Global Chip On Board Light Emitting Diodes Market

Market Size in USD Billion

CAGR :

%

USD

5.16 Billion

USD

70.62 Billion

2024

2032

USD

5.16 Billion

USD

70.62 Billion

2024

2032

| 2025 –2032 | |

| USD 5.16 Billion | |

| USD 70.62 Billion | |

|

|

|

|

Chip-On-Board Light Emitting Diodes Market Analysis

The Chip-on-Board (COB) Light Emitting Diodes (LEDs) market has been experiencing significant growth due to their high efficiency, compact design, and improved performance compared to traditional LEDs. COB LEDs are widely used in applications such as automotive lighting, backlighting, illumination, and horticulture lighting due to their superior light output, energy efficiency, and ability to generate uniform light. These LEDs feature multiple LED chips mounted directly onto a substrate, offering higher brightness and better thermal management.

Recent advancements in COB LED technology include improvements in light quality, thermal management, and energy efficiency. Companies like Cree LED and ams-OSRAM have launched upgraded products, such as the XLamp XE-G and OSCONIQ P 3737, which offer reduced forward voltage, higher light output, and enhanced energy efficiency, making them suitable for diverse applications, including architectural and horticultural lighting. Additionally, the development of high-power horticulture LEDs has contributed to optimizing plant growth, improving crop yields, and reducing energy consumption in greenhouses.

The market is also driven by innovations in smart lighting systems, with advancements in dimming technology, color tunability, and integration with IoT devices, allowing users to control and optimize lighting conditions remotely. As demand for energy-efficient and sustainable lighting solutions continues to rise, the COB LED market is expected to expand rapidly in the coming years.

