Global Ceramic Tiles Market

Market Size in USD Billion

CAGR :

%

USD

195.20 Billion

USD

337.90 Billion

2024

2032

USD

195.20 Billion

USD

337.90 Billion

2024

2032

| 2025 –2032 | |

| USD 195.20 Billion | |

| USD 337.90 Billion | |

|

|

|

|

Ceramic Tiles Market Size

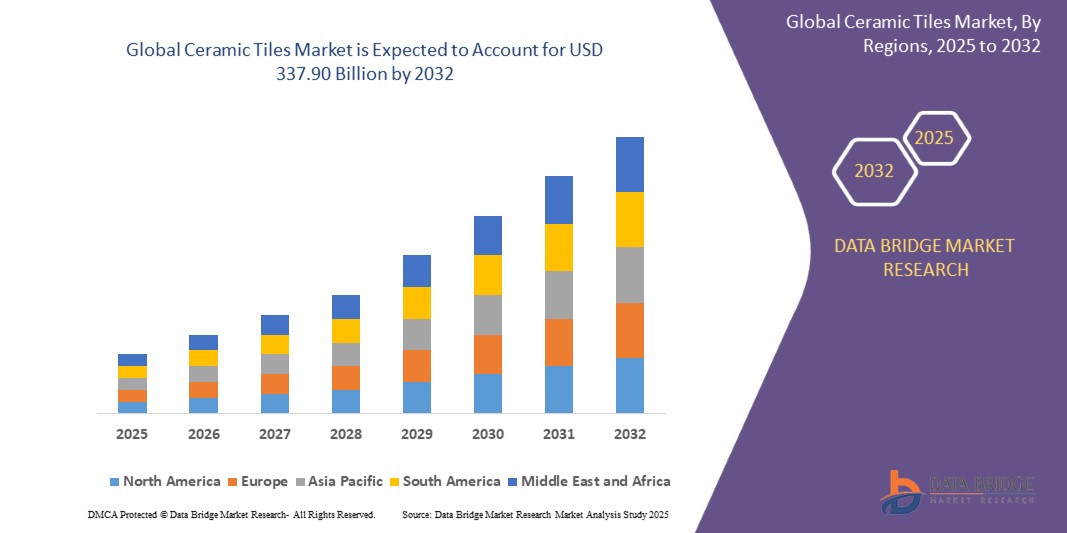

- The global ophthalmic operational microscope market was valued at USD 195.20 billion in 2024 and is expected to reach USD 337.90 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.1%, primarily driven by increasing demand for decorative and durable flooring solutions, urbanization, and growing construction activities

- This growth is driven by factors such as rising disposable incomes, the trend of home renovation and remodeling, increasing demand for sustainable and eco-friendly construction materials, and advancements in ceramic tile manufacturing technologies

Ceramic Tiles Market Analysis

- Ceramic tiles are widely used in residential, commercial, and industrial applications for flooring, walls, and other surface coverings. They are popular due to their durability, aesthetic appeal, and ease of maintenance. Ceramic tiles are used in kitchens, bathrooms, living rooms, and other interior and exterior spaces

- The demand for ceramic tiles is driven by factors such as the growing global construction industry, urbanization, and an increasing focus on home improvement and renovation projects. The rise of eco-friendly and sustainable living trends also boosts the demand for ceramic tiles, as they are available in various eco-friendly options, such as recycled materials and energy-efficient manufacturing processes

- The Asia-Pacific region stands out as the dominant region for ceramic tiles, with countries like China, India, and Indonesia being key contributors to both production and consumption. The region benefits from large-scale manufacturing capabilities, a growing middle class, and increasing construction activities, particularly in urban areas

- For instance, China is the largest producer and consumer of ceramic tiles globally, followed by India, which is witnessing a rising demand for affordable yet high-quality tiles for residential and commercial buildings. The growth of the real estate sector and increased urbanization are key factors contributing to the region's dominance in the market

- Globally, ceramic tiles rank as one of the most essential components in the construction industry, particularly for flooring and wall coverings, and are considered an integral part of both new constructions and renovations. Their ability to offer versatility in design and functionality makes them a staple material for builders and homeowners alike

Report Scope and Ceramic Tiles Market Segmentation

|

Attributes |

Ceramic Tiles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ceramic Tiles Market Trends

“Increased Demand for Eco-Friendly and Sustainable Tiles”

- One prominent trend in the global ceramic tiles market is the growing demand for eco-friendly and sustainable products

- Consumers and manufacturers are increasingly focused on using materials that minimize environmental impact, leading to the development of eco-friendly ceramic tiles. These tiles are produced using sustainable methods, such as recycling waste materials and using non-toxic, energy-efficient processes

