Global Chemical Software Market

Market Size in USD Million

CAGR :

%

USD

930.51 Million

USD

1,374.78 Million

2024

2032

USD

930.51 Million

USD

1,374.78 Million

2024

2032

| 2025 –2032 | |

| USD 930.51 Million | |

| USD 1,374.78 Million | |

|

|

|

|

Chemical Software Market Size

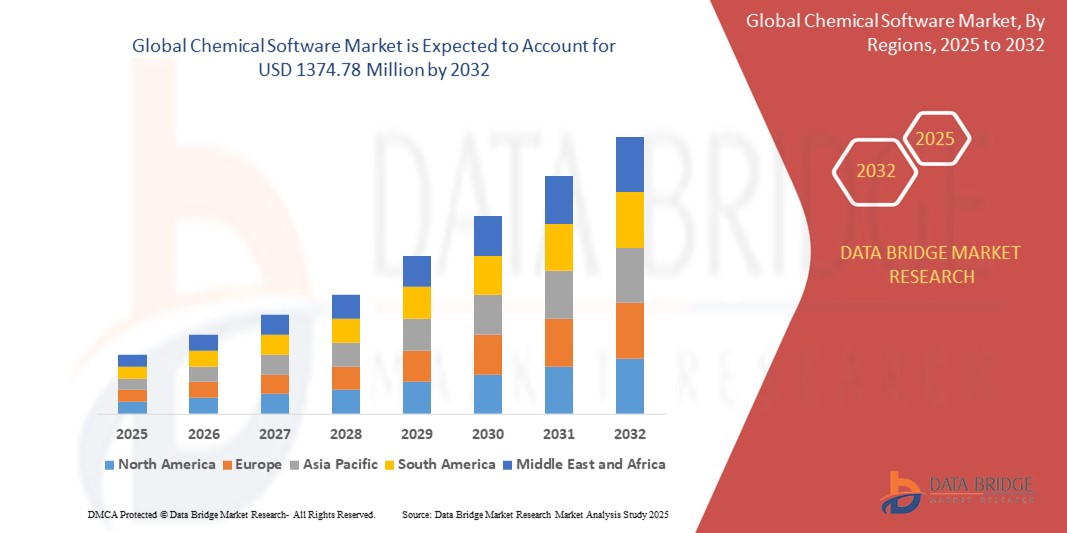

- The global chemical software market size was valued at USD 930.51 million in 2024 and is expected to reach USD 1374.78 million by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced simulation and modelling tools in chemical research, rising adoption of automation in chemical processes, and the need to enhance efficiency and safety across chemical manufacturing industries.

- In addition, the growing emphasis on regulatory compliance and environmental sustainability is driving the adoption of chemical software solutions that help companies manage data, reduce waste, and optimize resource utilization

Chemical Software Market Analysis

- The chemical software market is evolving with increasing integration of cloud-based platforms and artificial intelligence, enhancing the accuracy and efficiency of chemical process simulations and data management

- There is a rising trend toward user-friendly interfaces and customizable solutions, enabling diverse industries to optimize chemical research and production workflows while improving collaboration across teams

- North America dominates the chemical software market with the largest revenue share of 38.62% in 2024, driven by the presence of major chemical and pharmaceutical companies investing heavily in digital transformation

- Asia-Pacific region is expected to witness the highest growth rate in the global chemical software market, driven by rapid industrialization and government initiatives promoting digital transformation

- The molecular dynamics software segment dominated the largest market revenue share of 39.77% in 2024, driven by its growing use in simulating the physical movements of atoms and molecules to enhance R&D accuracy and reduce time-to-market. This software is widely used by pharmaceutical and chemical manufacturers to optimize compound interactions and predict stability under different environmental conditions

Report Scope and Chemical Software Market Segmentation

|

Attributes |

Chemical Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Software Market Trends

“Growing Adoption of Cloud-Based Chemical Software Solutions”

- The chemical software market is witnessing a significant shift toward cloud-based solutions that offer greater flexibility, scalability, and remote accessibility compared to traditional on-premise software

- Cloud platforms enable real-time data sharing and collaboration among scientists, researchers, and production teams across different locations, improving decision-making and reducing project timelines

- For instance, companies such as ChemAxon and BIOVIA have developed cloud-enabled platforms that streamline chemical data management and simulation workflows

- These solutions reduce the need for costly hardware investments and IT maintenance, making advanced chemical software accessible to smaller organizations and startups in addition to large enterprises

