Global Ceramic Injection Molding Market

Market Size in USD Million

CAGR :

%

USD

449.07 Million

USD

653.43 Million

2024

2032

USD

449.07 Million

USD

653.43 Million

2024

2032

| 2025 –2032 | |

| USD 449.07 Million | |

| USD 653.43 Million | |

|

|

|

|

Ceramic Injection Moldings Market Size

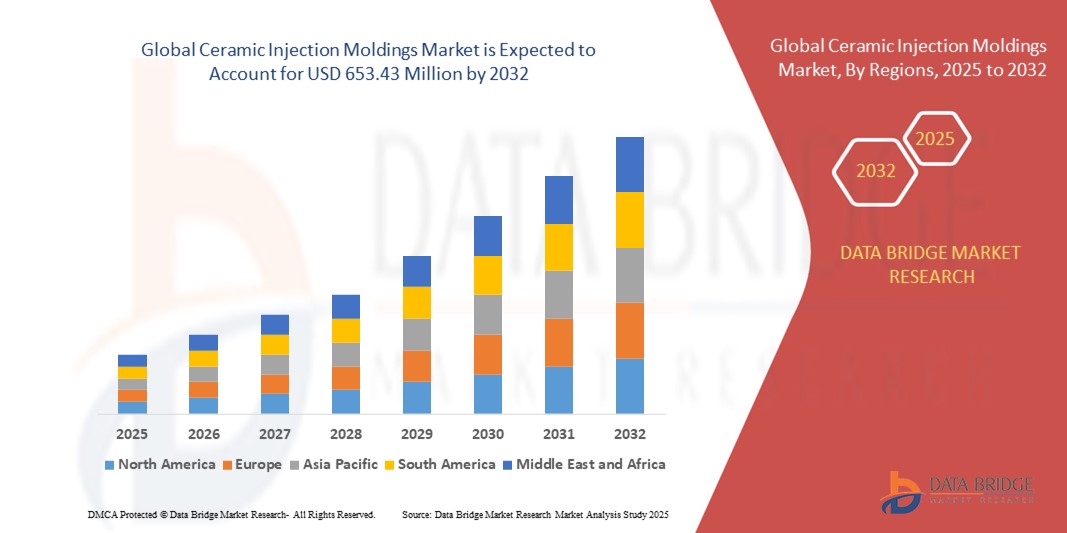

- The global ceramic injection moldings market size was valued at USD 449.07 million in 2024 and is expected to reach USD 653.43 million by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is primarily driven by increasing demand for lightweight, durable, and high-precision components in industries such as automotive, healthcare, and electronics, coupled with advancements in ceramic materials and manufacturing technologies

- Growing adoption of ceramic injection molding for complex geometries and high-performance applications is boosting market expansion across OEM and aftermarket channels

Ceramic Injection Moldings Market Analysis

- The ceramic injection moldings market is experiencing robust growth due to rising demand for precision-engineered components with superior mechanical and thermal properties

- The automotive and healthcare sectors are key drivers, with increasing use of ceramic components for engine parts, medical implants, and electronic devices, encouraging manufacturers to innovate with advanced materials suchh as alumina and zirconia

- Asia-Pacific dominates the ceramic injection moldings market with the largest revenue share of 41.3% in 2024, driven by a strong manufacturing base, rapid industrialization, and high demand for electronics and automotive components in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by technological advancements, increasing R&D investments, and growing adoption of ceramic injection molding in healthcare and aerospace applications

- The automotive segment held the largest market revenue share of 35% in 2024, driven by the increasing demand for lightweight, durable, and high-precision ceramic components in vehicle manufacturing

Report Scope and Ceramic Injection Moldings Market Segmentation

|

Attributes |

Ceramic Injection Moldings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ceramic Injection Moldings Market Trends

Increasing Adoption of Advanced Ceramic Materials and Automation

- The global ceramic injection molding (CIM) market is experiencing a notable trend toward the use of advanced ceramic materials, such as alumina, zirconia, and composite ceramics, due to their superior properties suchh as high thermal resistance, wear resistance, and biocompatibility

- Integration of automation technologies, including robotics and Industry 4.0 solutions suchh as IoT and data analytics, is enhancing manufacturing efficiency, reducing production times, and improving precision in CIM processes

- Advanced CIM techniques, such as cold isostatic pressing and hot isostatic pressing, are being adopted to produce complex, high-strength components with minimal defects, catering to industries requiring high-performance parts

- For instances, companies are leveraging slurry and suspension injection molding to create intricate ceramic components for applications in electronics and medical devices, enabling high-density and low-shrinkage parts

