North America Solvent Market

Market Size in USD million

CAGR :

%

USD

9,165.03 million

USD

12,504.57 million

2023

2030

USD

9,165.03 million

USD

12,504.57 million

2023

2030

| 2024 –2030 | |

| USD 9,165.03 million | |

| USD 12,504.57 million | |

|

|

|

North America Solvents Market Analysis and Size

Solvents play an important role as carriers for surface coatings such as paints, varnishes, and adhesives. The chemicals used in paints and coatings rely on solvents as they can dissolve and disperse components that are employed in the coatings formulations. It further ensures the quality of the final product obtained and optimal performance. Solvents act as essential components in paints and coatings formulations in the construction industry as they can dissolve pigments, additives, and binders to form high-performance coatings.

Various types of solvents are used depending on the requirements of the coatings such as drying time, film quality, and compatibility with other components. Solvent selection such as hydrocarbon solvents, ketones, esters, alcohols, and glycol ethers depends on factors such as solvating ability, polarity, and compatibility with other components in the formulation. Benzene, toluene, and xylenes are aromatic hydrocarbon solvents that are used in enamel-based paints, whereas lacquer-based paints need stronger solvents for faster drying.

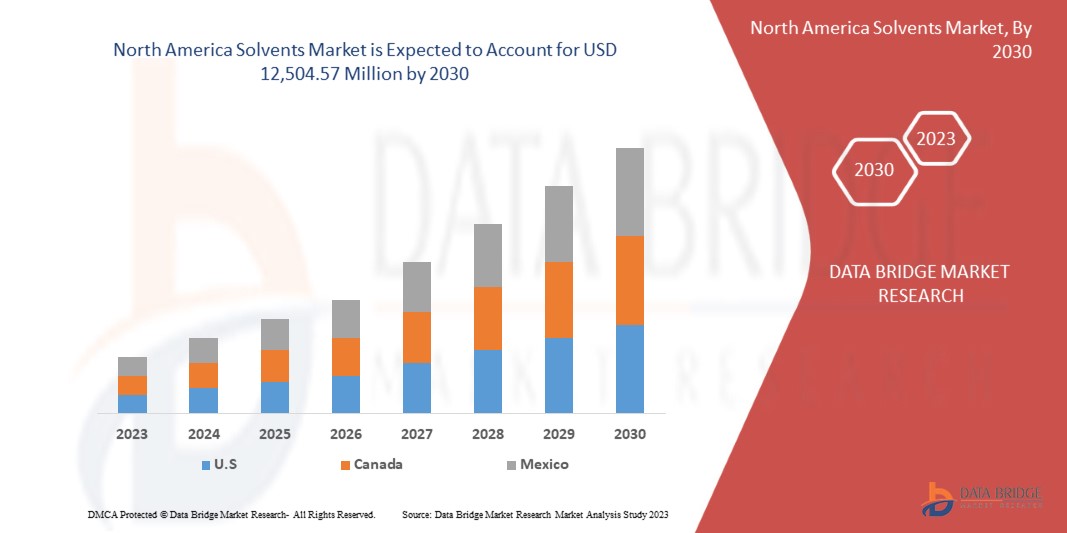

Data Bridge Market Research analyzes that North America solvents market is expected to reach USD 12,504.57 million by 2030 from USD 9,165.03 million in 2023, growing with a substantial CAGR of 4.5% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Category (Oxygenated Solvents, Hydrocarbon Solvents, and Halogenated Solvents), Source (Conventional and Bio-Based), Application (Paints and Coatings, Pharmaceuticals, Adhesives, Printing Inks, Personal Care, Polymer Manufacturing, Agricultural Chemicals, and Metal Cleaning) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Arkema, INVISTA (A Subsidiary of Koch Industries, Inc.), Ashland., Solvay, ADM, Shell Global, BP p.l.c., Eastman Chemical Company , INEOS GROUP HOLDINGS S.A., BASF SE, Celanese Corporation, Cargill, Incorporated, Reliance Industries Limited, Honeywell International Inc., LyondellBasell Industries Holding B.V., Exxon Mobil Corporation, Monument Chemical, Dow, and Olin Corporation among others |

Market Definition

Solvents are typically liquid substances with the capacity to dissolve or distribute a wide range of compounds, including solid, liquid, and gaseous substances. They are widely used in a variety of industries, including chemicals, pharmaceuticals, paints and coatings, adhesives, cleaning products, and many more. The market for solvents includes a variety of solvent types, such as hydrocarbons, oxygenated solvents, halogenated solvents, and other specialized solvents.

