Global Chemical Distribution Market

Market Size in USD Billion

CAGR :

%

USD

304.97 Billion

USD

471.59 Billion

2024

2032

USD

304.97 Billion

USD

471.59 Billion

2024

2032

| 2025 –2032 | |

| USD 304.97 Billion | |

| USD 471.59 Billion | |

|

|

|

|

Chemical Distribution Market Size

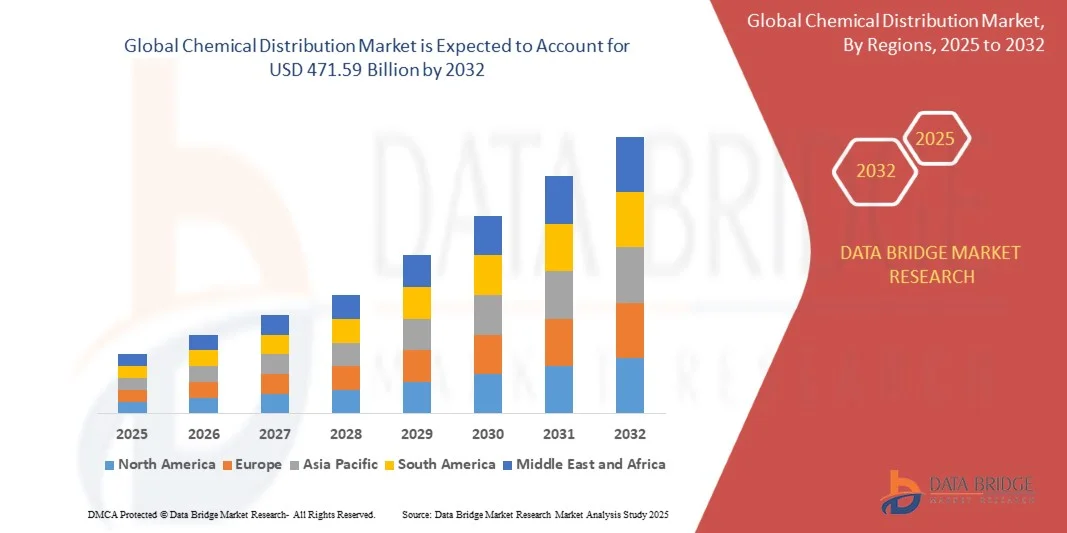

- The global chemical distribution market size was valued at USD 304.97 billion in 2024 and is expected to reach USD 471.59 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the increasing demand for specialty and commodity chemicals across diverse industries such as pharmaceuticals, manufacturing, and construction, coupled with expanding global supply chain networks that facilitate efficient distribution and product accessibility

- Furthermore, growing investments in infrastructure development, industrialization in emerging economies, and the rising need for sustainable and high-performance chemical solutions are driving the market’s expansion, positioning chemical distribution as a key enabler of global industrial growth

Chemical Distribution Market Analysis

- The chemical distribution market plays a crucial role in bridging chemical manufacturers with end-use industries by ensuring safe handling, storage, and transportation of chemicals while providing value-added services such as formulation support and regulatory compliance

- The increasing reliance on specialty chemicals, rapid industrial expansion in developing regions, and advancements in digital distribution platforms are fueling steady market growth, as distributors adapt to evolving customer needs and sustainability-driven supply chain models

- Asia-Pacific dominated the chemical distribution market with a share of 62.7% in 2024, due to the region’s extensive industrial base, growing consumption of specialty and commodity chemicals, and the presence of major manufacturing economies

- North America is expected to be the fastest growing region in the chemical distribution market during the forecast period due to growing demand for specialty and performance chemicals in industries such as pharmaceuticals, automotive, and construction

- Commodity chemicals segment dominated the market with a market share of 64.2% in 2024, due to rising global industrialization and the expanding demand for basic chemicals in construction, textiles, and consumer goods manufacturing. Commodity chemicals provide large-volume, cost-effective solutions, making them essential for emerging markets with growing industrial infrastructure. For instance, companies such as Brenntag are expanding their commodity chemical portfolios to cater to increased bulk demand in Asia-Pacific. The segment’s growth is also supported by efficient supply chains and regional distribution networks that allow timely delivery and cost optimization

Report Scope and Chemical Distribution Market Segmentation

|

Attributes |

Chemical Distribution Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Distribution Market Trends

