Global Cellulose Esters And Ethers Market

Market Size in USD Billion

CAGR :

%

USD

6.72 Billion

USD

10.43 Billion

2024

2032

USD

6.72 Billion

USD

10.43 Billion

2024

2032

| 2025 –2032 | |

| USD 6.72 Billion | |

| USD 10.43 Billion | |

|

|

|

|

Cellulose Esters and Ethers Market Size

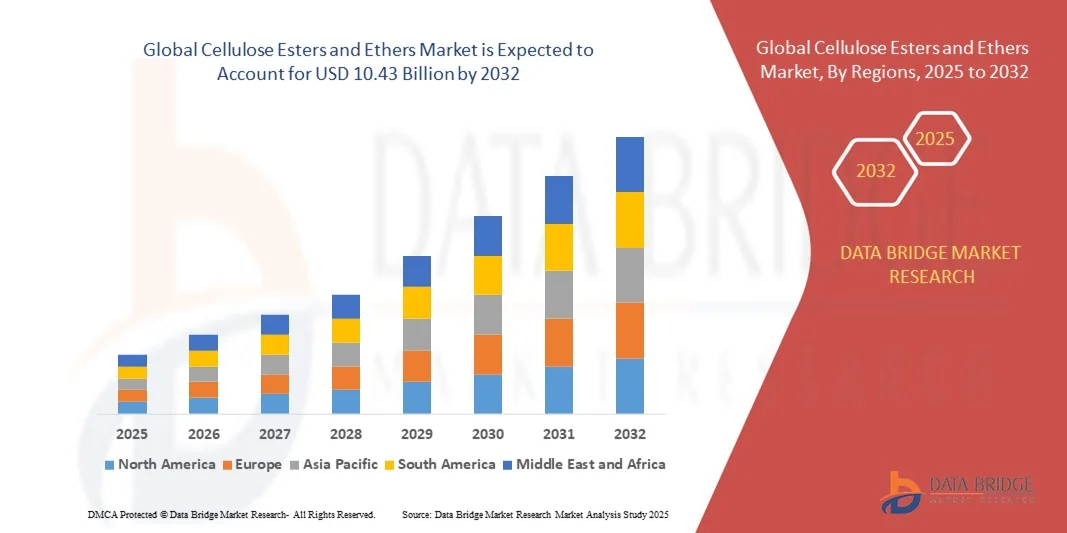

- The global cellulose esters and ethers market size was valued at USD 6.72 billion in 2024 and is expected to reach USD 10.43 billion by 2032, at a CAGR of 5.65% during the forecast period

- The market growth is largely fueled by increasing demand for sustainable and biodegradable materials across food, pharmaceuticals, personal care, and industrial applications, driving the adoption of cellulose esters and ethers as versatile functional ingredients

- Furthermore, growing emphasis on improving product performance, texture, and stability in end-use industries such as food and beverages, paints and adhesives, and oil and gas is boosting the utilization of cellulose derivatives, thereby significantly accelerating market expansion

Cellulose Esters and Ethers Market Analysis

- Cellulose esters and ethers, serving as thickeners, stabilizers, binders, and film-forming agents, are becoming essential in various industries due to their multifunctionality, compatibility with diverse formulations, and eco-friendly profile

- The rising market demand is driven by increasing applications in processed foods, pharmaceuticals, personal care products, and industrial formulations, along with the global shift toward renewable and sustainable materials, enhancing the overall growth trajectory of the industry

- Asia-Pacific dominated the cellulose esters and ethers market with a share of 56.5% in 2024, due to expanding food and beverage, pharmaceutical, and paper industries, along with a strong presence of chemical manufacturing hubs

- North America is expected to be the fastest growing region in the cellulose esters and ethers market during the forecast period due to rising demand in food and beverage, oil and gas, and coatings applications

- Kraft process segment dominated the market with a market share of 84.5% in 2024, due to its widespread industrial adoption for producing high-strength pulp with superior yield and durability. The process’s efficiency in handling various wood types and its economic advantages in chemical recovery systems make it a preferred choice among manufacturers. Growing use of kraft pulp in packaging and specialty papers further contributes to the dominance of this segment

Report Scope and Cellulose Esters and Ethers Market Segmentation

|

Attributes |

Cellulose Esters and Ethers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cellulose Esters and Ethers Market Trends

