Global Chinese Hamster Ovary Cho S Cells Market

Market Size in USD Million

CAGR :

%

USD

22.26 Million

USD

40.55 Million

2024

2032

USD

22.26 Million

USD

40.55 Million

2024

2032

| 2025 –2032 | |

| USD 22.26 Million | |

| USD 40.55 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) S Cells Market Size

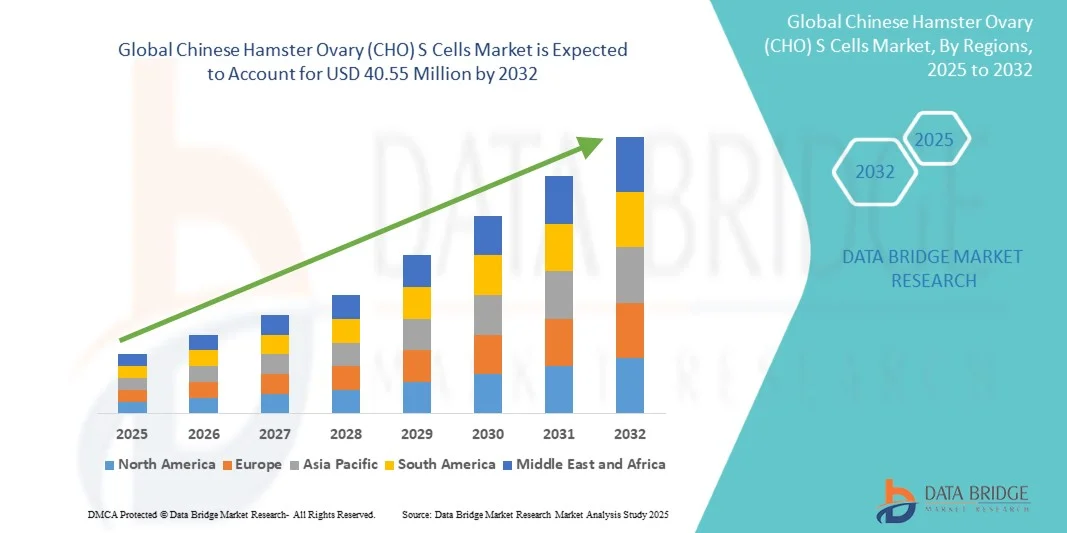

- The global chinese hamster ovary (CHO) S cells market size was valued at USD 22.26 Million in 2024 and is expected to reach USD 40.55 Million by 2032, at a CAGR of 7.78% during the forecast period

- The market growth is largely fueled by the increasing demand for biopharmaceutical products, including monoclonal antibodies, recombinant proteins, and vaccines, which rely heavily on chinese hamster ovary (CHO) S cells for production

- Furthermore, advancements in cell line engineering, process optimization, and large-scale biomanufacturing, along with rising investments in research and development, are accelerating the uptake of chinese hamster ovary (CHO) S cells solutions, thereby significantly boosting the industry's growth

Chinese Hamster Ovary (CHO) S Cells Market Analysis

- The Chinese Hamster Ovary (CHO) S Cells market is witnessing steady growth globally, driven by increasing demand for biopharmaceutical production, rising adoption of recombinant protein therapies, and advancements in cell culture technologies

- Growing R&D activities, improved bioprocessing infrastructure, and rising investment in biomanufacturing further support market expansion

- North America dominated the chinese hamster ovary (CHO) S cells market with the largest revenue share of 37.5% in 2024, attributed to the presence of leading biopharmaceutical companies, advanced bioprocessing facilities, and substantial R&D investments. The U.S. shows significant growth in CHO cell line applications, particularly in monoclonal antibody and therapeutic protein production, driven by innovations in gene editing and high-yield cell line development

- Asia-Pacific is expected to be the fastest growing region in the chinese hamster ovary (CHO) S Cells market during the forecast period, with a CAGR of 9.8%, fueled by increasing biopharmaceutical manufacturing activities in China and India, rising healthcare expenditure, and expanding adoption of advanced cell culture technologies

- The Monoclonal Antibodies segment dominated with 44.5% share in 2024, driven by the global increase in therapeutic antibody demand, chronic disease prevalence, and growing oncology and immunology pipelines

Report Scope and Chinese Hamster Ovary (CHO) S Cells Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) S Cells Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chinese Hamster Ovary (CHO) S Cells Market Trends

“Growing Need Due to Increasing Biopharmaceutical Demand and Advanced Therapeutic Development”

