Global Center Stack Display Market

Market Size in USD Million

CAGR :

%

USD

8.20 Million

USD

22.98 Million

2025

2033

USD

8.20 Million

USD

22.98 Million

2025

2033

| 2026 –2033 | |

| USD 8.20 Million | |

| USD 22.98 Million | |

|

|

|

|

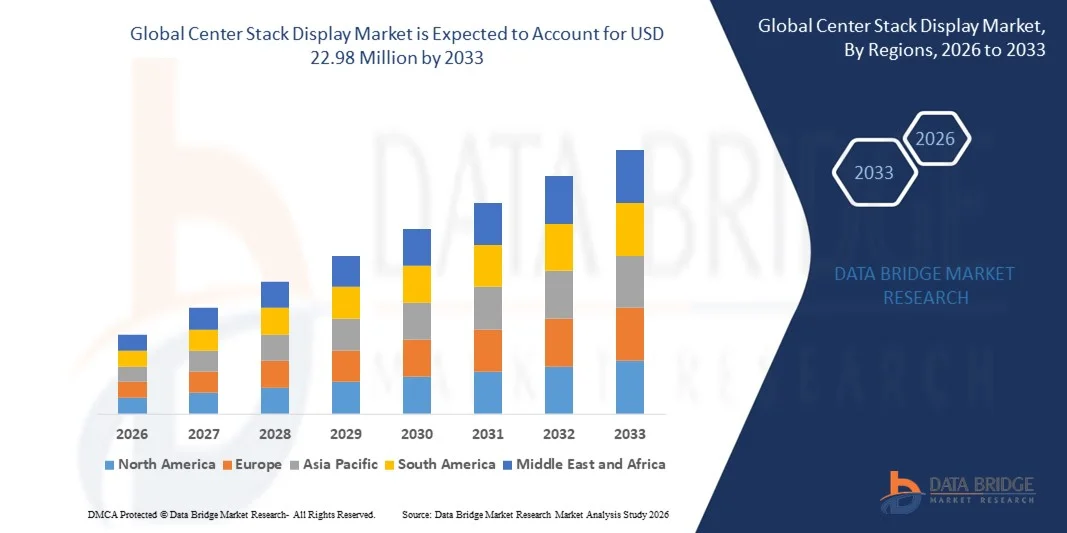

What is the Global Center Stack Display Market Size and Growth Rate?

- The global center stack display market size was valued at USD 8.20 million in 2025 and is expected to reach USD 22.98 million by 2033, at a CAGR of 13.75% during the forecast period

- Rising demand for advanced in-vehicle infotainment systems, increasing integration of digital instrument clusters, growing adoption of touch-based human–machine interfaces (HMI), and rapid electrification of vehicles are some of the major factors driving market growth

- In addition, increasing consumer preference for connected cars, enhanced user experience, and seamless smartphone integration, along with advancements in display technologies such as OLED, TFT-LCD, and curved displays, are significantly augmenting demand for center stack displays across passenger and commercial vehicles

What are the Major Takeaways of Center Stack Display Market?

- Growing adoption of electric and autonomous vehicles, increasing penetration of advanced infotainment systems, and rising focus on premium interior aesthetics across emerging economies are generating significant growth opportunities for the center stack display market

- However, high system integration costs, display reliability concerns under extreme automotive conditions, and complexities related to software compatibility and HMI design are expected to act as key restraints, potentially limiting market growth over the forecast period

- North America dominated the center stack display market with a 36.24% revenue share in 2025, driven by strong adoption of advanced infotainment systems, digital cockpits, and connected vehicle technologies across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by rapid automotive production, strong EV penetration, and expanding electronics manufacturing ecosystems across China, Japan, India, South Korea, and Southeast Asia

- The TFT LCD segment dominated the market with a 58.3% share in 2025, owing to its cost-effectiveness, wide availability, proven reliability, and strong adoption across mass-market passenger vehicles and commercial vehicles

Report Scope and Center Stack Display Market Segmentation

|

Attributes |

Center Stack Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Center Stack Display Market?

