Global Cetyl Palmitate Market

Market Size in USD Million

CAGR :

%

USD

187.34 Million

USD

287.51 Million

2025

2033

USD

187.34 Million

USD

287.51 Million

2025

2033

| 2026 –2033 | |

| USD 187.34 Million | |

| USD 287.51 Million | |

|

|

|

|

Cetyl Palmitate Market Size

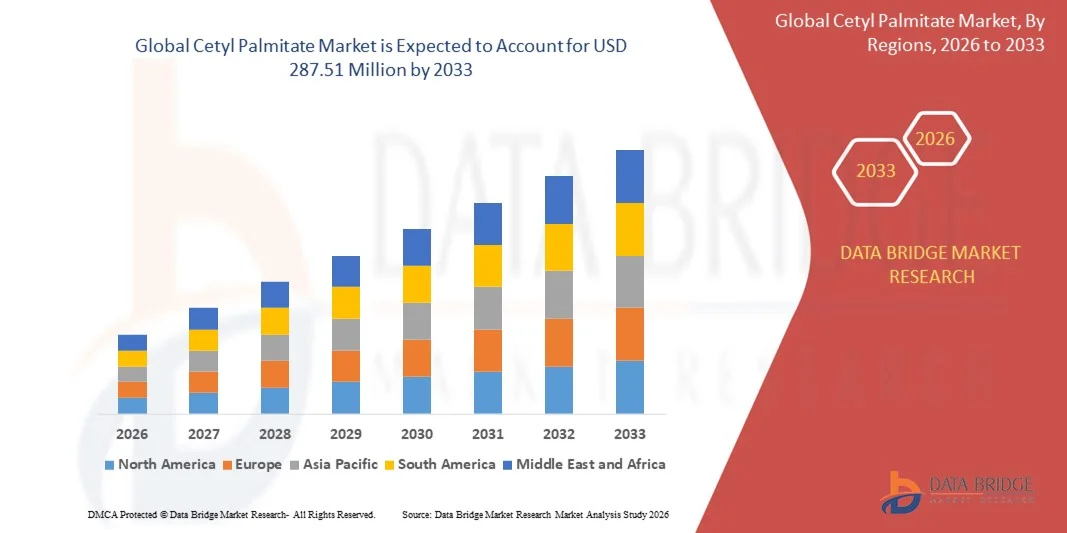

- The global cetyl palmitate market size was valued at USD 187.34 million in 2025 and is expected to reach USD 287.51 million by 2033, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the rising demand for natural, multifunctional, and skin-compatible ingredients in cosmetics, personal care, and pharmaceutical products, driving formulators to increasingly adopt cetyl palmitate in creams, lotions, ointments, and haircare formulations

- Furthermore, the growing consumer preference for products with improved texture, moisturization, and emulsion stability is establishing cetyl palmitate as a key ingredient in premium and clean-label formulations. These converging factors are accelerating the incorporation of cetyl palmitate across personal care and pharmaceutical products, thereby significantly boosting the industry's growth

Cetyl Palmitate Market Analysis

- Cetyl palmitate, serving as an emollient, emulsifier, and stabilizer, is increasingly vital in modern cosmetic, personal care, and pharmaceutical formulations due to its ability to enhance spreadability, texture, and product stability while maintaining compatibility with other natural ingredients

- The escalating demand for cetyl palmitate is primarily fueled by the global rise in skincare and personal care consumption, increasing awareness of multifunctional and natural ingredients, and the growing preference for high-quality, sustainable formulations that deliver enhanced sensory and therapeutic benefits

- North America dominated the cetyl palmitate market in 2025, due to increasing demand for natural and multifunctional ingredients in cosmetics and personal care products

- Asia-Pacific is expected to be the fastest growing region in the cetyl palmitate market during the forecast period due to increasing urbanization, rising disposable incomes, and growing awareness of cosmetic and pharmaceutical formulations containing natural and multifunctional ingredients

- Emollient segment dominated the market with a market share of 43% in 2025, due to its extensive use in skincare and personal care formulations for providing smoothness, softness, and improved texture to creams, lotions, and ointments. Consumers increasingly prefer products containing natural and skin-friendly emollients, which has further bolstered demand for cetyl palmitate in cosmetic preparations. Its compatibility with a wide range of ingredients and ability to enhance the sensory feel of topical products also contributes to its market leadership

Report Scope and Cetyl Palmitate Market Segmentation

|

Attributes |

Cetyl Palmitate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cetyl Palmitate Market Trends

