Global Chemical Indicators Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

2.60 Billion

2025

2033

USD

1.78 Billion

USD

2.60 Billion

2025

2033

| 2026 –2033 | |

| USD 1.78 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Chemical Indicators Market Size

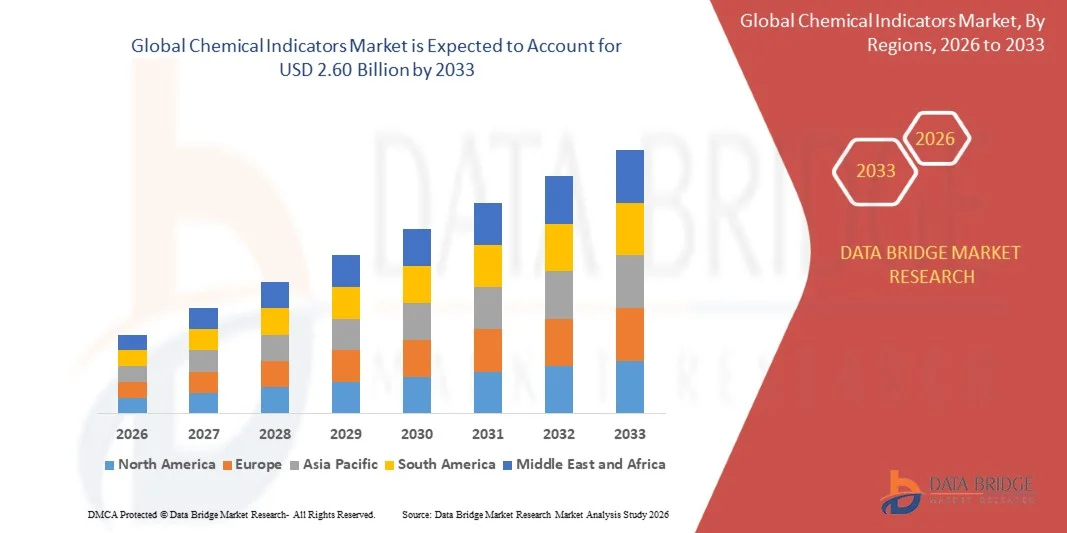

- The global chemical indicators market size was valued at USD 1.78 billion in 2025 and is expected to reach USD 2.60 billion by 2033, at a CAGR of 5.64% during the forecast period

- The market growth is largely fueled by the increasing demand for reliable sterilization verification across healthcare facilities, pharmaceutical manufacturing, and medical device production. Advancements in chemical indicator technologies, including multi-variable and rapid-read indicators, are improving sterilization accuracy and compliance, thereby driving market expansion

- Furthermore, growing regulatory requirements and standards for sterilization processes are compelling hospitals, clinics, and manufacturers to adopt chemical indicators to ensure patient safety and product quality. These converging factors are accelerating the uptake of chemical indicators, significantly boosting the industry's growth

Chemical Indicators Market Analysis

- Chemical indicators, providing visual or measurable confirmation of sterilization processes, are becoming essential in modern healthcare, pharmaceutical, and medical device operations due to their ability to verify sterilization efficacy for both routine and complex processes

- The escalating demand for chemical indicators is primarily driven by the rise in healthcare infrastructure, increasing surgical procedures, stringent sterilization regulations, and a growing emphasis on infection control and patient safety in hospitals and clinics worldwide

- North America dominated the chemical indicators market with a share of 35.9% in 2025, due to increasing investments in healthcare infrastructure, rising demand for sterilization verification, and stringent compliance requirements for patient safety

- Asia-Pacific is expected to be the fastest growing region in the chemical indicators market during the forecast period due to rising healthcare expenditure, rapid hospital expansion, and increasing adoption of sterilization monitoring in countries such as China, Japan, and India

- Single-variable indicators segment dominated the market with a market share of 58.8% in 2025, due to its straightforward design and ability to provide clear visual confirmation for a single critical sterilization parameter. Healthcare providers favor single-variable indicators for routine sterilization processes, given their ease of use, affordability, and quick interpretation. The segment’s compatibility with a wide range of sterilizers further strengthens its dominant position in the market

Report Scope and Chemical Indicators Market Segmentation

|

Attributes |

Chemical Indicators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Indicators Market Trends

“Growth of Multi-Variable and Rapid-Read Indicators”

- A significant trend in the chemical indicators market is the rising adoption of multi-variable and rapid-read indicators that provide faster, more reliable verification of sterilization processes across healthcare, pharmaceuticals, and food processing industries. These indicators are enabling more precise monitoring and reducing the risk of ineffective sterilization, which is critical for safety and compliance

