Global Chemical Enhanced Oil Recovery Eor Ior Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

1.67 Billion

2024

2032

USD

1.05 Billion

USD

1.67 Billion

2024

2032

| 2025 –2032 | |

| USD 1.05 Billion | |

| USD 1.67 Billion | |

|

|

|

|

What is the Global Chemical Enhanced Oil Recovery (EORIOR) Market Size and Growth Rate?

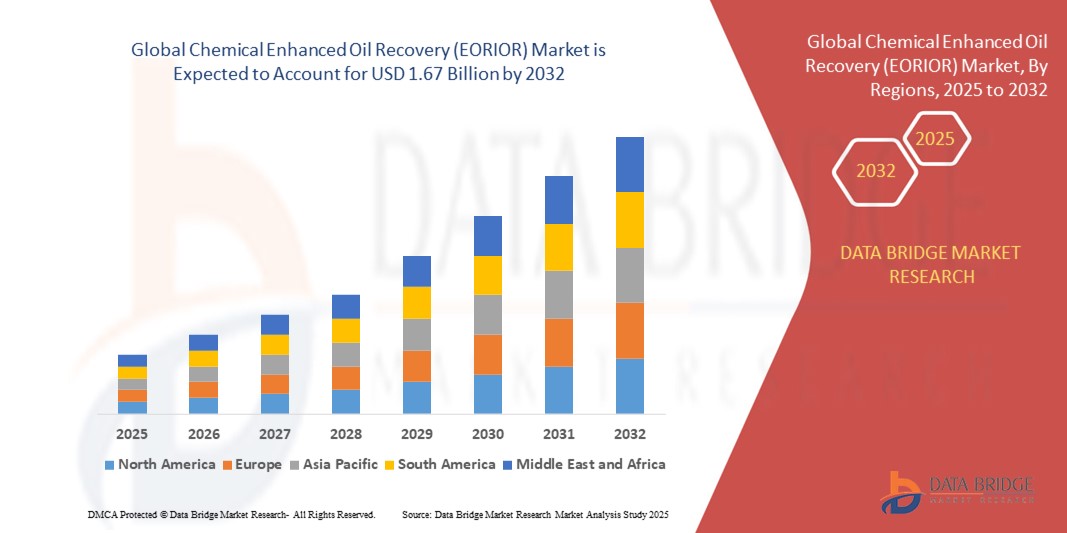

- The global chemical enhanced oil recovery (EORIOR) market size was valued at USD 1.05 billion in 2024 and is expected to reach USD 1.67 billion by 2032, at a CAGR of 5.90% during the forecast period

- The global chemical enhanced oil recovery (EOR/IOR) market is expanding due to factors such as increased adoption in developing economies such as India and China, diverse applications in onshore and offshore sectors, rising government R&D investments, and growing industrialization in developing nations

What are the Major Takeaways of Chemical Enhanced Oil Recovery (EORIOR) Market?

- Ongoing research and development efforts are yielding more efficient and cost-effective EOR methods. Innovations such as nanotechnology and improved chemical formulations enhance oil recovery rates, making EOR/IOR increasingly attractive for operators seeking to maximize production and reserves

- North America dominated the chemical enhanced oil recovery (EORIOR) market with the largest revenue share of 38.18% in 2024, supported by mature oilfield operations, strong investment in recovery technologies, and the rising focus on maximizing existing reservoir output

- The Asia-Pacific EORIOR market is projected to grow at the fastest CAGR of 9.14% from 2025 to 2032, driven by rising energy demand, rapid industrialization, and government-backed energy initiatives

- The sheets segment dominated the market with the largest revenue share of 46.5% in 2024, driven by their extensive use in large-scale applications due to easy handling, uniformity, and cost-effectiveness

Report Scope and Chemical Enhanced Oil Recovery (EORIOR) Market Segmentation

|

Attributes |

Chemical Enhanced Oil Recovery (EORIOR) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Chemical Enhanced Oil Recovery (EORIOR) Market?

Shift Toward Polymer- and Surfactant-Based EOR Techniques

- A major trend in the global Chemical EOR market is the rising adoption of polymer flooding and surfactant-polymer combinations to boost oil recovery efficiency, particularly in mature and declining oil fields

- Oil producers are increasingly deploying low-salinity water combined with polymers to enhance sweep efficiency and extend the economic life of reservoirs

- For instance, in 2023, Petrobras (Brazil) announced pilot projects to test polymer flooding in offshore fields, aiming to raise recovery factors by over 10%

- The integration of chemical EOR with digital reservoir modeling and simulation tools is further enabling oil companies to optimize chemical formulations and minimize operational costs

- This trend reflects a broader industry shift toward maximizing recovery from existing fields rather than exploring new ones, reshaping EOR strategies across major producing regions

What are the Key Drivers of Chemical Enhanced Oil Recovery (EORIOR) Market?