Increased Use of Sustainable Cellulose Derivatives

- The cellulose esters and ethers market is witnessing dynamic expansion driven by the rising preference for bio-based and sustainable materials across key industries such as pharmaceuticals, personal care, coatings, and textiles. These derivatives originate from renewable cellulose sources, aligning with global sustainability goals while reducing reliance on fossil-based chemical alternatives

- For instance, Ashland Global Holdings Inc. has launched a range of sustainable cellulose-based solutions under its Natrosol and Benecel product lines, catering to eco-conscious manufacturers in healthcare and cosmetics. These materials demonstrate improved biodegradability and functionality, reinforcing brand commitments toward sustainability and environmental responsibility

- The adoption of cellulose esters and ethers is growing in packaging and coatings as industries transition to environmentally compliant solutions with reduced volatile organic compound emissions. Their ability to provide surface film formation, mechanical strength, and clarity makes them valuable in the formulation of green coatings, paper coatings, and bio-based films

- In addition, increasing demand for cellulose derivatives in food and beverage sectors for thickening, stabilizing, and emulsifying purposes is highlighting their versatility. These applications cater to formulators seeking renewable and safe ingredients that meet global regulatory guidelines on food-grade polymers

- Cellulose ethers such as hydroxyethyl cellulose and carboxymethyl cellulose are also being widely adopted in construction and personal care formulations for their superior water retention and rheological control properties. This cross-sector integration is strengthening cellulose’s position as a multifunctional backbone for sustainable industrial innovation

- The overall industry direction reflects a growing movement toward resource-efficient chemistry, where renewable cellulose derivatives are actively replacing synthetic polymers. This trend is expected to play a key role in achieving circular economy objectives and advancing sustainable product development across multiple application sectors

Cellulose Esters and Ethers Market Dynamics

Driver

Demand for Ingredients Enhancing Product Performance

- The market is strongly driven by the rising use of cellulose esters and ethers as performance-enhancing additives that improve product quality, stability, and functionality across various end-use applications. Their natural origin combined with engineered chemical properties makes them ideal for improving consistency, texture, and strength in complex formulations

- For instance, Dow Chemical Company provides high-performing cellulose ethers such as Methocel, which are widely utilized in pharmaceuticals for controlled-release formulations, in addition to construction products for better adhesion and water retention. These applications reflect the compound’s adaptability in enhancing both functional and mechanical performance in high-precision manufacturing

- The ability of cellulose derivatives to provide improved viscosity control, film formation, and thermal stability makes them indispensable in coatings, adhesives, and inks. Their inherent compatibility with both aqueous and solvent-based systems ensures smooth texture and superior application efficiency

- In addition, cellulose esters are being increasingly preferred in plasticizers and coatings where they deliver enhanced flexibility, UV durability, and reduced yellowing over time. This performance-driven approach allows manufacturers to balance long-term aesthetics and functional reliability in industrial and consumer products

- With ongoing technological advancements and formulation innovation, cellulose esters and ethers are steadily evolving as essential additives across industries focused on quality optimization. Their broad application spectrum and reliable performance are consolidating their role as critical enablers of modern material engineering and processing efficiency

Restraint/Challenge

High Production Costs

- The production of cellulose esters and ethers involves multiple chemical modification steps, high-purity raw materials, and stringent process control, significantly increasing overall manufacturing costs. Dependence on natural cellulose from wood and cotton further contributes to price instability due to fluctuations in raw material availability and quality

- For instance, manufacturers such as Eastman Chemical Company face high operational expenditures associated with esterification and etherification processes, which require precise conditions and advanced catalysts. This cost burden can limit market entry for smaller producers and restrict pricing flexibility in competitive global markets

- Energy consumption for solvent recovery, purification, and drying operations adds to the total cost of production, making cellulose derivatives more expensive than conventional synthetic polymers. Maintaining consistent quality standards across batches also demands continual investment in automation and quality testing infrastructure

- In addition, logistical challenges such as storage, transportation, and handling of cellulose-based intermediates elevate operational expenses. The complexity of maintaining moisture control and solvent containment further heightens cost concerns, especially in tropical and high-humidity regions

- To address these challenges, industry participants are exploring green chemistry routes, process integration, and the use of bio-waste cellulose to reduce dependency on virgin inputs. Successful cost optimization through technological modernization and sustainable sourcing will be essential for expanding cellulose esters and ethers production at scale and ensuring long-term profitability

Cellulose Esters and Ethers Market Scope

The market is segmented on the basis of product, process, and application.

