Global Chamomile Herbal Tea Market

Market Size in USD Billion

CAGR :

%

USD

306.14 Billion

USD

680.49 Billion

2024

2032

USD

306.14 Billion

USD

680.49 Billion

2024

2032

| 2025 –2032 | |

| USD 306.14 Billion | |

| USD 680.49 Billion | |

|

|

|

|

Chamomile Herbal Tea Market Size

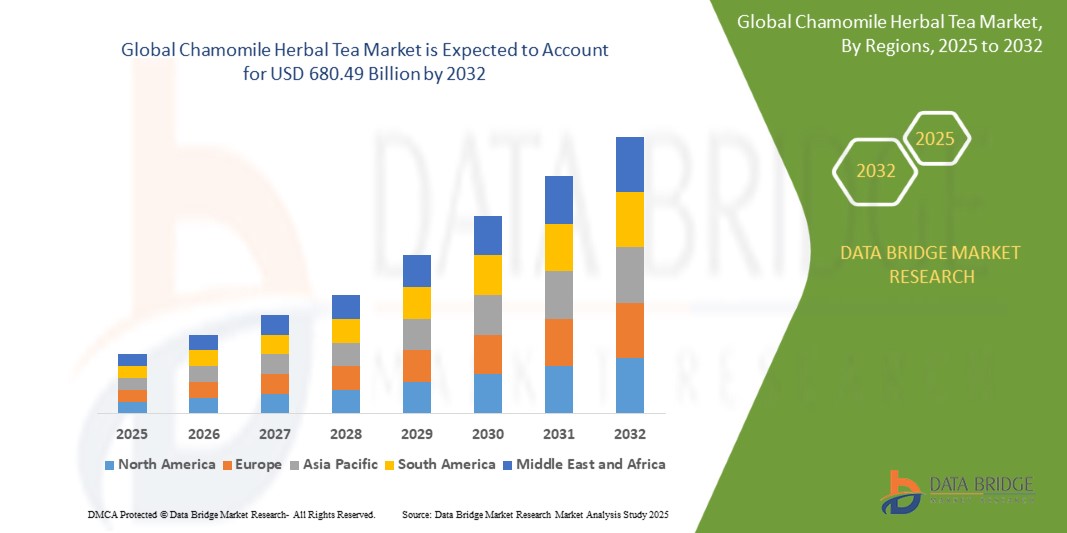

- The global Chamomile Herbal Tea market was valued at USD 306.14 billion in 2024 and is expected to reach USD 680.49 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.50% primarily driven by the increasing consumer preference for natural and organic herbal beverages, along with rising awareness of the health benefits of Chamomile Herbal Tea

- This growth is driven by factors such as growing demand for caffeine-free alternatives, increasing adoption of herbal teas for stress relief and better sleep, rising disposable income, and expanding distribution channels, including online retail platforms

Chamomile Herbal Tea Market Analysis

- Chamomile herbal tea holds a significant position in the herbal tea market, accounting for a substantial share due to its calming properties and delicate floral aroma, making it a preferred choice among health-conscious consumers

- For instance, brands such as Pukka Herbs and Bigelow have seen increasing sales of their chamomile tea products as more people seek natural sleep aids and stress relievers

- The global herbal tea market is projected to grow steadily, with chamomile tea being a major contributor due to its health benefits, including stress relief and improved sleep quality, driving consumer demand

- For instance, the rise of wellness trends has led cafes and wellness centers to introduce chamomile-infused beverages on their menus to attract customers seeking relaxation and mindfulness

- Innovations in product offerings, such as ready-to-drink chamomile tea and blends with other functional herbs such as lavender and peppermint, are expanding consumer interest and accessibility.

- For instance, Pure Leaf’s introduction of bottled chamomile tea, which provides a convenient option for busy consumers looking for a calming drink on the go

- The rise of online retail platforms has facilitated greater availability of chamomile herbal tea, allowing consumers to explore a diverse range of products and brands, contributing to higher sales and market expansion. Companies such as Twinings and Traditional Medicinals have leveraged e-commerce platforms such as Amazon and Walmart to reach a global audience and boost their sales

- Leading companies in the market, including Celestial Seasonings and Traditional Medicinals, are focusing on sustainable sourcing and organic certifications for their chamomile tea products, aligning with consumer preferences for environmentally friendly and health-conscious options.

