Global Cement Additives Market

Market Size in USD Billion

CAGR :

%

USD

18.78 Billion

USD

37.83 Billion

2025

2033

USD

18.78 Billion

USD

37.83 Billion

2025

2033

| 2026 –2033 | |

| USD 18.78 Billion | |

| USD 37.83 Billion | |

|

|

|

|

Global Cement Additives Market Size

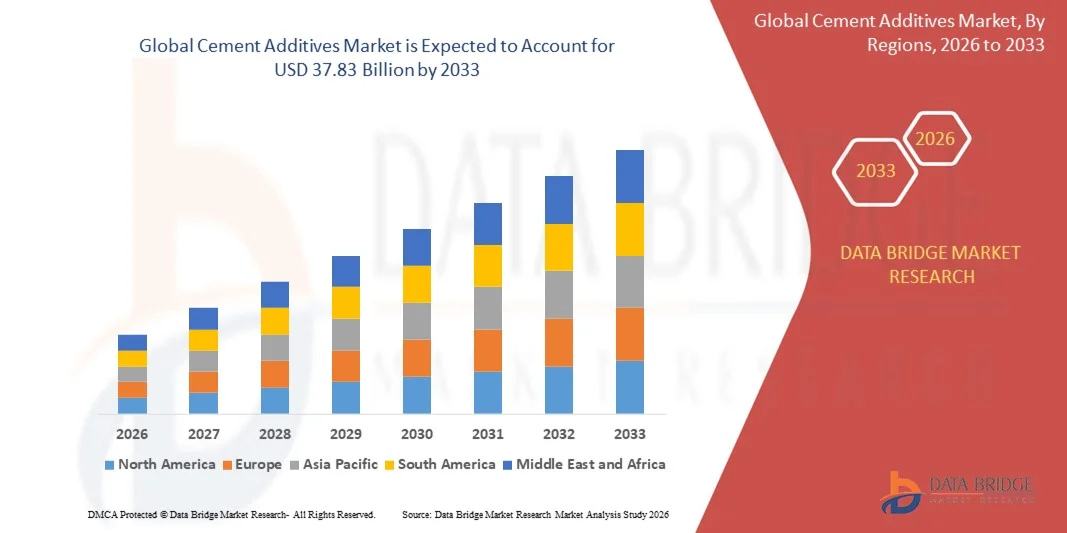

- The global Cement Additives Market size was valued at USD 18.78 billion in 2025 and is expected to reach USD 37.83 billion by 2033, at a CAGR of 9.15% during the forecast period.

- The market growth is primarily driven by increasing demand for high-performance and sustainable construction materials, alongside advancements in additive technologies that enhance the strength, durability, and workability of cement.

- Moreover, the rising focus on green construction practices, rapid urbanization, and expanding infrastructure projects across emerging economies is fueling the adoption of innovative cement additives. These factors collectively are accelerating the growth of the market and solidifying its importance in modern construction applications.

Global Cement Additives Market Analysis

- Cement additives, comprising chemical and mineral formulations that enhance the performance of cement, are increasingly essential in modern construction projects across residential, commercial, and industrial sectors due to their ability to improve strength, durability, and workability.

- The rising demand for cement additives is primarily driven by rapid urbanization, large-scale infrastructure projects, and the increasing focus on sustainable and high-performance construction materials.

- Asia-Pacific dominated the Global Cement Additives Market with the largest revenue share of 35.3% in 2025, supported by advanced construction practices, high investment in infrastructure, and the presence of major market players, with the U.S. witnessing significant adoption of specialty additives in both commercial and residential projects to meet stringent building standards.

- North America is expected to be the fastest-growing region in the Global Cement Additives Market during the forecast period due to rapid urbanization, industrial expansion, and rising investments in infrastructure development across emerging economies.

- The chemical additive segment dominated the market with the largest revenue share of 43.5% in 2025, driven by its ability to significantly improve cement performance by enhancing workability, strength, and durability.

