Global Cfrtp Market

Market Size in USD Million

CAGR :

%

USD

939.72 Million

USD

1,377.86 Million

2024

2032

USD

939.72 Million

USD

1,377.86 Million

2024

2032

| 2025 –2032 | |

| USD 939.72 Million | |

| USD 1,377.86 Million | |

|

|

|

|

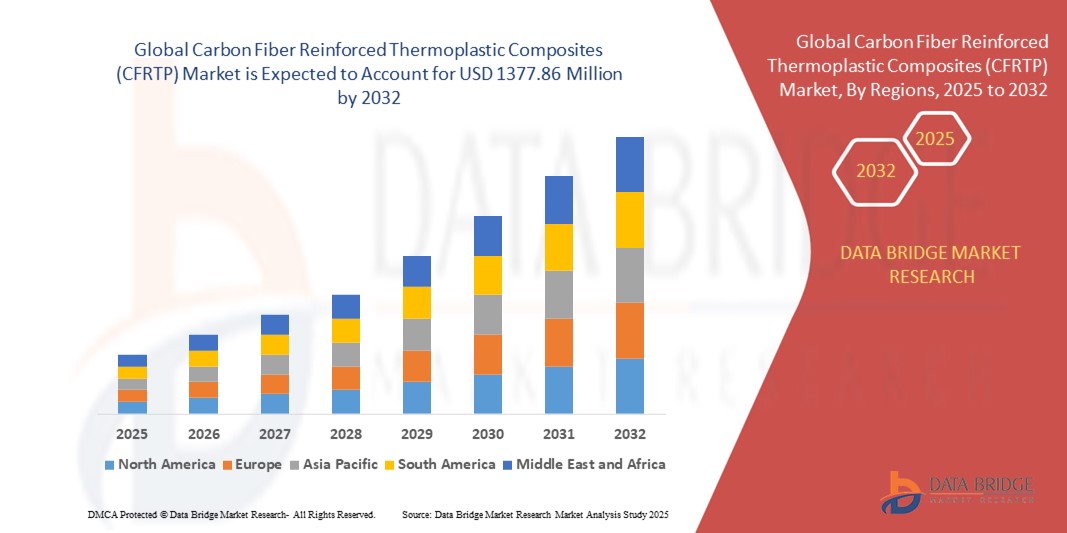

What is the Global Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market Size and Growth Rate?

- The global carbon fiber reinforced thermoplastic composites (CFRTP) market size was valued at USD 939.72 million in 2024 and is expected to reach USD 1377.86 million by 2032, at a CAGR of 4.90% during the forecast period

- The surge in demand for light weight vehicles across the globe acts as one of the major factors driving the growth of carbon fiber reinforced thermoplastic composites (CFRTP) market. The rise in demand for the material across aerospace, defense, and energy and power industries for excellent performance characteristics at very high temperatures, and high inclination towards carbon fiber reinforced thermoplastic composites owning to their functional stability accelerate the market growth

What are the Major Takeaways of Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

- The rise in awareness among population towards pollution fee and efficient vehicles, and high usage of the material to optimize efficiency in automotive applications further influence the market. In addition, rapid urbanization and industrialization, expansion of end-use industries, surge in investments and research and development activities positively affect the carbon fiber reinforced thermoplastic composites (CFRTP) market

- North America dominated the carbon fiber reinforced thermoplastic composites market with the largest revenue share of 42.69% in 2024, driven by strong demand from the aerospace and automotive industries. The region is home to leading aircraft manufacturers such as Boeing and Lockheed Martin, who are increasingly adopting carbon fiber reinforced thermoplastic composites to reduce aircraft weight and improve fuel efficiency

- Asia-Pacific carbon fiber reinforced thermoplastic composites market is projected to grow at the fastest CAGR of 8.36% from 2025 to 2032, supported by rapid industrialization, expanding aerospace manufacturing, and surging automotive production in countries such as China, Japan, and India

- The PEEK segment dominated the market with the largest revenue share of 38.5% in 2024, attributed to its exceptional mechanical strength, chemical resistance, and ability to perform in high-temperature environments

Report Scope and Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market Segmentation

|

Attributes |

Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

Lightweighting and Sustainability Driving Advanced Applications

- A major trend in the global carbon fiber reinforced thermoplastic composites market is the strong shift toward lightweight and recyclable composite materials, driven by the need for improved fuel efficiency, lower emissions, and sustainable manufacturing practices

