Global Cereals Seed Market

Market Size in USD Billion

CAGR :

%

USD

15.27 Billion

USD

24.53 Billion

2025

2033

USD

15.27 Billion

USD

24.53 Billion

2025

2033

| 2026 –2033 | |

| USD 15.27 Billion | |

| USD 24.53 Billion | |

|

|

|

|

Cereals Seed Market Size

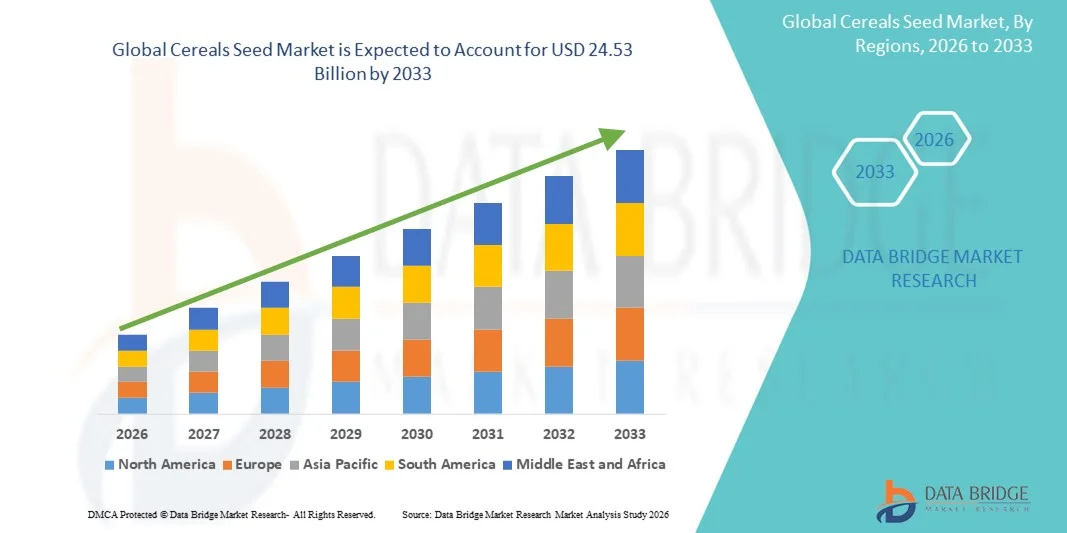

- The global cereals seed market size was valued at USD 15.27 billion in 2025 and is expected to reach USD 24.53 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-yield and disease-resistant cereal varieties, adoption of advanced agricultural practices, and rising global population requiring enhanced food production

- Growing awareness among farmers regarding genetically improved seeds and government initiatives supporting modern seed technologies are also driving market expansion

Cereals Seed Market Analysis

- The cereals seed market is witnessing steady growth due to technological advancements in seed genetics, improved crop productivity, and increased adoption of certified seeds by farmers

- Rising focus on sustainable agriculture and the need to ensure food security are encouraging the development and commercialization of high-quality cereal seeds

- North America dominated the cereals seed market with the largest revenue share in 2025, driven by the widespread adoption of high-yield and hybrid seed varieties, government support for modern agriculture, and rising awareness of sustainable farming practices.

- Asia-Pacific region is expected to witness the highest growth rate in the global cereals seed market, driven by rapid population growth, rising food demand, increasing government support for agricultural modernization, and growing awareness about high-performance seed varieties

- The wheat segment held the largest market revenue share in 2025, driven by its widespread cultivation, high demand for staple food, and use in processed food products. Improved wheat seeds with higher germination rates and disease resistance are preferred by both smallholder and commercial farmers

Report Scope and Cereals Seed Market Segmentation

|

Attributes |

Cereals Seed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cereals Seed Market Trends

Rise of High-Yield and Hybrid Cereals Seeds

- The growing adoption of high-yield and hybrid cereals seeds is transforming the cereals seed market by enabling farmers to achieve better crop productivity and improved resistance to pests and diseases. These seeds provide higher germination rates and optimized nutrient use, supporting overall farm profitability and reducing dependency on chemical fertilizers. Their enhanced traits also allow for multiple cropping cycles, further increasing yield potential and farm income