Growth in Demand for Natural and Multifunctional Cosmetic Ingredients

- A key trend in the cetyl palmitate market is the rising preference for natural and multifunctional ingredients in cosmetic and personal care formulations, driven by consumer demand for skin-friendly and sustainable solutions. This trend is boosting the incorporation of cetyl palmitate in creams, lotions, and hair care products due to its emollient, thickening, and texture-enhancing properties

- For instance, BASF and Croda supply high-purity cetyl palmitate for use in natural and organic cosmetic lines, supporting product claims of smooth application, enhanced moisturization, and eco-conscious sourcing. Such applications reinforce the ingredient’s importance in formulating high-performance personal care products that meet evolving consumer expectations

- The multifunctionality of cetyl palmitate is promoting its use as a stabilizer and viscosity enhancer in emulsions, allowing formulators to simplify ingredient lists while maintaining product performance. Its role in improving texture and sensory feel is positioning it as a preferred choice for premium and mass-market cosmetic offerings

- Rising demand for clean-label cosmetics is encouraging manufacturers to replace synthetic thickeners and emollients with natural alternatives, increasing the reliance on cetyl palmitate derived from sustainable vegetable sources. This is shaping product development strategies focused on transparency, eco-certifications, and reduced chemical additives

- The trend toward plant-based and vegan formulations is further expanding the adoption of cetyl palmitate in skincare and haircare, as it provides similar functionality to conventional animal-derived esters. This supports brand differentiation in competitive markets and aligns with consumer values around sustainability

- Market expansion is also driven by increased innovation in personal care products where cetyl palmitate contributes to product stability, enhanced skin feel, and improved formulation aesthetics. The cumulative effect of these factors is strengthening the global demand for cetyl palmitate across diverse cosmetic segments

Cetyl Palmitate Market Dynamics

Driver

Rising Consumer Preference for Clean-Label and Sustainable Formulations

- Consumer awareness of clean-label, sustainable, and environmentally friendly cosmetics is driving the demand for natural ingredients such as cetyl palmitate that deliver multifunctional benefits. Brands are reformulating products to meet these expectations, ensuring ingredient transparency and minimizing synthetic additives

- For instance, Croda’s naturally derived cetyl palmitate is used in skincare formulations promoting eco-certification and biodegradable properties, enabling brands to market products that appeal to health-conscious and environmentally aware consumers. These formulations support brand credibility and meet regulatory compliance in eco-conscious markets

- Increasing regulatory focus on environmentally safe and non-toxic cosmetic ingredients is encouraging formulators to use natural esters over petrochemical alternatives. This trend is particularly pronounced in the European Union, where REACH regulations and consumer safety standards favor plant-derived ingredients

- The expansion of premium and mass-market personal care segments globally is encouraging manufacturers to integrate cetyl palmitate for improved texture, emollience, and sensory attributes. This adoption supports product innovation and strengthens competitive positioning across skincare, haircare, and color cosmetics

- The continued push toward sustainable sourcing, biodegradable ingredients, and eco-friendly formulations is further supporting the adoption of cetyl palmitate. Brands are increasingly leveraging its natural origin to differentiate products and address consumer demand for responsible cosmetics

Restraint/Challenge

Supply Chain Dependence on High-Quality Raw Materials

- The cetyl palmitate market faces challenges due to dependence on high-quality raw materials derived from natural sources such as palm oil, coconut oil, and other vegetable esters. Variations in supply, quality, and sustainability certifications can affect product consistency and manufacturing reliability

- For instance, BASF emphasizes sourcing sustainable raw materials for cetyl palmitate production under RSPO-certified palm oil programs, highlighting the importance of traceability and ethical procurement. Supply chain disruptions or price volatility in these raw materials can directly impact production costs and availability

- Fluctuating agricultural yields and geopolitical factors influencing raw material sourcing contribute to supply instability, affecting both large-scale and small-scale manufacturers. Maintaining consistent quality while meeting regulatory and environmental standards remains a key operational challenge

- The need for high-purity esters for cosmetic applications requires stringent quality control and processing methods, adding complexity to manufacturing and supply chain operations. Companies must invest in advanced purification and quality assurance to meet the strict performance standards demanded by the personal care industry

- Market growth may be constrained if raw material supply cannot keep pace with increasing demand, particularly as natural and sustainable ingredients become mandatory for premium and clean-label products. Managing supply chain risks and ensuring long-term access to certified raw materials remains a strategic challenge for manufacturers

Cetyl Palmitate Market Scope

The market is segmented on the basis of application and end-use.