- The rising number of mature oil fields worldwide is a primary driver, as chemical EOR offers a cost-effective solution to increase recovery rates without new drilling

- For instance, in April 2024, Saudi Aramco announced expansion of chemical flooding trials in its giant reservoirs to sustain output amid field maturity

- Increasing oil demand in emerging economies coupled with efforts by producers to maintain supply stability is encouraging greater investment in chemical EOR projects

- Advances in chemical formulations (such as environmentally friendly surfactants and high-performance polymers) are making EOR operations more efficient and sustainable

- The driver is further supported by government and corporate focus on maximizing domestic energy output, reducing dependence on imports, and extending field lifespans

Which Factor is Challenging the Growth of the Chemical Enhanced Oil Recovery (EORIOR) Market?

- One of the biggest challenges is the high cost and operational complexity associated with large-scale chemical flooding projects. The requirement for specialized infrastructure and continuous chemical supply raises capital and operational expenditure

- For instance, reports highlight that polymer flooding costs can account for up to 30–40% of total project expenditure, making it less attractive in low oil-price environments

- In addition, environmental concerns linked to chemical usage, including potential groundwater contamination and waste disposal issues, pose regulatory hurdles

- Another challenge is reservoir compatibility, as not all formations respond well to chemical injection, limiting widespread adoption

- Overcoming these issues requires cost optimization, improved reservoir screening techniques, and development of eco-friendly chemical formulations. These advancements will be critical to building long-term confidence in chemical EOR projects

How is the Chemical Enhanced Oil Recovery (EORIOR) Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product Type

On the basis of product type, the chemical enhanced oil recovery (EOR) market is segmented into sheets, rods, and tubes. The sheets segment dominated the market with the largest revenue share of 46.5% in 2024, driven by their extensive use in large-scale applications due to easy handling, uniformity, and cost-effectiveness. Sheets are widely adopted in processing and storage facilities as they offer excellent structural integrity and are adaptable to different project requirements.

The rods segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, as their versatility in high-strength applications such as wellbore components and drilling tools gains traction. Tubes continue to find demand in specialized flow-control systems, though at a moderate growth pace. The growing need for lightweight, durable, and high-performance materials across EOR operations ensures that all three product forms will remain significant, with rods leading future growth.

- By Grades

On the basis of grades, the chemical enhanced oil recovery (EOR) market is segmented into standard, reinforced, impact modified, recycled, ultraviolet (UV) stabilized, and special grade. The reinforced grade held the dominant market share of 39.8% in 2024, as its superior strength, durability, and ability to withstand harsh reservoir environments make it the preferred choice for demanding operations. Reinforced grades offer better resistance to temperature, salinity, and chemical degradation, ensuring efficiency in long-term projects.

Meanwhile, the UV stabilized grade is projected to register the fastest CAGR of 20.7% during 2025–2032, driven by its suitability for above-ground equipment and outdoor applications where exposure to ultraviolet radiation can degrade performance. Impact modified and recycled grades are steadily gaining popularity due to cost-effectiveness and environmental considerations, while special grades serve niche applications requiring tailored properties. This segmentation reflects the increasing demand for performance-optimized solutions across different EOR conditions.

- By Application

On the basis of application, the chemical enhanced oil recovery (EOR) market is segmented into gears, engineering parts, and medical delivery devices. The engineering parts segment dominated with a market share of 51.2% in 2024, fueled by the rising demand for robust, lightweight, and efficient components in EOR field operations, such as pumps, injectors, and drilling systems. Their ability to enhance operational life and reduce maintenance costs makes them indispensable.

The medical delivery devices segment is anticipated to grow at the fastest CAGR of 19.6% from 2025 to 2032, owing to increased adoption of precision-engineered composites in chemical handling and injection systems for enhanced safety and efficiency. Gears maintain a steady demand as essential mechanical components for transmission and motion control. The growing focus on operational efficiency and safe chemical handling in EOR processes continues to shape application-specific material demand.

- By End User Industry

On the basis of end user industry, the chemical enhanced oil recovery (EOR) market is segmented into electrical and electronics, transportation, medical, food packaging, consumer goods and appliances, building and construction, and other industries. The transportation sector dominated the market with the largest share of 42.7% in 2024, attributed to the increasing requirement for durable and lightweight components in oilfield equipment, logistics, and chemical transport solutions. Transportation players are prioritizing efficiency and reliability, making EOR-focused materials critical.

The medical industry is forecasted to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by rising usage of advanced materials in chemical delivery systems, safety devices, and precision-engineered instruments. Electrical & electronics and consumer goods also maintain strong adoption levels, while building & construction benefits from demand in infrastructure linked to EOR projects. This segmentation underscores the market’s multi-industry reliance, with transportation leading revenue and medical fueling future growth.

Which Region Holds the Largest Share of the Chemical Enhanced Oil Recovery (EORIOR) Market?

- North America dominated the chemical enhanced oil recovery (EORIOR) market with the largest revenue share of 38.18% in 2024, supported by mature oilfield operations, strong investment in recovery technologies, and the rising focus on maximizing existing reservoir output

- The region benefits from well-established upstream players, advanced R&D capabilities, and government incentives promoting efficient energy recovery

- In addition, increasing crude oil demand, coupled with the shift towards sustainable extraction, strengthens North America’s leadership in the global EORIOR market

U.S. Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The U.S. accounted for 81% of North America’s revenue share in 2024, making it the single largest market for chemical EORIOR technologies. Growth is driven by extensive shale reserves, early adoption of polymer and surfactant flooding techniques, and robust government and private sector investments. Increasing emphasis on energy security, along with enhanced recovery efficiency in mature fields, positions the U.S. as a global leader in the EORIOR market.

