Global Cereals And Grain Seed Market

Market Size in USD Million

CAGR :

%

USD

57.39 Million

USD

102.36 Million

2025

2033

USD

57.39 Million

USD

102.36 Million

2025

2033

| 2026 –2033 | |

| USD 57.39 Million | |

| USD 102.36 Million | |

|

|

|

|

What is the Global Cereals and Grain Seed Market Size and Growth Rate?

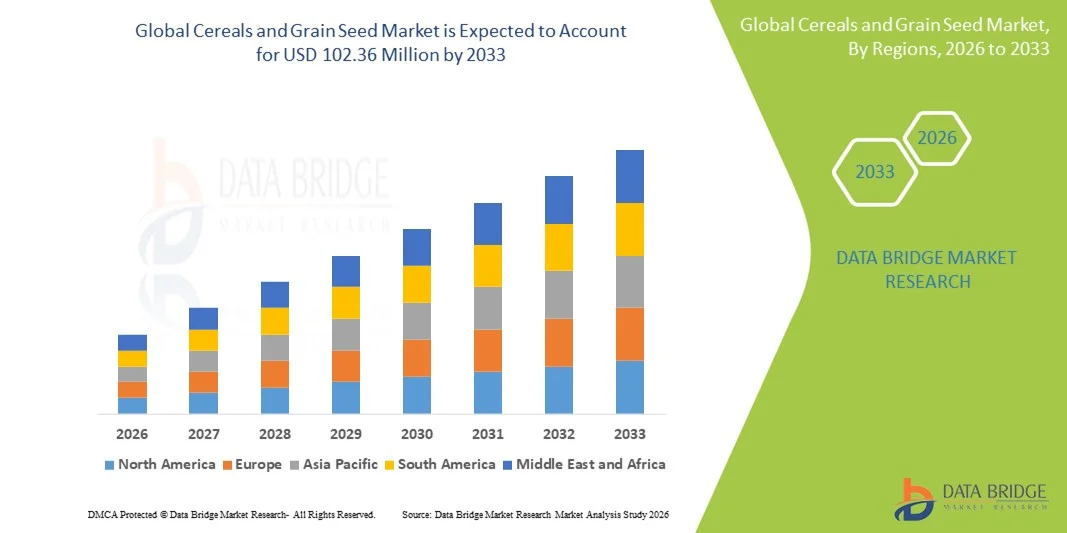

- The global cereals and grain seed market size was valued at USD 57.39 million in 2025 and is expected to reach USD 102.36 million by 2033, at a CAGR of 7.50% during the forecast period

- Increasing demand for natural cereals and growing number of suppliers, rising levels of disposable income of the people, increasing consumption of oats as it offers various health benefits, rapid urbanization along with high population growth, high demand for protein meals, rise in the seed replacement rate are some of the major as well as vital factors which will likely to augment the growth of the cereals and grain seed market

What are the Major Takeaways of Cereals and Grain Seed Market?

- Increasing demand for healthy and organic processed products, molecular breeding in seeds along with rising number of private public partnership in varietal development which will further contribute by generating massive opportunities that will lead to the growth of the cereals and grain seed market

- Volatility in the prices of seeds along with rising impact of climate change on crop production which will likely to act as market restraint factor for the growth of the cereals and grain seed

- Asia-Pacific dominated the cereals and grain seed market with a 42.8% revenue share in 2025, supported by large-scale rice, wheat, and maize cultivation across China, India, Japan, and Southeast Asian countries. Strong agricultural infrastructure, high seed replacement rates, and rising demand for high-yield hybrid and genetically modified varieties drive regional leadership

- North America is projected to record the fastest CAGR of 9.5% from 2026 to 2033, owing to rising adoption of high-quality, genetically modified, and trait-enhanced seeds across large-scale commercial farms in the U.S. and Canada

- The Maize (Corn) segment dominated the market with a revenue share of 38.6% in 2025, driven by its extensive use in food processing, animal feed, biofuel production, and nutraceutical formulation

Report Scope and Cereals and Grain Seed Market Segmentation

|

Attributes |

Cereals and Grain Seed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cereals and Grain Seed Market?

