Global Chili Flavor Market

Market Size in USD Billion

CAGR :

%

USD

433.76 Billion

USD

729.27 Billion

2024

2032

USD

433.76 Billion

USD

729.27 Billion

2024

2032

| 2025 –2032 | |

| USD 433.76 Billion | |

| USD 729.27 Billion | |

|

|

|

|

Chili Flavor Market Size

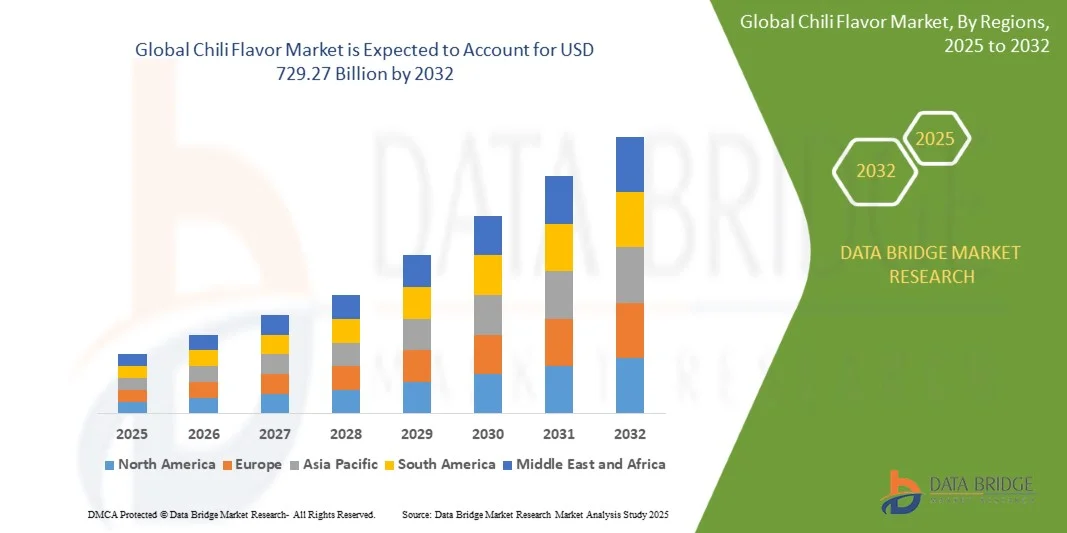

- The global chili flavor market size was valued at USD 433.76 billion in 2024 and is expected to reach USD 729.27 billion by 2032, at a CAGR of 6.71% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for bold, spicy, and exotic taste profiles across food and beverage applications

- Increasing incorporation of chili flavor in snacks, sauces, ready-to-eat meals, and beverages by manufacturers to meet evolving taste preferences is further propelling market expansion

Chili Flavor Market Analysis

- The global chili flavor market is witnessing robust growth, driven by the increasing demand for authentic, natural, and diverse flavor experiences in food consumption

- Manufacturers are focusing on innovation through new chili varieties, natural extracts, and clean-label formulations to cater to health-conscious consumers

- Asia-Pacific dominated the chili flavor market with the largest revenue share in 2024, driven by the widespread consumption of spicy foods and the deep cultural preference for chili-based cuisines in countries such as China, India, and Thailand. The region’s strong agricultural base and vast chili production capacity also support consistent ingredient availability for food manufacturers. The growing popularity of Asian flavors in global markets continues to reinforce Asia-Pacific’s leadership in the chili flavor industry

- North America region is expected to witness the highest growth rate in the global chili flavor market, driven by increasing multicultural culinary influences, growing demand for clean-label chili flavor ingredients, and rising penetration of chili-based sauces and seasonings across foodservice and retail sectors

- The Red Chili segment held the largest market revenue share in 2024, driven by its widespread use across global cuisines and its dominance in processed food formulations. Red chili is the most commonly used variant in sauces, seasonings, and snacks due to its intense heat, strong aroma, and vibrant color appeal, making it an essential component in both household and industrial applications

Report Scope and Chili Flavor Market Segmentation

|

Attributes |

Chili Flavor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chili Flavor Market Trends