Report Scope and Global Cement Additives Market Segmentation

|

Attributes |

Cement Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Sika AG (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Cement Additives Market Trends

Enhanced Performance Through Advanced Chemical and Mineral Technologies

- A significant and accelerating trend in the global Cement Additives Market is the growing adoption of advanced chemical and mineral formulations designed to enhance cement performance, including strength, workability, and durability across diverse construction applications. These innovations are enabling more efficient and sustainable building practices.

- For instance, superplasticizers allow concrete to achieve higher fluidity without increasing water content, improving workability for complex architectural designs. Similarly, silica fume and fly ash additives enhance strength and reduce permeability, extending the lifespan of infrastructure projects.

- Integration of specialty additives in cement enables tailored performance for specific requirements, such as faster setting times for rapid construction or improved resistance to chemical attack in industrial environments. For example, certain high-range water-reducing admixtures optimize concrete mix designs while maintaining structural integrity in large-scale projects.

- The seamless combination of multiple additives allows manufacturers and contractors to achieve precise control over concrete properties, enabling stronger, longer-lasting, and more sustainable structures. This integration supports modern construction demands for efficiency, resilience, and eco-friendly materials.

- This trend toward more intelligent, high-performance, and multifunctional cement additives is fundamentally reshaping construction standards. Consequently, companies such as Sika, BASF, and GCP Applied Technologies are developing advanced additive solutions that improve concrete performance while supporting sustainability initiatives.

- The demand for high-performance cement additives is growing rapidly across residential, commercial, and industrial sectors, as developers increasingly prioritize durability, efficiency, and environmentally friendly construction solutions.

Global Cement Additives Market Dynamics

Driver

Growing Demand Due to Rapid Urbanization and Infrastructure Development

- The increasing pace of urbanization and large-scale infrastructure development across emerging and developed economies is a significant driver for the heightened demand for cement additives.

- For instance, in 2025, LafargeHolcim launched an advanced range of high-performance admixtures aimed at enhancing the durability and workability of concrete for mega infrastructure projects. Strategies like these by key companies are expected to propel the growth of the cement additives market during the forecast period.

- As governments and private developers focus on sustainable and long-lasting construction, cement additives offer benefits such as faster setting times, improved strength, reduced permeability, and enhanced durability, providing a clear advantage over conventional cement formulations.

- Furthermore, the increasing adoption of green building standards and modern construction practices is making cement additives an essential component in achieving higher-quality concrete, energy efficiency, and reduced carbon footprint in construction projects.

- The growing need for rapid construction, resilient infrastructure, and cost-effective solutions is driving the adoption of cement additives across residential, commercial, and industrial projects. The trend toward innovation in cement formulations and the increasing availability of user-friendly additive solutions further contribute to market growth.

Restraint/Challenge

Concerns Regarding Cost, Compatibility, and Regulatory Compliance

- The relatively high cost of some advanced cement additives, along with compatibility concerns with local cement types and mix designs, poses a significant challenge to broader market adoption, particularly in price-sensitive regions.

- For instance, some specialty chemical admixtures and mineral additives require precise formulation and application techniques, which may deter smaller construction firms from adoption without proper training or technical support.

- Adhering to stringent environmental and safety regulations is also critical for additive manufacturers. Companies such as BASF and Sika emphasize compliance with global and regional standards to ensure safety and sustainability, which helps build trust among construction professionals.

- While prices for some basic additives are gradually decreasing, premium additives with advanced properties, such as ultra-high-performance concrete enhancers or corrosion inhibitors, still come with higher costs, potentially limiting widespread adoption.

- Overcoming these challenges through cost optimization, technical support, and regulatory compliance, as well as educating construction stakeholders on the long-term benefits of additives, will be vital for sustained market growth.

Global Cement Additives Market Scope

Cement additives market is segmented on the basis of type and application.

