Global Chinese Hamster Ovary Cho Enzymes Market

Market Size in USD Million

CAGR :

%

USD

28.66 Million

USD

53.73 Million

2024

2032

USD

28.66 Million

USD

53.73 Million

2024

2032

| 2025 –2032 | |

| USD 28.66 Million | |

| USD 53.73 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) Enzymes Market Size

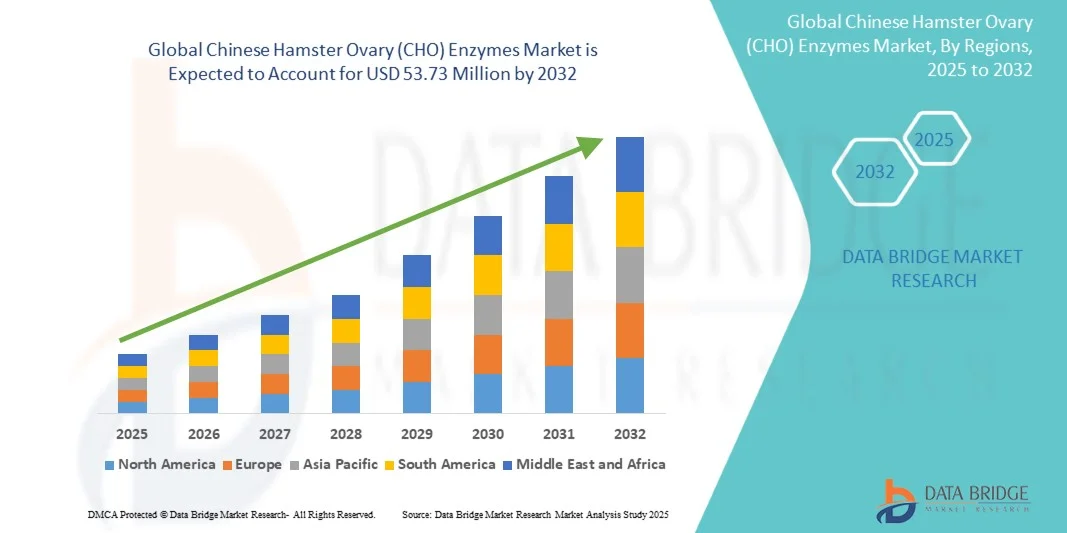

- The global Chinese hamster ovary (CHO) enzymes market size was valued at USD 28.66 Million in 2024 and is expected to reach USD 53.73 Million by 2032, at a CAGR of 8.17% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in biopharmaceutical production, particularly in the use of Chinese Hamster Ovary (CHO) cells for enzyme and therapeutic protein manufacturing, leading to enhanced efficiency and scalability in drug development

- Furthermore, rising demand for high-quality, consistent, and cost-effective enzyme solutions in applications such as monoclonal antibodies, vaccines, and recombinant proteins is driving the adoption of CHO enzymes, thereby significantly boosting the industry’s growth

Chinese Hamster Ovary (CHO) Enzymes Market Analysis

- The Chinese Hamster Ovary (CHO) Enzymes Market growth is largely fueled by the increasing adoption and technological advancements in biopharmaceutical production, particularly in the use of Chinese Hamster Ovary (CHO) cells for enzyme and therapeutic protein manufacturing, leading to enhanced efficiency, scalability, and consistency in drug development.

- Rising demand for high-quality, reliable, and cost-effective CHO enzymes in applications such as monoclonal antibodies, recombinant proteins, and vaccines is driving market expansion and encouraging further investment in bioprocessing technologies

- North America dominated the Chinese hamster ovary (CHO) enzymes market with the largest revenue share of 45.5% in 2024, characterized by the presence of leading biopharmaceutical manufacturers, advanced research infrastructure, and high adoption of CHO-based enzyme production. The U.S. contributed the majority of this growth, driven by innovations in cell line engineering, process optimization, and the rising demand for biologics

- Asia Pacific is expected to be the fastest-growing region in the Chinese hamster ovary (CHO) enzymes market during the forecast period, projected to register a CAGR , owing to expanding biopharmaceutical research, increasing recombinant protein production, and adoption of CHO-based enzyme solutions in clinical and industrial applications

- The Monoclonal Antibodies segment dominated the market with the largest revenue share of 45.3% in 2024, owing to the increasing adoption of CHO-based expression systems for the production of therapeutic antibodies

Report Scope and Chinese Hamster Ovary (CHO) Enzymes Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) Enzymes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) Enzymes Market Trends

“Enhanced Convenience Through Technological Advancements and Process Optimization”

