Global Cereals Grains Crop Oil Concentrates Market

Market Size in USD Billion

CAGR :

%

USD

38.50 Billion

USD

56.02 Billion

2025

2033

USD

38.50 Billion

USD

56.02 Billion

2025

2033

| 2026 –2033 | |

| USD 38.50 Billion | |

| USD 56.02 Billion | |

|

|

|

|

Cereals and Grains Crop Oil Concentrates Market Size

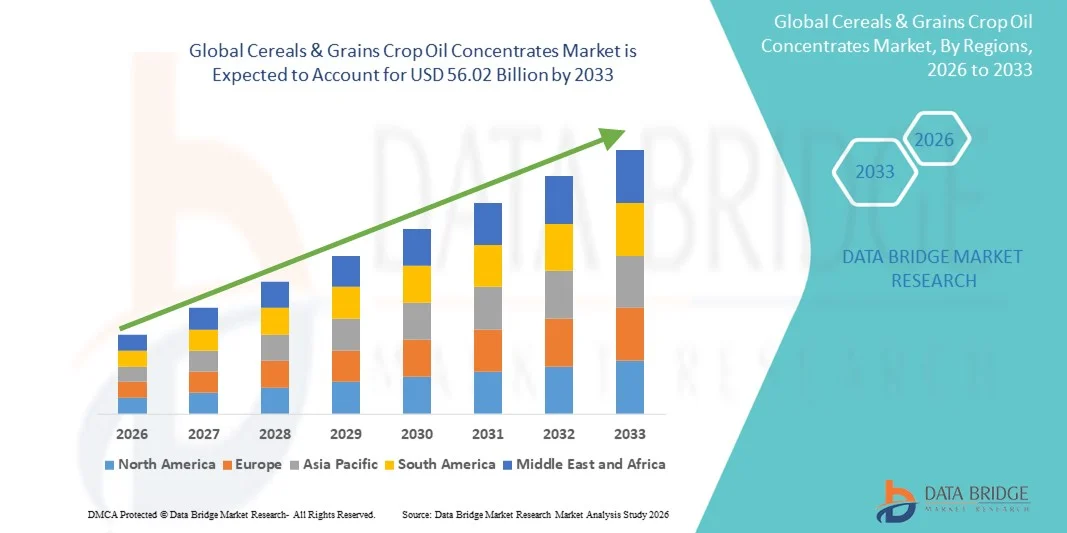

- The global cereals & grains crop oil concentrates market size was valued at USD 38.50 billion in 2025 and is expected to reach USD 56.02 billion by 2033, at a CAGR of4.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced agricultural inputs and technological progress in crop protection practices, leading to improved pest management, enhanced crop health, and higher yield efficiency across cereal and grain cultivation

- Furthermore, rising farmer awareness regarding cost-effective, eco-friendly, and performance-enhancing agrochemical solutions, along with the growing need for better spray coverage and efficacy, is establishing crop oil concentrates as a preferred adjuvant in cereals and grains farming. These converging factors are accelerating the uptake of Cereals & Grains Crop Oil Concentrates solutions, thereby significantly boosting the industry's growth

Cereals & Grains Crop Oil Concentrates Market Analysis

- Cereals & Grains Crop Oil Concentrates, used as spray adjuvants to improve the performance of herbicides, insecticides, and fungicides, are becoming increasingly essential components of modern crop protection programs in cereal and grain farming due to their ability to enhance spray coverage, penetration, and overall efficacy

- The escalating demand for crop oil concentrates is primarily fueled by the rising adoption of advanced agricultural practices, increasing focus on yield optimization, growing awareness of effective pest and weed control, and a preference for cost-efficient solutions that improve agrochemical performance

- North America dominated the cereals & grains crop oil concentrates market with the largest revenue share of approximately 37.4% in 2025, supported by large-scale commercial farming, high usage of crop protection chemicals, advanced agricultural infrastructure, and strong presence of major agrochemical manufacturers, with the U.S. witnessing substantial demand across corn, wheat, and soybean cultivation

- Asia-Pacific is expected to be the fastest-growing region in the cereals & grains crop oil concentrates market during the forecast period due to expanding agricultural activities, increasing food demand, rising adoption of modern farming inputs, and government initiatives supporting crop productivity

- The herbicides segment dominated the largest market revenue share of 46.8% in 2025, driven by the extensive use of herbicides in cereal and grain farming to control broadleaf weeds and grasses that significantly reduce crop yield

