Global Chip Antenna Market

Market Size in USD Billion

CAGR :

%

USD

4.43 Billion

USD

12.74 Billion

2025

2033

USD

4.43 Billion

USD

12.74 Billion

2025

2033

| 2026 –2033 | |

| USD 4.43 Billion | |

| USD 12.74 Billion | |

|

|

|

|

Chip Antenna Market Size

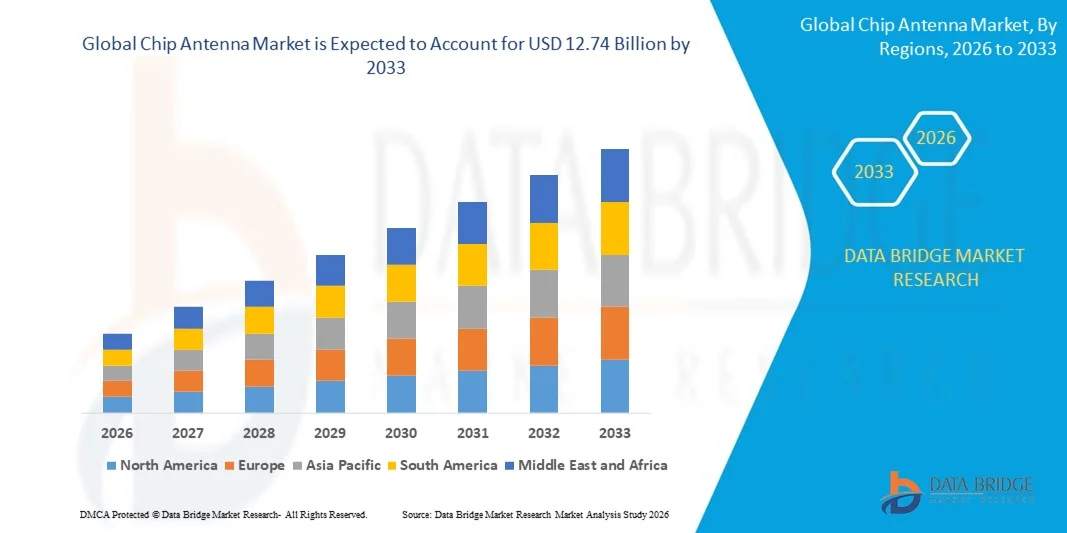

- The global chip antenna market size was valued at USD 4.43 billion in 2025 and is expected to reach USD 12.74 billion by 2033, at a CAGR of 14.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of compact and wireless electronic devices across consumer electronics, automotive, and IoT sectors, where space constraints demand smaller, high-performance antennas

- Increasing deployment of 5G networks and the growing demand for high-speed data connectivity are accelerating the need for efficient chip antennas with enhanced frequency performance and minimal signal loss

Chip Antenna Market Analysis

- The market is witnessing a trend toward miniaturization and multi-band chip antennas, which can support multiple communication protocols within a single component, reducing device complexity and cost

- Rising investments in automotive electronics, including telematics, infotainment, and ADAS systems, are driving the integration of chip antennas in connected vehicles, enhancing both safety and user experience

- North America dominated the chip antenna market with the largest revenue share of 38.75% in 2025, driven by the growing adoption of connected devices, automotive telematics, and industrial IoT solutions requiring compact, high-performance antennas

- Asia-Pacific region is expected to witness the highest growth rate in the global chip antenna market, driven by technological advancements, government initiatives promoting smart devices and 5G connectivity, urbanization, and rising demand for compact, high-efficiency antennas in consumer and industrial applications

- The Dielectric Chip Antennas segment held the largest market revenue share in 2025, driven by their high efficiency, small size, and ease of integration in compact devices. These antennas are widely used in consumer electronics, automotive, and IoT devices due to their reliable performance across multiple frequency bands

Report Scope and Chip Antenna Market Segmentation

|

Attributes |

Chip Antenna Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Chip Antenna Market Trends

Rise of Miniaturized And High-Performance Chip Antennas

- The growing shift toward miniaturized and high-performance chip antennas is transforming wireless device design by enabling compact form factors without compromising signal quality. These antennas allow reliable connectivity across multiple frequency bands, improving device efficiency and user experience in smartphones, wearables, and IoT devices. In addition, manufacturers can achieve smaller device footprints while maintaining robust connectivity, which is crucial for consumer acceptance and market competitiveness. Integration with emerging wireless standards ensures these antennas remain relevant in next-generation communication networks

