Global Chinese Hamster Ovary Cho K1 Cells Market

Market Size in USD Million

CAGR :

%

USD

53.24 Million

USD

104.92 Million

2024

2032

USD

53.24 Million

USD

104.92 Million

2024

2032

| 2025 –2032 | |

| USD 53.24 Million | |

| USD 104.92 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) K1 Cells Market Size

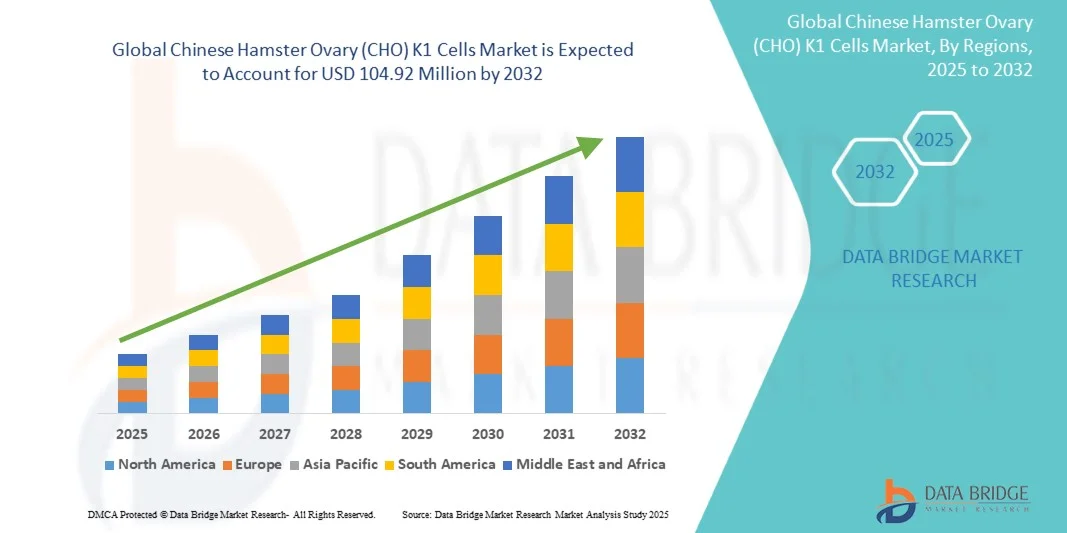

- The global Chinese Hamster Ovary (CHO) K1 Cells market size was valued at USD 53.24 million in 2024 and is expected to reach USD 104.92 million by 2032, at a CAGR of 8.85% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced biopharmaceutical manufacturing and research applications, along with technological progress in cell line development and genetic engineering

- Furthermore, rising demand for monoclonal antibodies, recombinant proteins, vaccines, and gene therapies is driving the uptake of Chinese Hamster Ovary (CHO) K1 Cells solutions, thereby significantly boosting the industry's growth

Chinese Hamster Ovary (CHO) K1 Cells Market Analysis

- The Chinese Hamster Ovary (CHO) K1 Cells market is a critical segment of the biopharmaceutical industry, primarily used for the production of monoclonal antibodies, therapeutic proteins, and vaccines, driven by increasing global demand for biologics

- Advancements in cell line engineering and process optimization are enhancing the productivity and quality of CHO K1 cells, enabling cost-effective therapeutic protein production

- North America dominated the Chinese hamster ovary (CHO) K1 cells market with the largest revenue share of 32.6% in 2024, characterized by a strong presence of key industry players, extensive R&D infrastructure, and robust biopharmaceutical manufacturing capabilities in the U.S., particularly for monoclonal antibodies and vaccine production

- Asia-Pacific is expected to be the fastest growing region in the Chinese hamster ovary (CHO) K1 cells market during the forecast period with a projected CAGR of 10.2% from 2025 to 2032, driven by increasing investments in biopharmaceutical production and rising demand for therapeutic proteins in countries such as China, India, and Japan

- The monoclonal antibodies segment dominated the Chinese Hamster Ovary (CHO) K1 Cells market with the largest market revenue share of 48.7% in 2024, driven by the growing global demand for targeted therapies for oncology, autoimmune disorders, and infectious diseases

Report Scope and Chinese Hamster Ovary (CHO) K1 Cells Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) K1 Cells Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) K1 Cells Market Trends

“Increasing Adoption of Optimized Cell Lines and Bioprocess Innovations”

