Global Chemical Indicator Inks Market

Market Size in USD Million

CAGR :

%

USD

100.40 Million

USD

181.74 Million

2024

2032

USD

100.40 Million

USD

181.74 Million

2024

2032

| 2025 –2032 | |

| USD 100.40 Million | |

| USD 181.74 Million | |

|

|

|

|

Chemical Indicator Inks Market Size

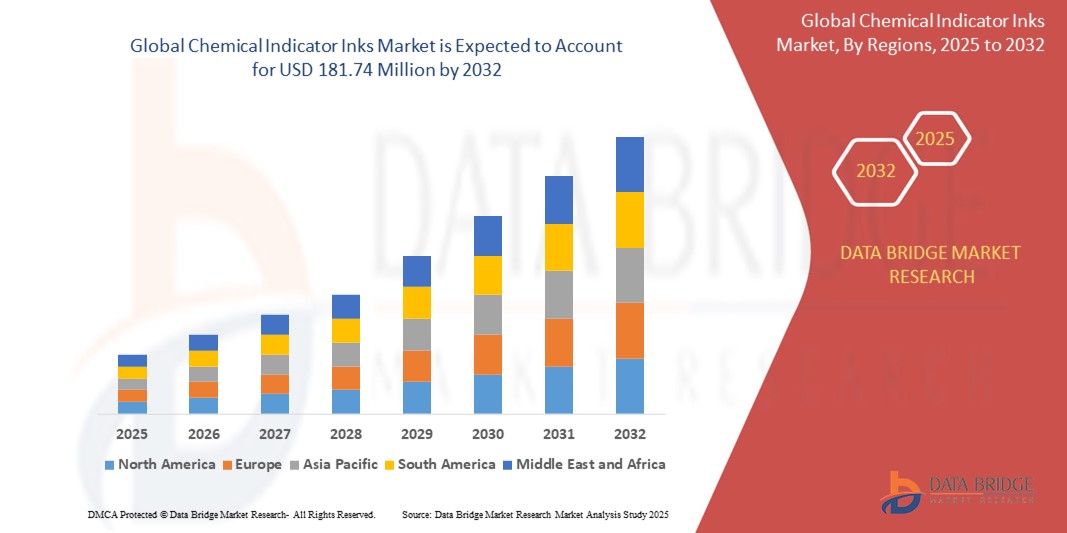

- The global chemical indicator inks market was valued at USD 100.4 Million in 2024 and is expected to reach USD 181.74 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.70%, primarily driven by the widespread use in sterilization and medical applications

- This growth is driven by factors such as the rising cases of hospital-acquired infections (HAIs) are pushing hospitals and clinics to adopt better sterilization practices

Chemical Indicator Inks Market Analysis

- The chemical indicator inks market is experiencing steady growth due to rising demand in sterilization, healthcare, and pharmaceutical applications. These inks play a crucial role in verifying sterilization processes in medical, food, and industrial applications. Stringent regulatory requirements and increasing concerns about healthcare-associated infections (HAIs) are further driving adoption

- The demand for this medical device industry is expanding rapidly, with new innovations in implants, surgical tools, and diagnostic equipment requiring stringent sterilization validation.

- The North America region stands out as one of the dominant region for chemical indicator inks, driven by stringent regulatory framework

- For instance, In the U.S., the Food and Drug Administration (FDA) governs packaging inks under the Federal Food, Drug, and Cosmetic Act (FD&C Act). Inks are considered indirect food additives and must comply with strict migration limits. The FDA’s Food Contact Notification (FCN) system allows manufacturers to apply for new substances to be reviewed for safety

- Globally, the sterilization monitoring dominates the chemical indicator inks market due to strict regulatory requirements, rising hospital sterilization needs, and growing demand from medical device and pharmaceutical industries

Report Scope and Chemical Indicator Inks Market Segmentation

|

Attributes |

Chemical Indicator Inks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Indicator Inks Market Trends

“Increased Adoption of 3D Imaging and Digital Integration”

- The rising adoption of advanced sterilization methods is reshaping the Chemical Indicator Inks Market, as traditional sterilization techniques such as steam autoclaving and ethylene oxide (EtO) sterilization are being phased out in favor of low-temperature, high-efficiency alternatives

