Global Cephalosporins Market

Market Size in USD Billion

CAGR :

%

USD

15.94 Billion

USD

20.36 Billion

2024

2032

USD

15.94 Billion

USD

20.36 Billion

2024

2032

| 2025 –2032 | |

| USD 15.94 Billion | |

| USD 20.36 Billion | |

|

|

|

|

Cephalosporin Market Size

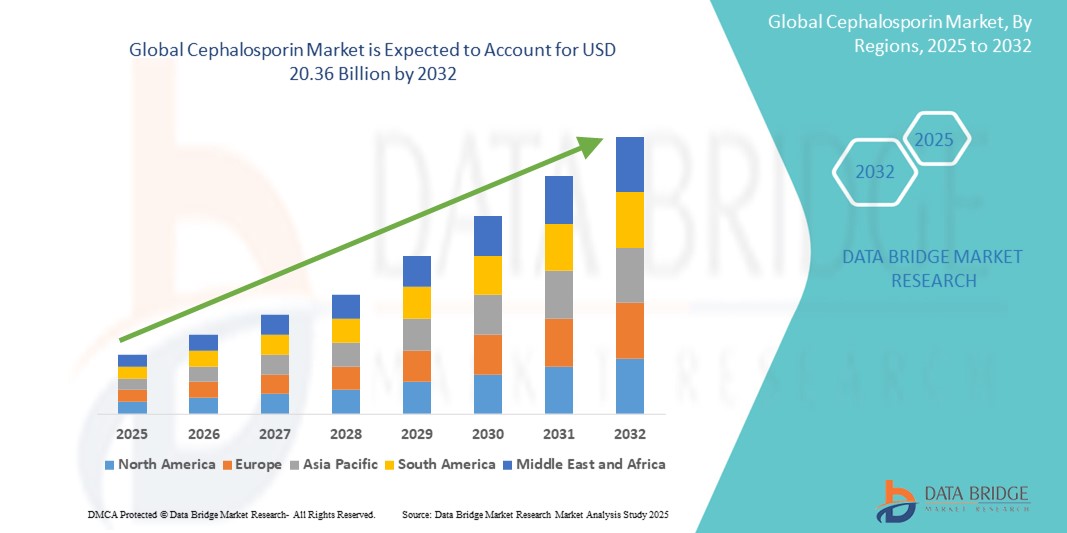

- The global cephalosporin market size was valued at USD 15.94 billion in 2024 and is expected to reach USD 20.36 billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of bacterial infections and the rising demand for broad-spectrum antibiotics, particularly in developing regions with inadequate sanitation and healthcare infrastructure. The cephalosporin class of antibiotics is widely prescribed due to its effectiveness, safety profile, and availability in multiple generations, making it a versatile treatment option for various infections including respiratory tract infections, skin infections, and urinary tract infections

- Furthermore, growing antibiotic resistance is prompting healthcare providers to adopt newer-generation cephalosporins that offer enhanced efficacy against multidrug-resistant strains. These emerging therapeutic needs, along with improved access to healthcare services and the expansion of hospital infrastructures globally, are accelerating the uptake of cephalosporin-based treatments, thereby significantly boosting the market’s growth trajectory

Cephalosporin Market Analysis

- Cephalosporins, a class of β-lactam antibiotics, are becoming increasingly essential in the treatment of bacterial infections due to their broad-spectrum activity, safety profile, and proven efficacy across multiple generations. They are widely used in both hospital and outpatient settings for treating respiratory tract infections, skin infections, urinary tract infections, and surgical prophylaxis, making them critical components of modern antimicrobial therapy.

- The escalating demand for cephalosporins is primarily fueled by the rising incidence of infectious diseases, growing antimicrobial resistance, and increased preference for third and fourth-generation cephalosporins among healthcare professionals. In addition, the introduction of combination therapies and the availability of both oral and injectable formulations have expanded their use across diverse patient populations and healthcare settings

- North America dominated the cephalosporin market with the largest revenue share of 38.7% in 2024, driven by the region’s well-established healthcare infrastructure, early adoption of advanced therapies, and significant R&D investments by pharmaceutical giants. The U.S. continues to experience robust growth in cephalosporin prescriptions, supported by stringent infection control guidelines, high awareness among physicians, and favourable reimbursement policies

- Asia-Pacific is expected to be the fastest-growing region in the cephalosporin market with 8.3% CAGR in the cephalosporin market during the forecast period, due to increasing urbanization, rising healthcare access, and a surge in infectious disease cases across densely populated countries such as China and India. Government healthcare initiatives, expansion of generic manufacturing capabilities, and growing investments in public health systems are key growth drivers in this region