- carbon fiber reinforced thermoplastic composites offers an excellent balance of mechanical strength, impact resistance, and reduced weight, making it highly attractive in automotive, aerospace, and consumer electronics applications

- For instance, Boeing and Airbus are increasingly incorporating carbon fiber reinforced thermoplastic composites components to replace traditional thermoset composites due to faster processing times and potential for recycling. Similarly, BMW’s i-series vehicles use carbon fiber reinforced thermoplastic composites structures to reduce overall weight and improve energy efficiency

- The integration of carbon fiber reinforced thermoplastic composites in next-generation electric vehicles (EVs) and aerospace innovations is shaping industry expectations by enabling manufacturers to meet stricter emission norms while maintaining performance

- This trend highlights the growing preference for sustainable, lightweight, and high-performance composites, positioning carbon fiber reinforced thermoplastic composites as a key enabler in future mobility and advanced industrial applications

What are the Key Drivers of Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

- The growing demand for lightweight materials in the automotive and aerospace industries to enhance fuel efficiency and reduce carbon emissions is a key driver for carbon fiber reinforced thermoplastic composites adoption

- For instance, in March 2024, Toray Industries announced expanded carbon fiber reinforced thermoplastic composites production to meet rising demand from the EV and aerospace sectors. Such investments by leading companies are fueling market growth

- Increasing focus on sustainability and recyclability in materials science positions carbon fiber reinforced thermoplastic composites as a favorable alternative to thermoset composites, offering shorter cycle times and lower lifecycle emissions

- Rapid expansion of EV production, consumer electronics, and sports equipment markets is further boosting carbon fiber reinforced thermoplastic composites demand due to its durability and lightweight advantages

- In addition, government regulations on emission reduction and rising adoption of advanced materials across industrial manufacturing are driving broader usage of carbon fiber reinforced thermoplastic composites globally

Which Factor is Challenging the Growth of the Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

- A major challenge restraining carbon fiber reinforced thermoplastic composites market growth is its high production cost compared to conventional thermoplastics and thermoset composites. The costs of carbon fiber precursors and specialized processing technologies limit its affordability for mass applications

- For instance, aircraft manufacturers face cost pressures in scaling carbon fiber reinforced thermoplastic composites adoption across all structural components, making them rely on hybrid materials in certain cases

- Moreover, challenges in recycling carbon fiber reinforced thermoplastic composites at scale and maintaining consistent material performance across industries raise concerns for wider commercialization

- The limited availability of large-scale automated production processes also restricts economies of scale, keeping end-product prices high

- Overcoming these hurdles through technological innovations in resin transfer molding, automated fiber placement, and cost-efficient precursor materials will be critical for enabling broader carbon fiber reinforced thermoplastic composites adoption in both premium and mass-market applications

How is the Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Resin Type

On the basis of resin type, the carbon fiber reinforced thermoplastic composites market is segmented into Polyetheretherketone (PEEK), Polyamide (PA), Polycarbonate (PC), and Polyphenylene Sulfide (PPS). The PEEK segment dominated the market with the largest revenue share of 38.5% in 2024, attributed to its exceptional mechanical strength, chemical resistance, and ability to perform in high-temperature environments. PEEK-based CFRTPs are widely used in aerospace and automotive applications where durability and lightweight properties are critical. Their recyclability and compatibility with automated manufacturing processes further strengthen their market appeal.

The Polyamide (PA) segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, driven by its cost-effectiveness, versatility, and increasing demand in consumer electronics and automotive interiors. PA-based CFRTPs are gaining traction in lightweight structural parts and under-the-hood components due to their balance of strength, flexibility, and affordability. This trend positions PA resins as a key growth driver for expanding carbon fiber reinforced thermoplastic composites applications across mass-market industries.

- By Product Type

On the basis of product type, the carbon fiber reinforced thermoplastic composites market is segmented into Carbon Fiber, Long Carbon Fiber, and Short Carbon Fiber. The Carbon Fiber segment dominated the market with a revenue share of 44.7% in 2024, primarily due to its superior strength-to-weight ratio, stiffness, and widespread adoption in high-performance aerospace and automotive applications. Carbon fiber carbon fiber reinforced thermoplastic composites are extensively utilized in structural components such as aircraft fuselages, automotive body panels, and high-end sports equipment, where performance efficiency and durability are crucial.

