Global Centralised Ran Radio Access Network Market

Market Size in USD Billion

CAGR :

%

USD

7.79 Billion

USD

37.26 Billion

2025

2033

USD

7.79 Billion

USD

37.26 Billion

2025

2033

| 2026 –2033 | |

| USD 7.79 Billion | |

| USD 37.26 Billion | |

|

|

|

|

Centralised RAN (Radio Access Network) Market Size

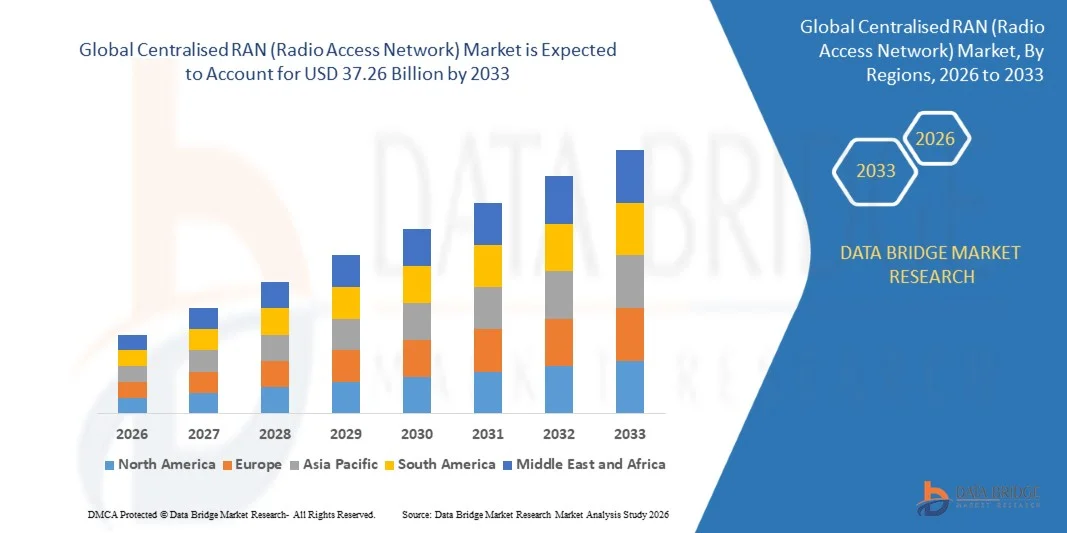

- The global centralised RAN (Radio Access Network) market size was valued at USD 7.79 billion in 2025 and is expected to reach USD 37.26 billion by 2033, at a CAGR of 21.60% during the forecast period

- The market growth is largely driven by the increasing deployment of 4G and 5G networks, rapid digitalization across urban and rural areas, and rising demand for high-speed mobile data connectivity. These trends are prompting telecom operators to adopt centralized RAN (Radio Access Network) architectures to improve network efficiency, reduce operational costs, and support scalable service delivery

- Furthermore, the growing focus on virtualization, cloud-native RAN (Radio Access Network), and software-defined networking is enabling operators to enhance network flexibility, automate resource management, and provide seamless connectivity across dense urban environments and enterprise networks. These technological advancements are accelerating the adoption of Centralised RAN (Radio Access Network) solutions, thereby significantly contributing to market expansion

Centralised RAN (Radio Access Network) Market Analysis

- Centralised RAN (Radio Access Network), which consolidates baseband processing for multiple radio sites into a centralized location, is becoming a critical component of modern telecom networks due to its ability to optimize spectrum use, reduce site-level infrastructure, and improve network performance for 4G and 5G services

- The growing adoption of centralized RAN (Radio Access Network) architectures is primarily fueled by increasing mobile data traffic, the need for low-latency and high-throughput networks, and rising investment in next-generation telecom infrastructure. In addition, network operators are leveraging cloud and virtualization technologies to enable cost-effective network expansion, support enterprise connectivity solutions, and enhance overall service quality

- Asia-Pacific dominated the centralised RAN (Radio Access Network) market with a share of 39.2% in 2025, due to rapid 4G and 5G network deployments, rising mobile data consumption, and increasing investments in telecom infrastructure

- North America is expected to be the fastest growing region in the centralised RAN (Radio Access Network) market during the forecast period due to rapid 5G adoption, high mobile data consumption, and extensive network modernization initiatives