- By Application

On the basis of application, the Cetyl Palmitate market is segmented into emollient, emulsifier & stabilizer, lubricating agent, and others. The emollient segment dominated the market with the largest market revenue share of 43% in 2025, driven by its extensive use in skincare and personal care formulations for providing smoothness, softness, and improved texture to creams, lotions, and ointments. Consumers increasingly prefer products containing natural and skin-friendly emollients, which has further bolstered demand for cetyl palmitate in cosmetic preparations. Its compatibility with a wide range of ingredients and ability to enhance the sensory feel of topical products also contributes to its market leadership.

The emulsifier & stabilizer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for stable cosmetic and pharmaceutical formulations. For instance, companies such as BASF utilize cetyl palmitate as a stabilizer in emulsions to maintain product consistency and extend shelf life. Its multifunctional properties allow formulators to reduce the use of synthetic additives while ensuring product performance, making it increasingly popular across both high-end and mass-market applications.

- By End-Use

On the basis of end-use, the Cetyl Palmitate market is segmented into cosmetics and personal care, pharmaceutical industry, and others. The cosmetics and personal care segment held the largest market revenue share in 2025, driven by the growing global demand for skincare, haircare, and body care products that incorporate natural and skin-compatible ingredients. Cetyl palmitate’s emollient and conditioning properties enhance product efficacy and user experience, which has encouraged widespread adoption in creams, lotions, lipsticks, and hair oils. Its compatibility with other natural ingredients and suitability for sensitive skin formulations also strengthens its dominant position in this sector.

The pharmaceutical industry segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the increasing use of cetyl palmitate in ointments, topical gels, and medicinal emulsions that require smooth texture and stability. For instance, GlaxoSmithKline leverages cetyl palmitate in certain topical formulations to enhance spreadability and patient comfort. Its ability to function as both an emollient and stabilizer in pharmaceutical products makes it a preferred choice for manufacturers seeking multifunctional excipients in advanced therapeutic applications.

Cetyl Palmitate Market Regional Analysis

- North America dominated the cetyl palmitate market with the largest revenue share in 2025, driven by increasing demand for natural and multifunctional ingredients in cosmetics and personal care products

- Consumers in the region highly prefer products containing cetyl palmitate for its emollient and stabilizing properties, which improve texture, spreadability, and skin compatibility in skincare and haircare formulations

- This widespread adoption is further supported by high consumer awareness of product safety, stringent cosmetic regulations, and a growing preference for premium and natural ingredient-based products, establishing cetyl palmitate as a favored formulation ingredient in North American cosmetics and pharmaceuticals

U.S. Cetyl Palmitate Market Insight

The U.S. Cetyl Palmitate market captured the largest revenue share in 2025 within North America, fueled by the rising demand for natural, plant-based, and multifunctional ingredients in cosmetics, personal care, and pharmaceutical applications. Consumers are increasingly seeking products that enhance skin softness, moisturization, and product stability, driving the uptake of cetyl palmitate. The market growth is further supported by the expansion of premium skincare brands and the trend toward clean and sustainable formulations. Moreover, the rising integration of cetyl palmitate in haircare, lip care, and therapeutic ointments is significantly contributing to market expansion.

Europe Cetyl Palmitate Market Insight

The Europe Cetyl Palmitate market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing demand for multifunctional cosmetic ingredients and adherence to stringent cosmetic safety regulations. The growing focus on sustainable and eco-friendly formulations is fostering the adoption of cetyl palmitate in personal care and pharmaceutical products. European consumers are also drawn to the product’s ability to enhance texture, spreadability, and stability in emulsions. The region is witnessing significant growth across skincare, haircare, and ointment applications, with cetyl palmitate being incorporated into both premium and mass-market products.

U.K. Cetyl Palmitate Market Insight

The U.K. Cetyl Palmitate market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of natural and plant-based cosmetic ingredients. Consumers increasingly prefer formulations that improve moisturization, skin feel, and product stability, boosting cetyl palmitate adoption. The U.K.’s strong cosmetic and personal care industry, combined with the growing popularity of at-home skincare and therapeutic products, continues to stimulate market growth.