The Long Carbon Fiber segment is projected to register the fastest CAGR of 20.8% from 2025 to 2032, fueled by its growing adoption in semi-structural automotive and industrial applications. Long fiber carbon fiber reinforced thermoplastic composites provide improved impact resistance and better load distribution compared to short fibers, making them increasingly attractive for applications requiring durability at lower costs than continuous carbon fiber. This rising demand highlights their role in expanding carbon fiber reinforced thermoplastic composites use beyond premium sectors into broader industrial and consumer applications.

- By Application

On the basis of application, the carbon fiber reinforced thermoplastic composites market is segmented into Aerospace, Automotive, and Consumer Durables. The Aerospace segment dominated the market with a revenue share of 41.6% in 2024, driven by the rising adoption of carbon fiber reinforced thermoplastic composites in aircraft structures to achieve fuel efficiency, reduce carbon emissions, and meet stringent regulatory standards. Leading aerospace manufacturers such as Boeing and Airbus are increasingly deploying carbon fiber reinforced thermoplastic composites for wings, fuselages, and interior components due to its lightweight, high strength, and faster processing compared to thermosets.

The Automotive segment is expected to record the fastest CAGR of 22.5% from 2025 to 2032, boosted by the global shift toward electric vehicles (EVs) and lightweight design. Automakers are integrating carbon fiber reinforced thermoplastic composites into body panels, chassis components, and interiors to enhance energy efficiency and performance. The rising trend of sustainable mobility and government incentives for EV adoption are accelerating carbon fiber reinforced thermoplastic composites penetration in the automotive sector, positioning it as the most dynamic growth application in the forecast period.

Which Region Holds the Largest Share of the Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

- North America dominated the carbon fiber reinforced thermoplastic composites market with the largest revenue share of 42.69% in 2024, driven by strong demand from the aerospace and automotive industries. The region is home to leading aircraft manufacturers such as Boeing and Lockheed Martin, who are increasingly adopting carbon fiber reinforced thermoplastic composites to reduce aircraft weight and improve fuel efficiency

- In the automotive sector, U.S. and Canadian manufacturers are integrating carbon fiber reinforced thermoplastic composites into electric vehicles (EVs) and high-performance cars to meet lightweighting and emission reduction targets

- The region’s leadership is further supported by robust R&D investments, advanced manufacturing infrastructure, and government regulations promoting sustainability, making carbon fiber reinforced thermoplastic composites a material of choice across multiple end-use industries

U.S. Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The U.S. accounted for 81% of the North American carbon fiber reinforced thermoplastic composites market share in 2024, fueled by aerospace and defense applications, where carbon fiber reinforced thermoplastic composites are valued for high strength-to-weight performance. In addition, U.S. automakers are accelerating adoption in EV platforms to extend driving range and reduce battery loads. Growing collaborations between material suppliers and OEMs, coupled with Department of Energy and Department of Defense initiatives to promote lightweight materials, are propelling the market. The U.S. remains a global innovation hub for carbon fiber reinforced thermoplastic composites R&D, particularly in PEEK- and PPS-based composites.

Europe Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The Europe carbon fiber reinforced thermoplastic composites market is projected to expand at a substantial CAGR during 2025–2032, supported by the region’s stringent sustainability goals and high adoption of lightweight materials in aerospace and automotive industries. Airbus is a major driver, incorporating carbon fiber reinforced thermoplastic composites into next-generation aircraft for fuel efficiency. In the automotive sector, European OEMs such as BMW and Volkswagen are integrating carbon fiber reinforced thermoplastic composites into vehicle structures to meet EU emission regulations. In addition, Europe’s strong recycling initiatives and investments in circular economy solutions are accelerating carbon fiber reinforced thermoplastic composites penetration across both aerospace and automotive applications.

U.K. Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, driven by government-backed aerospace innovation programs and investments in sustainable automotive manufacturing. With Rolls-Royce and BAE Systems focusing on advanced carbon fiber reinforced thermoplastic composites adoption in aerospace engines and defense systems, the U.K. has positioned itself as a key hub for high-performance composites. The country’s EV growth initiatives and its emphasis on reducing carbon footprints are also fostering carbon fiber reinforced thermoplastic composites demand across passenger vehicles and lightweight automotive components.