- A key trend in the global CHO K1 Cells market is the growing adoption of genetically optimized CHO K1 cell lines designed to improve protein yield, stability, and post-translational modifications

- For instance, in March 2022, Cytiva introduced a new CHO K1 cell line variant optimized for monoclonal antibody production, enabling faster and higher-yield biomanufacturing

- Companies are integrating advanced bioprocessing platforms, such as perfusion bioreactors and automated monitoring systems, to enhance scalability and reduce production costs. In July 2023, Sartorius launched a fully automated CHO-based perfusion system aimed at improving recombinant protein manufacturing efficiency

- The demand for biosimilars and next-generation biologics is encouraging pharmaceutical companies to adopt high-throughput screening and CRISPR-based gene editing techniques for CHO K1 cells. For example, in September 2021, Merck KGaA applied CRISPR optimization to develop CHO K1 cell lines for complex glycoprotein production

- Biopharmaceutical companies are increasingly focusing on serum-free and chemically defined media for CHO K1 cells to enhance reproducibility and reduce contamination risks. In February 2023, GE Healthcare announced a new chemically defined medium for CHO K1 cells that improved monoclonal antibody titers by 20%

- Integration of digital twins and AI-based predictive modeling in CHO K1 cell bioprocesses is gaining momentum. For instance, in November 2022, Amgen implemented a digital twin system to simulate CHO K1 cell growth and productivity, reducing experimental cycles and accelerating process optimization

- Collaborative research between academic institutions and biopharma companies is also on the rise, aiming to develop CHO K1 cells capable of producing complex biologics such as bispecific antibodies and fusion proteins. In June 2024, University of California, San Diego partnered with Bristol Myers Squibb to enhance CHO K1 cell lines for next-generation antibody therapeutics

Chinese Hamster Ovary (CHO) K1 Cells Market Dynamics

Driver

“Growing Need Due to Rising Biopharmaceutical and Research Demand”

- The increasing prevalence of biopharmaceutical research, particularly in recombinant protein production and monoclonal antibody development, is a significant driver for the heightened demand for CHO K1 cells

- For instance, in April 2024, leading biotech companies announced expansions in their cell culture production capacities to meet rising global demand for therapeutic proteins. Such strategies by key companies are expected to drive the CHO K1 Cells industry growth in the forecast period

- As the biopharmaceutical industry advances, there is growing adoption of CHO K1 cells due to their high productivity, human-like post-translational modifications, and adaptability to large-scale manufacturing processes

- Furthermore, the increasing number of clinical trials and research initiatives targeting biologics and vaccines is propelling demand for reliable and scalable cell line platforms such as CHO K1

- The versatility of CHO K1 cells in producing complex glycoproteins, enzymes, and viral vectors is a key factor supporting their adoption in research and industrial applications. The trend towards optimized cell line development and bioprocess innovation further contributes to market growth

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The relatively high production costs of CHO K1 cells, including expenses for culture media, bioreactors, and downstream processing, pose a significant challenge to market expansion, particularly for small- and medium-sized biotech companies

- Regulatory complexities and stringent compliance requirements for biologics manufacturing, including Good Manufacturing Practice (GMP) standards, increase time-to-market and operational costs, limiting the pace of adoption and commercialization

- Concerns surrounding batch-to-batch variability and potential contamination risks in large-scale cell culture can lead to reduced product consistency, raising challenges for manufacturers and end-users alike

- Intellectual property restrictions and licensing requirements for proprietary CHO cell lines may hinder new entrants and limit access to advanced production platforms

- Limited availability of skilled workforce and technical expertise in mammalian cell culture and bioprocessing further restricts rapid scaling and adoption in emerging regions

- Overcoming these challenges requires investments in process optimization, automation technologies, and strategic partnerships to reduce costs, ensure regulatory compliance, and maintain consistent high-quality output

Chinese Hamster Ovary (CHO) K1 Cells Market Scope

The market is segmented on the basis of cell line type, application, and end user.