- For instance, Yogi Tea, which has introduced organic, non-GMO certified chamomile tea to appeal to ethically conscious buyers

Report Scope and Chamomile Herbal Tea Market Segmentation

|

Attributes |

Bonsai Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chamomile Herbal Tea Market Trends

“Increasing Demand for Organic and Sustainably Sourced Chamomile Tea”

- Consumers are increasingly prioritizing organic and sustainably sourced chamomile tea due to growing awareness of health and environmental concerns, leading brands such as Pukka Herbs and Yogi Tea to expand their organic product lines

- For instance, Pukka Herbs offers chamomile tea certified by the Soil Association, ensuring ethical sourcing and organic integrity

- The demand for pesticide-free and chemical-free chamomile tea has surged, with companies obtaining certifications such as USDA Organic and Fair Trade to build trust and cater to the preferences of health-conscious buyers

- For instance, Traditional Medicinal, which prominently displays its Fair Trade and organic certifications to assure customers of its commitment to purity and sustainability

- Sustainable farming practices, including regenerative agriculture and ethical sourcing from small-scale farmers, are becoming more prominent

- For instance, Traditional Medicinal partners with Egyptian farmers who use organic methods to cultivate chamomile, supporting both environmental sustainability and fair wages for growers

- The shift towards eco-friendly packaging, such as compostable tea bags and recyclable containers, complements the demand for organic chamomile tea. Clipper Tea

- For instance, introduced plastic-free, unbleached tea bags and biodegradable packaging, significantly reducing waste while maintaining product quality

- As consumers seek transparency in sourcing and production, brands are providing detailed information about ingredient origins and sustainable practices on packaging and websites. Twining’s

- For instance, shares insights about its ethical sourcing initiatives, reassuring customers about the authenticity and sustainability of its chamomile tea products

Chamomile Herbal Tea Market Dynamics

Driver

“Growing Consumer Preference for Natural and Organic Beverages”

- Consumers are increasingly opting for natural and organic beverages due to rising health awareness, leading to a decline in demand for conventional drinks with synthetic additives. Brands such as Pukka Herbs and Twining’s have expanded their organic chamomile tea offerings to cater to this shift

- Chamomile tea’s popularity has surged as a natural remedy for ailments such as sleep disorders and digestive issues

- For instance, a study published by the National Center for Biotechnology Information highlights its effectiveness in improving sleep quality, which has further boosted its market appeal

- The global focus on maintaining a healthy lifestyle has driven demand for functional beverages such as chamomile herbal tea, known for its anti-inflammatory and antioxidant properties. Many wellness influencers and nutritionists, such as Dr. Andrew Weil, actively promote its benefits, influencing consumer choices

- The growing disposable income in developing economies is enabling consumers to invest more in premium health products. This trend is evident in Asia-Pacific countries such as India and China, where urban professionals are increasingly purchasing organic chamomile tea from brands such as Organic India and Traditional Medicinal

- Urbanization and economic growth in regions such as Latin America have led to changes in consumer purchasing behavior. Supermarkets and online platforms such as Amazon and Walmart have expanded their organic tea sections to meet the rising demand for premium herbal beverages

Opportunity

“Expansion into Emerging Markets”

- The expanding wellness and health-conscious consumer base in emerging economies offers significant growth potential for chamomile herbal tea. Countries such as India and Brazil are seeing a shift towards healthier lifestyles, with herbal teas gaining popularity as part of this trend

- The rising middle class and increased disposable incomes in these regions are encouraging consumers to invest in premium health products

- For instance, brands such as Organic India are targeting these markets by offering affordable, high-quality organic chamomile tea