Increasing Shift Toward Large, Integrated, and Software-Defined Center Stack Displays

- The center stack display market is witnessing strong adoption of large-format, high-resolution, and touch-enabled displays designed to support infotainment, navigation, climate control, ADAS visualization, and connected vehicle functionalities

- Automotive OEMs are increasingly integrating curved, OLED, AMOLED, and TFT-LCD displays with advanced HMIs, multi-screen layouts, and seamless smartphone connectivity to enhance in-vehicle user experience

- Growing demand for compact, lightweight, and energy-efficient display modules is driving adoption across passenger vehicles, premium cars, and electric vehicles

- For instance, companies such as Continental, Panasonic, HARMAN, Visteon, and Bosch are upgrading center stack displays with higher brightness, faster response times, over-the-air (OTA) software updates, and AI-enabled interfaces

- Rising need for intuitive controls, real-time vehicle information, and personalized infotainment is accelerating the shift toward fully digital and software-defined center stack systems

- As vehicles become more connected and user-centric, Center Stack Displays will remain central to digital cockpits, smart interiors, and next-generation mobility platforms

What are the Key Drivers of Center Stack Display Market?

- Rising demand for advanced infotainment systems, digital dashboards, and connected vehicle solutions across passenger and commercial vehicles

- For instance, in 2024–2025, leading automotive OEMs and Tier-1 suppliers expanded their digital cockpit portfolios with larger and multi-display center stack configurations

- Growing adoption of electric vehicles, autonomous driving features, and in-car connectivity is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in display technologies, including OLED, micro-LED, and haptic touch integration, are enhancing performance, aesthetics, and functionality

- Increasing use of AI-based voice assistants, gesture control, and real-time data visualization is driving demand for high-performance center stack displays

- Supported by rising vehicle production, premiumization trends, and continuous automotive R&D investments, the Center Stack Display market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Center Stack Display Market?

- High costs associated with advanced display technologies, large screen sizes, and software integration limit adoption in low-cost vehicle segments

- For instance, during 2024–2025, semiconductor shortages, display panel price volatility, and supply chain disruptions increased system costs for manufacturers

- Complexity in integrating displays with vehicle electronics, infotainment software, and safety systems increases development time and technical requirements

- Limited standardization across vehicle platforms and OEM-specific customization challenges slow large-scale deployment

- Competition from alternative HMI solutions, such as head-up displays and voice-based interfaces, creates pricing and differentiation pressure

- To address these challenges, companies are focusing on modular display architectures, cost-optimized designs, localized manufacturing, and software-centric platforms to expand global adoption of Center Stack Displays

How is the Center Stack Display Market Segmented?

The market is segmented on the basis of technology and display size.

- By Technology

On the basis of technology, the center stack display market is segmented into TFT LCD and OLED. The TFT LCD segment dominated the market with a 58.3% share in 2025, owing to its cost-effectiveness, wide availability, proven reliability, and strong adoption across mass-market passenger vehicles and commercial vehicles. TFT LCD displays offer adequate brightness, durability, and integration flexibility, making them suitable for infotainment, navigation, and climate control interfaces in mid-range vehicles. Their lower manufacturing cost compared to OLED continues to support large-scale deployment by OEMs, especially in price-sensitive markets.

The OLED segment is expected to register the fastest CAGR from 2026 to 2033, driven by growing demand for premium in-vehicle experiences, higher contrast ratios, thinner form factors, and curved display designs. Increasing adoption of OLED displays in luxury vehicles, EVs, and digital cockpits, along with advancements in lifespan and cost reduction, is accelerating their market penetration.

- By Display Size

On the basis of display size, the center stack display market is segmented into Up to 7 Inch and More than 7 Inch. The Up to 7 Inch segment dominated the market with a 54.6% share in 2025, supported by widespread use in entry-level and mid-segment vehicles where compact dashboards, cost efficiency, and functional infotainment systems are prioritized. These displays are commonly used for basic navigation, audio controls, and vehicle settings, offering sufficient usability while maintaining lower system costs and simpler integration.

The More than 7 Inch segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for larger touchscreens, multi-function displays, and immersive digital cockpits. Increasing adoption in premium cars and EVs, along with consumer preference for tablet-such as interfaces and advanced infotainment features, is significantly boosting demand for large-format center stack displays globally.

Which Region Holds the Largest Share of the Center Stack Display Market?

- North America dominated the center stack display market with a 36.24% revenue share in 2025, driven by strong adoption of advanced infotainment systems, digital cockpits, and connected vehicle technologies across the U.S. and Canada. High penetration of premium vehicles, rapid integration of ADAS, EVs, and human–machine interface (HMI) solutions, along with continuous OEM investments in in-vehicle user experience, continue to fuel demand for advanced center stack displays across passenger and commercial vehicles

- Leading automotive OEMs and Tier-1 suppliers in North America are introducing high-resolution touchscreens, multi-display architectures, and integrated infotainment platforms, strengthening the region’s technological leadership. Continuous investments in EV platforms, software-defined vehicles, and in-car connectivity further support long-term market growth

- Strong R&D capabilities, high consumer preference for premium vehicle features, and a mature automotive ecosystem reinforce North America’s dominance in the center stack display market

U.S. Center Stack Display Market Insight

The U.S. is the largest contributor within North America, supported by strong vehicle production, high EV adoption, and rapid deployment of digital infotainment and cockpit solutions. Increasing integration of large-format displays, voice-assisted controls, and connected navigation systems across mass-market and luxury vehicles is significantly driving demand.