• By Cell Line Type

On the basis of cell line type, the Chinese Hamster Ovary (CHO) K1 Cells market is segmented into Wild-type CHO K1 and Recombinant CHO K1. The Recombinant CHO K1 segment dominated the largest market revenue share of 46.3% in 2024, driven by its high adaptability for producing therapeutic proteins, monoclonal antibodies, and vaccines with consistent quality. The segment’s robust performance, coupled with the rising demand for biopharmaceuticals, makes it the preferred choice for large-scale industrial production. Manufacturers are increasingly leveraging recombinant CHO K1 cells due to their proven track record in high-yield protein expression, regulatory acceptance, and compatibility with advanced bioprocessing technologies. Additionally, the segment benefits from ongoing innovations in gene editing and process optimization that further enhance protein expression and stability. Strong R&D investments and collaborations between biotech companies and research institutes are also contributing to the segment’s dominance. As recombinant CHO K1 cells are extensively used in both preclinical and clinical production of therapeutic biologics, the market outlook for this segment remains highly favorable.

The Wild-type CHO K1 segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, owing to its cost-effectiveness for early-stage research and versatility in producing non-clinical proteins. Wild-type CHO K1 cells are increasingly used in academic and industrial research for functional studies, assay development, and experimental protein production. Their stable growth characteristics, ease of adaptation to suspension cultures, and compatibility with standard bioreactor systems make them attractive for small-scale and pilot-scale applications. Rising research activity in emerging markets and the growing focus on gene therapy and recombinant protein discovery are further accelerating the adoption of wild-type CHO K1 cells. This segment also benefits from improvements in culture media formulations, bioprocessing techniques, and high-throughput screening technologies that enhance cell line productivity and reproducibility.

• By Application

On the basis of application, the Chinese Hamster Ovary (CHO) K1 Cells market is segmented into monoclonal antibodies, recombinant proteins, vaccines, gene therapy, and others. The monoclonal antibodies segment dominated the largest market revenue share of 48.7% in 2024, driven by the growing global demand for targeted therapies for oncology, autoimmune disorders, and infectious diseases. CHO K1 cells provide high yields, post-translational modifications, and scalability, making them ideal for therapeutic antibody production. Strong adoption in both commercial manufacturing and contract development organizations further reinforces the segment’s leadership. Strategic partnerships between biopharma companies and cell line technology providers, as well as continuous R&D in antibody engineering and bioprocess optimization, contribute to the segment’s robust growth. Regulatory approvals of new antibody therapies and increasing investments in precision medicine are expected to sustain its dominance throughout the forecast period.

The gene therapy segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, fueled by increasing research in viral and non-viral gene delivery systems and rising investments in regenerative medicine. CHO K1 cells are increasingly used for the production of viral vectors, enzymes, and therapeutic proteins required in gene therapy. The segment benefits from ongoing advancements in cell line engineering, vector optimization, and high-efficiency transfection technologies, which enhance production yields and reduce manufacturing costs. Expanding clinical trials, growing patient awareness, and supportive government initiatives for advanced therapies are also driving the adoption of CHO K1 cells in gene therapy applications.

• By End User

On the basis of end user, the Chinese Hamster Ovary (CHO) K1 Cells market is segmented into biopharmaceutical companies, research institutes, contract research organizations (CROs), and academic institutions. The biopharmaceutical companies segment dominated the largest market revenue share of 50.2% in 2024, attributed to their extensive production of therapeutic proteins, monoclonal antibodies, and vaccines using CHO K1 cells. The segment benefits from advanced manufacturing facilities, high-volume production capabilities, and strong R&D pipelines for biologics. Regulatory compliance, quality control, and scalability requirements also favor the adoption of CHO K1 cells in this segment.

The research institutes segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by increasing preclinical and experimental research on protein expression, recombinant therapeutics, and gene therapy. Rising investments in biotechnology research, academic-industry collaborations, and government grants are contributing to higher demand for CHO K1 cells in research applications. This segment leverages CHO K1 cells for functional studies, assay development, and novel biologic discovery, making it a critical driver of innovation in the market. In addition, the growing focus on personalized medicine and novel biologic development is further accelerating the adoption of CHO K1 cells in research institutes.

Chinese Hamster Ovary (CHO) K1 Cells Market Regional Analysis

- North America dominated the Chinese hamster ovary (CHO) K1 cells market with the largest revenue share of 32.6% in 2024

- Characterized by a strong presence of key industry players, extensive R&D infrastructure, and robust biopharmaceutical manufacturing capabilities in the U.S., particularly for monoclonal antibodies and vaccine production

- The region’s focus on high-quality biologics, advanced cell line engineering, and government-supported initiatives for biopharmaceutical innovation are further driving market growth

U.S. Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The U.S. Chinese hamster ovary (CHO) K1 cells market captured the largest revenue share within North America in 2024, fueled by substantial investments in therapeutic protein production, increasing demand for monoclonal antibodies, and rapid adoption of advanced cell culture technologies across contract manufacturing organizations (CMOs) and research institutions.