- Increasing demand for drought-tolerant and climate-resilient cereals seeds in regions affected by erratic weather is accelerating the adoption of advanced seed varieties. These seeds allow farmers to mitigate climate risks and maintain consistent crop outputs, promoting food security while reducing crop failure losses. In addition, the adoption of resilient seeds encourages sustainable farming practices and lowers environmental impact

- The affordability and accessibility of modern hybrid and genetically improved cereals seeds are making them attractive for both smallholder and large-scale farmers, allowing for higher planting efficiency and reduced crop losses. Easy availability through government schemes, cooperatives, and e-commerce platforms ensures wider reach and adoption in remote and underserved regions

- For instance, in 2023, several agricultural cooperatives in India reported a significant increase in wheat and rice yields after adopting certified high-yield seed varieties, enhancing farmer income and overall production efficiency. This adoption also improved market supply stability and strengthened food supply chains, contributing to regional food security

- While hybrid and improved seeds are driving productivity, their impact depends on continued innovation, farmer education, and affordability. Seed manufacturers must focus on localized seed development, precision agriculture support, and extension services to fully capitalize on this growing demand

Cereals Seed Market Dynamics

Driver

Rising Demand for Food Security and Enhanced Crop Productivity

- The increasing global population and rising food demand are pushing governments and farmers to prioritize high-yield cereals seeds as a frontline strategy to enhance food security. Improved seed varieties help meet growing nutritional and caloric requirements while ensuring stable supply for domestic and export markets. Policy support and agricultural incentives further accelerate adoption

- Farmers are increasingly aware of the economic benefits of adopting certified, high-performance seeds, including better yields, disease resistance, and reduced input costs. This awareness drives regular adoption across small and large farms and encourages investment in complementary technologies such as irrigation and precision farming tools

- Public sector programs and international agencies have strengthened seed distribution and research initiatives. Subsidized seed schemes, national crop improvement programs, and access to high-quality germplasm are helping farmers adopt modern seeds effectively, while R&D investments ensure continuous improvement of seed traits to match regional farming conditions

- For instance, in 2022, the Food and Agriculture Organization (FAO) implemented initiatives to promote hybrid maize seeds in Africa, boosting productivity and adoption of modern cereals seed varieties. These programs also provided farmer training, extension services, and supply chain support, ensuring effective and sustained implementation

- While awareness and institutional support are driving adoption, there is still a need for efficient distribution, training programs, and localized research to ensure sustained use of high-quality seeds. Strengthening cold chain, transport logistics, and certification systems will further enhance seed utilization and farm productivity

Restraint/Challenge

High Seed Costs and Limited Access in Remote Regions

- The premium price point of hybrid and genetically improved cereals seeds makes them less accessible to low-income farmers, particularly in developing regions. High production and certification costs contribute to elevated retail prices, which can deter adoption among resource-constrained farmers

- In many rural and remote areas, limited access to certified seeds and lack of supporting infrastructure hinder timely adoption, forcing farmers to rely on traditional seed varieties with lower yields. The absence of local distribution networks and storage facilities further exacerbates this challenge

- Supply chain inefficiencies, including storage requirements and transportation constraints, further reduce availability in underdeveloped regions, limiting market penetration. Seasonal delays and inconsistent supply can also affect planting schedules, crop planning, and overall yield potential

- For instance, in 2023, surveys in Sub-Saharan Africa indicated that over 60% of smallholder farmers lacked access to certified cereals seeds, citing cost and logistical barriers as major challenges. These gaps directly impact productivity, profitability, and local food security in affected regions

- While the cereals seed market continues to grow, addressing affordability, accessibility, and supply chain efficiency remains crucial. Stakeholders must focus on decentralized distribution, scalable seed production, subsidized pricing, and farmer training programs to unlock long-term market potential and ensure equitable adoption

Cereals Seed Market Scope

The cereals seed market is segmented on the basis of type, product type, trait, seed treatment, availability, and application

- By Type

On the basis of type, the market is segmented into wheat, rice, barley, sorghum, and other cereals. The wheat segment held the largest market revenue share in 2025, driven by its widespread cultivation, high demand for staple food, and use in processed food products. Improved wheat seeds with higher germination rates and disease resistance are preferred by both smallholder and commercial farmers.