Canada Center Stack Display Market Insight

Canada contributes steadily through growing EV adoption, advanced automotive electronics manufacturing, and rising demand for connected vehicle technologies. Supportive government policies for clean mobility and smart transportation further enhance market adoption.

Asia-Pacific Center Stack Display Market

Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by rapid automotive production, strong EV penetration, and expanding electronics manufacturing ecosystems across China, Japan, India, South Korea, and Southeast Asia. Rising demand for touchscreen infotainment, digital dashboards, and smart vehicle interfaces is accelerating market growth.

China Center Stack Display Market Insight

China leads Asia-Pacific due to massive vehicle production volumes, strong EV sales, and rapid adoption of large, high-resolution center stack displays. Local manufacturing strength and cost competitiveness further expand market penetration.

Japan Center Stack Display Market Insight

Japan shows steady growth supported by advanced automotive engineering, focus on reliability, and continuous innovation in HMI and display technologies for passenger vehicles.

India Center Stack Display Market Insight

India is emerging as a high-growth market, driven by rising vehicle production, increasing demand for touchscreen infotainment in mid-range cars, and government support for automotive electronics manufacturing.

South Korea Center Stack Display Market Insight

South Korea contributes significantly due to strong presence of global display manufacturers, advanced automotive electronics, and growing adoption of premium digital cockpit solutions, supporting sustained market expansion.

Which are the Top Companies in Center Stack Display Market?

The center stack display industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Alpine Electronics, Inc. (Japan)

- Panasonic Holdings Corporation (Japan)

- HARMAN International (U.S.)

- MOBIS INDIA LIMITED (India)

- Robert Bosch Manufacturing Solutions GmbH (Germany)

- Texas Instruments Incorporated (U.S.)

- MTA S.p.A (Italy)

- PREH GMBH (Germany)

- Visteon Corporation (U.S.)

What are the Recent Developments in Global Center Stack Display Market?

- In January 2024, Continental AG launched the 10-inch Crystal Center Display, a transparent, high-resolution automotive display designed to seamlessly integrate into vehicle interiors. Featuring high contrast, low reflectivity, and energy-efficient performance, the display enhances both visual appeal and usability. Recognized as a CES 2024 Innovation Award Honoree, it delivers a sleek interface for infotainment and control systems, reinforcing Continental’s leadership in premium in-car display innovation and supporting the shift toward sophisticated digital cockpits

- In January 2024, Continental, in collaboration with Swarovski Mobility, unveiled the world’s first crystal-embedded center stack display, combining luxury crystal aesthetics with advanced automotive display technology. The solution elevates interior design while maintaining high functionality and durability, catering to premium vehicle segments. This innovation highlights the growing convergence of luxury design and smart display technologies in next-generation vehicles

- In April 2023, HannStar developed a TFT LCD-based Paper Display as an alternative to E Ink’s electronic paper display technology. Utilizing thin-film transistor LCD architecture, the display delivers low power consumption and a paper-such as visual experience in a thin and lightweight form factor. Designed for applications such as e-readers and electronic shelf labels, this development expands competitive options in low-power reflective display solutions

- In January 2023, HARMAN, a subsidiary of Samsung Electronics Co., Ltd., introduced HARMAN Ready Vision, an advanced hardware and software platform for augmented reality head-up displays. The solution integrates seamlessly with vehicle sensors to deliver real-time visual alerts and immersive audio cues in a non-intrusive manner. This innovation significantly enhances driver awareness and safety, supporting the evolution of intelligent and connected vehicle ecosystems

- In January 2023, HARMAN unveiled the HARMAN Ready Display powered by Neo QLED Auto technology, delivering near-OLED visual performance at a more accessible cost. Leveraging Samsung’s proprietary innovations, including eco-friendly Quantum Dot film and MINI LED backlighting, the display offers high brightness, contrast, and durability. This launch strengthens HARMAN’s position in scalable, high-quality automotive display solutions for mass-market adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.