- Companies can tap into these opportunities by customizing their marketing strategies to local preferences and incorporating culturally relevant messaging. In China, where herbal teas have a deep-rooted cultural history, chamomile tea can be marketed as an addition to traditional herbal remedies

- Collaborating with local distributors and retailers can ease market entry, and establishing partnerships with well-known regional brands can boost consumer trust. As seen in the Philippines, local retail chains have begun stocking chamomile tea as consumer demand for healthy beverages grows

- The rise of e-commerce platforms in developing countries is making it easier for consumers to access herbal tea products. Online marketplaces such as Flipkart and Lazada have become essential channels for chamomile tea brands looking to reach a wider audience in these regions

Restraint/Challenge

“High Cost of Organic Chamomile Production”

- One of the main challenges in the chamomile herbal tea market is the high cost of organic chamomile compared to conventional options. The process of obtaining organic certification involves strict regulations and practices, which result in higher production costs. This often leads to higher retail prices, making it less accessible for budget-conscious consumers, especially in developing markets

- Despite the widely acknowledged health benefits of chamomile tea, scientific research backing some of its claimed effects remains limited. This uncertainty could discourage potential customers from fully embracing chamomile tea as a go-to remedy for issues such as insomnia or digestion problems. The need for further research and clinical trials to validate these claims is critical to boosting consumer confidence

- The herbal tea market is highly fragmented, with numerous brands offering similar products. In such a competitive landscape, new entrants may struggle to distinguish their products and build brand loyalty.

- For instance, with many brands offering chamomile tea, it becomes challenging for smaller companies to stand out without a strong value proposition or unique selling point

- Companies must focus on educating consumers about the benefits of chamomile tea through informative marketing campaigns. This could involve using scientific evidence to back up health claims and promoting the natural, organic aspects of the product to build consumer trust and loyalty

- Managing production costs without compromising quality is crucial for companies to remain competitive. Streamlining supply chains, leveraging technology for better production practices, and investing in sustainable sourcing can help brands keep prices reasonable while maintaining the integrity of their products

Chamomile Herbal Tea Market Scope

The market is segmented on the basis of flower type, product type, packaging type, distribution channel, and end-user

|

Segmentation |

Sub-Segmentation |

|

By Flower Type |

|

|

By Product Type |

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

|

By End-User |

|

Chamomile Herbal Tea Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Chamomile Herbal Tea Market”

- Asia-Pacific chamomile herbal tea market is expected to dominate the chamomile herbal tea market

- Tea production and sales in key countries such as China, Japan, and India are major contributors to the market's growth

- Chamomile tea's popularity is driven by its anti-aging and detoxifying properties, making it a popular choice among health-conscious consumers

- Rising tea consumption across diverse age groups and demographics in the region further supports the market’s growth

- The increasing number of retail outlets dedicated to tea and health products is enhancing the accessibility of chamomile tea, driving further market expansion

“North America is Projected to Register the Highest Growth Rate”

- North America chamomile herbal tea market is expected to grow at a faster rate than other regions

- This growth is driven by the rising demand for green and herbal teas, including chamomile, as health consciousness increases among consumers

- Higher per capita tea consumption in North America contributes to the growth of chamomile tea demand

- A growing awareness of the health benefits associated with herbal teas plays a significant role in increasing demand

- As consumers in the U.S. and Canada opt for healthier beverage alternatives, the consumption of chamomile herbal tea is set to rise, boosting market growth

Chamomile Herbal Tea Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Tata Consumer Products Limited (India)

- Unilever (U.K.)

- Associated British Foods plc (U.K.)

- The Hain Celestial Group, Inc. (U.S)

- The Bombay Burmah Trading Corporation, Limited (India)

- Stash Tea (U.S.)

- Bigelow Tea (U.S.)