- Outdoor segment dominated the market with a market share of 61.8% in 2025, due to large-scale deployment across urban corridors, highways, and public infrastructure. Outdoor centralized RAN enables operators to consolidate processing resources while improving coverage and capacity over wide geographic areas

Report Scope and Centralised RAN (Radio Access Network) Market Segmentation

|

Attributes |

Centralised RAN (Radio Access Network) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Centralised RAN (Radio Access Network) Market Trends

“Rising Adoption of Cloud-Native and Virtualized RAN Architectures”

- A significant trend in the Centralised RAN (Radio Access Network) market is the increasing adoption of cloud-native and virtualized RAN (Radio Access Network) solutions, driven by the need for scalable, flexible, and automated mobile networks. These architectures enable operators to centralize baseband processing, optimize spectrum utilization, and simplify network management, thereby improving overall network efficiency and service quality

- For instance, Ericsson and Vodafone are deploying cloud-native RAN (Radio Access Network) across multiple European and Middle East markets, allowing telecom operators to reduce operational complexity, automate resource allocation, and enhance network performance for 5G services. Such deployments demonstrate how cloud-based RAN (Radio Access Network) is becoming foundational for next-generation mobile networks

- Telecom operators are increasingly leveraging virtualized RAN (Radio Access Network) to improve network flexibility, enabling rapid deployment of new services and faster response to traffic surges in urban and enterprise environments. This is positioning centralized RAN (Radio Access Network) solutions as critical enablers for dense urban coverage, low-latency applications, and cost-effective network upgrades

- The market is witnessing strong uptake of centralized architectures in both urban and suburban regions, where high data demand and user density require efficient resource management. Cloud and virtualization technologies are allowing operators to consolidate hardware resources while maintaining high service quality

- Emerging economies are investing in centralized RAN (Radio Access Network) deployments to accelerate 4G and 5G coverage, optimize network performance, and reduce site-level infrastructure requirements. This trend is supporting broader digitalization initiatives and improving connectivity across residential, commercial, and industrial sectors

- High-performance RAN (Radio Access Network) solutions are also being integrated with software-defined networking and AI-driven network management platforms, enhancing automation, predictive maintenance, and real-time traffic optimization. This convergence of technologies is reinforcing the transition toward more intelligent, flexible, and reliable telecom networks

Centralised RAN (Radio Access Network) Market Dynamics

Driver

“Growing Demand for High-Speed 4G and 5G Connectivity”

- The growing adoption of 4G and 5G networks is driving the demand for centralized RAN (Radio Access Network) solutions, as operators require architectures capable of supporting high-speed data, low latency, and dense user environments. These networks enable efficient spectrum usage, reduced operational costs, and enhanced quality of service for consumers and enterprises

- For instance, AT&T’s transition to Cloud RAN (Radio Access Network) allows the operator to manage commercial traffic more efficiently, reduce latency, and support new applications and enterprise services. The deployment demonstrates how centralized RAN (Radio Access Network) solutions are essential for meeting the increasing bandwidth and performance requirements of modern telecom networks

- Rising mobile data consumption, fueled by streaming, cloud services, and IoT connectivity, is accelerating the adoption of centralized architectures that can efficiently manage network loads. Operators are leveraging these solutions to enhance network reliability, capacity, and scalability

- The rollout of private 5G networks for enterprises is also contributing to growth, as centralized RAN (Radio Access Network) provides a flexible and cost-effective way to deploy high-speed, secure networks for industrial, retail, and campus applications

- Investments in network modernization, including virtualized and software-defined RAN (Radio Access Network), are further strengthening market adoption. Operators are increasingly prioritizing centralized architectures to improve service delivery, reduce downtime, and future-proof network infrastructure against growing connectivity demands

Restraint/Challenge

“High Capital Expenditure and Complex Network Integration”

- The Centralised RAN (Radio Access Network) market faces challenges due to the high initial costs associated with deploying centralized infrastructure, including baseband units, fronthaul networks, and virtualization platforms. These expenses can slow adoption, particularly for smaller operators or in emerging markets

- For instance, deploying cloud-native RAN (Radio Access Network) solutions requires substantial investment in hardware, software, and skilled personnel, which can limit rapid network rollout and scalability. The complexity of integrating multi-vendor systems and ensuring interoperability adds additional technical and operational hurdles