Germany Cetyl Palmitate Market Insight

The Germany Cetyl Palmitate market is expected to expand at a considerable CAGR during the forecast period, fueled by growing demand for high-quality, multifunctional ingredients in personal care and pharmaceutical applications. Germany’s emphasis on product safety, sustainability, and premium formulations promotes the adoption of cetyl palmitate in skincare, haircare, and ointment products. The ingredient’s ability to enhance spreadability, stability, and emollient properties aligns with consumer expectations for effective and natural products.

Asia-Pacific Cetyl Palmitate Market Insight

The Asia-Pacific Cetyl Palmitate market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing awareness of cosmetic and pharmaceutical formulations containing natural and multifunctional ingredients. The region's expanding personal care and pharmaceutical industries, particularly in countries such as China, Japan, and India, are driving cetyl palmitate adoption. Furthermore, Asia-Pacific’s role as a manufacturing hub for cosmetic ingredients improves affordability and accessibility, boosting its integration into mass-market and premium products.

Japan Cetyl Palmitate Market Insight

The Japan Cetyl Palmitate market is gaining momentum due to the country’s high consumer awareness of skincare, cosmetics, and therapeutic products containing natural and multifunctional ingredients. The Japanese market emphasizes high-quality formulations, and cetyl palmitate’s emollient and stabilizing properties make it ideal for premium skincare, haircare, and ointment applications. Moreover, the aging population is likely to increase demand for gentle and effective moisturizing products, further supporting market growth.

China Cetyl Palmitate Market Insight

The China Cetyl Palmitate market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising disposable incomes, and increasing demand for natural and multifunctional ingredients in cosmetics and pharmaceuticals. China represents one of the largest markets for skincare, haircare, and topical medicinal products, and cetyl palmitate is increasingly used to improve product texture, stability, and spreadability. The push toward premiumization and the availability of cost-effective manufacturing options are key factors propelling market growth in China.

Cetyl Palmitate Market Share

The cetyl palmitate industry is primarily led by well-established companies, including:

- Ashland Inc. (U.S.)

- BASF SE (Germany)

- Oleon NV (Belgium)

- Dien Inc. (U.S.)

- Mohini Organics Pvt. Ltd. (India)

- Hangzhou J&H Chemical Co., Ltd. (China)

- VMP Chemiekontor GmbH (Germany)

- Amadis Chemical Co., Ltd. (China)

- Stepan Company (U.S.)

- Croda International Plc (U.K.)

- Caesar & Loretz GmbH (Germany)

- Haihang Industry Co., Ltd. (China)

- CellMark AB (Sweden)

- KHBoddin GmbH (Germany)

- Gihi Chemicals Co., Ltd. (China)

- Mosselman S.A. (Belgium)

- Evonik Industries AG (Germany)

- SIGMA-ALDRICH Corporation (U.S.)

- Hangzhou Dayangchem Co. Ltd. (China)

- Lonza Group (Switzerland)

- Lubrizol Corporation (U.S.)

- Werner G. Smith Inc. (U.S.)

Latest Developments in Global Cetyl Palmitate Market

- In October 2025, Sigma-Aldrich launched next-generation high-purity cetyl palmitate grades with improved spreadability and reduced greasiness, enhancing formulation performance in premium skincare and haircare products. This development strengthened the company’s market position and increased adoption of cetyl palmitate in high-end personal care applications

- In September 2025, Croda International expanded its formulation support tools and ingredient development programs, enabling manufacturers to integrate cetyl palmitate more efficiently into diverse cosmetic and pharmaceutical products. This initiative accelerated product innovation and reinforced Croda’s role as a key supplier in the multifunctional ingredient market

- In March 2025, Croda International inaugurated a state-of-the-art advanced lipids manufacturing facility in Pennsylvania, USA, increasing production capacity for cetyl palmitate derivatives and ensuring reliable supply for premium personal care and therapeutic formulations. This expansion supported broader market adoption and met growing demand in North America

- In July 2024, BASF introduced a sustainable cetyl palmitate line sourced from certified palm oil, targeting eco-conscious cosmetic and personal care brands. This move strengthened BASF’s position in the clean and sustainable beauty segment and increased demand for responsibly sourced cetyl palmitate

- In January 2024, Fine Organics launched high-performance cetyl palmitate derivatives designed for enhanced emulsion stability and sensory experience, allowing formulators to improve texture and performance of skincare and haircare products. This development contributed to market growth by addressing the rising need for multifunctional and natural ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cetyl Palmitate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cetyl Palmitate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cetyl Palmitate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.