“Growing Digitalization in Chemical Distribution”

- The global chemical distribution market is undergoing rapid modernization with the integration of digital platforms, data analytics, and cloud-based supply chain management systems. Distributors are embracing digital tools to enhance transparency, efficiency, and customer engagement while managing increasingly complex logistics and product portfolios across specialty and commodity chemical segments

- For instance, Brenntag SE and Univar Solutions Inc. have launched digital marketplaces and customer portals offering online ordering, real-time inventory tracking, and safety data management. These initiatives reflect how distribution companies are evolving into digital service providers offering customized solutions and technical support for industrial clients

- The adoption of advanced analytics and predictive modeling is enabling distributors to optimize inventory planning, demand forecasting, and pricing management. Digital supply chain integration strengthens product traceability and compliance while reducing operational costs and delivery cycle times

- E-commerce platforms and enterprise resource planning (ERP) systems are transforming the chemical distribution landscape by supporting direct-to-customer engagement. This approach enhances customer reach, accelerates order fulfillment, and facilitates value-added services such as formulation support and application testing

- Integration of Internet of Things (IoT) and blockchain technologies is providing end-to-end visibility, ensuring product security, efficient asset utilization, and data-driven logistics coordination. Such tools are helping distributors monitor container safety, streamline global shipments, and comply with safety and documentation requirements

- As digitalization reshapes the global distribution value chain, forward-looking firms are combining technology-driven platforms with sustainability and compliance initiatives. This combination is advancing the chemical industry toward greater operational efficiency, customer centricity, and resilient supply networks

Chemical Distribution Market Dynamics

Driver

“Rising Demand for Specialty Chemicals”

- The surge in demand for high-performance specialty chemicals across industries such as automotive, pharmaceuticals, and electronics is driving growth in the chemical distribution market. Specialty chemicals require tailored logistics, technical expertise, and strong supplier–customer collaboration, providing a significant opportunity for distributors offering value-added services

- For instance, IMCD N.V. and Azelis Holding S.A. have expanded their portfolios through strategic acquisitions to enhance application-specific distribution networks in coatings, life sciences, and food additives. Their focus on specialty chemicals allows them to leverage technical support capabilities and strengthen client relationships across niche industrial sectors

- Growing industrial diversification and the rising adoption of advanced materials are increasing the need for specialty chemical intermediates. Distributors play a key role in bridging technical knowledge gaps by supplying customized solutions, laboratory support, and formulation expertise to end-use manufacturers

- The trend of outsourcing logistics and supply management among small and medium-sized manufacturers is further fueling distributor involvement. Partnering with specialized distributors enables producers to manage compliance, storage, and transportation of chemicals more efficiently while focusing on core production activities

- As end-user industries continue to prioritize performance efficiency and product innovation, the demand for specialty chemicals and value-integrated distribution services is expected to remain a major growth driver. The specialized expertise of distributors will be crucial in facilitating product accessibility and technical assistance across global markets

Restraint/Challenge

“Strict Environmental and Safety Regulations”

- Stringent environmental and safety regulations concerning the handling, storage, and transportation of chemicals represent a key challenge in the chemical distribution market. Compliance requirements under frameworks such as REACH (EU), OSHA (U.S.), and GHS (Globally Harmonized System) add complexity and increase operating costs for distributors

- For instance, companies such as Brenntag SE and Univar Solutions must continually invest in upgrading storage facilities, waste management systems, and safety equipment to comply with evolving regional and international safety norms. This significantly affects profit margins, particularly for mid-sized and local distributors

- Frequent updates to chemical classification and labeling standards complicate global distribution networks, as different jurisdictions often enforce varying compliance timelines. Adhering to transport safety codes for hazardous or toxic chemicals further adds logistical and documentation burdens

- The need for rigorous emissions monitoring, spill prevention, and employee safety training drives up operational expenditures. Distributors face additional costs for third-party audits, certifications, and insurance to manage environmental and occupational risk factors

- To address these challenges, the industry is increasingly adopting digital compliance systems, sustainable storage technologies, and renewable-based chemical portfolios. Enhanced regulatory harmonization and adoption of safer, bio-based chemicals will be pivotal in minimizing compliance risks and ensuring the long-term efficiency of global chemical distribution operations

Chemical Distribution Market Scope

The market is segmented on the basis of product and end-use.