- A significant and accelerating trend in the global Chinese hamster ovary (CHO) enzymes market is the increasing adoption of advanced bioprocessing technologies and automation solutions. These innovations are enhancing production efficiency, product quality, and scalability, enabling manufacturers to meet growing demand for CHO-derived enzymes in pharmaceuticals, diagnostics, and research applications

- For instance, bioreactor optimization systems and automated cell culture platforms are being increasingly implemented to streamline CHO cell cultivation, improve enzyme yield, and maintain consistent quality. Companies such as Lonza and Cytiva are pioneering the deployment of automated platforms to enhance reproducibility and process control

- The integration of high-throughput screening, process analytics, and machine learning techniques in CHO enzyme production allows for better monitoring of cell growth, productivity, and metabolite profiles, leading to optimized enzyme output and reduced production costs

- Moreover, the expansion of contract manufacturing and outsourced bioproduction services is contributing to improved supply chain efficiency, enabling smaller biotech firms and research institutions to access high-quality CHO enzymes without heavy capital investments

- This trend towards more automated, scalable, and data-driven CHO enzyme production is reshaping industry standards, driving the development of more robust and reliable production processes

- The market is witnessing growing interest in sustainable and environmentally friendly production techniques, such as serum-free media and single-use bioreactor systems, which reduce contamination risks and lower resource consumption

- The demand for high-purity, consistent, and cost-effective CHO enzymes is increasing across pharmaceutical R&D, biotherapeutic manufacturing, and diagnostic applications, making technological innovation a critical market driver

Chinese Hamster Ovary (CHO) Enzymes Market Dynamics

Driver

“Rising Demand for Biopharmaceuticals and Enzyme-Based Therapeutics”

- The escalating demand for monoclonal antibodies, recombinant proteins, and other biologics is a major driver for the growth of the CHO enzymes market. CHO cells are the preferred host system for producing complex proteins due to their human-like post-translational modifications and high expression capabilities

- For instance, in March 2023, Cytiva launched a new bioprocessing solution aimed at enhancing CHO cell productivity, targeting pharmaceutical companies and research institutions engaged in monoclonal antibody production. Such developments are expected to drive CHO enzyme demand over the forecast period

- The increasing prevalence of chronic diseases and the growing need for enzyme-based therapeutics further propel market growth. CHO-derived enzymes are extensively used in drug manufacturing, diagnostics, and cell-based therapies

- Expansion of biopharmaceutical manufacturing facilities, particularly in North America, Europe, and Asia-Pacific, is supporting increased CHO enzyme consumption

- Contract manufacturing organizations (CMOs) and outsourcing trends are enabling smaller companies to access high-quality CHO enzymes, further boosting market adoption

- Rapid advancements in cell line engineering, media optimization, and process analytics are improving production efficiency, yield, and cost-effectiveness, strengthening the market’s growth trajectory

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The relatively high cost of CHO enzyme production, driven by complex cell culture requirements, expensive media, and advanced bioprocessing equipment, poses a challenge to widespread adoption, especially among small- and mid-sized enterprises

- For instance, the cost of establishing and maintaining GMP-compliant CHO production facilities remains a barrier to entry for emerging biotech companies, limiting access to high-quality enzymes.

- Strict regulatory requirements governing biologics and enzyme production, including compliance with FDA, EMA, and ICH guidelines, add to operational complexities and prolong product development timelines

- Quality control and assurance measures, such as rigorous testing for contamination, protein glycosylation patterns, and enzyme activity, require significant investment in specialized personnel and equipment

- Variability in CHO cell line performance and potential batch-to-batch inconsistencies further complicate production and increase costs

- Environmental concerns related to waste management, water usage, and energy consumption in large-scale CHO enzyme production facilities present additional challenges

- Overcoming these challenges through process optimization, cost-effective bioreactor technologies, and adherence to regulatory frameworks is crucial to sustaining long-term growth in the CHO enzymes market

Chinese Hamster Ovary (CHO) Enzymes Market Scope

The market is segmented on the basis of application, product type, end-user, and system.

• By Application

On the basis of application, the Chinese Hamster Ovary (CHO) Enzymes market is segmented into Monoclonal Antibodies, Recombinant Proteins, Vaccines, Gene Therapy, and Others. The Monoclonal Antibodies segment dominated the market with the largest revenue share of 45.3% in 2024, owing to the increasing adoption of CHO-based expression systems for the production of therapeutic antibodies. This growth is driven by the rising prevalence of chronic and autoimmune diseases, coupled with significant investments in biopharmaceutical research and development. Advanced cell line engineering and process optimization have enabled higher yields, making CHO enzymes the preferred choice in monoclonal antibody manufacturing. The segment also benefits from strong collaborations between biotech companies and academic research institutes, supporting innovation in antibody therapies. Regulatory approvals for novel monoclonal antibodies and continuous pipeline expansion further strengthen this segment’s dominance globally.