- The high demand for multi-band and multi-standard communication in consumer electronics, automotive, and industrial IoT is accelerating the adoption of advanced chip antennas. These components are particularly effective in devices requiring seamless integration of 4G, 5G, Wi-Fi, Bluetooth, and GNSS functionality. As IoT adoption rises, the need for antennas supporting simultaneous connectivity across multiple protocols is becoming critical. This trend drives innovation in antenna miniaturization and performance optimization, allowing devices to maintain consistent signal quality

- The affordability, small footprint, and ease of integration of modern chip antennas are making them attractive for both high-volume consumer devices and specialized industrial applications. Manufacturers benefit from simplified PCB design, reduced electromagnetic interference, and improved device performance. The combination of lower material costs and efficient production techniques is enabling broader adoption across cost-sensitive markets. Enhanced integration also reduces design cycles and accelerates product time-to-market, providing a competitive advantage

- For instance, in 2023, several smartphone manufacturers in Asia-Pacific reported enhanced signal stability and reduced device size after integrating advanced multi-band chip antennas, boosting user satisfaction and device competitiveness. The improved signal quality also led to fewer dropped connections and better performance in high-density urban environments. Furthermore, the adoption of these antennas supported enhanced battery efficiency, as devices required less power to maintain consistent connectivity

- While chip antennas are enhancing device connectivity and miniaturization, their impact depends on continued innovation in materials, design, and multi-frequency performance. Vendors must focus on high-efficiency designs, thermal stability, and compatibility with various substrates to fully capitalize on growing demand. Standardization and rigorous testing are also necessary to ensure reliable performance in diverse environmental and operational conditions, mitigating the risk of customer dissatisfaction

Chip Antenna Market Dynamics

Driver

Rising Demand For Compact And Multi-Band Wireless Devices

- The increasing need for compact, lightweight, and multi-band wireless devices in consumer electronics, automotive telematics, and industrial IoT is driving strong adoption of chip antennas. Device makers are prioritizing reliable signal performance while minimizing space usage. The trend toward wearable technology, smart home devices, and connected vehicles further emphasizes the need for miniaturized, high-efficiency antennas capable of supporting multiple frequency bands

- Engineers and designers are increasingly aware of the benefits of chip antennas, including smaller PCB footprints, multi-frequency operation, and simplified integration, which reduce overall product complexity and cost. These advantages translate into faster development cycles and lower production costs for OEMs. The improved design flexibility also allows manufacturers to explore novel form factors and enhance device aesthetics without sacrificing performance

- Growing deployment of 5G networks, Wi-Fi 6, and GNSS-enabled applications is fueling the demand for antennas capable of handling high-frequency, high-speed communications in compact form factors. The proliferation of autonomous systems, smart cities, and industrial automation creates a need for high-performance, reliable antennas. Advanced chip antennas are critical for maintaining connectivity, ensuring real-time data exchange, and supporting IoT-enabled analytics across diverse sectors

- For instance, in 2023, several automotive OEMs in Europe adopted advanced chip antennas for connected cars, enhancing infotainment systems, telematics, and autonomous driving sensor networks. The integration improved vehicle-to-everything (V2X) communication capabilities and ensured consistent network performance in challenging urban environments. Adoption also helped optimize antenna placement, reducing interference with other electronic components and improving overall system reliability

- While demand for miniaturized and multi-functional devices is driving growth, there is still a strong need for chip antennas with high efficiency, thermal stability, and compatibility with diverse device architectures. Companies must invest in research and development to innovate antenna materials, designs, and manufacturing processes. Regulatory compliance and interoperability testing are also vital to support global adoption and market expansion

Restraint/Challenge

High Design Complexity And Cost Constraints

The high design complexity of multi-band, high-efficiency chip antennas increases development costs, making them less accessible for low-cost devices and small-scale manufacturers. Advanced materials and precision fabrication contribute to higher prices. The need for sophisticated simulation tools and iterative prototyping further adds to development timelines and costs

