Global Chinese Hamster Ovary Cho Fc Fusion Protein Market

Market Size in USD Million

CAGR :

%

USD

34.58 Million

USD

66.29 Million

2024

2032

USD

34.58 Million

USD

66.29 Million

2024

2032

| 2025 –2032 | |

| USD 34.58 Million | |

| USD 66.29 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Size

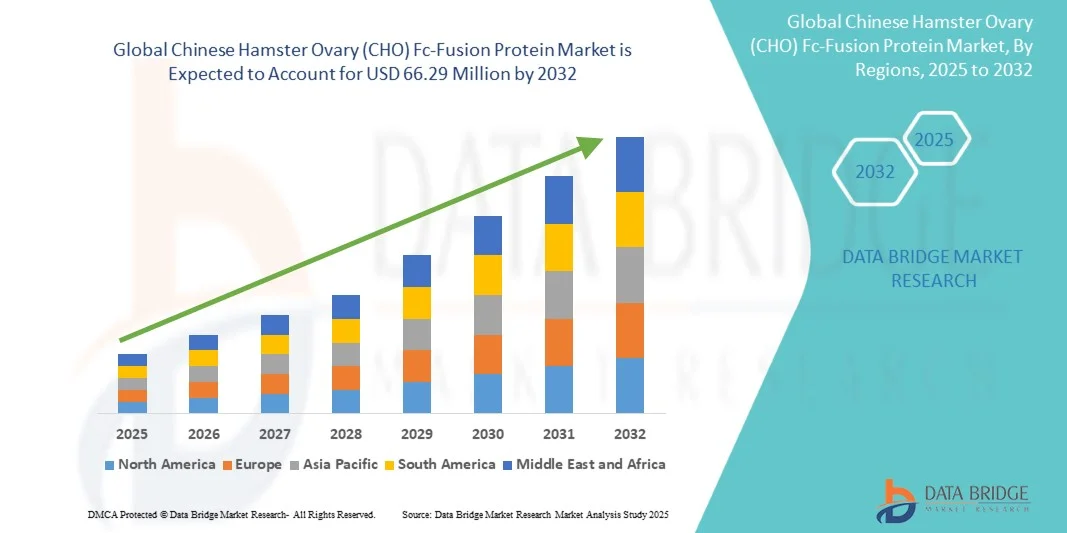

- The global Chinese Hamster Ovary (CHO) Fc-fusion protein market size was valued at USD 34.58 million in 2024 and is expected to reach USD 66.29 million by 2032, at a CAGR of 8.47% during the forecast period

- The market expansion is primarily driven by the increasing adoption of CHO cell lines for large-scale biologics production, owing to their high protein yield, post-translational modification capabilities, and regulatory acceptance for therapeutic manufacturing

- In addition, the rising demand for Fc-fusion therapeutics across oncology, autoimmune, and ophthalmic indications, coupled with advancements in cell line engineering and bioprocess optimization, is propelling market growth. These combined factors are reinforcing CHO-based systems as the preferred platform for Fc-fusion protein development, significantly accelerating the industry’s trajectory

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Analysis

- CHO Fc-fusion proteins, combining the functional properties of biologically active proteins with the stability and half-life extension of the Fc domain, are increasingly vital in biopharmaceutical manufacturing for treating autoimmune, oncologic, and ophthalmic disorders due to their high therapeutic efficacy, scalability, and regulatory acceptance of CHO expression systems

- The growing demand for CHO Fc-fusion proteins is primarily fueled by the expanding biologics pipeline, advancements in cell line engineering, and the rising prevalence of chronic diseases, driving pharmaceutical and biotechnology companies to adopt CHO-based platforms for reliable and high-yield therapeutic production

- North America dominated the CHO Fc-fusion protein market with the largest revenue share of 39.3% in 2024, supported by strong biopharma infrastructure, significant R&D investments, and the presence of major biologics developers utilizing CHO systems for commercial-scale production

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid biomanufacturing expansion in China, India, and South Korea, growing biosimilar development, and government initiatives promoting local biologics production