- The Republic of Tea (U.S)

- Numi, Inc. P.B.C. (U.S.)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Apeejay Surrendra Group (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHAMOMILE HERBAL TEA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHAMOMILE HERBAL TEA MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CHAMOMILE HERBAL TEA MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 IMPORT-EXPORT ANALYSIS

5.3 PRODUCT DEVELOPED IN RESPONSE TO THE CONSUMER TRENDS

5.4 FACTORS INFLUENCING PURCHASING DECISION

5.5 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.6 SHOPPING BEHAVIOUR AND DYNAMICS

5.6.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.6.2 RESEARCH

5.6.3 IMPULSIVE

5.6.4 ADVERTISEMENT

5.6.4.1. TTELEVISION ADVERTISEMENT

5.6.4.2. OONLINE ADVERTISEMENT

5.6.4.3. IIN-STORE ADVERTISEMENT

5.6.4.4. OOUTDOOR ADVERTISEMENT

5.7 PRIVATE LABEL VS BRAND ANALYSIS

5.8 PROMOTIONAL ACTIVITIES

5.9 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.1 NEW PRODUCT LAUNCH STRATEGY

5.10.1 NUMBER OF NEW PRODUCT LAUNCH

5.10.1.1. LLINE EXTENSTION

5.10.1.2. NNEW PACKAGING

5.10.1.3. RRE-LAUNCHED

5.10.1.4. NNEW FORMULATION

5.11 CONSUMER LEVEL TRENDS

5.12 MEETING CONSUMER REQUIREMENT

5.13 BRAND COMAPARATIVE ANALYSIS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY CHAMOMILE TYPE

11.1 OVERVIEW

11.2 EGYPTIAN CHAMOMILE

11.2.1 EGYPTIAN CHAMOMILE, BY NATURE

11.2.1.1. CONVENTIONAL

11.2.1.2. ORGANIC

11.3 GERMAN CHAMOMILE

11.3.1 GERMAN CHAMOMILE, BY NATURE

11.3.1.1. CONVENTIONAL

11.3.1.2. ORGANIC

11.4 ROMAN CHAMOMILE

11.4.1 ROMAN CHAMOMILE, BY NATURE

11.4.1.1. CONVENTIONAL

11.4.1.2. ORGANIC

11.5 OTHERS

12 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY AROMA

12.1 OVERVIEW

12.2 HERBAL

12.3 FRUITY

12.4 FLORAL

12.5 OTHERS

13 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY NATURE

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY FORM

14.1 OVERVIEW

14.2 LOOSE LEAF/FLOWERS

14.3 POWDER

14.4 TEA BAGS

14.5 OTHERS

15 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY COLOR

15.1 OVERVIEW

15.2 YELLOW

15.2.1 PALE YELLOW

15.2.2 BRIGHT YELLOW

15.3 PINK

15.4 OTHERS

16 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY FUNCTION

16.1 OVERVIEW

16.2 REDUCES STRESS AND ANXIETY

16.3 COGNITIVE FUNCTION

16.4 STAMINA BOOST

16.5 DIGESTION

16.6 IMMUNITY

16.7 OTHERS

17 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY CERTIFICATION

17.1 OVERVIEW

17.2 KOSHER

17.3 ORGANIC

17.4 OTHERS

18 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY BRAND

18.1 OVERVIEW

18.2 BRANDED

18.3 PRIVATE LABEL

19 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY PACKAGING TYPE

19.1 OVERVIEW

19.2 TIN JARS

19.3 POUCHES

19.4 CARDBOARD BOXES

19.5 OTHERS

20 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 STORE BASED RETAILERS

20.2.1 SUPERMARKETS/HYPERMARKETS

20.2.2 GROCERY STORES

20.2.3 CONVENIENCE STORES

20.2.4 SPECIALITY STORES

20.2.5 OTHERS

20.3 NON-STORE RETAILERS

20.3.1 COMPANY WEBSITE

20.3.2 END USERS

21 GLOBAL CHAMOMILE HERBAL TEA MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS & PARTNERSHIP

21.8 REGULATORY CHANGES

22 GLOBAL CHAMOMILE HERBAL TEA MARKET, BY GEOGRAPHY

22.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

22.2 NORTH AMERICA

22.2.1 U.S.

22.2.2 CANADA

22.2.3 MEXICO

22.3 EUROPE

22.3.1 GERMANY

22.3.2 U.K.

22.3.3 ITALY

22.3.4 FRANCE

22.3.5 SPAIN

22.3.6 SWITZERLAND

22.3.7 NETHERLANDS

22.3.8 BELGIUM

22.3.9 RUSSIA

22.3.10 TURKEY

22.3.11 REST OF EUROPE

22.4 ASIA-PACIFIC

22.4.1 JAPAN

22.4.2 CHINA

22.4.3 SOUTH KOREA

22.4.4 INDIA

22.4.5 AUSTRALIA

22.4.6 SINGAPORE

22.4.7 THAILAND

22.4.8 INDONESIA

22.4.9 MALAYSIA

22.4.10 PHILIPPINES

22.4.11 REST OF ASIA-PACIFIC

22.5 SOUTH AMERICA

22.5.1 BRAZIL

22.5.2 ARGENTINA

22.5.3 REST OF SOUTH AMERICA

22.6 MIDDLE EAST AND AFRICA