Many regions face a shortage of skilled RF engineers capable of designing and testing chip antennas for optimal performance across multiple frequency bands. Lack of expertise can lead to signal degradation, suboptimal device performance, and regulatory non-compliance. Training programs and specialized talent acquisition are necessary to mitigate these challenges and ensure consistent quality across products

Market growth is also constrained by challenges in integration with high-density PCBs, thermal management issues, and interference with nearby components, which can affect overall device performance and reliability. Manufacturers must carefully balance antenna placement with device design to prevent signal loss. Compatibility testing with multiple communication standards and real-world deployment scenarios is required to ensure robust performance

For instance, in 2023, several IoT device manufacturers in APAC delayed deployment due to design complexity and integration challenges, impacting time-to-market. Such delays can result in lost revenue and reduced competitiveness, particularly in rapidly evolving technology markets

While technological advancements continue to improve chip antenna performance, addressing cost, design complexity, and integration hurdles is essential. Vendors must focus on modular designs, simulation-driven optimization, and scalable manufacturing to expand market adoption and maximize potential. In addition, partnerships with chipset manufacturers and device OEMs can facilitate smoother integration and accelerate market penetration

Chip Antenna Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the chip antenna market is segmented into Dielectric Chip Antennas and Low Temperature Co-Fired Ceramics (LTCC) Chip Antennas. The Dielectric Chip Antennas segment held the largest market revenue share in 2025, driven by their high efficiency, small size, and ease of integration in compact devices. These antennas are widely used in consumer electronics, automotive, and IoT devices due to their reliable performance across multiple frequency bands.

The LTCC Chip Antennas segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their capability to integrate multiple functions and support high-frequency applications. LTCC antennas are increasingly adopted in automotive, industrial IoT, and multi-band wireless devices where durability, thermal stability, and miniaturization are critical.

- By Application

On the basis of application, the chip antenna market is segmented into Bluetooth/BLE, Wi-Fi/WLAN, GPS/GNSS, and Dual Band/Multi Band. The Bluetooth/BLE segment held the largest market revenue share in 2025, driven by the rapid adoption of wireless consumer devices, wearables, and smart home solutions. Bluetooth/BLE antennas enable reliable short-range connectivity with low power consumption, making them ideal for smartphones, smartwatches, and IoT devices.

The Dual Band/Multi Band segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing demand for multi-standard connectivity in smartphones, automotive telematics, and industrial IoT applications. These antennas support simultaneous operation across multiple frequency bands, reducing the need for multiple separate components and enabling compact device designs.

- By End User

On the basis of end user, the chip antenna market is segmented into Automotive, Consumer Electronics, Smart Home/Smart Grid, Industrial and Retail, Healthcare, and Others. The Consumer Electronics segment held the largest market revenue share in 2025, driven by the widespread adoption of smartphones, wearables, and other connected devices requiring compact and efficient antennas. High integration, reliability, and multi-frequency support are key factors driving adoption in this segment.

The Automotive segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising integration of advanced infotainment, telematics, and autonomous vehicle communication systems that require high-performance multi-band antennas. Increasing deployment of connected car technologies, 5G-enabled communication, and vehicle-to-everything (V2X) applications is accelerating demand in this sector.

Chip Antenna Market Regional Analysis

- North America dominated the chip antenna market with the largest revenue share of 38.75% in 2025, driven by the growing adoption of connected devices, automotive telematics, and industrial IoT solutions requiring compact, high-performance antennas

- Manufacturers and designers in the region highly value the advantages of miniaturized, multi-band chip antennas that improve device connectivity, reduce PCB footprint, and enable integration across 4G, 5G, Wi-Fi, Bluetooth, and GNSS applications

- This widespread adoption is further supported by strong R&D capabilities, high disposable incomes, and a technology-driven ecosystem, establishing North America as a preferred market for both consumer electronics and industrial applications

U.S. Chip Antenna Market Insight

The U.S. chip antenna market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of 5G networks, IoT adoption, and rising consumer demand for compact, multi-band wireless devices. Engineers are increasingly prioritizing reliable connectivity, reduced device size, and integration with advanced electronics. The demand for automotive infotainment, telematics, and wearable devices is also driving market growth. Moreover, the U.S. emphasis on high-performance electronics and technological innovation is significantly contributing to market expansion.