The Gene Therapy segment is expected to witness the fastest CAGR of 22.4% from 2025 to 2032. This growth is fueled by the rapid development of gene-modified therapies and the increased reliance on CHO enzymes for viral vector production. Expansion in personalized medicine and the rise of advanced therapy pipelines have increased demand for high-efficiency CHO-based systems. Collaborations between biopharmaceutical companies and contract development & manufacturing organizations (CDMOs) are accelerating the adoption of CHO enzymes in gene therapy applications. Government and regulatory support for innovative therapies further boost the segment’s rapid growth, positioning it as the fastest-growing application in the market.

• By Product Type

On the basis of product type, the market is segmented into CHO-DG44, CHO-K1, CHO-S, CHO-DXB1, and Others. The CHO-K1 segment held the largest revenue share of 41.8% in 2024 due to its extensive utilization in recombinant protein production and monoclonal antibody synthesis. Its popularity stems from robust growth characteristics, high transfection efficiency, and compatibility with multiple expression systems. CHO-K1 is highly scalable, reproducible, and reliable, making it the preferred choice for biopharmaceutical manufacturing across both large CDMOs and biotech firms. Continued R&D, technological improvements, and the requirement for consistent high-quality protein production further drive its market dominance.

The CHO-DG44 segment is anticipated to register the fastest CAGR of 21.9% from 2025 to 2032. The segment benefits from the increasing demand for gene amplification systems and high-expression protein production. Advancements in metabolic engineering, improved process efficiency, and the focus on high-yield recombinant protein manufacturing drive its adoption. Growing collaborations between biotech companies and academic research centers, along with expansion in novel therapeutic development, reinforce DG44 as the fastest-growing product type in the market. In addition, rising investments in biopharmaceutical R&D and the development of next-generation biologics further support its growth. Increasing adoption of CHO-DG44 in vaccine production and gene therapy applications also contributes to its accelerating market trajectory.

• By End-User

On the basis of end-user, the market is segmented into CDMOs, Biopharmaceutical Companies, Academic Institutes & Research, Biotech Companies, CROs, and Others. The Biopharmaceutical Companies segment accounted for the largest market revenue share of 46.2% in 2024, fueled by continuous investment in R&D, expansion of therapeutic pipelines, and consistent demand for CHO enzymes in monoclonal antibody, recombinant protein, and vaccine production. The segment benefits from process optimization, regulatory compliance, and the need for high-quality enzyme systems for large-scale manufacturing. Strong collaborations with academic institutes and CROs further solidify its leading position in the market.

The CDMOs segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032. The rapid growth is driven by the increasing outsourcing of biopharmaceutical manufacturing to specialized service providers. Rising demand for scalable production, high-efficiency systems, and advanced process development solutions contribute to CDMOs’ adoption of CHO enzymes. Collaborative initiatives with biotech startups and large pharmaceutical firms for novel therapies accelerate market penetration, making it the fastest-growing end-user segment globally. Furthermore, the emphasis on reducing time-to-market for innovative biologics and personalized medicines is boosting reliance on CDMOs. Expansion of global CDMO networks and investments in state-of-the-art manufacturing facilities are also supporting sustained growth in this segment.

• By System

On the basis of system, the market is segmented into Metabolic Selection System, Antibiotic Selection System, and Others. The Metabolic Selection System segment held the largest revenue share of 42.5% in 2024, owing to its effectiveness in selecting high-expressing clones for protein production. Its reliability, reproducibility, and compatibility with large-scale industrial processes support its widespread adoption among biopharmaceutical companies and research institutions. Continuous process innovations and the system’s integration with advanced cell line development further strengthen its dominant position.

The Antibiotic Selection System segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032. This growth is fueled by its increasing application in generating stable cell lines and enhancing protein expression efficiency. Developments in antibiotic-resistant selection markers, automation technologies, and integration with gene editing tools drive rapid adoption. The rising demand for cost-effective, scalable, and high-yield production methods positions this system as the fastest-growing segment within the market. In addition, expanding research in biopharmaceuticals and the push for more efficient therapeutic protein production are further accelerating the segment’s growth. Increasing collaboration between biotech firms and academic institutions to develop innovative enzyme applications also contributes to its rapid market expansion.