The rice segment is expected to witness the fastest growth rate from 2026 to 2033, due to rising adoption of high-yield, hybrid, and climate-resilient rice varieties, especially in Asia-Pacific. These seeds enhance multiple cropping cycles and strengthen food security in rice-dependent regions.

- By Product Type

On the basis of product type, the market is segmented into conventional seeds and genetically modified seeds. Conventional seeds held the largest revenue share in 2025 due to well-established cultivation practices, strong farmer familiarity, and widespread regulatory acceptance. These seeds continue to dominate because of their proven performance across diverse crops and regions. Farmers prefer conventional seeds for their reliability and ease of integration into existing farming systems.

Genetically modified seeds are expected to witness the fastest growth from 2026 to 2033, driven by the increasing adoption of high-yield, pest-resistant, and climate-resilient varieties. These seeds help reduce input costs, improve crop productivity, and support sustainable agriculture practices. Growth is further encouraged by technological advancements in seed biotechnology and rising demand for resilient crops in extreme climatic conditions.

- By Trait

On the basis of trait, the market is segmented into herbicide tolerance, insecticide resistance, and other traits. Herbicide-tolerant seeds dominated in 2025 due to their ability to simplify weed management, reduce labor costs, and maintain stable yields. Farmers benefit from easier crop maintenance and consistent productivity, enhancing overall farm efficiency.

Insecticide-resistant seeds are expected to grow rapidly from 2026 to 2033, minimizing pest-related crop losses and reducing reliance on chemical pesticides. Other traits, including disease resistance, drought tolerance, and high-nutrient content, are increasingly important for improving crop resilience and ensuring sustainable agricultural outputs. These traits support both commercial and smallholder farmers in maintaining productivity under challenging conditions.

- By Seed Treatment

On the basis of seed treatment, the market is segmented into treated and non-treated seeds. Treated seeds held the largest share in 2025 as they offer protection against diseases, pests, and adverse environmental conditions, resulting in higher germination rates and better yields. Treated seeds are widely preferred in commercial agriculture for their reliability and enhanced crop performance.

Non-treated seeds are expected to grow steadily from 2026 to 2033, especially in organic and chemical-free farming practices. These seeds cater to eco-conscious farmers and sustainable agriculture initiatives, supporting natural cultivation methods. Their growth is aided by increasing demand for organic crops and stricter environmental regulations.

- By Availability

On the basis of availability, the market is segmented into commercial seeds and saved seeds. Commercial seeds dominated in 2025 due to guaranteed quality, certification, and consistent germination, which are crucial for large-scale cultivation and ensuring predictable yields. These seeds are widely adopted in professional and high-volume farming operations.

Saved seeds are expected to grow from 2026 to 2033 as farmers reuse seeds to lower costs and preserve locally adapted crop varieties. This segment supports traditional farming practices, maintains genetic diversity, and provides farmers with a cost-effective option for cultivation. Increased awareness of seed-saving benefits is driving adoption in emerging markets.

- By Application

On the basis of application, the market is segmented into plant and research. Plant application held the largest share in 2025, driven by large-scale cultivation, staple food production, and commercial farming practices. High adoption in crop fields ensures improved food security and supports economic stability for farmers.

Research application is expected to grow significantly from 2026 to 2033, fueled by the need for high-yield, climate-resilient, and genetically enhanced seeds. Advanced breeding programs, agricultural biotechnology initiatives, and government-supported research projects are driving demand. This segment plays a key role in developing future-ready crop varieties to meet global food requirements.

Cereals Seed Market Regional Analysis

- North America dominated the cereals seed market with the largest revenue share in 2025, driven by the widespread adoption of high-yield and hybrid seed varieties, government support for modern agriculture, and rising awareness of sustainable farming practices.

- Farmers in the region highly value the improved germination rates, disease resistance, and productivity offered by certified cereals seeds, which enable higher crop yields and efficient resource utilization.

