Global Ceramic Filters Market

Market Size in USD Billion

CAGR :

%

USD

2.13 Billion

USD

5.97 Billion

2024

2032

USD

2.13 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 2.13 Billion | |

| USD 5.97 Billion | |

|

|

|

|

Ceramic Filters Market Size

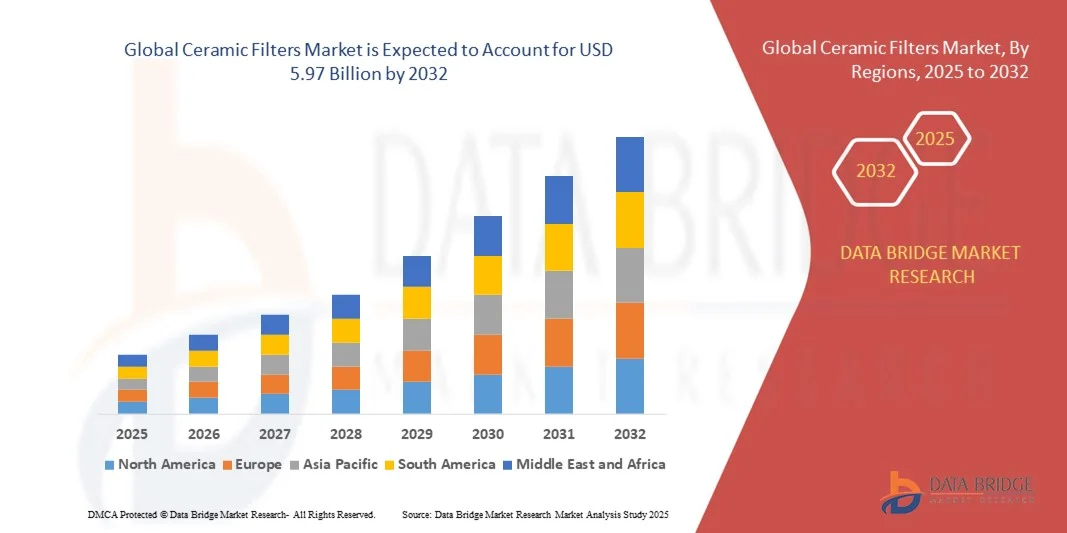

- The global ceramic filters market size was valued at USD 2.13 billion in 2024 and is expected to reach USD 5.97 billion by 2032, at a CAGR of 13.75% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-efficiency filtration solutions across industrial, automotive, and water treatment applications

- Rising adoption of ceramic filters in air and gas filtration systems, coupled with stringent environmental regulations, is further driving market expansion

Ceramic Filters Market Analysis

- Ceramic filters are increasingly preferred for their high thermal stability, mechanical strength, and ability to filter fine particulates, making them essential in automotive, chemical, and water treatment sectors

- The market is witnessing growth due to the expansion of end-use industries such as power generation, pharmaceuticals, food and beverages, and electronics, which require precise and reliable filtration

- North America dominated the ceramic filters market with the largest revenue share in 2024, driven by rising industrialization, stringent emission regulations, and increased adoption of high-performance filtration solutions across automotive, chemical, and power generation sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global ceramic filters market, driven by urbanization, increasing automotive production, expanding industrial sectors, and rising adoption of sustainable and high-performance filtration technologies

- The Ceramic Air Filters segment held the largest market revenue share in 2024, driven by increasing demand for high-efficiency particulate removal in industrial, automotive, and HVAC systems. These filters offer superior heat resistance, chemical stability, and fine particle filtration, making them ideal for both emission control and air purification applications

Report Scope and Ceramic Filters Market Segmentation

|

Attributes |

Ceramic Filters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ceramic Filters Market Trends

Increasing Adoption of Ceramic Filters in Industrial and Automotive Applications

- The growing demand for ceramic filters is transforming the industrial filtration and automotive sectors by providing efficient, high-temperature, and high-precision filtration solutions. Their durability, chemical resistance, and fine particulate removal capabilities improve operational efficiency and product quality, while also reducing downtime and maintenance requirements. These attributes make ceramic filters a preferred choice in high-stress industrial and automotive environments

- Rising industrialization and stringent emission regulations are accelerating the adoption of ceramic filters in automotive exhaust systems, power generation, and chemical processing plants. The filters help meet environmental compliance while enhancing performance and reliability, lowering operational costs, and supporting sustainable practices. Their ability to withstand harsh conditions ensures long-term efficiency and reliability

- The trend toward eco-friendly and sustainable filtration solutions is boosting the use of ceramic filters in water treatment, air purification, and industrial waste management applications. Their long life, recyclability, and minimal environmental impact reduce replacement frequency and waste generation, making them integral to green initiatives across industries. Widespread adoption supports regulatory compliance and operational sustainability

- For instance, in 2023, several automotive manufacturers in Europe reported improved emission compliance and reduced maintenance costs after implementing ceramic diesel particulate filters, enhancing overall operational efficiency. The adoption also enabled these manufacturers to meet stricter EU emission standards while lowering lifecycle costs. This demonstrates the practical value and market potential of ceramic filters