- Oncology segment dominated the CHO Fc-fusion protein market with a market share of 41.7% in 2024, owing to increased clinical adoption of Fc-fusion therapeutics targeting tumor growth and immune modulation, alongside continuous innovation in recombinant protein engineering to enhance potency and safety profiles

Report Scope and Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Trends

“Advancements in Fc-Fusion Engineering and Half-Life Extension”

- A significant and accelerating trend in the CHO Fc-fusion protein market is the development of engineered Fc domains and glyco-optimized variants, enhancing therapeutic half-life, stability, and efficacy in clinical applications

- For instance, companies such as Amgen and Biogen are leveraging Fc-engineering strategies to improve the pharmacokinetics of existing Fc-fusion therapeutics, reducing dosing frequency for patients

- Advanced engineering allows Fc-fusion proteins to achieve prolonged circulation and targeted activity, increasing patient compliance and overall therapeutic benefit

- The seamless integration of optimized CHO expression systems with advanced bioprocessing techniques facilitates higher yield and consistent glycosylation profiles, critical for regulatory approval and commercial scalability

- This trend towards more potent, long-acting, and engineered Fc-fusion proteins is reshaping R&D strategies and driving innovation pipelines

- The demand for Fc-fusion therapeutics with enhanced stability and engineered properties is growing rapidly across oncology, autoimmune, and ophthalmic applications as biopharma companies aim to differentiate their biologics

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Dynamics

Driver

“Increasing Adoption Due to Rising Biologics Demand and Chronic Disease Prevalence”

- The growing prevalence of chronic diseases and the expansion of the global biologics pipeline is a key driver for the rising adoption of CHO Fc-fusion proteins

- For instance, in March 2024, Pfizer announced the advancement of a CHO-derived Fc-fusion candidate for autoimmune disorders, highlighting the scalability of CHO systems for clinical production

- As biologics become the standard of care in oncology and immune-mediated diseases, Fc-fusion proteins offer targeted therapies with improved half-life and reduced dosing frequency

- Furthermore, advancements in CHO cell line engineering and bioprocess optimization are making Fc-fusion production more efficient, consistent, and cost-effective

- The growing focus on biosimilars and biobetters in emerging markets is driving additional demand for CHO-expressed Fc-fusion proteins

- For instance, partnerships between biotech firms and CDMOs are expanding production capacity, enabling faster commercialization of Fc-fusion therapeutics

- Continuous innovation in Fc-fusion molecular design and half-life extension strategies is further enhancing market attractiveness and adoption

- The increasing emphasis on patient-centric biologics and high-yield manufacturing is accelerating the adoption of CHO Fc-fusion platforms in both developed and developing regions

Restraint/Challenge

“High Production Costs and Regulatory Complexity”

- The high cost of CHO-based Fc-fusion protein development and manufacturing poses a significant challenge to market growth, particularly for smaller biotech firms

- For instance, the extensive process development and GMP compliance requirements for CHO-expressed therapeutics increase capital expenditure and operational complexity

- Addressing stringent regulatory standards and ensuring batch-to-batch consistency require advanced analytics and process monitoring, adding to production costs

- Furthermore, the relatively long development timelines and high failure rates in clinical trials can discourage investment in novel Fc-fusion constructs

- The complexity of biologics manufacturing, including glycosylation control and scale-up challenges, can limit market penetration, especially in emerging regions

- Overcoming these challenges through process innovation, cost optimization, and streamlined regulatory strategies will be vital for sustained market growth

- For instance, limited availability of skilled workforce in bioprocessing and regulatory affairs can slow down development and commercialization timelines

- Intellectual property and patent-related hurdles for novel Fc-fusion designs may restrict market entry for emerging biotech players, posing a barrier to innovation

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Scope

The market is segmented on the basis of molecule type, expression system, application, and end user.