- By Product

On the basis of product, the cellulose esters and ethers market is segmented into cellulose acetate, cellulose nitrate, carboxymethyl cellulose, methyl cellulose, ethyl cellulose, hydroxyethyl cellulose, and hydroxypropyl cellulose. The cellulose acetate segment dominated the market with the largest revenue share in 2024, attributed to its extensive use in textile fibers, photographic films, and cigarette filters. Its biodegradability, excellent film-forming capability, and compatibility with various polymers make it a preferred material in industries seeking sustainable alternatives to synthetic plastics. Growing demand from the packaging and coatings sectors, driven by increasing environmental regulations, further strengthens the cellulose acetate segment’s market position.

The carboxymethyl cellulose (CMC) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its expanding application in food and beverages, pharmaceuticals, and oil and gas. CMC offers superior water retention, thickening, and stabilizing properties, making it ideal for processed food, drilling fluids, and personal care formulations. Rising demand for low-fat and gluten-free food products is further driving CMC usage as a texture modifier and fat replacer. In addition, its role in improving recovery efficiency in oilfield applications supports the segment’s robust growth outlook.

- By Process

On the basis of process, the market is segmented into the kraft process, sulfite process, and others. The kraft process segment held the largest market share of 84.5% in 2024 due to its widespread industrial adoption for producing high-strength pulp with superior yield and durability. The process’s efficiency in handling various wood types and its economic advantages in chemical recovery systems make it a preferred choice among manufacturers. Growing use of kraft pulp in packaging and specialty papers further contributes to the dominance of this segment.

The sulfite process segment is projected to record the fastest growth during 2025–2032, driven by its increasing application in producing cellulose derivatives and specialty papers. The process provides smoother pulp with high brightness, suitable for high-grade writing papers and cellulose ester production. Environmental upgrades in sulfite mills and advancements in waste liquor recovery technologies are also improving its sustainability profile, thereby enhancing adoption across niche applications.

- By Application

On the basis of application, the cellulose esters and ethers market is segmented into food and beverages, oil and gas, paper and board, paints and adhesives, detergents, and others. The food and beverages segment dominated the market in 2024, primarily due to growing demand for cellulose derivatives as stabilizers, emulsifiers, and thickeners in processed food formulations. Their ability to enhance texture, moisture retention, and shelf life makes them essential in bakery, dairy, and beverage products. The rising trend toward clean-label and plant-derived ingredients further strengthens their market share in the food sector.

The oil and gas segment is anticipated to register the fastest growth from 2025 to 2032, driven by increasing utilization of cellulose ethers in drilling muds and completion fluids. Their exceptional rheological control, water-binding, and filtration-reduction properties improve wellbore stability and drilling efficiency. The surge in exploration activities in unconventional reserves and the focus on eco-friendly drilling additives are key factors accelerating demand for cellulose ethers in this segment.

Cellulose Esters and Ethers Market Regional Analysis

- Asia-Pacific dominated the cellulose esters and ethers market with the largest revenue share of 56.5% in 2024, driven by expanding food and beverage, pharmaceutical, and paper industries, along with a strong presence of chemical manufacturing hubs

- The region’s cost-effective production landscape, rising investments in specialty cellulose derivatives, and growing exports of cellulose-based products are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of cellulose esters and ethers across various applications

China Cellulose Esters and Ethers Market Insight

China held the largest share in the Asia-Pacific cellulose esters and ethers market in 2024, owing to its leading chemical manufacturing capabilities and strong industrial base. Government support for specialty chemicals, expanding domestic demand in food, paper, and coatings sectors, and extensive export infrastructure are key growth drivers. Continuous investment in research and development for innovative cellulose derivatives further strengthens market dominance.

India Cellulose Esters and Ethers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing demand from the food and beverage, oil and gas, and pharmaceutical industries. Initiatives to boost domestic chemical production, rising investments in specialty chemical infrastructure, and growing exports of cellulose-based products are driving market expansion. The focus on sustainable and biodegradable materials also supports increasing adoption of cellulose esters and ethers.

Europe Cellulose Esters and Ethers Market Insight

The Europe market is expanding steadily, supported by stringent regulatory standards, rising demand for high-purity cellulose derivatives, and investments in specialty chemical production. The region emphasizes sustainability, environmental compliance, and advanced formulations, particularly in food, pharmaceuticals, and coatings. Growing use of cellulose esters and ethers in industrial and specialty applications is further enhancing market growth.