- The third-generation cephalosporins segment dominated the cephalosporin market with a market share of 43.2% in 2024, owing to its superior efficacy against gram-negative bacteria and its broad clinical applications. These agents are widely utilized in hospital settings for serious infections and continue to be a preferred choice in the treatment of community-acquired and hospital-acquired infections

Report Scope and Cephalosporin Market Segmentation

|

Attributes |

Cephalosporin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cephalosporin Market Trends

“Increased Demand for Broad-Spectrum Antibiotics in Infectious Disease Management”

- A prominent and accelerating trend in the global cephalosporin market is the growing reliance on broad-spectrum antibiotics for managing a wide range of bacterial infections, especially in hospital and outpatient settings. Cephalosporins, with their efficacy against both Gram-positive and Gram-negative bacteria, are increasingly viewed as a frontline treatment option in clinical practice

- For instance, third-generation cephalosporins such as ceftriaxone and cefotaxime are widely prescribed for serious infections like pneumonia, urinary tract infections, and sepsis, owing to their excellent safety profiles and extended half-lives. Similarly, fourth-generation cephalosporins, such as cefepime, are becoming essential in treating nosocomial infections and drug-resistant pathogens

- The global increase in surgical procedures, particularly in developing regions, is fueling demand for cephalosporins due to their use in surgical prophylaxis. Infections acquired during surgeries remain a major concern, prompting hospitals to use reliable and broad-spectrum agents to prevent complications

- Moreover, the pediatric segment represents a significant consumer base for cephalosporins, as they are frequently used in treating middle ear infections, tonsillitis, and bronchitis in children. Formulations such as oral suspensions and dispersible tablets cater to the compliance needs of this age group, driving product innovation and expansion in this category

- Globally, public health programs targeting communicable diseases in low- and middle-income countries are increasingly incorporating cephalosporins into their treatment protocols. This trend, combined with government tenders and procurement initiatives, is enhancing the availability and affordability of cephalosporin-based drugs in underserved regions

- As resistance to other antibiotic classes continues to rise, the repositioning and combination of cephalosporins with β-lactamase inhibitors is gaining attention. These combination therapies are being developed to combat multidrug-resistant (MDR) bacteria, further expanding the clinical utility and commercial potential of cephalosporins in the global market

Cephalosporin Market Dynamics

Driver

“Growing Need Due to Rising Antimicrobial Resistance and Infectious Disease Burden”

- The increasing global burden of infectious diseases and the alarming rise in antimicrobial resistance (AMR) are key drivers propelling the demand for cephalosporins. As resistant strains of bacteria become more prevalent, there is a growing need for broad-spectrum antibiotics capable of treating both Gram-positive and Gram-negative infections effectively

- For instance, in January 2024, the World Health Organization reiterated its call for prioritizing access to essential antibiotics, including cephalosporins, to address rising resistance in lower- and middle-income countries. This emphasis on accessible and effective antimicrobials is expected to significantly boost the cephalosporin market during the forecast period

- Cephalosporins are widely used across various therapeutic areas, including respiratory tract infections, urinary tract infections, skin infections, and septicemia. Their versatility, safety profile, and clinical effectiveness have made them a mainstay in both hospital and outpatient care

- Furthermore, cephalosporins play a critical role in surgical prophylaxis, with most hospitals adopting third- and fourth-generation cephalosporins to prevent post-operative infections. This application is particularly relevant given the global rise in elective surgeries and increasing demand for infection control in healthcare settings

- Pediatric use also remains high, with oral cephalosporins frequently prescribed for conditions such as otitis media, pharyngitis, and bronchitis in children. The availability of palatable formulations such as suspensions enhances compliance among pediatric patients, contributing to strong product demand

- The consistent endorsement of cephalosporins by clinical guidelines and public health organizations continues to reinforce their widespread use, driving robust sales and R&D interest in developing novel and combination therapies

Restraint/Challenge

“Stringent Regulatory Environment and Resistance Development”

- One of the significant challenges facing the cephalosporin market is the increasing regulatory scrutiny and the potential for bacterial resistance development. The overuse and misuse of antibiotics, including cephalosporins, have led to growing concerns over drug-resistant pathogens, prompting tighter regulatory frameworks and controlled prescribing practices in many regions

- For instance, various governments have implemented antibiotic stewardship programs to minimize inappropriate use, which, while beneficial from a public health perspective, may limit market expansion for broad-spectrum antibiotics unless positioned correctly in treatment guidelines