- The integration of cloud computing with artificial intelligence and machine learning is enhancing predictive capabilities, helping users to simulate complex chemical reactions more accurately and optimize formulations faster

- As regulatory requirements become more stringent, cloud-based software offers secure data storage and compliance tracking, facilitating easier audits and documentation processes for chemical manufacturers and researchers

Chemical Software Market Dynamics

Driver

“Increasing Need for Advanced Chemical Process Simulation and Optimization”

- The chemical industry is under increasing pressure to improve efficiency, cut costs, and meet strict environmental regulations, driving demand for advanced process simulation and optimization software

- These tools enable detailed modeling of chemical reactions, process flows, and equipment performance, helping businesses predict outcomes and find optimal conditions without expensive physical trials

- By virtually simulating complex processes, companies can reduce waste, enhance product quality, and speed up time-to-market, supporting safer and more effective scale-up of production

- For instance, BASF uses simulation software to optimize chemical processes and reduce environmental impact

- Integration of simulation software with real-time data from sensors and automation systems creates continuous feedback loops that improve resource utilization and energy savings, aiding environmental sustainability efforts

- The software’s ability to optimize processes fosters innovation, allowing companies to develop new chemical products faster and maintain competitiveness across research, manufacturing, and quality control functions

Restraint/Challenge

“High Implementation Costs and Complexity of Chemical Software Solutions”

- High implementation costs and complexity of chemical software pose significant challenges, requiring large investments in licensing, hardware, and skilled personnel

- Smaller companies and start-ups often struggle to afford these costs, limiting their access to advanced technologies in the market

- Specialized training is needed to operate the software and understand chemical engineering principles, which can be time-consuming and expensive

- Integrating new software with existing IT systems can disrupt workflows and face resistance from employees, hindering smooth adoption

- For instance, a mid-sized chemical firm reported delayed software rollout due to integration challenges and staff retraining requirements

- Concerns over data security and intellectual property, especially with cloud-based solutions, cause hesitation among companies, slowing overall market growth despite clear benefits

Chemical Software Market Scope

The market is segmented on the basis of product type, capabilities, and deployment.

- By Product Type

On the basis of product type, the chemical software market is segmented into molecular dynamics software and molecular modelling software. The molecular dynamics software segment dominated the largest market revenue share of 39.77% in 2024, driven by its growing use in simulating the physical movements of atoms and molecules to enhance R&D accuracy and reduce time-to-market. This software is widely used by pharmaceutical and chemical manufacturers to optimize compound interactions and predict stability under different environmental conditions.

The molecular modelling software segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for precise visualization and prediction of molecular behaviour. These tools are becoming critical for structural analysis and drug discovery, enabling chemists to design novel compounds more efficiently. Rising academic and research activities further contribute to its rapid growth.

- By Capabilities

On the basis of capabilities, the chemical software market is segmented into waste management, compliances management, inventory management, manufacturing process management, and others. The manufacturing process management segment held the largest market revenue share in 2024, owing to its pivotal role in streamlining operations, ensuring product consistency, and minimizing production downtime. Companies utilize these solutions to model, control, and optimize complex chemical processes, resulting in better resource utilization and operational efficiency.

The compliances management segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing regulatory scrutiny and the need for transparent reporting in hazardous material handling. Software solutions offering real-time compliance tracking and automated documentation are gaining popularity, especially in highly regulated sectors such as specialty chemicals and agrochemicals.

- By Deployment

On the basis of deployment, the chemical software market is segmented into on-premise and cloud-based. The on-premise segment held the largest market revenue share in 2024, favoured by large enterprises for its robust data security, internal control, and customization capabilities. It is especially preferred by organizations with established IT infrastructures and concerns about intellectual property protection.

The cloud-based segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising digital transformation initiatives, ease of scalability, and lower upfront costs. Small to medium enterprises are rapidly adopting cloud-based solutions for their flexibility, automatic updates, and ability to support remote collaboration across global research teams.

Chemical Software Market Regional Analysis

- North America dominates the chemical software market with the largest revenue share of 38.62% in 2024, driven by the presence of major chemical and pharmaceutical companies investing heavily in digital transformation

- Strong R&D infrastructure and stringent regulatory frameworks encourage adoption of advanced chemical software for process optimization and compliance

- The region’s technological maturity and integration of AI and cloud-based solutions further fuel market growth

U.S. Chemical Software Market Insight

The U.S. holds the largest revenue share in North America, supported by rapid digitalization and automation across chemical manufacturing and research sectors. Government initiatives promoting innovation and strict environmental regulations boost demand for software that enhances operational efficiency and regulatory compliance. Leading industry players’ investments strengthen the market landscape significantly.