- For instance, 3M and Steris Corporation offer rapid-read chemical indicators that deliver visual confirmation of sterilization in minutes, enhancing operational efficiency in hospital sterilization units. Such indicators support better workflow management and help maintain compliance with stringent sterilization protocols

- The market is witnessing increased integration of chemical indicators in automated sterilization monitoring systems where real-time feedback ensures process validation and reduces manual inspection errors. This trend is driving innovation in smart indicator technologies with embedded sensors and colorimetric reporting

- Healthcare facilities are increasingly employing multi-variable indicators that respond to multiple sterilization parameters such as temperature, pressure, and time. This enables higher accuracy in process verification and reduces the chances of false positives or incomplete sterilization

- Industries including pharmaceuticals and medical device manufacturing are standardizing the use of advanced chemical indicators to comply with ISO and FDA sterilization requirements. The integration of these indicators is improving traceability, documentation, and quality assurance practices

- The market is also experiencing growth in environmentally friendly and non-toxic indicators that provide safe alternatives for operators while maintaining regulatory compliance. This rising preference is reinforcing the development of innovative chemical indicators that balance safety, speed, and reliability

Chemical Indicators Market Dynamics

Driver

“Rising Regulatory Compliance in Healthcare and Medical Devices”

- Increasing enforcement of sterilization standards by organizations such as the FDA, ISO, and WHO is driving demand for chemical indicators to ensure compliance across healthcare and medical device sectors. These regulations require consistent and verifiable sterilization processes to reduce infection risks and maintain patient safety

- For instance, 3M’s chemical indicator portfolio is widely used in hospitals to meet FDA sterilization guidelines, supporting adherence to strict quality protocols. The growing regulatory focus is prompting healthcare providers to adopt more sophisticated indicators for process validation

- Hospitals and clinics are investing in multi-parameter chemical indicators that monitor critical sterilization conditions and provide accurate process validation. This investment enhances patient safety and minimizes potential operational liabilities

- Medical device manufacturers are increasingly integrating chemical indicators into packaging and sterilization workflows to comply with international safety standards. This integration strengthens brand reputation and ensures consistent product safety

- The global expansion of healthcare services and rising awareness of infection control measures continue to fuel the adoption of chemical indicators. This trend is positioning chemical indicators as essential tools in maintaining regulatory compliance and operational reliability

Restraint/Challenge

“Reliance on High-Quality Sterilization Equipment”

- The chemical indicators market faces challenges due to dependence on reliable sterilization equipment, as inconsistent or low-quality sterilizers can produce inaccurate results even with advanced indicators. Ensuring proper equipment performance is critical for indicators to provide accurate verification

- For instance, Steris Corporation emphasizes the use of high-performance autoclaves and sterilizers in conjunction with their chemical indicators to achieve validated sterilization outcomes. Such reliance increases operational costs and requires ongoing maintenance and calibration

- Variation in sterilization methods across different healthcare and industrial facilities can limit the effectiveness of chemical indicators. Indicators must be carefully matched to the sterilization process to ensure reliable results

- The market encounters challenges in standardizing indicator performance across diverse sterilization technologies such as steam, ethylene oxide, and hydrogen peroxide plasma. This requires continuous innovation and testing to maintain indicator accuracy

- Ensuring compatibility between chemical indicators and sterilization equipment while managing cost and supply chain complexities remains a key constraint. These factors collectively restrict faster market penetration in regions with limited access to high-quality sterilization infrastructure

Chemical Indicators Market Scope

The market is segmented on the basis of product, parameter, sterilization method, and end-user.

• By Product

On the basis of product, the chemical indicators market is segmented into steam chemical indicators, hydrogen peroxide chemical indicators, and others. The steam chemical indicators segment dominated the market with the largest revenue share in 2025, driven by the extensive use of steam sterilization in healthcare facilities and its reliable visual confirmation of sterilization processes. Hospitals and clinics often prefer steam indicators for their accuracy, ease of interpretation, and cost-effectiveness. The segment also benefits from widespread compatibility with a variety of autoclaves and sterilizers, enhancing adoption across surgical and diagnostic settings.

The hydrogen peroxide chemical indicators segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of low-temperature sterilization methods for heat-sensitive medical instruments. Hydrogen peroxide indicators provide quick and precise verification of sterilization cycles, making them highly suitable for pharmaceutical and medical device manufacturing. Their rising use in minimally invasive surgical tools and advanced medical equipment contributes to strong market expansion, supported by growing awareness of sterilization compliance and patient safety standards.