Report Scope and Cereals & Grains Crop Oil Concentrates Market Segmentation

|

Attributes |

Cereals & Grains Crop Oil Concentrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Corteva Agriscience (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cereals & Grains Crop Oil Concentrates Market Trends

Rising Adoption of Crop-Specific Oil Concentrates for Enhanced Yield Protection

- A significant and accelerating trend in the global cereals & grains crop oil concentrates market is the increasing use of crop-specific oil concentrate formulations designed to improve the effectiveness of agrochemicals applied to cereals and grains. These concentrates are widely used to enhance spray coverage, penetration, and adhesion on crop surfaces, thereby improving overall crop protection outcomes

- For instance, farmers across North America, Europe, and Asia-Pacific are increasingly incorporating crop oil concentrates in herbicide and pesticide applications to improve weed control efficiency in cereal crops such as wheat, corn, rice, and barley

- Advancements in formulation technologies have led to the development of more refined oil concentrates derived from vegetable oils and petroleum-based sources, offering improved compatibility with a wide range of agrochemicals while minimizing crop stress

- Furthermore, the growing emphasis on precision agriculture practices globally is driving the adoption of oil concentrates that support uniform spray distribution and reduce chemical runoff, helping farmers optimize input usage and enhance crop productivity

- This trend toward more efficient and targeted crop protection solutions is reshaping agronomic practices worldwide, positioning crop oil concentrates as an essential component in modern cereal and grain farming systems

- The increasing demand for higher crop yields to support global food security is further reinforcing the adoption of oil concentrate solutions across both large-scale commercial farms and smallholder agricultural operations

Cereals & Grains Crop Oil Concentrates Market Dynamics

Driver

Growing Global Demand for High Crop Productivity and Efficient Agrochemical Performance

- The rising global demand for cereals and grains, driven by population growth, changing dietary patterns, and expanding use in animal feed and biofuels, is a key driver for the Cereals & Grains Crop Oil Concentrates market

- For instance, increased cereal production targets in regions such as Asia-Pacific and Latin America have encouraged farmers to adopt adjuvants, including crop oil concentrates, to maximize the performance of herbicides and fungicides under varying climatic conditions

- Crop oil concentrates help improve agrochemical absorption and reduce evaporation losses, enabling farmers to achieve better pest and weed control with optimized chemical application rates

- Furthermore, the expansion of mechanized farming and modern crop management practices worldwide is supporting the consistent use of spray adjuvants, particularly in large-scale cereal cultivation

- The need to reduce overall input costs while maintaining high yields is driving growers to adopt crop oil concentrates as a cost-effective solution to enhance agrochemical efficiency across diverse agricultural regions

Restraint/Challenge

Environmental Concerns and Crop Sensitivity Risks

- Despite their benefits, the cereals & grains crop oil concentrates market faces challenges related to environmental concerns and potential crop sensitivity when products are improperly formulated or applied at incorrect rates. Excessive use of oil concentrates can lead to phytotoxicity, especially under high-temperature or drought-stressed conditions

- For instance, improper application of oil concentrates during sensitive growth stages of cereal crops has, in some cases, resulted in leaf burn or reduced crop vigor, making some farmers cautious about widespread usage

- In addition, increasing regulatory scrutiny on agricultural inputs, particularly in Europe and parts of North America, is placing pressure on manufacturers to develop environmentally friendly and biodegradable formulations

- The lack of adequate farmer awareness and training in certain developing regions can also limit adoption, as misuse may negatively impact crop performance rather than improve it

- Overcoming these challenges through improved farmer education, clearer usage guidelines, and continued innovation in sustainable oil concentrate formulations will be critical for ensuring long-term market growth and wider global acceptance

Cereals & Grains Crop Oil Concentrates Market Scope

The market is segmented on the basis of application and surfactant concentration.

- By Application

On the basis of application, the Global Cereals & Grains Crop Oil Concentrates market is segmented into herbicides, insecticides, and fungicides. The herbicides segment dominated the largest market revenue share of 46.8% in 2025, driven by the extensive use of herbicides in cereal and grain farming to control broadleaf weeds and grasses that significantly reduce crop yield. Crop oil concentrates are widely used with post-emergent herbicides to improve spray retention, penetration, and efficacy, particularly in large-scale wheat, corn, and rice cultivation. The rising adoption of no-till and conservation agriculture practices further supports demand for herbicide adjuvants. Increasing weed resistance issues have also led farmers to rely on enhanced formulations, boosting the use of crop oil concentrates. Strong demand from commercial farming operations and government-supported crop protection programs reinforces this dominance.