North America Solvents Market Dynamics

This section deals with understanding the market drivers, advantages, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Demand for Solvents in the Paints and Coatings Industry

Solvents play an important role as carriers for surface coatings such as paints, varnishes, and adhesives. The chemicals used in paints and coatings rely on solvents as they can dissolve and disperse components that are employed in the coatings formulations. It further ensures the quality of the final product obtained and optimal performance. Solvents act as essential components in paints and coatings formulations in the construction industry as it can dissolve pigments, additives, and binders to form high-performance coatings. Various types of solvents are used depending on the requirements of the coatings such as drying time, film quality, and compatibility with other components.

Other than paints and coatings, solvents find applications in adhesives for binding materials. The adhesives are of different types such as polychloroprene, polyurethane, acrylate, and silicone-based adhesives. Moreover, solvents are used in cleaning and degreasing agents, paint removers, and varnishes. As the construction and automotive sector around the world is booming due to urbanization, infrastructure development, increasing construction activities, and growing demand for automobiles. This construction and automotive industry growth further drives the demand for paints, coatings, and adhesives and thus the solvents demand to increase.

- Rising Usage of Printing Inks for Different Industrial Applications

Solvents play a crucial role in the printing industry as they offer solvency to inks to dissolve pigments and vehicles such as water-soluble glycol vehicles into a solution. This is done so that the ink can be easily applied to the paper or any other substrates. The printing inks need solvents through which proper distribution of color and consistency could be achieved. The solvents that have high solvency power can yield vibrant and long-lasting prints. The solvents having a narrow boiling range evaporates rapidly after ink application, thus there is effective and proper drying of ink on the applied substrates.

The application of solvents in printing inks is widely done in different applications such as printing, packaging, bottle printing, and plastic printing among others. The packaging industry plays a significant role in driving the demand for ink solvents for printing applications. There has been a rise in demand for flexible packaging due to its customizable nature, low cost, and lightweight properties. Such flexible packaging is used in various sectors ranging from consumer goods to healthcare, thus driving the demand for solvents during the forecast period. The growth of the food and beverage industry is also expected to increase the demand for packaging, which will further drive the demand for printing inks. The ink solvents help in achieving the required quality of printing and durability needed for packaging materials used in the food and beverages sector. In the upcoming, the demand for high-quality printing inks is going to rise for different applications in a wide range of industries such as packaging solutions for food and beverage, consumer goods, and healthcare applications thus propelling the North America solvents market forward.

Opportunities

- Shifting the Focus of Manufacturers toward Eco-Friendly Solvents

In recent years, there has been a significant shift of end-users towards environmentally friendly solvents which are also called bio-solvents or green solvents. Most of these solvents are derived from the processing of crops. As the solvents derived from petrochemicals contribute to the emissions of volatile organic compounds, they have serious side effects on the environment. These solvents are non-carcinogenic and non-corrosive which makes them safe to handle and reduces risks for workers.

Ethyl lactate is one of the green solvents that is derived from the processing of corn and has advantages such as biodegradability when compared to conventional solvents. They too are used in applications such as paint stripper, and the removal of greases, oils, adhesives, and solid fuels from various metal surfaces. There are further ongoing research and development efforts from manufacturers for the improvement of the performance and range of eco-friendly solvents.

- Immense Potential in the Renewable Energy Sector

As there has been a rise in demand for cleaner and sustainable energy sources, the renewable energy sector is experiencing significant growth in recent years. Solar panel systems and wind turbines, essential components of renewable energy generation require semiconductors for effective power conversion and control.