Growing Focus on Functional Foods and Nutraceutical Applications

- The cereals and grain seed market is experiencing a major trend toward the integration of cereal-based ingredients into functional foods, nutraceuticals, and dietary supplements, driven by rising global health consciousness and demand for natural bioactive compounds. Cereals such as oats, barley, sorghum, millet, and quinoa offer antioxidant, fiber-rich, anti-inflammatory, and cholesterol-lowering benefits, making them highly sought after for preventive nutrition

- For instance, Kellogg’s and Nestlé Health Science have expanded their fortified cereal product lines enriched with beta-glucans, micronutrients, and whole-grain extracts to support heart health and metabolic wellness

- The rising prevalence of lifestyle diseases—including cardiovascular disorders, obesity, diabetes, and digestive ailments—is accelerating the demand for cereal-based functional ingredients that support gut health, weight management, and immune function

- Food and beverage manufacturers are developing high-fiber cereals, granola bars, instant porridges, protein blends, and fortified beverages enriched with grain-derived nutrients to meet demand for natural health-oriented foods

- Increased research on the bioavailability, prebiotic properties, and functional synergy of cereal components such as beta-glucans, lignans, and resistant starches is fueling innovation across the nutraceutical landscape

- As consumers increasingly prefer plant-based, clean-label, whole-grain-rich diets, Cereals and Grain Seeds will remain central to the development of functional foods and modern nutritional formulations

What are the Key Drivers of Cereals and Grain Seed Market?

- Rising awareness about the nutritional benefits of Cereals and Grain Seeds—including high fiber content, essential amino acids, antioxidants, and minerals—is a major growth driver of the market, especially in health-oriented and vegan consumer groups

- For instance, in 2025, Ardent Mills and Bunge expanded production of specialty grains such as ancient grains, quinoa, and high-protein wheat varieties to support the fast-growing functional food and bakery industries

- The demand for natural, plant-based, organic, and clean-label ingredients in food, beverage, and nutraceutical products is boosting adoption across both developed and emerging regions

- Technological advancements in seed breeding, hybrid cereal development, bio-fortification, and precision agriculture are resulting in higher yields, enhanced nutritional profiles, and greater climate resilience of cereal crop

- Rapid adoption of cereal-based ingredients in preventive healthcare, nutraceuticals, dietary supplements, and sports nutrition is further strengthening market demand across Asia-Pacific, North America, and Europe

- With increasing investment in R&D, functional ingredient innovation, and health-driven consumer trends, the global Cereals and Grain Seed market is expected to maintain strong growth momentum in the coming years

Which Factor is Challenging the Growth of the Cereals and Grain Seed Market?

- High production costs associated with premium grains, hybrid seeds, and specialty cereals, along with climate-related challenges, limit large-scale adoption of Cereals and Grain Seeds in cost-sensitive markets

- For instance, fluctuations in global supply of oats, wheat, sorghum, and millet during 2024–2025 impacted production volumes of premium grain ingredients used in bakery and nutraceutical applications

- Stringent regulations surrounding GM seeds, grain fortification standards, and food safety compliance create barriers for manufacturers and increase overall operational costs

- Limited consumer awareness in rural and emerging markets regarding the health benefits of whole grains and functional cereals slows market penetration, particularly for specialty and fortified grain products

- Competition from other plant-based bioactives—including protein isolates, legumes, pulses, and botanical extracts—adds pricing pressure and affects ingredient adoption across industries

- To overcome these challenges, market players are investing in advanced seed technologies, climate-resilient grain varieties, supply chain optimization, and targeted marketing to ensure stable, high-quality, and affordable cereal ingredient production

How is the Cereals and Grain Seed Market Segmented?

The market is segmented on the basis of crop type, type, treatment, and trait.

- By Crop Type

On the basis of crop type, the cereals and grain seed market is segmented into Rice, Wheat, Maize (Corn), Sorghum, and Other Crop Types. The Maize (Corn) segment dominated the market with a revenue share of 38.6% in 2025, driven by its extensive use in food processing, animal feed, biofuel production, and nutraceutical formulation. High global cultivation rates, hybrid seed availability, and strong demand from feed and ethanol industries contribute to the dominance of maize seed varieties.