• By Product

On the basis of product, the chemical distribution market is segmented into specialty chemicals and commodity chemicals. The commodity chemicals segment dominated the market with the largest revenue share of 64.2% in 2024, driven by rising global industrialization and the expanding demand for basic chemicals in construction, textiles, and consumer goods manufacturing. Commodity chemicals provide large-volume, cost-effective solutions, making them essential for emerging markets with growing industrial infrastructure. For instance, companies such as Brenntag are expanding their commodity chemical portfolios to cater to increased bulk demand in Asia-Pacific. The segment’s growth is also supported by efficient supply chains and regional distribution networks that allow timely delivery and cost optimization.

The specialty chemicals segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for high-performance chemicals across industries such as pharmaceuticals, agrochemicals, and electronics. Specialty chemicals often command higher margins due to their complex formulations and tailored applications, attracting distributors who focus on value-added offerings. The segment benefits from strong innovation, frequent product launches, and evolving regulatory compliance standards that require specialized solutions. In addition, the growing adoption of sustainable and eco-friendly chemicals in industries further reinforces the preference for specialty chemicals. Distributors leverage these products to build long-term partnerships with industrial clients who seek customized solutions for specific processes and applications.

• By End-Use

On the basis of end-use, the chemical distribution market is segmented into industrial manufacturing, pharmaceuticals, textile, and electrical & electronics. The industrial manufacturing segment dominated the market in 2024, attributed to the widespread use of chemicals in metal treatment, lubricants, coatings, and process management. The growing emphasis on production efficiency and process optimization in manufacturing industries drives strong demand for chemical distributors who provide technical expertise and timely supply. The segment also benefits from the adoption of automation and sustainable production practices that require advanced formulations and precise chemical integration. As industries modernize globally, distributors play a crucial role in ensuring the availability of performance-enhancing chemicals across production chains.

The pharmaceuticals segment is expected to witness the fastest growth from 2025 to 2032, driven by expanding healthcare infrastructure and increased production of APIs, excipients, and formulation ingredients. For instance, Univar Solutions and IMCD are strengthening their pharmaceutical distribution networks to cater to growing demand in North America and Asia-Pacific. The segment’s growth is supported by stringent quality standards, rising R&D investments, and the development of novel drug formulations requiring high-purity specialty chemicals. In addition, the rising prevalence of chronic diseases and increasing pharmaceutical exports are fueling the expansion of this segment, making it a major contributor to overall market growth.

Chemical Distribution Market Regional Analysis

- Asia-Pacific dominated the chemical distribution market with the largest revenue share of 62.7% in 2024, driven by the region’s extensive industrial base, growing consumption of specialty and commodity chemicals, and the presence of major manufacturing economies

- The region’s cost-competitive production capabilities, rising investments in chemical logistics infrastructure, and expansion of industrial and construction sectors are fueling market growth

- Increasing foreign direct investment, rapid urbanization, and supportive government initiatives across emerging economies are further strengthening the chemical distribution network in Asia-Pacific

China Chemical Distribution Market Insight

China held the largest share in the Asia-Pacific chemical distribution market in 2024, owing to its dominance in global chemical manufacturing and robust domestic demand across end-use industries such as construction, automotive, and electronics. The nation’s extensive production capacity, cost-efficient supply chains, and well-established export infrastructure continue to drive distribution expansion. Ongoing investments in green and specialty chemical production are enhancing China’s position as a global distribution hub.

India Chemical Distribution Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, propelled by expanding industrial output, rapid growth in the pharmaceuticals and textile industries, and government-led initiatives supporting domestic chemical manufacturing. The “Make in India” and Production Linked Incentive (PLI) schemes are attracting multinational distributors to establish operations locally. Rising export opportunities and strong infrastructure development are further fueling the growth of the Indian chemical distribution sector.

Europe Chemical Distribution Market Insight

The Europe chemical distribution market is growing steadily, supported by stringent regulatory frameworks, a strong focus on sustainability, and a high demand for specialty chemicals across industrial and pharmaceutical applications. The region’s commitment to circular economy goals and energy-efficient production is reshaping supply chains toward greener solutions. Collaborative partnerships between distributors and manufacturers are enhancing efficiency and transparency across European markets.

