Global Chemical Zirconia Market

Market Size in USD Million

CAGR :

%

USD

498.21 Million

USD

631.11 Million

2025

2033

USD

498.21 Million

USD

631.11 Million

2025

2033

| 2026 –2033 | |

| USD 498.21 Million | |

| USD 631.11 Million | |

|

|

|

|

Chemical Zirconia Market Size

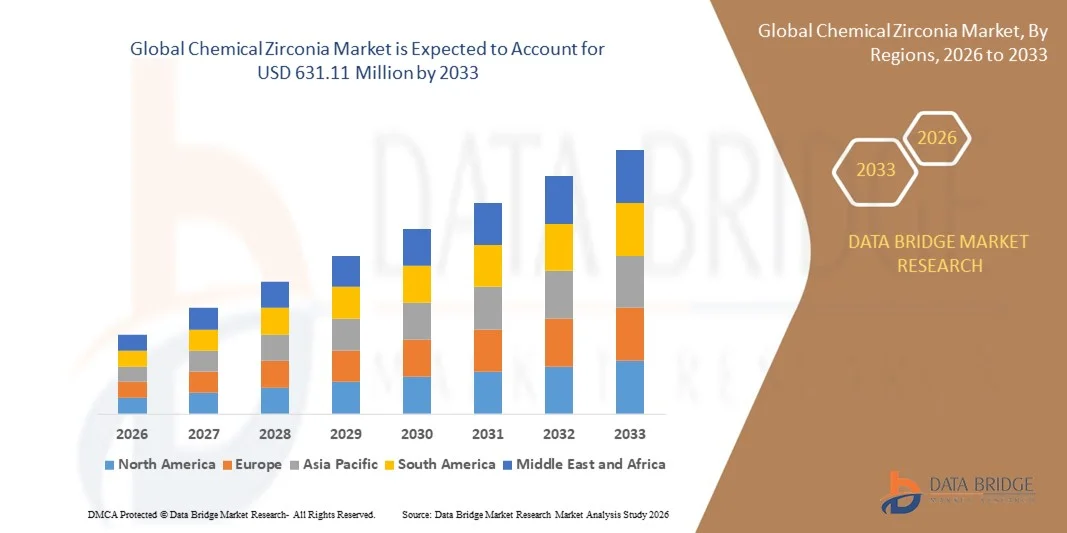

- The global chemical zirconia market size was valued at USD 498.21 million in 2025 and is expected to reach USD 631.11 million by 2033, at a CAGR of 3.0% during the forecast period

- The market growth is largely fueled by the expanding applications of chemical zirconia in advanced ceramics, automotive components, biomaterials, and industrial tooling, driving increasing demand for high-purity and ultrafine zirconium oxide products

- Furthermore, rising investments in research and development, coupled with growing adoption of zirconia-based materials in high-performance and wear-resistant applications, are establishing chemical zirconia as a critical material across industrial, healthcare, and electronics sectors. These converging factors are accelerating the uptake of zirconia solutions, thereby significantly boosting the industry’s growth

Chemical Zirconia Market Analysis

- Chemical zirconia, offering exceptional hardness, thermal stability, chemical inertness, and biocompatibility, is increasingly vital in applications such as advanced ceramics, automotive exhaust treatment, dental and orthopedic biomaterials, and wear-resistant products due to its superior performance characteristics

- The escalating demand for chemical zirconia is primarily fueled by the growing need for high-performance materials in automotive, healthcare, electronics, and industrial applications, increasing focus on material innovation, and rising preference for durable, high-quality, and specialized zirconia products

- Asia-Pacific dominated the chemical zirconia market with a share of 46.8% in 2025, due to expanding ceramics, electronics, and automotive manufacturing, increasing adoption of advanced biomaterials, and a strong presence of zirconia production hubs

- North America is expected to be the fastest growing region in the chemical zirconia market during the forecast period due to robust demand for zirconia in biomaterials, automotive components, and high-performance mechanical applications