Solvents and combinations of solvents are widely used in the semiconductor industry for various purposes such as equipment cleaning, wafer drying, and deposition or removal of substrates. The semiconductor grade solvents have an important role in the fabrication of semiconductors. They are designed for the semiconductor industry and electronic industries, which requires low impurities level. Isopropyl alcohol and acetone are among the most popular cleaning solvents in the semiconductor industry. The solvent manufacturers thus can invest in research and development activities for the development of new solvents including eco-friendly solvents that fulfill the requirements of semiconductor manufacturing. Such steps will help the expansion of renewable energy systems worldwide, thus offering a wide range of opportunities for the market growth.

Restraint/Challenge

- Health and Safety Concerns Related to the Usage of Solvents

Solvents are used for varied applications for dissolving or diluting components. Solvents used in construction products such as paints, paint strippers, and thinners pose potential health hazards to the individuals that are exposed to it. The solvents such as dichloromethane, toluene, and ethyl acetate influence the health of humans in different ways such as skin contact, ingestion, inhalation, and eye contact. While the application of such products takes place, breathing happens that leads to side effects such as headaches, nausea, and irritation to the eyes, skin, lungs, and skin. Moreover long exposures to such solvents results in health issues such as dermatitis, and damage to the body parts such as eyes, kidney, lungs, nervous system, and skin. High doses of solvents can even lead to unconsciousness and death, especially in the case of occupational exposure.

Such health and safety concerns related to solvents will lead to the reduction in demand for solvent consisting products. These industries such as paints, coatings, and adhesives too can face significant challenges thus restraining the market growth.

Recent Development

- In April 2023, LyondellBasell announced that the company will participate in Chinaplas 2023 which will be held on April 17th-20th in Shezhen. During the exhibition, LyondellBasell will also announce their latest collaborative work with upstream and downstream parties in the value chain, including Nippon Paint China, Jiangsu WMGrass and Genox. By deepening local cooperation, LyondellBasell aimed to promote local innovative recycling ecosystems and together with industry partners shape a more sustainable future

- In March 2023, Shell plc published its Energy Transition Progress Report 2022, which showed that it has again met its climate targets as part of its energy transition strategy. The report highlights important steps that Shell has taken to advance its energy transition strategy