• By Parameter

On the basis of parameter, the chemical indicators market is segmented into single-variable indicators and multi-variable indicators. The single-variable indicators segment held the largest revenue share of 58.8% in 2025, owing to its straightforward design and ability to provide clear visual confirmation for a single critical sterilization parameter. Healthcare providers favor single-variable indicators for routine sterilization processes, given their ease of use, affordability, and quick interpretation. The segment’s compatibility with a wide range of sterilizers further strengthens its dominant position in the market.

The multi-variable indicators segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing need for comprehensive sterilization verification that covers multiple critical parameters such as time, temperature, and chemical concentration. For instance, 3M’s multi-variable chemical indicators are widely adopted in hospitals and medical device manufacturing due to their enhanced accuracy and ability to minimize sterilization errors. Growing regulatory emphasis on multi-parameter monitoring and advanced sterilization protocols is further accelerating the segment’s adoption.

• By Sterilization Method

On the basis of sterilization method, the chemical indicators market is segmented into steam sterilization, hydrogen peroxide sterilization, ethylene oxide sterilization, and others. The steam sterilization segment dominated the market in 2025, driven by the extensive use of autoclaves across hospitals and clinics and its effectiveness in sterilizing a wide range of medical instruments. Steam sterilization indicators are highly reliable, cost-effective, and widely accepted under global sterilization standards. The segment benefits from consistent demand due to routine sterilization practices and the high volume of reusable medical devices in healthcare facilities.

The hydrogen peroxide sterilization segment is projected to witness the fastest growth from 2026 to 2033, owing to its suitability for heat-sensitive instruments and increasing adoption in pharmaceutical and medical device manufacturing. For instance, indicators from companies such as Steris Corporation are gaining traction due to their precise monitoring of low-temperature sterilization cycles. The growing trend toward minimally invasive procedures and advanced medical equipment requiring low-temperature sterilization is driving the segment’s rapid expansion.

• By End-User

On the basis of end-user, the chemical indicators market is segmented into hospitals & clinics, pharmaceutical & medical device manufacturers, and others. The hospitals & clinics segment dominated the market in 2025, attributed to the high frequency of sterilization cycles in surgical wards, diagnostic labs, and emergency care facilities. Hospitals rely on chemical indicators to ensure patient safety and compliance with stringent sterilization protocols, reinforcing their leading market share. The segment also benefits from consistent demand due to recurring sterilization requirements and large-scale adoption of reusable medical instruments.

The pharmaceutical & medical device manufacturers segment is expected to witness the fastest growth from 2026 to 2033, driven by the need for validated sterilization processes for drug production and high-precision medical devices. For instance, Becton Dickinson’s chemical indicators are widely used in medical device manufacturing to ensure sterilization compliance and regulatory adherence. Rising production of advanced medical instruments and stringent quality control standards are propelling the rapid adoption of chemical indicators in this segment.

Chemical Indicators Market Regional Analysis

- North America dominated the chemical indicators market with the largest revenue share of 35.9% in 2025, driven by increasing investments in healthcare infrastructure, rising demand for sterilization verification, and stringent compliance requirements for patient safety

- Healthcare facilities in the region prioritize reliable chemical indicators to ensure sterilization efficacy, particularly in hospitals, surgical centers, and diagnostic labs

- This widespread adoption is further supported by advanced medical technologies, high disposable incomes, and strong regulatory frameworks, making chemical indicators a standard solution for both hospitals and pharmaceutical manufacturers

U.S. Chemical Indicators Market Insight

The U.S. chemical indicators market captured the largest revenue share in 2025 within North America, fueled by the growing number of healthcare facilities and the expansion of medical device manufacturing. Hospitals and clinics are increasingly adopting chemical indicators to comply with stringent sterilization standards and ensure patient safety. The rising focus on minimizing hospital-acquired infections, coupled with growing awareness of sterilization best practices, is driving market growth. In addition, innovations in multi-variable and advanced indicators, offering precise cycle monitoring, are contributing significantly to the market expansion in the U.S.

Europe Chemical Indicators Market Insight

The Europe chemical indicators market is projected to expand at a substantial CAGR during the forecast period, driven by regulatory mandates for sterilization validation and increasing adoption in pharmaceutical manufacturing. Countries such as Germany and the U.K. are witnessing rising demand due to stringent hygiene protocols and high awareness regarding infection control. The region’s developed healthcare infrastructure, along with increasing use of reusable surgical instruments, is fostering adoption of both single-variable and multi-variable indicators.

U.K. Chemical Indicators Market Insight

The U.K. chemical indicators market is anticipated to grow at a noteworthy CAGR, driven by growing investments in hospital sterilization processes and the expanding pharmaceutical sector. Hospitals are increasingly prioritizing chemical indicators to ensure compliance with sterilization standards and reduce infection risks. In addition, awareness campaigns on sterilization efficacy and patient safety are encouraging adoption across clinics and medical device manufacturers, further boosting market growth.