- By Molecule Type

On the basis of molecule type, the CHO Fc-fusion protein market is segmented into monomeric Fc-fusion proteins, multivalent Fc-fusion proteins, and modified Fc variants. The monomeric Fc-fusion protein segment dominated the market in 2024 due to its established presence in approved therapeutics across autoimmune, oncology, and ophthalmic indications. Monomeric constructs offer predictable pharmacokinetics, stable clinical performance, and easier large-scale production in CHO systems, making them the preferred choice for first-generation Fc-fusion drugs. Many blockbuster Fc-fusion therapeutics, such as etanercept, fall under this category, sustaining high demand. The segment also benefits from regulatory familiarity and mature manufacturing processes. Ongoing R&D continues to enhance glycosylation, stability, and efficacy, reinforcing its market dominance.

The modified Fc variants segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising development of glycoengineered and half-life extended constructs. These variants are designed to improve serum half-life, reduce immunogenicity, and enhance therapeutic efficacy, particularly for oncology and autoimmune applications. Biopharmaceutical companies are increasingly adopting this segment to differentiate their products and develop biobetters. Advances in CHO cell line engineering and Fc-domain modifications have accelerated development. Regulatory approvals of novel Fc-modified biologics support rapid commercialization. The growing focus on personalized medicine and next-generation therapies further drives adoption.

- By Expression System

On the basis of expression system, the CHO Fc-fusion protein market is segmented into CHO-K1, CHO-S, CHO-DG44, and other CHO-derived cell lines. The CHO-K1 segment dominated the market in 2024 due to its long-standing use in commercial biologics manufacturing, offering stable expression, reliable glycosylation, and scalability for large-volume production. It is widely used by major biopharmaceutical companies for both monomeric and modified Fc-fusion proteins. Extensive process knowledge, regulatory acceptance, and robust supply chains make CHO-K1 the preferred choice for established biologics. Many blockbuster Fc-fusion proteins are produced in CHO-K1, further reinforcing dominance. Its flexibility allows adoption across multiple therapeutic applications. Continuous improvements in CHO-K1 media and bioprocess optimization enhance productivity.

The CHO-S segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its adaptability for high-density, serum-free, and suspension cultures. CHO-S is ideal for transient expression, facilitating rapid preclinical and early clinical development. Startups and CDMOs increasingly adopt CHO-S for its flexibility and compatibility with high-throughput screening platforms. The increasing demand for biosimilars and biobetters accelerates its adoption. Technological advancements in fed-batch processes and media optimization improve yields. Cost-effectiveness and scalability further support CHO-S expansion, especially in emerging markets.

- By Application

On the basis of application, the CHO Fc-fusion protein market is segmented into oncology, autoimmune & inflammatory diseases, ophthalmic disorders, metabolic & cardiovascular diseases, infectious diseases, rare diseases, and others. The oncology segment dominated the market in 2024, with a market share of 41.7%, due to high clinical adoption of Fc-fusion therapeutics targeting tumor growth and immune modulation. Fc-fusion proteins offer extended half-life and improved efficacy, reducing dosing frequency for patients. Rising global cancer prevalence and increasing biologics R&D investments drive segment dominance. Regulatory approvals of new oncology Fc-fusions further support the market. Established efficacy and safety profiles of existing oncology therapeutics strengthen adoption. Continuous pipeline expansion of Fc-fusions for solid tumors and hematologic malignancies sustains market leadership.

The autoimmune & inflammatory diseases segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing prevalence of rheumatoid arthritis, psoriasis, and other chronic immune disorders. Fc-fusion proteins targeting cytokines and immune checkpoints provide enhanced efficacy and patient compliance. Biotech companies are actively developing biosimilars and next-generation Fc-fusions for autoimmune indications. Advances in CHO-based production and Fc engineering accelerate development. Government initiatives promoting biologics adoption in emerging markets support rapid growth. Strong pipeline activity and growing awareness among physicians and patients further drive expansion.

- By End User

On the basis of end user, the CHO Fc-fusion protein market is segmented into biopharmaceutical companies, biotechnology startups, contract development & manufacturing organizations (CDMOs), and academic & research institutes. The biopharmaceutical companies segment dominated the market in 2024 due to strong in-house R&D capabilities, access to advanced CHO cell lines, and regulatory expertise for Fc-fusion therapeutics. They lead in developing and commercializing high-value Fc-fusion drugs across oncology, autoimmune, and ophthalmology. Large-scale production, regulatory compliance, and IP protection reinforce their dominance. Strategic partnerships with CDMOs and continuous innovation sustain market leadership. Established distribution networks and clinical trial experience further support dominance. Biopharmaceutical companies continue to invest in next-generation Fc-fusion designs, maintaining competitive advantage.