- Hydrogen peroxide plasma sterilization is gaining traction due to its low-temperature operation, compatibility with heat-sensitive medical devices, and reduced toxic residue, making it ideal for sterilizing endoscopes, implants, and surgical instruments. Similarly, gamma radiation and electron beam (E-Beam) sterilization are becoming popular for single-use medical products, pharmaceutical packaging, and laboratory equipment, offering high penetration and effectiveness against resistant microorganisms

- For instance, Steris Corporation, a global leader in sterilization and infection prevention, developed the V-PRO Low-Temperature Sterilization System, which uses hydrogen peroxide vapor to sterilize heat- and moisture-sensitive medical instruments

- Additionally, formaldehyde sterilization is being used in hospitals and pharmaceutical cleanrooms due to its ability to sterilize complex instruments without causing material degradation. These evolving sterilization technologies require specialized chemical indicator inks that can accurately respond to different sterilization conditions, ensuring precise validation of the sterilization process

- As a result, the demand for customized, multi-parameter chemical indicator inks is surging, with manufacturers investing in R&D to develop inks tailored to these emerging sterilization techniques

Chemical Indicator Inks Market Dynamics

Driver

“Rising Demand from the Pharmaceutical & Biotech Industries”

- The pharmaceutical and biotech sectors require validated sterilization processes to ensure the sterility of drug packaging, biologics, vaccines, and lab environments

- The increasing production of injectable medications, mRNA vaccines, and sterile pharmaceutical containers is driving demand for gamma and hydrogen peroxide-compatible chemical indicator inks

- Strict Good Manufacturing Practices (GMP) regulations require effective sterilization validation, fueling market growth

For instance,

- In March 2023, the World Health Organization (WHO) reported that 7 out of 100 hospitalized patients in high-income countries and 15 out of 100 in low- and middle-income countries acquire at least one healthcare-associated infection (HAI). This has led to stricter sterilization protocols in hospitals, boosting demand for chemical indicator inks to ensure compliance with infection control standards

- In September 2022, the U.S. FDA announced updated sterilization guidelines for medical devices, emphasizing the need for validated sterilization processes using chemical indicator inks. This regulatory shift has prompted major medical device manufacturers like Medtronic and Stryker to integrate multi-parameter chemical indicator inks into their sterilization protocols

- As a result of the rising prevalence of biotech firms like Moderna and BioNTech, which manufacture mRNA-based vaccines, have implemented advanced sterilization techniques using hydrogen peroxide sterilization chambers with customized chemical indicator inks to maintain sterility throughout vaccine production and distribution

Opportunity

“Growth of Eco-Friendly & Non-Toxic Indicator Inks”

- The demand for eco-friendly and non-toxic chemical indicator inks is increasing due to stricter environmental regulations and concerns over hazardous chemical exposure in sterilization processes. Many traditional indicator inks contain solvent-based or heavy-metal compounds, which pose health and environmental risks.

- Water-based, biodegradable, and solvent-free indicator inks are emerging as sustainable alternatives, reducing VOC emissions and toxic residues while maintaining sterilization efficacy.

- Manufacturers are investing in R&D to develop safer, non-toxic inks that comply with global sterilization and environmental standards, particularly in regions such as Europe and North America, where sustainability regulations are stringent.

For instance,

- In March 2024, Crosstex, a division of Cantel Medical, launched a new range of water-based, solvent-free indicator inks designed for use in ethylene oxide (EtO) and steam sterilization. These inks comply with ISO 11140 standards and European REACH regulations, ensuring they are free from harmful solvents and heavy metals while providing reliable sterilization validation

- In July 2023, 3M introduced a line of eco-friendly chemical indicator inks that are biodegradable and free from lead or mercury compounds. These inks have been adopted by major hospitals in the U.S. and Europe, helping healthcare facilities meet sustainability goals without compromising sterilization accuracy

- The shift toward non-toxic sterilization indicator inks is not only driven by regulatory pressure but also by hospitals and pharmaceutical companies seeking to enhance workplace safety. By adopting environmentally friendly sterilization validation solutions, healthcare institutions can minimize chemical waste and improve overall patient and staff safety

Restraint/Challenge

“High Production Costs and Limited Availability of Eco-Friendly Raw Materials”

- The transition to eco-friendly and non-toxic chemical indicator inks is hindered by high production costs and the limited availability of sustainable raw materials. Many traditional indicator inks rely on solvent-based formulations and chemical compounds that are widely available and cost-effective