Chinese Hamster Ovary (CHO) Enzymes Market Regional Analysis

- North America dominated the Chinese hamster ovary (CHO) enzymes market with the largest revenue share of 45.5% in 2024

- Characterized by the presence of leading biopharmaceutical manufacturers, advanced research infrastructure, and high adoption of CHO-based enzyme production

- The market contributed the majority of this growth, driven by innovations in cell line engineering, process optimization, and the rising demand for biologics

U.S. Chinese Hamster Ovary (CHO) Enzymes Market Insight

The U.S. Chinese hamster ovary (CHO) enzymes market captured the largest revenue share in 2024 within North America, fueled by increasing investments in biopharmaceutical R&D, expansion of contract manufacturing organizations (CMOs), and advancements in high-yield CHO cell lines. The market growth is further supported by adoption of process automation, bioreactor optimization, and improvements in culture media to enhance production efficiency and quality. The U.S. market also benefits from strong government support for biotechnology initiatives, robust clinical research infrastructure, and rising demand for monoclonal antibodies and recombinant proteins.

Europe Chinese Hamster Ovary (CHO) Enzymes Market Insight

The Europe Chinese hamster ovary (CHO) enzymes market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in biologics manufacturing, adoption of advanced bioprocessing technologies, and government initiatives supporting biotech research. Countries such as Germany, France, and the U.K. are witnessing significant growth, backed by well-established research infrastructure, skilled workforce, and rising demand for recombinant proteins in both therapeutic and industrial applications.

U.K. Chinese Hamster Ovary (CHO) Enzymes Market Insight

The U.K. Chinese hamster ovary (CHO) enzymes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expanding biopharmaceutical sector, increased investment in process innovation, and growing focus on monoclonal antibody production using CHO cell platforms. Research collaborations, clinical trial activities, and adoption of high-throughput screening methods are further fueling market expansion.

Germany Chinese Hamster Ovary (CHO) Enzymes Market Insight

Germany’s Chinese hamster ovary (CHO) enzymes market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of process optimization, focus on eco-conscious and sustainable production solutions, and the adoption of single-use bioreactors and serum-free culture media. The country’s well-developed infrastructure, technological expertise, and government support for innovation encourage growth across industrial and clinical applications.

Asia-Pacific Chinese Hamster Ovary (CHO) Enzymes Market Insight

Asia-Pacific is expected to be the fastest-growing region in the CHO Enzymes market during the forecast period, projected to register the highest CAGR owing to expanding biopharmaceutical research, increasing recombinant protein production, and growing adoption of CHO-based enzyme solutions in clinical, research, and industrial applications.

Japan Chinese Hamster Ovary (CHO) Enzymes Market Insight

Japan’s Chinese hamster ovary (CHO) enzymes market is gaining momentum due to high investment in biotechnology R&D, adoption of innovative CHO cell line technologies, and rising demand for biologics in healthcare. The aging population, expansion of clinical research facilities, and focus on process efficiency further contribute to market growth.

China Chinese Hamster Ovary (CHO) Enzymes Market Insight

The China Chinese hamster ovary (CHO) enzymes market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by expanding biopharmaceutical manufacturing infrastructure, government initiatives supporting biotechnology, rapid urbanization, and strong adoption of CHO-based enzymes in clinical and industrial research. The presence of domestic manufacturers scaling production to meet both local and international demand is a key growth driver, alongside the rising middle-class population and increased healthcare investments.

Chinese Hamster Ovary (CHO) Enzymes Market Share

The Chinese Hamster Ovary (CHO) Enzymes industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- GE Healthcare (U.S.)

- Bracco Imaging S.p.A. (Italy)

- Guerbet Group (France)

- Lantheus Medical Imaging (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Spago Nanomedical AB (Sweden)

- Magnus Medical GmbH (Germany)

- Curium (France)

- Subhra Pharma Pvt. Ltd. (India)

Latest Developments in Global Chinese Hamster Ovary (CHO) Enzymes Market

- In September 2025, CHO Plus, Inc. announced the receipt of a U.S. patent for its innovative cell engineering technology aimed at enhancing recombinant protein production. This advancement is expected to significantly improve the efficiency of producing food ingredients, industrial enzymes, and other bioproducts

- In August 2025, CHO Pharma's CHO-A04 received approval from the U.S. FDA to proceed to Phase I clinical trials. This marks a significant milestone in the development of novel therapies utilizing CHO cell lines

- In August 2025, Genentech implemented AI-driven protein engineering techniques to enhance the production of hard-to-express antibodies in CHO cells. This initiative aims to improve the yield and quality of therapeutic proteins, addressing challenges in biomanufacturing

- In August 2025, Moderna reported optimized mRNA constructs for challenging proteins, enabling higher expression levels in lipid nanoparticle platforms. This development is expected to enhance the production of mRNA-based therapeutics using CHO cell systems

- In August 2025, Gilead Sciences advanced baculovirus expression systems for producing difficult-to-express viral proteins in vaccine development. This approach aims to improve the scalability and efficiency of protein production, complementing CHO cell-based systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.