North America Solvents Market Scope

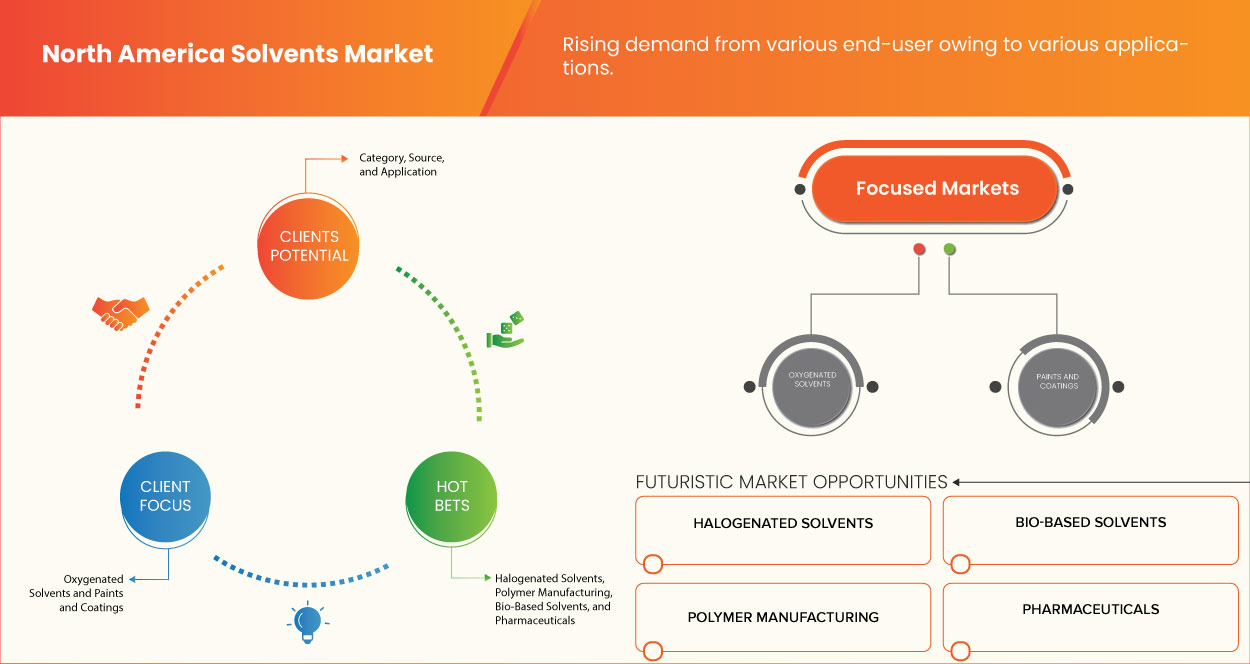

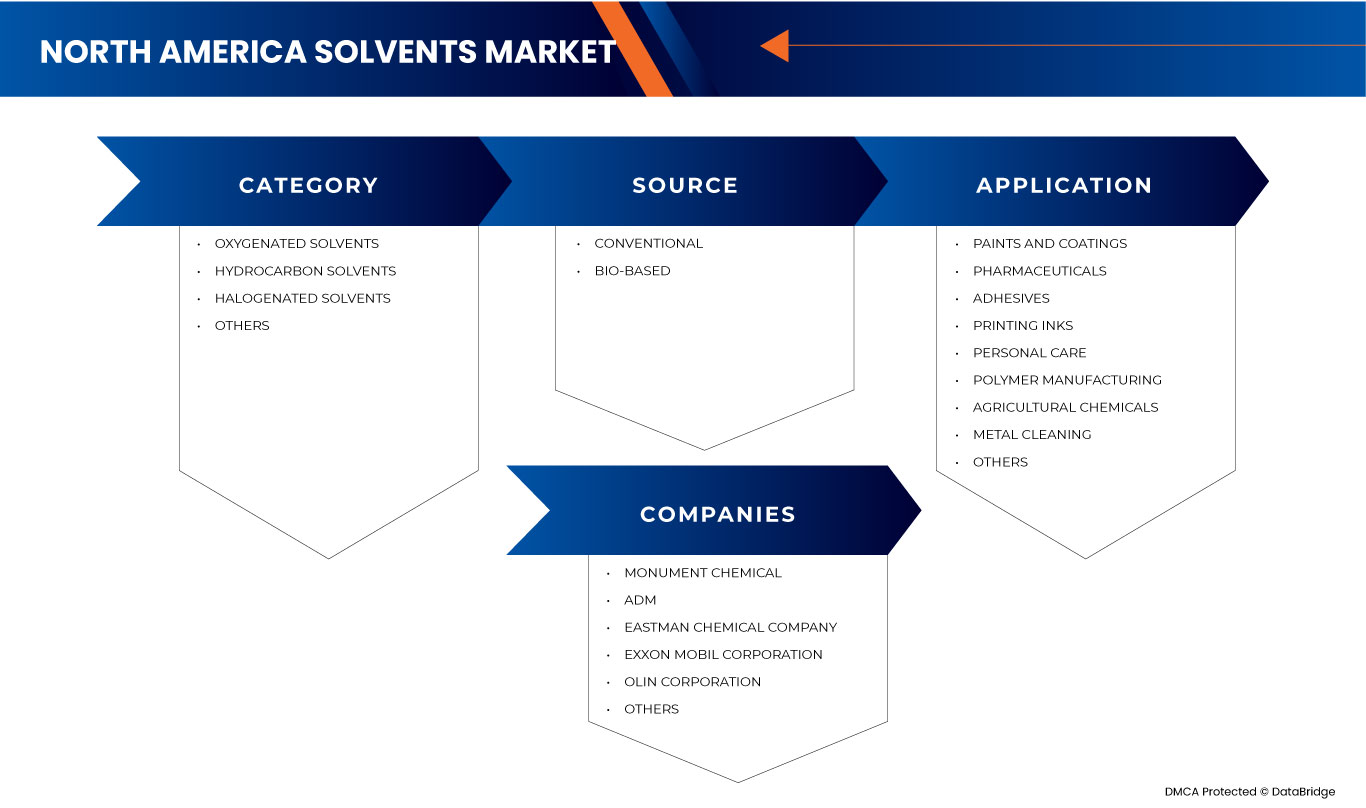

The North America solvents market is segmented based on category, source, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Category