“Rising Popularity of Spicy and Exotic Flavors in Global Cuisin”

- The increasing global appetite for bold and exotic flavors is driving the demand for chili-based seasonings and ingredients across the food and beverage industry. Consumers are actively seeking diverse flavor profiles inspired by Asian, Latin American, and African cuisines, positioning chili flavor as a core component of culinary innovation and global fusion dishes. This trend is particularly strong among younger demographics seeking adventurous taste experiences and multicultural food diversity that reflects global flavor exploration. The growing popularity of fusion restaurants and premium condiments has further boosted demand for authentic chili-infused offerings across regions

- The rapid growth of the convenience food sector, including ready-to-eat meals, sauces, snacks, and marinades, has boosted the use of chili flavoring as a key taste enhancer. Manufacturers are responding with customized chili flavor blends catering to regional preferences and varying levels of spiciness, ensuring broad consumer appeal and market expansion. In addition, the growing working-class population and the demand for flavorful quick meals are stimulating chili flavor usage in packaged and instant foods. These factors are reshaping product formulations and expanding flavor portfolios across both retail and foodservice sectors

- The rising influence of global street food culture is also contributing to chili flavor adoption in mainstream food products. Quick-service restaurants and food brands are launching chili-flavored offerings to attract consumers looking for vibrant, fiery, and authentic taste experiences, further diversifying product portfolios. The inclusion of chili flavor in fast food, frozen snacks, and ready sauces is reshaping consumer expectations around spice and quality. This movement is also encouraging global brands to introduce limited-edition spicy variants to cater to evolving regional preferences and spice tolerance

- For instance, in 2024, McCormick & Company launched a new global line of chili-infused spice blends inspired by Mexican, Thai, and Indian cuisines, aiming to capture growing consumer interest in cross-cultural flavor exploration and premium spice experiences. The product range targets both household consumers and professional chefs, emphasizing authenticity and flavor precision. This innovation reflects a broader industry trend toward hybrid flavor concepts, which combine regional chili varieties with contemporary culinary techniques to enhance flavor intensity and appeal

- While chili flavor continues to dominate new product formulations, its future growth depends on balancing heat intensity with flavor depth. Manufacturers are focusing on natural chili extracts and advanced encapsulation technologies to maintain authenticity and stability across product categories. The development of microencapsulated chili oils and controlled-release flavor systems ensures long-lasting taste and consistency during processing. Such innovations are improving heat control in recipes while retaining the natural aroma and color characteristics of fresh chili varieties

Chili Flavor Market Dynamics

Driver

“Increasing Demand for Natural and Clean-Label Ingredients”

- The growing preference for natural and minimally processed ingredients is significantly driving the chili flavor market. Consumers are shifting away from artificial additives and opting for clean-label products containing naturally derived spices such as chili, which are perceived as healthier and more authentic. The trend is reinforced by stricter food regulations emphasizing ingredient transparency and traceability. Manufacturers are leveraging this demand by highlighting “100% natural chili flavor” and “no artificial color or preservatives” claims on packaging to enhance product appeal

- Food and beverage manufacturers are increasingly replacing synthetic flavoring agents with natural chili extracts, oleoresins, and powders to align with consumer demand for transparency and sustainability. This transition is also supported by regulatory moves promoting natural ingredient disclosure on product labels. The integration of organic chili sources and sustainable farming practices further strengthens brand image among eco-conscious consumers. As a result, companies are forming long-term partnerships with certified suppliers to ensure traceability and consistency in natural flavor production

- The trend toward plant-based and vegan diets has amplified the role of chili flavor as a key ingredient for enhancing taste and depth in meat alternatives and plant-based dishes. This has opened new opportunities across the processed food and functional food segments. Chili flavor adds sensory appeal to protein substitutes that often lack robust taste, making it essential in flavor balancing for vegan meals. The adoption of chili flavor in plant-based snacks, sauces, and frozen meals continues to expand, offering healthier yet indulgent product experiences