The CDMOs segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing outsourcing of CHO Fc-fusion protein production, particularly by small and mid-sized biotech firms. CDMOs offer specialized services including cell line development, process optimization, and GMP-compliant manufacturing. Growing demand for cost-effective production and reduced time-to-market drives adoption. Expansion of CDMO capabilities in Asia-Pacific and Europe supports global commercialization. Integrated solutions covering upstream, downstream, and analytical services accelerate clinical and commercial supply. Partnerships between biopharma companies and CDMOs further fuel segment growth.

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Regional Analysis

- North America dominated the CHO Fc-fusion protein market with the largest revenue share of 39.3% in 2024, supported by strong biopharma infrastructure, significant R&D investments, and the presence of major biologics developers utilizing CHO systems for commercial-scale production

- Companies in the region prioritize high-quality CHO-based biologics production due to stringent regulatory standards and advanced manufacturing capabilities, ensuring consistent therapeutic efficacy and safety of Fc-fusion proteins

- This widespread adoption is further supported by significant investment in novel biologics, government initiatives promoting advanced therapeutics, and the increasing prevalence of chronic diseases, establishing North America as a leading hub for both clinical and commercial Fc-fusion protein production

U.S. Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The U.S. CHO Fc-fusion protein market captured the largest revenue share of 82% in 2024 within North America, fueled by the presence of leading biopharmaceutical companies and advanced biomanufacturing infrastructure. Biotech firms in the region are increasingly investing in CHO-based Fc-fusion therapeutics for oncology, autoimmune, and ophthalmic indications. The growing demand for high-quality, reliable biologics, combined with robust clinical development pipelines and regulatory support, further propels the market. Moreover, partnerships with CDMOs and adoption of innovative CHO cell line technologies are significantly contributing to the expansion of Fc-fusion protein production in the U.S.

Europe Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The Europe CHO Fc-fusion protein market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing biologics R&D activities and regulatory support for advanced therapeutics. The rise in chronic disease prevalence and government initiatives promoting biopharmaceutical manufacturing are fostering adoption of CHO Fc-fusion proteins. European biopharma companies are integrating optimized CHO-based production platforms for both clinical and commercial manufacturing. The region is witnessing significant growth across oncology and autoimmune applications, with Fc-fusion proteins being incorporated into novel therapeutic pipelines and biosimilar development projects.

U.K. Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The U.K. CHO Fc-fusion protein market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investment in biologics R&D and demand for innovative Fc-fusion therapeutics. In addition, rising prevalence of autoimmune disorders and oncology indications is encouraging biopharmaceutical companies to leverage CHO-based production systems. The U.K.’s strong academic-industry collaborations and well-established biopharma ecosystem are expected to continue stimulating market growth. Increasing adoption of biosimilars and next-generation Fc-fusion proteins further enhances the market outlook.

Germany Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The Germany CHO Fc-fusion protein market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing biologics manufacturing capabilities and demand for high-quality therapeutics. Germany’s well-developed infrastructure, coupled with strong focus on R&D and innovation, promotes the adoption of CHO Fc-fusion protein production. Pharmaceutical companies in the region are integrating CHO cell platforms for both monomeric and modified Fc-fusion proteins. The emphasis on quality, regulatory compliance, and process optimization is driving adoption across clinical and commercial applications, aligning with local industry standards and therapeutic demand.

Asia-Pacific Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The Asia-Pacific CHO Fc-fusion protein market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing biopharma R&D investments, expansion of CDMOs, and growing demand for biosimilars. The region’s rising focus on developing local biologics manufacturing capabilities and government initiatives supporting biotechnology are driving the adoption of CHO Fc-fusion proteins. Furthermore, APAC is emerging as a hub for cost-effective production and clinical development of Fc-fusion therapeutics, making these proteins more accessible to a wider patient population.