- Managing centralized processing for multiple sites demands advanced planning and coordination, particularly when upgrading legacy networks or ensuring seamless service continuity during deployment

- Supply chain dependencies on specialized equipment, high-capacity fiber, and optical transport solutions further complicate network integration and increase project timelines

- Operators must carefully balance the benefits of improved network efficiency and scalability against the significant financial and technical challenges, which can impact ROI and slow market penetration despite strong demand for high-speed connectivity

Centralised RAN (Radio Access Network) Market Scope

The market is segmented on the basis of component, network type, deployment model, application, end user, cell size, and technology.

• By Component

On the basis of component, the Centralised RAN (Radio Access Network) market is segmented into infrastructure, software, and services. The infrastructure segment dominated the market with the largest revenue share in 2025, driven by high investments in centralized baseband units, fronthaul, and backhaul equipment required to support large-scale network consolidation. Telecom operators prioritize infrastructure as it forms the foundation for capacity enhancement, latency reduction, and efficient spectrum utilization. The shift toward centralized architectures to reduce site-level complexity further supports infrastructure dominance.

The software segment is anticipated to witness the fastest growth from 2026 to 2033, supported by increasing adoption of virtualization, cloud-native RAN (Radio Access Network), and network automation platforms. Operators are focusing on software-defined functionalities to enable dynamic resource allocation, faster upgrades, and lower operational expenditure. Growing emphasis on AI-driven network optimization and open RAN interoperability further accelerates software adoption.

• By Network Type

On the basis of network type, the Centralised RAN (Radio Access Network) market is segmented into 2G and 3G, 4G, and 5G. The 4G segment dominated the market revenue share in 2025 due to its extensive installed base and continued demand for capacity expansion in urban and suburban areas. Operators continue to centralize 4G networks to improve spectral efficiency, manage rising data traffic, and extend network life cycles while controlling costs.

The 5G segment is expected to register the fastest growth rate from 2026 to 2033, driven by rapid 5G rollouts and the need for ultra-low latency and high throughput. Centralised RAN (Radio Access Network) architectures support advanced 5G use cases such as enhanced mobile broadband and network slicing. Increasing investments in standalone 5G networks further reinforce growth in this segment.

• By Deployment Model

On the basis of deployment model, the Centralised RAN (Radio Access Network) market is segmented into indoor and outdoor. The outdoor segment dominated the market with the largest share of 61.8% in 2025, supported by large-scale deployment across urban corridors, highways, and public infrastructure. Outdoor centralized RAN enables operators to consolidate processing resources while improving coverage and capacity over wide geographic areas.

The indoor segment is projected to witness the fastest growth during the forecast period, driven by rising demand for high-quality indoor coverage in offices, malls, airports, and stadiums. Centralised indoor RAN (Radio Access Network) improves signal quality, reduces interference, and supports high user density. Growing enterprise digitalization and private network deployments further accelerate indoor adoption.

• By Application

On the basis of application, the market is segmented into large public venues, targeted outdoor urban areas, high-density urban areas, suburban, and rural areas. High-density urban areas dominated the market revenue share in 2025 due to heavy mobile data consumption and dense user populations. Centralised RAN (Radio Access Network) helps operators efficiently manage traffic loads and optimize spectrum usage in congested city environments.

Large public venues are expected to experience the fastest growth from 2026 to 2033, driven by the need for reliable high-capacity connectivity during events. Centralised architectures support rapid scaling and seamless mobility management for thousands of concurrent users. Increasing smart city and smart venue initiatives further contribute to growth.

• By End User

On the basis of end user, the Centralised RAN (Radio Access Network) market is segmented into telecom operators and enterprises. Telecom operators dominated the market in 2025, driven by nationwide network modernization programs and cost optimization strategies. Centralised RAN (Radio Access Network) enables operators to reduce site-level equipment, lower power consumption, and simplify network management across regions.

The enterprise segment is anticipated to witness the fastest growth over the forecast period, supported by rising adoption of private LTE and 5G networks. Enterprises leverage centralized architectures for better control, security, and performance management. Growing use across manufacturing, logistics, and campus networks accelerates segment expansion.