- For instance, in 2023, Nestlé launched its plant-based chili-flavored meat substitute range under the Garden Gourmet brand in Europe, appealing to flexitarian consumers seeking natural yet bold flavor experiences. The launch reflects a growing synergy between plant-based innovation and spicy food trends, targeting health-conscious yet adventurous consumers. Nestlé’s move underscores how chili flavor is being used to bridge the gap between indulgence and nutrition in modern food formulations

- While clean-label innovation drives the market forward, ensuring consistent flavor quality and heat stability remains crucial for manufacturers looking to capture growing consumer trust and loyalty. Advances in extraction and drying technology are enabling producers to deliver superior natural flavor profiles without compromising color or intensity. To maintain competitive advantage, companies are investing in R&D for organic certification and heat-stabilized formulations suited for diverse processing environments

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Instability”

- The chili flavor market faces significant challenges due to volatile chili pepper prices influenced by climatic variations, crop diseases, and fluctuating global demand. Such price instability directly affects production costs and profit margins for food manufacturers relying on chili-based ingredients. Inconsistency in raw material quality further complicates formulation standardization across product batches. These fluctuations are particularly problematic for large-scale processors managing long-term supply contracts with fixed pricing structures

- Supply chain disruptions caused by adverse weather conditions or geopolitical factors can lead to raw material shortages and inconsistent quality. This instability poses risks for large-scale food processors and exporters dependent on steady chili supplies from producing countries. Disruptions in transportation networks and storage logistics also amplify losses during harvest seasons. Manufacturers are increasingly turning to contract farming and vertical integration strategies to reduce supply risks and stabilize sourcing channels

- The market is also constrained by regional disparities in chili cultivation and processing capacities, which create sourcing challenges for manufacturers aiming to maintain uniform flavor quality and cost efficiency across markets. Developing nations often lack advanced post-harvest infrastructure and drying facilities, resulting in quality degradation. These challenges push manufacturers to explore local partnerships and adopt modern processing technologies to enhance value chain efficiency and product consistency

- For instance, in 2023, reduced chili yields in India and China due to prolonged heat waves resulted in a sharp price surge, disrupting exports and impacting international manufacturers dependent on Asian chili supplies. The shortage caused reformulation delays and increased reliance on alternative sourcing from Africa and South America. This event underscored the need for diversified chili supply chains and sustainable agricultural practices to mitigate climate-related risks

- Although supply chain and cost volatility persist, the growing investment in sustainable farming, contract cultivation, and regional processing facilities is expected to stabilize chili sourcing and ensure long-term market resilience. Companies are focusing on improving traceability systems, crop insurance mechanisms, and blockchain-enabled supplier verification. These initiatives are strengthening supply transparency, reducing risk exposure, and enhancing global confidence in chili-based ingredient production

Chili Flavor Market Scope

The market is segmented on the basis of species, form, category, and application.

• By Species

On the basis of species, the global chili flavor market is segmented into Red Chili, Green Chili, and Yellow Chili. The Red Chili segment held the largest market revenue share in 2024, driven by its widespread use across global cuisines and its dominance in processed food formulations. Red chili is the most commonly used variant in sauces, seasonings, and snacks due to its intense heat, strong aroma, and vibrant color appeal, making it an essential component in both household and industrial applications.

The Green Chili segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for fresher and milder flavor profiles in global culinary products. Green chili’s natural pungency and crisp taste have made it increasingly popular in ready-to-cook meals and authentic regional dishes, particularly in Asian and Latin American cuisines emphasizing fresh flavor integration.

• By Form

On the basis of form, the global chili flavor market is segmented into Liquid and Dry. The Dry segment held the largest market revenue share in 2024, primarily attributed to its extended shelf life, easy storage, and versatile usage across food manufacturing and retail applications. Dry chili forms such as powders, flakes, and granules are widely utilized in packaged seasonings, spice blends, and convenience foods, offering flexibility in processing and flavor standardization.

The Liquid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its growing use in sauces, marinades, beverages, and flavor emulsions. Liquid chili extracts and oleoresins are gaining popularity for their ability to deliver consistent heat and natural color in processed food applications. The segment’s growth is further supported by advancements in extraction technologies that preserve aroma intensity and flavor stability during production.

