Global Chemicals Market

Market Size in USD Million

CAGR :

%

USD

145.00 Million

USD

214.40 Million

2024

2032

USD

145.00 Million

USD

214.40 Million

2024

2032

| 2025 –2032 | |

| USD 145.00 Million | |

| USD 214.40 Million | |

|

|

|

|

Chemical Market Size

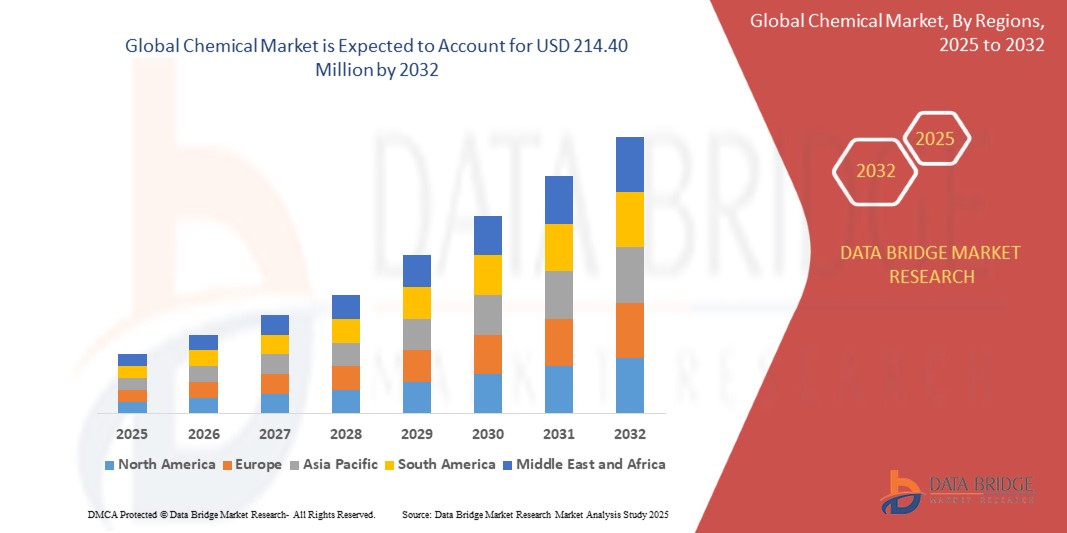

- The global Chemical market was valued at USD 145.00 million in 2024 and is expected to reach USD 214.40 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.01 % primarily driven by the increasing demand for sustainable and eco-friendly chemical solutions

- This growth is driven by factors such as advancements in chemical manufacturing technologies, growing environmental awareness, regulatory pressure on carbon emissions, and the rise in demand for specialty chemicals across various industries

Chemical Market Analysis

- The global chemicals market is growing due to strong demand in industries such as agriculture, manufacturing, and healthcare, with companies such as BASF and Dow Chemical leading the way in producing chemicals for various applications

- For instance, BASF's chemical solutions are used in agricultural products such as pesticides and fertilizers, which are essential for global food production

- Technological advancements are improving production efficiency, with innovations such as sustainable bio-based chemicals being developed by companies such as NatureWorks for the packaging and plastics sectors. NatureWorks produces Ingeo, a bio-based plastic made from renewable plant materials, which is used in packaging and consumer goods

- Eco-friendly chemicals are gaining popularity, driven by increasing environmental regulations and consumer demand, such as the rise of green solvents in the cleaning and coatings industries.

- For instance, the development of water-based paints and coatings by companies such as AkzoNobel, reducing the environmental impact of harmful VOCs (volatile organic compounds)

- The market is also impacted by global supply chain dynamics, with disruptions such as the COVID-19 pandemic highlighting the need for more resilient and adaptable supply chains in chemical production

- For instance, the shortage of raw materials such as acrylic acid, which affected global supply chains and production timelines in industries such as automotive and construction

- Mergers, acquisitions, and strategic partnerships are becoming more common, such as the merger of DuPont and Dow Chemical, as companies look to expand their market presence and diversify their product offerings. The merger formed one of the largest chemical companies globally, enhancing their ability to compete in key markets such as electronics, agriculture, and materials science

Report Scope and Chemical Market Segmentation

|

Attributes |

Chemical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Market Trends

“Shift Towards Sustainability and Eco-Friendly Chemicals”

- The shift towards sustainability is gaining momentum in the chemical market, with companies focusing on eco-friendly solutions such as biodegradable plastics and non-toxic solvents

- For instance, BASF developed "ecovio," a biodegradable plastic used in packaging, addressing concerns about plastic waste