- By Type

On the basis of type, the Global Cement Additives Market is segmented into fiber additive, chemical additive, and mineral additive. The chemical additive segment dominated the market with the largest revenue share of 43.5% in 2025, driven by its ability to significantly improve cement performance by enhancing workability, strength, and durability. Chemical additives such as superplasticizers, retarders, and accelerators are widely used in both residential and commercial construction projects to meet specific performance requirements and reduce construction time. Fiber additives, including polypropylene and steel fibers, are increasingly adopted to improve crack resistance and structural integrity in high-performance concrete, particularly in industrial and infrastructure projects.

The mineral additive segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, propelled by the growing demand for sustainable construction materials. Mineral additives such as fly ash, silica fume, and slag enhance cement sustainability, reduce carbon emissions, and provide long-term durability benefits.

- By Application

On the basis of application, the Global Cement Additives Market is segmented into residential construction, commercial construction, and industrial construction. The residential construction segment accounted for the largest market revenue share of 41.7% in 2025, driven by increasing urbanization, demand for durable and high-quality concrete, and the growth of multi-family housing and real estate development projects. Cement additives are widely used in residential buildings to improve structural strength, workability, and reduce maintenance costs, while also supporting green building initiatives.

The commercial construction segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, fueled by rapid expansion of office complexes, retail centers, and hospitality infrastructure. Developers increasingly prefer chemical and mineral additives in commercial projects to enhance concrete performance, accelerate project timelines, and meet stricter construction standards, while also achieving energy efficiency and sustainability goals. Industrial construction also contributes significantly, particularly for infrastructure and large-scale manufacturing facilities.

Global Cement Additives Market Regional Analysis

- Asia-Pacific dominated the Global Cement Additives Market with the largest revenue share of 35.3% in 2025, driven by robust infrastructure development, advanced construction practices, and increasing demand for high-performance and sustainable cement formulations.

- Construction companies and developers in the region prioritize the use of chemical, mineral, and fiber additives to enhance concrete strength, durability, and workability, particularly in commercial, residential, and industrial projects.

- This widespread adoption is further supported by high investment in infrastructure, well-established building standards, and the presence of major market players, which facilitate access to technologically advanced additives. The region’s emphasis on sustainable construction and green building practices also contributes to the growing preference for additives that improve energy efficiency, reduce carbon emissions, and extend the lifespan of concrete structures, solidifying North America as a key hub for the cement additives industry.

U.S. Cement Additives Market Insight

The U.S. cement additives market captured the largest revenue share of 81% in 2025 within North America, driven by large-scale infrastructure projects, growing urbanization, and the increasing demand for high-performance and sustainable construction materials. Developers and construction companies are prioritizing chemical, mineral, and fiber additives to enhance concrete strength, durability, and workability across residential, commercial, and industrial projects. Additionally, the adoption of green building standards and energy-efficient construction practices further supports market expansion. The availability of advanced additive solutions and a well-established construction ecosystem encourages widespread adoption, making the U.S. the key contributor to the region’s cement additives market.

Europe Cement Additives Market Insight

The Europe cement additives market is projected to expand at a substantial CAGR during the forecast period, driven by stringent building codes, sustainability mandates, and the growing need for durable and eco-friendly construction solutions. Urbanization and industrialization, along with the demand for high-performance concrete in residential and commercial projects, are fostering adoption. European developers increasingly prefer specialty additives to improve structural integrity, accelerate curing times, and reduce environmental impact, particularly in renovation and new construction projects.

U.K. Cement Additives Market Insight

The U.K. cement additives market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increased infrastructure development, modern construction practices, and demand for higher-quality concrete. Concerns regarding long-term building durability and environmental compliance are encouraging developers to adopt chemical and mineral additives. Additionally, government initiatives promoting sustainable construction and energy-efficient buildings are expected to stimulate market growth across residential, commercial, and industrial applications.

Germany Cement Additives Market Insight

The Germany cement additives market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s focus on high-performance and sustainable construction solutions. Germany’s advanced infrastructure, technological expertise, and stringent environmental regulations promote the use of specialty additives to enhance concrete strength, durability, and longevity. The integration of innovative cement technologies in residential, commercial, and industrial projects is further supporting market adoption, especially for eco-conscious and energy-efficient construction solutions.