Europe Chip Antenna Market Insight

The Europe chip antenna market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing adoption of connected cars, smart manufacturing, and IoT-enabled devices. Rising urbanization, stringent emission and energy efficiency standards, and government support for smart infrastructure are fostering chip antenna adoption. European consumers and industries are focusing on high-performance, energy-efficient wireless solutions, and the integration of multi-band antennas in both new and retrofitted devices is increasing across automotive, industrial, and consumer sectors.

U.K. Chip Antenna Market Insight

The U.K. chip antenna market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising penetration of smart homes, wearable devices, and connected automotive technologies. The demand for miniaturized, high-efficiency antennas that support multiple frequency bands is growing due to increasing connectivity requirements. In addition, government initiatives supporting smart infrastructure and digitalization, along with robust e-commerce and electronics manufacturing capabilities, are expected to propel market expansion.

Germany Chip Antenna Market Insight

The Germany chip antenna market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s strong automotive sector, advanced electronics manufacturing, and focus on industrial automation. German OEMs and electronics developers are adopting chip antennas that offer compact size, high reliability, and multi-band connectivity. The integration of chip antennas in connected vehicles, industrial IoT systems, and consumer electronics is increasing, supported by Germany’s technological innovation and emphasis on quality and sustainability.

Asia-Pacific Chip Antenna Market Insight

The Asia-Pacific chip antenna market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising smartphone penetration, rapid urbanization, and increasing adoption of 5G and IoT devices in countries such as China, Japan, and India. The region’s growing electronics manufacturing ecosystem, coupled with government initiatives for smart cities and digital infrastructure, is boosting demand for compact, high-performance antennas. Furthermore, affordable production and strong local manufacturers are expanding the accessibility of chip antennas to a wider consumer and industrial base.

Japan Chip Antenna Market Insight

The Japan chip antenna market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, demand for wearable and automotive connectivity solutions, and focus on precision electronics. Japanese manufacturers are increasingly integrating multi-band chip antennas in smart devices and connected vehicles to enhance signal reliability and device efficiency. In addition, Japan’s aging population is likely to increase demand for easy-to-use, high-performance wireless devices in both residential and industrial applications.

China Chip Antenna Market Insight

The China chip antenna market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, growing middle-class consumers, and high adoption of smartphones, wearables, and IoT devices. China is a major hub for electronics manufacturing, and chip antennas are becoming increasingly integrated across consumer electronics, automotive, and industrial applications. The push for smart cities, domestic production capabilities, and cost-effective multi-band antenna solutions are key factors driving market growth.

Chip Antenna Market Share

The Chip Antenna industry is primarily led by well-established companies, including:

- YAGEO Corp. (Taiwan)

- Vishay Intertechnology, Inc. (U.S.)

- Mitsubishi Materials Corporation (Japan)

- INPAQ Technology Co., Ltd. (Taiwan)

- PARTRON (South Korea)

- Fractus Antennas S.L. (Spain)

- Abracon (U.S.)

- Linx Technologies (U.S.)

- Johanson Technology (U.S.)

- Antenova Ltd. (U.K.)

- Pulse Electronics (U.S.)

- Sunrom (China)

- 2j-antennae (Germany)

- Sunlord (China)

- Rainsun Corporation (Taiwan)

- TAIYO YUDEN CO., LTD. (Japan)

- TDK Corporation (Japan)

- Würth Elektronik GmbH & Co. KG (Germany)

- Cirocomm Technology Corp. (Taiwan)

- Taoglas (Ireland)

Latest Developments in Global Chip Antenna Market

- In November 2022, Impinj introduced its new Impinj Core 3D antenna, designed to enable omnidirectional reading of the M700 series chips. The development simplifies label placement and enhances readability, accuracy, and reliability, improving inventory tracking and supply chain efficiency. This advancement supports broader adoption of RFID solutions across retail, logistics, and industrial applications, strengthening Impinj’s position in the market

- In March 2022, Kyocera AVX showcased its advanced passive component solutions at the 2022 Optical Fiber Communication Conference and Exhibition. The company highlighted ultra-broadband capacitors, ultraminiature multilayer ceramic chip inductors, and single-layer ceramic capacitors, optimized for RF and optical communications. These innovations enhance signal integrity, reduce component size, and improve overall system performance, driving growth in high-speed communications and IoT device markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chip Antenna Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chip Antenna Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chip Antenna Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.