Germany Cellulose Esters and Ethers Market Insight

Germany’s market is driven by its leadership in high-quality chemical manufacturing, strong R&D infrastructure, and export-oriented production model. Collaboration between academic institutions and chemical companies fosters continuous innovation in cellulose derivatives. Demand is particularly strong from paper, paints and adhesives, and pharmaceutical sectors.

U.K. Cellulose Esters and Ethers Market Insight

The U.K. market is supported by a mature chemical and pharmaceutical sector, rising focus on local production, and increasing adoption of sustainable cellulose derivatives. Investments in R&D, lab-scale production, and specialty formulations are encouraging the use of cellulose esters and ethers in high-value applications across food, pharmaceuticals, and industrial sectors.

North America Cellulose Esters and Ethers Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand in food and beverage, oil and gas, and coatings applications. Strong focus on innovation, sustainability, and high-performance materials is boosting consumption of cellulose derivatives. Collaboration between chemical manufacturers and end-use industries is further supporting market expansion.

U.S. Cellulose Esters and Ethers Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its robust chemical manufacturing industry, strong R&D capabilities, and extensive investments in specialty cellulose derivatives. High demand from food, pharmaceuticals, and paper industries, combined with a mature distribution network, reinforces the country’s leading position in the region.

Cellulose Esters and Ethers Market Share

The cellulose esters and ethers industry is primarily led by well-established companies, including:

- Borregaard (Norway)

- Rayonier Advanced Materials (U.S.)

- Celanese Corporation (U.S.)

- Eastman Chemical Company (U.S.)

- Nouryon (Netherlands)

- Ashland (U.S.)

- Daicel Corporation (Japan)

- Dow (U.S.)

- Lamberti S.p.A. (Italy)

- Sappi (South Africa)

- Asha Cellulose (I) Pvt. Ltd. (India)

- Merck KGaA (Germany)

- Nitrex Chemicals India Ltd (India)

- Nitro Química (Brazil)

- Synthesia a.s. (Czech Republic)

- Sichuan Nitrocell Co. Ltd. (China)

- Hangzhou Dayangchem Co. Ltd. (China)

- NOBEL NC (Mexico)

- Hagedorn AG (Germany)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in Global Cellulose Esters and Ethers Market

- In May 2023, Borregaard launched a new bio-based cellulose ether product, significantly strengthening the market for sustainable cellulose derivatives. This introduction addresses rising demand for eco-friendly alternatives in construction, paints, and food processing applications. The launch reinforces the shift toward biodegradable and renewable materials, encouraging competitors to innovate and increasing adoption of green cellulose solutions across multiple industries

- In August 2022, Eastman Chemical Company committed substantial investment toward research and development of sustainable cellulose derivatives. This move is accelerating the market transition to biodegradable and eco-conscious products, particularly in packaging, pharmaceuticals, and personal care sectors. The investment is expected to enhance product quality, expand application potential, and stimulate overall market growth by meeting rising regulatory and consumer demand for sustainable materials

- In March 2021, Celanese Corporation expanded its cellulose acetate production capacity, enabling the company to meet growing global demand in textiles and cigarette filters. This strategic capacity enhancement strengthens market supply chains, supports industrial growth, and reinforces Celanese’s leadership in cellulose esters. The move also helps stabilize pricing and ensures timely availability for rapidly expanding end-use industries

- In November 2020, leading cellulose producers formed strategic partnerships to co-develop innovative cellulose derivatives. These collaborations are boosting market competitiveness by combining technological expertise and resources, accelerating the introduction of specialized products for pharmaceuticals, food processing, and biodegradable packaging. The partnerships enhance market reach and create opportunities for expanded adoption of cellulose esters and ethers globally

- In July 2020, Rayonier Advanced Materials acquired a specialty cellulose producer to diversify its portfolio and strengthen its global presence. This acquisition expanded the range of cellulose-based offerings, particularly for pharmaceuticals, food, and personal care industries. By consolidating capabilities and broadening product availability, the deal enhanced market competitiveness, supported growth in high-value applications, and encouraged industry-wide innovation in specialty cellulose derivatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cellulose Esters And Ethers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cellulose Esters And Ethers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cellulose Esters And Ethers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.