- Oxygenated Solvents

- Hydrocarbon Solvents

- Halogenated Solvents

On the basis of category, the market is segmented into oxygenated solvents, hydrocarbon solvents, and halogenated solvents.

Source

- Conventional

- Bio-Based

On the basis of source, the market is segmented into conventional and bio-based.

Application

- Paints and Coatings

- Pharmaceuticals

- Adhesives

- Printing Inks

- Personal Care

- Polymer Manufacturing

- Agricultural Chemicals

- Metal Cleaning

- Others

On the basis of application, the market is segmented into paints and coatings, pharmaceuticals, adhesives, printing inks, personal care, polymer manufacturing, agricultural chemicals, metal cleaning, and others.

North America Solvents Market Regional Analysis/Insights

The North America solvents market is segmented on the basis of category, source, and application.

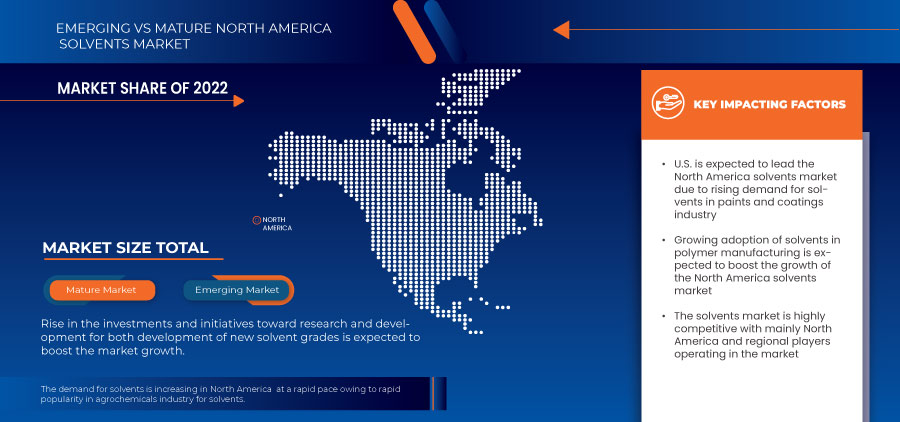

The countries covered in the North America solvents market report are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America solvents market due to the growing demand for solvents in the paints and coatings industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Solvents Market Share Analysis

North America solvents market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent market players operating in the North America solvents market are Arkema, INVISTA (A Subsidiary of Koch Industries, Inc.), Ashland., Solvay, ADM, Shell Global, BP p.l.c., Eastman Chemical Company , INEOS GROUP HOLDINGS S.A., BASF SE, Celanese Corporation, Cargill, Incorporated, Reliance Industries Limited, Honeywell International Inc., LyondellBasell Industries Holding B.V., Exxon Mobil Corporation, Monument Chemical, Dow, and Olin Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 OVERVIEW

4.1.2 LOGISTIC COST SCENARIO

4.1.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.2 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.3 VENDOR SELECTION CRITERIA

4.4 LIST OF KEY BUYERS

4.5 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 RISING DEMAND FOR BEAUTY AND PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 RISING USE OF SOLVENTS IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 NORTH AMERICA SOLVENTS MARKET, BY CATGEORY