Germany Chemical Distribution Market Insight

Germany’s chemical distribution market is driven by its leading industrial base, advanced manufacturing capabilities, and established position as a key exporter of specialty and performance chemicals. The presence of major multinational distributors and integrated logistics networks ensures efficient supply to end-use industries. Strong emphasis on innovation and sustainable chemical practices reinforces Germany’s dominant role within the European market.

U.K. Chemical Distribution Market Insight

The U.K. market is characterized by a mature chemical distribution ecosystem, supported by the expansion of specialty chemical applications in pharmaceuticals, construction, and electronics. Post-Brexit trade realignments and investments in domestic supply chain resilience are driving localized distribution networks. The increasing adoption of digital platforms for inventory management and customer engagement is further improving operational efficiency.

North America Chemical Distribution Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, driven by growing demand for specialty and performance chemicals in industries such as pharmaceuticals, automotive, and construction. The region benefits from technological advancements in distribution management, strong industrial R&D, and reshoring of manufacturing activities. Rising collaborations between distributors and chemical producers are further supporting market expansion.

U.S. Chemical Distribution Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its expansive industrial manufacturing base, advanced logistics systems, and strong presence of global distributors. The country’s focus on digitalization, sustainability, and efficient supply chain management is driving innovation in distribution practices. The dominance of specialty chemical demand from the healthcare and electronics sectors continues to reinforce the U.S.’s leadership in the regional market.

Chemical Distribution Market Share

The chemical distribution industry is primarily led by well-established companies, including:

- Univar Inc. (U.S.)

- HELM AG (Germany)

- Brenntag AG (Germany)

- ICC Industries, Inc. (U.S.)

- Barentz International B.V. (Netherlands)

- Azelis S.A. (Belgium)

- Omya AG (Switzerland)

- Biesterfeld AG (Germany)

- Safic-Alcan (France)

- STOCKMEIER Group (Germany)

- REDA Chemicals (United Arab Emirates)

- Ashland (U.S.)

- BASF SE (Germany)

- Jebsen & Jessen Pte Ltd. (Singapore)

- Quimidroga (Spain)

- solvadis deutschland gmbh (Germany)

- TER HELL & CO. GMBH (Germany)

Latest Developments in Global Chemical Distribution Market

- In July 2024, Specialty chemical distributor Krahn Chemie Benelux entered into a strategic alliance with Mitsubishi Chemical Europe (MCE) to expand its product portfolio and strengthen its position in the European specialty chemicals market. This collaboration enables Krahn Chemie Benelux to distribute high-end MCE products, enhancing its access to advanced materials and catering to the growing demand for specialty solutions across various industries. The partnership is expected to boost Krahn Chemie’s competitive edge and reinforce its role as a key distributor of premium chemical products in the region

- In April 2024, Rhenus Logistics and Brenntag introduced their first-ever fully electric truck in India, marking a significant milestone in promoting sustainable logistics within the chemical distribution industry. The initiative aims to streamline supply chain operations, reduce carbon emissions, and align with India’s growing emphasis on green transportation. This development underscores Brenntag’s commitment to integrating environmentally responsible practices and enhancing supply chain efficiency through innovation and sustainability

- In January 2024, Azelis launched a comprehensive sustainability initiative focused on minimizing its environmental footprint and advancing supply chain transparency. The program emphasizes the introduction of eco-friendly product lines and the adoption of responsible sourcing practices aligned with global sustainability goals. This strategic move strengthens Azelis’ market position as a sustainability-focused distributor, appealing to environmentally conscious clients and reinforcing its leadership in ethical and transparent operations

- In 2024, DKSH announced the acquisition of Terra Firma, a leading Australian specialty chemicals distributor, to expand its market presence and strengthen its distribution capabilities in the Asia-Pacific region. This acquisition enhances DKSH’s access to local markets, broadens its specialty chemical portfolio, and supports its strategic focus on regional growth and customer proximity. The move further consolidates DKSH’s position as a key distributor of specialty chemicals in emerging economies

- In 2024, IMCD inaugurated its new regional headquarters and technical center in Dubai, reflecting its commitment to expanding operations across the Middle East and Africa. The facility is designed to enhance technical expertise, support innovation, and provide localized customer service. This expansion strengthens IMCD’s regional footprint and enables the company to address increasing demand for specialty chemicals through improved technical capabilities and regional presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Distribution Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Distribution Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Distribution Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.