- The increasing prevalence of biopharmaceutical production and rising demand for therapeutic proteins, monoclonal antibodies, and vaccines are significant drivers for the growth of the Chinese Hamster Ovary (CHO) S Cells market

- For instance, in April 2024, leading biomanufacturing firms expanded their CHO S cell production platforms to meet the growing requirements of mAb and recombinant protein therapies. Such initiatives by key companies are expected to drive the Chinese Hamster Ovary (CHO) S Cells industry growth in the forecast period

- The use of CHO S cells in research and development for novel biologics and complex therapeutics further propels market expansion, as these cells provide high productivity and reliable post-translational modifications

- Furthermore, the increasing trend of contract manufacturing organizations (CMOs) outsourcing biologics production is boosting CHO S cell adoption, as these cells are widely recognized for scalable, consistent, and high-quality protein production

- Advancements in genetic engineering, optimization of culture conditions, and high-throughput screening methods are key factors contributing to increased CHO S cell utilization in both academic research and commercial biopharmaceutical production

Chinese Hamster Ovary (CHO) S Cells Market Dynamics

Driver

“Advancements in Genetic Engineering and Bioprocess Optimization”

- A major trend in the global chinese hamster ovary (CHO) S cells market is the increasing adoption of advanced genetic engineering techniques, including CRISPR/Cas9, RNA interference, and gene amplification strategies, to develop high-yield, stable, and high-quality cell lines. This is significantly improving the efficiency and consistency of biologic production

- Biopharmaceutical companies are also focusing on optimizing culture media formulations, bioreactor conditions, and fed-batch or perfusion strategies, enabling higher productivity and reduced production timelines

- The integration of automated high-throughput screening, robotics, and digital bioprocess monitoring platforms is helping researchers accelerate R&D cycles while improving reproducibility and reducing human error

- For instance, in March 2023, Lonza announced the implementation of an automated CHO cell line development platform, combining high-throughput screening and AI-driven analytics to accelerate monoclonal antibody production while maintaining consistent quality

- This trend is fueling the wider adoption of CHO S cells for the production of novel biologics, vaccines, and personalized medicine, transforming expectations for scalable and cost-efficient biomanufacturing and providing a competitive advantage to companies investing in these advanced technologies

Restraint/Challenge

“High Production Costs and Complex Process Management”

- High operational costs, including media, reagents, and bioreactor infrastructure, pose a significant challenge for broad market penetration of CHO S cells. The requirement for specialized equipment and skilled personnel adds to production complexity, limiting accessibility for smaller biotechnology firms

- For instance, process optimization challenges and batch-to-batch variability in CHO S cell culture can lead to inconsistencies in product yield and quality, making large-scale production demanding and cost-intensive

- Addressing these challenges through advanced bioprocessing technologies, automation, and continuous culture systems is crucial for improving efficiency and reducing costs. Leading companies are investing in high-yield cell line development and process standardization to mitigate these constraints

- While CHO S cells offer superior protein expression, the time-intensive development and regulatory approval processes for therapeutic applications can delay commercialization, impacting overall market growth

- Overcoming these challenges through improved cell line engineering, cost-effective media formulations, and streamlined bioprocess workflows will be vital for sustained expansion of the Chinese Hamster Ovary (CHO) S Cells market

Chinese Hamster Ovary (CHO) S Cells Market Scope

The market is segmented on the basis of type, application, end-user, and scale.

• By Type

On the basis of type, the Chinese Hamster Ovary (CHO) S Cells market is segmented into CHO-K1, CHO-S, CHO-DG44, and Others. The CHO-S segment dominated the largest market revenue share of 42.8% in 2024, driven by its robustness in producing high-yield recombinant proteins, adaptability to suspension cultures, and wide adoption in biopharmaceutical manufacturing. CHO-S cells are preferred due to consistent glycosylation patterns, scalability in large bioreactors, and proven reliability for monoclonal antibody production. High-density culture compatibility and optimized growth kinetics ensure productivity for research and commercial purposes. Standardized protocols and regulatory approvals further enhance adoption across pharmaceutical companies and research institutions. The segment benefits from strong supply chains, established cell banks, and well-documented bioprocessing workflows.

The CHO-K1 segment is anticipated to witness the fastest CAGR of 9.6% from 2025 to 2032, fueled by growing demand in emerging markets, increased biosimilar R&D, and advanced genetic engineering applications. CHO-K1 cells are commonly used for transfection studies and recombinant protein expression. Rising investments in CMOs and expansion of biopharmaceutical production facilities contribute to accelerated growth. Cell line engineering, process optimization, and scalability improvements enhance productivity and reduce costs. Increasing adoption in pilot-scale and early-stage development further supports expansion.