Europe Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The European Chinese hamster ovary (CHO) K1 cells market is projected to expand at a significant CAGR during the forecast period, driven by the presence of leading biopharmaceutical companies, increasing adoption of CHO-based production platforms, and supportive regulatory frameworks for biologics manufacturing. Countries like Germany and the U.K. are witnessing increased investments in state-of-the-art bioreactor facilities and R&D for next-generation therapeutic proteins.

U.K. Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The U.K. Chinese hamster ovary (CHO) K1 cells market is anticipated to grow steadily, supported by strong biotechnology research programs, collaborations between academia and industry, and a focus on high-value biologics manufacturing, including monoclonal antibodies and vaccines.

Germany Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The Germany Chinese hamster ovary (CHO) K1 cells market is expected to expand at a considerable CAGR, fueled by a mature biopharmaceutical ecosystem, extensive investment in process optimization technologies, and high demand for recombinant protein therapies. The country emphasizes sustainability and efficiency in biologics production, promoting adoption of CHO K1 cell lines in commercial-scale manufacturing.

Asia-Pacific Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The Asia-Pacific Chinese hamster ovary (CHO) K1 cells market is expected to be the fastest-growing region in the Chinese Hamster Ovary (CHO) K1 Cells market during the forecast period, with a projected CAGR of 10.2% from 2025 to 2032. Growth is driven by increasing investments in biopharmaceutical production, rising demand for therapeutic proteins, and expansion of contract development and manufacturing organizations (CDMOs) in countries such as China, India, and Japan.

Japan Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The Japanese Chinese hamster ovary (CHO) K1 cells market is gaining momentum due to robust R&D capabilities, increasing adoption of CHO cell-based biologics, and rising focus on biopharmaceutical innovation. High demand for monoclonal antibodies and vaccines supports continued expansion in both commercial and clinical production sectors.

China Chinese Hamster Ovary (CHO) K1 Cells Market Insight

The China Chinese hamster ovary (CHO) K1 cells market accounted for the largest market revenue share within Asia-Pacific in 2024, driven by substantial government support, expanding biopharmaceutical manufacturing infrastructure, and rising demand for therapeutic proteins. The country is rapidly adopting CHO K1 cell technologies for large-scale production of monoclonal antibodies, vaccines, and other biologics, supported by domestic manufacturers and international collaborations.

Chinese Hamster Ovary (CHO) K1 Cells Market Share

The Chinese Hamster Ovary (CHO) K1 Cells industry is primarily led by well-established companies, including:

- Cytiva (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Lonza Group AG (Switzerland)

- Fujifilm Diosynth Biotechnologies (Japan)

- Selexis SA (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- FujiFilm Wako Chemicals (Japan)

- ProBio (China)

- GenScript (China)

- Samsung Biologics (South Korea)

- WuXi Biologics (China)

- Lonza (Switzerland)

- Ubigene (U.S.)

- Cytion (U.S.)

Latest Developments in Chinese Hamster Ovary (CHO) K1 Cells Market

- In April 2025, Thermo Fisher Scientific announced the launch of an enhanced CHO K-1 cell line capable of delivering up to 8g/L protein expression levels. This advancement aims to accelerate Investigational New Drug (IND) timelines by providing higher protein yields and increased stability, thereby supporting the rapid development of biopharmaceuticals

- In September 2025, Accegen Biotech highlighted the growing utilization of CHO cells, particularly CHO-K1, as a predominant platform for the production of therapeutic proteins. The company emphasized the importance of CHO cells in manufacturing a broad array of biologics, underscoring their significance in the biopharmaceutical industry

- In September 2025, a study published in Nature Communications described the development of a comprehensive genome-scale CRISPR knockout screening platform in CHO-K1 cells. This platform aims to identify genes that enhance recombinant protein production, thereby improving the efficiency and yield of biopharmaceutical manufacturing processes

- In October 2023, PharmiWeb announced that the CHO cells market is expected to reach USD 688.95 million by 2030. The report attributes this growth to rising demand for monoclonal antibodies and other therapeutic proteins, highlighting the pivotal role of CHO cells in the production of these biologics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.