- In addition, the regulatory approval process for new-generation cephalosporins and combination drugs often involves stringent clinical trials and safety evaluations, leading to higher R&D costs and extended timelines for market entry

- The rise of resistant bacteria such as extended-spectrum beta-lactamase (ESBL) producing organisms has challenged the efficacy of older-generation cephalosporins, necessitating innovation in formulation and combination therapies (such as, pairing with beta-lactamase inhibitors)

- Moreover, the availability of lower-cost generic cephalosporins in emerging markets can lead to pricing pressures, impacting profit margins for leading manufacturers. For companies to succeed in this evolving market, they must invest in next-generation formulations, ensure compliance with antimicrobial resistance (AMR) guidelines, and differentiate their products through efficacy and safety profiles

Cephalosporin Market Scope

The market is segmented into type, indication, drug type, dosage form, route of administration, end user and distribution channel.

- By Type

On the basis of type, the cephalosporin market is segmented into first-generation cephalosporins, second-generation cephalosporins, third-generation cephalosporins, fourth-generation cephalosporins, fifth-generation cephalosporins, and others. The third-generation cephalosporins segment dominated the market with a 43.2% revenue share in 2024, owing to their broad-spectrum effectiveness against Gram-negative bacteria.

The fifth-generation cephalosporins segment is expected to witness the fastest CAGR of 7.4% from 2025 to 2032, driven by rising demand for MRSA-effective antibiotics.

- By Indication

On the basis of indication, the cephalosporin market is segmented into skin infection, urinary tract infections (UTIs), strep throat, ear infections, pneumonia, sinus infections, meningitis, gonorrhoea, and others. The urinary tract infections (UTIs) segment accounted for the largest market share of 22.8% in 2024, driven by high global incidence rates.

The pneumonia segment is projected to grow at the fastest CAGR of 6.9% from 2025 to 2032, supported by increasing respiratory infections and hospitalizations.

- By Drug Type

On the basis of drug type, the cephalosporin market is segmented into branded and generics. The generics segment held the largest revenue share of 66.3% in 2024, due to affordability and widespread accessibility in emerging markets.

The branded segment is expected to grow at a CAGR of 5.1% from 2025 to 2032, driven by innovation and uptake of newer-generation cephalosporins.

- By Dosage Form

On the basis of dosage form, the cephalosporin market is segmented into tablets, capsules, and others. The tablets segment dominated the market with a 45.9% share in 2024, owing to ease of administration and outpatient use.

The capsules segment is anticipated to witness the fastest CAGR of 5.8% from 2025 to 2032, driven by better patient compliance among children and elderly.

- By Route of Administration

On the basis of route of administration, the cephalosporin market is segmented into oral, parenteral, and others. The oral segment held the largest market share of 61.4% in 2024, attributed to its widespread use in primary care settings.

The parenteral segment is expected to grow at the highest CAGR of 6.7% during 2025–2032, due to its use in treating severe infections in hospitals.

- By End Users

On the basis of end users, the cephalosporin market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment captured the largest revenue share of 52.6% in 2024, driven by bulk administration and surgical prophylaxis.

The homecare segment is anticipated to grow at the fastest CAGR of 6.3% from 2025 to 2032, supported by the growing trend of outpatient antibiotic therapy.

- By Distribution Channel

On the basis of distribution channel, the cephalosporin market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment led with a 48.2% market share in 2024, supported by large-scale procurement for inpatient and emergency care.

The Online Pharmacy segment is projected to grow at the fastest CAGR of 7.6% during 2025–2032, driven by rising e-commerce use and digital health integration.

Cephalosporin Market Regional Analysis

- North America dominated the cephalosporin market with the largest revenue share of 38.7% in 2024, driven by the high prevalence of bacterial infections, well-established healthcare infrastructure, and increased use of third and fourth-generation cephalosporins in both outpatient and inpatient settings

- The region also benefits from the presence of key pharmaceutical companies, strong R&D initiatives, and growing antibiotic resistance concerns that fuel the demand for advanced cephalosporin formulations

- Furthermore, favorable reimbursement policies, high awareness among healthcare professionals, and rising government efforts to combat antimicrobial resistance contribute significantly to the widespread adoption of cephalosporin antibiotics across North America

U.S. Cephalosporin Market Insight

The U.S. cephalosporin market captured the largest revenue share of 79.2% in 2024 within North America, driven by the high incidence of bacterial infections, widespread use of third- and fourth-generation cephalosporins, and a robust pharmaceutical infrastructure. The presence of major industry players, increased healthcare expenditure, and rising antibiotic prescriptions contribute significantly to the market's dominance. Furthermore, government initiatives to curb antimicrobial resistance and enhance antibiotic stewardship programs continue to promote the use of cephalosporins in both hospital and outpatient settings.