• By Application

On the basis of application, the market is segmented into Monoclonal Antibodies, Recombinant Proteins, Vaccines, and Others. The Monoclonal Antibodies segment dominated with 44.5% share in 2024, driven by the global increase in therapeutic antibody demand, chronic disease prevalence, and growing oncology and immunology pipelines. Monoclonal antibody production relies on CHO cells for consistent protein expression, scalability, and regulatory compliance. Partnerships between biotech firms and CMOs further strengthen adoption. Rising biosimilar development and supportive government initiatives contribute to market growth. The segment benefits from technological advancements in purification, bioreactor efficiency, and process automation, ensuring high-quality output.

The Vaccines segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, supported by global immunization initiatives, novel recombinant protein vaccines, and increased funding for vaccine research. CHO cells are increasingly adopted for producing complex viral proteins and experimental vaccine candidates. Expansion of CROs and vaccine manufacturing facilities in Asia-Pacific and Europe accelerates growth. Process optimization and high-throughput expression systems enhance yields. Collaboration with academic and government institutes further drives adoption. Rising demand for personalized and mRNA-based vaccines boosts CHO cell utilization. Regulatory support and streamlined approval pathways for novel vaccines further accelerate market growth.

• By End-User

On the basis of end-user, the market is segmented into Biopharmaceutical Companies, Research Institutes, Contract Research Organizations (CROs), and Others. The Biopharmaceutical Companies segment dominated with 45.1% revenue share in 2024, supported by large-scale production of therapeutic proteins, monoclonal antibodies, and biosimilars. Extensive R&D pipelines, GMP-compliant manufacturing facilities, and partnerships with CROs strengthen dominance. Regulatory approvals, established supply chains, and technological capabilities further enhance growth. Commercial production requirements and market demand for biologics ensure continued expansion.

The Research Institutes segment is expected to witness the fastest CAGR of 11.3% from 2025 to 2032, driven by increasing funding in cellular biology, gene editing, and recombinant protein studies. Academic and government-funded labs are adopting CHO cell lines for experimental research and high-throughput screening. Expansion of collaborative research, pilot-scale studies, and access to advanced bioreactors supports growth. Rising emphasis on novel therapies and preclinical testing further fuels adoption. Integration of AI and automation in research workflows enhances efficiency and accuracy. Strategic partnerships with biopharmaceutical companies provide access to cutting-edge technology and expertise, further driving market expansion.

• By Scale

On the basis of scale, the market is segmented into Laboratory Scale, Pilot Scale, and Commercial Scale. The Commercial Scale segment dominated the market with a 43.7% revenue share in 2024, driven by large-volume therapeutic protein, monoclonal antibody, and vaccine production. Industrial-scale bioreactors, process automation, and optimized bioprocess protocols ensure consistent high yield. Compliance with GMP standards and robust quality control support large-scale adoption. Established pharma companies leverage commercial-scale operations for full product commercialization, strengthening market dominance.

The Pilot Scale segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, fueled by rising R&D activities, early-stage biologics development, and process optimization studies. Pilot-scale facilities allow scalability testing, technology transfer, and process validation prior to commercialization. Adoption is increasing in emerging biopharma hubs. Investment in automated systems and flexible bioreactors enhances productivity and reduces operational risks. Early-stage product development and experimental research further drive growth. Collaborations between academic institutions and biotech startups are also boosting pilot-scale utilization.

Chinese Hamster Ovary (CHO) S Cells Market Regional Analysis

- North America dominated the chinese hamster ovary (CHO) S cells market with the largest revenue share of 37.5% in 2024, attributed to the presence of leading biopharmaceutical companies, advanced bioprocessing facilities, and substantial R&D investments

- The market shows significant growth in CHO cell line applications, particularly in monoclonal antibody and therapeutic protein production

- Driven by innovations in gene editing and high-yield cell line development

U.S. Chinese Hamster Ovary (CHO) S Cells Market Insight

The U.S. chinese hamster ovary (CHO) S cells market captured the largest revenue share of 81% in 2024 within North America, fueled by the early adoption of advanced cell culture platforms, large-scale manufacturing capabilities, and initiatives supporting biologics development. Expanding R&D in gene editing, high-throughput screening, and bioprocess optimization is further driving market growth, alongside robust regulatory support for novel therapies.