• By Category

On the basis of category, the global chili flavor market is segmented into Organic and Conventional. The Conventional segment held the largest market revenue share in 2024, driven by its high availability, cost-effectiveness, and wide use in mass-produced food products. Conventional chili flavors continue to dominate due to established farming practices and a broad consumer base in both developed and emerging markets.

The Organic segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing consumer preference for natural and chemical-free food products. Growing health awareness and sustainable agriculture initiatives are encouraging manufacturers to invest in certified organic chili cultivation. The demand for organic chili flavor is also rising across premium and clean-label food segments seeking to meet eco-conscious consumer expectations.

• By Application

On the basis of application, the global chili flavor market is segmented into Household Sector, Food Service Sector, and Industrial Sector. The Industrial Sector held the largest market revenue share in 2024, supported by its extensive use in large-scale food processing, packaged snacks, sauces, and ready-to-eat meals. Manufacturers in this segment are increasingly incorporating chili flavor to enhance taste complexity and align with regional spice preferences.

The Food Service Sector is expected to witness the fastest growth rate from 2025 to 2032, driven by the expansion of quick-service restaurants and global fusion cuisine trends. Rising demand for chili-infused dishes, condiments, and beverages in commercial kitchens is significantly driving this segment. The growing influence of international culinary styles and consumer inclination toward spicy dining experiences continue to fuel market opportunities in this sector.

Chili Flavor Market Regional Analysis

- Asia-Pacific dominated the chili flavor market with the largest revenue share in 2024, driven by the widespread consumption of spicy foods and the deep cultural preference for chili-based cuisines in countries such as China, India, and Thailand. The region’s strong agricultural base and vast chili production capacity also support consistent ingredient availability for food manufacturers. The growing popularity of Asian flavors in global markets continues to reinforce Asia-Pacific’s leadership in the chili flavor industry

- Consumers across the region are drawn to bold, authentic, and heat-intensive flavor profiles, prompting food and beverage companies to expand their chili-based product lines. Increased consumption of sauces, snacks, and ready-to-eat meals featuring chili flavor further boosts market growth

- The regional dominance is also supported by the expansion of local food processing industries and the rise of international spice exporters. Growing urbanization, coupled with a young population and evolving food preferences, is positioning Asia-Pacific as a key innovation hub for chili flavor products

China Chili Flavor Market Insight

The China chili flavor market captured the largest revenue share in 2024 within Asia-Pacific, driven by the country’s rich culinary heritage and strong domestic chili production. Chinese consumers’ preference for spicy food continues to inspire innovation across sauces, seasonings, and instant meal products. The rapid expansion of quick-service restaurants and packaged food brands incorporating regional chili varieties is fueling demand. Moreover, China’s export strength in chili-based products supports its leading role in the global chili flavor supply chain.

Japan Chili Flavor Market Insight

The Japan chili flavor market is expected to witness steady growth from 2025 to 2032, driven by the increasing incorporation of chili flavor in sauces, snacks, and instant foods. Although Japanese cuisine traditionally favors mild flavors, the growing influence of global culinary trends and fusion dishes is expanding consumer acceptance of spicier tastes. The introduction of chili-based condiments and spicy ramen varieties by local brands is further enhancing market growth. Moreover, Japan’s focus on product innovation and quality assurance supports the development of premium chili flavor offerings.

Europe Chili Flavor Market Insight

The Europe chili flavor market is expected to experience strong growth from 2025 to 2032, primarily driven by the increasing acceptance of spicy and exotic flavors among consumers. The growing popularity of ethnic cuisines, including Asian and Latin American dishes, is influencing the inclusion of chili flavor in mainstream European products. Furthermore, the rising trend of gourmet cooking and experimentation with global spices supports market expansion across sauces, seasonings, and snacks.