Europe Cephalosporin Market Insight

The Europe cephalosporin market is projected to expand at a substantial CAGR throughout the forecast period, driven by the growing prevalence of community- and hospital-acquired infections, especially among the elderly and immunocompromised. Stringent regulatory guidelines on antimicrobial use, rising demand for broad-spectrum antibiotics, and increasing healthcare awareness are influencing the market positively. Moreover, efforts to optimize antimicrobial therapy across European countries are fostering increased cephalosporin consumption.

U.K. Cephalosporin Market Insight

The U.K. cephalosporin market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by an increasing burden of respiratory tract infections, urinary tract infections (UTIs), and skin infections. Growing concerns over antimicrobial resistance are prompting the adoption of next-generation cephalosporins in clinical practice. Additionally, support from the National Health Service (NHS) and public health initiatives for appropriate antibiotic use are contributing to sustained market growth.

Germany Cephalosporin Market Insight

The Germany cephalosporin market is expected to expand at a considerable CAGR during the forecast period, driven by the rise in multi-drug-resistant bacterial infections and strong government focus on infection control practices. The country’s advanced healthcare infrastructure and its focus on early diagnosis and prompt antibiotic treatment are fostering demand. Moreover, clinical trials and product innovations by German pharmaceutical companies further support market expansion.

Asia-Pacific Cephalosporin Market Insight

The Asia-Pacific cephalosporin market is poised to grow at the fastest CAGR of 8.3% during the forecast period of 2025 to 2032, due to rising healthcare investments, improving access to antibiotics, and increased awareness regarding bacterial infections. Countries such as China, India, and Japan are witnessing a surge in demand for generic cephalosporins due to affordability and widespread healthcare coverage initiatives. In addition, the growing pharmaceutical manufacturing capabilities in the region enhance both supply and export potential.

Japan Cephalosporin Market Insight

The Japan cephalosporin market is gaining momentum due to the aging population, frequent healthcare utilization, and high incidence of nosocomial infections. Japan's preference for beta-lactam antibiotics, coupled with strict regulatory frameworks for quality and safety, has led to the continued use of advanced cephalosporin formulations. Moreover, innovative research and high domestic production capacity are aiding market growth.

China Cephalosporin Market Insight

The China cephalosporin market accounted for the largest revenue share in Asia Pacific in 2024, attributed to the rapid increase in healthcare demand, high antibiotic prescription rates, and government support for domestic pharmaceutical production. The country is home to several large-scale generic drug manufacturers that provide affordable cephalosporin products to meet the needs of its vast population. The push toward healthcare reform and antimicrobial resistance control programs is expected to drive further market expansion.

Cephalosporin Market Share

The cephalosporin industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Aurobindo Pharma (India)

- Cipla (U.S.)

- Lannett (U.S.)

- Bausch Health Companies Inc. (Canada)

- Sun Pharmaceutical Industries Ltd. (India)

- Novo Nordisk A/S (Denmark)

- Currax Pharmaceuticals LLC (U.S.)

- Eisai Co., Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

Latest Developments in Global Cephalosporin Market

- In April 2024, the U.S. FDA approved ZEVTERA (ceftobiprole), marking the first MRSA-active cephalosporin available since 2006. It's authorized for treating bloodstream infections (including right-sided endocarditis), acute bacterial skin and skin structure infections (ABSSSI), and community-acquired pneumonia for patients aged 3 months and older

- In February 2024, the fixed-dose combination Exblifep (cefepime/enmetazobactam) was approved in both the U.S. and EU for treating complicated urinary tract infections. This represents a significant step forward in combating ESBL-producing gram-negative pathogens

- In November 2023, Japan’s Ministry of Health approved Fetroja (cefiderocol) for treating carbapenem-resistant infections (Such as, E. coli, Klebsiella, Pseudomonas) and introduced drug‑susceptibility testing protocols alongside its launch

- In October 2021, Sandoz, a division of Novartis, successfully completed its acquisition of GSK’s cephalosporin antibiotics business. As part of the deal, Sandoz gained the rights to three well-established brands—Zinnat, Zinacef, and Fortum—across more than 100 markets, strengthening its global leadership in the antibiotics sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.