Germany Chemical Indicators Market Insight

The Germany chemical indicators market is expected to expand at a considerable CAGR, fueled by increasing awareness of sterilization compliance and demand for advanced monitoring solutions. Germany’s robust healthcare system, strong regulatory environment, and emphasis on innovation support the adoption of chemical indicators in both hospitals and medical device manufacturing facilities. Growing integration of multi-variable indicators to monitor complex sterilization processes is driving market expansion across the country.

Asia-Pacific Chemical Indicators Market Insight

The Asia-Pacific chemical indicators market is poised to grow at the fastest CAGR during 2026 to 2033, driven by rising healthcare expenditure, rapid hospital expansion, and increasing adoption of sterilization monitoring in countries such as China, Japan, and India. The region’s growing focus on patient safety, combined with government initiatives to improve healthcare quality, is accelerating the adoption of chemical indicators. Moreover, Asia-Pacific is emerging as a manufacturing hub for sterilization solutions, making indicators more affordable and accessible to a wider base of healthcare providers.

Japan Chemical Indicators Market Insight

The Japan chemical indicators market is gaining momentum due to a technologically advanced healthcare system, increasing number of hospitals, and emphasis on sterilization standards. Hospitals and clinics are adopting chemical indicators to ensure compliance with sterilization protocols and minimize infection risks. In addition, integration with automated sterilization equipment and the adoption of multi-variable indicators are supporting market growth, particularly in high-tech hospitals and medical device facilities.

China Chemical Indicators Market Insight

The China chemical indicators market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid hospital expansion, rising investments in healthcare, and growing pharmaceutical manufacturing. The country is witnessing increasing demand for reliable sterilization verification to comply with safety standards and support reusable medical instruments. The presence of domestic manufacturers offering cost-effective indicators, combined with initiatives to modernize healthcare facilities and improve patient outcomes, is further propelling market growth in China.

Chemical Indicators Market Share

The chemical indicators industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific, Inc. (U.S.)

- Tuttnauer (Netherlands)

- Propper Manufacturing Co., Inc. (U.S.)

- BiomatiQ Scientific Pvt. Ltd. (India)

- Crosstex International, Inc. (U.S.)

- STERIS (U.S.)

- BEYA Medical Machinery Equipments CO. (Turkey)

- 3M Company (U.S.)

- Bioquell (Ecolab) (U.K.)

- LISTER BIOMEDICAL CO., LTD (China)

- Andersen Products, Inc. (U.S.)

- Getinge (Sweden)

- ASP (Fortive) (U.S.)

- Solventum (U.S.)

- McKesson Medical-Surgical Inc. (U.S.)

- Terragene (Argentina)

Latest Developments in Global Chemical Indicators Market

- In September 2025, Nelson Laboratories launched its RapidCert Biological Indicator Sterility Testing service, reducing sterility confirmation time from seven days to approximately two days. This accelerated testing capability enhances efficiency for pharmaceutical and medical device manufacturers by speeding up sterilization validation workflows and supporting faster time-to-market for critical products, improving quality assurance processes globally

- In June 2025, Solventum introduced the Attest Super Rapid Vaporized Hydrogen Peroxide (VH₂O₂) Clear Challenge Pack, a ready-to-use testing solution that combines biological and chemical indicators in a transparent design for low-temperature sterilization monitoring. This innovation helps healthcare facilities and sterilization service providers streamline every-load monitoring, boost accuracy in sterilization verification, and reduce procedural complexities across diverse sterilizer models

- In May 2025, STERIS announced the opening of a new ethylene oxide processing facility in Batu Kawan, Malaysia, aimed at strengthening its sterilization capabilities and expanding its global manufacturing footprint. This strategic investment enhances the company’s ability to meet rising demand for chemical and sterilization indicators in the Asia-Pacific region, improving supply chain resilience and supporting faster product delivery to key healthcare and life science customers

- In November 2023, STERIS disclosed participation of its Applied Sterilization Technologies (AST) business in the U.S. FDA Radiation Sterilization Master File Pilot Program, reflecting its engagement with regulatory bodies to improve sterilization process validation frameworks. This involvement positions STERIS to influence emerging standards and reinforces confidence among healthcare and manufacturing customers in its sterilization assurance technologies

- In October 2023, Mesa Laboratories Inc. acquired the sterilization indicators business of GKE-GmbH, a strategic move designed to expand Mesa’s product portfolio and bolster its presence in the sterilization indicators market. This acquisition enables broader geographic reach and enhanced competitive positioning, allowing Mesa to meet the increasing demand for advanced sterilization monitoring solutions across healthcare and life sciences sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Indicators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Indicators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Indicators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.