- While ceramic filters are gaining popularity across multiple sectors, their impact depends on continued innovation, cost-effectiveness, and technical support. Manufacturers must focus on quality, material advancement, and tailored solutions to fully capitalize on growing global demand, as well as expanding applications in emerging industries and environmental technologies

Ceramic Filters Market Dynamics

Driver

Increasing Demand for High-Performance and Eco-Friendly Filtration Solution

- The rising industrial and automotive demand for high-performance ceramic filters is driving market growth. Their ability to withstand high temperatures, corrosive environments, and fine particulate matter makes them indispensable for advanced filtration processes, while reducing operational inefficiencies and maintenance interventions. This positions ceramic filters as critical components in modern industrial systems

- Growth in industrial production, stringent environmental regulations, and increasing awareness about emission control have escalated the need for ceramic filters. Adoption across multiple applications ensures steady demand and market stability, supporting operational continuity and environmental compliance. Industries increasingly rely on ceramic filters to meet regulatory benchmarks efficiently

- Manufacturers are increasingly integrating ceramic filters in automotive, chemical, and water treatment processes to enhance efficiency, reduce downtime, and ensure regulatory compliance. This trend is reinforced by sustainability initiatives and operational cost reduction strategies, promoting the adoption of durable, high-performance filters across new markets

- For instance, in 2023, power plants in the U.S. reported enhanced emission control and lower maintenance costs after replacing conventional filters with advanced ceramic filter units, leading to increased adoption. The switch also facilitated improved regulatory adherence and long-term reliability of filtration systems

- While industrial adoption is propelling market growth, ensuring affordability, consistent material quality, and technical support remain crucial for long-term market expansion. Companies must also invest in R&D to develop next-generation filters that address emerging environmental and industrial challenges

Restraint/Challenge

High Production Cost and Technical Complexity of Ceramic Filters

- The high manufacturing cost of ceramic filters, due to specialized raw materials and precision engineering, limits adoption among small-scale industries and cost-sensitive applications. Production complexity remains a significant barrier, while research and development expenses increase the overall price of filters for end-users. This restricts market penetration in emerging and price-competitive regions

- Technical challenges, including brittleness, difficulty in handling, and sensitivity to thermal shock, restrict wider utilization in certain industrial environments. Adequate training and handling protocols are required to maintain performance and longevity, while improper handling can lead to increased failure rates and maintenance issues, affecting operational continuity

- Supply chain limitations and raw material price fluctuations can impact production costs and availability, particularly in emerging economies. This affects adoption timelines and operational planning for end-users, especially those in regions dependent on imported ceramic materials, leading to potential delays in project execution

- For instance, in 2023, several chemical processing units in Asia faced delays in filter replacement and procurement due to supply chain disruptions and rising ceramic material costs, impacting operational efficiency. These challenges highlight the need for alternative sourcing strategies and localized production capabilities to mitigate supply risks

- While technological advancements and alternative materials are being explored, overcoming cost and technical complexity is critical for broader adoption and sustained growth in the global ceramic filters market. Companies must focus on scalable production methods, innovation in material science, and comprehensive technical support to address these challenges effectively

Ceramic Filters Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the ceramic filters market is segmented into Ceramic Air Filters and Ceramic Water Filters. The Ceramic Air Filters segment held the largest market revenue share in 2024, driven by increasing demand for high-efficiency particulate removal in industrial, automotive, and HVAC systems. These filters offer superior heat resistance, chemical stability, and fine particle filtration, making them ideal for both emission control and air purification applications.

The Ceramic Water Filters segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of clean water solutions and the adoption of sustainable water treatment technologies. Ceramic water filters are valued for their long lifespan, low maintenance, and ability to remove bacteria, sediments, and other impurities, making them particularly popular in residential and commercial water filtration systems.

- By Application

On the basis of application, the market is segmented into Residential, Commercial, and Industrial. The Industrial segment held the largest share in 2024, fueled by the need for advanced filtration in chemical processing, power generation, and automotive sectors. Ceramic filters in industrial applications ensure compliance with stringent environmental regulations and improve operational efficiency.

The Residential segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption of home air purifiers and water filtration systems. Rising consumer focus on health, indoor air quality, and safe drinking water is accelerating demand for compact and efficient ceramic filters suitable for household use.

Ceramic Filters Market Regional Analysis

- North America dominated the ceramic filters market with the largest revenue share in 2024, driven by rising industrialization, stringent emission regulations, and increased adoption of high-performance filtration solutions across automotive, chemical, and power generation sectors

- Industries in the region highly value the durability, chemical resistance, and fine particulate removal capabilities offered by ceramic filters, which enhance operational efficiency and ensure regulatory compliance

- This widespread adoption is further supported by advanced manufacturing infrastructure, high technological penetration, and growing demand for eco-friendly filtration solutions, establishing ceramic filters as a preferred choice in both industrial and residential applications

U.S. Ceramic Filters Market Insight

The U.S. ceramic filters market captured the largest revenue share in 2024 within North America, fueled by increasing adoption in automotive exhaust systems, water treatment plants, and industrial filtration processes. Manufacturers are prioritizing high-efficiency filtration solutions to meet stringent environmental and emission standards. The growing focus on sustainability, along with robust investment in industrial upgrades and technological innovations, is further propelling market growth. Moreover, the integration of ceramic filters in critical processes enhances productivity, reduces maintenance costs, and ensures regulatory compliance, strengthening their market presence.