- For instance, manufacturers are adopting technologies that reduce water usage and energy consumption during production, while also incorporating recycled content such as glass, porcelain, or ceramic waste in the tiles

- The demand for eco-friendly tiles is also driven by the increasing consumer awareness of sustainability and green building practices, particularly in residential and commercial construction projects

- This trend is revolutionizing the ceramic tiles market, as more consumers opt for environmentally conscious products without compromising on design, quality, or durability. The growing adoption of sustainable ceramic tiles is expected to drive market growth in the coming years, while also aligning with global initiatives to reduce carbon footprints and promote sustainability in the building materials sector

Ceramic Tiles Market Dynamics

Driver

“Growing Demand Due to Urbanization and Infrastructure Development”

- The rising urbanization and ongoing infrastructure development are significantly contributing to the increased demand for ceramic tiles in both residential and commercial construction

- As the global population grows and more people move to urban areas, the demand for new homes, office buildings, and public spaces increases, leading to higher consumption of building materials, including ceramic tiles

- Ceramic tiles are widely used due to their durability, aesthetic appeal, and easy maintenance, making them a popular choice for flooring, walls, and countertops in both residential and commercial properties

- The continuous growth of the construction sector in emerging economies, particularly in countries like India, China, and Brazil, further accelerates the need for ceramic tiles as part of modernizing infrastructure

- The demand for eco-friendly and sustainable ceramic tiles is also rising in urban development projects, aligning with the increasing preference for green building materials in modern construction

For instance,

- In 2022, according to a report published by the International Trade Administration, urbanization trends in Asia-Pacific and Latin America are expected to drive significant demand for ceramic tiles as part of the infrastructure boom in these regions

- In 2023, sustainable architecture trends in Europe and North America, along with government incentives for eco-friendly construction materials, are expected to further contribute to the growth of the ceramic tile market, with a focus on energy-efficient buildings

- As a result of the growing urbanization and infrastructure development, there is a significant increase in the demand for ceramic tiles, ensuring elevated construction standards and creating opportunities for manufacturers to innovate with new designs and sustainable production methods

Opportunity

“Embracing Digitalization and Smart Tiles Technology”

- The growing integration of digitalization and smart technologies presents a significant opportunity for the global ceramic tiles market. The introduction of smart tiles with built-in features such as motion sensors, LED lighting, and temperature control is transforming the traditional tile industry

- Smart ceramic tiles can provide functionalities beyond decoration, such as monitoring and adjusting room temperatures or controlling lighting. These tiles can also be integrated with home automation systems, creating more interactive and energy-efficient living spaces

- The use of IoT (Internet of Things) technology allows for the connection of smart tiles to other home devices, offering increased control and convenience for homeowners and building occupants. This integration can also improve energy management and resource efficiency, appealing to consumers who are increasingly prioritizing sustainability

- Moreover, digital printing technologies are revolutionizing tile design, enabling manufacturers to create highly customized and intricate patterns, textures, and colors. This provides opportunities for greater design innovation and personalization in both residential and commercial spaces

For instance,

- The integration of smart home technology and advanced manufacturing processes in the ceramic tiles industry is expected to drive market growth, with manufacturers focusing on creating innovative, high-tech tiles that offer both aesthetic appeal and practical functionality

- In 2023, digital printing advancements in the ceramic tiles market allowed companies to produce customized designs with greater precision and lower costs, meeting the rising demand for unique, personalized interiors

- The shift towards digitalization and smart tile solutions opens new avenues for growth in the ceramic tile market, as these technologies provide consumers with advanced features, improved energy efficiency, and enhanced interactivity, creating a competitive advantage for manufacturers. The demand for smart tiles is expected to grow, particularly in modern urban developments and smart homes, where technology and sustainability are key priorities

Restraint/Challenge

“High Production Costs Limiting Market Accessibility”

- The high production costs of ceramic tiles pose a significant challenge for the market, particularly affecting the pricing and affordability of tiles, especially in developing regions or low-budget construction projects

- The production of ceramic tiles involves the use of raw materials, advanced machinery, and energy-intensive processes, which contribute to the overall high costs. Additionally, the development of eco-friendly or smart ceramic tiles often requires specialized production techniques and higher material costs, further increasing the price

- This substantial financial burden can deter small construction companies or homeowners with limited budgets from investing in premium ceramic tiles or upgrading their existing materials, leading to reliance on cheaper, lower-quality alternatives

For instance,

- In January 2025, according to an article published by the Ceramic Industry Magazine, one of the main concerns surrounding the high production costs of ceramic tiles is its potential impact on construction affordability and market accessibility. The rising costs of raw materials, coupled with the demand for high-quality finishes and innovative designs, add to the overall financial barrier, limiting access to premium tiles, especially in developing markets