- Many companies are turning to renewable raw materials to reduce their reliance on fossil fuels, such as the use of plant-based feedstocks for producing chemicals. In collaboration with NatureWorks, Cargill is producing Ingeo, a bio-based plastic made from renewable plant materials

- Water-based products are becoming increasingly popular in industries such as coatings and paints to reduce harmful emissions. AkzoNobel has introduced water-based paints to replace traditional oil-based formulations, significantly reducing volatile organic compound emissions

- Stricter environmental regulations are encouraging chemical companies to develop greener alternatives, such as sustainable solvents and energy-efficient production methods. The European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation is pushing companies to reduce harmful chemical substances in their products

- The circular economy model is being embraced by the chemical industry, with companies focusing on reducing waste and reusing materials. Dow Chemical’s collaboration with the recycling firm, Plastic Energy, is aimed at turning plastic waste into high-quality feedstock for new plastic production

Chemical Market Dynamics

Driver

“Increasing Demand for Sustainable Chemicals”

- The rising demand for sustainable chemicals is driven by increased environmental awareness and government regulations focused on reducing pollution and harmful chemical waste

- For instance, the European Union's stricter environmental regulations encourage companies to adopt eco-friendly chemical solutions

- Consumers are shifting towards environmentally responsible products, prompting manufacturers to develop biodegradable plastics, renewable chemicals, and low-emission products. Companies such as BASF have developed "ecovio," a biodegradable plastic, to meet growing consumer demand for sustainable packaging

- The global push to reduce plastic waste is fueling the demand for bio-based polymers and alternative packaging solutions. Companies such as NatureWorks, which produces Ingeo, a bio-based plastic, are meeting this demand by offering sustainable alternatives to conventional petroleum-based plastics

- Industries such as agriculture and automotive are increasingly adopting greener chemical solutions to meet sustainability targets

- For instance, the use of bio-based fertilizers and plant protection products is on the rise in the agriculture sector to minimize the environmental footprint of traditional chemicals

- Sustainable chemical solutions are not only improving environmental health but also driving growth in the chemical market, as companies such as Dow Chemical and BASF contribute to lowering carbon footprints and advancing greener alternatives across multiple sectors

Opportunity

“Technological Advancements in Chemical Production”

- Technological advancements, including artificial intelligence, automation, and sustainable manufacturing, are opening up significant opportunities in the chemical market by improving production processes and efficiency

- The integration of AI in chemical production allows for real-time monitoring and predictive maintenance, reducing disruptions and improving product quality

- For instance, AI-driven systems in chemical plants can optimize operations, lowering costs and minimizing waste

- Advances in green chemistry, such as the development of energy-efficient catalysts, are enabling more sustainable chemical production. These innovations help reduce energy consumption and carbon emissions, supporting the industry's shift towards sustainability

- Leading companies such as Siemens and Honeywell are pioneering automation and process control technologies that improve the operational efficiency of chemical plants while reducing their environmental impact, making chemical production more sustainable

- Innovations such as 3D printing and advanced materials are expanding the application of chemicals in new industries such as electronics and healthcare, allowing chemical companies to tap into emerging markets and stay competitive in a fast-evolving landscape

Restraint/Challenge

“Supply Chain Disruptions”

- Supply chain disruptions are a major challenge in the global chemical market, as the industry relies on raw materials and intermediates sourced from diverse global regions

- For instance, during the COVID-19 pandemic, chemical companies faced significant delays in accessing key raw materials, highlighting the fragility of global supply chains

- The COVID-19 pandemic exposed vulnerabilities in the chemical supply chain, causing shortages of essential raw materials such as petrochemicals and specialty chemicals

- For instance, the shortage of personal protective equipment (PPE) and hand sanitizers during the pandemic, where the demand for chemicals such as alcohol and other disinfectants surged, causing delays and price hikes in supply chains

- Geopolitical tensions, trade restrictions, and natural disasters can further disrupt the flow of chemicals, exacerbating supply chain risks

- For instance, the blockage of the Suez Canal in March 2021, which delayed shipments of essential chemicals globally, affecting industries reliant on timely deliveries

- These disruptions pressure chemical companies to create more resilient and flexible supply chains, including finding alternative sources and improving logistics to ensure a stable supply of raw materials. Companies such as BASF have started to diversify their supply sources and implement better risk management strategies to address these challenges

- To mitigate supply chain risks, companies are investing in strategic alternatives such as local production capabilities, diversified sourcing strategies, and advanced inventory management systems

- For instance, Dow Chemical has been investing in local production facilities to reduce dependency on distant suppliers and improve supply chain resilience during global disruptions

Chemical Market Scope

The market is segmented on the basis of product and Application

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

Chemical Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Chemical Market”