- Eco-friendly alternatives, such as water-based and biodegradable inks, require specialized raw materials that are often more expensive and less readily available, increasing the overall production cost

- Manufacturers face challenges in sourcing non-toxic pigments, binders, and stabilizers that meet both regulatory sterilization requirements and sustainability standards, leading to higher R&D investments and slower adoption rates

For instance,

- In October 2023, an industry report published by the European Chemical Agency (ECHA) highlighted that the cost of producing solvent-free indicator inks is up to 30% higher than traditional formulations due to the complexity of developing stable, heat-resistant, and sterilization-responsive eco-friendly compounds. This price disparity has slowed adoption among small and mid-sized medical sterilization facilities

- Consequently, such limitations can result in the push for sustainability continues to drive innovation. Manufacturers are investing in alternative sourcing strategies and bio-based formulations to reduce dependency on expensive raw materials and make eco-friendly sterilization inks more accessible and cost-effective in the long run

Chemical Indicator Inks Market Scope

The market is segmented on the basis printing process, application, and end user industry.

|

Segmentation |

Sub-Segmentation |

|

By Printing Process |

|

|

By Application |

|

|

By End User Industry |

|

Chemical Indicator Inks Market Regional Analysis

“North America is the Dominant Region in the Chemical Indicator Inks Market”

- North America dominates the chemical indicator inks market, driven by stringent sterilization regulations, advanced healthcare infrastructure, and strong presence of key market players

- The U.S. holds a significant share due to high demand for advanced sterilization validation methods, increasing concerns about healthcare-associated infections (HAIs), and widespread adoption of low-temperature sterilization techniques like hydrogen peroxide plasma and E-Beam sterilization

- The availability of well-established regulatory frameworks (FDA, CDC, AAMI) and growing investments in research & development by leading medical sterilization companies further strengthen the market.

- Additionally, the increasing number of medical device sterilization procedures and pharmaceutical packaging requirements, along with a high rate of adoption of smart sterilization tracking systems, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Chemical Indicator Inks market, driven by expanding healthcare infrastructure, increasing sterilization awareness, and rising demand for advanced medical device manufacturing

- Countries such as China, India, and Japan are emerging as key markets due to rapid industrialization, growing hospital networks, and increasing pharmaceutical production that require stringent sterilization validation

- Japan, with its advanced medical technology and strict sterilization standards, remains a crucial market for chemical indicator inks. The country continues to lead in the adoption of hydrogen peroxide and low-temperature sterilization methods to enhance infection control measure

- China and India, with their large healthcare sectors and rising surgical volumes, are witnessing increased government and private sector investments in medical sterilization infrastructure. The expanding presence of global sterilization solution providers and growing focus on reducing hospital-acquired infections (HAIs) further contribute to market growth

Chemical Indicator Inks Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Tempil (LA-CO Industries, Inc.) (U.S.)

- North American Science Associates Inc. (NAMSA) (U.S.)

- 3M (U.S.)

- Terragene SA (Argentina)

- STERIS Corporation (U.S.)

- RIKEN CHEMICAL Co., Ltd. (Japan)

- Propper Manufacturing Co., Inc. (U.S.)

- SteriTec Products Inc. (U.S.)

- ETIGAM Bv (Netherlands)

- NiGK Corporation (Japan)

- gke GmbH (Germany)

- Crosstex International Inc. (U.S.)

Latest Developments in Global Chemical Indicator Inks Market

- In September 2024, Propper Manufacturing Company announced FDA clearance for its EO Chex Ethylene Oxide (EO) Indicator Tape, making it the only FDA-cleared ethylene oxide indicator tape available in the U.S. This innovative tape features diagonal stripes of pink chemical indicator ink that change to orange-brown upon exposure to EO sterilization, helping distinguish processed from unprocessed packages. The EO Chex tape addresses a market gap following the exit of previous suppliers during the pandemic, ensuring reliable sterilization for medical devices that require ethylene oxide

- In March 2024, Crosstex, a division of Cantel Medical, launched a new range of water-based, solvent-free indicator inks designed for use in ethylene oxide (EtO) and steam sterilization. These inks comply with ISO 11140 standards and European REACH regulations, ensuring they are free from harmful solvents and heavy metals while providing reliable sterilization validation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Indicator Inks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Indicator Inks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Indicator Inks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.