Europe Ceramic Filters Market Insight

The Europe ceramic filters market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict emission regulations, rising environmental awareness, and increasing industrial modernization. The demand for high-efficiency filtration solutions across automotive, chemical, and power sectors is accelerating adoption. European industries are also investing in eco-friendly and sustainable filtration technologies. The region is witnessing notable growth in both new industrial setups and retrofitting projects, with ceramic filters being incorporated to ensure compliance with evolving environmental standards.

U.K. Ceramic Filters Market Insight

The U.K. ceramic filters market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing emphasis on emission control, air purification, and sustainable industrial practices. Industries are adopting ceramic filters to meet stringent environmental and safety regulations. In addition, government initiatives promoting green technologies and technological advancements in filtration systems are encouraging the deployment of high-performance ceramic filters. The country’s well-established industrial base and focus on innovation are expected to continue stimulating market growth.

Germany Ceramic Filters Market Insight

The Germany ceramic filters market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in automotive, chemical, and power generation sectors. Germany’s strong emphasis on sustainability, environmental protection, and energy efficiency promotes the use of ceramic filtration systems. The integration of advanced ceramic filters in manufacturing and industrial processes enhances operational efficiency and reduces maintenance costs. Consumer and industrial preference for eco-friendly and durable filtration solutions further reinforces the market’s expansion.

Asia-Pacific Ceramic Filters Market Insight

The Asia-Pacific ceramic filters market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and rising environmental awareness in countries such as China, Japan, and India. The region’s growing automotive, chemical, and power generation industries are adopting ceramic filters to meet emission and environmental standards. Government initiatives promoting industrial modernization and sustainable manufacturing practices are accelerating adoption. Moreover, the APAC region’s emerging role as a manufacturing hub for ceramic filter components is increasing affordability and accessibility for both industrial and residential applications.

Japan Ceramic Filters Market Insight

The Japan ceramic filters market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on advanced manufacturing, environmental compliance, and high-tech industrial processes. Japanese industries prioritize high-efficiency filtration solutions to maintain emission standards and operational productivity. The growing adoption of ceramic filters in automotive, chemical, and water treatment sectors is fueling market growth. Furthermore, Japan’s emphasis on technological innovation and eco-friendly solutions is expected to drive demand in both industrial and residential segments.

China Ceramic Filters Market Insight

The China ceramic filters market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, urbanization, and stringent environmental regulations. The adoption of ceramic filters in automotive, chemical, and industrial water treatment processes is increasing steadily. The push for smart and sustainable manufacturing practices, coupled with strong domestic production capabilities, is enhancing affordability and availability. China’s large industrial base and rising awareness of eco-friendly filtration solutions are key factors propelling market growth across both industrial and residential applications.

Ceramic Filters Market Share

The Ceramic Filters industry is primarily led by well-established companies, including:

- LENZING AG (Austria)

- Kelheim Fibers GmbH (Germany)

- Grasim (India)

- Fulida Group Holding Co., Ltd (China)

- Corning Incorporated (U.S.)

- Doulton Water Filter (U.K.)

- Eastman Chemical Company (U.S.)

- CFF GmbH & Co. KG (Germany)

- Haldor Topsoe A/S (Denmark)

- Unifrax (U.S.)

- Veolia (France)

- ASK Chemicals (Germany)

- Kyocera Corporation (Japan)

- Ceramic Filters (U.K.)

Latest Developments in Global Ceramic Filters Market

- In June 2025, Nanostone Water and Pureflow Filtration introduced CUF|Shield, a new ceramic ultrafiltration solution designed to address high-solids content, biofouling, and variable feed water conditions in municipal and industrial water treatment. This advanced ceramic membrane module enhances filtration efficiency, reduces operational downtime, and improves water quality, strengthening the adoption of high-performance ceramic filters in the water treatment market

- In November 2024, Evove launched the CeraFab S320, an advanced ceramic filter developed using Lithoz’s 3D printing technology. The filter targets applications such as lithium extraction and provides benefits including an 80% reduction in energy consumption, enhanced water recycling efficiency, and a fivefold increase in output capacity, boosting productivity and promoting sustainable practices in industrial filtration

- In December 2024, GBC Advanced Materials acquired the XJet Carmel 1400 Ceramic AM solution, transforming its production process by cutting the production-to-delivery cycle from months to weeks. The acquisition enables improved geometric design flexibility, higher production efficiency, and superior product performance, enhancing the company’s service offerings across medical, aerospace, semiconductor, and defense sectors while driving growth in the global ceramic filters market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ceramic Filters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ceramic Filters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ceramic Filters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.