Japan Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The Japan CHO Fc-fusion protein market is gaining momentum due to the country’s advanced biotech ecosystem, growing clinical trials, and demand for innovative biologics. The Japanese market emphasizes quality, safety, and efficacy, with increasing adoption of CHO-based Fc-fusion proteins for oncology and autoimmune therapies. Integration of CHO cell line technologies with high-throughput screening and process optimization is fueling growth. In addition, Japan’s aging population is such likely to spur demand for targeted, long-acting biologics, enhancing market expansion in both clinical and commercial sectors.

India Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Insight

The India CHO Fc-fusion protein market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding biopharmaceutical industry, increasing biosimilar development, and strong domestic CDMO presence. India is becoming a key hub for cost-effective CHO Fc-fusion protein manufacturing and contract development services. Government initiatives promoting biotechnology, rising investment from multinational companies, and expanding clinical research infrastructure are key factors propelling market growth. The increasing adoption of Fc-fusion therapeutics across oncology, autoimmune, and rare disease indications further strengthens market expansion.

Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market Share

The Chinese Hamster Ovary (CHO) Fc-Fusion Protein industry is primarily led by well-established companies, including:

- Lonza (Switzerland)

- Thermo Fisher Scientific Inc (U.S.)

- Sartorius AG (Germany)

- Revvity Discovery Limited (U.K.)

- ATCC (U.S.)

- WuXi Biologics (China)

- KBI Biopharma (U.S.)

- R&D Systems, Inc. (U.S.)

- AGC Biologics (Japan)

- Icosagen (U.S.)

- FUJIFILM Biotechnologies (Japan)

- GTP Bioways (France)

- Proteos (U.S.)

- Creative Biolabs (U.S.)

- Chitose Laboratory, Inc. (Japan)

- Synthon Biopharmaceuticals (Netherlands)

- Cellca GmbH (Germany)

- Bio-Techne (U.S.)

- Catalent, Inc (U.S.)

- Sandoz Group AG (Austria)

What are the Recent Developments in Global Chinese Hamster Ovary (CHO) Fc-Fusion Protein Market?

- In September 2025, Samsung Biologics achieved a 7% reduction in acidic charge variants and a 25% reduction in basic charge variants for CHO-derived Fc-fusion proteins. In addition, they observed measurable shifts toward desired glycoforms, such as afucosylation, galactosylation, and high-mannose. These improvements were realized through Design-of-Experiment (DoE) studies, enhancing the consistency and quality of complex therapeutic proteins

- In December 2024, A study published in ScienceDirect explored the impact of linker peptides on Fc-fusion protein production in HEK293 and CHO cell-based transient gene expression systems. The research aimed to optimize the design of linker peptides to enhance the stability and yield of Fc-fusion proteins, providing insights into the molecular engineering of therapeutic proteins

- In October 2024, WuXi Biologics introduced the WuXia™ RidGS platform, a non-antibiotic mammalian cell line development system designed to enhance cell line stability and productivity for various therapeutic modalities, including monoclonal antibodies (mAbs), bispecific antibodies, and Fc-fusion proteins. This platform boasts an average clonal expression level exceeding 6 g/L, marking a significant advancement in the development of stable cell lines for biopharmaceutical production

- In October 2024, WuXi Biologics unveiled the fourth-generation WuXia™4.0 platform, incorporating the TrueSite TI™ targeted integration technology. This platform offers high-yield mammalian cell lines with up to 11 g/L expression levels for various recombinant proteins, including Fc-fusion proteins. The platform has been accepted by regulatory agencies worldwide and has been instrumental in generating over 1,000 cell lines for clinical and commercial manufacturing

- In November 2022, Researchers engineered a recombinant fusion protein combining the HTLV-1 protease (HTLV-1-PR) with the human Fcγ1 domain, expressed in CHO cells. This construct was designed for dual applications: as a potential therapeutic agent targeting HTLV-1 and as a subunit peptide vaccine candidate. The fusion protein was successfully produced and purified, demonstrating appropriate folding and dimeric secretion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.