- Consequently, these limitations can result in disparities in the quality of materials used in construction and market penetration, ultimately hindering the overall growth of the ceramic tile market, particularly in cost-sensitive regions

Ceramic Tiles Market Scope

The market is segmented on the basis raw Material, product type, formulation, tile features, application, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By Raw Material |

|

|

By Product Type |

|

|

By Formulation |

|

|

By Tile Features |

|

|

By Application |

|

|

By End-Use |

|

Ceramic Tiles Market Regional Analysis

“North America is the Dominant Region in the Ceramic Tiles Market”

- North America dominates the ceramic tiles market, driven by strong construction activity, high demand for premium flooring solutions, and the presence of leading tile manufacturers

- The U.S. holds a significant share due to the growing trend of home renovations, increasing demand for durable and aesthetically appealing flooring options, and advancements in tile manufacturing technologies

- The availability of well-established distribution networks, rising adoption of eco-friendly tiles, and supportive government policies promoting sustainable building materials further strengthen the market

- In addition, the increasing number of commercial and residential construction projects, along with a high rate of adoption of digital printing technologies for customized tile designs, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the ceramic tiles market, driven by rapid urbanization, booming construction activities, and increasing demand for affordable and aesthetically appealing building materials

- Countries such as China, India, and Japan are emerging as key markets due to the rising population, growing disposable incomes, and expanding infrastructure development in both residential and commercial sectors

- Japan, with its advanced manufacturing technology and increasing preference for high-quality, innovative tiles, remains a crucial market for premium ceramic tiles. The country continues to lead in the adoption of digitally printed and eco-friendly tile solutions to enhance modern architecture

- China and India, with their large-scale construction projects and government initiatives promoting smart cities and sustainable housing, are witnessing increased investments from global ceramic tile manufacturers. The expanding presence of international brands, coupled with improving accessibility to high-quality and affordable tiles, further contributes to market growth

Ceramic Tiles Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Corona Vitrified (India)

- Cersanit (Poland)

- Johnson Tiles (India)

- Kajaria Ceramics Limited (India)

- Koninklijke Mosa bv (Netherlands)

- RAK CERAMICS (UAE)

- MOHAWK INDUSTRIES, INC. (U.S.)

- Grupo Lamosa (Mexico)

- Cerâmica Carmelo Fior (Brazil)

- CERAMICHE ATLAS CONCORDE S.P.A. (Italy)

- Florim Ceramiche S.P.A. (Italy)

- GranitiFiandre S.p.A. (Italy)

- Grupo Fragnani (Brazil)

- PAMESA CERÁMICA S.L. (Spain)

- Saudi Ceramics (Saudi Arabia)

- PORCELANOSA Grupo A.I.E. (Spain)

- Crossville Inc. (U.S.)

- LIXIL Group Corporation (Japan)

- Dongpeng (China)

- Nitco Tiles (India)

- China Ceramics Co., Ltd. (China)

- Lasselsberger (Austria)

- Daltile (U.S.)

- Newpearl (China)

Latest Developments in Global Ceramic Tiles Market

- In February 2023, Kajaria Ceramics Limited, India's largest ceramic tile manufacturer, unveiled its latest line of products at the UPITEX show in Lucknow, India. This launch reflects the company's ongoing efforts to innovate and cater to evolving consumer preferences in the ceramic tiles market

- In February, 2023, RAK Ceramics, based in the UAE, announced a USD 14 million investment to upgrade its sanitaryware production line. The goal is to achieve savings in energy consumption and reduce carbon emissions, aligning with the company's commitment to sustainability and operational efficienc

- In June 2022, Mohawk Industries, Inc., a leading U.S.-based flooring manufacturer, agreed to acquire the Vitromex ceramic tile business from Grupo Industrial Saltillo (GIS) for approximately USD 293 million. Vitromex, established in 1967, operates four manufacturing plants in Mexico. This acquisition aims to enhance Mohawk's client base, manufacturing efficiencies, and logistical capabilities in conjunction with its existing operations

- In August 2021, Grupo Lamosa, a prominent Mexican ceramic tile manufacturer, announced the acquisition of Grupo Roca’s tile division. Grupo Roca operates in Spain and the Americas. This strategic move is part of Grupo Lamosa's growth and diversification strategy, reinforcing its position in the Americas, including entry into the Brazilian market and increased presence in the U.S., while also expanding its footprint in Europe

- In September 2021, Pamesa Ceramica acquired Azuliber, a major tile manufacturer operating six factories—Cerámicas Myr, Azulejera Alcorense, Click Cerámica, Valentia Ceramics, Oset, and Azulejos Plaza. These facilities house 12 kilns, collectively producing 3 million square meters of tiles per month, amounting to an annual output of 36 million square meters

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.