- Precipitation method segment dominated the market with a market share of 60.6% in 2025, due to its cost-effectiveness, scalability, and ability to produce high-purity zirconia powders consistently. Industries prefer this method for producing uniform particle sizes suitable for ceramics, coatings, and refractory applications. The precipitation method also allows precise control over chemical composition, enhancing product performance and reliability. Established industrial adoption and widespread technical know-how further support the segment’s market dominance

Report Scope and Chemical Zirconia Market Segmentation

|

Attributes |

Chemical Zirconia Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Zirconia Market Trends

Growing Use of Zirconia in Advanced Ceramics and Industrial Applications

- The chemical zirconia market is experiencing robust growth propelled by expanding applications of zirconia in advanced ceramics, industrial materials, and biomedical devices. Zirconia's excellent thermal stability, mechanical toughness, and biocompatibility make it a preferred choice for high-performance ceramics used in electronics, dental implants, aerospace components, and solid oxide fuel cells. Continuous innovation in yttria-stabilized zirconia (YSZ) and multilayer composites is enabling broader use across demanding industrial sectors requiring durability and precision

- For instance, companies such as Tosoh Corporation and Saint-Gobain are leading the development of high-purity zirconia powders tailored for additive manufacturing of complex ceramic parts, dental restorations, and wear-resistant coatings in turbines. These advancements enhance product lifespan and performance, addressing stringent industrial demands while opening new avenues in energy and healthcare technologies

- The increasing adoption of zirconia in the electronics sector—especially for insulating layers and sensors in solid-state devices—is driven by trends toward miniaturization and higher efficiency. Similarly, growth in electric and hybrid vehicles boosts demand for chemical zirconia in battery components and exhaust gas treatment due to its chemical inertness and heat resistance

- Zirconia's biocompatibility supports its rising application in medical and dental implants, where translucent zirconia formulations provide superior aesthetics alongside mechanical strength. The healthcare segment's growth is bolstered by advancements in sintering and coating techniques that improve both functionality and patient safety

- Industrial uses in refractories, foundry molds, and cutting tools benefit from zirconia’s exceptional hardness and resistance to thermal shock. This versatility underlies its demand in emerging manufacturing processes emphasizing precision engineering and sustainable materials

- The broadening adoption of zirconia in advanced ceramics and industrial applications signals sustained market growth, supported by continuous technological innovation and expanding demand from healthcare, energy, and high-tech manufacturing sectors

Chemical Zirconia Market Dynamics

Driver

Rising Demand for High-Purity Zirconium Oxide

- The increasing requirement for high-purity zirconium oxide is a key growth driver as industries pursue enhanced material performance and process reliability. High-purity zirconia powders and stabilized zirconia grades are critical for producing ceramics with superior mechanical properties, chemical resistance, and thermal stability essential in electronics, energy storage, and medical implant manufacturing

- For instance, several zirconium chemical producers, such as ZIRCAR Ceramics and ESK Ceramics, are expanding their capabilities to manufacture ultrafine powder grades with purity levels exceeding 99.5%, supporting sophisticated applications such as solid oxide fuel cells and laser components. These investments reflect industry focus on quality standards that directly influence device performance and durability

- Growth in the electric vehicle market and renewable energy sectors further stimulates demand for high-purity zirconia as battery electrolytes and exhaust catalysts, requiring materials with tightly controlled phase stability and minimal impurities. The healthcare industry also increasingly demands biocompatible zirconia alloys for dental and orthopedic applications to meet stringent regulatory criteria

- Advancements in synthesis methods such as hydrothermal processing and controlled precipitation enable manufacturers to meet purity and particle size specifications more reliably. These innovations improve yield and efficiency, strengthening supply chain resilience amid growing global demand

- The rising adoption of customized zirconia formulations tailored for specific industrial requirements underlines the strategic importance of high-purity zirconia products in sustaining industry growth and securing long-term contracts with key end users across sectors

Restraint/Challenge

High Production Costs of Ultrafine and Stabilized Zirconia

- The production of ultrafine and stabilized zirconia involves complex, energy-intensive processes and sophisticated raw material purification, leading to elevated manufacturing costs. These expenses constrain wider adoption, particularly where cost sensitivity exists, such as in emerging markets or commodity applications