- This trend is increasing the appeal of CIM for producing compact, high-precision components, making it a preferred choice for manufacturers in automotive, healthcare, and electrical & electronics sectors

- Automation in CIM processes allows for real-time monitoring and optimization, reducing material waste and ensuring consistent quality across large-scale production

Ceramic Injection Moldings Market Dynamics

Driver

Growing Demand for Precision Components in High-Performance Applications

- The rising need for high-precision, complex ceramic components in industries such as automotive, aerospace, healthcare, and electronics is a primary driver for the global CIM market

- CIM enables the production of intricate parts, such as turbocharger rotors, dental implants, and electronic substrates, with high dimensional accuracy and minimal post-processing, meeting stringent industry requirements

- Government initiatives promoting sustainable manufacturing and the use of eco-friendly materials, suchh as recyclable ceramics, are boosting CIM adoption, particularly in Asia-Pacific, where industrialization is rapid

- The proliferation of advanced technologies, such as 5G and IoT, is driving demand for ceramic components in electrical and electronics applications, where CIM’s ability to produce miniaturized, high-performance parts is critical

- Major automakers and medical device manufacturers are increasingly integrating CIM-produced components to enhance product durability, reduce weight, and improve performance, further fueling market growth

Restraint/Challenge

High Initial Investment and Technical Complexity

- The high cost of setting up CIM facilities, including specialized equipment for processes suchh as hot isostatic pressing and slip casting, poses a significant barrier, particularly for small and medium-sized enterprises (SMEs) in emerging markets

- The complexity of CIM processes, such as multi-step injection and debinding, requires advanced technical expertise and stringent quality control, increasing operational costs

- Concerns over the limited availability of high-quality ceramic feedstocks, such as single-phase and multi-phase ceramics, can hinder large-scale production and scalability

- The brittleness of ceramic materials and challenges in maintaining consistent quality during powder injection, slurry injection, or suspension injection processes can lead to defects, impacting production yields

- Regulatory variations across regions, particularly in Asia-Pacific and North America, regarding material standards and environmental compliance, add complexity for global manufacturers, potentially limiting market expansion

Ceramic Injection Moldings market Scope

The market is segmented on the basis of application, feedstock type, manufacturing process, material type, and technology.

- By Application

On the basis of application, the global ceramic injection moldings market is segmented into industrial machinery, automotive, healthcare, consumer goods, electrical & electronics, and others. The automotive segment held the largest market revenue share of 35% in 2024, driven by the increasing demand for lightweight, durable, and high-precision ceramic components in vehicle manufacturing. These components, used in engines, exhaust systems, and sensors, benefit from ceramics’ superior heat resistance, wear resistance, and dimensional stability, which enhance fuel efficiency and performance. The push for electric vehicles and stringent emission regulations further bolsters demand for ceramic injection molded parts in this sector.

The healthcare segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the rising adoption of ceramic injection molding for producing complex medical devices such as dental implants, surgical instruments, and orthopedic components. Ceramics’ biocompatibility, corrosion resistance, and ability to form intricate shapes make them ideal for medical applications. The growing prevalence of chronic diseases, increasing demand for minimally invasive surgeries, and advancements in medical technology are key drivers for this segment’s rapid expansion.

- By Feedstock Type Outlook

On the basis of feedstock type, the global ceramic injection moldings market is categorized into powder injection, slurry injection, and suspension injection. The powder injection segment dominated the market with the largest revenue share in 2024, attributed to its widespread use in producing high-precision ceramic parts with excellent mechanical properties. Powder injection molding enables the creation of complex geometries with minimal material waste, making it cost-effective for high-volume production in industries suchh as automotive and electronics. Its compatibility with advanced ceramic materials, such as alumina and zirconia, further strengthens its market dominance.

The suspension injection segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by its ability to produce components with enhanced surface finishes and tighter tolerances. This feedstock type is gaining traction in the healthcare and aerospace sectors, where precision and quality are critical. Innovations in suspension formulations and increasing demand for customized ceramic components are expected to accelerate this segment’s growth.

- By Manufacturing Process Outlook

On the basis of manufacturing process, the global ceramic injection moldings market is segmented into single-step injection and multi-step injection. The single-step injection segment accounted for the highest revenue share in 2024, owing to its efficiency in producing complex ceramic parts with reduced production time and costs. This process is widely adopted in industries suchh as electronics and consumer goods, where high-volume production of small, intricate components is required. The streamlined nature of single-step injection minimizes post-processing needs, enhancing its appeal for manufacturers.