The Sorghum segment is projected to grow at the fastest CAGR during 2026–2033, fueled by rising adoption in gluten-free foods, health beverages, and high-fiber functional products. Growing consumer preference for ancient grains, improving sorghum seed breeding technologies, and increasing use in climate-resilient agriculture further propel segment growth. Strong R&D investments in high-yield and drought-tolerant sorghum varieties are expected to support long-term expansion across global food and feed applications.

- By Type

Based on type, the cereals and grain seed market is categorized into Conventional and Genetically Modified seeds. The Conventional segment dominated the market with a revenue share of 57.4% in 2025, primarily due to its widespread acceptance in both developed and developing regions, lower regulatory complexities, and strong demand from organic and clean-label food industries. Conventional seeds are widely preferred among small and medium farmers, especially in regions with limited access to biotech crop approvals.

The Genetically Modified (GM) segment is expected to register the fastest CAGR from 2026 to 2033, driven by the increasing global adoption of high-yield, pest-resistant, and climate-resilient crop varieties. The rising need to address food security, reduce crop losses, and enhance productivity in regions facing climatic stress is accelerating GM seed adoption. Continuous advancements in biotechnology, gene-editing, and precision breeding are expected to boost the uptake of genetically modified cereal seeds across major agricultural economies.

- By Treatment

On the basis of treatment, the market is segmented into Treated and Non-Treated seeds. The Treated seed segment dominated the market with a revenue share of 61.2% in 2025, driven by increasing use of seed coatings, fungicides, insecticides, micronutrients, and biological treatments that enhance germination rates, improve crop resilience, and ensure higher productivity. Treated seeds are extensively adopted for large-scale commercial farming, where uniformity, disease resistance, and enhanced crop performance are critical.

The Non-Treated segment is expected to grow at the fastest CAGR during 2026–2033, supported by rising demand for organic farming, chemical-free agricultural inputs, and sustainable crop production practices. Increasing consumer preference for organic and non-GMO food products is further driving adoption. The shift toward eco-friendly seed enhancement technologies, including microbial inoculants and bio-based coatings, is expected to support long-term growth of this segment across global markets.

- By Trait

Based on trait, the cereals and grain seed market is segmented into Herbicide Tolerant, Insect Resistant, and Other Traits. The Herbicide Tolerant segment dominated the market with a revenue share of 44.9% in 2025, attributed to its growing adoption in large-scale commercial farming to enable efficient weed control and improve crop yield. These traits help reduce labor costs, enhance productivity, and support sustainable farming practices in major cereal-growing regions.

The Insect Resistant segment is projected to grow at the fastest CAGR between 2026 and 2033, driven by increasing pest challenges, climate change impacts, and rising demand for seeds that reduce dependency on chemical pesticides. Growing regulatory support for integrated pest management (IPM) and advancements in gene-editing technologies further promote segment growth. Continuous R&D investment in pest-resistant hybrid seeds is expected to strengthen adoption across global agricultural markets.

Which Region Holds the Largest Share of the Cereals and Grain Seed Market?

- Asia-Pacific dominated the cereals and grain seed market with a 42.8% revenue share in 2025, supported by large-scale rice, wheat, and maize cultivation across China, India, Japan, and Southeast Asian countries. Strong agricultural infrastructure, high seed replacement rates, and rising demand for high-yield hybrid and genetically modified varieties drive regional leadership

- Governments are investing in modern agronomy practices, precision farming, and certified seed distribution networks to improve productivity and enhance food security. These initiatives, combined with the growing adoption of treated and trait-enhanced seeds, strengthen Asia-Pacific’s dominance

- Rapid population growth, increasing mechanization, and the expansion of commercial farming also contribute to rising demand for high-quality cereal and grain seeds across the region

China Cereals and Grain Seed Market Insight

China is the largest contributor to the Asia-Pacific Cereals and Grain Seed market, driven by extensive rice and wheat cultivation, large-scale hybrid seed adoption, and government programs promoting high-yield varieties. Investments in biotechnology, seed R&D, and precision farming technologies support China's leadership in both domestic consumption and seed export capacity.

India Cereals and Grain Seed Market Insight

India is emerging as a key contributor, supported by strong demand for high-yield and climate-resilient rice, wheat, and maize seeds. Government initiatives such as “Make in India,” along with subsidies for certified seeds and mechanized agriculture, are boosting adoption. Expanding agritech startups and improved supply chains further strengthen India’s position.