- Asia-Pacific dominates the global chemical market due to a surge in manufacturing activities driven by robust industrial growth across key sectors

- The region’s expanding industrial base, particularly in automotive, construction, and electrical and electronics, has significantly increased the demand for chemicals

- Rising per capita disposable income in the region has led to higher consumption of products, further boosting the demand for chemicals across various industries

- As industries continue to grow, the need for chemical solutions in applications such as materials, coatings, and electronics is expanding, solidifying Asia-Pacific’s position in the global market

- Competitive manufacturing costs, well-established supply chains, and a strong industrial infrastructure have helped Asia-Pacific maintain its dominance in global chemical production

“North America is Projected to Register the Highest Growth Rate”

- North America is emerging as a rapidly growing player in the chemical market, primarily driven by a strong emphasis on research and development within the sector

- Investments in innovation and technological advancements are propelling the growth of the region's chemical industry, particularly in the development of novel products and solutions

- Companies in North America are adopting cutting-edge technologies to enhance production processes, improve efficiency, and create more sustainable chemical solutions

- The focus on R&D has positioned North America as a key region for advancing chemical innovations, enabling the development of specialized products that meet evolving industry needs

- As the industry increasingly prioritizes environmentally friendly solutions, North America's commitment to technological development is expected to continue driving significant growth in the chemical sector

Chemical Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- Dow (U.S.)

- SABIC (Saudi Arabia)

- Exxon Mobil Corporation (U.S.)

- DuPont (U.S.)

- LyondellBasell Industries Holdings B.V. (U.S.)

- INEOS Group Holdings S.A. (U.K.)

- Mitsubishi Chemical Group Corporation (Japan)

- LG Chem (South Korea)

- Formosa Plastics Corporation (Taiwan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Evonik Industries AG (Germany)

- Akzo Nobel N.V. (Netherlands)

- Air Liquide (France)

Latest Developments in Global Chemical Market

- In November 2024, Total Energies unveiled its hydrogen platform at La Mède as part of its broader strategy to accelerate decarbonization. The platform will focus on producing low-carbon hydrogen to replace fossil fuels in industrial processes, contributing to significant reductions in carbon emissions. This initiative enhances TotalEnergies' role in the renewable energy market, positioning the company as a leader in the hydrogen sector. By promoting green hydrogen solutions, the project supports industries in achieving their sustainability targets. It is expected to drive the global hydrogen market’s growth and transform energy consumption practices across various sectors

- In August 2024, Linde Engineering, a leading global industrial gases and engineering company, announced its development of a 100 MW green hydrogen plant for Shell's Refhyne II project. This facility will produce green hydrogen through electrolysis powered by renewable energy sources. The hydrogen will be used to support Shell's refining processes, helping reduce the carbon footprint of its operations. This development is a significant step in advancing green hydrogen production and its adoption in the industrial sector. The plant is expected to drive the growth of the hydrogen market, supporting the transition to cleaner energy solutions and enhancing the chemical market’s shift toward sustainable practices

- In May 2024, Nel ASA, a leading provider of hydrogen production technologies, signed a licensing agreement with Reliance Industries, an Indian multinational conglomerate. The agreement focuses on the production and commercialization of green hydrogen using Nel’s electrolysis technology. This collaboration aims to enhance Reliance’s clean energy initiatives and support its transition towards more sustainable practices. By leveraging Nel's advanced hydrogen technology, the partnership is expected to drive the growth of green hydrogen production in India, significantly impacting the chemical and energy markets. This move aligns with global efforts to decarbonize industries and promote eco-friendly energy solutions

- In March 2024, Sumitomo Metal Mining Co., Ltd. (SMM), a Japanese mining and smelting company, announced its new initiative to build a state-of-the-art facility for producing high-purity hydrogen at its refinery in Japan. The facility will utilize renewable energy sources to generate green hydrogen, which will be used to decarbonize the company's industrial processes, particularly in the production of non-ferrous metals. This move aligns with Japan's push for hydrogen as a clean energy solution, benefiting industries across the region by reducing reliance on fossil fuels. It also supports the chemical market's transition to sustainable energy sources, positioning SMM as a key player in the growing green hydrogen market

- In April 2024, Honda Motor Co., Ltd. announced its collaboration with other industry leaders to develop and expand the use of hydrogen fuel cell technology. The company plans to accelerate the production of hydrogen-powered vehicles and support the development of hydrogen refueling infrastructure. This initiative is aimed at reducing carbon emissions and promoting cleaner energy solutions in the automotive sector. Honda's efforts will not only help boost the demand for hydrogen as an alternative energy source but also impact the chemical market by increasing the need for green hydrogen production and supporting the growth of the global hydrogen economy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.