Chip-On-Board Light Emitting Diodes Market Size

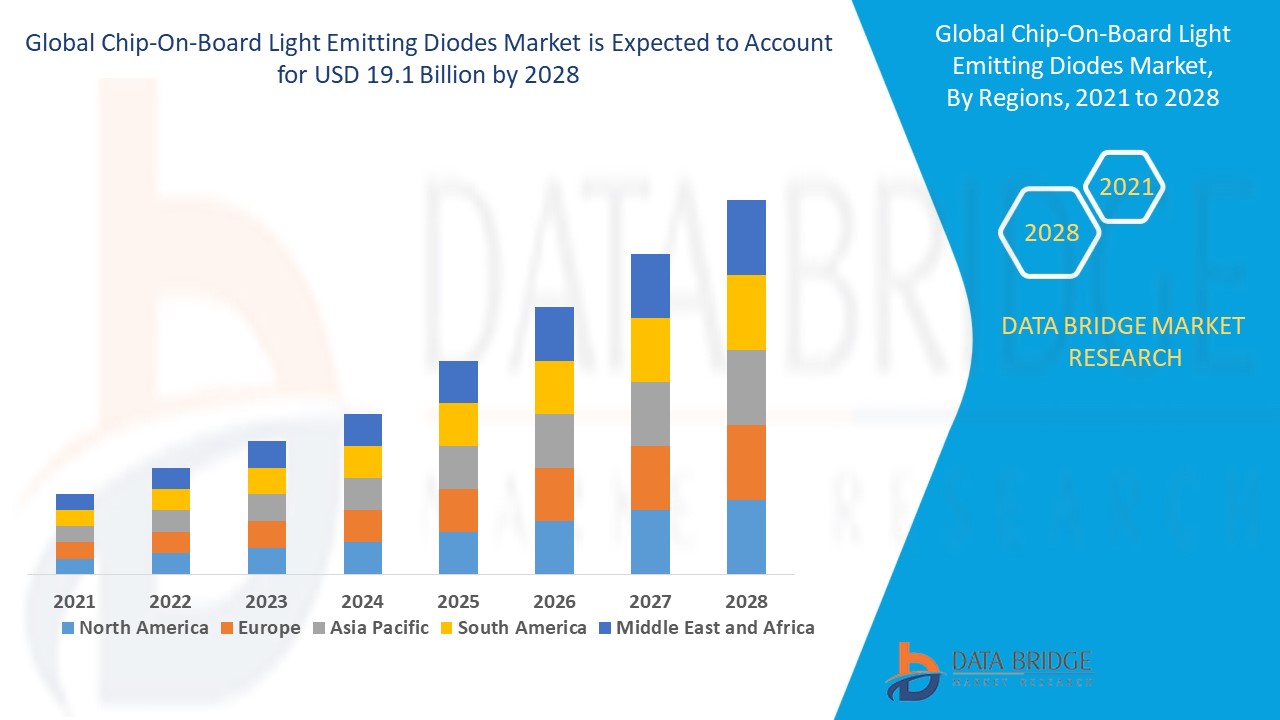

The global chip-on-board light emitting diodes market size was valued at USD 5.16 billion in 2024 and is projected to reach USD 70.62 billion by 2032, with a CAGR of 38.67% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Chip-On-Board Light Emitting Diodes Market Trends

“Increasing Adoption of COB LEDs in Automotive Lighting and Horticulture”

The Chip-on-Board (COB) Light Emitting Diodes (LEDs) market is witnessing significant growth, driven by advancements in energy-efficient lighting and superior performance. A key trend in the market is the increasing adoption of COB LEDs in automotive lighting and horticulture. For instance, ams-OSRAM's OSCONIQ P 3737 has been specifically designed for horticultural applications, offering improved photon flux and energy efficiency, which helps in reducing energy costs while boosting plant growth. In the automotive sector, COB LEDs are becoming more popular due to their higher brightness and compact design, enabling better illumination in vehicle headlights and taillights. In addition, advancements in thermal management and light uniformity continue to enhance the COB LED's performance in various applications. As the demand for energy-efficient, long-lasting lighting solutions increases, COB LEDs are expected to dominate sectors such as architectural lighting, backlighting, and industrial applications, positioning them as a key player in the global LED market.

Report Scope and Chip-On-Board Light Emitting Diodes Market Segmentation

|

Attributes |

Chip-On-Board Light Emitting Diodes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

OSRAM GmbH (Germany), CITIZEN ELECTRONICS CO., LTD (Japan), Wolfspeed, Inc. (U.S.), EVERLIGHT ELECTRONICS CO., LTD. (Taiwan), Tridonic (Austria), Sharp Devices Europe (Japan), ProPhotonix (U.K.), Luminus, Inc. (U.S.), Bridgelux, Inc. (U.S.), LG Innotek (South Korea), SAMSUNG (South Korea), Trans-Lux Corporation (U.S.), NICHIA CORPORATION (Japan), Acuity Brands, Inc. (U.S.), Mouser Electronics, Inc. (U.S.), Excelitas Technologies Corp. (U.S.), Havells India Ltd. (India), Lumileds Holding B.V (Netherlands), Molex (U.S.), and Component Distributors, Inc. (CDI) (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Chip-On-Board Light Emitting Diodes Market Definition

Chip-on-Board (COB) Light Emitting Diodes (LEDs) are a type of LED technology where multiple LED chips are directly mounted onto a substrate or circuit board, creating a high-density light source. Unsuch as traditional LEDs that use individual diodes, COB LEDs feature a collection of micro-sized chips in a single, compact array, allowing for greater brightness, improved light uniformity, and better thermal management.

Chip-On-Board Light Emitting Diodes Market Dynamics

Drivers

- Growth in the Automotive and Horticulture Sectors

The growth in the automotive and horticulture sectors is a significant driver for the Chip-on-Board (COB) Light Emitting Diodes (LEDs) market. In the automotive industry, COB LEDs are increasingly used in headlights and taillights due to their superior brightness, compact size, and enhanced thermal management. For instance, Cree's XLamp XE-G series is being adopted by automakers for more efficient and brighter automotive lighting solutions. Similarly, in the horticultural sector, COB LEDs are gaining traction as they provide high-intensity light that supports plant growth. Products such as ams-OSRAM's OSCONIQ P 3737 are designed specifically for greenhouse applications, offering improved energy efficiency and higher photon flux to accelerate photosynthesis, increase crop yields, and reduce energy costs. These advancements are propelling the COB LED market forward, as the demand for high-performance lighting solutions in both automotive and agricultural applications continues to rise.