• By Cell Size

On the basis of cell size, the Centralised RAN (Radio Access Network) market is segmented into small cells and macrocells. The macrocells segment dominated the market revenue share in 2025 due to their critical role in providing wide-area coverage and backbone connectivity. Centralising macrocell processing improves network efficiency and supports large-scale traffic handling.

The small cells segment is expected to register the fastest growth from 2026 to 2033, driven by increasing densification requirements in urban and indoor environments. Centralised RAN (Radio Access Network) supports coordinated small cell deployments, reducing interference and improving user experience. Rising demand for high-capacity localized coverage fuels growth.

• By Technology

On the basis of technology, the Centralised RAN (Radio Access Network) market is segmented into dedicated fiber, WDM, OTN, PON, Ethernet, microwave, millimeter wave, G.Fast, and others. Dedicated fiber dominated the market in 2025, supported by its high bandwidth, low latency, and reliability for fronthaul and backhaul connectivity. Operators prefer fiber to meet stringent performance requirements of centralized and 5G networks.

Millimeter wave technology is anticipated to witness the fastest growth from 2026 to 2033, driven by its ability to deliver ultra-high data rates where fiber deployment is challenging. It supports rapid rollout of centralized architectures in dense urban areas. Advancements in wireless backhaul technologies further strengthen adoption.

Centralised RAN (Radio Access Network) Market Regional Analysis

- Asia-Pacific dominated the centralised RAN (Radio Access Network) market with the largest revenue share of 39.2% in 2025, driven by rapid 4G and 5G network deployments, rising mobile data consumption, and increasing investments in telecom infrastructure

- The region’s cost-effective network deployment environment, growing adoption of cloud-based and virtualized RAN solutions, and strong presence of telecom equipment manufacturers are accelerating market expansion

- The availability of skilled telecom workforce, favorable government policies supporting digital infrastructure, and increasing urbanization across developing economies are contributing to higher adoption of centralized RAN architectures

China Centralised RAN (Radio Access Network) Market Insight

China held the largest share in the Asia-Pacific Centralised RAN (Radio Access Network) market in 2025, owing to its leadership in 5G rollout, strong domestic telecom infrastructure, and active participation of major network equipment providers such as Huawei and ZTE. The country’s supportive government policies, extensive fiber network, and focus on smart city initiatives are key growth drivers. Demand is further boosted by ongoing modernization of 4G networks and expansion of high-speed mobile broadband services.

India Centralised RAN (Radio Access Network) Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rapid telecom network expansion, increasing smartphone penetration, and growing government initiatives such as Digital India and 5G trials. Investments by telecom operators in network densification, rural connectivity, and adoption of virtualized and cloud-based RAN (Radio Access Network) solutions are strengthening market growth. In addition, rising demand for high-speed mobile data services and enterprise connectivity solutions is accelerating adoption.

Europe Centralised RAN (Radio Access Network) Market Insight

The Europe Centralised RAN (Radio Access Network) market is expanding steadily, supported by increasing 5G deployments, demand for network efficiency, and adoption of software-defined and virtualized RAN (Radio Access Network) solutions. The region emphasizes energy-efficient networks, high-quality service, and regulatory compliance for telecom infrastructure. Growing investments in smart city projects and urban connectivity solutions further enhance market growth.

Germany Centralised RAN (Radio Access Network) Market Insight

Germany’s Centralised RAN (Radio Access Network) market is driven by advanced telecom infrastructure, strong industrial and enterprise connectivity requirements, and high adoption of 5G and virtualized network solutions. The country benefits from robust R&D initiatives, public-private collaborations, and presence of leading telecom operators and equipment vendors. Demand is particularly strong in high-density urban areas, smart manufacturing, and public venue connectivity.

U.K. Centralised RAN (Radio Access Network) Market Insight

The U.K. market is supported by the expansion of 5G networks, growing focus on network efficiency, and adoption of centralized and cloud-based RAN (Radio Access Network) solutions. Telecom operators are investing in densification projects, indoor coverage improvements, and next-generation mobile services. Increasing government support for digital infrastructure, enterprise network modernization, and R&D collaborations continue to drive market growth.

North America Centralised RAN (Radio Access Network) Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid 5G adoption, high mobile data consumption, and extensive network modernization initiatives. Telecom operators are focusing on network densification, virtualization, and deployment of advanced RAN (Radio Access Network) solutions for both urban and rural coverage. In addition, enterprise and government investments in private networks and cloud-based RAN (Radio Access Network) architectures are supporting market expansion.