The insecticides segment is expected to witness the fastest CAGR of 6.9% from 2026 to 2033, driven by increasing pest pressure due to climate variability and rising incidences of insect infestations in cereal crops. Crop oil concentrates enhance insecticide spreadability and leaf coverage, improving pest control efficiency. Growth is further supported by expanding integrated pest management practices and increasing adoption in developing agricultural economies. Rising awareness among farmers about improving insecticide performance is accelerating this segment’s growth globally.

- By Surfactant Concentration

On the basis of surfactant concentration, the Global Cereals & Grains Crop Oil Concentrates market is segmented into less than 15%, between 15% and 25%, and more than 25%. The between 15% and 25% segment accounted for the largest market revenue share of 44.1% in 2025, owing to its balanced formulation that offers optimal wetting, spreading, and penetration without causing phytotoxicity. This concentration range is widely preferred for cereal and grain applications because it provides effective compatibility with herbicides, insecticides, and fungicides. Farmers favor these formulations for their consistent performance across different climatic conditions and crop stages. Additionally, regulatory compliance and reduced crop damage risks make mid-range surfactant concentrations the standard choice for commercial agricultural use. Strong demand from large farming operations and agrochemical distributors further supports this segment’s dominance.

The more than 25% surfactant concentration segment is projected to grow at the fastest CAGR of 7.4% from 2026 to 2033, driven by rising demand for high-performance adjuvants in challenging weed and pest conditions. These high-concentration formulations are increasingly used in resistant weed management and low-volume spray applications. Growth is supported by advanced farming practices, precision agriculture, and increasing adoption of concentrated agrochemical formulations. Expanding use in high-value cereal crops and commercial farming is accelerating market expansion for this segment.

Cereals & Grains Crop Oil Concentrates Market Regional Analysis

- North America dominated the cereals & grains crop oil concentrates market with the largest revenue share of approximately 37.4% in 2025, supported by large-scale commercial farming operations, high usage of crop protection chemicals, advanced agricultural infrastructure, and the strong presence of major agrochemical manufacturers. The region’s focus on improving crop yield and spray efficiency has significantly driven the adoption of crop oil concentrates across cereal and grain cultivation

- Farmers in the region highly value the role of crop oil concentrates in enhancing pesticide performance, improving spray coverage, and increasing the effectiveness of herbicides and insecticides in cereals and grains such as corn, wheat, and barley

- This widespread adoption is further supported by high mechanization levels, strong awareness of modern farming inputs, and a growing emphasis on precision agriculture, establishing crop oil concentrates as a preferred adjuvant solution across large commercial farms

U.S. Cereals & Grains Crop Oil Concentrates Market Insight

The U.S. cereals & grains crop oil concentrates market accounted for the largest share within North America in 2025, driven by extensive cultivation of corn, wheat, and soybeans and the widespread application of agrochemicals. Strong adoption of advanced farming practices, coupled with increasing focus on maximizing crop productivity and input efficiency, continues to support market growth. Additionally, the presence of leading agrochemical companies and ongoing innovation in formulation technologies further strengthens demand across U.S. farms.

Europe Cereals & Grains Crop Oil Concentrates Market Insight

The Europe cereals & grains crop oil concentrates market is expected to grow at a steady CAGR during the forecast period, driven by increasing emphasis on sustainable agriculture and optimized agrochemical usage. Regulatory focus on efficient pesticide application and reduced chemical wastage is encouraging the adoption of crop oil concentrates across cereal and grain farming. Growth is observed across both Western and Eastern Europe, supported by modernization of agricultural practices.

U.K. Cereals & Grains Crop Oil Concentrates Market Insight

The U.K. cereals & grains crop oil concentrates market is anticipated to register moderate growth over the forecast period, supported by strong cereal production, particularly wheat and barley. Increasing awareness among farmers regarding spray adjuvants that improve agrochemical efficacy and reduce overall chemical usage is contributing to market expansion.

Germany Cereals & Grains Crop Oil Concentrates Market Insight

The Germany cereals & grains crop oil concentrates market is projected to expand steadily, driven by advanced agricultural practices, high mechanization, and a strong focus on efficiency and sustainability. German farmers increasingly adopt crop oil concentrates to enhance the performance of crop protection products while complying with strict environmental regulations.