22.6.1 SOUTH AFRICA

22.6.2 UAE

22.6.3 SAUDI ARABIA

22.6.4 KUWAIT

22.6.5 REST OF MIDDLE EAST AND AFRICA

23 GLOBAL CHAMOMILE HERBAL TEA MARKET, SWOT & DBMR ANALYSIS

24 GLOBAL CHAMOMILE HERBAL TEA MARKET, COMPANY PROFILE

24.1 MARTIN BAUER GROUP

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHICAL PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 TEA FORTE

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHICAL PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 UNILEVER

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHICAL PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 ORGANIC INDIA

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHICAL PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 THE HAIN CELESTIAL GROUP

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHICAL PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 ASSOCIATED BRITISH FOODS

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHICAL PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 BARRY'S TEA

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHICAL PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 DILMAH CEYLON TEA COMPANY

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHICAL PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 HARNEY & SONS

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHICAL PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 ADAGIO TEAS

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 PRODUCT PORTFOLIO

24.10.4 GEOGRAPHICAL PRESENCE

24.10.5 RECENT DEVELOPMENTS

24.11 MOTHERS PARKERS TEA

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 PRODUCT PORTFOLIO

24.11.4 GEOGRAPHICAL PRESENCE

24.11.5 RECENT DEVELOPMENTS

24.12 TYPHOO

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHICAL PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 THE LONDON TEA COMPANY

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHICAL PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 MCLEOD RUSSEL

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHICAL PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 TWININGS

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHICAL PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 TATA GLOBAL BEVERAGE

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHICAL PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 TEA LIFE

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 GEOGRAPHICAL PRESENCE

24.17.5 RECENT DEVELOPMENTS

24.18 TEA TOO PTY LTD.

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHICAL PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 ORIGIN TEA

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHICAL PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 TIELEKA

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHICAL PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 MADURA

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHICAL PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 THE TEA HUT

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 PRODUCT PORTFOLIO

24.22.4 GEOGRAPHICAL PRESENCE

24.22.5 RECENT DEVELOPMENTS

24.23 ADORE TEA

24.23.1 COMPANY OVERVIEW

24.23.2 REVENUE ANALYSIS

24.23.3 GEOGRAPHICAL PRESENCE

24.23.4 PRODUCT PORTFOLIO

24.23.5 RECENT DEVELOPMENTS

24.24 YOGI

24.24.1 COMPANY OVERVIEW

24.24.2 REVENUE ANALYSIS

24.24.3 GEOGRAPHICAL PRESENCE

24.24.4 PRODUCT PORTFOLIO

24.24.5 RECENT DEVELOPMENTS

24.25 KARMA KETTLE TEAS

24.25.1 COMPANY OVERVIEW

24.25.2 REVENUE ANALYSIS

24.25.3 GEOGRAPHICAL PRESENCE

24.25.4 PRODUCT PORTFOLIO

24.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Global Chamomile Herbal Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chamomile Herbal Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chamomile Herbal Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.