- Increasing Demand Energy Efficiency and High Brightness

Energy efficiency and high brightness with uniform light output are key drivers propelling the growth of the Chip-on-Board (COB) LED market. COB LEDs are highly energy-efficient, consuming less power than traditional lighting sources, which significantly lowers operational costs. For instance, COB LEDs used in architectural lighting and street lighting, such as Philips' Fortimo range, are reducing energy consumption while delivering brighter, more consistent illumination. This energy efficiency is crucial as industries and governments around the world increasingly prioritize sustainable solutions. In addition, COB LEDs' ability to provide high brightness and uniform light distribution makes them ideal for demanding applications such as automotive lighting and backlighting. Products such as Cree's XLamp XE-G are being used in automotive headlights, offering exceptional brightness and improved visibility, while their uniform light output ensures no dark spots or glare. As the demand for energy-efficient and high-performance lighting solutions continues to rise, these benefits of COB LEDs are fueling their adoption across various sectors, making them a dominant force in the global lighting market.

Opportunities

- Increasing Technological Advancements

Technological advancements in thermal management and light quality have created significant opportunities for the Chip-on-Board (COB) LED market, making them more durable and reliable in high-performance settings. Innovations in heat dissipation technology have enabled COB LEDs to operate at higher power levels without overheating, leading to extended lifespans and reduced maintenance costs. For instance, Luminus's COB LEDs incorporate advanced thermal management systems, ensuring better heat dissipation and enhanced light output, making them ideal for demanding applications such as high-bay lighting and industrial settings. These improvements increase the overall efficiency of COB LEDs and ensure that they perform reliably in challenging environments, offering a cost-effective solution for industries looking to minimize downtime and maintenance. As the demand for long-lasting and high-performance lighting solutions grows across sectors such as manufacturing, commercial, and outdoor lighting, these technological innovations present a major market opportunity for COB LEDs, driving further adoption and expansion of the technology.

- Increasing Government Regulations and Sustainability Initiatives

Government regulations and sustainability initiatives are creating a significant market opportunity for Chip-on-Board (COB) LEDs, especially in regions such as Europe and North America, where stringent energy efficiency standards are being enforced. For instance, the European Union's Ecodesign Directive sets high energy efficiency requirements for lighting products, encouraging industries to transition to eco-friendly technologies such as COB LEDs, which offer lower energy consumption and longer lifespans compared to traditional lighting. In the U.S., the Energy Star certification for lighting products is driving the adoption of energy-efficient COB LED solutions across commercial and residential sectors. These regulatory pressures, along with increasing consumer preference for sustainable products, are pushing businesses to invest in COB LEDs for their energy-saving benefits and environmental advantages. As a result, the push for stricter energy efficiency and sustainability measures is promoting the growth of the COB LED market and opening up new opportunities for manufacturers to capitalize on the growing demand for eco-friendly lighting solutions.

Restraints/Challenges

- High Initial Costs

High initial costs remain a significant challenge in the Chip-On-Board (COB) Light Emitting Diodes (LED) market, as these advanced lighting solutions typically come with a higher upfront investment compared to traditional LEDs. The production of COB LEDs requires sophisticated manufacturing techniques and specialized materials, such as high-quality semiconductors and phosphors, which increase their cost. For instance, COB LEDs used in automotive lighting or high-end display applications often involve complex assembly processes and precision bonding, further raising production expenses. This higher cost can be a barrier to adoption, especially for industries or businesses with limited budgets or those focused on cost efficiency. Despite the long-term energy savings and enhanced performance offered by COB LEDs, the initial investment required can deter potential customers from making the switch, limiting the broader market penetration of COB technology. As a result, the high initial costs pose a key challenge for companies looking to capitalize on this growing market.