Europe Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, fueled by growing emphasis on reducing import dependency and optimizing domestic oil production. Key contributors include the North Sea operations, adoption of advanced flooding methods, and supportive EU policies on sustainable extraction technologies. Demand for innovative, cost-efficient solutions continues to rise as oilfield operators balance recovery performance with environmental considerations.

U.K. Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by the need to extend the lifespan of aging North Sea oilfields. Rising adoption of polymer flooding and government support for maximizing domestic reserves are crucial growth factors. The U.K.’s focus on technological collaborations and investments in offshore recovery projects is expected to further accelerate market penetration.

Germany Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The Germany market is expected to expand considerably during the forecast period, supported by technological innovation and sustainability-driven energy strategies. The integration of advanced chemical formulations and a strong focus on eco-friendly processes are encouraging wider adoption. Germany’s emphasis on R&D and its robust energy infrastructure position it as a prominent growth hub within Europe’s EORIOR market.

Which Region is the Fastest Growing in the Chemical Enhanced Oil Recovery (EORIOR) Market?

The Asia-Pacific EORIOR market is projected to grow at the fastest CAGR of 9.14% from 2025 to 2032, driven by rising energy demand, rapid industrialization, and government-backed energy initiatives. Countries such as China, India, and Japan are investing heavily in recovery techniques to reduce import reliance and strengthen domestic production. The region’s emergence as a manufacturing hub for chemical formulations further enhances affordability and adoption of EORIOR solutions.

Japan Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The Japan market is gaining momentum due to its advanced technological base, urban energy requirements, and strong focus on efficiency. Aging oilfields, coupled with the demand for sustainable recovery methods, are fueling adoption of surfactant-polymer techniques. Japan’s emphasis on innovation and integration of digital monitoring systems enhances the effectiveness of EORIOR deployment.

China Chemical Enhanced Oil Recovery (EORIOR) Market Insight

The China market held the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding energy needs, and government-led smart energy initiatives. Strong domestic chemical production and large-scale deployment of polymer flooding across mature fields strengthen its market dominance. China’s positioning as both a major consumer and manufacturer ensures its long-term leadership in the regional EORIOR market.

Which are the Top Companies in Chemical Enhanced Oil Recovery (EORIOR) Market?

The chemical enhanced oil recovery (EORIOR) industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Baker Hughes Company (U.S.)

- Halliburton Company (U.S.)

- Nalco Champion (U.S.)

- BASF SE (Germany)

- Solvay S.A. (Belgium)

- AkzoNobel N.V. (Netherlands)

- Chevron Phillips Chemical Company LP (U.S.)

- Exxon Mobil Corporation (U.S.)

- Royal Dutch Shell plc (Netherlands)

- Dow Chemical Company (U.S.)

- Occidental Petroleum Corporation (U.S.)

- Weatherford International plc (Switzerland)

- Praxair, Inc. (U.S.)

What are the Recent Developments in Global Chemical Enhanced Oil Recovery (EORIOR) Market?

- In May 2025, SLB introduced Electris, a portfolio of digitally enabled electric well completion technologies aimed at boosting production and recovery while lowering the total cost of ownership of assets. The technology enables digitalized control of the entire productive wellbore area, offering real-time production intelligence across reservoirs, thereby setting a new benchmark in well completion innovation

- In October 2024, ICM entered into an EPC agreement with Absolute Energy, LLC to deploy its patented FOT Oil Recovery™ technology, designed to improve oil production while reducing natural gas consumption and enhancing overall energy efficiency. This innovative approach provides ethanol producers with a more sustainable and cost-effective recovery solution, strengthening the push toward energy-efficient oil recovery

- In October 2024, Japan Petroleum Exploration Co., in collaboration with PT Pertamina, initiated an inter-well CO₂ injection test in Indonesia to evaluate the effectiveness of CO₂ sequestration and CO₂-EOR across multiple wells. This initiative highlights the growing importance of CO₂-based techniques in enhancing oil recovery and reducing carbon footprints in the energy sector

- In June 2024, Vedanta Group and Cairn Oil & Gas, leading private oil and gas producers in India, launched the country’s largest commercial ASP flooding project in Rajasthan. This initiative focuses on boosting oil recovery from mature fields, marking a significant step in India’s energy security and enhanced production efforts

- In February 2022, SNF implemented its polymer flooding technique using modular skids, delivering up to a 20% increase in oil recovery at an additional cost of only $3 to $6 per barrel while significantly cutting CO₂ emissions. With more than 300 global projects and plug-and-pump facilities, this approach has established itself as a scalable and sustainable EOR solution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Enhanced Oil Recovery Eor Ior Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Enhanced Oil Recovery Eor Ior Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Enhanced Oil Recovery Eor Ior Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.