North America Cereals and Grain Seed Market Insight

North America is projected to record the fastest CAGR of 9.5% from 2026 to 2033, owing to rising adoption of high-quality, genetically modified, and trait-enhanced seeds across large-scale commercial farms in the U.S. and Canada. Growing focus on crop resilience, high productivity, drought tolerance, and pest-resistant varieties is fueling market expansion. Advanced biotechnology research, seed innovation capabilities, and mechanized agricultural operations further accelerate regional growth.

U.S. Cereals and Grain Seed Market Insight

The U.S. is the largest market in North America, driven by strong corn and wheat production, widespread acceptance of genetically modified and herbicide-tolerant seeds, and advanced agronomic practices. Seed manufacturers are focusing on high-yield hybrids, climate-resilient varieties, and treated seeds to support farm productivity and sustainability goals.

Canada Cereals and Grain Seed Market Insight

Canada contributes steadily, supported by strong wheat and barley cultivation, increasing adoption of hybrid seeds, and government-backed agricultural innovation programs. Research institutions and seed companies are collaborating on climate-resilient, pest-resistant, and high-nutrient grain varieties to support sustainable farming across diverse agro-climatic zones.

Europe Cereals and Grain Seed Market Insight

Europe holds a significant share of the global market, driven by strong demand for certified seeds, sustainable crop production, and advanced agronomic practices across Germany, the U.K., France, and the Netherlands. Increasing focus on high-quality cereal varieties, precision agriculture, and eco-friendly farming methods supports regional adoption.

Germany Cereals and Grain Seed Market Insight

Germany leads the European market owing to its strong agricultural infrastructure, high seed replacement rates, and growing adoption of premium-quality wheat, barley, and maize seeds. Investments in R&D, trait-enhanced varieties, and sustainable crop technologies further strengthen Germany’s market position.

U.K. Cereals and Grain Seed Market Insight

The U.K. market is expanding steadily, supported by rising demand for advanced cereal seed varieties, increasing adoption of hybrid and treated seeds, and strong emphasis on food security. Manufacturers are focusing on improving crop yield, disease resistance, and climate adaptability to meet growing production needs.

Which are the Top Companies in Cereals and Grain Seed Market?

The cereals and grain seed industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta Crop Protection AG (Switzerland)

- KWS SAAT SE & Co. KGaA (Germany)

- Corteva Inc. (U.S.) Wikipedia

- Land O'Lakes, Inc. (U.S.)

- Limagrain (France)

- UPL (India)

- DLF (Denmark)

- Rallis India Limited (India)

- TAKII & CO., LTD. (Japan)

- Barenbrug South Africa (Pty) Ltd (South Africa)

- FMC Corporation (U.S.)

- Allied Seed, LLC (U.S.)

- IMPERIAL SEED (U.K.)

- Mahyco (India)

- TNAU (India)

- BRETTYOUNG (Canada)

- Rasi Seeds (P) Ltd. (India)

- CN Seeds (Canada)

What are the Recent Developments in Global Cereals and Grain Seed Market?

- In September 2025, Valley Seeds rolled out two new wheat varieties, Limpopo and Zambezi, in Kwekwe, aiming to reduce Zimbabwe’s wheat import dependency for bread production. Early harvest results from DCK Farms showed strong performance, averaging 6.5–7 metric tons/ha, highlighting enhanced productivity and baking quality. This development is expected to significantly strengthen domestic wheat output and improve farmer profitability

- In July 2025, BASF and the Malaysian Agricultural Research and Development Institute (MARDI) introduced two Clearfield rice varieties, MR-CL3 and MR-CL4, in Malaysia, offering improved weed control and higher yield potential for sustainable rice cultivation. This launch is anticipated to boost Malaysia’s rice productivity and support long-term agricultural sustainability

- In October 2024, Nuziveedu Seeds released NWS-2214 Kanak, a new wheat variety for Rabi 2024, featuring high yield potential, strong disease resistance, and superior grain quality to benefit wheat growers in India. This variety is expected to enhance wheat productivity and increase farmer income across key cultivation regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.