The multi-step injection segment is projected to grow at the fastest CAGR from 2025 to 2032, as it offers greater flexibility in producing large or highly complex ceramic components. This process is particularly suited for applications in aerospace and industrial machinery, where customized designs and enhanced material properties are essential. Advancements in automation and process optimization are expected to drive the adoption of multi-step injection processes.

- By Material Type Outlook

On the basis of material type, the global ceramic injection moldings market is segmented into single-phase ceramics, multi-phase ceramics, and composite ceramics. The single-phase ceramics segment, primarily driven by alumina, held the largest revenue share in 2024 due to its widespread use in electronics, automotive, and medical applications. Alumina’s exceptional hardness, thermal stability, and cost-effectiveness make it the preferred material for producing high-performance ceramic components.

The composite ceramics segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by increasing demand for advanced materials with superior mechanical and thermal properties. Composite ceramics, combining ceramics with other materials suchh as metals or polymers, are gaining popularity in aerospace and defense for their lightweight and high-strength characteristics. Ongoing research in material science and the development of new composite formulations are key growth drivers for this segment.

- By Technology Outlook

On the basis of technology outlook, the global ceramic injection moldings market is segmented into cold isostatic pressing, hot isostatic pressing, and slip casting. The hot isostatic pressing segment dominated the market in 2024, driven by its ability to produce dense, high-strength ceramic components with minimal defects. This technology is widely used in aerospace and healthcare, where structural integrity and precision are paramount. Its ability to enhance material properties through uniform pressure application solidifies its market leadership.

The cold isostatic pressing segment is projected to grow at the fastest CAGR from 2025 to 2032, as it offers cost-effective solutions for producing complex shapes with consistent quality. This technology is gaining traction in the electrical & electronics and automotive sectors due to its scalability and ability to reduce production costs. Increasing adoption of Industry 4.0 technologies, such as automation and real-time monitoring, further supports the growth of cold isostatic pressing in ceramic injection molding.

Ceramic Injection Moldings Market Regional Analysis

- Asia-Pacific dominates the ceramic injection moldings market with the largest revenue share of 41.3% in 2024, driven by a strong manufacturing base, rapid industrialization, and high demand for electronics and automotive components in countries such as China, Japan, and South Korea

- Consumers prioritize ceramic injection molded products for their high strength, heat resistance, and corrosion resistance, particularly in applications requiring complex geometries and durability in harsh environments

- Growth is supported by advancements in ceramic material formulations, such as alumina and zirconia, and the adoption of innovative manufacturing processes suchh as cold isostatic pressing and multi-step injection, catering to both OEM and aftermarket demands

Japan Ceramic Injection Moldings Market Insight

Japan’s ceramic injection moldings market is expected to witness rapid growth, fueled by strong consumer preference for high-quality, technologically advanced ceramic components that enhance performance in automotive, electronics, and healthcare applications. The presence of major manufacturers and the integration of ceramic injection moldings in OEM vehicles accelerate market penetration. Growing interest in aftermarket customization and precision engineering further contributes to market growth.

China Ceramic Injection Moldings Market Insight

China holds the largest share of the Asia-Pacific ceramic injection moldings market, driven by rapid urbanization, rising vehicle ownership, and increasing demand for precision ceramic components in electronics and healthcare. The country’s growing middle class and focus on advanced manufacturing support the adoption of ceramic injection moldings. Strong domestic production capabilities, competitive pricing, and advancements in feedstock types (powder, slurry, and suspension injection) and manufacturing processes (single-step and multi-step injection) enhance market accessibility.

U.S. Ceramic Injection Moldings Market Insight

The U.S. ceramic injection moldings market is expected to witness significant growth, fueled by strong demand in the healthcare and automotive sectors, alongside growing adoption in aerospace for high-precision components. Increasing awareness of ceramic materials’ durability and thermal stability drives aftermarket demand. The trend toward advanced manufacturing technologies and regulatory emphasis on high-performance materials further accelerates market expansion. The integration of ceramic injection moldings in medical devices and premium vehicles complements both OEM and aftermarket segments, fostering a robust market ecosystem.

Europe Ceramic Injection Moldings Market Insight

The Europe ceramic injection moldings market is expected to witness significant growth, supported by a strong focus on vehicle safety, energy efficiency, and advanced manufacturing. Consumers demand ceramic components that offer superior thermal insulation and wear resistance for automotive and industrial applications. The market sees notable uptake in Germany, France, and the U.K., driven by environmental concerns and the need for high-performance materials in aerospace and electronics. Both new installations and retrofit projects contribute to market growth.