- For instance, yttria-stabilized zirconia (YSZ), essential for many high-performance applications, requires precise doping and sintering protocols that increase production time and energy consumption. Companies face challenges balancing product quality with operational efficiency to maintain competitive pricing while meeting rigorous specifications

- High capital investment in advanced manufacturing infrastructure, including cleanroom facilities and real-time process monitoring systems, adds to fixed costs faced by zirconia producers. Supply chain complexities, including dependence on high-grade zirconium ore and rare earth dopants, also contribute to price volatility and production bottlenecks

- These cost challenges limit scalability for smaller producers and inhibit price-sensitive sectors from adopting advanced zirconia grades despite the material’s performance benefits. The market requires ongoing R&D to reduce synthesis costs through innovative processing routes and material recycling initiatives

- Addressing these barriers through technology improvements, strategic partnerships, and government support for sustainable manufacturing will be vital in ensuring the chemical zirconia market’s long-term profitability and responsiveness to growing demand in advanced industrial and biomedical applications

Chemical Zirconia Market Scope

The market is segmented on the basis of product, type, forms, process, and application.

- By Product

On the basis of product, the chemical zirconia market is segmented into industrial zirconium oxide, ultrafine zirconium oxide, and others. The industrial zirconium oxide segment dominated the market with the largest revenue share in 2025, driven by its extensive use in high-temperature applications and corrosion-resistant environments. Industries such as metallurgy, ceramics, and chemical processing favor industrial zirconium oxide for its superior thermal stability and chemical inertness. The segment also benefits from established supply chains and consistent quality standards, ensuring its widespread adoption across industrial applications. Its versatility in applications such as refractory linings, coatings, and structural ceramics further reinforces market dominance.

The ultrafine zirconium oxide segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by growing demand in advanced ceramics, electronics, and biomedical sectors. Ultrafine zirconium oxide offers enhanced mechanical strength, higher surface area, and improved thermal and electrical properties, making it suitable for precision applications. For instance, its use in dental ceramics and high-performance coatings by companies such as Tosoh Corporation is accelerating adoption. Increasing research in nanostructured zirconia for electronic components and catalysts also drives growth. The segment’s ability to meet stringent performance requirements in emerging applications positions it as a high-growth product type.

- By Type

On the basis of type, the market is segmented into ceramics, refractories, zircon chemicals, foundry sand, and others. The ceramics segment dominated the market with the largest revenue share in 2025, owing to the widespread use of zirconia in structural and functional ceramics. Zirconia ceramics are valued for their exceptional hardness, thermal shock resistance, and biocompatibility, making them ideal for industrial, medical, and electronics applications. The established demand for advanced ceramic components in aerospace, automotive, and dental applications contributes to market leadership. In addition, the availability of tailored ceramic grades with superior performance characteristics supports steady growth in this segment.

The zircon chemicals segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising use in chemical manufacturing, catalysts, and coatings. For instance, zirconium-based catalysts produced by companies such as Saint-Gobain are increasingly adopted in industrial processes due to their efficiency and durability. Growing demand from the chemical and pharmaceutical industries for high-purity zirconium compounds further accelerates growth. The segment benefits from advancements in zircon chemistry, enabling innovative applications across multiple industries.

- By Forms

On the basis of forms, the chemical zirconia market is segmented into crystal and powder. The powder form dominated the market with the largest revenue share in 2025, due to its extensive application in ceramics, coatings, and catalyst supports. Powdered zirconia offers ease of processing, uniform particle distribution, and compatibility with various fabrication techniques, making it suitable for large-scale industrial use. The segment also benefits from established supply chains and consistent particle size grades required for high-performance applications. Industries leverage powder zirconia for advanced coatings, dental materials, and refractory components, further driving dominance.

The crystal form is anticipated to witness the fastest CAGR from 2026 to 2033, driven by its adoption in optical, electronic, and specialized biomedical applications. For instance, companies such as KYOCERA Corporation use zirconia crystals in precision engineering components and optical devices due to their high purity and structural integrity. Growing research in crystal-based zirconia for laser components and bioimplants is propelling demand. The segment’s precision application capability and superior mechanical properties make it a high-growth market segment.