Europe Chinese Hamster Ovary (CHO) S Cells Market Insight

The Europe chinese hamster ovary (CHO) S cells market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing biopharmaceutical production, well-established research infrastructure, and regulatory support for biologics manufacturing. Countries such as Germany, France, and the U.K. are leading growth, supported by advanced cell culture facilities, specialized workforce, and collaborations between academic and industrial research centers.

U.K. Chinese Hamster Ovary (CHO) S Cells Market Insight

The U.K. chinese hamster ovary (CHO) S cells market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-backed biopharmaceutical initiatives, expansion of contract development and manufacturing organizations (CDMOs), and growing investments in high-yield CHO cell lines for therapeutic applications.

Germany Chinese Hamster Ovary (CHO) S Cells Market Insight

The Germany chinese hamster ovary (CHO) S cells market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing adoption of advanced bioprocessing technologies, focus on sustainable production, and strong presence of biopharmaceutical manufacturing clusters. The country’s emphasis on innovation and quality standards is promoting the development and application of CHO S cells for high-value biologics.

Asia-Pacific Chinese Hamster Ovary (CHO) S Cells Market Insight

The Asia-Pacific chinese hamster ovary (CHO) S cells market is poised to grow at the fastest CAGR of 9.8% during the forecast period, driven by increasing biopharmaceutical manufacturing activities in China and India, rising healthcare expenditure, and expanding adoption of advanced cell culture technologies. The region is witnessing accelerated investments in monoclonal antibody production, vaccine manufacturing, and biosimilar development.

Japan Chinese Hamster Ovary (CHO) S Cells Market Insight

The Japan chinese hamster ovary (CHO) S cells market is gaining momentum due to the country’s advanced R&D capabilities, growing biologics production facilities, and strong focus on next-generation therapeutic development. Government initiatives and collaborations with global pharmaceutical companies are supporting the expansion of CHO-based production platforms.

China Chinese Hamster Ovary (CHO) S Cells Market Insight

The China chinese hamster ovary (CHO) S cells market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding biopharmaceutical infrastructure, growing domestic demand for therapeutic proteins, and strong government support for biologics manufacturing. China is emerging as a hub for monoclonal antibody and biosimilar production, supported by domestic CHO cell line development and large-scale bioprocessing capabilities.

Chinese Hamster Ovary (CHO) S Cells Market Share

The Chinese Hamster Ovary (CHO) S Cells industry is primarily led by well-established companies, including:

- Cytiva (U.S.)

- Sartorius AG (Germany)

- Sigma-Aldrich Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Horizon Discovery Group plc (U.K.)

- GE Healthcare Life Sciences (U.S.)

- Selexis SA (Switzerland)

- Fujifilm Diosynth Biotechnologies (Japan)

- Biogen Inc. (U.S.)

- Codexis Inc. (U.S.)

- Charles River Laboratories International, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Celonic AG (Switzerland)

Latest Developments in Chinese Hamster Ovary (CHO) S Cells Market

- In September 2025, CHO Plus, a biotechnology company specializing in cell engineering, announced the receipt of a U.S. patent for an innovative method to enhance protein production using engineered yeast cells. This advancement aims to increase the yield of recombinant proteins for applications in food ingredients, industrial enzymes, and other products, thereby expanding the utility of CHO cell-based systems in various biotechnological fields

- In August 2025, CHO Plus entered into a project agreement with the Biomedical Advanced Research and Development Authority (BARDA) under the BioManufacturing Assistance Program (BioMaP). This collaboration focuses on improving the production of viral vectors for gene therapy, addressing unmet therapeutic needs by reducing costs and increasing the availability of gene therapy treatments

- In January 2025, researchers at the CHO Systems Biology Center reported a genetic modification in CHO cells that blocks the accumulation of toxic byproducts during cell culture. This optimization enhances the efficiency and viability of CHO cells in producing therapeutic proteins, contributing to more sustainable and cost-effective biomanufacturing processes

- In February 2024, CHO Plus strengthened its leadership team with the appointment of Joseph Tarnowski as Chief Technology and Business Officer. His expertise is expected to drive further advancements in CHO cell-based technologies and expand the company's capabilities in recombinant protein production

- In July 2023, a study published in Nature Communications highlighted the development of a genome-scale CRISPR knockout screening platform in CHO-K1 cells. This platform enables systematic identification of genetic factors influencing recombinant protein production, paving the way for more efficient and tailored CHO cell lines in biopharmaceutical manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.