U.K. Ceramic Injection Moldings Market Insight

The U.K. market for ceramic injection moldings is expected to exhibit rapid growth, driven by increasing demand for high-precision components in automotive and healthcare applications. Rising consumer interest in durable, heat-resistant materials for consumer electronics and industrial machinery supports market expansion. Evolving regulations promoting material efficiency and sustainability influence consumer preferences, balancing performance with compliance in ceramic injection molding applications.

Germany Ceramic Injection Moldings Market Insight

Germany is expected to experience rapid growth in the ceramic injection moldings market, attributed to its advanced automotive and industrial manufacturing sectors. German consumers favor technologically advanced ceramics, such as alumina and zirconia, for their ability to reduce operational costs and enhance component longevity. The integration of ceramic injection moldings in premium vehicles, medical devices, and industrial machinery, alongside strong aftermarket demand, supports sustained market growth.

Ceramic Injection Moldings Market Share

The ceramic injection moldings industry is primarily led by well-established companies, including:

- Eleanor Technologies, Inc. (U.S.)

- Morgan Advanced Materials (U.K.)

- Farallon Materials, Inc. (U.S.)

- Ceramtec Group (Germany)

- Atlantic Powdered Metals, Inc. (U.S.)

- Forta Corporation (U.S.)

- Mitsui Mining & Smelting Co., Ltd. (Japan)

- Plasma Processes, Inc. (U.S.)

- Pacific International Group (U.S.)

- D.M. Wilkinson (U.S.)

- Kyocera Group (Japan)

- Arburg GmbH + Co KG (Germany)

- Coorstek Inc (U.S.)

- Ortech Advanced Ceramics (U.S.)

- Oechsler AG (Germany)

What are the Recent Developments in Global Ceramic Injection Moldings Market?

- In April 2025, French company Nanoe unveiled the Zetasinter 4L sintering furnace, developed in collaboration with Cerinnov Group. This advanced furnace is designed to enhance Nanoe’s Zetamix product ecosystem, which includes metal and ceramic filaments and 3D printing equipment. With a sintering volume of 4 liters—four times larger than its predecessor—it supports small production batches and larger components. Featuring digital controls and a simplified loading system, the Zetasinter 4L offers a comprehensive solution for sinter-based additive manufacturing, particularly in ceramic and metal injection molding applications. It marks a significant step in Nanoe’s Zetafactory 4.0 initiative

- In July 2024, Blackford Capital, a U.S.-based private equity firm, acquired Industrial Molding Corporation (IMC), a Texas-based manufacturer of precision-engineered injection molded components. The acquisition, valued at approximately $16 million, marks the first add-on to Blackford’s portfolio company, Davalor Mold Company. This strategic move aims to expand Blackford’s footprint in the injection-molded plastics sector, particularly for automotive applications. IMC’s experienced management team will remain in place, and the company will operate as a separate business unit. The acquisition strengthens Blackford’s capabilities and sets the foundation for a global, full-service plastics injection molding platform

- In October 2023, GKN plc, a prominent player in the automotive and aerospace sectors, formed strategic partnerships with specialty material suppliers across Europe. These alliances were designed to streamline production workflows, enhance supply chain resilience, and improve cost-efficiency. By integrating advanced additive fabrication and localized sourcing, GKN aimed to reduce lead times and dependency on traditional casting and forging methods. This initiative supports GKN’s broader goals of sustainability and operational excellence, particularly in response to global disruptions and the push for net-zero emissions by 2050

- In September 2023, CoorsTek, a leading U.S.-based technical ceramics manufacturer, inaugurated a new research and development center in Uden, the Netherlands. This European R&D hub is closely integrated with CoorsTek’s teams in the U.S. and Japan, and is dedicated to advancing technical ceramic capabilities. The facility aims to support CoorsTek’s growing customer base across Europe by developing innovative solutions tailored to demanding applications in industries such as electronics, automotive, and healthcare. This investment marks a strategic step in expanding CoorsTek’s global footprint and enhancing its ability to deliver localized, high-performance ceramic technologies

- In February 2023, Sumitomo Heavy Industries (SHI) launched the iM18E, a compact 20-ton hybrid injection molding machine tailored for electronic components suchh as connectors and precision gears. With a footprint 21% smaller than its predecessor, the iM18E integrates a hydraulic direct-pressure clamping system and an electric plasticizing unit powered by a low-inertia servomotor. This hybrid configuration enhances mold venting and precision, reducing shot-to-shot weight variation to one-third of comparable hydraulic machines. Notably, it consumes 50% less energy, making it a sustainable choice for high-precision, small-part molding in electronics manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ceramic Injection Molding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ceramic Injection Molding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ceramic Injection Molding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.