U.S. Centralised RAN (Radio Access Network) Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by a mature telecom industry, strong 5G network rollout, and significant investment in cloud and software-defined RAN solutions. The country’s focus on innovation, digital transformation, and high-speed connectivity is boosting adoption across urban and enterprise networks. Presence of key network equipment providers and large-scale telecom operators further strengthens the U.S.’s leading position in the region.

Centralised RAN (Radio Access Network) Market Share

The centralised RAN (Radio Access Network) industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Nokia Corporation (Finland)

- Huawei Technologies Co., Ltd. (China)

- NEC Corporation (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Altiostar Networks, Inc. (U.S.)

- ZTE Corporation (China)

- Fujitsu Limited (Japan)

- Intel Corporation (U.S.)

- Mavenir Systems, Inc. (U.S.)

- ASOCS Ltd. (Israel)

- Radisys Corporation (U.S.)

- CommScope, Inc. (U.S.)

- Artiza Networks, Inc. (U.S.)

- Anritsu Corporation (Japan)

- EXFO Inc. (Canada)

- Airspan Networks, Inc. (U.S.)

- 6WIND S.A. (France)

- VIAVI Solutions Inc. (U.S.)

Latest Developments in Global Centralised RAN (Radio Access Network) Market

- In October 2025, Ericsson and Vodafone announced a major five‑year strategic partnership to modernize Vodafone’s network infrastructure across Ireland, the Netherlands, Portugal, Germany, Romania, and Egypt, deploying advanced RAN solutions supporting 5G Standalone and programmable network capabilities. This partnership is expected to accelerate the adoption of centralized and cloud‑native RAN technologies across multiple European and Middle East markets, enabling operators to consolidate baseband units, reduce operational complexity, and improve spectral efficiency. The deployment enhances network automation, provides faster service provisioning, and allows the introduction of differentiated connectivity solutions for both consumer and enterprise segments, strengthening Vodafone’s competitive positioning in high-demand urban and industrial regions

- In June 2025, Ericsson successfully demonstrated a Cloud RAN 5G call using the latest HPE ProLiant Compute Gen12 server and Intel Xeon 6 system-on-chip, showcasing the technical readiness of Cloud RAN on modern cloud-native compute platforms. This milestone highlights the scalability, low-latency performance, and flexible resource allocation capabilities of centralized RAN architectures. It is expected to encourage telecom operators worldwide to adopt cloud-based RAN solutions, optimize network costs, support multi-vendor interoperability, and accelerate next-generation 5G deployments, particularly in high-density urban and enterprise environments

- In February 2024, O2 Telefónica began deploying Ericsson Cloud RAN for 5G Standalone (SA) in Offenbach, Germany, using advanced virtualization and cloud technologies to enhance network flexibility, scalability, and service delivery. This deployment strengthens Germany’s 5G infrastructure by enabling centralized management of baseband resources, reducing the need for physical equipment at individual sites, and facilitating faster rollout of new services. The implementation also supports efficient spectrum utilization, improved coverage in urban and suburban areas, and the potential for advanced enterprise and consumer applications such as smart city solutions and low-latency industrial connectivity

- In February 2024, AT&T and Ericsson completed the transition to virtualized RAN (vRAN), with AT&T now handling commercial traffic on Cloud RAN sites. This transformation allows AT&T to manage data traffic more cost-effectively while improving network agility, automation, and operational efficiency. The deployment fosters an open ecosystem for developers to create innovative applications and services, enhances network scalability to meet growing mobile data demand, and positions AT&T as a leader in modern, software-defined mobile networks capable of supporting 5G SA and advanced enterprise solutions

- In July 2023, Telstra and Ericsson deployed Cloud RAN infrastructure on Telstra’s 5G commercial network at several operational sites, marking Australia’s first Cloud RAN deployment. The implementation improves network efficiency, enables centralized resource management, and allows rapid scaling to meet high-capacity demands in both urban and regional areas. It supports Telstra’s ability to offer next-generation 5G services nationwide, including enhanced mobile broadband, ultra-low latency connectivity, and enterprise-grade applications, while reducing capital and operational expenditures associated with traditional distributed RAN deployments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.