- By Process

On the basis of process, the market is segmented into hydrothermal method and precipitation method. The precipitation method dominated the market with the largest revenue share of 60.6% in 2025, due to its cost-effectiveness, scalability, and ability to produce high-purity zirconia powders consistently. Industries prefer this method for producing uniform particle sizes suitable for ceramics, coatings, and refractory applications. The precipitation method also allows precise control over chemical composition, enhancing product performance and reliability. Established industrial adoption and widespread technical know-how further support the segment’s market dominance.

The hydrothermal method is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing demand for ultrafine and high-purity zirconia for advanced applications. For instance, researchers and companies such as Tosoh Corporation utilize hydrothermal synthesis for biomedical implants and electronic ceramics due to superior crystallinity and particle homogeneity. The method enables enhanced functional properties, including thermal stability, high surface area, and mechanical strength. Increasing investment in advanced materials research supports accelerated growth for hydrothermal-processed zirconia.

- By Application

On the basis of application, the market is segmented into biomaterials, mechanical components, automotive exhaust treatment, wear-resistant products, and special tools. The mechanical components segment dominated the market with the largest revenue share in 2025, owing to extensive use in high-performance industrial machinery, turbines, and aerospace components. Zirconia’s exceptional hardness, wear resistance, and thermal stability make it ideal for precision mechanical parts that operate under extreme conditions. Companies rely on zirconia-based components to enhance durability and reduce maintenance costs. The segment’s established industrial usage and consistent demand contribute to its market dominance.

The biomaterials segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by the rising adoption of zirconia in dental implants, orthopedic devices, and other medical applications. For instance, companies such as Straumann and Nobel Biocare utilize zirconia in dental and orthopedic biomaterials due to its biocompatibility and strength. Growing healthcare expenditure and advancements in implant technology are driving demand. The segment’s capability to meet stringent medical standards and support minimally invasive procedures positions it as a high-growth application area.

Chemical Zirconia Market Regional Analysis

- Asia-Pacific dominated the chemical zirconia market with the largest revenue share of 46.8% in 2025, driven by expanding ceramics, electronics, and automotive manufacturing, increasing adoption of advanced biomaterials, and a strong presence of zirconia production hubs

- The region’s cost-effective manufacturing landscape, rising investments in high-purity zirconia production, and growing exports of industrial and ultrafine zirconium oxide are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of zirconia in both industrial and biomedical sectors

China Chemical Zirconia Market Insight

China held the largest share in the Asia-Pacific chemical zirconia market in 2025, owing to its status as a global leader in ceramics, electronics, and chemical manufacturing. The country's strong industrial base, favorable government policies supporting advanced material production, and extensive export capabilities for zirconium compounds are major growth drivers. Demand is also bolstered by ongoing investments in ultrafine zirconia for electronics, coatings, and biomaterials.

India Chemical Zirconia Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapidly expanding automotive and healthcare industries, increasing demand for advanced ceramics, and rising investments in specialty zirconia infrastructure. Government initiatives promoting “Make in India” and self-reliance in high-performance materials are strengthening market growth. In addition, increasing R&D in biomaterials and wear-resistant products is contributing to robust market expansion.

Europe Chemical Zirconia Market Insight

The Europe chemical zirconia market is expanding steadily, supported by stringent quality standards, high demand for high-purity zirconium compounds, and growing investments in sustainable ceramic and refractory production. The region places strong emphasis on environmental compliance, advanced formulations, and specialized applications in mechanical components and medical devices. Increasing use of zirconia in automotive and industrial tooling is further enhancing market growth.

Germany Chemical Zirconia Market Insight

Germany’s zirconia market is driven by its leadership in high-precision industrial components, strong ceramics and chemical industry heritage, and export-oriented production model. The country has well-established R&D networks and partnerships between academic institutions and material manufacturers, fostering continuous innovation in zirconium-based products. Demand is particularly strong for automotive exhaust treatment, wear-resistant products, and biomaterials.

U.K. Chemical Zirconia Market Insight

The U.K. market is supported by a mature engineering and biomedical industry, growing efforts to localize high-performance material production, and increased demand for specialty zirconia compounds. Rising focus on R&D, collaborations between universities and manufacturers, and investments in advanced ceramic production continue to strengthen the market. The country remains significant in supplying high-purity zirconia for medical and industrial applications.

