Global Cellulose Ether Derivatives Market

Market Size in USD Billion

CAGR :

%

USD

9.73 Billion

USD

19.97 Billion

2024

2032

USD

9.73 Billion

USD

19.97 Billion

2024

2032

| 2025 –2032 | |

| USD 9.73 Billion | |

| USD 19.97 Billion | |

|

|

|

|

Cellulose Ether and Its Derivatives Market Size

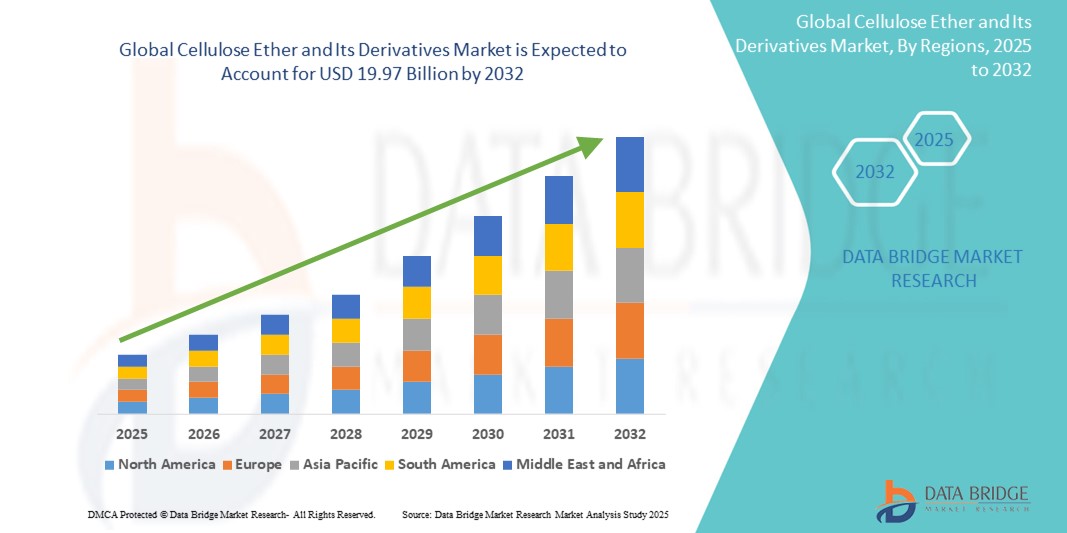

- The global cellulose ether and its derivatives market size was valued at USD 9.73 billion in 2024 and is expected to reach USD 19.97 billion by 2032, at a CAGR of 9.40% during the forecast period

- This growth is driven by factors such as the increasing demand from the construction and pharmaceutical industries, rising adoption in food and personal care products, and growing preference for eco-friendly and biodegradable materials

Cellulose Ether and Its Derivatives Market Analysis

- The cellulose ether and its derivatives market is witnessing steady growth as companies focus on product innovation to meet evolving industrial needs

- This trend highlights a growing demand for multifunctional materials that offer consistency, stability, and compatibility across various processes

- Asia-Pacific is expected to dominate the cellulose ether and its derivatives market with 5.10% of share due to rapid industrialization, particularly in China, India, and Japan, driving demand across various sectors

- Europe is expected to be the fastest growing region in the Cellulose Ether and Its Derivatives market during the forecast period with share of 6.07% due to the demand from construction, pharmaceutical, and personal care sectors

- The methyl cellulose segment is expected to dominate the cellulose ether and its derivatives market with the largest share of 40.05% in 2025 due to its versatile properties and widespread applications across various industries. Methyl cellulose is widely used in construction for its water retention, thickening, and binding properties, making it essential in tile adhesives, mortars, and plasters

Report Scope and Cellulose Ether and Its Derivatives Market Segmentation

|

Attributes |

Cellulose Ether and Its Derivatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cellulose Ether and Its Derivatives Market Trends

“Advancements in R&D for High-Performance Derivatives”

- The cellulose ether and derivatives market is steadily moving toward product customization to suit varied industrial needs

- Companies are focusing on tailored solutions that deliver specific performance features in different end-use applications

- Customized cellulose ethers are increasingly preferred in formulations requiring controlled viscosity and consistency

- This trend supports product quality across sectors such as construction mixes, pharmaceutical coatings, and food processing

- Manufacturers are enhancing their R&D to create high-performance cellulose derivatives for targeted functional roles

- These innovations are making cellulose ether more versatile in texture, stability, and usability

- Collaboration between producers and end-users is becoming common to co-develop formulations for specialized results

- This strategy helps ensure product compatibility with evolving technical and regulatory demands

- For instance, in tile adhesives, customized cellulose ether improves workability and water retention for smoother application

- In conclusion, the market is expected to keep advancing as demand grows for highly tailored cellulose ether solutions across industries.

Cellulose Ether and Its Derivatives Market Dynamics

Driver

“Increasing Demand for Eco-friendly Products”

- The global shift toward sustainability is driving demand for cellulose ether and its derivatives

- Industries are turning to greener alternatives such as cellulose ethers in packaging and coatings

- Biodegradability and non-toxicity make cellulose ethers ideal for eco-conscious markets

- Stricter environmental regulations are encouraging the use of renewable materials such as cellulose ethers

- Manufacturers are focusing on sustainable sourcing to meet growing green product demand

- In conclusion, sustainability is a key factor propelling the growth and innovation in the cellulose ether market

Opportunity

“Expanding Applications in Emerging Markets”

- Emerging markets offer significant growth opportunities for the cellulose ether and derivatives industry

- Rising demand for cellulose ethers in the construction sector, especially in tile adhesives and mortars

- The expanding pharmaceutical and food industries in emerging markets boost demand for cellulose derivatives