Germany Chili Flavor Market Insight

The Germany chili flavor market is expected to grow significantly from 2025 to 2032, driven by the rising consumer interest in spicy and exotic foods. The country’s evolving food culture, influenced by global cuisines such as Mexican, Indian, and Thai, is encouraging the integration of chili flavor into sauces, meat products, snacks, and ready meals. German manufacturers are focusing on developing natural and clean-label chili-based seasonings to meet the growing demand for healthy and authentic taste experiences. Furthermore, the popularity of gourmet and artisanal food products is strengthening the adoption of premium chili flavor formulations across both retail and foodservice sectors.

U.K. Chili Flavor Market Insight

The U.K. chili flavor market is expected to experience strong growth from 2025 to 2032, propelled by the rising preference for spicy and bold taste profiles in both home-cooked and restaurant meals. The increasing availability of chili-infused sauces, snacks, and condiments is reshaping the country’s flavor landscape. In addition, the growing multicultural population and the influence of global cuisines are stimulating innovation among local manufacturers, who are introducing diverse chili blends catering to varying heat levels and regional preferences.

North America Chili Flavor Market Insight

The North America chili flavor market is expected to experience strong growth from 2025 to 2032, driven by the rising popularity of Mexican, Asian, and fusion cuisines that prominently feature chili flavor. Consumers are increasingly experimenting with heat and spice, leading to product innovations across sauces, seasonings, and snack foods. The growing demand for clean-label, natural chili ingredients is further shaping the regional market, as manufacturers focus on authenticity and health-conscious product formulations.

U.S. Chili Flavor Market Insight

The U.S. chili flavor market held a significant revenue share in 2024 within North America, driven by the growing appetite for spicy foods and cross-cultural flavors. Consumers are seeking chili-based innovations across categories such as sauces, snacks, and ready meals, inspired by global cuisines. The surge in popularity of hot sauces, combined with rising interest in craft and artisanal products, continues to fuel the market. Moreover, the trend toward health-conscious eating has led to greater use of natural chili ingredients as clean-label flavor enhancers.

Chili Flavor Market Share

The Chili Flavor industry is primarily led by well-established companies, including:

- International Flavors & Fragrances, Inc. (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Sensient Technologies Corporation (U.S.)

- T. Hasegawa USA Inc. (Japan)

- McCormick & Company Inc. (U.S.)

- Symrise (Germany)

- Bickford Flavors (U.S.)

- DSM-Firmenich AG (Switzerland)

- Givaudan SA (Switzerland)

- Keva Flavours Private Limited (India)

Latest Developments in Global Chili Flavor Market

- In April 2024, Givaudan, in collaboration with MISTA and Bühler, inaugurated a state-of-the-art extrusion hub at the MISTA Innovation Center in San Francisco. This facility is designed to accelerate advancements in sustainable food processing and flavor innovation. By integrating cutting-edge extrusion technology, the hub will enable the creation of plant-based and clean-label food products, enhancing Givaudan’s position in the global taste and wellbeing market and supporting the growing demand for alternative proteins

- In December 2023, DSM-Firmenich established a new Science & Research Hub in Switzerland, housing over 200 experts in chemistry, data science, personal care, aroma, and analytics. This development strengthens the company’s research capabilities and fosters innovation in sustainable flavor and fragrance solutions. The hub’s focus on advanced science and collaboration is expected to drive the next generation of natural and functional ingredients, reinforcing DSM-Firmenich’s global leadership in flavor innovation

- In October 2023, Symrise introduced advanced separation technologies aimed at refining and enriching food essentials and valuable by-products. This technological leap enables more efficient extraction of flavor compounds, supporting sustainable production and minimizing waste. The innovation enhances Symrise’s ability to deliver high-quality, natural flavor solutions while aligning with the industry’s shift toward eco-friendly processing methods

- In June 2023, T. Hasegawa USA Inc. launched two new flavor-enhancing technologies, Hasearoma and ChefAroma, across North America. These solutions are designed to replicate authentic culinary experiences in food and beverage products, improving depth, aroma, and taste consistency. The introduction of these technologies strengthens T. Hasegawa’s market footprint by meeting rising consumer demand for premium, true-to-taste flavor profiles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chili Flavor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chili Flavor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chili Flavor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.