7.1 OVERVIEW

7.2 OXYGENATED SOLVENTS

7.2.1 OXYGENATED SOLVENTS, BY CATEGORY

7.2.1.1 ALCOHOLS

7.2.1.1.1 ETHANOL

7.2.1.1.2 METHANOL

7.2.1.1.3 PROPANOL

7.2.1.1.4 BUTANOL

7.2.1.2 GLYCOL ETHERS

7.2.1.2.1 E-SERIES GLYCOL ETHERS

7.2.1.2.2 P-SERIES GLYCOL ETHERS

7.2.1.2.3 BUTYL GLYCOL ETHERS

7.2.1.3 KETONES

7.2.1.3.1 ACETONE

7.2.1.3.2 MEK

7.2.1.3.3 MIBK

7.2.1.4 ESTERS

7.2.1.4.1 ETHYL ACETATE

7.2.1.4.2 BUTHYL ACETATE

7.2.1.5 GLYCOLS

7.2.1.5.1 ETHYLENE GLYCOL

7.2.1.5.1.1 MEG

7.2.1.5.1.2 DEG

7.2.1.5.1.3 TEG

7.2.1.5.2 PROPYLENE GLYCOL

7.3 HYDROCARBON SOLVENTS

7.3.1 ALIPHATIC SOLVENTS

7.3.2 AROMATIC SOLVENTS

7.3.2.1 TOLUENE

7.3.2.2 XYLENE

7.3.2.2.1 MIXED-XYLENE

7.3.2.2.2 PARA-XYLENE

7.3.2.3 EHTYLBENZENE

7.4 HALOGENATED SOLVENTS

7.4.1 HALOGENATED SOLVENTS, BY CATEGORY

7.4.1.1 TRICHLOROETHYLENE

7.4.1.2 PERCHLOROETHYLENE

7.4.1.3 METHYLENE CHLORIDE

7.5 OTHERS

8 NORTH AMERICA SOLVENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 BIO-BASED

9 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PAINTS AND COATINGS

9.3 PHARMACEUTICALS

9.4 ADHESIVES

9.5 PRINTING INKS

9.6 PERSONAL CARE

9.7 POLYMER MANUFACTURING

9.8 AGRICULTURAL CHEMICALS

9.9 METAL CLEANING

9.1 OTHERS

10 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SOLVENTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 PRODUCT LAUNCH

11.3 ACQUISITION

11.4 COLLABORATION

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 REVENUE ANALYSIS

13.1.4 RECENT DEVELOPMENTS

13.2 RELIANCE INDUSTRIES LIMITED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 BP P.L.C.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 EASTMAN CHEMICAL COMPANY (2022)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 OLIN CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ARKEMA (2022)

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ASHLAND.(2022)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 BASF SE

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 CARGILL, INCORPORATED

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 CELANESE CORPORATON(2022)

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DOW

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 EXXON MOBIL CORPORATION(2022)

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 HONEYWELL INTERNATIONAL INC. (2022)

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 HUNTSMAN INTERNATIONAL LLC (2022)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 INEOS GROUP HOLDINGS S.A. (2022)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 MONUMENT CHEMICAL

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SHELL GLOBAL (2022)

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOLVAY (2022)

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 4 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HALOGENATED SOLVENTS, BY CATEGORY IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 17 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 19 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 21 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 23 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 31 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 35 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 36 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 38 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 40 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 48 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 51 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 52 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 53 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 55 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 57 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 70 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

List of Figure

FIGURE 1 NORTH AMERICA SOLVENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SOLVENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SOLVENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SOLVENTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SOLVENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SOLVENTS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SOLVENTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SOLVENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SOLVENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SOLVENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SOLVENTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SOLVENTS MARKET: SEGMENTATION

FIGURE 13 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SOLVENTS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE OXYGENATED SOLVENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SOLVENTS MARKET IN 2023 AND 2030

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SOLVENTS MARKET

FIGURE 17 NORTH AMERICA SOLVENTS MARKET: BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA SOLVENTS MARKET: BY SOURCE, 2022

FIGURE 19 NORTH AMERICA SOLVENTS MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA SOLVENTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA SOLVENTS MARKET: COMPANY SHARE 2022 (%)

North America Solvent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Solvent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Solvent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.