Asia-Pacific Cereals & Grains Crop Oil Concentrates Market Insight

The Asia-Pacific cereals & grains crop oil concentrates market is expected to grow at the fastest CAGR during the forecast period, driven by expanding agricultural activities, rising food demand, and increasing adoption of modern farming inputs. Government initiatives supporting crop productivity and yield improvement, particularly in developing economies, are accelerating the use of crop oil concentrates across cereal and grain farming.

Japan Cereals & Grains Crop Oil Concentrates Market Insight

The Japan cereals & grains crop oil concentrates market is witnessing gradual growth due to the adoption of precision farming practices and the need to maximize yields from limited arable land. Japanese farmers increasingly utilize crop oil concentrates to improve the effectiveness of agrochemicals in rice and grain cultivation while minimizing input waste.

China Cereals & Grains Crop Oil Concentrates Market Insight

The China cereals & grains crop oil concentrates market held the largest revenue share in Asia-Pacific in 2025, driven by large-scale cereal production, rapid modernization of agriculture, and strong government support for improving crop productivity. Rising adoption of advanced agrochemical formulations and increasing awareness of adjuvant benefits among farmers continue to propel market growth across major grain-producing regions.

Cereals & Grains Crop Oil Concentrates Market Share

The Cereals & Grains Crop Oil Concentrates industry is primarily led by well-established companies, including:

• Corteva Agriscience (U.S.)

• BASF SE (Germany)

• Bayer AG (Germany)

• Syngenta Group (Switzerland)

• UPL Limited (India)

• FMC Corporation (U.S.)

• ADAMA Agricultural Solutions (Israel)

• Nufarm Limited (Australia)

• Croda International Plc (U.K.)

• Wilbur-Ellis Company (U.S.)

• Helena Agri-Enterprises (U.S.)

• WinField United (U.S.)

• Brandt Consolidated (U.S.)

• Stepan Company (U.S.)

• KAO Corporation (Japan)

• Solvay S.A. (Belgium)

• Arkema S.A. (France)

• Clariant AG (Switzerland)

• Evonik Industries (Germany)

• Nouryon (Netherlands)

Latest Developments in Global Cereals & Grains Crop Oil Concentrates Market

- In April 2025, Nouryon (Netherlands) announced the launch of its advanced crop oil concentrate Adsee Flex 960 in the United States and key European markets, designed to improve herbicide efficacy and spray retention in cereal and grain crops. The product focuses on enhanced spreading, adhesion, and rainfastness, supporting precision agriculture practices. This launch highlights Nouryon’s continued investment in sustainable agricultural adjuvants for large-scale grain production

- In September 2024, Wilbur-Ellis (United States) introduced a biodegradable crop oil concentrate specifically formulated for cereal and grain applications across North America. The new formulation improves compatibility with herbicides and fungicides while addressing increasing regulatory and environmental concerns. This development strengthens Wilbur-Ellis’ portfolio in sustainable crop input solutions

- In June 2024, BASF SE (Germany) expanded its crop oil concentrate product line in Europe with a new high-performance adjuvant aimed at herbicide and fungicide applications in wheat and barley cultivation. The product enhances active ingredient uptake and reduces spray drift, aligning with stricter European Union agricultural regulations

- In March 2024, Syngenta Group (Switzerland) announced the rollout of upgraded crop oil concentrate adjuvants across Latin America, particularly in Brazil and Argentina, targeting large-scale cereal and grain farming systems. These formulations are optimized for tank-mix compatibility and improved pest control efficiency, supporting higher crop yield

- In January 2024, UPL Ltd. (India) strengthened its crop protection portfolio used alongside crop oil concentrates by acquiring fungicide assets from Corteva Agriscience in multiple global markets. This strategic move enhanced UPL’s integrated crop protection offerings for cereals and grains, indirectly driving demand for compatible crop oil concentrates

- In October 2023, Croda International Plc (United Kingdom) expanded its agricultural adjuvants manufacturing capacity in Europe to meet rising demand for crop oil concentrates used in cereal and grain crop protection. The expansion supports increased production of high-purity surfactants and oil-based adjuvants for sustainable farming

- In July 2023, Evonik Industries (Germany) announced R&D investments in specialty agricultural adjuvants, including crop oil concentrates, focusing on improving pesticide performance in cereal crops across Europe and North America. This initiative aligns with the company’s strategy to support precision agriculture and reduced chemical usage

- In May 2022, Nufarm Ltd. (Australia) introduced enhanced crop oil concentrate formulations for use in cereal and grain farming across Australia and New Zealand. These products were designed to improve herbicide absorption and consistency under diverse climatic conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.