Germany Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The Germany Carbon Fiber Reinforced Thermoplastic Composites market is set to expand at a considerable CAGR during the forecast period, supported by the country’s role as a global automotive leader. German automakers, including BMW, Audi, and Mercedes-Benz, are increasingly utilizing carbon fiber reinforced thermoplastic composites in body panels, chassis, and interiors to achieve lightweight designs for both ICE and EV models. In addition, Germany’s focus on industrial automation and advanced materials R&D strengthens CFRTP adoption. The integration of carbon fiber reinforced thermoplastic composites into eco-conscious, high-performance products aligns with Germany’s strong sustainability-driven policies and consumer demand.

Which Region is the Fastest Growing Region in the Carbon Fiber Reinforced Thermoplastic Composites Market?

Asia-Pacific carbon fiber reinforced thermoplastic composites market is projected to grow at the fastest CAGR of 8.36% from 2025 to 2032, supported by rapid industrialization, expanding aerospace manufacturing, and surging automotive production in countries such as China, Japan, and India. APAC is emerging as both a manufacturing hub and a high-demand market for carbon fiber reinforced thermoplastic composites, as governments push for lightweight materials in EVs, public transport, and next-generation aircraft. Increasing investments in renewable energy and infrastructure projects also boost composite demand in the region.

Japan Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The Japan carbon fiber reinforced thermoplastic composites market is gaining momentum, driven by the country’s high-tech culture and leadership in advanced materials manufacturing. Japanese companies such as Toray and Mitsubishi Chemical are global leaders in carbon fiber reinforced thermoplastic composites development, supplying to aerospace and automotive giants. The adoption of carbon fiber reinforced thermoplastic composites in high-speed trains, EVs, and aircraft is accelerating, supported by Japan’s focus on reducing emissions and creating lightweight, efficient transport solutions. The country’s rapidly aging population is also spurring demand for lightweight consumer durables and mobility devices, boosting carbon fiber reinforced thermoplastic composites penetration.

China Carbon Fiber Reinforced Thermoplastic Composites Market Insight

The China carbon fiber reinforced thermoplastic composites market accounted for the largest share in Asia-Pacific in 2024, fueled by massive automotive production and government-led initiatives for EV adoption and smart city projects. carbon fiber reinforced thermoplastic composites are increasingly used in EV body panels, aerospace structures, and wind energy applications, supported by China’s large domestic manufacturing base. Strong local production capacity, coupled with cost-competitive carbon fiber reinforced thermoplastic composites suppliers, makes China a global growth driver. The rising middle-class population and urbanization are further fueling demand for lightweight and durable consumer products, solidifying China’s leadership in APAC carbon fiber reinforced thermoplastic composites adoption.

Which are the Top Companies in Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

The carbon fiber reinforced thermoplastic composites (CFRTP) industry is primarily led by well-established companies, including:

- LANXESS (Germany)

- Solvay (Belgium)

- PolyOne Corporation (U.S.)

- RTP Company (U.S.)

- Celanese Corporation (U.S.)

- Avient Corporation (U.S.)

- Daicel Corporation (Japan)

- Sumitomo Bakelite Co., Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- PPG Industries, Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- SABIC (Saudi Arabia)

- Owens Corning (U.S.)

- TORAY INDUSTRIES, INC (Japan)

- BASF SE (Germany)

- SGL Carbon (Germany)

- SKYi Composites Pvt. Ltd. (India)

- Great Eastern Resins Industrial Co. Ltd. (Taiwan)

- JNC Corporation (Japan)

What are the Recent Developments in Global Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market?

- In January 2025, Syensqo joined the ThermoPlastic Composites Research Center (TPRC) and formed partnerships with Trillium for bio-based acrylonitrile production and with Baker Hughes to develop offshore composite systems, strengthening its position in sustainable and advanced composite solutions

- In November 2024, Toray Advanced Composites acquired the assets of Gordon Plastics in Colorado to boost its production capacity for continuous carbon fiber thermoplastic composites, reinforcing its manufacturing presence in North America

- In October 2023, Toray Industries, Inc. announced the expansion of its French subsidiary Toray Carbon Fibers Europe S.A.’s manufacturing facilities for specific carbon fibers, with production starting in 2025, to significantly enhance the plant’s annual output capacity

- In June 2023, Solvay partnered with Spirit AeroSystems (Europe) Limited, becoming a strategic collaborator at Spirit's Aerospace Innovation Centre to advance composite manufacturing, automate fabrication, and streamline assembly technologies, aiming to shorten the overall development cycle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cfrtp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cfrtp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cfrtp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.