Asia-Pacific Cement Additives Market Insight

The Asia-Pacific cement additives market is poised to grow at the fastest CAGR of 24% during 2026–2033, fueled by rapid urbanization, industrialization, and rising construction activities in countries such as China, India, and Japan. The increasing focus on high-performance and sustainable construction materials, coupled with government infrastructure initiatives, is driving additive adoption. Additionally, as APAC becomes a manufacturing hub for cement additives and construction materials, the availability and affordability of these products are expanding to a wider market, supporting growth across residential, commercial, and industrial sectors.

Japan Cement Additives Market Insight

The Japan cement additives market is gaining momentum due to advanced construction technology adoption, urbanization, and demand for durable, long-lasting concrete structures. Japanese developers increasingly rely on chemical and fiber additives to improve structural performance, ease of application, and environmental sustainability. The integration of additives in residential and commercial construction projects, alongside a focus on green building practices, is driving market expansion. Aging infrastructure replacement projects also contribute to growth in the sector.

China Cement Additives Market Insight

The China cement additives market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, large-scale infrastructure development, and a growing construction industry. China’s push toward smart cities, sustainable construction, and high-performance building materials is encouraging widespread adoption of chemical, mineral, and fiber additives. Strong domestic production capabilities and the availability of cost-effective additive solutions further boost market penetration in residential, commercial, and industrial construction projects.

Global Cement Additives Market Share

The Cement Additives industry is primarily led by well-established companies, including:

• Sika AG (Switzerland)

• GCP Applied Technologies (U.S.)

• BASF SE (Germany)

• Fosroc International Ltd. (U.K.)

• LafargeHolcim (Switzerland)

• Cemex S.A.B. de C.V. (Mexico)

• Chryso (France)

• Mapei S.p.A. (Italy)

• W. R. Grace & Co. (U.S.)

• MBCC Group (Germany)

• Euclid Chemical Company (U.S.)

• Admixtures India Pvt. Ltd. (India)

• Carmeuse Group (Belgium)

• MC-Bauchemie (Germany)

• Tianjin Cement Additive Co., Ltd. (China)

• HeidelbergCement (Germany)

• Kirkstall Ltd. (U.K.)

• FanCement Additives Pvt. Ltd. (India)

• Chilworth Group (U.K.)

• Propex Operating Company, LLC (U.S.)

What are the Recent Developments in Global Cement Additives Market?

- In April 2024, Sika AG, a global leader in construction chemicals, launched a new line of high-performance cement additives in South Africa aimed at enhancing concrete durability and workability for both residential and commercial projects. This initiative demonstrates the company’s commitment to providing innovative, reliable solutions tailored to regional construction needs, strengthening its presence in the rapidly expanding global cement additives market.

- In March 2024, BASF SE introduced a next-generation range of chemical admixtures specifically designed for industrial construction projects, focusing on accelerated curing times and improved structural integrity. This advancement highlights BASF’s dedication to developing cutting-edge cement technologies that support high-performance and sustainable construction practices.

- In March 2024, Fosroc International Ltd. successfully implemented its eco-friendly cement additive solutions for a large-scale urban infrastructure project in Bengaluru, India, aimed at improving concrete durability while reducing environmental impact. The project underscores the growing significance of sustainable additive technologies in modern construction and urban development.

- In February 2024, GCP Applied Technologies announced a strategic partnership with a major Middle Eastern construction consortium to supply advanced fiber and mineral additives for high-rise and commercial building projects. This collaboration is designed to enhance concrete performance, reduce construction time, and ensure long-term durability, reinforcing GCP’s commitment to innovation and operational excellence.

- In January 2024, LafargeHolcim unveiled its new line of multi-functional chemical and mineral additives at the World of Concrete Expo 2024. These additives enable improved strength, workability, and sustainability for residential and commercial construction. The launch highlights LafargeHolcim’s focus on integrating advanced technologies into cement formulations to meet evolving construction demands and environmental standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cement Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cement Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cement Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.