- Competition from Alternative Technologies

Competition from alternative technologies is a significant challenge in the Chip-On-Board (COB) Light Emitting Diodes (LED) market, as other lighting solutions such as OLEDs and traditional LED modules present viable alternatives with their own set of advantages. OLEDs, for instance, offer flexible, lightweight designs that are ideal for applications such as curved displays or interior lighting, making them a strong competitor to COB LEDs in certain segments. Traditional LED modules, on the other hand, are more widely adopted due to their lower initial costs and simpler manufacturing processes, making them an attractive choice for cost-sensitive applications. This competition from OLEDs and traditional LED modules can slow the adoption of COB LEDs, as many businesses and consumers are already familiar with these alternative technologies, which may not require the same level of investment or expertise to integrate. As the demand for cost-effective and flexible lighting solutions continues to rise, the competition from these alternatives challenges the growth potential of COB LEDs in both commercial and consumer markets.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Chip-On-Board Light Emitting Diodes Market Scope

The market is segmented on the basis of type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Organized Structure

- Unorganized Structure

Application

- Automotive

- Backlighting

- Illumination

Chip-On-Board Light Emitting Diodes Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the chip-on-board light emitting diodes (COB LED) market, driven by rapid technological advancements and innovations in COB LED technology. Significant government support and favorable policies in countries such as China, South Korea, and Japan further fuel market growth. In addition, the region benefits from strong manufacturing capabilities and a growing demand for energy-efficient lighting solutions. This combination of factors positions Asia-Pacific as a dominant player in the global COB LED market.

Europe is projected to experience fastest growth in the chip-on-board light emitting diodes (COB LED) market, driven by the increasing demand for energy-efficient lighting solutions. The region's commitment to sustainability and reducing carbon emissions is fueling the adoption of advanced, energy-saving technologies such as COB LEDs. Moreover, stringent regulations and government incentives promoting energy efficiency are further accelerating market growth. As a result, Europe is poised to become a key player in the global COB LED market in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Chip-On-Board Light Emitting Diodes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Chip-On-Board Light Emitting Diodes Market Leaders Operating in the Market Are:

- OSRAM GmbH (Germany)

- CITIZEN ELECTRONICS CO., LTD (Japan)

- Wolfspeed, Inc. (U.S.)

- EVERLIGHT ELECTRONICS CO., LTD. (Taiwan)

- Tridonic (Austria)

- Sharp Devices Europe (Japan)

- ProPhotonix (U.K.)

- Luminus, Inc. (U.S.)

- Bridgelux, Inc. (U.S.)

- LG Innotek (South Korea)

- SAMSUNG (South Korea)

- Trans-Lux Corporation (U.S.)

- NICHIA CORPORATION (Japan)

- Acuity Brands, Inc. (U.S.)

- Mouser Electronics, Inc. (U.S.)

- Excelitas Technologies Corp. (U.S.)

- Havells India Ltd. (India)

- Lumileds Holding B.V (Netherlands)

- Molex (U.S.)

- Component Distributors, Inc. (CDI) (U.S.)

Latest Developments in Chip-On-Board Light Emitting Diodes Market

- In August 2024, Cree LED launched its upgraded XLamp XE-G LEDs, offering enhanced energy efficiency with lower forward voltage and increased light output. These high-performance LEDs are expected to be well-received in applications such as architectural lighting, indoor directional lighting, and aftermarket automotive lighting

- In May 2024, ams-OSRAM AG introduced its high-power horticulture LED, the OSCONIQ P 3737. This LED is designed to deliver energy efficiency and stable photon flux for plants and vegetables, helping reduce greenhouse energy costs. It also improves photosynthesis rates, shortens harvest cycles, and boosts crop yields

- In April 2021, LG Innotek developed the Nexlide-E automotive lighting module, which consists of a light source, an LED package, and optical resin. The Nexlide-E offers improved light distribution and is 63% brighter than the previous model. It uses optical films created with LG Innotek's micropatterning method, enhancing illumination performance and dependability

- In December 2021, Everlight launched its UVC LED (275nm) Series, designed to aid in disinfecting public spaces during the COVID-19 pandemic. This UVC LED technology is a safer and more eco-friendly alternative to traditional mercury lamps, making it ideal for home, hotel, and restaurant disinfection without harmful mercury or ozone

- In September 2021, ProPhotonix Limited introduced the COBRA Cure FX4, an addition to its range of UV LED curing systems. Featuring high-density chip-on-board LED arrays, it offers intensities up to 14 W/cm² and energy densities of up to 58 mJ/cm², available in four wavelengths (365nm, 385nm, 395nm, and 405nm) with a wide 40mm window for uniform UV light and maximum dwell time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chip On Board Light Emitting Diodes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chip On Board Light Emitting Diodes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chip On Board Light Emitting Diodes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.