- Growing middle-class populations in regions such as Asia-Pacific and Latin America drive personal care product demand

- Companies can capitalize on favorable economic conditions to expand their market share and introduce tailored solutions

- In conclusion, emerging markets present vast growth potential for cellulose ether manufacturers, driven by urbanization, industrial expansion, and consumer demand

Restraint/Challenge

“Price Fluctuations and Raw Material Availability”

- Price volatility and raw material availability pose significant challenges in the cellulose ether market

- Fluctuations in wood and cotton supply, influenced by climate change and geopolitical issues, affect production costs

- Droughts or crop diseases can disrupt supply chains, leading to price hikes and production delays

- Increased demand for cellulose ethers compounds pressure on raw material availability and drives up competition for resources

- Rising raw material costs may lead to higher product prices, potentially reducing demand in price-sensitive markets

- In conclusion, raw material price volatility and supply challenges are significant obstacles for cellulose ether manufacturers, requiring investment in sustainable sourcing and supply chain optimization

Cellulose Ether and Its Derivatives Market Scope

The market is segmented on the basis of product type, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the methyl cellulose segment is projected to dominate the market with a largest share in product type segment

The methyl cellulose segment is expected to dominate the cellulose ether and its derivatives market with the largest share of 40.05% in 2025 due to its versatile properties and widespread applications across various industries. Methyl cellulose is widely used in construction for its water retention, thickening, and binding properties, making it essential in tile adhesives, mortars, and plasters. Its non-toxic and biodegradable nature also makes it an attractive option for the food and pharmaceutical industries, where it is used as a stabilizer and thickening agent. Additionally, the increasing demand for environmentally friendly and sustainable materials further supports the growth of methyl cellulose, as it is derived from renewable plant sources.

The carboxy methyl cellulose segment is expected to account for the largest share during the forecast period in product type segment

In 2025, the carboxy methyl cellulose segment is expected to dominate the market with the largest market share of 51.31% due to, the carboxy methyl cellulose segment is expected to dominate the market with the largest market share of 51.31% due to its widespread use in diverse industries and its excellent properties as a thickening, stabilizing, and binding agent. Carboxy methyl cellulose is extensively used in the food and beverage industry, particularly in processed foods, where it enhances texture and acts as a stabilizer. Its demand is also increasing in the pharmaceutical sector for use in drug formulations and as a controlled-release agent.

Cellulose Ether and Its Derivatives Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Cellulose Ether and Its Derivatives Market”

- Asia-Pacific holds the largest share of the cellulose ether and derivatives market with 5.10% of share due to rapid industrialization, particularly in China, India, and Japan, driving demand across various sectors

- China's extensive urbanization and infrastructure projects have significantly increased the demand for cellulose ethers in construction applications

- India's growing pharmaceutical industry contributes to the rising need for cellulose ethers in drug formulations and excipients

- Japan's focus on high-quality food and personal care products further propels the market growth for cellulose ethers

- The region benefits from a strong manufacturing base, low labor costs, and the presence of key producers, making it a dominant player in the global market

“Europe is Projected to Register the Highest CAGR in the Cellulose Ether and Its Derivatives Market”

- Europe is expected to experience significant growth in the cellulose ether market, with share of 6.07% due to the demand from construction, pharmaceutical, and personal care sectors

- The growth is fueled by steady demand from the construction sector, with cellulose ethers used in cement-based products, adhesives, and coatings

- Germany plays a key role in driving the market with its high demand for cellulose ethers in construction and industrial applications

- The U.K. demand for cellulose ethers is increasing due to their use in personal care and cosmetic products such as creams and lotions

- The region's focus on environmentally friendly and high-quality building materials boosts the demand for cellulose ethers in construction applications

Cellulose Ether and Its Derivatives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Rayonier Inc. (U.S.)

- Lampert Lumber (U.S.)

- Borregaard AS (Norway)

- Ashland (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Dow (U.S.)

- CP Kelco U.S., Inc. (U.S.)

- LOTTE Fine Chemical CO,.Ltd. (South Korea)

- DKS Co. Ltd. (South Korea)

- Daicel Corporation (Japan)

- FENCHEM (China)

- J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany)

- SE Tylose GmbH & Co. KG (Germany)

- Shandong Head Group Co., Ltd. (China)

- Nouryon Chemical Holdings B.V. (Netherlands)

- J.M. Huber Corporation (U.S.)

- Colorcon (U.S.)

- Hebei JiaHua Cellulose Co., Ltd. (China)

- Zibo Hailan Chemical Co., Ltd. (China)

Latest Developments in Global Cellulose Ether and Its Derivatives Market

- In January 2024, Dow received ISCC PLUS certification for its production facilities in Freeport, Texas, covering both PO/PG and Polyol manufacturing. This certification highlights Dow's commitment to sustainable practices in its chemical production processes, ensuring environmental and social sustainability standards are met

- In November 2023, Ashland introduced Perfectyl biofunctional chamomile, a groundbreaking product designed to enhance skin perfection without the need for injections. This innovation draws inspiration from advanced aesthetic procedures, offering users a non-invasive solution to achieve smoother, more flawless skin

- In January 2024, Nouryon unveiled Berol Nexus surfactant at the 2024 ACI Annual Meeting and Industry Convention in Orlando, Florida. This latest innovation is a multifunctional hydrotrope, tailored for the North American cleaning market and promises enhanced performance and versatility in cleaning applications

- In January 2022, Ashland began efforts to significantly boost its production capacity for Benecel cellulose ethers in Belgium. The expansion aims to increase production by over 50% by 2023, meeting the rising demand for cellulose ethers and derivatives in nutrition and pharmaceutical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.