North America Chemical Zirconia Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for zirconia in biomaterials, automotive components, and high-performance mechanical applications. Increasing investments in material science, advanced ceramics manufacturing, and adoption of wear-resistant products are boosting demand. In addition, reshoring of advanced material production and collaborations between industrial and healthcare sectors are supporting market expansion.

U.S. Chemical Zirconia Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive industrial base, strong R&D infrastructure, and significant investment in high-purity zirconia production. The country’s focus on innovation, regulatory compliance, and sustainable manufacturing is encouraging the use of zirconia in biomaterials, mechanical components, and automotive exhaust treatment. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Chemical Zirconia Market Share

The chemical zirconia industry is primarily led by well-established companies, including:

- ZIRCOMET LIMITED (U.S.)

- Saint-Gobain (France)

- HC Starck Tungsten GmbH (Germany)

- American Elements (U.S.)

- Tronox Holdings plc (U.K.)

- DuPont (U.S.)

- Alkane Resources Ltd (Australia)

- Astron Limited (U.S.)

- ATI (U.S.)

- Australian Zircon NL (Australia)

- Exxaro (South Africa)

- Bemax Resources Limited (Australia)

- Rio Tinto (U.K.)

- DAIICHI KIGENSO KAGAKU KOGYO CO., LTD. (Japan)

- Tosoh Corporation (Japan)

- Solvay (Belgium)

- INNOVNANO (Spain)

- Luxfer MEL Technologies (U.K.)

- KCM Corporation (South Korea)

- Sinoceramics, Inc. (China)

Latest Developments in Global Chemical Zirconia Market

- In June 2025, Zircomet launched the “ZrO₂ NanoX” nano-structured zirconia powder line, targeting additive manufacturing and high-strength ceramic applications. This product enables manufacturers to produce components with superior mechanical strength, thermal stability, and precision, driving adoption in aerospace, electronics, and biomedical industries. The launch positions Zircomet as a leader in advanced zirconia materials, catering to high-performance applications that require nanostructured powders, and is expected to accelerate the company’s market share growth in the high-end zirconia segment

- In March 2025, Iluka Resources completed the acquisition of Advanced Ceramic Materials (ACM), integrating ACM’s high-purity zirconia powder production capabilities into its global portfolio. This strategic move strengthens Iluka’s position in the industrial and biomedical zirconia markets, enhancing its product offering for applications such as wear-resistant components, dental implants, and electronics. The acquisition allows Iluka to expand its global footprint, improve supply chain efficiency, and respond more effectively to growing demand for high-performance zirconia materials in emerging markets

- In early 2025, H.C. Starck inaugurated a new R&D center in Singapore dedicated to advanced zirconia applications, particularly for the electronics and industrial sectors. The center focuses on developing high-purity zirconia powders and innovative material solutions to meet evolving performance requirements. This investment enhances H.C. Starck’s technological capabilities, fosters collaboration with regional manufacturers, and supports the adoption of zirconia in high-growth sectors such as semiconductors, precision ceramics, and additive manufacturing, driving long-term market expansion

- In 2025, Tosoh Corporation launched a new line of stabilized zirconia products specifically designed for electric vehicle (EV) battery applications. These materials provide high thermal stability, ionic conductivity, and mechanical strength, making them essential for next-generation solid-state batteries. The product introduction strengthens Tosoh’s position in the growing EV materials market, supports the automotive industry’s shift toward sustainable energy solutions, and is expected to drive increased demand for specialized zirconia products in both domestic and international markets

- In 2025, Saint-Gobain announced a USD 180 million expansion of its zirconia production facility in Australia to meet increasing demand in the Asia-Pacific region. This expansion improves production capacity for industrial and ultrafine zirconium oxide, catering to applications in ceramics, refractories, coatings, and advanced industrial components. The move reinforces Saint-Gobain’s leadership in global zirconia supply, enables faster response to customer demand, and supports growth in high-performance industrial and biomedical sectors across Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemical Zirconia Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemical Zirconia Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemical Zirconia Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.