Europe Chemical Software Market Insight

The Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by strict environmental and safety regulations that encourage the use of chemical software for compliance and process improvement. Countries such as Germany, France, and the U.K. are investing in cloud-based and AI-enabled chemical software to modernize their manufacturing and research operations, fostering increased adoption across the region.

U.K. Chemical Software Market Insight

The U.K. chemical software market is expected to witness the fastest growth rate from 2025 to 2032, due to rising focus on sustainable chemical production and digital innovation. Increasing R&D activities and government support for clean technologies accelerate software adoption, helping chemical firms comply with evolving regulations and improve productivity.

Germany Chemical Software Market Insight

The Germany’s chemical software market is expected to witness the fastest CAGR from 2025 to 20 is expected to witness the fastest growth rate from 2025 to 203232, as manufacturers emphasize digital transformation for efficiency and regulatory adherence. The country’s strong industrial base, focus on Industry 4.0, and environmental sustainability drive demand for integrated chemical software solutions that support innovation and process optimization.

Asia-Pacific Chemical Software Market Insight – Fastest Growing

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, in chemical software adoption, propelled by rapid industrialization, growing chemical manufacturing hubs, and government digitalization initiatives. Key countries such as China, India, and Japan are embracing software solutions to enhance production efficiency, safety, and compliance, significantly accelerating market expansion.

Japan Chemical Software Market Insight

The Japan’s chemical software market is expected to witness the fastest growth rate from 2025 to 2032due to its high-tech industrial ecosystem and emphasis on innovation. Increasing integration of digital tools in chemical research and manufacturing supports efficiency improvements and compliance with strict environmental standards.

China Chemical Software Market Insight

China leads the Asia-Pacific region with the largest revenue share, fuelled by massive industrial growth, urbanization, and rising demand for automation. The government’s push for smart manufacturing and environmental regulations drives widespread adoption of chemical software across the chemical and pharmaceutical sectors.

Chemical Software Market Share

The Chemical Software industry is primarily led by well-established companies, including:

- ANSYS, Inc (U.S.)

- Frontline Data Solutions (U.S.)

- FindMolecule (Canada)

- Metso (Finland)

- eLogger (U.S.)

- Chemstations Inc. (U.S.)

- deepmatter Group Limited (Germany)

- Antipodes Scientific Ltd. (New Zealand)

- Vicinity (U.S.)

- Sivco Inc. (U.S.)

- Labcup, Ltd. (U.K.)

- QIAGEN (Germany)

- Alchemy Cloud, Inc. (U.S.)

- YASH Technologies (U.S.)

- Yordas Limited (U.K.)

- Kintech Lab (Russia)

- Hypercube, Inc. (U.S.)

Latest Developments in Global Chemical Software Market

- In March 2024, Revvity, Inc. announced the launch of its latest development under its software division, Signals ChemDraw, as part of the Revvity Signals Software portfolio. This advanced chemistry suite is designed to enhance how researchers in both pharmaceutical and non-pharmaceutical sectors, as well as academia, visualize and share complex chemical structures. The platform aims to streamline collaboration across scientific disciplines, enabling more efficient communication of chemical data. By improving workflow integration and scientific productivity, this launch is expected to strengthen Revvity's market position and support the growing demand for digital chemistry solutions

- In August 2020, Thermo Fisher Scientific Launched Core Informatics 7.0, a cloud-based software upgrade aimed at improving data management within research and development settings. This solution introduced advanced data visualization, collaboration features, and enhanced integration, empowering scientists to manage complex workflows more efficiently. The software supports better decision-making and accelerates innovation, reinforcing Thermo Fisher's position in the digital laboratory solutions market.

- In July 2020, Agilent Technologies released OpenLab CDS 3.0, a cloud-enabled software enhancement designed to streamline data acquisition, processing, and reporting. Featuring improved user interfaces, stronger data security, and seamless lab instrument integration, this version helps laboratories boost productivity while ensuring compliance. The update underscores Agilent’s commitment to simplifying lab operations through digital transformation

- In June 2020, Waters Corporation introduced NuGenesis 8.0, an advanced cloud-based platform focused on optimizing laboratory workflows. With upgrades supporting data integrity, compliance, and global data management, this software caters to the stringent needs of industries such as pharmaceuticals. The release strengthens Waters' role in delivering scalable informatics solutions for regulated research environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.