and increased reagent accessibility

- In January 2024, Agilent Technologies announced a collaboration with several academic institutions to develop a next-generation permeabilization platform integrated with real-time imaging tools. The project aims to enhance live-cell imaging applications by enabling temporary and reversible permeabilization, allowing researchers to track intracellular changes dynamically without compromising cell viability

- In December 2023, Bio-Rad Laboratories launched a custom reagent formulation service for permeabilization solutions tailored to specific research needs, including organelle-specific assays and multiplex analysis. This move highlights the increasing demand for personalized research tools and Bio-Rad's commitment to supporting advanced cell biology and translational research through customizable and scalable solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.