- This widespread adoption is further supported by advanced agricultural infrastructure, access to quality inputs, and strong research and development initiatives, establishing cereals seeds as a preferred solution for both smallholder and commercial farmers.

U.S. Cereals Seed Market Insight

The U.S. cereals seed market captured the largest revenue share in 2025 within North America, fueled by the growing adoption of hybrid and genetically improved seed varieties. Farmers are increasingly prioritizing yield enhancement, pest and disease resistance, and climate-resilient crops to ensure food security. Government programs and subsidies promoting modern seed usage, combined with robust agricultural research and seed certification systems, are further boosting the market. In addition, the integration of precision farming techniques is enhancing seed performance and optimizing crop management practices.

Europe Cereals Seed Market Insight

The Europe cereals seed market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent agricultural regulations, increasing focus on sustainable farming, and rising demand for high-quality cereals. Expansion of organic and specialty cereals cultivation, coupled with technological advancements in seed development, is fostering adoption. The region is witnessing significant growth across wheat, barley, and rice applications, with certified seeds being incorporated into both conventional and innovative farming practices.

U.K. Cereals Seed Market Insight

The U.K. cereals seed market is expected to witness strong growth from 2026 to 2033, driven by the increasing adoption of high-yield and climate-resilient varieties. Rising awareness about soil health, pest management, and sustainable agricultural practices is encouraging farmers to adopt certified seeds. The U.K.’s robust agri-tech ecosystem and government support for crop productivity improvements are expected to further stimulate market growth.

Germany Cereals Seed Market Insight

The Germany cereals seed market is expected to witness substantial growth from 2026 to 2033, fueled by advanced agricultural research, digital farming adoption, and demand for high-quality seed varieties. German farmers are increasingly leveraging herbicide-tolerant, insect-resistant, and climate-adapted seeds to enhance yield stability. Integration of seeds with modern crop management systems and precision agriculture techniques is further contributing to the adoption of improved seed varieties.

Asia-Pacific Cereals Seed Market Insight

The Asia-Pacific cereals seed market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing food demand, and technological advancements in agriculture across countries such as China, India, and Japan. The region's growing focus on high-yield, drought-tolerant, and hybrid cereals seeds, supported by government initiatives promoting modern farming, is driving adoption. Furthermore, expansion of seed production facilities and increased accessibility of certified seeds are enabling a broader farmer base to adopt improved cereals seeds.

China Cereals Seed Market Insight

The China cereals seed market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s vast agricultural landscape, growing demand for staple crops, and high adoption of modern seed varieties. Farmers are increasingly leveraging hybrid and genetically improved seeds for wheat, rice, and maize to boost productivity. Government support, research and development in seed technology, and the push for food security through high-yield crops are key factors driving market growth.

Japan Cereals Seed Market Insight

The Japan cereals seed market is expected to witness significant growth from 2026 to 2033 due to the country’s advanced farming technology, high focus on crop efficiency, and limited arable land requiring optimized seed usage. Adoption of high-yield, pest-resistant, and climate-resilient cereals seeds is driven by farmers’ need to maximize output per hectare. Integration of seeds with precision agriculture and IoT-based farm management systems is further accelerating market expansion.

Cereals Seed Market Share

The Cereals Seed industry is primarily led by well-established companies, including:

- KWS SAAT SE & Co. KGaA (Germany)

- Advanta Seeds US (U.S.)

- DuPont (U.S.)

- Limagrain UK Ltd. (U.K.)

- Bayer AG (Germany)

- Syngenta (Switzerland)

- Dow (U.S.)

- Corteva (U.S.)

- BASF SE (Germany)

- Land O'Lakes, Inc. (U.S.)

- UPL (India)

- DLF (Denmark)

- Rallis India Limited (India)

- Enza Zaden (Netherlands)

- Kellogg’s Company (U.S.)

- TAKII & CO., LTD. (Japan)

- General Mills, Inc. (U.S.)

- Conagra Brands, Inc. (U.S.)

- IMPERIAL SEED (India)

- Ampac Seed (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.